A family budget comes down to four things: figuring out what your family truly cares about, tracking where your money is coming from and where it's going, giving every single dollar a job to do, and checking in on the plan together. Regularly.

This process turns money from a source of stress and arguments into a tool you can use to build a secure future. It’s less about spreadsheets and more about aligning your finances with your shared vision for life.

Your Family Budget Is More Than Just Numbers

Let's reframe how we talk about creating a family budget. For so many of us, the word "budget" immediately makes us think of restriction, sacrifice, and everything we can't do.

But in a family, especially one juggling multiple generations, a budget is something else entirely. It’s a communication tool. A roadmap. It's how you build a legacy together.

A well-crafted plan isn’t about limiting your lifestyle; it's about designing it with intention. It's what provides security for aging parents, gives the next generation a head start, and turns vague dreams into real, achievable steps. This is the framework that makes sure your money is working for what your family truly values—whether that’s education, travel, generosity, or just plain old peace of mind.

Why a Written Plan Is Non-Negotiable Today

With the cost of living climbing faster than most paychecks, a written financial plan has shifted from a "nice-to-have" to an absolute necessity for stability. A family budget brings the clarity you need to make smart financial decisions, especially when things feel tight.

Just look at the numbers. The Global Family Inflation Index showed that essential costs for a typical family in Spain shot up by 78% over the last decade. In the U.S., basic family expenses are on track to hit nearly $82,500 per year by 2035. That’s a huge jump that requires a real strategy to manage.

A budget gives every dollar a purpose. It's the difference between passively watching your money disappear and actively directing it toward the life you want to build together.

The Four Pillars of a Values-Based Budget

At its heart, a successful family budget is built on four simple but powerful pillars. When you get these right, managing your money stops feeling like a chore and starts feeling like a collaborative family project.

To make it simple, I've broken down these core ideas into a quick-reference table.

The Four Pillars of a Smart Family Budget

| Pillar | Description | Key Action |

|---|---|---|

| Values Alignment | This is your "why." It's about defining what matters most to your family—security, freedom, education, legacy—and using those values to guide every decision. | Have open conversations to define your family's top 3-5 financial values. |

| Total Tracking | You can't manage what you don't measure. This means getting a complete, honest picture of every dollar that comes in and every dollar that goes out. | Use an app or spreadsheet to track all income and spending for 30-60 days. |

| Purposeful Allocation | This is where you give every dollar a job. Instead of letting money just sit there or get spent on impulse, you assign it to a specific category. | Create budget categories based on your values and spending habits. |

| Regular Rhythm | A budget is a living document, not a static spreadsheet. This pillar is about setting up a simple routine to review progress, celebrate wins, and adjust as needed. | Schedule a brief weekly check-in and a more detailed monthly review. |

Mastering these four pillars turns budgeting from a dreaded task into a shared mission.

Understanding your spending habits is the first practical step, but it's also worth exploring the psychology of spending and how your brain can sabotage your budget to make the process stick.

Building Your Family's Financial Blueprint

Before you ever open a spreadsheet or crunch a single number, the real work of building a family budget begins with a simple conversation. I’ve seen it time and time again: the most successful financial plans aren’t built on complicated formulas, but on a foundation of shared goals and mutual respect.

Think of it as hosting a "family money summit." This is a calm, no-blame meeting where the only thing on the agenda is getting on the same page. It’s not about digging up past mistakes or figuring out who spent what. It’s about looking forward, together, and deciding what you want your money to do for your family.

Hosting the Family Money Summit

This first meeting really sets the tone for your entire financial journey. It’s so important to create a safe space where everyone, from your spouse to an aging parent living with you, feels comfortable and heard.

The best way to get started is with open-ended questions that focus on dreams and values, not just dollars and cents. These can help break the ice and steer the chat in a really positive direction.

Conversation Starters for Your Summit:

- "If money were no object, what would our family life look like in five years?"

- "What does 'financial security' actually mean to you? What would it feel like?"

- "When we think about our legacy, what’s the most important thing we want to provide for our kids or grandkids?"

- "What's one money-related stress you're carrying that we could tackle as a team?"

Questions like these shift the focus from a mindset of restriction to one of possibility. You’re not just talking about cutting back; you’re designing a life you’re all genuinely excited to live.

The Non-Negotiable First Task: Tracking Everything

Once you have that shared vision, it’s time to get a clear picture of where you are right now. The single most powerful thing you can do at this stage is to track 100% of your income and expenses for 90 days. I know, it sounds like a chore, but it is the only way to get a truly accurate snapshot of your family's financial reality.

This isn’t about judgment or feeling guilty about that daily latte. It’s purely about gaining clarity. You can't build a solid plan on guesswork. You need to know exactly where every dollar is going.

A 90-day tracking period is like a diagnostic test for your financial health. It uncovers the unconscious spending habits and hidden costs that are often the biggest hurdles to reaching your long-term goals.

There are a few great ways to do this, and honestly, the best method is the one your family will actually use consistently.

- The Simple Notebook: A dedicated notebook and pen can be surprisingly powerful. The act of manually writing down every purchase makes you incredibly mindful of your spending in a way digital tools sometimes can't.

- A Shared Spreadsheet: Something like Google Sheets is perfect for this. It allows multiple family members to log expenses in real-time from their phones, creating one central place for all your financial data.

- Budgeting Apps: Apps like YNAB or Monarch Money can sync directly with your bank accounts and credit cards. They do a lot of the heavy lifting by automating the tracking and categorizing transactions for you.

Which tool you pick is far less important than your commitment to the process itself. For these 90 days, every coffee, subscription renewal, grocery run, and utility bill gets recorded. This detailed financial snapshot is the raw material you'll use to build a budget that actually works in the real world—not just on paper. This is the bedrock for learning how to create a family budget that lasts.

Designing Budget Categories for Real Life

So, you've tracked your spending and now you have a pile of raw data. Great start! The next move is to shape that data into a budget that actually fits your family’s unique life. Generic categories like 'food' or 'utilities' are fine, but they don’t tell the whole story, especially for complex, multigenerational households.

Your budget categories should be a roadmap, telling a story about your priorities. They need to be specific enough to give you clarity but flexible enough to roll with life’s punches. This is where we shift from just counting dollars to building a real strategic plan for your family's future.

Moving Beyond Basic Categories

When you're juggling different needs under one roof, a more thoughtful approach is a game-changer. A caregiver managing expenses for an elderly parent and their own kids needs a system that simplifies, not complicates. This is where the idea of 'shared cost centers' can be a lifesaver.

Instead of trying to split every grocery receipt or power bill three ways, you can create a single, unified category like 'Household Operations'. This one bucket can cover all the shared essentials—groceries, utilities, home maintenance, you name it. It streamlines the tracking and acknowledges the reality that you're running one cohesive household, not three separate ones.

This approach is so powerful because it leans into the natural financial efficiencies of a larger household. The way you structure your budget really depends on how many people you're caring for. A recent analysis of household spending patterns showed that in North America, single-person households spend about US$55,760 per person annually. In contrast, five-person households average roughly US$40,400 per person—that’s a 28% drop in per-person spending. The gap in Europe is even wider, with a 55% decrease. You can dig into more of these insights about how household size shapes global economics on weforum.org. Using 'shared cost centers' just makes this reality intentional and a whole lot easier to manage.

Creating Categories That Reflect Your Goals

Your budget categories should also be a mirror, reflecting your family’s unique goals and stage in life. This is how you connect your day-to-day spending to your long-term vision. Generic advice just doesn't cut it when you have specific dreams and responsibilities that define your family.

Let's look at a few real-world examples of creating purpose-driven categories:

- The 'Legacy Fund' for Grandparents: This isn't just a generic 'savings' line item. It’s a specific fund earmarked for creating lasting memories, maybe contributing to a grandchild's education, or funding that special family trip. Naming it gives it power and purpose.

- The 'Career Pivot Fund' for Mid-Life Transitions: For someone thinking about a new career or starting a business, this fund provides a crucial safety net. It allows for intentional risk-taking without putting the family's overall financial stability on the line.

- The 'Elder Care Reserve' for the Sandwich Generation: This category is specifically for future costs tied to aging parents, like home health aides, medical equipment, or accessibility upgrades to the home. Planning for these expenses proactively cuts down on stress when the need suddenly arises.

The names you give your budget categories really matter. "Vacation Fund" feels a lot more motivating than "Discretionary Spending," and "Future Freedom Fund" is way more inspiring than "Retirement Savings."

By designing categories that truly resonate with your family’s values, you transform your budget from a restrictive document into an empowering roadmap. Every dollar you allocate to these categories becomes a tangible step toward achieving what matters most. This personalized approach makes sticking to the plan feel less like a chore and more like a shared family project, ensuring your financial decisions are always aligned with your deepest commitments.

Allocating Your Resources With Purpose

Okay, you’ve tracked your finances and created categories that actually make sense for your family. Now for the fun part: telling your money where to go. This is the allocation phase, where you give every single dollar a job. It's the moment your values and goals start to become your financial reality.

You’ve probably heard of the 50/30/20 rule, which suggests putting 50% of your income toward Needs, 30% toward Wants, and 20% toward Savings. It’s a decent starting point, but let’s be real—modern families, especially those juggling multiple generations, need a bit more flexibility.

The Five Essential Buckets for Family Wealth

Instead of sticking to just three categories, I find it’s more powerful to expand the model into five "buckets." This framework is much more adaptable to what your family is actually dealing with, whether that’s aggressively tackling debt, saving for retirement, or building something for the next generation.

- Needs (Roughly 50%): These are the non-negotiables. Think housing, utilities, groceries, transportation, insurance, and the minimum payments on any debts. Basically, everything required to keep your household running.

- Wants (Roughly 20-30%): This is for the stuff that makes life more enjoyable but isn't strictly essential. We're talking about dining out, hobbies, streaming services, and that family vacation you've been dreaming of.

- Savings (10-20%): This bucket is all about your future. It’s where you fund your emergency savings, retirement accounts, and other big-picture goals like a down payment on a home.

- Debt Reduction (Variable %): This is specifically for any payments you make above the minimums on high-interest debt, like credit cards or personal loans. The percentage here is flexible—if you’re laser-focused on getting out of debt, this bucket might temporarily get a much bigger share of your income.

- Legacy (Variable %): This is a special one. It’s for goals that stretch beyond your own immediate needs—things like contributing to a grandchild's college fund, making charitable donations, or setting up a family trust.

Using these five buckets helps you see exactly where your money is going and allows you to make changes with intention. A retiree, for instance, might allocate more to their Legacy and asset protection, while a young family might pour everything they can into Savings and Debt Reduction.

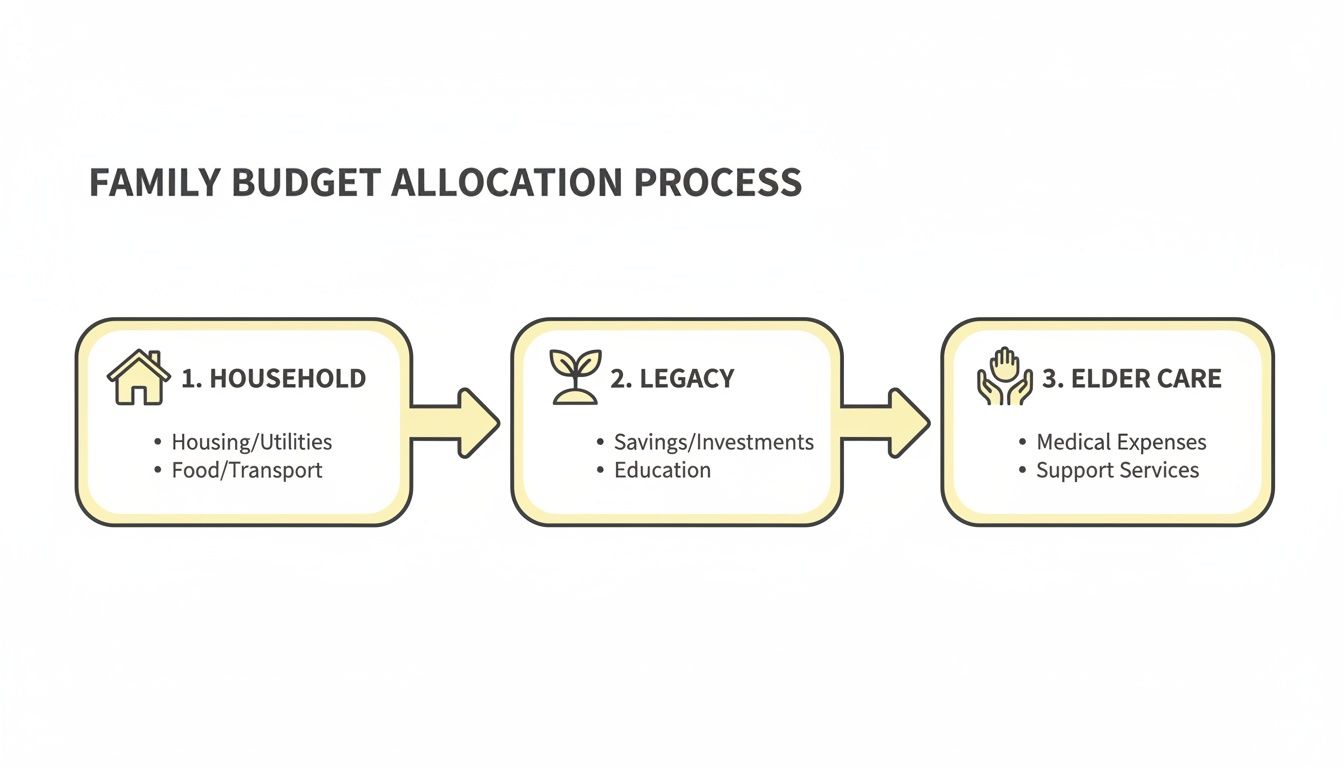

This flowchart shows a simplified view of how your income can be channeled into core areas like running the household and planning for the future.

This visual is a great reminder that every financial choice you make is a step toward building a secure and meaningful future for the people you love.

The Power of Paying Yourself First

If you take only one thing away from this section, let it be this: pay yourself first. Before you spend a dime on discretionary items, you absolutely must set aside money for your Savings, Debt Reduction, and Legacy buckets. This isn't just a nice idea; it's the foundation of building real, long-term wealth.

Your family budget is your roadmap for turning your income, which can fluctuate, into stable, lasting security. We've all seen the stats. The personal saving rate in the United States can be disappointingly low. The families I've worked with who succeed make a simple rule: they pre-commit a percentage of every paycheck—often 10–20% for higher earners, or even 5–10% when things are tight—to savings and debt before anything else. It's amazing how even a small, consistent amount can compound into significant wealth over time.

Here's the magic trick: automation. Set up automatic transfers from your checking account to your savings, investment, and debt accounts for the day after you get paid. This takes willpower completely out of the equation and guarantees you're always making progress on your most important goals.

Once you’ve nailed the habit of saving, the next step is making that money work for you. For those ready to move beyond a simple savings account, it's time to explore how to start investing for beginners and really put your wealth-building on the fast track. By allocating your money with purpose and always paying yourself first, you transform your budget from a boring spreadsheet into a powerful engine for achieving your family's dreams.

Keeping Your Budget Alive with a Simple Rhythm

So you've built your family budget. Great! But here's the honest truth I've learned over the years: a budget fails the second you treat it like a static document, something you create once and then shove in a drawer. Its real power comes from making it a living, breathing part of your family's weekly and monthly life.

This isn't about chasing rigid perfection. It's about finding a simple rhythm that keeps your financial plan relevant, effective, and connected to your goals. This rhythm turns your budget from a spreadsheet into an ongoing, productive conversation—and that's the secret to making it stick for the long haul.

The Quick Weekly Check-In

Think of this as your family's financial huddle. It should take no more than 15-20 minutes a week, tops. I always recommend picking a consistent time, like Sunday evening after dinner, so it becomes a habit.

The goal here is simple: update your spending and see where you stand. All you’re doing is logging transactions from the past week. Did the electric bill come in a little higher than planned? Did you spend less on gas because you worked from home? It’s a quick data-entry session that stops tiny spending leaks from turning into major problems. This weekly touchpoint keeps everyone in the loop and makes staying on track so much easier.

The Deeper Monthly Review

Once a month, you'll want to set aside about an hour for a more comprehensive look. This is where you zoom out from the day-to-day transactions and really look at the big picture. It’s your chance to assess your progress, make adjustments, and—most importantly—celebrate your wins.

This meeting isn't just about crunching numbers; it's a strategy session for your family's finances. You'll analyze trends, talk about upcoming expenses, and make sure your spending categories still make sense for your life.

Your monthly review is your family's financial board meeting. It's where you celebrate progress, solve problems together, and reaffirm your commitment to your shared goals. This transforms budgeting from a chore into a collaborative project.

To keep these meetings positive and productive, I suggest following a simple checklist:

- Review Last Month’s Spending: How did you actually do in each category? Where did you overspend, and where did you come in under budget? No judgment, just facts.

- Celebrate the Wins: Did you crush a savings goal or finally pay off that nagging credit card? Acknowledge it! Celebrating these milestones as a team is huge for morale.

- Look at What’s Coming: Glance at the calendar for the month ahead. Are there birthdays, holidays, car registration fees, or annual subscriptions coming up? Plan for them now.

- Adjust and Allocate: Based on your review, do you need to shift some money around for the upcoming month? Maybe less for groceries and a bit more for home repairs?

- Check in on Your Big Goals: How are you tracking toward your larger savings, debt, and legacy goals? Are you still on the path you set for yourselves?

Adapting to Life's Curveballs

Let's be real—life is unpredictable. A job change, an unexpected medical bill, or even a sudden windfall can throw a wrench in the works. A flexible budget is designed to handle these moments without completely derailing your financial plan. Your monthly review is the perfect time to address whatever life has thrown at you.

Together, you can decide how to adjust. Do you need to temporarily pause contributions to a savings goal? Is it time to tap into the emergency fund? Having a solid safety net is absolutely essential. For more on that, our emergency fund checklist provides must-have steps for true financial resilience.

The key is to adapt with confidence. Your budget is a resilient tool designed for the messiness of real life, not an unbreakable set of rules. This simple rhythm of regular reviews ensures it remains a powerful asset on your family's journey to financial well-being.

Common Questions About Family Budgeting

Even with a perfect plan, hitting a few bumps on the road to a family budget is completely normal. In fact, I expect it. Answering these common questions head-on is often what separates a budget that works from one that gets abandoned after a month.

Think of this as your troubleshooting guide. Let's walk through the most common sticking points I see with families so you can keep moving forward with confidence.

How Do I Get My Spouse or Family on Board with Budgeting?

Here’s the secret: frame it as a team sport, not a punishment. Nobody wants to be put on a "financial diet." The key is to start the conversation with shared dreams, not restrictions.

Instead of talking about cutting back, talk about what you can achieve. Use words like "we" and "us" to make it feel collaborative. Try opening with questions that spark possibility, like:

- "What would give us more peace of mind in our financial life?"

- "What amazing things could we do if we were just a little more intentional with our money?"

- "If we tackled this as a team, what's one big goal we could knock out in the next year?"

A fantastic, no-pressure way to start is to simply track your spending together for one month. No changes, no judgment. Just gather the data. More often than not, this simple exercise reveals surprising spending habits that everyone agrees could be tweaked. When the budget becomes a tool to build a better future together, it stops being a chore and starts being a project.

How Can We Budget with an Irregular Income?

This is a huge one for freelancers, commission-based workers, and small business owners. The financial rollercoaster can feel chaotic, but a solid system brings stability. The trick is to budget based on your lowest-earning month from the past year.

That number becomes your baseline income. It's the rock-solid figure you use to cover all your essential "Needs" every single month. Any money that comes in above that baseline is treated like a bonus. Before it even lands in your main checking account, you allocate it according to a pre-agreed plan.

My favorite strategy for this "bonus" income is to immediately split it into three buckets:

- A "buffer" account that holds one or two months of essential living expenses. This is your safety net.

- An aggressive, extra payment toward any high-interest debt you're carrying.

- A top-up for your long-term savings or legacy funds.

This approach turns unpredictable paychecks from a source of stress into an opportunity to fast-track your goals. It creates a reliable financial floor, even when your income feels anything but.

What Are the Best Tools for Managing a Family Budget?

Honestly, the best tool is the one you'll actually use. There's no magic app or perfect spreadsheet that works for everyone. It all comes down to your family's personality and habits.

For some people, a simple pen and notebook does the trick. The physical act of writing down every dollar spent creates a powerful mindfulness that an app just can't replicate. For others, a shared spreadsheet is perfect because it offers real-time transparency for everyone involved.

Of course, modern budgeting apps can be incredibly helpful. They can link to your bank accounts, automatically categorize spending, and give you visual reports that show you exactly where the money went.

Before you commit, have a family chat. What do you need? Shared access? A simple way to track cash? Grab a free trial of a couple of options and see what sticks. Remember, the goal here is consistency and clarity, not fancy technology.

We Tried Budgeting Before and Failed—How Can We Make It Stick This Time?

I hear this all the time. From my experience, budgets usually fail for two reasons: they're way too rigid, or they aren't connected to a powerful "why." Let's fix both.

First, build in some wiggle room. Life happens. One unexpected car repair can blow up a perfectly crafted budget. That's why you need a "Miscellaneous" or "Stuff Happens" category. Having that buffer means one slip-up won't derail the entire month, making it much easier to hop back on track.

Second, give your money a mission. Instead of a generic "Savings" category, give it a name that fires you up, like the "Future Freedom Fund" or "Grandkids' College Fund." That emotional connection is what will keep you motivated when the daily choices get tough.

Finally, celebrate the small victories. When you do your monthly check-in, point out what went right. Did you nail the grocery budget? Pay off a small debt? Acknowledging your progress makes the whole process feel rewarding and builds the momentum you need to succeed long-term.

At Smart Financial Lifestyle, we believe that making Smart Financial Decisions starts with a clear plan. These tools and mindsets are designed to help your family build wealth and redefine your American dream, one intentional choice at a time. Discover more insights and guidance at https://smartfinancialifestyle.com.