Imagine the financial choices you make today planting seeds of opportunity for your grandchildren. That's the heart of generational wealth. It boils down to a powerful, time-tested formula: build a rock-solid financial foundation, consistently invest for long-term growth, and protect your legacy with smart planning. This isn't just theory; it's a practical blueprint I've seen work time and again for families looking to create lasting prosperity.

The Great Wealth Transfer And Your Family's Future

Talking about legacy isn't just for the ultra-wealthy anymore. We're living through the single most significant financial shift in history. This is about more than just passing down an inheritance; it's about seizing a rare moment to completely change your family's financial story.

This massive global event, often called the 'Great Wealth Transfer,' is reshaping entire economies. The World Economic Forum estimates an astonishing $80 trillion in wealth will change hands over the next few decades, mostly in developed nations. This unprecedented movement of capital makes the conversation about creating generational wealth more urgent than ever. You can read more about this global shift and its economic implications on weforum.org.

Your Money Sends a Message

Every financial decision you make—whether it's saving an extra hundred dollars or setting up a trust—sends a message to the next generation. It tells them what you value, what your priorities are, and what you hope for their future. This is the real core of multi-generational planning.

Are your actions signaling the importance of discipline, long-term vision, and stewardship? Or are they accidentally teaching lessons of short-term spending? Building a lasting legacy starts the moment you align your financial strategy with the values you want to pass down.

Your financial plan is more than just numbers on a page; it's a story you're writing for your family's future. The goal is to ensure that story is one of opportunity, security, and wisdom.

To give you a quick overview, here are the core pillars we'll be covering. Think of this as the high-level roadmap for our journey.

Generational Wealth Blueprint at a Glance

| Pillar | Objective | Key Actions |

|---|---|---|

| Financial Foundation | Create stability and eliminate financial drains. | Budgeting, building an emergency fund, and getting out of high-interest debt. |

| Strategic Growth | Make your money work for you over the long haul. | Consistent investing in diversified assets like stocks, real estate, and businesses. |

| Legacy Protection | Safeguard your assets for future generations. | Creating wills, establishing trusts, and utilizing tax-efficient strategies. |

| Family Education | Prepare heirs to be responsible stewards of wealth. | Teaching financial literacy, communicating values, and setting up family governance. |

Each of these pillars is a critical piece of the puzzle. Skipping one can undermine the strength of the others.

Why This Moment is Critical

Understanding this historic financial backdrop isn't just interesting—it's powerful motivation. It frames legacy planning not as some distant "someday" task, but as a practical and immediate goal. Your family's ability to participate in this transfer depends entirely on the groundwork you lay today.

Starting now is what matters most. For those ready to dive deeper into the specific strategies, our comprehensive guide on multi-generational wealth planning offers more advanced insights. The journey, however, always begins with a single, intentional step.

Building Your Financial Foundation

Before you can even think about building a legacy that lasts for generations, you have to pour a rock-solid foundation. Forget complex investment strategies for a minute. This is about mastering the essential, non-negotiable habits that create the bedrock for everything else.

Think of it like building a skyscraper. Without a powerful base, the whole structure is at risk, no matter how ambitious the design. The journey to real, lasting wealth starts with these disciplined, intentional first steps. They create the system that not only protects your family from financial shocks but also positions you to actually build something that endures.

Master Your Cash Flow with a Purposeful Budget

The first pillar is knowing, without a doubt, where your money is going. A budget isn't a financial straitjacket meant to make you miserable; it’s a strategic plan that lines up your spending with what you actually want out of life. It gives every single dollar a job.

This isn't just about tracking expenses. It’s about having honest conversations, setting shared priorities as a family, and consciously directing your funds toward wealth-building activities instead of letting them vanish. We've got a whole guide on how to create a family budget that actually works, and I highly recommend you check it out.

A budget isn't about what you can't have. It's about deciding what you truly want and creating a clear path to get there. It’s the single most powerful tool for taking control of your financial destiny.

Once you have this clarity, you can start automating your finances. That’s when the real progress begins to feel effortless.

Build Your Financial Moat with an Emergency Fund

Life happens. A sudden job loss, a medical emergency, a major home repair—these things can completely derail even the best-laid plans. An emergency fund is your family’s financial shock absorber. It’s a cash reserve that protects your long-term investments from being raided during a crisis.

Without this cushion, you’re forced to make bad decisions under pressure, like selling investments at a loss or racking up high-interest debt. Honestly, this is one of the biggest reasons wealth gets lost. One emergency can undo years of hard work.

Here’s a practical target to aim for:

- Starter Fund: Get $1,000 to $2,000 saved up first. This gives you a small but immediate buffer.

- Full Fund: Your real goal is 3 to 6 months' worth of essential living expenses. Think mortgage, utilities, food, and transportation.

- Where to Keep It: This needs to be liquid. Put it in a high-yield savings account, completely separate from your everyday checking account.

Building this fund provides an incredible amount of peace of mind. It’s the ultimate defensive play that allows you to navigate life’s storms without sacrificing your long-term vision.

Eliminate Wealth-Destroying Debt

High-interest debt is the silent killer of wealth creation. Every dollar you pay in interest on a credit card is a dollar that isn't working and compounding for your family’s future.

Paying an 18% interest rate is like trying to swim upstream against a powerful current. You’re working hard, but you’re not getting anywhere.

Wiping out this kind of debt is non-negotiable. I tell my clients to use the "avalanche" method: list all your debts and throw every extra dollar you have at the one with the highest interest rate. Once it’s gone, roll that entire payment amount over to the next one. This strategy builds momentum and frees up a ton of cash flow that you can finally put to work building your family’s legacy.

Growing Your Assets Beyond Just Saving

Once you've got your financial house in order—the budget is working, the emergency fund is healthy, and the high-interest debt is gone—it's time for a major mindset shift. Saving money builds a vital wall of security around your family. But investing is what builds the legacy itself. This is where you switch from playing defense to playing offense, making your money work for you to create opportunities for generations to come.

Saving preserves what you have; investing multiplies it. This is the engine of wealth creation, plain and simple. Instead of letting your hard-earned cash sit on the sidelines, you put it into assets with the potential to grow significantly over time. Let's be clear: this is a patient, long-term game, not some get-rich-quick scheme.

The goal isn't to chase hot stocks or time the market perfectly. It's about consistently putting your capital into proven, wealth-building vehicles. This strategic growth is what separates families who simply maintain their financial footing from those who elevate it for their children and grandchildren.

The Twin Engines of Generational Wealth

For centuries, two asset classes have been the undisputed champions of serious wealth accumulation: stocks and real estate. Understanding how to harness the power of both, even on a small scale, can dramatically accelerate your family's financial journey.

-

Investing in Stocks: This just means buying small ownership stakes in businesses. You don't need to be a Wall Street whiz. For most people, the simplest and most effective route is investing in low-cost, diversified index funds or ETFs. These funds hold tiny pieces of hundreds or thousands of companies, which spreads out your risk and lets you capture the growth of the broader economy.

-

Investing in Real Estate: Owning property is a double-whammy for wealth building. You get the potential for the property's value to go up over time (appreciation) and the ability to generate rental income. This can start with the home you live in and later expand to a rental property, creating a separate income stream that builds your equity at the same time.

Think of wealth as a family tree. The roots are deep in smart financial habits, and the branches grow into lasting prosperity. It's no accident that newer generations have amassed significantly more wealth than their predecessors. They've shifted from pure saving to focusing on asset growth in housing and the stock market. Just look at the Baby Boomers in the US—they currently hold $78.55 trillion, or 51.8% of the national wealth, setting the stage for a massive transfer to their heirs. You can dig into more insights on wealth across generations at CEPR.org.

Strategic Tools for Tax-Efficient Growth

Growing your money is one thing; keeping as much of that growth as possible is the real trick. The government offers some incredibly powerful investment accounts with huge tax advantages designed specifically to help families save for the long haul. Using them isn't just a good idea—it's a critical part of any smart wealth-building strategy.

A Roth IRA is a fantastic tool for this. You put in money you've already paid taxes on, and in return, all future growth and withdrawals in retirement are 100% tax-free. Imagine this: your high schooler earns a summer income, and you help them open a Roth IRA. A few thousand dollars invested at age 18 can mushroom into a massive, tax-free nest egg by the time they retire, giving them an unbelievable head start.

The magic of a Roth IRA isn't just the tax savings; it's the gift of time. A small contribution today can become a life-changing amount of tax-free money decades from now, a true foundational gift for the next generation.

Another key tool is the 529 plan, designed specifically for education savings. Contributions grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses. This lets you build a dedicated fund for a child's or grandchild's future education, giving them the freedom to chase their dreams without being shackled by student loan debt.

Building Multiple Streams of Income

Relying on a single income source, like your 9-to-5 job, is risky. If you want to really accelerate wealth creation, you need to focus on developing multiple streams of income. This doesn't mean you need to work three jobs. It’s about building systems and owning assets that generate cash flow for you.

Here are a few practical examples to get you thinking:

- Rental Income: As we talked about, a rental property can provide a steady monthly check that supplements your primary income.

- Side Business: Start a small business based on a skill or passion you already have. This could be anything from consulting in your field to a weekend photography business.

- Dividend Investing: Own stocks that pay dividends—regular cash payments that companies make to their shareholders just for owning the stock.

Each new stream of income provides more capital to reinvest, creating a powerful snowball effect. This approach not only builds financial resilience but also dramatically speeds up the timeline for achieving your family’s long-term goals. The journey to create generational wealth is a marathon, and every extra income stream helps you run it faster and more securely.

Protecting Your Legacy For The Next Generation

You’ve worked hard your entire life to build something meaningful. But piling up assets is just one part of the equation. The other, arguably more critical, part is making sure that wealth is protected and passed on smoothly to the people you care about most.

Without a solid plan, a lifetime of work can get chipped away by taxes, legal battles, and ugly family fights. It’s a sad but common story. Research has shown that a shocking 70% of family wealth is gone by the second generation, and it's almost always due to a lack of planning.

This is where estate planning comes in. It’s not about stuffy legal documents; it’s about creating a financial fortress around your family’s future. Think of it as the ultimate instruction manual you leave behind, ensuring your wishes are followed to the letter and transforming your assets into a true, lasting legacy.

The Foundational Documents Everyone Needs

At its core, protecting your legacy relies on a handful of key legal documents. Each one serves a distinct, complementary purpose—think of them as the pillars holding up your financial fortress. Getting these in place removes any guesswork and gives your loved ones the confidence to act on your behalf when they need it most.

These aren't just for the ultra-wealthy; they're essential for anyone who wants to protect their family.

-

Last Will and Testament: This is your baseline. It spells out exactly who gets your assets, who you want to be the guardian for your minor kids, and who you trust as the executor to manage it all. Without a will, the state makes those calls for you, and their decisions probably won't match yours.

-

Durable Power of Attorney for Finances: This document is a lifesaver. It lets you appoint someone you trust to handle your financial decisions if you ever become unable to do so yourself. They can pay bills, manage investments, and keep your financial life running smoothly, preventing a crisis.

-

Advance Directive for Health Care: Sometimes known as a living will, this outlines your wishes for medical treatment. It also names a trusted person to make healthcare decisions if you can't communicate them, taking an immense burden off your family during a stressful time.

Why a Trust is Your Most Powerful Tool

A will is a must-have, but it comes with a major catch: it has to go through probate. That’s a public, often painfully slow, and expensive court process. A trust, on the other hand, is a far more powerful tool that lets you bypass probate entirely, saving your family a ton of time, money, and stress.

A trust is simply a legal container that holds your assets—like your house, investments, and bank accounts—for your heirs. Since the trust owns the property (not you personally), it isn't part of your probate estate when you pass away.

A revocable living trust is one of the single most effective tools for creating a seamless wealth transfer. It maintains your control over your assets while you are alive and ensures they pass directly to your heirs privately and efficiently after you're gone.

This structure provides incredible peace of mind. To get a better handle on this, you can learn more about what is a revocable living trust in our detailed guide, which breaks down how it can become the cornerstone of your entire plan.

The Strategic Role of Life Insurance

Finally, let’s talk about life insurance. It plays a unique and absolutely vital role in protecting your legacy. It’s not just about replacing lost income; it's a strategic tool for giving your heirs an injection of instant, tax-free cash.

This liquidity can be a game-changer for several reasons:

- Paying off the mortgage or other debts, freeing your family from those financial burdens.

- Covering final expenses and any estate taxes without forcing them to sell other assets.

- Providing an immediate, tax-free inheritance to give your loved ones financial stability.

By weaving these elements together—a will, powers of attorney, a trust, and life insurance—you create a comprehensive shield. This isn't just paperwork; it’s strategic planning that ensures the wealth you've worked so hard for becomes a source of opportunity and security for generations to come.

Navigating The Human Side Of Wealth

Let's be honest. Building and protecting your assets is the easy part—it's mostly a mechanical process of numbers and legal structures. The real challenge, the one that keeps people up at night, is making sure that wealth becomes a source of unity and opportunity, not division and entitlement.

A successful wealth transfer has very little to do with the dollars in an account and everything to do with family dynamics, communication, and education. This is where the real work of creating a lasting legacy happens.

It’s a staggering statistic, but 70% of family wealth is completely gone by the second generation. And it's not because of bad investments or a market downturn. It's lost because of breakdowns in trust and communication. You can have the most sophisticated financial plan in the world, but it will crumble if your heirs aren't prepared to receive it—both emotionally and intellectually.

Fostering Stewardship Over Entitlement

The single greatest risk to your family's legacy isn't a stock market crash; it's raising children who feel entitled to wealth they didn't help create. The antidote? Stewardship. It's a mindset shift from "this is mine to spend" to "this is ours to manage responsibly for the future."

This shift starts with how you talk about money. It can't be a taboo topic, hidden away in a lockbox. Money needs to be a normal part of the family conversation, always framed around your values, goals, and responsibilities.

Here’s how you can start building this mindset from an early age:

- Bring kids into age-appropriate financial decisions. Let your teenager help research the family vacation budget or compare costs for a big purchase. This gives them a real-world peek into trade-offs and what responsible spending actually looks like.

- Separate chores from allowances. Chores are about contributing to the family. An allowance, or money from a part-time job, is a tool for learning how to budget, save, and give. This simple change breaks the transactional "I do this, I get that" cycle.

- Share your financial story—the good and the bad. Talk openly about your successes, but don't skip the failures. Sharing the hard work, the discipline, and even the mistakes that went into building your wealth makes it real. It makes it relatable.

The Family Financial Meeting

One of the most powerful tools I've seen for getting a family on the same page is the family financial meeting. And no, this isn't some stuffy, intimidating boardroom session. It’s just a dedicated time to have open, honest conversations about the family's financial picture and where you're all headed.

The goal here is transparency and a shared sense of purpose. A typical agenda might be reviewing the family’s mission statement, celebrating a few financial wins (like paying off a car), talking about a big goal on the horizon, or even planning a family charitable project.

Think of the family meeting as the regular huddle for your family's financial team. It’s where you reinforce shared values, teach critical lessons, and make sure everyone understands the "why" behind your financial plan.

This simple act transforms heirs from passive recipients into active, engaged partners in their own legacy. It's where you teach them how to think about wealth, not just what to do with it.

The stakes for getting this right are enormous. Imagine your grandkids stepping into adulthood with the tools to thrive, not just survive—that's what we're talking about. The Baby Boomer generation currently holds over $83 trillion in net wealth globally. Over the next couple of decades, more than $74 trillion of that is expected to be passed down. You can dig into more insights on this historic wealth shift in UBS's latest report. Preparing your family for that responsibility is the single most important investment you will ever make.

This human element—the education, the communication, the shared values—is the glue that holds a multi-generational plan together. Without it, you’re just passing down money. With it, you’re passing down a legacy of wisdom and opportunity that can truly last.

Putting It All Together: Your Legacy In Action

We’ve covered a lot of ground, and now you have the complete blueprint for creating real, lasting generational wealth. This isn't about abstract theory; it's about taking concrete steps that can reshape your family’s trajectory for decades. It goes so far beyond just piling up money. What we're really talking about is building lasting security, opening up incredible opportunities, and achieving true peace of mind.

At the end of the day, the whole process rests on four essential pillars:

- Building Your Foundation: Getting your budget right, creating a solid emergency fund, and crushing any wealth-destroying debt.

- Growing Your Assets: Making consistent, disciplined investments in proven vehicles like stocks and real estate.

- Protecting Your Legacy: Using the right tools—wills, trusts, and insurance—to safeguard everything you've worked for.

- Preparing Your Family: This is the big one. It's all about financial education and fostering open, honest communication.

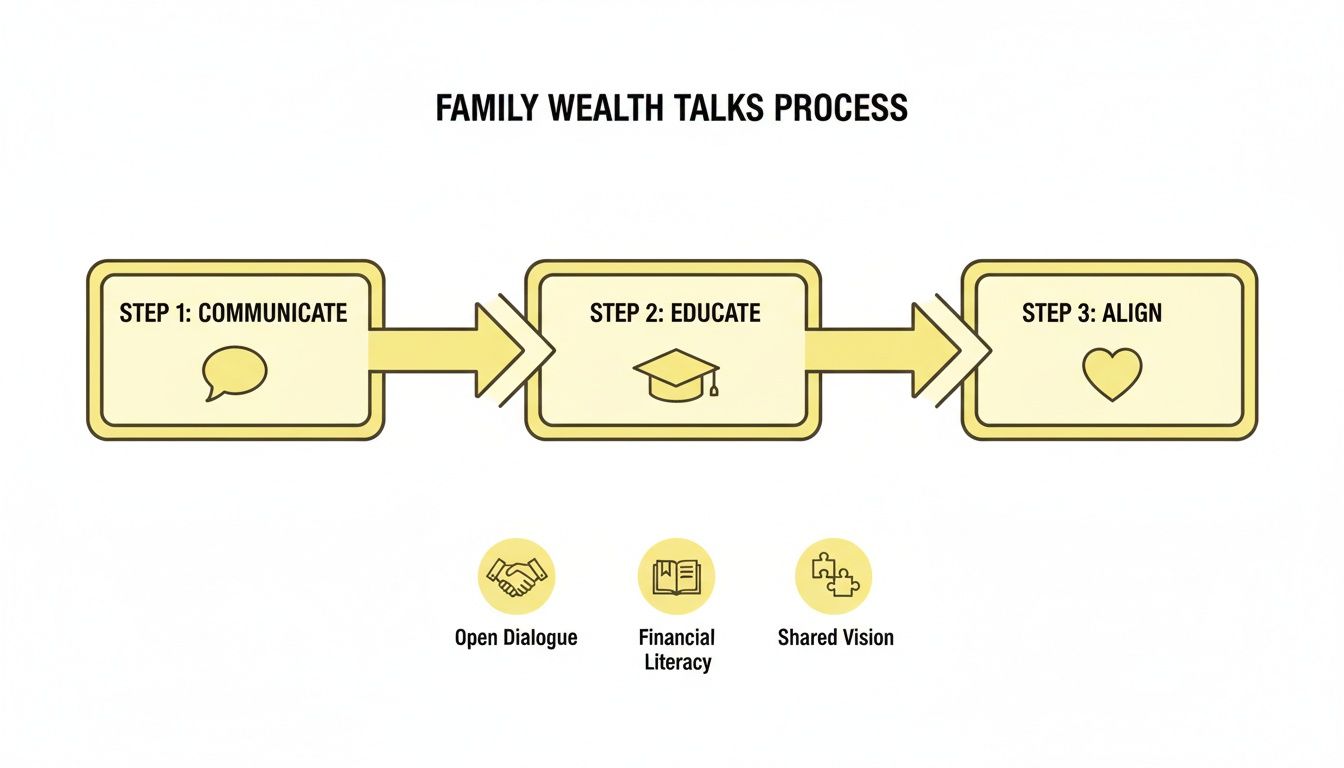

Aligning Your Family's Vision

Ultimately, success hangs on one thing: communication. Getting everyone on the same page is what makes a wealth transfer smooth instead of stressful. I like to think about it with a simple process flow.

This visual really drives home a key point: all the financial tools in the world are only as good as the shared values and mutual understanding that support them. And that foundation is only built through intentional, meaningful conversations.

Building a legacy is the ultimate expression of care for your family's future. It’s a marathon, not a sprint, and it begins the moment you decide to take that first intentional step.

It honestly doesn't matter where you're starting from. Whether you're just climbing out of debt or you're already well on your way with investing, the principles don't change. The only thing that truly matters is that you start today. You now have the knowledge and the roadmap to do just that.

Common Questions About Building Generational Wealth

When you start thinking about building a financial legacy, a lot of questions pop up. It's only natural. Let's walk through some of the most common ones I hear from families, cutting through the noise to give you the clarity you need.

When Should I Start Planning? Is My Income High Enough?

This is probably the biggest misconception out there. People think they need to hit some magic income number before they can even think about generational wealth. That's just not true.

It’s all about habits, not income brackets. You can start the journey today, right where you are. It begins with the simple, powerful act of creating a budget you can stick to, automating your savings, and aggressively paying down any high-interest debt that's holding you back. The core of it all is living on less than you make and putting the difference to work.

Even small, consistent investments into something like a diversified, low-cost index fund can balloon into a serious nest egg over a few decades. That's the beautiful math of compounding at work. Whether you're starting with $100 a month or $10,000, the principle is exactly the same. Consistency trumps amount every single time.

What's the Single Biggest Mistake Families Make?

Hands down, it's the failure to communicate. So many families treat money like a forbidden topic, cloaking it in secrecy. This almost always backfires, leading to confusion, resentment, and ugly conflicts when it's time to pass assets to the next generation. This silence is the number one reason why a staggering 70% of family wealth is gone by the time it reaches the kids.

I've seen it happen time and again: a perfectly crafted estate plan can completely unravel if the heirs aren't ready for it, both emotionally and financially. Talking openly about the values, responsibilities, and the why behind the wealth is just as vital as any legal document.

Running a close second is failing to prepare heirs with real financial literacy. The goal isn't just to transfer assets; it's to transfer wisdom, too.

How Do I Protect My Kids' Inheritance From a Divorce or Lawsuit?

This is a critical piece of the puzzle, and thankfully, there are powerful legal tools designed for exactly this purpose. The most effective strategy I've seen is placing the assets into an Irrevocable Trust for your children's benefit.

When an experienced estate planning attorney sets this up correctly, the trust acts like a fortress around the inheritance. It typically includes specific language to shield the assets:

- A Spendthrift Clause: This is a legal provision that keeps the trust's assets out of the reach of your children's future creditors or anyone who might sue them.

- Asset Segregation: The trust legally separates the inheritance from any marital property. This is huge, as it protects the funds from being divided up in a potential divorce.

Setting this up ensures the wealth you worked so hard to build stays in your family, doing what you intended it to do for generations to come.

At Smart Financial Lifestyle, we're dedicated to helping families make smart decisions that create lasting security and opportunity. To see more on how to build your own family's financial blueprint, check out the resources on our website.