Ever wonder if you’re financially “on track”? It’s a natural question, but finding a real answer is tough. Averages don’t help much since they’re often skewed by the ultra-wealthy. This is where understanding your net worth by age percentile becomes an incredibly useful gut check.

A Better Way to Measure Your Financial Progress

Think of it like this: if you score in the 75th percentile on a test, it just means you did better than 75% of the people who took it. It’s the same with your finances. If your net worth is in the 75th percentile for your age, you’re financially ahead of three-quarters of your peers.

This gives you a much more grounded benchmark than comparing yourself to some national average that lumps a 25-year-old just starting out with a 65-year-old who’s been saving for decades.

This isn’t about keeping up with the Joneses or feeling behind. It’s a private way to see how you’re doing compared to others who have had a similar amount of time to work, save, and invest.

Why Age-Based Benchmarks Matter

Building wealth is a long game, and it happens in stages. Someone just starting their career is wrestling with different challenges and opportunities than someone nearing retirement.

- Early Career (Under 35): The main focus is usually on boosting income and tackling debts like student loans. Net worth is often low, but the potential for growth is massive.

- Mid-Career (35-54): This is when things really kick into gear. It’s often a time of peak earnings, buying a home, and seeing investments start to compound seriously.

- Late Career & Retirement (55+): The goal shifts from growing wealth to protecting it and figuring out how to turn those assets into a steady income stream.

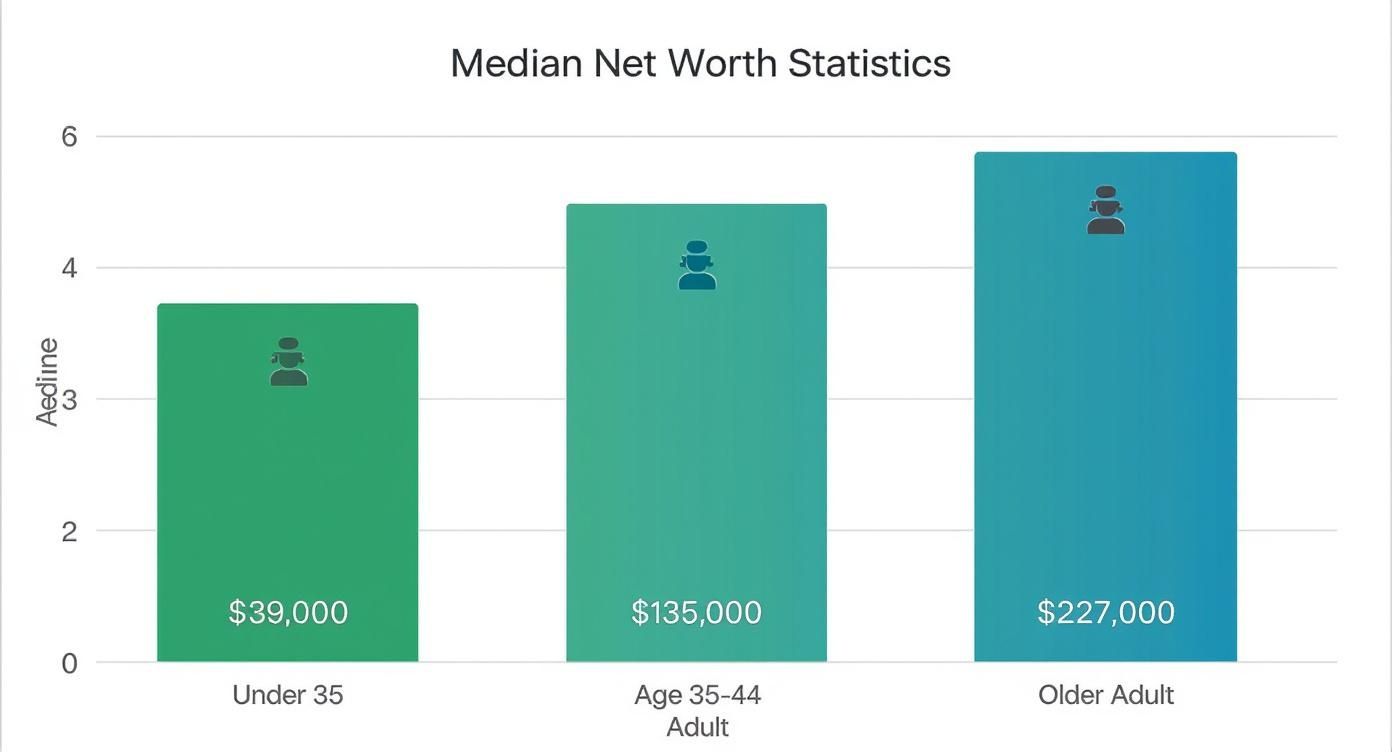

The data backs this up. In 2022, the median net worth for Americans under 35 was $39,000. That number jumps to $135,300 for the 35-44 age group and hits $246,700 for those 45-54. These numbers show just how much our financial lives evolve, making age-specific comparisons the only ones that really make sense.

Using percentiles helps you set realistic goals. It’s an acknowledgment that building wealth is a marathon, not a sprint, and your progress should be measured against the right milestones.

Ultimately, knowing your net worth by age percentile provides context. It helps you see where you stand, appreciate how far you’ve come, and make smarter moves for the future. You can learn more about how planning and saving for your future helps you build wealth in our detailed guide. Once you understand these benchmarks, you can build a clear, actionable path toward your long-term goals.

US Net Worth Percentiles by Age

Now that we’ve covered why comparing your net worth to your peers makes sense, let’s dig into the actual numbers. Seeing where you stand is often the first real step in building a financial plan that feels grounded in reality, not just wishful thinking. It’s an objective snapshot of how things are going.

Below is a full breakdown of net worth by age percentile here in the U.S. This isn’t about judgment; think of each column as a financial milestone for that particular chapter of life. The table shows you the nest egg required to land in the 25th, 50th (median), 75th, 90th, and 95th percentiles for your age group.

Finding Your Financial Standing

To find your place, just locate your age bracket in the first column. From there, scan across the row and see how your current net worth stacks up against the different percentile markers. For instance, if you're 40 and have a net worth of $200,000, you’d find yourself comfortably between the 50th and 75th percentiles for the 35-44 age group.

Here are the latest figures from the most recent Survey of Consumer Finances, which gives us a solid, data-backed look at how American households are doing.

U.S. Net Worth by Age Percentile

| Age Group | 25th Percentile | 50th Percentile (Median) | 75th Percentile | 90th Percentile | 95th Percentile |

|---|---|---|---|---|---|

| Under 35 | $4,200 | $39,000 | $124,100 | $355,900 | $614,300 |

| 35–44 | $37,000 | $135,600 | $412,500 | $958,800 | $1,632,500 |

| 45–54 | $65,500 | $247,200 | $716,400 | $1,732,800 | $2,968,200 |

| 55–64 | $92,900 | $392,600 | $1,118,500 | $2,789,500 | $4,570,300 |

| 65+ | $83,300 | $454,500 | $1,342,700 | $3,586,300 | $6,128,100 |

Seeing the data laid out like this really highlights the natural progression of wealth-building over a lifetime. The numbers start small and then pick up serious steam in the middle and later years.

This infographic paints a clear picture, visualizing how that median net worth really starts to climb as people move through different life stages.

You can see how wealth accumulation really takes off during those mid-career years. It’s a powerful reminder of just how critical that window of time is for financial growth.

Decoding the Story Behind the Numbers

These figures tell a pretty compelling story about the typical American financial journey. Each age bracket is dealing with its own unique challenges and opportunities, which directly shape how wealth gets built. Understanding this context is way more important than just staring at the raw numbers.

Your net worth percentile is not a final grade on your financial life; it's a diagnostic tool. It shows you what’s working and where you might need to adjust your strategy as you move through different seasons of life.

So let's pull back the curtain on each age group to get a better feel for what these benchmarks truly represent.

Under 35: The Foundation Years

For anyone under 35, the numbers can look a little discouraging at first glance. This is the era of getting a career off the ground, chipping away at student loans, and maybe—just maybe—saving for a down payment. The median net worth of $39,000 perfectly captures that reality.

- Key Milestones: Landing that first "real" job, finally starting a 401(k), and figuring out how to budget are the big wins here.

- Common Challenges: Crushing student debt can be a major anchor on net worth, and lower starting salaries make it tough to save aggressively.

- Strategic Takeaway: The single greatest asset you have at this age is time. The focus should be on building rock-solid financial habits. Automating savings and investing consistently, even if it's just small amounts, lays the groundwork for incredible compound growth down the road.

35 to 54: The Peak Accumulation Years

This is where the magic starts to happen. For the 35-44 and 45-54 age groups, financial momentum really starts to build as they hit their peak earning years. Careers are more established, incomes are climbing, and big assets like a home start building serious equity. You can see it in the data, with the median net worth jumping from $135,600 to $247,200 during this stretch.

These middle years are absolutely crucial for kicking wealth-building into high gear. Mortgages are being paid down, retirement contributions are getting maxed out, and investment portfolios have had more time to cook. Of course, this is also when the financial pressures of raising kids and caring for aging parents often show up, making every financial decision feel that much more critical.

55 and Over: The Preservation and Legacy Years

As people get closer to retirement, the entire game shifts from accumulation to preservation. The median net worth for the 55-64 group is a hefty $392,600, a testament to a lifetime of working and saving.

For the 65+ crowd, sitting on a median of $454,500, the main goal is making sure that nest egg lasts. This means creating reliable income streams from their assets, planning for healthcare costs, and thinking about how to pass wealth to the next generation. It’s a time to enjoy the fruits of decades of labor while making sure the foundation is secure for the long haul.

By understanding the story behind your net worth by age percentile, you can move past simple comparison and start making smart, confident choices for your own financial future.

Exploring the Path to the Top 1 Percent Net Worth

Beyond the usual benchmarks, there's a goal many of us quietly aspire to: joining the top one percent. This isn't just a single number; it's a moving target that shifts dramatically as we get older. Reaching this elite tier requires a completely different level of financial strategy and discipline, one that goes far beyond standard savings advice.

The climb to the top isn't a straight line. It's usually a mix of high income, savvy investing, starting a business, or an exceptional career path. Looking at the net worth by age percentile thresholds for this group gives us a much clearer picture of what it takes to build exceptional wealth at different stages of life.

What It Takes to Join the Elite

The financial bar for entering the top 1% starts out surprisingly low and then grows exponentially. For example, the top 1% net worth for Americans aged 18-24 is around $435,076, which climbs to $606,188 for those 25-29. That's a huge jump, and it shows just how fast high earners can build wealth right after graduation. You can discover more insights about the top 1% at every age to see exactly how these numbers evolve.

Once you hit your 30s and 40s, the threshold soars into the millions. This reflects decades of compounding returns, business growth, and making the right money moves year after year.

The journey to the top 1% is less about a single lucky break and more about a sustained series of smart, intentional financial decisions. It combines high earning potential with an even higher savings rate and a sophisticated investment approach.

Getting to this level often means mastering a few key financial areas.

Common Traits of Top 1% Wealth Holders

While every story is unique, the people who reach the top 1% tend to share some powerful financial habits. These aren't secrets—they’re just principles applied with extraordinary consistency.

- High-Income Generation: Many are high-earning professionals like doctors, lawyers, and executives, or they're successful business owners who have created multiple income streams. Their focus isn't just on saving; it's on maximizing their earning power first.

- Aggressive Investment Strategies: They typically have a high tolerance for calculated risk and are heavily invested in equities, real estate, and private businesses. They don't let cash just sit on the sidelines.

- Tax Efficiency: Minimizing what they owe in taxes through legal and strategic planning is a core part of their wealth-building engine. This includes maxing out retirement accounts, using tax-loss harvesting, and making smart decisions about when to take gains.

- Leveraging Debt Wisely: Instead of seeing all debt as bad, they often use leverage—like real estate mortgages or business loans—as a tool to acquire assets that grow in value.

For those in this high-net-worth category, financial planning becomes more about asset protection and building a legacy. You can read more about the advanced strategies involved in retirement planning for high net worth individuals.

Ultimately, studying the top 1% offers valuable lessons for anyone looking to improve their financial situation. It underscores the importance of a growth mindset, continuous learning, and a proactive approach to managing your money. By adopting these principles, you can build a stronger financial future, no matter which percentile you’re aiming for.

A Global Perspective on Net Worth

It's one thing to know where you stand financially in the U.S., but widening the lens to a global view gives you a much richer perspective. The core principles of building wealth—spend less than you earn, invest the difference—are pretty much universal. But the economic game board you're playing on? That changes everything.

Taking a quick look at other developed nations, like the United Kingdom or Canada, shows just how much different systems can shape a family's financial journey. A simple currency conversion just doesn't tell the whole story.

Several key factors are at play here:

- Real Estate's Role: In many parts of the U.K. and Canada, owning a home is a massive driver of net worth. It often makes up a much bigger piece of a family's financial pie earlier in life compared to what we see in the States.

- Pension Systems: The strength of government and employer-sponsored pension plans varies wildly. In countries with more robust systems, the pressure on individuals to save for their own retirement can look very different.

- Money Culture: How people feel about debt, savings, and investing is deeply cultural. Some cultures might laser-focus on paying off a mortgage above all else, while others might be more aggressive with stock market investments.

All these ingredients create unique recipes for hitting those big financial milestones.

A Look at the UK and Canada

To see how this plays out, let's look at a few numbers. In the United Kingdom, the wealth-building path follows a familiar upward slope. The median net worth for a Brit aged 25-34 is about £109,800. That number swells to an impressive £502,500 for those between 65 and 74, proving that long-term saving and investing pays off no matter where you live. You can discover more insights about these U.K. benchmarks and see the clear parallels in our financial life stages.

This is a stark contrast to the U.S. median of $39,000 for those under 35. That gap is likely a result of things like America's heavy student loan burden and different timelines for buying a first home.

Over in Canada, a 25 to 29-year-old has a median net worth of around $85,000 CAD, which is a pretty strong start often tied to the country's housing market. The bar for entering the top 1% also shifts; in your late twenties in Canada, it takes over $450,000 CAD, a different goalpost than you'd find in the U.S.

Comparing your net worth by age percentile globally isn't about finding a "winner." It's about recognizing that your financial plan must be tailored to the economic environment you live in.

What These Comparisons Really Teach Us

These international snapshots drive home a critical truth: while the end goal of financial security is universal, the rulebook changes depending on where you're playing the game. Someone mapping out their retirement in London is dealing with entirely different housing costs, tax laws, and government benefits than a person doing the same in Chicago.

Ultimately, looking at global net worth by age percentile data reminds us that a solid financial strategy has to be rooted in your reality. It pushes us to think beyond the raw numbers and truly understand the forces shaping our ability to build, protect, and one day pass on our wealth.

Practical Steps to Improve Your Net Worth Percentile

Knowing your net worth by age percentile is the starting point. The real work—and the real reward—comes from taking action to build a stronger financial future.

The good news? You don't need a lottery win or some stock market miracle. Improving your financial standing really just boils down to making a string of smart, consistent decisions in three key areas of your life.

It helps to think of your net worth as a simple equation: Assets - Liabilities = Net Worth. If you want that final number to go up, you have two levers to pull. You can either increase what you own (assets) or decrease what you owe (liabilities).

Of course, the best approach is to do both at the same time. Let’s break down how to tackle each side of that equation.

Boost Your Income to Grow Assets

Your ability to earn money is the most powerful engine you have for building wealth. A bigger income gives you more fuel to save, invest, and knock out debt that much faster.

- Advance Your Career: The most direct path to earning more is usually right where you are. Get proactive about seeking promotions, learn to negotiate your salary based on what the market is paying, or pick up new skills that make you indispensable in your field.

- Develop a Side Hustle: In today's economy, it's never been easier to create a second stream of income. You could freelance with your existing professional skills, turn a hobby into a small business, or join the gig economy. Even an extra $500 a month can make a huge difference in how quickly you reach your goals.

Systematically Reduce Your Liabilities

Debt is a major drag on your net worth. It’s like an anchor holding you back from sailing forward. A focused plan to eliminate it is one of the fastest ways to watch your percentile ranking climb.

There are two popular and highly effective strategies for getting out of debt:

- The Debt Snowball Method: You list all your debts from the smallest balance to the largest. Then, you make minimum payments on everything except the smallest one—you throw every extra dollar you have at that one until it's gone. Once it's paid off, you roll that payment amount over to the next-smallest debt, creating a "snowball" of momentum. This method is fantastic for motivation.

- The Debt Avalanche Method: With this approach, you list your debts by interest rate, from highest to lowest. You'll make minimum payments on everything but attack the debt with the highest interest rate first. While it might feel a bit slower at the start, this strategy saves you the most money in interest payments over the long haul.

Tackling debt isn't just a numbers game; it's about reclaiming your financial freedom. Every single payment is a step toward owning your future outright, freeing up your income for building wealth instead of just servicing interest.

Which strategy is right for you? It really depends on your personality. Do you thrive on quick wins to stay motivated (Snowball), or are you purely focused on the math (Avalanche)? For a deeper look, check out our guide on how to pay off debt faster without making more money.

Intelligently Increase Your Assets

Once you have a good handle on your income and your debts, the next move is to put your money to work. This is where you build true, lasting wealth—by consistently investing and making smart ownership choices.

- Automate Your Investments: Make investing a habit you don't even have to think about. Set up automatic transfers from your checking account to your retirement and brokerage accounts on every payday. This "pay yourself first" approach ensures you're always building your asset base.

- Maximize Retirement Accounts: Don't leave free money on the table. Take full advantage of tax-advantaged accounts like a 401(k) or an IRA. If your employer offers a match on your 401(k) contributions, contribute at least enough to get the full match. It's an instant, guaranteed return on your money.

- Invest Beyond Retirement: While retirement accounts are a must, you should also think about building wealth in a standard taxable brokerage account. It gives you far more flexibility and access to your money for big goals that pop up before retirement, like a down payment on a house or seed money for a business.

- Make Smart Property Choices: For most families, their home becomes their single largest asset. Making a wise purchase, building equity over the years, and being careful not to over-leverage yourself can become a powerful cornerstone of your net worth.

By focusing on these three pillars—earning more, owing less, and owning more income-producing assets—you create a powerful system for climbing up the net worth by age percentile rankings. It’s the small, steady actions in each of these areas that compound over time and lead to incredible financial progress.

Interpreting Net Worth Percentile for Future Planning

Finding out your net worth by age percentile feels a bit like getting a financial report card. It's a powerful number, but it's not a final grade on your success or failure. Think of it more like a diagnostic tool—a way to see what's working and pinpoint exactly where you have the most room to grow.

The real power of this data comes alive when you use it to look forward, not just back. Your percentile tells a story about your past decisions, sure, but your plan for the future is what will determine the chapters yet to be written. This isn't about chasing a number on a chart; it's about turning that insight into a clear, personalized roadmap.

When you understand what the numbers mean for your specific stage of life, you can transform a simple benchmark into concrete goals and wealth-building habits that actually stick. Let’s break down how to read your results and build a plan that truly fits you.

Turning Insights into Action at Every Age

Your strategy for building wealth has to evolve as you do. The opportunities and challenges you're facing in your 20s are a world away from those in your 50s. If your financial plan doesn't adapt to your age, you'll be making decisions that are out of sync with your long-term vision.

Here’s how you can translate your percentile into a smart plan, no matter where you are in life:

- For Young Adults (Under 35): Your greatest asset is time. Even if your net worth is in a lower percentile because of student loans or just starting your career, every dollar invested now has decades to compound. Your focus should be on creating rock-solid savings habits, automating your investments, and aggressively knocking out any high-interest debt.

- For Mid-Career Professionals (35-54): This is your peak accumulation phase. If you're at or above the median, it's time to hit the accelerator. Max out those retirement accounts and start exploring other investment vehicles. If you feel like you're behind, the game plan shifts to boosting your income and making catch-up contributions.

- For Near-Retirees (55+): The focus shifts from growth to preservation. The goal now is to protect what you've built and create reliable income streams that will last through retirement. A high percentile means your plan is working; now it's all about managing risk and fine-tuning your withdrawal strategy.

Your net worth percentile is a single frame in a very long movie. The key is not to fixate on that one image, but to use it as motivation to direct the rest of the story toward a secure and prosperous ending.

A Personalized Roadmap for Your Future

Ultimately, your net worth by age percentile is just a number. What truly matters is what you do with it.

View it as a check-in, not a final score. Pinpoint just one area where you can make a change—maybe it’s increasing your savings rate by 2%, throwing an extra $100 at a loan each month, or finally opening that brokerage account you’ve been putting off.

These small, intentional actions are what build real wealth. They are the steps that move you from one percentile to the next and, more importantly, get you closer to the financial peace and security you deserve.

Common Questions About Net Worth Percentiles

When you start digging into net worth percentiles, a few questions always pop up. It's totally normal. Let's walk through some of the most common ones we hear, breaking them down into simple, practical answers.

Think of this as your go-to guide for making sense of the numbers and what they really mean for your family's financial story.

How Is Net Worth Actually Calculated for These Tables?

It’s simpler than you might think. When you see those percentile charts, the net worth number comes from a straightforward formula: Total Assets - Total Liabilities.

- Assets are everything you own that holds value. This isn't just the cash in your bank account; it includes your investment portfolio (stocks, bonds), retirement accounts (like your 401(k) or IRA), the equity you have in your home, and even the value of your car.

- Liabilities are just the opposite—it's everything you owe. Think mortgages, student loans, car loans, and any outstanding credit card balances.

Subtract what you owe from what you own, and that final number gives you a clear snapshot of your financial health.

Does My House Really Count Toward My Net Worth?

Absolutely. For most American families, the equity in their primary home is a huge piece of their net worth puzzle, and it's definitely included in the Federal Reserve data. Home equity is simply the market value of your house minus whatever you still owe on the mortgage.

Over a lifetime, a home often becomes the single largest asset a family owns and a major engine for building wealth.

But here’s a crucial point to remember: while home equity is a massive part of your net worth, it's not liquid. You can't just spend it without selling your house or borrowing against it. A truly balanced financial picture includes a healthy mix of both real estate and more accessible financial assets.

What’s a "Good" Net Worth Percentile to Shoot For?

Honestly, what’s “good” is completely personal and depends on your own life goals. But if you’re looking for a solid benchmark, a great initial target is hitting the 50th percentile (the median) for your age group.

Getting to the median means you're doing better financially than half of your peers. It's a strong signal that you're on the right track. Once you're there, aiming for the 75th percentile is a fantastic next step. Reaching that level puts you in the top quarter of your age group and usually means you've achieved a significant degree of financial security.

Why Does Net Worth Often Drop in Late Retirement?

It’s pretty common to see net worth peak somewhere around retirement age (usually between 65 and 74) and then start to gently decline. This isn't a red flag or a sign of trouble; it's a natural and expected part of the financial lifecycle.

Retirement marks a shift from saving and growing your assets to actually using them to live on. This phase is called decumulation, and it involves strategically drawing down your savings and investments to cover your expenses. As retirees spend their nest egg and maybe give gifts to loved ones, their net worth will naturally decrease. It’s all part of a successful retirement plan in action.

At Smart Financial Lifestyle, we believe understanding these benchmarks is the first step toward building a secure future for your family. We provide the tools and wisdom to help you make smart financial decisions at every stage of life. Find more resources and guidance at https://smartfinancialifestyle.com.