When you're buried under a pile of credit card bills, it's easy to feel trapped. But here's something the credit card companies don't always advertise: you have more leverage than you think. You can absolutely learn how to negotiate credit card debt.

Creditors are in the business of making money, and they know that getting something from you is a whole lot better than getting nothing if you default. This simple fact is the foundation of any successful negotiation. Instead of just chipping away at the balance with minimum payments, which can feel like trying to empty the ocean with a teaspoon, you can take control and propose a real solution. To really grasp why this is so critical, it's worth understanding why minimum payments keep you in debt longer.

The real challenge is figuring out which path makes the most sense for your life right now. Your income, your expenses, and the story behind your financial hardship will all point you toward the best strategy.

Your Starting Point for Debt Negotiation

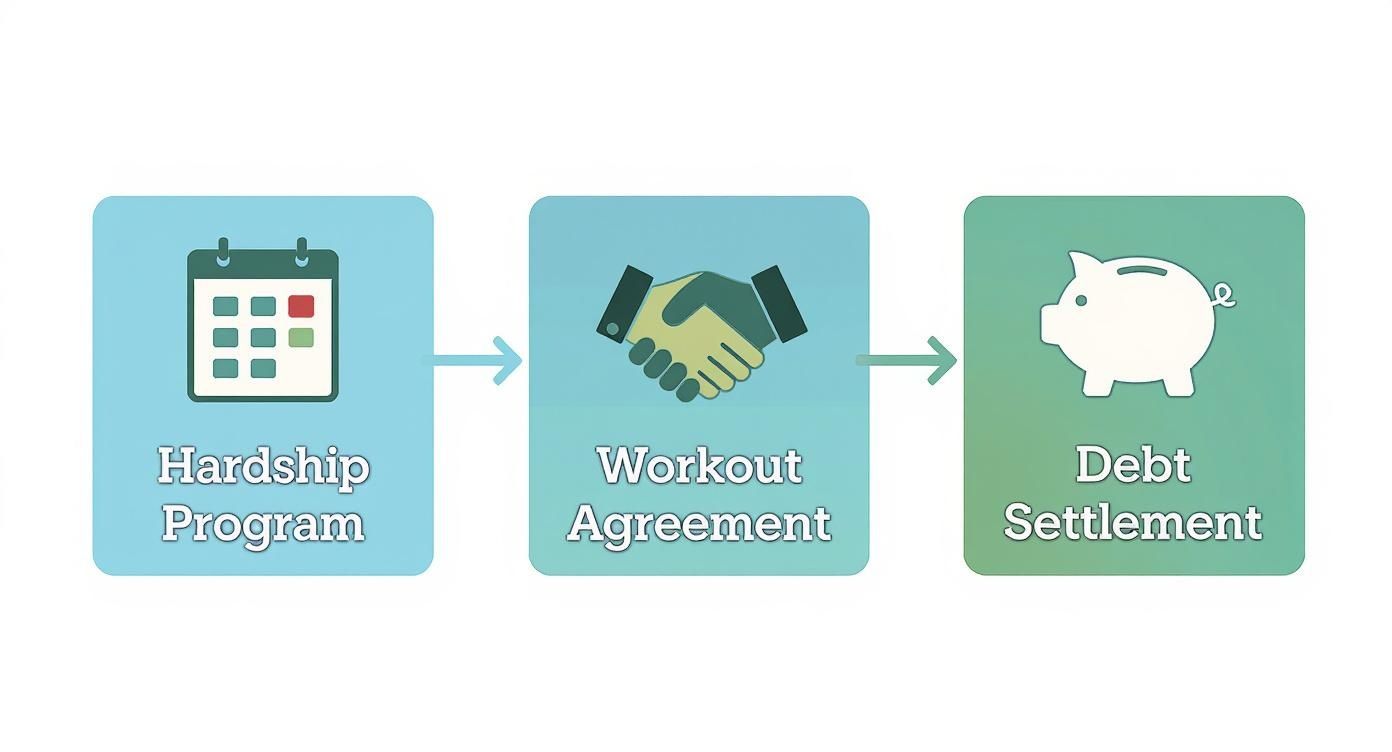

Before you pick up the phone, it helps to know what you're asking for. Most negotiations fall into one of three main categories. Each one is designed for a different situation and has a different effect on your finances and credit.

Understanding Your Main Options

-

Hardship Programs: Think of these as a temporary lifeline. If you've hit a rough patch—maybe a job loss or an unexpected medical bill—a creditor might agree to a hardship plan. This could mean they lower your interest rate or reduce your monthly payment for a set amount of time, usually somewhere between 3-12 months, to help you get back on your feet.

-

Workout Agreements: This is a more permanent fix than a hardship plan. A workout agreement actually changes the original terms of your loan. The goal is to make your payments more manageable for the long haul, maybe by permanently slashing your interest rate or stretching out the repayment timeline.

-

Debt Settlements: This is the most aggressive option. With a settlement, you offer to pay a portion of what you owe in a single lump sum. In return, the creditor agrees to forgive the rest of the debt. While this can offer the quickest way out, it usually leaves the biggest mark on your credit score.

This infographic breaks down these three paths visually, helping you see where your situation might fit.

As you can see, each approach serves a very different purpose. One might offer a bit of breathing room, while another provides a final resolution.

These kinds of negotiations are happening more and more, especially as the average American's credit card balance has shot up to $6,735. A successful negotiation, particularly with an account that's already in collections, can often slash the balance by 25–50%. That's a huge step toward financial freedom. To dig deeper, you can find more on these credit card debt statistics from Experian.com. The first step is always a clear-eyed look at your own financial reality.

Credit Card Negotiation Options at a Glance

Choosing the right path can feel overwhelming, so here’s a quick comparison to help you see how these three strategies stack up against each other.

| Negotiation Type | Primary Goal | Typical Credit Impact | Best For |

|---|---|---|---|

| Hardship Program | Temporary relief from high payments | Minimal to moderate (often noted on credit report) | Short-term financial setbacks (e.g., job loss, medical emergency) where recovery is expected. |

| Workout Agreement | Make payments permanently manageable | Moderate (can lower score initially but improves with on-time payments) | Situations where you can afford consistent payments, just not at the original high interest rate. |

| Debt Settlement | Eliminate the debt for less than owed | Significant negative impact (account is marked as "settled for less than full amount") | Those with access to a lump sum of cash who need to resolve a delinquent account quickly. |

This table should give you a clearer picture of the trade-offs involved with each option. Consider your long-term financial goals and your current ability to pay when deciding which direction to take.

Building Your Financial Case Before You Call

Trying to negotiate with a creditor without your facts straight is like walking into a final exam without studying. You just won't succeed. Before you even think about picking up the phone, you need to build a clear, honest, and compelling case for yourself.

It’s about more than just knowing your numbers. You’re creating a powerful story that shows the creditor exactly what you can realistically pay. Remember, creditors are businesses, and they run on data. A vague "I can't pay" is easy for them to brush off. But a well-documented financial snapshot? That changes the game. It turns you from just another delinquent account into a real person with a problem they can help solve.

Gathering Your Financial Evidence

First things first, you need to become the world's leading expert on your own financial situation. This means collecting the documents that paint the full picture of your income, debts, and essential living expenses. Think of it as building a case file for a lawyer—every piece of paper matters.

Here's the evidence you'll need to pull together:

- Recent Pay Stubs: These are your proof of income. No wiggle room here.

- Bank Statements: Shows the money coming in and, more importantly, exactly where it's going out.

- All Credit Card Statements: You absolutely must have a complete list of who you owe, how much, and the interest rate for every single account.

- Other Loan Statements: Don't forget mortgages, car loans, or student loans. These are all part of your total debt picture.

- Essential Bills: Grab your latest utility, rent or mortgage, and insurance bills. These establish your basic cost of living.

Having these documents ready during the call shows you're organized, serious, and have put real thought into your request. It immediately gives you more credibility.

Create a Bare-Bones Budget

With your documents in hand, the next step is to create what I call a "hardship budget." This isn't your dream budget with fun money and savings goals. It’s a stark, honest look at your absolute bare-bones spending. Its only purpose is to calculate the maximum amount you can offer a creditor each month.

Start with your total take-home pay. Then, list only your essential, non-negotiable expenses.

Essential Spending Categories

| Category | Description |

|---|---|

| Housing | Your monthly rent or mortgage payment. |

| Utilities | Gas, electric, water, and essential internet. |

| Food | A realistic grocery budget—we're not talking about dining out. |

| Transportation | Gas and insurance to get to work, or public transit costs. |

| Childcare | Necessary costs for any dependents. |

| Healthcare | Insurance premiums and unavoidable medical expenses. |

Subtract your total essential spending from your income. The number that's left over is what’s available to pay down debt. This figure is your single most powerful negotiating tool because it's based on hard facts, not just feelings.

Knowing exactly what you can afford empowers you to make a firm, realistic offer. It shifts the conversation from what the creditor says you owe to what you can actually pay—which is what they’re really interested in.

This process is also a great reality check for your overall financial health. If you want a more structured approach to getting your balances under control, these 7 steps to pay off debt fast provide a solid framework.

Frame Your Hardship Story

Finally, you need a short, honest explanation for your financial trouble. Did you lose your job? Were you hit with unexpected medical bills? Did your income get cut? A clear, concise story helps the person on the other end of the line understand your situation.

Keep it simple and stick to the facts. For example: "I was laid off three months ago and am currently working part-time while looking for a new full-time role. My income has dropped by 60%, which is why I can no longer keep up with the current payment." This is way more effective than a long, emotional story.

With your evidence gathered, your budget calculated, and your story straight, you're finally ready to make that call.

Mastering the Negotiation Conversation

You’ve done the hard work of gathering your documents and mapping out your budget. Now it's time to pick up the phone. This is the moment where all that preparation pays off, turning your financial story into a solid case for a better arrangement with your creditors. The goal here is simple: stay calm, confident, and in control.

Remember, the person on the other end of the line is just doing their job. A respectful, business-like tone will get you so much further than showing frustration or anger. You aren't asking for a handout; you're proposing a practical solution that helps both of you avoid a worse outcome.

Opening the Call with Confidence

How you start the conversation sets the tone for everything that follows. Avoid sounding desperate or making demands. Your best tool is a simple, direct, and respectful opening.

Start by clearly identifying yourself and stating the reason you’re calling.

- Example Opening: "Hello, my name is Jane Doe, and my account number is 123-456. I've been a customer for eight years, and I'm calling today because I'm facing a financial hardship. I’d like to discuss the options available for managing my account."

This approach immediately shows you’re being proactive and responsible, not just trying to dodge a bill. It frames the call as a collaborative effort to find a workable solution.

Timing really is everything. Consumers who get ahead of the problem and call creditors early—before falling delinquent—tend to get better results. This is especially true if you can document a specific hardship like a job loss or medical emergency. These talks aren't just about cutting your balance; they can also lead to lower interest rates, waived fees, or more flexible payment terms. For more context, you can read the full analysis on credit card trends on sellerscommerce.com.

Scripts for Different Hardship Scenarios

Your personal situation dictates your strategy. A temporary rough patch calls for a different approach than a permanent change in your financial reality. Having a script ready helps you stay on track and communicate your needs without getting flustered.

Scenario 1: The Temporary Setback (Requesting a Hardship Plan) Let's say you just lost your job but are actively looking for new work. Your goal is temporary relief to bridge the gap.

"As I mentioned, I was recently laid off, which has significantly cut my income. While I search for a new job, I simply can't afford my current minimum payment of $250. My budget shows I can realistically pay $100 per month for the next six months. Would it be possible to enroll in a temporary hardship program to lower my payments and interest rate until I'm back on my feet?"

Scenario 2: The Long-Term Challenge (Proposing a Settlement) Now, imagine a major medical event has left you with a pile of bills and permanently reduced your ability to earn. You might have access to a small lump sum from savings or help from family.

"Due to a recent medical diagnosis, my ability to work has been permanently impacted, and I can no longer sustain payments on my $10,000 balance. I want to resolve this debt responsibly. I can offer a one-time lump-sum payment of $4,000 to settle the account in full. Would you be willing to accept this offer?"

The screenshot below from the Consumer Financial Protection Bureau explains what debt settlement services do, which is helpful context even when you're negotiating on your own.

This official definition shows that settlement means paying just a portion of what you owe. You can apply the exact same principles when you negotiate for yourself.

Handling Common Creditor Tactics

Creditors and their collection agents are trained negotiators. They have their own scripts and tactics designed to get you to pay as much as you possibly can. Knowing what to expect keeps you from getting caught off guard.

Here’s how to handle their common responses calmly and effectively:

-

The High-Pressure Push: They might say something like, "We need a payment of at least $200 today or we can't help you."

- Your Calm Response: "I understand your position, but as my budget shows, that amount isn't possible for me right now. My offer of $100 is what I can realistically and consistently pay."

-

The Vague Promise: They might offer a "review" in a few months without committing to anything specific.

- Your Calm Response: "I appreciate that, but I need a concrete solution today. Can we agree to the terms of the hardship plan we discussed for a fixed period of six months?"

-

The Request for Bank Access: They may push for your checking account or debit card number for an immediate payment.

- Your Calm Response: "I am not comfortable providing that information over the phone. I will send payments via check or through my bank's bill pay service once we have a written agreement."

Always, always stick to the facts of your budget. If the person you're speaking with can't or won't help, politely ask to speak with a supervisor or someone in the "loss mitigation" or "hardship" department. This simple step can often get you to someone with the authority to actually approve your request.

Finalizing Your Agreement and Understanding the Aftermath

Getting a verbal "yes" from a creditor feels like you've crossed the finish line, but the race isn't quite over. Securing that agreement is a massive victory, no doubt. Yet, the final steps are what truly protect you and lock in all your hard-won progress.

Think of this phase like reading the fine print before signing a major contract—it’s the part that ensures your efforts don't backfire into future financial surprises.

This process isn't without its potential downsides. Even a successful negotiation can lead to notations on your credit report or an unexpected tax bill for the forgiven debt. For most people, though, the relief of resolving the debt far outweighs these costs.

Credit card companies often prefer to settle for less rather than risk a total charge-off, especially when you consider the reputational risks they face. You can discover more insights about credit card statistics on use.expensify.com to get a better feel for these industry dynamics.

Get Every Detail in Writing

This is the golden rule of debt negotiation: never send a single dollar until you have the agreement in writing. A verbal promise made over the phone is not legally binding and can be conveniently forgotten later. A written agreement is your only proof and your ultimate protection.

Your settlement letter needs to clearly spell out several key pieces of information. Insist that the document includes:

- Your full name and account number.

- The exact settlement amount.

- The date your payment is due.

- A statement that this payment will satisfy the debt in full.

- Confirmation of how the account will be reported to credit bureaus (e.g., "paid settled" or "settled for less than full amount").

Review this document with a fine-tooth comb. If anything looks unclear or is missing, call them back and ask for a revised letter before you make any payment. This step is absolutely non-negotiable.

The Impact on Your Credit Score

Once the dust settles, you’re naturally going to wonder what this all means for your credit. A settled account will be noted on your credit report, usually with a phrase like "settled for less than the full amount." While this notation is less damaging than a charge-off or an account that’s still in collections, it will lower your credit score.

The exact impact varies from person to person, but you can expect the notation to stay on your report for up to seven years. The good news? Its effect on your score will lessen over time. As you start building a new history of on-time payments and responsible credit use, that old settled account becomes a much smaller part of your overall financial story.

A settled account is not the end of your financial journey; it's a turning point. It closes a difficult chapter and allows you to start building a healthier credit history from a place of control rather than crisis.

Think of it as a strategic trade-off. You're accepting a temporary hit to your credit in exchange for getting out from under an overwhelming debt, which gives you the breathing room you need to rebuild.

Facing the Tax Implications

Here’s a curveball that catches many people by surprise: forgiven debt is often considered taxable income by the IRS. If a creditor forgives $600 or more of your debt, they are required to send both you and the IRS a Form 1099-C, "Cancellation of Debt."

This means the amount of debt you didn't have to pay could be added to your income for the year, potentially leading to a higher tax bill. For example, if you settled a $10,000 credit card balance for $4,000, that forgiven $6,000 might be treated as income.

However, there are exceptions. The most common one is the insolvency exclusion. If you were insolvent—meaning your total liabilities were greater than the fair market value of your total assets—right before the debt was cancelled, you may not have to pay taxes on it.

Figuring out insolvency can be complex, so it's a very good idea to talk to a tax professional if you receive a 1099-C. Being prepared for this possibility ensures your successful negotiation doesn’t create a brand-new financial headache when tax season rolls around.

Common Negotiation Mistakes You Must Avoid

Knowing how to negotiate credit card debt is as much about sidestepping the traps as it is about following the right script. I’ve seen it happen countless times—one wrong move can completely undo all your hard work, landing you right back where you started, or worse.

Think of this section as your defensive playbook. By understanding these common pitfalls before you even pick up the phone, you can navigate the conversation with confidence, deflect high-pressure tactics, and walk away with a deal that actually sticks.

Agreeing to Payments You Cannot Afford

This is, without a doubt, the number one mistake people make, and it’s the most damaging. When you're on the phone with a collector, the pressure is on. It's incredibly tempting to agree to a monthly payment that’s just a little bit over your budget, thinking you'll "somehow" make it work.

That's a recipe for disaster.

The moment you miss a single payment on that new agreement, the entire deal is often voided. All those waived fees and forgiven interest charges? They can come roaring back onto your balance, leaving you in a far worse position than before.

Your budget is your anchor in this storm. Stick to the number you calculated based on your real-world income and essential expenses. A sustainable plan you can actually keep is always, always better than an ambitious one that's doomed to fail.

Giving a Collector Direct Bank Access

A creditor or collection agent might push hard for your checking account number or debit card info, often framing it as a "good faith" payment to seal the deal. You need to politely but firmly say no. Handing over direct access to your bank account is a massive risk.

Once they have that information, you lose control. They could withdraw more than you agreed to or pull the money at an unexpected time, triggering overdraft fees and causing a cascade of financial problems. Always, always maintain control over how and when you pay.

Send a physical check, use your bank's bill pay service, or make a one-time payment through their official online portal. Never, ever set up automatic debits with a collector.

It’s also crucial to be aware of the emotional triggers that drive our financial choices. Staying disciplined during a stressful negotiation is a lot easier when you understand your own psychology. To dig deeper into this, you can explore the psychology of spending on our blog and better prepare yourself for these conversations.

Relying on a Verbal Promise

In the world of debt negotiation, if it isn’t in writing, it didn’t happen. A verbal agreement is completely worthless. A friendly representative might promise you the moon and stars over the phone, but unless you have it documented, that promise means nothing.

This is a non-negotiable rule you have to live by.

Once you've reached terms you're happy with, your next sentence should always be: "That sounds great. I will make the first payment as soon as I receive the complete agreement in writing." This protects you and holds them accountable. Don't send them a single cent until that letter is in your hands.

Quick Reference: Negotiation Do's and Don'ts

To help keep these crucial points fresh in your mind during the call, use this table as a quick cheat sheet. It's a simple guide to ensure you're protecting your interests and maximizing your chances of a successful outcome.

| Negotiation Do's and Don'ts | | :--- | :--- | | Do | Don't | | Keep detailed notes of every call, including the date, time, and representative's name. | Admit fault or share overly emotional stories that don't relate to the core financial facts. | | Remain calm and professional, even if the agent is aggressive or unhelpful. | Accept the first offer they make; there is almost always room for further negotiation. | | Ask to speak to a supervisor if the person you're speaking with cannot help you. | Give them your bank account information or agree to automatic withdrawals. | | Get every single agreement in writing before you make any payment. | Make a payment promise that your budget shows you cannot realistically keep. |

Sticking to these principles transforms the negotiation from a high-stress event into a controlled, business-like transaction where you have the upper hand.

When to Call for Professional Help

Learning to negotiate your own credit card debt is a huge step, and it's incredibly empowering. But there are times when going it alone isn't the best play. Knowing when to tag in a professional isn't a sign of weakness—it's a sign of strength. It means you're committed to the best possible outcome, even if that means getting some guidance.

Recognizing these moments can save you from wasted time, added stress, and financial missteps that could set you back even further. If your debt has become too complex or creditors just won't budge, an expert can bring the leverage and structure you need to the table.

Who to Call for Debt Assistance

When you need help, you have to know who you’re calling. The world of debt assistance is filled with different kinds of professionals, and they all play a different role. Picking the right one for your situation is the first real step toward getting things sorted out.

You'll generally run into three types of professionals:

-

Nonprofit Credit Counselors: These agencies are fantastic for education and helping you create a debt management plan (DMP). With a DMP, they work with your creditors to get your interest rates down, and you make one monthly payment to the agency. They handle distributing it to everyone else. It's a solid option if you have a steady income but are just getting crushed by high interest.

-

For-Profit Debt Settlement Companies: These companies negotiate with creditors to let you pay back less than you actually owe. It sounds great, but be careful here. They often charge hefty fees, sometimes a percentage of the debt they "forgive," and their tactics can absolutely wreck your credit score. Do your homework and research any company inside and out before you sign anything.

-

Bankruptcy Attorneys: If your debt feels completely insurmountable and you're starting to see legal threats like lawsuits or wage garnishment, it's time to talk to a bankruptcy attorney. They can walk you through your legal rights and help you figure out if bankruptcy is the most realistic path to a fresh start.

Seeking professional help is a strategic move. A good credit counselor can build a repayment plan you can actually stick to, while an attorney is your best defense when legal notices start showing up.

Clear Signs You Need an Expert

Sometimes the signs are subtle, but other times they’re flashing red lights you just can't ignore. If you find yourself in any of these situations, take it as a clear signal that it's time to get some professional backup.

Think about getting help if:

- You're Facing a Lawsuit: Have you been served with a summons or any kind of legal notice from a creditor? Stop everything. Stop negotiating. Call an attorney. This has moved beyond a simple negotiation and is now a legal matter.

- Your Debt Exceeds Your Income: When your total unsecured debt—credit cards, personal loans—is more than your entire annual income, a DIY approach probably isn't going to cut it. The math just isn't on your side.

- Negotiations Have Stalled: You've made honest, good-faith efforts to work with your creditors, but they're just not offering any reasonable solutions. A professional might have relationships or strategies that can break the stalemate.

- The Stress is Overwhelming: The emotional weight of financial hardship is real and serious. If trying to manage all this is causing you severe anxiety or impacting your health, handing the reins to a professional can be an immense relief.

A Few More Questions About Debt Negotiation

Even with a solid plan, you're bound to have some questions pop up. It happens to everyone. Let's walk through some of the most common things people ask when they're figuring out how to negotiate their credit card debt.

https://www.youtube.com/embed/sCj03tsiy3I

How Much Will a Settlement Impact My Credit Score?

There's no sugarcoating it: a debt settlement will ding your credit score. When you settle, the creditor will typically mark the account on your credit report as "settled for less than the full amount." While that’s not as harsh as a charge-off, it’s still a negative mark that can stick around for up to seven years.

It's tough to say exactly how many points your score will drop, but the good news is that the hit lessens over time. As you start building a fresh history of on-time payments, your score will begin to recover. Think of it as a strategic trade-off—you're taking a short-term hit to your credit for some much-needed long-term financial breathing room.

Can I Negotiate Debt That Is Not Past Due?

Yes, you absolutely can. In fact, it’s often a very smart move. Creditors tend to appreciate it when you're proactive instead of waiting for things to spiral. If you can see financial trouble on the horizon—maybe a layoff is coming or you have a big medical bill due—calling your creditor before you miss a payment shows you're taking responsibility.

When you get ahead of the problem like this, you're in a much better position to qualify for something like a temporary hardship program. These programs might lower your interest rate or your monthly payment, and they have a much less severe impact on your credit than settling a delinquent account down the line.

Approaching your creditor early shows good faith. It changes the entire conversation from reacting to a crisis to working together to find a solution.

Is Negotiating Different with a Collection Agency?

While the basic steps are similar, the dynamic is completely different. Your original creditor, like your bank, might still have an interest in keeping you as a customer. A third-party collection agency? They have one job and one job only: to collect as much money as they can.

Here’s the thing, though. Collection agencies often buy old debts for pennies on the dollar, which sometimes gives them more room to settle for a lower amount than the original creditor had. On the flip side, they can be far more aggressive in their tactics. The golden rule here is to always verify the debt is legitimate and get any settlement agreement in writing before you even think about sending them a payment.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to creating security and peace of mind for your family’s future. With over 50 years of experience, Paul Mauro has seen firsthand that taking control of your finances is the first step toward building the life you truly want. Find out more about our approach at https://smartfinancialifestyle.com.