After decades of saving, investing, and planning, the moment of truth arrives: turning your nest egg into a reliable income stream. This transition from accumulation to distribution is arguably the most critical phase of your financial life. The decisions you make now will directly impact your lifestyle, your ability to weather market downturns, and the legacy you leave behind. Simply put, having a well-structured plan is not just a good idea; it's the foundation of a secure and fulfilling retirement.

Choosing the right approach among various retirement withdrawal strategies can feel overwhelming, but it doesn't have to be. A successful strategy isn't about finding a single "perfect" rule, but about selecting a framework that aligns with your specific goals, risk tolerance, and family circumstances. For a family steward managing multigenerational needs, the priority might be flexibility. For a woman navigating a life transition, clarity and control are paramount. For a near-retiree, it’s about creating predictable income while protecting principal.

This comprehensive guide is designed to cut through the complexity. We will explore 10 distinct and proven retirement withdrawal strategies, breaking each one down with actionable steps, clear pros and cons, and practical examples. You will learn not just what each strategy is, but how to implement it in a way that addresses key challenges like sequence-of-returns risk and tax efficiency. Whether you’re aiming to secure your own financial independence or ensure your wealth supports future generations, the right withdrawal plan changes everything. Let's find the one that fits you.

1. 4% Rule (Safe Withdrawal Rate)

The 4% Rule is one of the most foundational and widely discussed retirement withdrawal strategies. Pioneered by financial advisor William Bengen in 1994, this guideline suggests you can safely withdraw 4% of your portfolio's value in your first year of retirement. In subsequent years, you adjust that dollar amount for inflation to maintain your purchasing power.

The original research, supported by the famous "Trinity Study," found that this method gave a portfolio a very high probability of lasting at least 30 years, based on historical market data. It assumes a balanced portfolio, typically around 60% stocks and 40% bonds.

How It Works: A Practical Example

Imagine you retire with a $1.5 million portfolio.

- Year 1: Your initial withdrawal is $60,000 ($1,500,000 x 4%).

- Year 2: If inflation is 3%, you increase your withdrawal amount by 3%. Your new withdrawal is $61,800 ($60,000 x 1.03). You take this amount regardless of whether your portfolio grew or shrank.

This systematic approach provides a predictable income stream, which is crucial for budgeting and peace of mind, especially for those newly retired or women in transition who value financial stability.

Key Insight: The 4% Rule’s strength lies in its simplicity. It provides a clear, easy-to-follow starting point for creating a sustainable retirement income plan without requiring complex daily calculations.

Actionable Implementation Steps

- Calculate Your Initial Withdrawal: Determine your portfolio's total value on your retirement date and multiply it by 4% (0.04).

- Set Your Asset Allocation: Adhere to a diversified portfolio, such as the classic 60/40 stock-to-bond mix. This balance is critical to weathering market volatility.

- Adjust Annually for Inflation: At the start of each new year, use the previous year's Consumer Price Index (CPI) to adjust your withdrawal amount, not the percentage.

- Rebalance Your Portfolio: At least once a year, rebalance your investments back to your target allocation to manage risk.

2. Dynamic Withdrawal Strategy

The Dynamic Withdrawal Strategy is a flexible approach that adapts your retirement income to market performance. Unlike the rigid inflation adjustments of the 4% Rule, this strategy ties your withdrawal amounts directly to your portfolio's actual returns and value, allowing you to take more in good years and prudently cut back in down years.

This method, supported by research from firms like Vanguard and Fidelity, is designed to reduce the risk of depleting your assets too quickly during a market downturn, a key concern for many retirees. It provides a more responsive framework for managing retirement withdrawal strategies by aligning spending with portfolio reality.

How It Works: A Practical Example

Let's say you retire with a $1.2 million portfolio and plan an initial $48,000 withdrawal. You set "guardrails" for your strategy: if the portfolio's value rises 15% above its initial value, you increase withdrawals by 10%. If it falls 15% below, you decrease withdrawals by 10%.

- Year 1: You withdraw your planned $48,000.

- Year 2: A strong market pushes your portfolio to $1.4 million, which is more than 15% above your starting value. You can increase your withdrawal by 10% to $52,800.

- Year 3: A market correction drops your portfolio to $1.1 million. Since this is within your guardrails, your withdrawal remains $52,800 plus an inflation adjustment.

This approach helps preserve capital during downturns while allowing you to enjoy the fruits of market growth, making it ideal for grandparents focused on legacy and women in transition who need to adapt to changing financial circumstances.

Key Insight: The Dynamic Withdrawal Strategy's power is its responsiveness. It directly addresses the "sequence of returns" risk by automatically reducing withdrawals when the portfolio is most vulnerable.

Actionable Implementation Steps

- Establish Clear Rules: Before retiring, define your "guardrails." Set specific percentage thresholds for your portfolio's value (e.g., +/- 15% from the previous year's value) that will trigger a spending increase or decrease.

- Define Your Adjustment: Decide how much you will adjust withdrawals when a guardrail is breached. A common approach is a 5% or 10% change to the previous year's withdrawal amount.

- Set a Floor and Ceiling: Establish a minimum withdrawal amount you need to cover essential expenses and a maximum amount to prevent overspending, ensuring your lifestyle remains stable.

- Schedule Annual Reviews: Review your portfolio's value against your guardrails once a year. Avoid making reactive changes based on short-term market fluctuations.

3. Bucket Strategy (Time-Segmented Approach)

The Bucket Strategy is a popular retirement withdrawal method that mentally and physically segments your assets based on when you'll need the money. Instead of viewing your portfolio as one large pool, you divide it into multiple "buckets," each with a specific time horizon and corresponding investment risk level. This approach is designed to provide peace of mind by insulating near-term spending needs from market volatility.

Pioneered by financial planner Harold Evensky, this strategy helps retirees feel more comfortable staying invested for long-term growth. By securing short-term income in safe assets, you can let the rest of your portfolio ride out market fluctuations without panic selling.

How It Works: A Practical Example

Imagine you need $50,000 per year for living expenses and retire with a $1 million portfolio. You could set up three buckets:

- Bucket 1 (Short-Term: 1-3 years): Contains $100,000 in cash, CDs, and a high-yield savings account. This covers your immediate expenses for the next two years and is shielded from market risk.

- Bucket 2 (Mid-Term: 4-10 years): Holds $250,000 in a balanced mix of bond funds and low-volatility dividend stocks. This bucket is designed for moderate growth and income to refill Bucket 1.

- Bucket 3 (Long-Term: 10+ years): Contains the remaining $650,000 in a diversified portfolio of growth stocks and index funds, positioned for maximum long-term returns.

As you spend down Bucket 1, you periodically sell appreciated assets from Bucket 2 or 3 to replenish it.

Key Insight: The Bucket Strategy’s power is psychological. It creates a "safety net" for immediate cash needs, which empowers you to invest confidently for the long term and avoid emotional decisions during market downturns.

Actionable Implementation Steps

- Define Your Buckets and Timeframes: Decide how many buckets you need (typically two or three) and set the time horizon for each (e.g., 1-3 years, 4-10 years, 11+ years).

- Calculate Your Spending Needs: Determine your annual living expenses and fund your first bucket with 1 to 3 years' worth of cash in safe, liquid assets.

- Allocate Remaining Assets: Invest the funds for your mid-term and long-term buckets according to their respective risk profiles, from conservative bonds to growth stocks.

- Establish a Refill Strategy: Create a plan for how and when you will replenish your cash bucket. This is typically done by selling gains from your other buckets annually or when market conditions are favorable.

4. Systematic Withdrawal Plan (SWP)

A Systematic Withdrawal Plan (SWP) is a highly structured and automated approach to generating retirement income. This method allows you to withdraw a fixed amount of money or a fixed percentage from your investment portfolio at regular intervals, such as monthly, quarterly, or annually. It transforms your accumulated assets into a predictable cash flow, much like a paycheck.

SWPs are commonly offered by mutual fund companies and brokerage firms like Vanguard, Fidelity, and Schwab. They are designed to automate the process of selling off small portions of your investments to provide a steady income stream, which can be directly deposited into your checking account.

How It Works: A Practical Example

Let's assume you have a $1 million portfolio and need approximately $40,000 in annual income to cover your expenses.

- Monthly Fixed Amount: You could set up an SWP to automatically sell $3,333 worth of your mutual fund shares each month. This amount is then transferred to your bank account.

- Annual Fixed Percentage: Alternatively, you could decide to withdraw 4% of the portfolio's value at the beginning of each year. In year one, this would be $40,000. If the portfolio grows to $1.1 million by year two, your next 4% withdrawal would be $44,000.

This strategy is particularly beneficial for retirees, including women in transition, who want a hands-off, automated system for managing their cash flow without having to manually sell assets.

Key Insight: The SWP’s primary advantage is its discipline and automation. It removes emotion from withdrawal decisions and creates a reliable, predictable income flow that simplifies budgeting in retirement.

Actionable Implementation Steps

- Contact Your Brokerage or Fund Company: Reach out to the institution holding your retirement funds to set up an SWP. Most major firms offer this service online or with advisor assistance.

- Determine Your Withdrawal Schedule: Decide on the amount (or percentage) and frequency (monthly, quarterly, etc.) that best aligns with your budget and income needs.

- Set Up Automatic Transfers: Arrange for the withdrawn funds to be automatically deposited into your primary checking or savings account to streamline your finances.

- Review and Adjust Periodically: At least once a year, review your SWP to ensure it still meets your needs. Adjust the withdrawal amount as necessary to account for inflation, market performance, or changes in your spending.

5. Guardrail Strategy (Corridor Method)

The Guardrail Strategy, also known as the Corridor Method, is a dynamic and responsive approach to retirement income. This strategy adapts your withdrawal amounts based on your portfolio's performance, setting upper and lower boundaries (guardrails) to guide spending adjustments and protect your long-term plan.

Unlike the static inflation adjustments of the 4% Rule, this method allows for more spending in strong market years and mandates disciplined cutbacks during downturns. This flexibility helps mitigate the risk of depleting assets too quickly, a key concern for retirees aiming to preserve capital for their lifetime and for future generations.

How It Works: A Practical Example

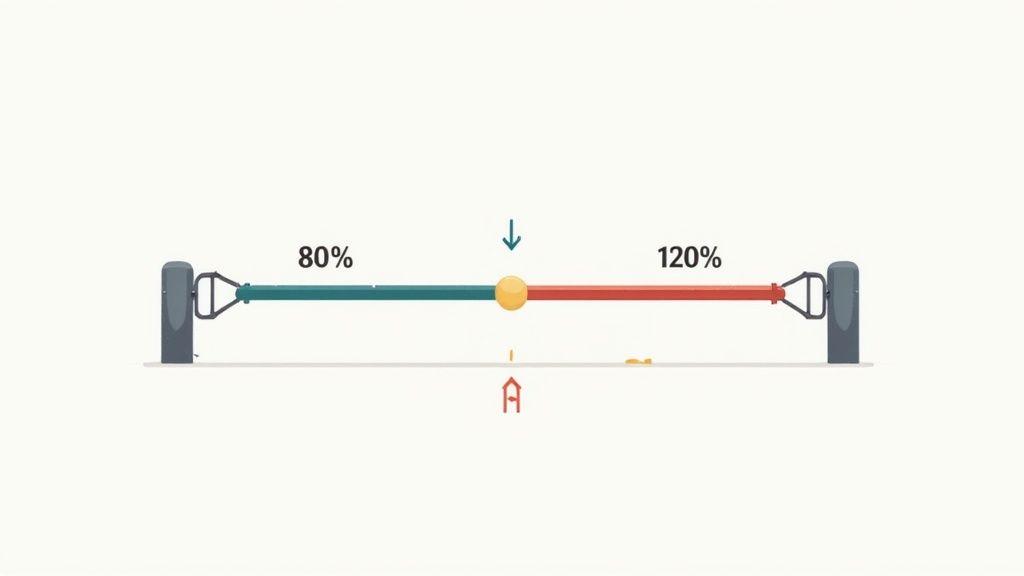

Let's say you retire with a $1 million portfolio and a target withdrawal rate of 5%, or $50,000. You set guardrails at 20% above and below your initial portfolio value.

- Upper Guardrail: $1,200,000 ($1M x 120%)

- Lower Guardrail: $800,000 ($1M x 80%)

- Scenario 1 (Portfolio Grows): After a strong year, your portfolio hits $1.25 million. You have crossed the upper guardrail. You would then increase your annual withdrawal by a predetermined amount, such as 10%, making your new withdrawal $55,000.

- Scenario 2 (Portfolio Declines): In a market downturn, your portfolio drops to $790,000. You have breached the lower guardrail. You would then decrease your spending by 10%, reducing your withdrawal to $45,000 until the portfolio recovers.

Key Insight: The Guardrail Strategy provides a systematic framework for making difficult spending decisions. It replaces emotional reactions to market volatility with a pre-defined, logical plan, offering confidence to those managing their finances through life transitions.

Actionable Implementation Steps

- Define Your Initial Withdrawal Rate: Start with a reasonable withdrawal percentage based on your needs and portfolio size (e.g., 4% or 5%).

- Set Your Guardrails: Establish upper and lower portfolio value thresholds, typically +/- 20% from your starting value, or from the value at the time of your last adjustment.

- Establish Adjustment Rules: Clearly define the action you will take when a guardrail is breached. For instance, a 10% increase or decrease in the withdrawal amount is a common rule.

- Monitor and Review Annually: At least once a year, check your portfolio's value against your guardrails to see if an adjustment is necessary. This makes it one of the more hands-on retirement withdrawal strategies.

6. Annuity-Based Strategy

The Annuity-Based Strategy is a hybrid approach that secures a baseline of guaranteed income while allowing the rest of your portfolio to pursue growth. This retirement withdrawal strategy involves allocating a portion of your savings to purchase an annuity, which provides a predictable, pension-like stream of payments for life or a set period.

By covering essential living expenses like housing, utilities, and healthcare with guaranteed annuity income, you can reduce longevity risk (the fear of outliving your money) and feel more confident taking withdrawals from your remaining invested assets. This method, often advocated by academics and insurance providers, blends the security of a fixed income floor with the flexibility of a traditional investment portfolio.

How It Works: A Practical Example

Imagine you retire with a $1 million portfolio and your essential annual expenses are $18,000.

- Annuity Purchase: You allocate $300,000 to purchase an immediate annuity, which generates a guaranteed lifetime income of $18,000 per year, covering your core needs.

- Investment Portfolio: The remaining $700,000 stays invested in a diversified portfolio. You apply a 5% withdrawal strategy to this portion for discretionary spending, resulting in $35,000 in the first year.

- Total Income: Your total income is $53,000, composed of $18,000 in guaranteed income and $35,000 in variable income, giving you both security and flexibility.

Key Insight: The Annuity-Based Strategy separates your needs from your wants. It uses the annuity to create a personal pension for your essential expenses, which frees up the rest of your portfolio for growth and discretionary spending without jeopardizing your financial foundation.

Actionable Implementation Steps

- Cover Your Core Expenses: Tally your non-negotiable annual living expenses. This is the income target your annuity should aim to cover.

- Shop for Annuities: Get quotes from multiple highly-rated insurance companies (check A.M. Best or S&P ratings). Compare payouts, fees, and features before committing.

- Implement Partial Annuitization: Consider using only a portion of your assets (e.g., 20-40%) to purchase the annuity. This preserves liquidity and growth potential in the rest of your portfolio.

- Manage Your Remaining Assets: Apply a separate, flexible withdrawal strategy to your remaining investments to fund travel, hobbies, and other discretionary goals.

7. Dividend and Interest-Based Withdrawal

The Dividend and Interest-Based Withdrawal strategy is a conservative approach where retirees aim to live primarily off the income generated by their portfolio, such as dividends from stocks and interest from bonds. This method prioritizes capital preservation by minimizing the need to sell the underlying assets, making it a popular choice for those focused on creating a lasting legacy.

This strategy shifts the focus from a total-return mindset to an income-generation mindset. Instead of selling off shares, you're essentially "harvesting" the cash flow your investments produce naturally. This can provide a psychologically comforting and sustainable income stream, especially during volatile market periods when selling assets at a loss is undesirable.

How It Works: A Practical Example

Imagine you retire with a $1.2 million portfolio structured for income.

- Portfolio Yield: Your portfolio, consisting of dividend-paying stocks, bonds, and REITs, has an average yield of 3.5%.

- Annual Income: This generates an annual income of $42,000 ($1,200,000 x 3.5%). This becomes your primary withdrawal amount for the year.

- Capital Preservation: In most years, your $1.2 million principal remains untouched, continuing to generate income and potentially grow in value. If income is insufficient one year, you might supplement it by selling a small portion of appreciated assets.

This approach offers a variable but potentially rising income stream, as healthy companies often increase their dividends over time, providing a natural hedge against inflation.

Key Insight: This strategy decouples your retirement income from the daily fluctuations of the stock market. Your focus is on the reliability of the cash flow, not the portfolio's current market value, which can reduce stress for income-focused retirees.

Actionable Implementation Steps

- Build an Income-Oriented Portfolio: Construct a diversified portfolio of high-quality, dividend-paying stocks, bonds, REITs, and other income-producing assets. Focus on companies with a history of stable and growing dividends.

- Determine Your Income Needs: Calculate your annual expenses to see if the portfolio's expected yield can cover them. This is a crucial step in assessing if this strategy is viable for your situation.

- Create a Cash Buffer: Hold one to two years' worth of living expenses in cash or cash equivalents. This buffer allows you to avoid selling assets if dividends are temporarily cut or market conditions are poor.

- Monitor and Adjust: Regularly review your holdings to ensure dividend sustainability and credit quality. Be prepared to replace investments if their income-producing capabilities decline.

8. Present Value of Annuity (PVA) Method

The Present Value of Annuity (PVA) Method is a sophisticated retirement withdrawal strategy that treats your portfolio like a personal pension. It uses actuarial principles and longevity assumptions to calculate a sustainable annual withdrawal percentage. By converting your nest egg into an equivalent annuity, you align spending with life expectancy and market forecasts.

Actuarial science professionals, advanced planning software, and academic researchers popularized this approach. It accounts for expected investment returns and inflation, making it one of the most precise options among retirement withdrawal strategies.

How It Works: A Practical Example

Imagine you have a $1 million portfolio and apply the PVA Method under similar return and inflation assumptions:

- 80-year-old retiree with a 10-year life expectancy

- PVA calculation yields about a 7–8% withdrawal rate

- 55-year-old retiree with a 40-year life expectancy

- PVA calculation yields about a 3–4% withdrawal rate

This method produces an age- and assumption-specific rate, helping manage longevity risk while preserving principal.

Key Insight: The PVA Method transforms your savings into a virtual pension, ensuring your withdrawal rate adapts to your unique life expectancy and economic outlook.

Actionable Implementation Steps

- Gather Inputs: Record your current portfolio value, assumed annual return, inflation rate, and select a mortality table for your demographic.

- Set Assumptions: Define scenarios for investment returns and inflation based on conservative and moderate forecasts.

- Run the PVA Calculation: Use financial planning software or a spreadsheet template to compute the present value of an annuity and derive your sustainable withdrawal percentage.

- Establish Your Rate: Lock in your initial withdrawal percentage as determined by the PVA output.

- Review Annually: Update life expectancy, portfolio value, and economic assumptions yearly—then adjust your rate accordingly.

- Consult an Expert: Engage an actuary or qualified financial advisor to validate your inputs and refine assumptions.

By applying the PVA Method within your retirement withdrawal strategies, you gain a data-driven, personalized plan that balances income needs with longevity protection.

9. Required Minimum Distribution (RMD) Strategy

The Required Minimum Distribution (RMD) Strategy leverages IRS-mandated minimum withdrawals from tax-deferred accounts as the foundation of your retirement income plan. Once you hit age 73, the IRS requires you to take a calculated minimum each year from IRAs, 401(k)s, and similar plans. This approach turns a compliance requirement into an organized withdrawal strategy that supports cash flow, tax management, and legacy goals.

The IRS first introduced RMD rules to ensure tax-deferred savings eventually get taxed. By treating RMDs as your baseline, you avoid steep penalties and can layer additional withdrawals or Roth conversions around these distributions. This method is ideal for retirees seeking predictable income and for Family Stewards balancing multigenerational needs.

How It Works: A Practical Example

Imagine two scenarios using joint life expectancy tables or the Uniform Lifetime Table:

-

Age 73, $500,000 traditional IRA

- RMD = $500,000 ÷ 26.5 = $18,868 (approximate)

-

Age 85, $1,000,000 in IRAs

- RMD ≈ $45,000–$50,000 based on life expectancy factor

By using each year’s IRS divisor, you establish a clear withdrawal floor. Any additional needs or Roth conversions occur on top of these distributions.

Key Insight: Turning RMDs into a base withdrawal plan streamlines compliance, prevents 25% IRS penalties, and anchors your tax bracket planning.

Actionable Implementation Steps

- Calculate Your RMD Early: Use the IRS RMD worksheet or online calculator before December 31.

- Confirm Life Expectancy Factor: Refer to the Uniform Lifetime Table or Joint Life Table if married.

- Schedule Distributions: Automate your withdrawals to meet deadlines and avoid penalties.

- Plan Roth Conversions: In low-income years, convert amounts beyond your RMD to a Roth to manage future RMDs.

- Track Pro-Rata Rules: If you have multiple IRAs, calculate combined balances and apply pro-rata rules correctly.

- Coordinate with Tax Bracket Goals: Time your RMD and any extra withdrawals to smooth taxable income and protect Social Security taxation.

10. Roth Conversion and Tax-Efficient Withdrawal Strategy

The Roth Conversion strategy is an advanced tax-planning technique designed to minimize your lifetime tax burden in retirement. It involves strategically converting funds from a tax-deferred account, like a Traditional IRA or 401(k), to a tax-free Roth IRA. This is typically done during years of lower income, such as the gap between retirement and the start of Social Security or Required Minimum Distributions (RMDs).

While you pay ordinary income tax on the converted amount today, all future growth and withdrawals from the Roth account are completely tax-free after five years and age 59½. This approach creates a powerful source of tax-free income later in life, providing flexibility and control over your taxable income.

How It Works: A Practical Example

Consider a 62-year-old retiree with a $500,000 Traditional IRA who has not yet started Social Security.

- Low-Income Year: They convert $50,000 from their Traditional IRA to a Roth IRA. Assuming they are in the 24% federal tax bracket, they pay $12,000 in taxes on the conversion, ideally from a separate taxable account.

- Future Benefit: That $50,000, now in a Roth IRA, grows tax-free. When they are 75 and facing large RMDs, they can withdraw from this Roth account without increasing their taxable income, helping to keep them in a lower tax bracket and potentially reducing taxes on Social Security benefits.

This proactive method is one of the most effective retirement withdrawal strategies for those focused on legacy planning and managing future tax uncertainty.

Key Insight: A Roth Conversion strategy transforms future taxable income into tax-free income. Paying taxes at a known, lower rate today can save you from paying unknown, potentially higher rates on a larger sum tomorrow.

Actionable Implementation Steps

- Identify Low-Income Years: Pinpoint the years between retiring and starting Social Security or RMDs (age 73/75) to execute conversions at a lower marginal tax rate.

- Plan Your Conversion Amount: Convert just enough to "fill up" a lower tax bracket without pushing yourself into a significantly higher one.

- Pay Taxes with External Funds: Use funds from a taxable brokerage or savings account to pay the conversion tax. Using IRA funds to pay the tax is inefficient and may incur penalties if you're under 59½.

- Coordinate with a Professional: Work with a financial advisor or tax professional to model the long-term impact, manage the pro-rata rule if you have non-deductible IRA funds, and avoid unintended consequences like increased Medicare premiums.

Retirement Withdrawal: 10-Strategy Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐ / 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| 4% Rule (Safe Withdrawal Rate) | Low — simple fixed rule, annual review 🔄 | Low — basic portfolio (60/40), annual rebalance ⚡ | Predictable income; historically ~90–95% 30‑yr success 📊 | Retirees seeking simplicity and stable spending plan 💡 | Easy to implement; historically tested; reduces emotional choices ⭐ |

| Dynamic Withdrawal Strategy | Moderate–High — annual adjustments & triggers 🔄 | Moderate — modelling tools or advisor; active monitoring ⚡ | Variable income that adapts to returns; can extend longevity ⭐📊 | Retirees comfortable with variable income and active management 💡 | Adaptive to markets; can increase withdrawals in good years ⭐ |

| Bucket Strategy (Time-Segmented) | Moderate — set up multiple buckets and rebalance 🔄 | Moderate — cash reserves, multiple accounts, rebalancing ⚡ | Reduces sequence‑of‑returns risk; psychological cash buffer 📊 | Those wanting visible short‑term reserves and long‑term growth plan 💡 | Reduces need to sell in downturns; clear time‑segmented structure ⭐ |

| Systematic Withdrawal Plan (SWP) | Low — automate fixed withdrawals on schedule 🔄 | Low — brokerage tools; set-and-forget transfers ⚡ | Consistent cash flow; may lag inflation if fixed 📊 | Retirees preferring automation and predictable monthly income 💡 | Highly automated; convenient; predictable distributions ⭐ |

| Guardrail Strategy (Corridor Method) | High — define guardrails and action rules; monitor 🔄 | Moderate — modeling, discipline, possible advisor/software ⚡ | Flexible spending within bands; research shows high success rates 📊 | Those wanting rule-based flexibility between fixed and dynamic plans 💡 | Balances spending flexibility and sustainability; research-backed ⭐ |

| Annuity-Based Strategy | Moderate — select product, terms, provider review 🔄 | High — upfront capital to annuitize; insurer due diligence ⚡ | Guaranteed lifetime income for annuitized portion; reduces longevity risk 📊 | Retirees prioritizing guaranteed base income and longevity protection 💡 | Provides income floor; eliminates longevity risk on annuitized funds ⭐ |

| Dividend & Interest-Based Withdrawal | Moderate — build income-focused portfolio; monitor payouts 🔄 | High — sizable principal needed to generate income ⚡ | Income-focused with principal preservation goal; yields may be low 📊 | Conservative retirees focused on capital preservation and steady yield 💡 | Preserves principal; income-oriented; possible favorable dividend tax treatment ⭐ |

| Present Value of Annuity (PVA) Method | High — actuarial calculations and assumptions 🔄 | Moderate — software or professional/actuarial help ⚡ | Personalized sustainable withdrawal rate tied to life expectancy 📊 | Those seeking bespoke rates based on mortality and portfolio size 💡 | Highly personalized; actuarial foundation; age‑adjustable withdrawals ⭐ |

| Required Minimum Distribution (RMD) Strategy | Low–Moderate — annual IRS calculations required 🔄 | Low — tax-aware planning and account tracking ⚡ | Compliance-driven withdrawals; may increase taxable income 📊 | Owners of tax‑deferred accounts required to take RMDs (IRAs/401(k)s) 💡 | Clear legal framework; avoids penalties; predictable schedule ⭐ |

| Roth Conversion & Tax‑Efficient Withdrawals | High — timing, tax coordination, pro‑rata rules 🔄 | High — upfront tax payments, advisor and record‑keeping ⚡ | Potential long‑term tax savings and future tax‑free flexibility 📊 | Early retirees with low‑income years aiming to minimize lifetime taxes 💡 | Reduces lifetime tax burden; creates tax‑free buckets and lowers future RMDs ⭐ |

Your Next Steps to Smart Withdrawals

As you wrap up this exploration of retirement withdrawal strategies, it’s time to translate insights into action. You have ten proven approaches at your fingertips—from the classic 4% Rule to a tax-efficient Roth Conversion method. By focusing on clear steps, annual reviews, and your family’s unique goals, you’ll craft a sustainable income stream that aligns with your legacy vision.

Summary of Key Insights

- 4% Rule (Safe Withdrawal Rate): Simple framework for steady income.

- Dynamic Withdrawal Strategy: Adjusts to market swings and portfolio performance.

- Bucket Strategy: Segments assets by time horizon for stability.

- Systematic Withdrawal Plan (SWP): Automates income while preserving growth.

- Guardrail Strategy: Triggers adjustments at pre-set portfolio thresholds.

- Annuity-Based Strategy: Offers predictable payments in exchange for capital.

- Dividend and Interest-Based Withdrawal: Leverages passive income streams.

- Present Value of Annuity (PVA) Method: Calculates a withdrawal rate tailored to life expectancy.

- Required Minimum Distribution (RMD) Strategy: Complies with IRS rules while maximizing tax deferral.

- Roth Conversion and Tax-Efficient Withdrawal: Optimizes tax brackets and future backdoor benefits.

“Annual checkups and small tweaks beat big one-time overhauls every time.” – Paul Mauro’s guiding principle

Actionable Next Steps

- Choose One Strategy to Start

- Pick the approach that best matches your risk tolerance and legacy goals.

- Use our sample illustrations to model Year 1 withdrawals.

- Map Your First Year

- Draft a cash-flow calendar with income dates, RMD deadlines, and conversion windows.

- List estimated taxes, fees, and reinvestment needs.

- Set Quarterly Reviews

- Compare actual returns to projections.

- Adjust withdrawal amounts or bucket allocations within guardrail limits.

- Involve Family or Advisers

- Share your plan with a Financial Steward or loved one.

- Use collaborative tools for transparent tracking and legacy conversations.

Why Mastering These Concepts Matters

- Financial Confidence: You gain clarity over income sources, market risks, and tax impacts.

- Lifestyle Protection: A sustainable withdrawal plan helps safeguard vacations, healthcare, and family support.

- Legacy Preservation: Align your distribution strategy with your values, ensuring wealth passes on in the way you intend.

Connecting to Your Broader Vision

By mastering these retirement withdrawal strategies, you are not just managing numbers—you are securing peace of mind. Every adjustment you make, whether via a small Roth conversion or a bucket reallocation, strengthens your family’s financial foundation. Your grandchildren see firsthand the power of intentional planning, and your transition as a steward of wealth becomes a lesson in multigenerational collaboration.

Take a moment today to review your estate documents, update beneficiaries, or run a “what-if” scenario using your chosen strategy. Small efforts compound into lasting impact, reinforcing your role as a trusted guide through life’s transitions.

Remember, flexibility is your ally. Markets change, tax codes evolve, and personal needs shift. Embrace an iterative mindset—annual reviews, friendly check-ins with financial advisers, and open discussions with loved ones keep your plan responsive. This is how you turn static advice into a living blueprint that grows with you.

End this chapter not with uncertainty, but with purpose. You now hold the tools to design an income plan that meets today’s needs, anticipates tomorrow’s challenges, and reflects the legacy you wish to leave. Your future self will thank you for the deliberate steps taken now.

Ready to refine your retirement withdrawal strategies and build a roadmap that stands the test of time? Join Smart Financial Lifestyle for expert guidance, interactive planning tools, and a supportive community focused on sustainable wealth management. Discover how Smart Financial Lifestyle can help you implement these strategies with confidence.

Article created using Outrank