To get a handle on budgeting with an irregular income, you have to nail down two things first: your absolute bare-bones monthly expenses and a cash buffer to smooth out the ride. Think of it as creating your own stable "paycheck" from an otherwise unpredictable cash flow. This system isn't just about managing money; it's about taking the financial stress right out of the equation.

The Reality of Managing an Irregular Income

If that rollercoaster paycheck makes you feel stressed and out of control, you're not alone. This isn't some personal failing. It's the day-to-day reality for millions of freelancers, entrepreneurs, and commission-based workers. That constant feast-or-famine cycle can make financial planning feel completely out of reach, leaving too many families feeling like they're just one slow month away from a crisis.

This guide is designed to move you beyond generic advice. We’re handing you a practical system built from decades of real-world experience, one designed to bring stability and genuine peace of mind back into your life. Together, we'll walk through a clear, actionable path to help you finally gain control over your finances.

A Challenge Shared by Millions

You might be surprised just how many people are in the same boat. The uncertainty of an irregular income is a massive economic reality for a huge slice of the workforce. According to research from Nest Insight, about 25 million people in the UK deal with volatile pay. The numbers are just as stark in the United States, where roughly 36% of the entire workforce consists of freelance and independent workers. That means more than one-third of Americans are staring down this same monthly uncertainty. Learn more about the research on volatile incomes.

This shared struggle highlights just how badly we need a different approach to personal finance—one that actually acknowledges income volatility instead of pretending everyone gets a steady paycheck every two weeks.

A New Mindset for Financial Control

Successfully managing a variable income requires a big shift in how you think about your money. Instead of just reacting to each check as it comes in, you're going to build a system that acts like a dam. It will collect all your incoming funds and then release a steady, predictable stream into your household budget.

This method completely transforms your financial life because it puts the focus back on what you can control: your spending, your savings, and your allocation strategy. The goal here isn't just to scrape by during the lean months. It's to thrive in all of them.

By mastering how to budget with irregular income, you are not just managing money; you are building a fortress of financial resilience for your family. This system is about creating a predictable lifestyle from an unpredictable career path.

This guide will give you the exact tools and strategies you need to:

- Establish a baseline budget to cover your absolute necessities.

- Create a cash flow buffer to smooth out those income peaks and valleys.

- Allocate income strategically during high-earning months.

- Plan for long-term goals like taxes, retirement, and legacy building.

You can build a secure foundation, ensuring your family's future is protected, no matter what your income looks like from one month to the next.

Establish Your Financial Foundation with a Baseline Budget

Alright, the first real step in taming an unpredictable income is to get brutally honest about your numbers. You need to know, without a doubt, the absolute minimum your family needs to survive each month.

I’m not talking about what you’d like to spend. This is the rock-bottom figure required to keep the lights on, the mortgage paid, and food on the table.

This core number is your baseline budget. Think of it as your financial bedrock. It’s the non-negotiable amount you have to cover, no matter what. Knowing this single figure gives you a clear, achievable target for even your leanest months and becomes the anchor for every other decision you make.

Identifying Your Core Needs

To build this baseline, you have to separate your true "needs" from your "wants." It sounds simple, but modern life has seriously blurred those lines. For this exercise, we focus only on the absolute essentials.

Financial experts often call these "the four walls": food, utilities, shelter, and transportation. These are the critical pillars of your financial life. By making sure they're covered first, you create a powerful safety net that prevents a low-income month from turning into a disaster.

Your four walls might include:

- Shelter: Mortgage or rent, property taxes, and homeowner's insurance.

- Utilities: Electricity, water, natural gas, and essential internet service.

- Food: Your realistic monthly grocery bill—and no, that doesn't include takeout or fancy dinners.

- Transportation: Car payments, insurance, gas, and basic maintenance to keep it running.

How to Calculate Your Actual Baseline

Guesswork won't cut it here. To get a real, hard number, it’s time to become a financial detective. Pull up your bank and credit card statements from the last three to six months.

Go through them line by line, highlighting only the expenses that fall squarely into those four walls. Add them all up, then divide by the number of months you reviewed to get your average. That number is your baseline.

Let's walk through how to pin down your non-negotiable costs with this simple table.

Calculating Your Baseline Essential Expenses

| Expense Category (The Four Walls) | Monthly Cost Estimate | Your Actual Cost |

|---|---|---|

| Shelter (Mortgage/Rent) | e.g., $1,800 | |

| Utilities (Electric, Water, Gas) | e.g., $250 | |

| Food (Groceries Only) | e.g., $800 | |

| Transportation (Car Pmt, Gas) | e.g., $450 | |

| Total Baseline | $3,300 |

This exercise isn't just about crunching numbers; it's about gaining clarity on what it truly costs to run your household.

Real-World Example:

The Miller family, with a freelance graphic designer dad and a stay-at-home mom, did exactly this. They initially guessed their baseline was around $4,500. But after combing through their statements, they discovered their true essential costs were closer to $3,200. The extra $1,300 was disappearing into streaming services, eating out, kids' activities, and random Amazon purchases—all "wants" that could be paused during a tight month. Their new, clear target of $3,200 felt so much more manageable.

Putting Your Baseline Budget to Work

Once you have your number, it becomes the first goal you fund every single month. It’s the bill you pay to yourself before anything else touches your account. This baseline isn’t meant to be your permanent living standard; it’s your survival number.

Having this figure defined does a few powerful things for you:

- It simplifies decision-making: In a slow month, you know exactly what must be paid, which eliminates the stress of choosing between bills.

- It provides a clear savings goal: Your income buffer and emergency fund targets can now be built directly from this number.

- It offers peace of mind: Knowing you can cover the absolute necessities removes a massive emotional weight from your shoulders.

This process is all about creating clarity. By defining your baseline, you’re drawing a line in the sand that separates survival from lifestyle. For a deeper dive into structuring your spending, check out our guide on how to create a family budget. Getting this foundational step right is the key to building a resilient financial system that can handle anything.

Smooth Out Cash Flow with an Income Buffer

Alright, you've got your baseline budget—that rock-solid number that covers your family's absolute must-haves each month. Now it’s time to build the engine that creates real stability. The single most powerful tool for anyone on an irregular income isn't some fancy spreadsheet; it's a dedicated income buffer.

Think of this buffer as your personal cash flow shock absorber. It’s a totally separate savings or checking account where all your income goes first. Before a single dollar hits your main household account, it lands here. Its only job is to collect your earnings and smooth out the crazy peaks and valleys that come with self-employment or commission-based work.

This one account is the secret to creating your own predictable "paycheck." It lets you pay your family the exact same amount every single month, whether you just had a record-breaking quarter or a client paid 60 days late. It completely flips your financial life from reactive to proactive.

Why Your Buffer Is Not an Emergency Fund

This is critical: your income buffer and your emergency fund are two completely different things. Mixing them up is a common mistake that can leave you dangerously exposed when a real crisis hits.

An emergency fund is for true, unexpected disasters—the car’s transmission dies, a medical emergency pops up, or the roof springs a massive leak. It’s your final line of defense, and you should only touch it when you have no other choice. If you haven't built one yet, our emergency fund checklist with 8 must-have steps is the perfect place to start.

Your income buffer, on the other hand, is a working tool. It’s designed to handle the expected chaos of your income. For a freelancer or business owner, a slow month isn't an emergency; it's just part of the business cycle. Your buffer absorbs this normal volatility so your actual emergency fund can stay locked away for genuine catastrophes.

The buffer account is your business's 'retained earnings,' and your household is the sole shareholder. It holds the profits from good months to ensure the company (your family) can always make payroll.

This simple mental shift—treating your household finances with the same discipline as a successful business—is what makes this whole system click.

How to Calculate and Build Your Buffer

So, how big should this buffer be? The size is directly tied to that baseline budget you just figured out. The goal is to get between one to three months of your essential expenses sitting in this separate account.

- Starting Goal: One month of your baseline expenses.

- Ideal Goal: Three months of your baseline expenses.

If your baseline budget is $3,300, your first target for the buffer account is $3,300. Your ultimate goal would be to build that up to $9,900. Hitting that three-month mark gives you a powerful cushion that can soak up several slow months in a row without you even breaking a sweat.

A Practical Example of the Buffer in Action

Let’s see how this works for the Miller family. Their baseline budget was $3,200, and they decided to aim for a two-month buffer, which comes out to $6,400.

- Depositing All Income: For the first few months, every check from a client and every dollar from a side hustle went straight into their new, separate "Buffer Account."

- Paying Themselves: On the first of the month, like clockwork, they transferred exactly $3,200 from the Buffer Account into their main household checking. This became their steady, predictable "paycheck."

- Building the Surplus: One month was fantastic, and they brought in $7,000. All of it went into the buffer. After paying themselves their $3,200 salary, the buffer's balance shot up by $3,800.

- Covering a Slow Month: Two months later, a big project got delayed, and their income dropped to just $1,500. No panic. They still paid themselves their regular $3,200 paycheck, simply drawing the $1,700 difference from the surplus they’d already built.

Their day-to-day life didn't feel that income drop at all. The buffer did its job perfectly, absorbing the financial shock and letting them pay their bills on time without any stress.

This system breaks the toxic link between what you earn in a given month and what you spend. By creating this separation, you give yourself the consistency and peace of mind of a traditional 9-to-5 salary, even while navigating the wild world of variable income. Your buffer becomes the engine of your financial stability.

Choose Your Income Allocation System

Okay, so you've built up your income buffer and all your earnings are now flowing into one central account. That’s a huge win. The next big question is: what do you do the moment a payment actually lands?

You need a game plan. Without one, that money will just evaporate. Having a predefined system for how you slice up each check is how you give every single dollar a job, making sure nothing gets wasted or mindlessly spent.

Two of the most effective strategies I’ve seen work for freelancers, entrepreneurs, and commission-based professionals are the Percentage Method and the Priority Method. Each gives you a different way to look at your money, and picking the one that clicks with your personality is the secret to sticking with it for the long haul.

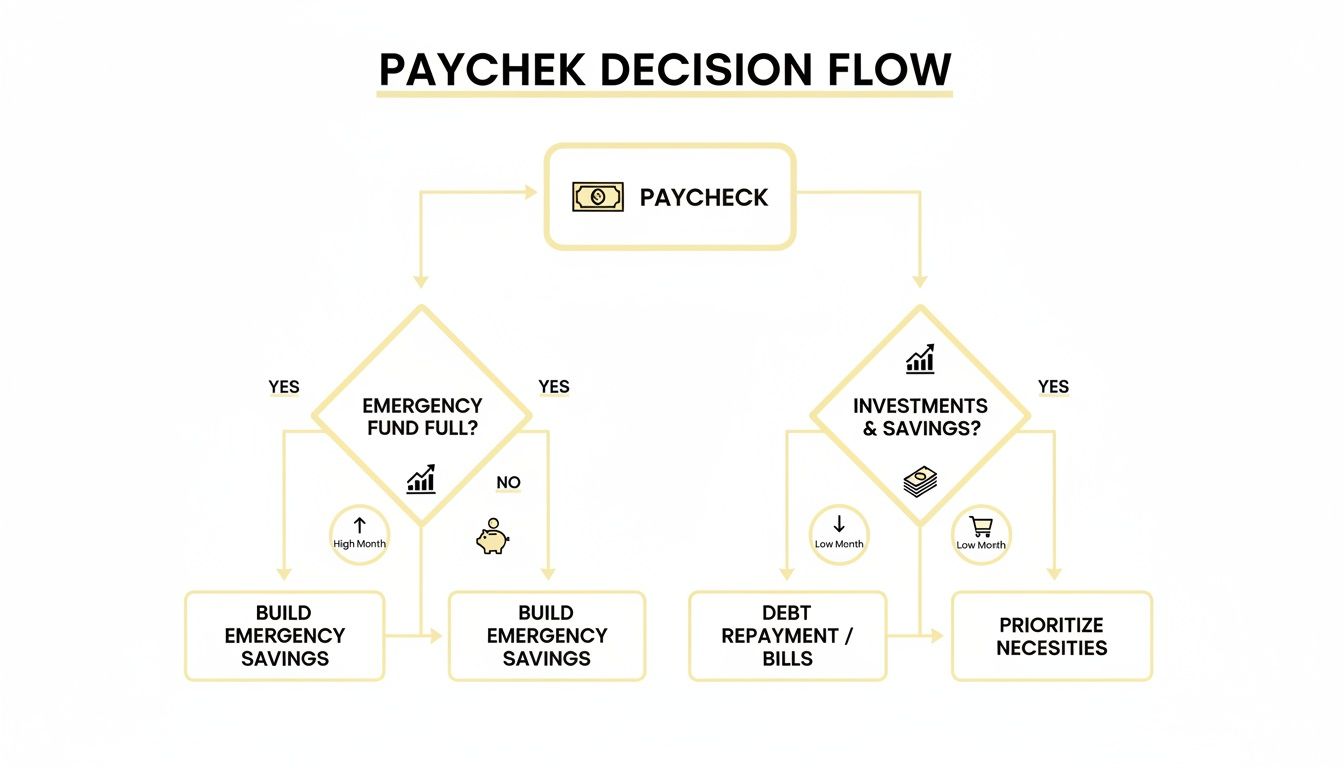

This flowchart gives you a simple visual for directing your funds, whether you’re in a feast or famine month. It’s a core concept no matter which system you choose.

The big idea here is that every dollar has a purpose. In a lean month, its job is to cover the absolute necessities. In a great month, its job is to aggressively build your future.

The Percentage Method

If you're someone who loves structure and automation, the Percentage Method is for you. It’s beautifully simple. You decide ahead of time what percentage of every single dollar that comes in goes to specific categories.

It’s a true set-it-and-forget-it approach that works automatically, no matter if the check is for $500 or $15,000.

For example, your personal allocation could look something like this:

- 50% to Living Expenses: This slice goes right into the account you use to pay yourself that consistent "paycheck" we talked about, funding your core budget.

- 30% to Taxes: This is non-negotiable. Move this immediately to a separate high-yield savings account so you’re always ready for quarterly tax payments. No surprises.

- 10% to Business Reinvestment: Money for new software, a better laptop, or professional development to keep growing your income.

- 10% to Long-Term Goals: This bucket is for the big stuff—retirement, investments, or saving for a down payment.

The beauty of this method is the built-in discipline. It forces you to make progress on all your financial fronts at the same time, every single time you get paid.

The Priority Method

Think of the Priority Method (sometimes called the "waterfall method") as more of a hands-on, goal-smashing approach. It's perfect for people who are intensely focused on hitting one big target at a time.

With this system, you don’t split every dollar. Instead, you create a ranked list of your financial priorities. When a check comes in, you fund the first priority completely, then move to the second, and so on, until the money runs out.

A typical priority list might look like this:

- Fund this month's "paycheck" (your baseline budget amount).

- Set aside money for taxes on this specific income.

- Top off the income buffer if you had to dip into it last month.

- Max out your Roth IRA contribution.

- Throw extra cash at high-interest credit card debt.

- Add to the family vacation fund.

A smaller check might only cover the first two items on the list. But a massive commission check? It could fund the entire list and then some, letting you make incredible headway on your most important goals. It’s an incredibly intentional way to direct your money where it will have the biggest impact right now.

For those looking to accelerate their earnings to fund these priorities even faster, our guide on how to create multiple income streams offers some practical strategies.

Choosing Your Income Allocation Method

So, which one is right for you? Both are powerful, but they suit different personalities. This table breaks down the key differences to help you decide.

| Feature | Percentage Method | Priority Method |

|---|---|---|

| Best For | People who love automation and want a consistent, balanced approach to their finances. | Goal-oriented people who prefer tackling one financial priority at a time with intense focus. |

| How It Works | Each dollar you earn is automatically split into pre-set percentages for different goals (taxes, savings, etc.). | Money "waterfalls" down a ranked list of priorities, funding each one completely before moving to the next. |

| Primary Benefit | Ensures you are always making steady progress in every important category at the same time. | Lets you direct large sums of money toward a single, high-priority goal, like debt payoff, to accelerate progress. |

| Potential Drawback | Can feel slow if you're trying to fast-track one specific goal. | Lower-priority goals (like fun money or long-term investing) might go unfunded during slow income months. |

Ultimately, there’s no single "right" answer. The best system is the one you’ll actually stick with. Whether you automate with percentages or focus with priorities, just having a plan is what turns that unpredictable income stream into a powerful wealth-building tool.

Plan for Taxes, Retirement, and Long-Term Goals

Budgeting with an irregular income isn't just about weathering the slow months. It's about leveraging the great months to build a truly secure financial future. Once you’ve nailed down your baseline budget and built up a solid income buffer, it’s time to zoom out and look at the big picture.

The two most critical—and most frequently ignored—pieces of this puzzle are taxes and retirement.

It’s tempting to push these to the back burner, but that’s a surefire recipe for stress down the road. If you're self-employed, a freelancer, or work on commission, the IRS sees you as a business. That means you’re on the hook for your own taxes, and they expect their cut throughout the year, not just in one big check next April.

Taming the Tax Beast

When an employer isn't withholding taxes from your paycheck, that responsibility lands squarely on you. The secret is to stop thinking of taxes as a surprise and start treating them like a non-negotiable business expense. The second you get paid, a piece of that money belongs to Uncle Sam.

A simple, bulletproof rule of thumb is to immediately set aside 25% to 30% of every single payment you receive. This isn’t your money. Move it straight into a separate, dedicated high-yield savings account that you label "Tax Savings."

This habit accomplishes two huge things:

- It kills the massive tax bill surprise. You'll have the cash sitting there, ready to go when your quarterly estimated tax payments are due.

- It gets the money out of sight and out of mind. By transferring it right away, you won't be tempted to dip into it for something else.

This one simple discipline turns tax time from a moment of sheer panic into a boring administrative task.

Retirement Planning Without a 9-to-5

One of the biggest financial hurdles of not having a traditional job is the lack of an employer-sponsored retirement plan like a 401(k). But that doesn't mean you're out of luck. In fact, you have access to some incredibly powerful retirement accounts designed specifically for people like you.

Two of the most popular are the SEP IRA and the Solo 401(k). Both let you contribute far more than a traditional IRA, giving you the chance to really turbocharge your savings in your high-income years.

- SEP IRA (Simplified Employee Pension): This account is ridiculously easy to set up. It lets you contribute up to 25% of your net adjusted self-employment income, with a 2024 maximum of $69,000. The beauty is in its flexibility—you can stash away a ton in a great year and contribute less (or even nothing) in a lean one.

- Solo 401(k): This option is a bit more involved but offers even more flexibility. You can contribute as both the "employee" and the "employer," which often allows for even higher contribution limits. It also gives you the option to take out a loan against your savings, something a SEP IRA won't let you do.

The real key here is to automate your contributions whenever you can. When a fantastic month hits, make it a top priority to funnel a significant chunk of that income straight into your retirement account before you even have a chance to miss it.

Your financial system should serve your future self just as much as your present self. By automating tax and retirement savings, you're making a binding contract with your long-term goals, ensuring they get funded no matter what the month looks like.

Integrating Long-Term Goals into Your Budget

Beyond the non-negotiables of taxes and retirement, your irregular income can be a powerful engine for hitting other major life goals. Think about that down payment on a house, funding your kids' college education, or finally taking that dream trip.

This is where the "Priority Method" for allocating income really proves its worth. Once your baseline expenses, taxes, and retirement contribution are covered, you can strategically aim any leftover income at your next biggest priority.

For example, a freelance writer might have this game plan for a high-income month:

- Fund this month's $3,500 baseline "paycheck."

- Set aside 30% of total income for taxes.

- Send $1,000 over to their SEP IRA.

- Throw an extra $2,500 at their down payment fund.

- Add $500 to the family vacation account.

This structure stops those windfall months from vanishing into thin air or getting absorbed by lifestyle creep. Instead, every high-income month becomes rocket fuel for your most important ambitions, turning today's unpredictable earnings into tomorrow's lasting wealth and security. This is how you build a legacy.

Your Irregular Income Budgeting Questions, Answered

Even with the best system, real life happens. Learning to budget on a fluctuating income is less about getting it perfect on day one and more about adjusting and refining as you go. This is your troubleshooting guide for the most common sticking points people run into.

Think of these as the “what if” scenarios. From a buffer that gets drained to handling a surprise windfall, we’ve got you covered.

What If a Slow Month Wipes Out My Buffer?

This is the number one fear for anyone with a variable income, and it's a completely valid one. If a really lean month drains your income buffer, take a deep breath. This means the system worked—it shielded your family from a full-blown financial crisis. It’s also a clear signal that it's time to act.

Your immediate first step is to hit the pause button on all non-essential spending. Go right back to your bare-bones baseline budget. This isn't a punishment; it's a strategic move to stop the bleeding and protect your core needs.

Next, make refilling that buffer your absolute top financial priority. Every spare dollar from the next few months goes directly to rebuilding that one-month cushion. That comes before adding to long-term savings and before paying extra on debt.

A depleted buffer isn't a failure. It's a stress test. It just proved your system can handle a hit and gave you a new, crystal-clear mission: rebuild your stability fund.

How Do I Budget for Big, Irregular Expenses?

Life is full of lumpy expenses that can demolish a budget if you're not ready. We're talking about things like:

- Annual insurance bills

- Holiday and birthday gifts

- Car repairs and new tires

- Property taxes

The best way to tame these budget-busters is with sinking funds. A sinking fund is just a fancy name for a dedicated savings account for a specific future expense. You tuck a little bit of money away for it each month, so when the bill arrives, the cash is already sitting there, waiting.

For example, if you know your car insurance costs $1,200 a year, you’d set up a "Car Insurance" sinking fund and aim to put $100 into it every single month. This simple, proactive habit turns a massive, stressful bill into a predictable, manageable line item.

My Partner and I Both Have Irregular Incomes. What Do We Do?

When you’re a dual-variable-income household, the principles are the same, but communication and teamwork become non-negotiable. The goal is to combine your financial streams into a single, unified system that works for the whole family.

- Create a Joint Buffer Account: All income from both of you flows into one central buffer account. Think of this account as the "business" that pays your family.

- Establish One Household "Paycheck": Based on your combined baseline budget, you’ll transfer one, consistent "paycheck" from that joint buffer to your shared household checking account each month.

- Hold Weekly Money Meetings: This is the secret sauce. A quick, 15-minute check-in every week is crucial. It’s where you review what money is coming in, see how you’re progressing on refilling the buffer, and decide together how to use any extra cash from a great month.

This "one team" approach gets rid of the whole "my money vs. your money" tug-of-war and gets you both pulling in the same direction: creating stable ground for your family.

What’s the Difference Between a Buffer and Sinking Funds?

It's easy to mix these two up, but they have very different jobs.

- An income buffer is for smoothing out your income volatility. Its job is to absorb the financial peaks and valleys so you can give yourselves a steady, predictable paycheck.

- Sinking funds are for smoothing out your spending volatility. Their job is to prepare for those large, predictable, but non-monthly expenses so they don't turn into financial emergencies.

Here’s the simplest way to think about it: your buffer handles the unpredictable money coming in, while sinking funds handle the big, lumpy expenses going out. Both are absolutely essential tools for building predictability in an unpredictable financial world.

Managing an unpredictable income is about building a system that serves your family's real needs, creating peace of mind and a clear path toward your legacy. At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to redefining your American Dream. Learn more about our approach and find resources to guide your journey at https://smartfinancialifestyle.com.