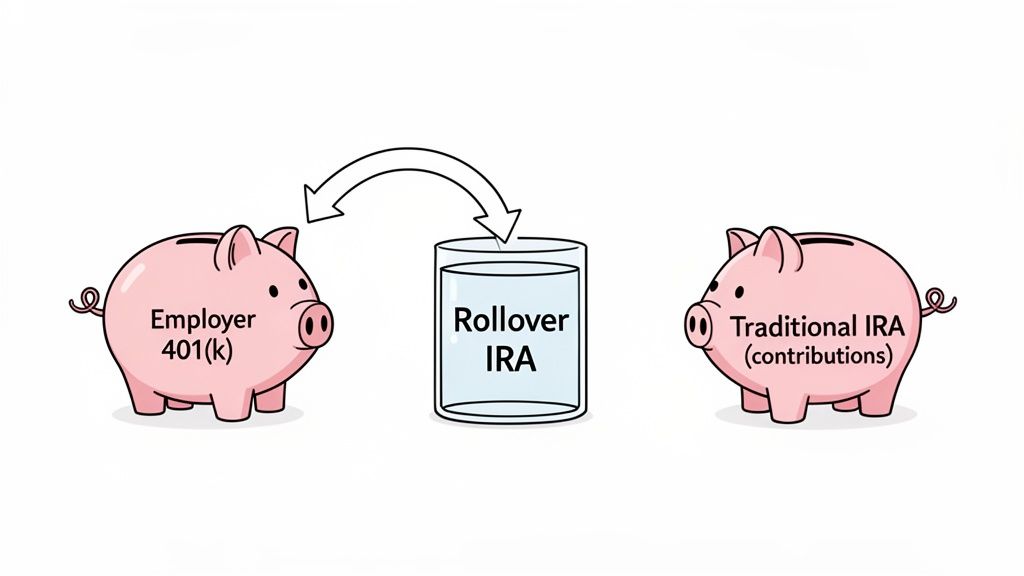

When people ask about the difference between a Rollover IRA and a Traditional IRA, the answer is simpler than you might think. A Rollover IRA isn't a separate type of account—it's just a Traditional IRA that's been specifically set up to receive money from an old employer-sponsored plan, like a 401(k).

Think of it this way: a Traditional IRA is like a big storage room for your retirement savings. A Rollover IRA is just a container inside that room that you've labeled "From My Old Job's 401(k)." They both follow the same tax rules, but keeping those rollover funds separate has some real strategic advantages.

Understanding The Key Difference Between A Rollover And Traditional IRA

At the end of the day, every Rollover IRA is a Traditional IRA, but not every Traditional IRA holds rollover money. This might seem like a minor detail, but it can make a big difference in how you manage your retirement funds down the road.

The main job of a Rollover IRA is to act as a clean receiving account for assets you've built up in a workplace retirement plan. This keeps those funds neatly separated, which is a smart move for a couple of key financial strategies.

A Traditional IRA, on the other hand, is the account most people think of when they're making their yearly retirement contributions from their personal savings, up to the annual IRS limits. In contrast, a Rollover IRA is usually funded with a single, often large, transfer from a 401(k) or similar plan when you switch jobs, get laid off, or retire.

Funding Sources and Purpose

The easiest way to see the difference is to look at where the money comes from.

- Traditional IRA: You typically fund this account yourself with annual contributions from your income. You might even get a tax deduction for it. The goal here is steady, year-over-year saving.

- Rollover IRA: This is funded by moving a lump sum from an old employer's plan. The goal is to consolidate those assets, giving you far more control and a wider universe of investment options than your old 401(k) likely offered.

From my experience, labeling an IRA as a 'Rollover' account is simply good housekeeping. It helps you and your advisor track the origin of your funds, which becomes critical if you ever want to move that money back into a new employer's 401(k) plan in the future. Some company plans will only accept rollovers that have been kept separate from your personal IRA contributions.

Rollover IRA vs Traditional IRA Core Characteristics

To make this crystal clear, let's break down the core differences in a simple table. This highlights the fundamental distinctions between an IRA funded primarily by rollovers and one funded by your annual contributions.

| Feature | Rollover IRA | Contribution-Based Traditional IRA |

|---|---|---|

| Primary Funding Source | Lump-sum transfer from an old employer plan (e.g., 401(k)) | Annual personal contributions up to IRS limits |

| Typical Account Size | Often larger due to accumulated employer plan assets | Generally smaller, built up by yearly contributions |

| Strategic Purpose | To consolidate old retirement funds for better control | To systematically save for retirement each year |

Ultimately, both accounts serve the same purpose: helping you build a secure retirement. The key is knowing which one to use and when, based on where your money is coming from.

How Rollovers Fuel Your Retirement Growth

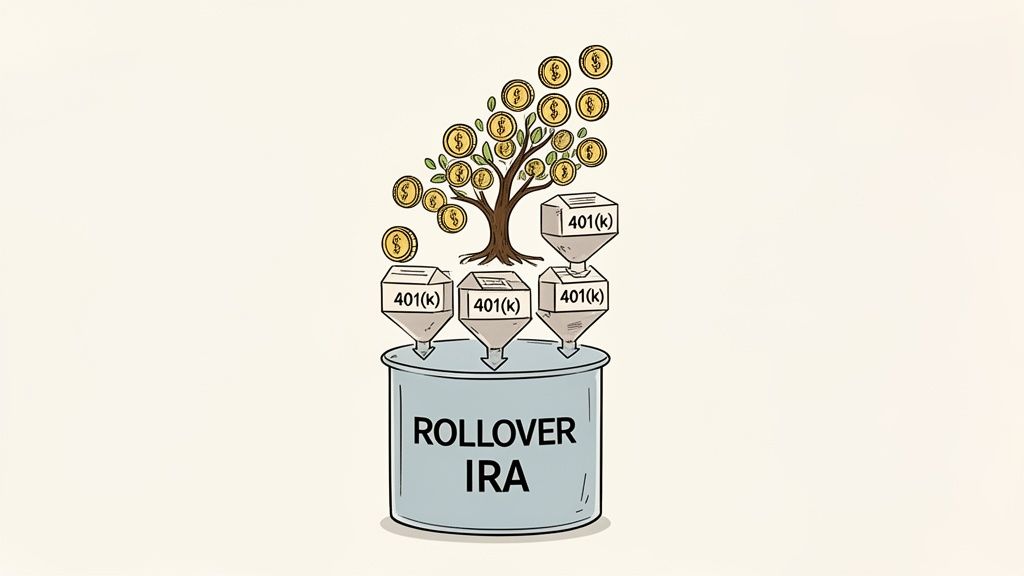

While making steady annual contributions to a Traditional IRA is a fantastic habit, it's not the whole story. For most people with substantial IRA balances, the real engine of growth is the rollover. A rollover is the single most powerful move you can make to consolidate and supercharge the savings you’ve built up over a career.

It’s not about adding a few thousand dollars a year. It’s about moving an entire nest egg into an account where it can keep growing, tax-deferred, under your direct control.

Think of it like this: your annual contributions are like planting a new tree in your orchard each year. A rollover is like transplanting an entire mature grove from someone else's property onto your own land. Now you can tend to it, choose the fertilizer, and make sure it thrives for decades. This consolidation is the key to unlocking serious, long-term compounding.

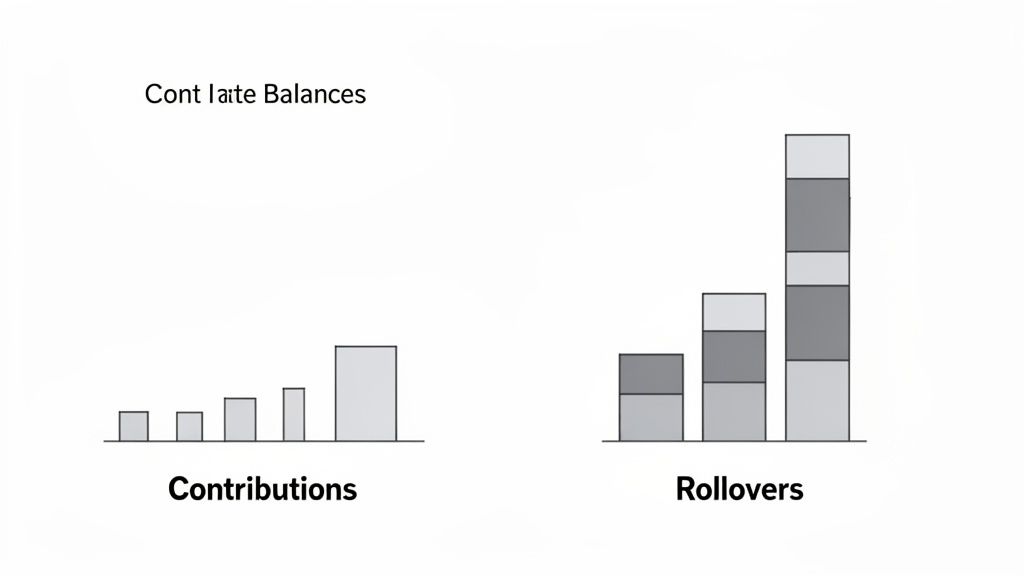

The Scale of Rollovers vs Contributions

To really get a feel for the power of rollovers, you just have to look at the numbers. The vast majority of money flowing into Traditional IRAs isn't coming from individuals making their yearly contributions. It's coming from assets moved out of employer-sponsored plans like 401(k)s.

The data paints a startlingly clear picture. Back in 2020, a staggering 96.4% of the $616.9 billion that went into Traditional IRAs—that's $594.8 billion—came directly from rollovers. In comparison, a tiny 3.6%, or $22.1 billion, trickled in from personal contributions.

More recent data from 2023 showed that 62% of households with a Traditional IRA reported having rollovers in their accounts. The difference is stark: the median balance for those with rollovers hit $150,000, while it was a mere $55,000 for contribution-only IRAs. You can learn more about these retirement funding trends and what they mean for savers.

This distinction is vital. It completely reframes the conversation from 'How much can I save each year?' to 'How can I best protect and grow the significant wealth I've already built?' For families managing wealth across generations or individuals nearing retirement, the rollover isn't just an administrative task; it's the primary strategic move.

Why Consolidation Maximizes Growth Potential

Moving funds from an old 401(k) into a Rollover IRA is about so much more than just tidying up your finances. It unlocks several key advantages that can directly boost the growth and preservation of your retirement savings.

- Expanded Investment Choices: Most 401(k) plans offer a limited menu of investment options, usually just a handful of mutual funds. An IRA, on the other hand, opens up a nearly limitless universe of stocks, bonds, ETFs, and mutual funds. This allows for a much more personalized strategy tailored to your goals.

- Lower Fees and Expenses: Let's be honest, some employer-sponsored plans come with high administrative fees or expensive fund options. By moving your money to a low-cost IRA provider, you can dramatically reduce the fees that eat away at your returns over time. Even a 1% difference in fees can translate to tens or even hundreds of thousands of dollars over a lifetime.

- Simplified Management: If you've had a few jobs over the years, you might have several old 401(k)s scattered across different providers. Consolidating them into a single Rollover IRA just simplifies your financial life. It’s far easier to monitor performance, manage your asset allocation, and plan for distributions when everything is in one place.

Strategic Implications for Your Financial Future

Once you grasp this dynamic between a rollover IRA vs a Traditional IRA, your focus naturally shifts. The real power isn't just in saving, but in strategically managing what you've already saved. A rollover preserves the tax-deferred status of your money, allowing your entire balance to keep growing without being chipped away by annual taxes on investment gains.

This is especially critical for those in their peak earning years or getting close to retirement. The large sums you've accumulated in a 401(k) represent years of hard work. A rollover ensures that this capital continues working for you efficiently, giving you the control and flexibility needed to navigate your financial future with confidence. It transforms a collection of fragmented accounts into a unified, powerful tool for building a lasting legacy.

Comparing Funding Methods and Account Balances

The real story behind a Rollover IRA versus a Traditional IRA isn't just about the name; it’s about how the money gets in there. This single difference explains the massive gap you often see in their account balances.

A Traditional IRA is built brick-by-brick through your annual contributions. A Rollover IRA, on the other hand, is usually funded in one big move—transferring the entire balance you’ve built up in an old 401(k) from a previous job. It’s like comparing years of steady saving to inheriting a lump sum.

That’s not just a technical detail; it’s the key reason for the huge difference in retirement wealth between the two. The money you can sock away in a 401(k) over a decade, especially with an employer match, often dwarfs what you could ever contribute to an IRA in the same amount of time. A rollover simply moves that accumulated wealth into an account where you have full control.

The Numbers Tell the Story

When you look at the data, the picture becomes crystal clear. We're not talking about a small difference here—it’s a chasm that highlights just how much financial power is sitting dormant in old employer-sponsored plans.

According to the 2022 Survey of Consumer Finances, households with rollover IRAs reported a median balance of $120,000 and an average balance of a whopping $384,239. Compare that to IRAs funded only by annual contributions, and you'll see they don't even come close. By mid-2020, about 59% of all Traditional IRA households held assets that started as a rollover, which shows you how common this strategy is. This trend is fueled by huge sums of money, like the $517 billion rolled into Traditional IRAs back in 2018 alone. You can dig into the financial survey findings on retirement accounts for the full breakdown.

After decades of working with families, I can tell you this is the single most overlooked source of wealth out there. People leave behind significant 401(k) balances from jobs they held years ago, not realizing they are sitting on a powerful, dormant asset. Consolidating this into a Rollover IRA is the first step toward putting that money back to work with purpose.

Why Such a Massive Difference in Balances

The reason for the gap is just simple math, dictated by IRS contribution limits. Your ability to save in a 401(k) is just on another level compared to what you can put into an IRA each year.

- 401(k) Contribution Power: In 2024, you can contribute up to $23,000 to your 401(k). If you’re 50 or older, you can add another $7,500 as a catch-up contribution. And that’s before any company match.

- IRA Contribution Limits: For an IRA in 2024, the limit is only $7,000, with a $1,000 catch-up contribution.

Think about that over 10 years. A focused saver could put $230,000 or more into their 401(k) from their paycheck alone. In that same decade, they could only contribute $70,000 to an IRA. When you move that larger 401(k) balance into a Rollover IRA, you’re locking in that superior savings power.

What This Means for Your Strategy

If you've ever changed jobs, understanding the difference between a rollover IRA vs a Traditional IRA is absolutely critical. The money in your old 401(k) represents your best chance to supercharge your retirement savings in a way that small annual contributions never could.

When you start a rollover, you're not just organizing your accounts—you're grabbing the wheel of a much bigger financial engine. It’s a move that lets you keep growing your largest pool of retirement assets with far more investment flexibility and potentially lower fees. For anyone serious about building a secure retirement, learning what to do after you've maxed out your current 401(k) is the logical next step. You can explore more strategies in our guide on how to save for retirement after maxing out your 401k.

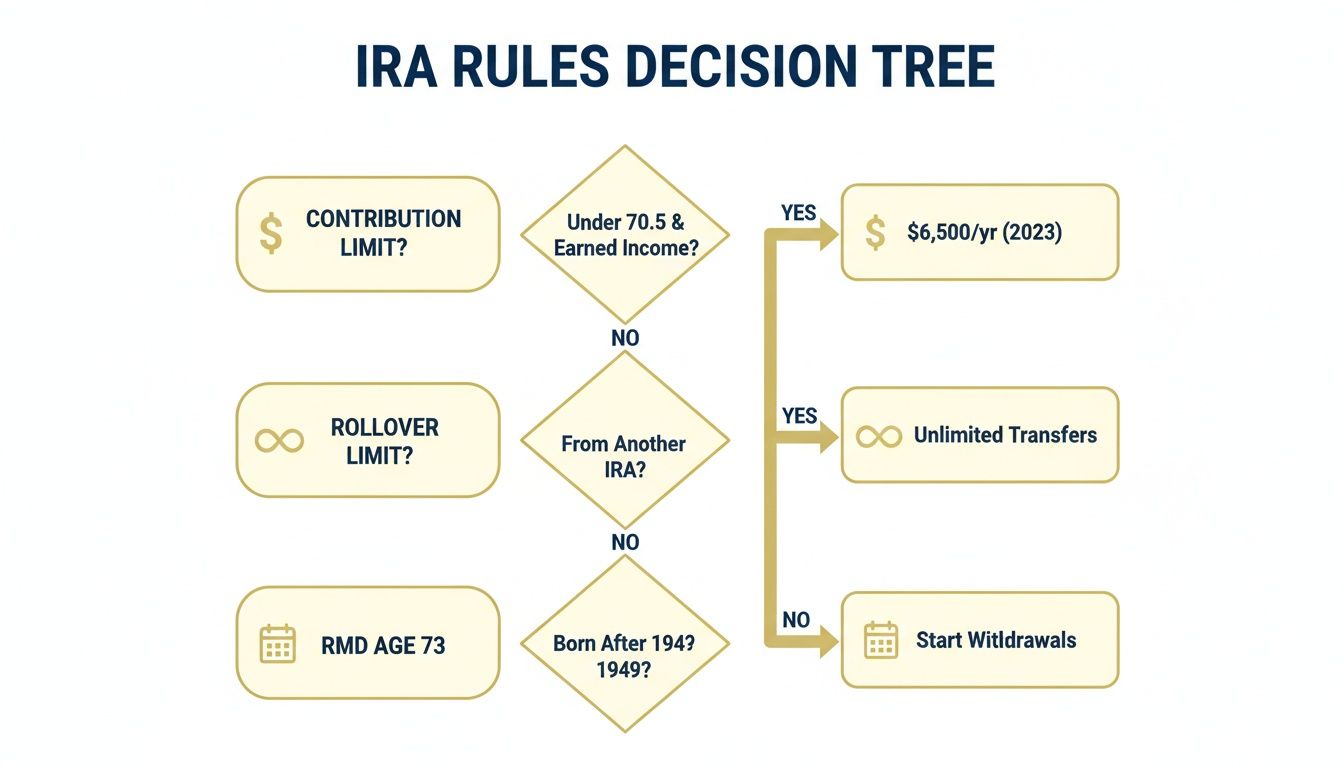

Understanding Contribution and Withdrawal Rules

When you stack a Rollover IRA next to a Traditional IRA, the rules for putting money in and taking it out are a huge source of confusion. The two processes are on completely different tracks. It helps to think of it like filling a reservoir: contributions are a slow, controlled stream, while a rollover is like diverting an entire river into it all at once.

One path has strict annual limits, while the other is a one-time event with no cap at all. Getting this distinction right is everything, because it shapes how you build your retirement savings and how you’ll eventually get that money back out.

The Clear Line Between Contributions and Rollovers

A Traditional IRA is built for annual contributions from your income. This is the money you intentionally set aside each year to save for your future. The IRS is very firm on how much you can put in, setting the limit for 2024 at $7,000, or $8,000 if you're age 50 or older. This is a hard-and-fast rule that applies to your total contributions across all your IRAs for the year.

A rollover, however, is not a contribution. It’s simply a transfer of assets from one qualified retirement account (like a 401(k)) into another (your IRA). Because of this, rollovers don’t fall under the annual contribution limit. You can roll over $50,000, $500,000, or even more from an old employer plan in a single move without an issue.

This is the key reason why IRAs funded by a rollover often hold much larger balances. They’re built on years of savings from 401(k)s with higher contribution limits, not just the smaller annual additions allowed for IRAs.

Navigating Required Minimum Distributions (RMDs)

The rules for taking money out are just as critical as the ones for putting money in. With both a standard Traditional IRA and a Rollover IRA, the government eventually requires you to start taking withdrawals once you hit a certain age. We call these Required Minimum Distributions (RMDs).

Thanks to the SECURE 2.0 Act, the current RMD age is 73. This means that starting in the year you turn 73, you must withdraw a certain percentage of your account balance every year, calculated based on your account value and life expectancy.

This is a non-negotiable rule with steep penalties. Failing to take your full RMD can result in a penalty of up to 25% of the amount you were supposed to withdraw. For anyone planning their retirement income, managing RMDs is a critical piece of the puzzle.

These mandatory withdrawals are how the IRS makes sure it eventually collects taxes on your tax-deferred savings. It’s a vital detail to consider not just for your own retirement planning but also for anyone hoping to leave a financial legacy for their family.

The RMD Impact on Savers and Legacy Goals

The data shows just how central RMDs are in the world of Traditional IRAs. In tax year 2022, only about 22% of Traditional IRA owners actually made a contribution. On the flip side, RMDs drive most of the withdrawal activity; 76% of those who took money out in 2019 did so because of these requirements. For a deeper look, you can discover more insights about these IRA savings trends on PlanAdviser.com.

This highlights a key strategic point for legacy planning. If your goal is to pass on as much wealth as possible, the mandatory drawdowns from a Traditional IRA can work against you.

This is where a powerful alternative comes into play: the Roth IRA.

- Roth IRA Advantage: Roth IRAs are funded with after-tax dollars, so qualified withdrawals in retirement are completely tax-free.

- No Lifetime RMDs: Most importantly, the original owner of a Roth IRA is never required to take RMDs during their lifetime. This allows the entire account balance to keep growing, tax-free, for as long as you live.

This feature makes the Roth IRA an exceptionally powerful tool for estate planning, allowing you to preserve wealth for your heirs without forced distributions eating away at the principal. For those managing family wealth, knowing when to use a Traditional IRA for consolidation and when to consider a Roth conversion for legacy is key to a well-rounded strategy. You can also explore our guide on effective retirement withdrawal strategies to better plan your financial future.

When to Choose a Rollover IRA for Your Goals

Figuring out whether to leave your money in an old 401(k) or move it into an IRA is a major financial crossroad. While a Traditional IRA is a fantastic tool for your yearly savings, the decision to actually do a rollover usually comes up during specific life events. A rollover isn’t just about shuffling money around; it’s about taking the reins of your financial future.

This move is especially powerful when you're going through big changes. Whether you’re switching jobs, getting close to retirement, or just want more say over your investments, a rollover offers the kind of flexibility you rarely get with an employer-sponsored plan. It turns an old, forgotten account into a tool that’s actively working for you.

Aligning Rollovers with Key Life Stages

The choice to roll over an old 401(k) gets a lot clearer when you look at it through the lens of where you are in life. What makes sense for a mid-career professional is completely different from what someone planning their legacy needs.

For Those Changing Jobs

Leaving a job is the number one reason people consider a rollover. Instead of leaving a 401(k) behind with a company you no longer work for, consolidating it into a Rollover IRA just makes life simpler. You get a single, clear picture of your retirement assets, which makes it much easier to manage your overall investment strategy without having to log into three different old accounts.

For Near-Retirees

As retirement gets closer, control and flexibility become everything. A Rollover IRA opens up a much wider world of investment choices, like specific bonds, ETFs, and other assets designed to generate income that your 401(k) might not offer. This allows you to really fine-tune your portfolio to protect what you've built and create a reliable income stream. It also simplifies calculating your Required Minimum Distributions (RMDs) by having everything in one place.

For Individuals Seeking Financial Control

A 401(k) plan is built for everyone at the company, which often means a limited, one-size-fits-all menu of investments. A Rollover IRA puts you in the driver’s seat. You and your financial advisor can build a personalized portfolio that truly reflects your comfort with risk, your growth goals, and even your personal financial values.

This decision tree helps visualize some of the core rules that govern IRA accounts, from how much you can contribute each year to when you have to start taking withdrawals.

As the chart shows, while your annual contributions are capped, rollovers are a way to move much larger sums without those limits, though RMDs will eventually come into play.

Making the Decision with Confidence

Seeing the specific situations where a rollover excels helps clear up the rollover IRA vs traditional IRA debate. Think of it this way: a Traditional IRA is for building savings year by year, while a Rollover IRA is for consolidating and managing the significant nest egg you've already worked hard to build.

In my 50+ years of experience, I’ve seen that the most confident financial decisions come from aligning your actions with your goals. A rollover is often the first major step people take to truly own their retirement strategy, moving from a passive saver to an active steward of their family’s wealth.

Ask yourself these key questions to guide your thinking:

- Do you want more investment options? If the limited funds in your old 401(k) feel restrictive, a rollover is your ticket to a much broader universe of choices.

- Are you trying to simplify your financial life? Pulling multiple old 401(k)s into one IRA makes tracking and managing your money worlds easier.

- Are the fees in your old plan too high? A rollover can give you access to lower-cost investments, which means more of your returns stay in your pocket over the long haul.

Answering yes to any of these is a strong sign that a Rollover IRA is the right strategic move for you. It's a proactive step toward building a secure, well-managed financial future that’s built around your personal vision for retirement and beyond.

Navigating the Rollover Process and Avoiding Common Mistakes

Executing a rollover sounds simple enough, but a few critical missteps can turn a straightforward transfer into a costly tax nightmare. The single most important decision you'll face is how the money gets from your old 401(k) to your new IRA. This choice alone can mean the difference between a smooth transition and an unexpected bill from the IRS.

The process really comes down to two paths, and they come with very different rules and risks. Getting these methods straight is the key to protecting your nest egg and making sure it continues to grow tax-deferred without a hitch.

Direct vs. Indirect Rollovers: A Critical Distinction

The safest and, frankly, the only method I recommend is the direct rollover, also known as a trustee-to-trustee transfer. In this scenario, you never actually touch the money. Your old 401(k) provider sends the funds straight to your new IRA custodian, either by check or wire transfer. Because the money moves from one financial institution to another without ever passing through your personal bank account, it’s a clean, non-taxable event that isn't even reported to the IRS as a distribution.

The alternative is an indirect rollover, often called a 60-day rollover. This method is far riskier. Your old plan administrator will cut you a check for the balance, but not before withholding a mandatory 20% for federal taxes. You then have exactly 60 days to deposit the entire original amount (including the 20% that was withheld) into your new IRA. If you miss that deadline for any reason, the whole distribution could be taxed as income, plus a potential 10% early withdrawal penalty if you're under 59½.

From my experience, the 60-day rollover introduces unnecessary risk for almost no benefit. I’ve seen people miss the deadline due to a simple oversight or a life event, and the financial consequences are severe. Always choose the direct rollover to protect your capital.

Common Mistakes and How to Avoid Them

Even with a direct rollover, you still need to be diligent. A few common errors can still cause headaches, but they are easy to sidestep with a little prep work.

- Failing to Research the New Provider: Before you even start the process, thoroughly vet your new IRA custodian. Compare their investment options, look at the account fees, and check out their customer service. You need to be sure their platform aligns with your long-term goals.

- Missing the 60-Day Window (Indirect Rollover): This is the most catastrophic error you can make. If you do go the indirect route, set multiple calendar alerts. You absolutely must deposit the full pre-tax amount to avoid penalties. For example, on a $100,000 rollover, you'd only receive a check for $80,000. You have to come up with $20,000 from your own pocket to deposit the full $100,000 into the new IRA, then wait to get the withheld amount back when you file your taxes.

- Incorrectly Handling Company Stock: If you hold highly appreciated company stock in your 401(k), there are special tax rules (called Net Unrealized Appreciation) that could save you a ton of money. Rolling that stock directly into an IRA can wipe out these benefits. Always talk to a financial professional if this is part of your situation.

By choosing a direct rollover and carefully selecting your new IRA provider, you can confidently consolidate your retirement assets. This thoughtful approach ensures your wealth is preserved and positioned for future growth. Making smart choices at this stage is crucial, and you can learn more about related tax strategies in our guide on how to reduce taxes in retirement.

Your IRA Questions, Answered

When you're sorting out the details between a Rollover IRA and a Traditional IRA, a few common questions always pop up. Let's get you some direct answers so you can move forward with your retirement plan confidently.

Can I Contribute Annually To A Rollover IRA?

Yes, you absolutely can. Think of it this way: once you move funds from an old 401(k) to start a Rollover IRA, it immediately starts acting just like any other Traditional IRA. You're free to make annual contributions to that same account, as long as you stick to the yearly IRS limits for your age and income. It's a great way to keep building your savings in one consolidated place.

What Happens If I Miss The 60-Day Rollover Deadline?

Missing that 60-day window for an indirect rollover is a big deal, and the consequences are serious. The IRS will almost always treat the entire amount as a taxable distribution for that year. If you’re under age 59½, you’ll likely get hit with a 10% early withdrawal penalty on top of the income taxes. This is a costly and completely avoidable mistake, which is why the direct, trustee-to-trustee rollover is always the method I recommend.

This deadline is unforgiving. I've seen clients face significant tax bills that could have been entirely avoided, all because of a simple oversight during a 60-day rollover. Always, always opt for the direct transfer to take this risk off the table.

Can I Roll A Roth 401(k) Into A Traditional IRA?

No, you can't mix your pre-tax and after-tax retirement funds like that. A Roth 401(k) is built with after-tax dollars, so to keep its tax-free growth status, it has to be rolled over into a Roth IRA. A Traditional IRA is for pre-tax money, and trying to combine them would create a real tax mess.

Does A Rollover IRA Stop Me From Opening Other Accounts?

Not at all. Having a Rollover IRA doesn't affect your ability to open and fund other retirement accounts one bit. You can still contribute to a Roth IRA, open a SEP IRA if you're self-employed, or start a new 401(k) with your current job, just as long as you meet the specific eligibility rules for each of those accounts.

At Smart Financial Lifestyle, we believe in making smart financial decisions that build lasting wealth and redefine what's possible for your family. Explore our resources to learn more about creating a secure financial future.