It’s easy to get the terms confused, but the difference between being rich and being wealthy boils down to one simple thing: sustainability.

Being rich is all about high income. Think of a surgeon or a top sales rep pulling in a huge salary. It looks fantastic on paper, but that income stream can dry up in an instant if the job disappears. In sharp contrast, being wealthy is defined by owning assets that do the heavy lifting for you—things that generate income on their own. This is where true, lasting financial security and freedom live, even when you're not actively working.

Understanding The Core Distinction

At its heart, this isn't just a word game. Shifting your focus from "rich" to "wealthy" is a fundamental change in how you see money. One path is focused on temporary cash flow, while the other is all about building permanent asset ownership. Getting this distinction right is the first, and most critical, step toward creating a legacy that lasts for generations and finally achieving genuine peace of mind.

For anyone trying to steer their family's financial future, this concept is foundational. Think about how you’d explain it to your kids or grandkids. Being rich is like having a full bucket of water, but you have to keep running back to the faucet to refill it. Being wealthy is like owning the well itself—it provides water continuously, whether you feel like carrying a bucket that day or not.

To really nail down the difference, here’s what it comes down to:

- Income vs. Assets: Rich people focus on the size of their monthly paycheck. Wealthy people focus on how much their assets are earning for them.

- Consumption vs. Accumulation: A rich lifestyle is often flashy, marked by high spending on luxury goods that lose value. A wealthy lifestyle prioritizes buying more assets that produce income.

- Dependence vs. Freedom: The rich are often shackled to a high-stress, high-paying job. The wealthy have true financial freedom because their assets work around the clock for them.

Rich vs Wealthy At a Glance

To put it all in one place, this table gives you a clear side-by-side look at what separates the rich from the truly wealthy. It’s a handy reference for keeping the core ideas straight.

| Characteristic | Rich (Income-Focused) | Wealthy (Asset-Focused) |

|---|---|---|

| Primary Metric | High annual income or salary | Strong and growing net worth |

| Financial State | Often liquid, high cash flow | Sustainable, self-perpetuating |

| Mindset Focus | Spending and consumption | Saving, investing, and asset growth |

| Time Horizon | Short-term (paycheck to paycheck) | Long-term (multi-generational) |

| Source of Money | Active income (job, business) | Passive income (investments, real estate) |

At the end of the day, a high income alone guarantees nothing. Global data shows that while the top 1% captured 20.3% of global income in 2025, a surprising number of these high earners still live paycheck-to-paycheck. Why? Because income without a plan is just money passing through your hands. It doesn't create lasting prosperity until you make the smart decisions that turn those earnings into wealth. You can learn more about these global inequality trends on inequality.org.

Key Financial Indicators That Separate Rich from Wealthy

To really get what separates the rich from the truly wealthy, you have to look past the fancy cars and expensive dinners and dig into the numbers. Four financial indicators act as a scorecard, showing you whether someone is just living a high-income lifestyle or actually building lasting prosperity. Think of these as a practical way to check your own financial health.

High income is the most obvious sign of being "rich." It's the big salary a surgeon makes or the fat commissions a top real estate agent pulls in. But income is just cash flow. It tells you how much is coming in, not how much is staying and growing. A high earner can easily be broke if their lifestyle eats up every penny they make.

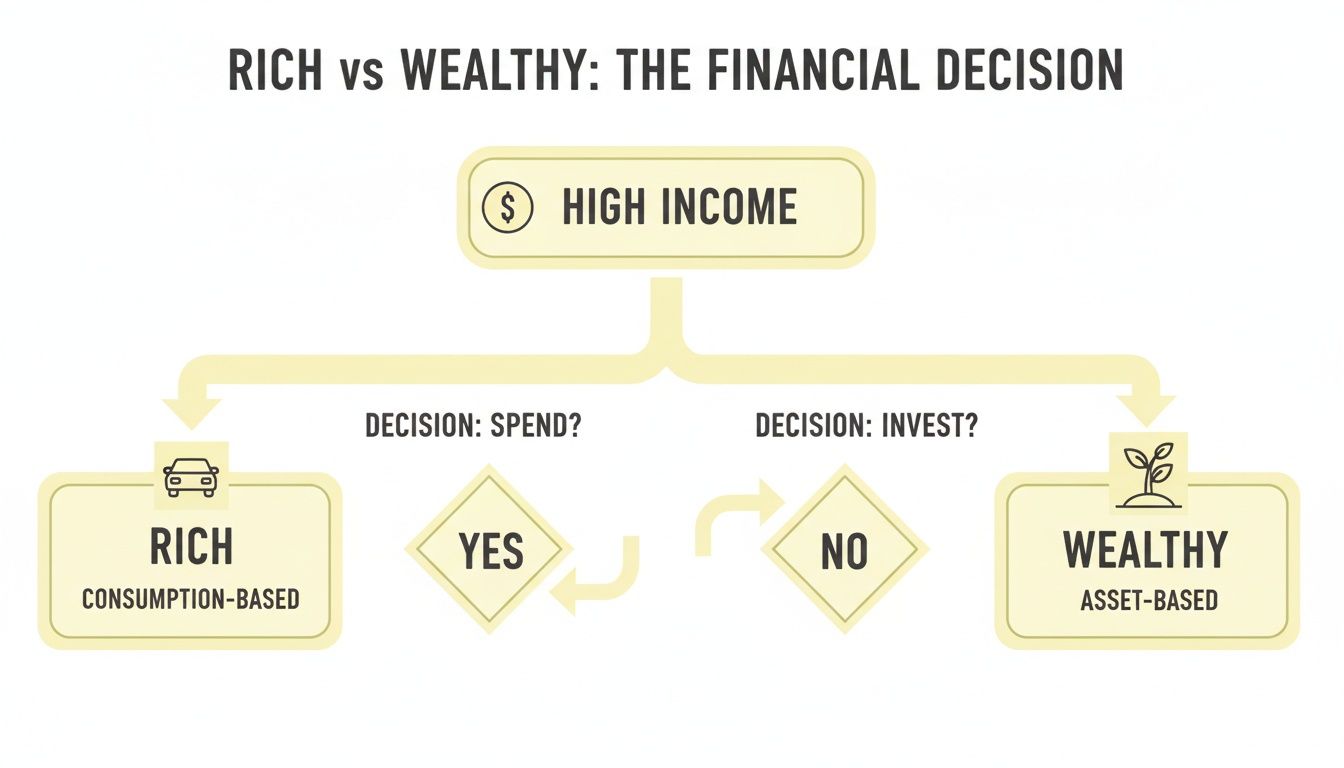

This simple flowchart nails it: high income is just the starting line. The real race begins with what you do next.

It boils down to a simple choice: spend it or invest it. That single decision pretty much seals your financial fate.

Net Worth and Liquidity

This is where net worth comes in, which is the truest measure of wealth. It’s a simple calculation: subtract what you owe (liabilities) from what you own (assets). The result gives you the full, unfiltered picture of where you stand financially.

Someone pulling in a $300,000 salary but drowning in $400,000 of student loans and credit card debt actually has a negative net worth. On the flip side, a schoolteacher who has been diligently investing for 20 years might have a modest salary but a net worth of over $1 million. If you're curious about where you stand, you can learn more about the average net worth by age and percentile in our detailed guide.

Another critical indicator is liquidity. This is all about how quickly you can get your hands on cash without being forced to sell your core assets, like your house or stock portfolio.

A wealthy individual has enough liquid cash or cash equivalents (like money market funds) to cover emergencies or jump on opportunities. This protects their long-term investments from being sold off at the worst possible time, like during a market crash.

That financial cushion is a hallmark of genuine security.

The Power of Passive Income

Finally, let’s talk about the engine that keeps wealth growing: passive income. This is the money your assets earn for you, not the money you earn by trading your time. For anyone chasing financial freedom, this is the ultimate goal.

Common sources of passive income include things like:

- Rental income from investment properties

- Dividends paid out from a stock portfolio

- Interest from bonds or high-yield savings accounts

- Royalties from creative work or intellectual property

When a rich person stops working, their income stops. But for a wealthy person, their assets keep generating income, day in and day out, whether they're working or not. This steady, automated cash flow is what allows wealth to compound, creating a legacy that can last for generations. It’s the ultimate separator between temporary riches and enduring prosperity.

The Mindset and Habits That Build Sustainable Wealth

Beyond the balance sheets and income statements, the real gap between being rich and being truly wealthy is carved out by psychology and daily habits. It’s less about how much you earn and far more about how you think about the money you have. A high income provides the fuel, but a wealth-building mindset is the engine that actually gets you there.

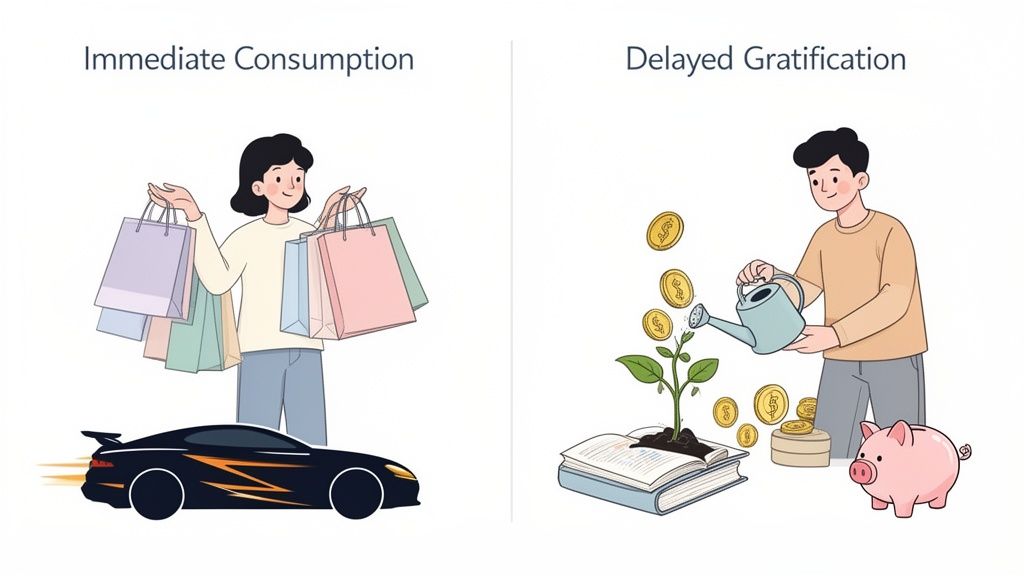

The "rich" mindset often revolves around immediate consumption. It’s driven by the desire to show off success through status symbols—the luxury car, designer clothes, and five-star vacations. This approach is all about spending what you make, which, more often than not, leaves very little on the table for long-term growth.

In stark contrast, the wealthy mindset is built on delayed gratification and a relentless focus on asset accumulation. Instead of asking, "What can I buy with this money?" the wealthy person asks, "How can I make this money work for me?" This one shift in perspective is what powers sustainable prosperity.

From Spending to Investing

Let's imagine two families who each get a $20,000 bonus. The family with a "rich" mindset might see this as the perfect excuse for a once-in-a-lifetime luxury getaway. They’ll have an amazing time and create some great memories, but once the vacation is over, that $20,000 is gone for good.

The family with a "wealthy" mindset sees that same bonus as seed money. They might funnel it into a dividend-paying stock portfolio or use it as a down payment on a small rental property. Sure, it doesn’t deliver that instant thrill, but it creates an asset that will generate passive income for years to come.

"Wealth is a measurement not of your capital, but of the growth of your capital. Either your capital is growing at a pace greater than that which you are withdrawing from it... or it's not. And if it's not, I don't care how shiny it looks from the outside—it's not wealth."

That quote nails the essence of the wealthy mindset. It’s about making sure your financial foundation is always growing, not shrinking.

Core Behavioral Differences

The path from being a high-income earner to a genuinely wealthy individual is paved with intentional, daily choices. These are the behaviors, practiced consistently over decades, that separate fleeting riches from a lasting legacy. Here’s a look at how the two approaches really stack up.

Comparing Mindsets: Rich Habits vs. Wealthy Behaviors

The table below breaks down the fundamental differences in philosophy and daily actions that distinguish the rich from the wealthy. It's these small, consistent behaviors that compound over time to produce dramatically different financial outcomes.

| Aspect | The Rich Mindset (Spending & Status) | The Wealthy Mindset (Building & Security) |

|---|---|---|

| Financial Philosophy | Money is a tool for immediate enjoyment and status. | Money is a tool for creating freedom and opportunity. |

| View on Debt | Often comfortable with "lifestyle debt" for cars and vacations. | Averse to consumer debt; uses leverage strategically for assets. |

| Learning | Focuses on skills to increase active income. | Prioritizes continuous financial education and investing. |

| Long-Term Goal | Maintain a high-consumption lifestyle. | Build a self-sustaining asset base for future generations. |

At the end of the day, a rich person’s financial security is tied directly to their ability to keep earning. A wealthy person’s security comes from the assets they’ve already put to work. This distinction in mindset and habits is what makes all the difference in achieving true financial independence.

Understanding Global Wealth and Its Impact on Your Family

If you zoom out and look at your family's financial journey from a global perspective, one powerful truth snaps into focus: real financial strength comes from owning assets, not just earning a big paycheck. Look at any developed nation, and you'll see that long-term prosperity is built on financial assets, not salaries. This isn't just theory—it’s a critical piece of the puzzle for anyone nearing retirement or trying to navigate the Great Wealth Transfer.

Thinking about wealth this way makes it feel less like an abstract number and more like something you can actually build. It’s a powerful reminder that creating a solid base of assets is the most reliable way to secure your family's future, even as economic inequality seems to grow. It’s the real difference between a temporary financial high and security that lasts.

The Global Picture of Asset Ownership

When you look at how wealth is spread across the globe, the line between being rich and being wealthy becomes incredibly sharp. A high income feels great, but it can disappear in an instant. True wealth is about owning and controlling assets that go to work for you.

Imagine an experienced advisor explaining this at a family meeting: being rich is like the top 10% of the world holding 85.1% of global wealth—an enormous but shaky number. But being wealthy is like the top 10% in developed nations holding a still-massive 60.4% on average—a sum built to handle college tuition, down payments, and elder care without breaking a sweat.

This is a huge deal for grandparents who want to leave a meaningful legacy. The United States is a giant in this landscape, home to 39.7% of the world’s millionaires, which is four times more than China. This dominance is overwhelmingly driven by financial assets, with securities making up more than a third of the typical portfolio. You can dig deeper into these numbers in the global wealth findings from Allianz.

Why This Matters for Your Family’s Future

Seeing these big-picture trends really brings the importance of accumulating assets back home. It’s not about chasing statistics; it’s about using the proven strategies that create stability for generations. The data is clear: people who build lasting wealth do it by systematically turning their income into a growing portfolio of assets.

This strategy gives you a buffer against all the curveballs life throws your way. A high salary can vanish with a single layoff, but a diversified portfolio of stocks, bonds, and real estate keeps generating income and growing in value. This is the foundation that allows families to:

- Fund major life events without having to take on crippling debt.

- Navigate economic downturns with a sense of confidence.

- Create a legacy that gives the next generation a real head start.

When you align your family’s financial strategy with these time-tested principles, you start moving beyond the limits of just being rich. You begin the essential work of building a financial structure designed to last, giving you and your loved ones security and peace of mind for decades.

Practical Strategies for Transitioning From Rich to Wealthy

Making the jump from a high-income lifestyle to lasting wealth isn't something that happens by accident. It takes a deliberate, actionable plan. The whole idea is to stop trading your time for money and start making your money work for you, creating a system that builds prosperity pretty much on autopilot. It’s about moving away from depending on your next paycheck and toward genuine financial independence.

This journey kicks off with a simple family financial plan. No need for a 100-page document; just something that outlines your goals, spending, and investment strategy is enough to bring some much-needed clarity. After that, it's all about execution—making consistent, smart decisions that stack up over time.

Building Your Wealth-Generating Engine

You might be surprised to learn that the most effective wealth-building strategies are often the simplest ones. At its core, the goal is to create a powerful, self-sustaining financial engine that grows your net worth month after month, year after year.

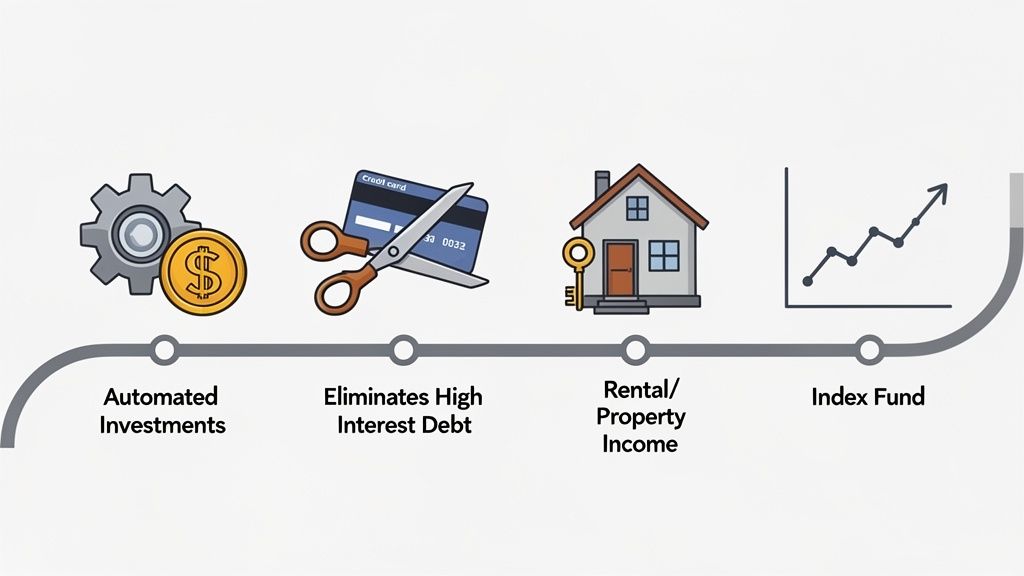

Here are the four foundational pillars to start building on:

- Automate Your Investments: This is non-negotiable. Set up automatic transfers from your checking account into low-cost index funds or ETFs. This "pay yourself first" method ensures you're consistently buying assets without a second thought, taking the emotion completely out of the equation.

- Eliminate High-Interest Debt: Think of consumer debt from credit cards or personal loans as a wealth-destroying fire. Create an aggressive plan to put it out. The guaranteed return you get from wiping out an 18% interest debt is a win you’ll almost never beat in the stock market.

- Develop Diverse Income Streams: Lasting wealth is rarely built on a single paycheck. Start exploring opportunities for passive income, whether that's through dividend stocks, real estate rentals, or even a small side business. For some practical ideas, check out our guide on how to create multiple income streams.

- Initiate Multi-Generational Conversations: This is a big one for family leaders. Talking openly about financial goals and legacy is crucial. Discussing wealth transfer and financial education early and often ensures the values—and the assets—you build are preserved for the generations that follow.

A Legacy-Focused Perspective

Thinking about the rich vs. wealthy distinction is also about understanding your place in the larger financial story. While being rich might be about today's income, becoming wealthy is about building a foundation that stands the test of time.

While the wealthiest 1% captured 20.3% of global income in 2025, true wealth is what holds up the entire pyramid. The U.S. alone holds 35% of worldwide wealth, not just from big paychecks but from a massive base of assets. A monumental $83 trillion wealth transfer is on the horizon, set to shift significant capital and empower new generations.

This data, highlighted in reports like the Global Wealth Report by UBS, makes one thing crystal clear: legacy is built on assets, not income. The families who quietly build their net worth through smart, consistent strategies are the ones who truly outlast the temporary flash of just being rich.

By focusing on these practical steps, you can start your own transition from simply earning a high income to building a life of true, lasting wealth and security.

Building a Legacy Beyond Money

The journey from earning a high income to building lasting prosperity eventually moves beyond the mechanics of money. It’s about figuring out your "why." The real payoff isn't just watching your net worth grow; it’s the profound freedom, security, and opportunity that true wealth provides for you and your family.This is where the distinction between wealthy and rich becomes deeply personal. Being rich might get you the luxuries, but being wealthy gives you choices. It's the ability to support loved ones through tough times, chase passions without worrying about the bills, and create a launchpad for the next generation.

Redefining Your Definition of Success

When you really think about it, success isn't defined by the flashy, high-spending lifestyle. It's found in the quiet confidence of knowing your financial foundation is rock-solid, built on assets that are working for you around the clock. This kind of security lets you focus on what actually matters.

True wealth is about more than capital; it's about the ability to support your family, create opportunities, and build a meaningful life. It's the freedom to live by your values, unburdened by financial stress.

This shift in perspective transforms money from a simple tool for buying things into a powerful instrument for creating a lasting impact. Building this kind of legacy requires a clear vision and a long-term plan. For anyone looking to structure their financial future, understanding the principles of multi-generational wealth planning is a critical first step.

Your Path to Lasting Prosperity Starts Now

The strategies we've discussed aren't just for the ultra-rich; they are accessible principles for anyone committed to building a life of meaning and security. By prioritizing asset accumulation over immediate spending, you're laying the groundwork for a future where your money works to support your family’s dreams for decades.

Start today. Every smart financial decision, no matter how small, is another step toward a life of genuine prosperity. It’s a journey that creates not just financial independence, but a legacy of security and opportunity that will echo through generations.

Rich vs. Wealthy: Your Questions Answered

Digging into the difference between a high income and true financial freedom brings up some great questions. Here are the answers to the ones I hear most often from people on the journey from earning a lot to building something that lasts.

Can You Be Both Rich and Wealthy at the Same Time?

You absolutely can. In fact, that's the ideal place to be. Being both rich (pulling in a high income) and wealthy (owning a high net worth) happens when a high earner makes a habit of turning that income into assets that work for them.

Think of a successful business owner who doesn't just spend their profits but consistently plows them back into a mix of real estate and a solid stock portfolio. They're rich because the business generates a ton of cash. They're wealthy because their assets are growing, throwing off their own income, and securing their future whether the business has a good month or not.

It all comes down to discipline. A big income is the fuel, but a wealth-building mindset is the engine. The goal is simple: make sure your assets are growing faster than your spending.

What Is the First Step to Becoming Wealthy with a High Income?

The single most important first step is to pay yourself first and automate it. Before a dime goes to bills, rent, or a fancy dinner, you need to have automatic transfers set up. Money should move from your paycheck directly into your investment accounts without you ever having to think about it.

This one move does two critical things. It forces the habit of building assets, and it stops "lifestyle creep" dead in its tracks. Lifestyle creep—where your spending magically rises to meet every pay raise—is the number one reason high earners fail to build real wealth.

How Long Does It Realistically Take to Build Wealth?

Building wealth is a marathon, not a sprint. Anyone who tells you otherwise is probably selling something. For most people, it takes decades of consistent saving and investing to let the power of compound interest really work its magic.

A realistic timeline is somewhere in the ballpark of 15 to 25 years of disciplined financial habits. That’s enough time to ride out the market’s ups and downs and let your investments generate serious momentum. Patience isn't just a virtue here; it's a non-negotiable asset.

Is It Possible to Become Wealthy on an Average Income?

Yes, without a doubt. Wealth is a game of habits, not just income. Someone making an average salary who diligently saves 20% of their income, steers clear of consumer debt, and invests wisely can absolutely build a multi-million dollar net worth over their career.

Their path might be a bit slower than a high-flyer's, but the principles are identical. It’s the ultimate proof that what you keep and grow is infinitely more important than what you make.

At Smart Financial Lifestyle, our mission is to give you the clarity to make financial decisions that build a legacy. To start your journey, explore our resources at https://smartfinancialifestyle.com.