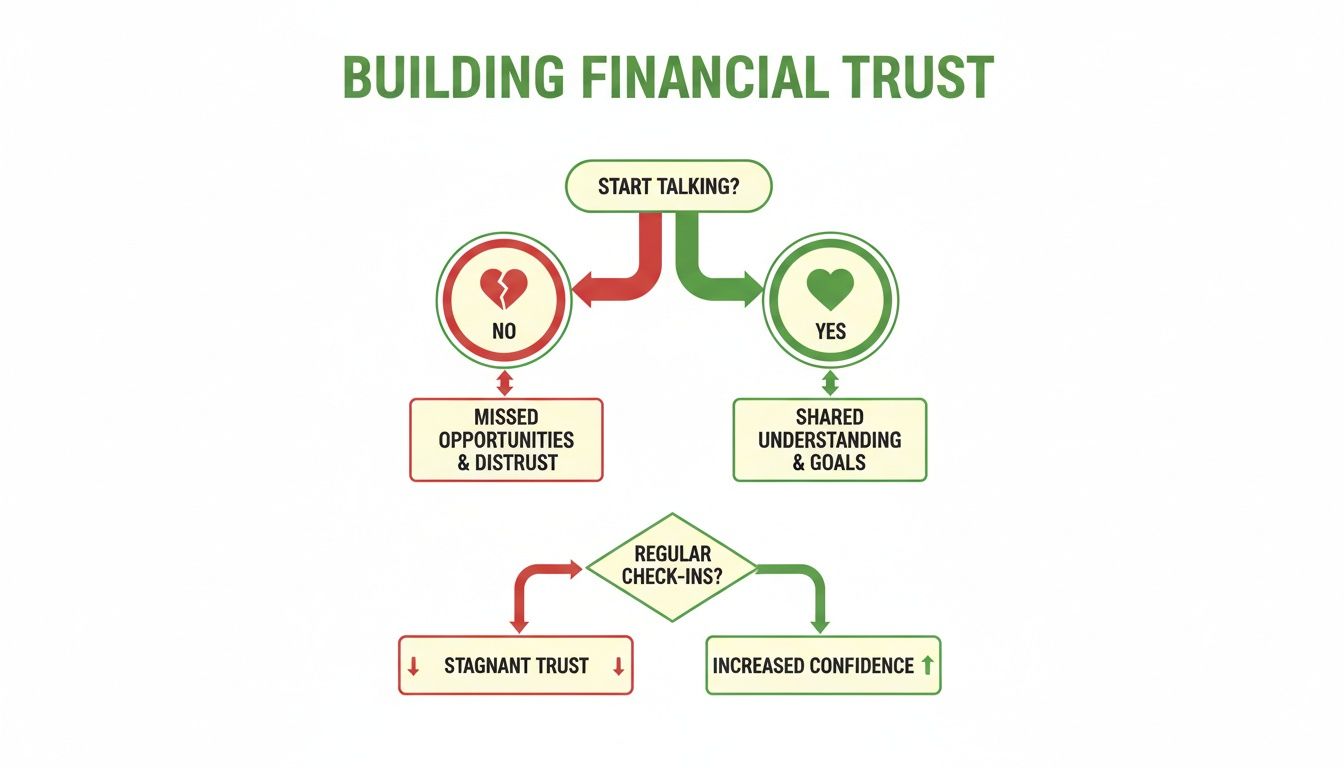

Effectively managing money as a couple really starts with one thing, and it's not a spreadsheet or a fancy app. It's trust. It all boils down to creating a safe space where you can have open, honest conversations about your financial histories, your fears, and your biggest dreams. This shared understanding is the absolute bedrock of a strong financial partnership.

Building a Foundation of Financial Trust

Before you even think about combining accounts or drafting a budget, you have to build that foundation of unwavering financial trust. This isn’t just a preliminary step; it’s the most critical part of figuring out how to manage money together. It’s about getting beyond the numbers on a bank statement to really understand the stories and emotions behind them.

This whole process kicks off with "The Money Talk," a conversation so many couples dodge because it feels awkward or scary. But the goal isn't to point fingers or assign blame for past mistakes. It's about being vulnerable and creating a unified vision for your future together. You're not just sharing figures; you're sharing pieces of your life—your first job, the lessons your parents taught you about money, your anxieties about debt, and what you dream about for retirement.

Uncovering Your Financial Stories

Every single person has a unique relationship with money, shaped by their upbringing and life experiences. Maybe one of you grew up in a household where money was a constant source of stress, which turned you into an aggressive saver. The other might associate money with freedom and generosity, making them more likely to spend. Neither of these is inherently "right" or "wrong," but you absolutely have to understand where these beliefs come from. Digging into the psychology of spending can be a real eye-opener, revealing why you and your partner have such different financial habits.

To get this conversation started, lead with curiosity, not judgment. You're simply trying to understand your partner's financial blueprint.

- Financial Histories: Gently talk about past debts, credit scores, and any big financial wins or losses.

- Money Mindsets: Explore what money truly means to each of you. Is it security? Opportunity? A source of stress? Or total freedom?

- Long-Term Dreams: What do you want your life to look like in five, ten, or even twenty years? Get specific.

This kind of transparency is vital. Financial secrets, even the small ones, can eat away at a relationship's foundation. The data backs this up—research shows that a startling 17% of Brits admit their partners have lied to them about debt. On the flip side, building that financial unity can have a profound impact. A study on newlyweds found that couples who combined their accounts saw no decline in relationship satisfaction over two years, which wasn't the case for their separate-account counterparts.

The goal isn't just to share numbers, but to understand the stories and emotions behind them. This creates a unified vision that becomes the bedrock for all future financial decisions.

Conversation Starters for Financial Intimacy

Kicking this off can feel daunting, I get it. The key is to use open-ended questions that invite storytelling instead of simple yes-or-no answers. Set aside some dedicated, distraction-free time where you can both feel relaxed and truly heard.

To help you get started, here are a few gentle, open-ended questions. Think of this table as your guide to a "money date." Make some coffee, get comfortable, and agree that this is a judgment-free zone.

Your First Financial Conversation Starters

| Topic Area | Conversation Starter Question | Goal of the Conversation |

|---|---|---|

| Childhood & Money | What's your earliest memory about money? What did your parents teach you about it? | To understand the foundational beliefs and habits formed early in life. |

| Values & Priorities | If we had an extra $5,000 right now, what's the first thing you'd want to do with it? | To uncover what each person truly values—experiences, security, generosity, etc. |

| Fears & Anxieties | What is your biggest fear when it comes to money? | To create a safe space for vulnerability and identify shared (or different) anxieties. |

| Dreams & Goals | What does your ideal retirement look like? Paint a picture for me. | To align on long-term goals and build a shared vision for the future. |

| Financial Wins | What's a financial accomplishment you're really proud of? | To celebrate past successes and build confidence as a financial team. |

The whole point here is to listen and learn, building a bridge of understanding that will support every single financial choice you make together from here on out. This first conversation really does set the tone for a lifetime of healthy financial communication and teamwork.

Choosing Your Financial System Together

Once you’ve built that foundation of trust, you can start digging into the mechanics of how you'll manage your money day-to-day. Let’s be clear: there's no single "right" way for couples to do this. The best system for you depends entirely on your comfort levels, how your incomes compare, and what you’re trying to achieve together.

Most couples land on one of three systems: going "All In" with fully joint accounts, keeping things separate with a "Yours and Mine" approach, or finding a middle ground with a hybrid "Ours, Yours, and Mine" model. Each one has its perks and potential pitfalls. The goal isn't to copy what your friends are doing, but to choose a system together that feels fair, open, and right for your unique partnership.

Comparing Financial Management Systems for Couples

Choosing how to structure your finances is a big decision, and it’s helpful to see the options side-by-side. The table below breaks down the three main systems to help you and your partner find the best fit for your goals and lifestyle.

| System | Best For | Key Benefit | Potential Challenge |

|---|---|---|---|

| All In (Joint) | Married couples with shared long-term goals who value simplicity and complete transparency. | Maximum simplicity and a powerful "we're a team" mindset. All income and expenses flow through one place. | Can lead to a loss of financial autonomy for one partner or create friction if spending habits clash. |

| Yours & Mine (Separate) | Couples who value financial independence, have significant individual assets or debts, or are not married. | Each partner maintains full control over their own money, which can reduce arguments over minor purchases. | Requires constant communication to ensure shared bills are paid fairly and can prevent resentment from building. |

| Ours, Yours, & Mine (Hybrid) | Couples who want a balance of teamwork and autonomy; great for those with different spending styles or income levels. | Offers the best of both worlds—collaboration on shared goals with the freedom of personal spending. | Requires setting up a clear system for contributions to the joint account to maintain a sense of fairness. |

Ultimately, the best system is the one that reduces conflict and helps both of you feel secure. It's about what works for your team of two.

The "All In" Approach: Fully Joint Finances

Imagine finally sitting down with your partner to have the talk about money. It can be daunting, but with 89% of women and 70% of men now in dual-career couples, managing finances together isn’t just a nice idea—it’s a modern survival skill. In my 50+ years of experience, I've seen how going all-in works for many. According to the National Couples’ Health and Time Study, 66% of married different-gender couples choose fully joint finances, compared to just 23% of cohabiting couples.

This approach is built on total transparency. All income goes into one pot, and all expenses are paid from it, fostering a powerful "we're in this together" mentality. For more details, you can explore this guide to joint vs separate finances.

The "Yours and Mine" Approach: Separate Finances

On the other end of the spectrum, some couples choose to keep their finances completely separate. In this setup, each person has their own accounts and is responsible for specific, agreed-upon bills.

This system often works well for couples who cherish their financial independence or for those entering a relationship with significant individual assets or debts. It gives each person total control over their own money without needing to run every purchase by their partner. The biggest challenge here is making sure shared expenses are divided fairly, which demands ongoing conversations to keep resentment from bubbling up.

As you can see, the first real step to financial harmony is simply starting the conversation. Choosing to talk leads to positive outcomes, while avoidance almost always leads to bigger problems down the road.

The Hybrid Model: "Ours, Yours, and Mine"

The hybrid model has become incredibly popular for good reason—it offers a fantastic balance between teamwork and autonomy. The concept is simple: you have a joint account for shared household expenses, but you each keep separate accounts for your own personal spending.

This "yours, mine, and ours" system is wonderfully flexible. It lets you tackle shared goals together while giving each partner the freedom to spend their own money without guilt or oversight. I’ve seen this work wonders for couples where one partner is making a career change; they can still feel empowered by having their own funds, even if their contribution to the joint account temporarily goes down.

To keep the hybrid model fair, many couples contribute to the joint account proportionally based on their income. So, if one partner earns 60% of the total household income, they contribute 60% to the shared expenses. This approach recognizes different earning levels and helps both partners feel they’re contributing equitably, which is vital for making it work long-term.

Creating a Shared Budget That Actually Works

Let's be honest, most couples hear the word "budget" and immediately picture a financial straitjacket—all restriction, no fun. But I want you to think about it differently. A shared budget isn't about sacrifice; it's the roadmap you design together to get you exactly where you want to go.

This is the tool that turns those "someday" dreams into a real, concrete plan. When you're both on the same page with your money, it wipes out so much stress and guesswork. You’re no longer just hoping for a down payment or a debt-free life. You're actively building it, together.

Choosing Your Budgeting Framework

There's no single "best" budget. The right one is whichever system feels empowering, not punishing, for both of you. And remember, you can always switch things up as your life changes.

Here are a couple of popular frameworks that I've seen work really well for couples just starting out:

-

The 50/30/20 Rule: This is a fantastic, simple starting point. The idea is to divide your combined take-home pay into three buckets: 50% for Needs (rent/mortgage, groceries, utilities), 30% for Wants (restaurants, hobbies, that weekend trip), and 20% for Savings & Debt Repayment.

-

Zero-Based Budgeting: This one's more hands-on, but it gives you incredible control. At the start of the month, every single dollar of your income gets assigned a specific job. Your income minus your expenses should equal zero. Nothing gets left to chance.

The best approach is the one you can both actually stick with. Don't be afraid to try one for a few months and see how it feels.

From Theory to Practice: Making Your Budget Real

Okay, you've picked a framework. Now it's time to put it into action. This is where you get honest about where your money has been going so you can start telling it where to go next.

Kick things off by tracking all your spending—both shared and individual—for one full month. Use an app, a spreadsheet, or a notebook. It doesn't matter how you do it, just that you do it. This isn't about judging each other's coffee habits; it's about collecting the facts so you can make smart decisions together.

Once you have that clear picture, you can start plugging numbers into your chosen framework. For a deeper dive, check out our guide on how to create a family budget that's tailored to your unique situation.

A budget isn't about limiting your freedom; it’s about creating it. By consciously deciding where your money goes, you empower yourselves to build the life you both want.

This plan needs to include a few key things that are often overlooked but are absolutely crucial for keeping the peace.

Must-Haves in Every Couple's Budget

To build a plan that lasts, you have to balance shared goals with personal autonomy. It's this balance that prevents little resentments from building up and makes both partners feel respected.

Here are three things I consider non-negotiable in a couple's budget:

-

Individual 'Fun Money' Allowances: This is a game-changer. Agree on a set amount of cash each month that you both can spend, no questions asked. It completely eliminates arguments over small, personal purchases and gives each of you a healthy dose of financial independence.

-

Sinking Funds for Big Goals: Think of a sinking fund as a dedicated savings bucket for a specific, upcoming expense. Instead of getting blindsided by a huge bill, you save for it a little at a time. This is perfect for predictable costs like annual car insurance, property taxes, holiday gifts, or that dream vacation to Italy.

-

Regular Budget Meetings: Put a recurring "money date" on the calendar once a month. Keep it light! Grab a coffee or pour a glass of wine and review your progress. This is your time to celebrate your wins, tweak the plan for upcoming expenses, and make sure you’re still pulling in the same direction toward your big goals.

Tackling Debt and Building Savings as a Team

Debt can feel like an anchor holding your relationship back, while savings are the wind in your sails, pushing you toward your shared dreams. When you decide to manage money as a couple, facing these two powerful forces together is more than just a financial strategy—it's a profound statement of unity.

That shared commitment is what turns what might feel like an individual burden into a team mission.

It all starts with total transparency. It’s time to lay all the cards on the table by listing every single debt, both yours and theirs. We’re talking credit cards, student loans, car payments, personal loans—everything.

Seeing the complete picture without judgment is the only way to build a plan that actually works. This isn't about blaming anyone for past choices; it's about looking forward and deciding how "we" are going to move on from this exact point.

Choosing Your Debt Repayment Strategy

With all your debts listed out, you can decide on a unified plan of attack. Two of the most effective methods I see couples use are the "Debt Snowball" and the "Debt Avalanche." Neither is inherently better; the right one is simply the one that keeps you both motivated.

-

The Debt Snowball Method: You focus on paying off the smallest debt first, regardless of the interest rate, while making minimum payments on everything else. Once that smallest debt is gone, you roll its payment amount onto the next smallest one. This method delivers quick wins, which can be incredibly motivating when you're working together.

-

The Debt Avalanche Method: With this approach, you prioritize paying off the debt with the highest interest rate first. Mathematically, this saves you the most money on interest over time. It just requires a bit more patience, especially if the first debt on your list is a big one.

If you want a more detailed breakdown, you might find our guide on how to pay off debt faster without making more money helpful. The key is deciding on a method together so you're both committed to the same game plan.

Building Your Financial Safety Net

Before getting too aggressive with debt repayment, it's critical to build a small emergency fund. Think of this as your financial firewall. It protects all your hard-earned progress from being wiped out by a surprise car repair or an unexpected medical bill.

Start with a small, achievable goal, like $1,000. Put this money in a separate, high-yield savings account where it’s easy to get to but not mixed in with your daily spending money. This initial fund provides an essential buffer, preventing you from having to take on new debt when life happens.

Once your high-interest debt is gone, you can shift your focus to beefing this fund up to cover three to six months of essential living expenses.

A joint commitment to eliminating debt and building savings sends a powerful message: "Your burden is my burden, and your future is my future." It’s one of the most tangible ways to build a life of shared responsibility.

Automating Your Savings for Shared Goals

With a debt plan in motion and a starter emergency fund in place, you can finally turn your attention to the exciting part: saving for your future. The secret to successful saving is automation. Set up automatic transfers from your checking account to your various savings accounts on payday.

This strategy works beautifully within the hybrid "Ours, Yours, and Mine" financial system, which is surging in popularity. I see this all the time—a couple navigates career changes, craving independence without losing the team's strength by contributing proportionally to joint goals from their personal accounts. In fact, U.S. Census data shows the share of couples with no joint accounts rose from 15% in 1996 to 23% in 2023, and those mixing joint and solo accounts jumped from 9% to 17%. You can discover more insights about these trends on census.gov.

Create separate, named savings accounts for each of your major goals. This brings clarity and a bit of fun to the process.

- Vacation Fund: Saving for a specific trip.

- New Car Fund: Building up for a future vehicle purchase.

- Home Down Payment: The big one for your long-term housing goals.

Automating these savings makes progress feel effortless. By treating your savings contributions like any other bill, you consistently build wealth in the background while you go about your lives. It's a powerful, unified approach that strengthens both your finances and your partnership.

Planning for Your Financial Future Together

Managing money as a team is about way more than just covering the monthly bills. It's about building a life together—a secure, prosperous future that honors both of your dreams and the new vision you're creating as a couple. This is where you zoom out from the day-to-day grind and start looking decades ahead.

We’re talking about investing, retirement, and the legacy you’ll eventually leave behind. These conversations aren't just about spreadsheets and market returns; they're about what gives you security, freedom, and a sense of purpose. When you get aligned on these big-picture goals, you turn your financial partnership into an engine for building real, lasting wealth and peace of mind.

Aligning Your Investment Strategies

Investing is your best tool for building wealth over time, but it’s an area where couples often have wildly different comfort levels. One of you might be a natural risk-taker, drawn to the high-growth potential of individual stocks. The other might sleep better at night knowing your money is in the slow-and-steady world of bonds and index funds.

Neither approach is wrong. The trick is to find a unified strategy that works for both of you.

Start by getting real about your individual risk tolerance. How do you actually feel when the market takes a nosedive? Then, look at your time horizon. Are you saving for a down payment in five years or a retirement that's 30 years away?

A fantastic approach I’ve seen work wonders is what I call a "core and explore" strategy.

- The Core: This is the bulk of your portfolio, maybe 70-80%, invested in diversified, lower-risk assets you both feel good about, like broad-market ETFs. This is the solid foundation of your financial house.

- The Explore: A much smaller slice is set aside for those individual stocks or niche sectors one of you is passionate about. This gives each person room to express their investment style without risking the whole nest egg.

This kind of balance respects the need for security and the desire for growth, making investing a team sport instead of a battleground.

Coordinating Your Retirement Accounts

Getting your retirement savings strategy right is one of the most powerful moves you can make as a couple. You have to stop seeing your 401(k)s, IRAs, and HSAs as separate pots of money. They're all puzzle pieces that need to fit together perfectly.

Your absolute first priority? Contribute enough to each of your employer plans to get the full company match. Seriously. This is free money, and walking away from it is one of the biggest financial blunders a couple can make.

Once you’ve both locked in your full match, you can get strategic. If one partner has a 401(k) with amazing, low-cost funds and a great match, it might make sense to max out that account before putting extra money into the other partner's plan, especially if it has higher fees.

Smart financial decisions are not just about numbers, but about building a secure and prosperous future. Your coordinated efforts in retirement planning are a testament to your long-term commitment to each other's well-being.

Building Your Legacy Through Estate Planning

I get it—talking about what happens when you're gone is uncomfortable. But getting your estate plan in order is one of the most profound acts of love you can do for your family. This isn't just for the super-wealthy; it’s for anyone who wants to protect their loved ones from a world of confusion and legal chaos.

If you don't have a plan, the state will make one for you. Trust me, you won't like it.

Here are the non-negotiable documents every couple needs to have sorted out:

| Document | What It Does | Why It's Crucial for Couples |

|---|---|---|

| Will | Dictates how your assets are distributed and names a guardian for minor children. | Ensures your partner and kids get what you intend, preventing ugly family feuds. |

| Durable Power of Attorney | Appoints someone to handle your finances if you're unable to. | Lets your partner pay bills and manage joint accounts without getting a court order. |

| Healthcare Proxy | Names someone to make medical decisions for you if you can't. | Empowers your partner to be your advocate and honor your wishes during a crisis. |

| Beneficiary Designations | Names who inherits assets like retirement accounts and life insurance policies. | These often override your will, so keeping them updated is absolutely critical. |

Look over these documents together regularly, especially after big life events like getting married, buying a house, or having a baby. It's a foundational part of managing your finances responsibly and making sure the life you've built together truly takes care of the people you love.

Handling Common Money Challenges as a Couple

Even the most in-sync couples are going to hit some financial bumps in the road. It's just part of life. Navigating these tricky situations with open communication and a true partnership mindset is what separates a minor hurdle from a major conflict. Think of these moments not as failures, but as opportunities to strengthen your financial teamwork.

Tackling these common questions head-on, with a plan in place, is a huge part of learning how to manage money together for the long haul. Let's dig into some of the most frequent challenges I've seen over my decades of helping couples.

What Should We Do if One of Us Earns Significantly More?

This is easily one of the most common scenarios I see, and it's where the idea of fairness has to trump strict equality. Forcing a 50/50 split on everything when one person's income dwarfs the other's is a fast track to resentment. The higher earner might feel like they have no personal spending money left, while the lower earner is constantly stressed, feeling like they can never keep up.

A much healthier and more sustainable approach is to use proportional contributions.

Here’s how it works. First, figure out your total combined take-home pay. Then, calculate what percentage of that total each of you brings in. Let's say one partner earns $70,000 and the other brings home $30,000, making your combined income $100,000. In this case, Partner A contributes 70% of the income, and Partner B contributes 30%.

You then apply those same percentages to all of your shared expenses. Partner A would cover 70% of the mortgage, utilities, and groceries, while Partner B covers the remaining 30%. This method feels fair because both people are contributing equitably to the household. It’s also crucial that your budget includes personal, no-questions-asked spending money for each of you, regardless of who earns what.

The goal isn't a rigid 50/50 split that doesn't match your reality. It's about making sure both partners feel they are contributing fairly while still having financial autonomy.

How Do We Combine Finances if One Partner Has a Lot of Debt?

Finding out your partner has a mountain of debt can feel like a gut punch, but it absolutely does not have to be a dealbreaker. The very first thing you have to do is make a mental shift from "your debt" to "our plan." If you're building a life together, that debt is now a shared obstacle you'll conquer as a team.

Come at this conversation with empathy, not blame. Sit down and lay out all the debts together—every single credit card, student loan, and car payment. Get it all onto a spreadsheet where you can see the balances, interest rates, and minimum payments. Just seeing the full picture, together, helps strip away the shame and secrecy that often surrounds debt.

From there, you build a unified attack plan using your shared budget.

- Pick a Strategy: Decide together on a repayment method. Will you use the "Debt Snowball" (paying off the smallest debts first for quick psychological wins) or the "Debt Avalanche" (tackling the highest-interest debt to save the most money)?

- Allocate the Funds: Figure out exactly how much extra money you can throw at the debt from your combined budget each month. Be aggressive.

- Invest in Your Future: The partner without debt isn't just "bailing out" the other. They are investing in a debt-free future for the partnership, which is a massive win for both of you.

How Often Should We Have Money Dates to Review Our Finances?

When it comes to check-ins, consistency is way more important than frequency. A great rhythm to start with is a monthly chat. But please, don't let this feel like some stressful corporate audit. Frame it as a "money date" and make it a genuinely relaxed and positive experience.

Grab coffee together on a Saturday morning or pour a glass of wine after dinner on a weeknight. The whole point is to build a positive association with talking about your finances.

During this monthly get-together, you should:

- Glance at Your Budget: How did you do against your plan for the last month? Where did you win? Where can you improve?

- Check on Your Goals: Celebrate the progress! Get excited about how much closer you are to saving for that vacation or putting a down payment on a car.

- Look at the Month Ahead: Talk about any big or unusual expenses coming up, like a wedding gift you need to buy or some car maintenance you've been putting off.

Beyond these monthly check-ins, it's also a great idea to schedule a more in-depth "financial summit" once or twice a year. This is where you zoom out and look at the big picture—reviewing your investment performance, adjusting retirement contributions, and just making sure your long-term goals still align with the life you want to build together.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building wealth and redefining the American dream. Our resources are designed to help you and your partner navigate these conversations with confidence and clarity. Learn more at https://smartfinancialifestyle.com.