When you inherit money, the single most important thing you can do is pause.

It’s an incredibly emotional time, a mix of grief and sudden financial responsibility. The urge to do something—pay off the mortgage, quit your job, make a huge investment—can feel overwhelming. But in my decades of guiding families through this exact moment, I’ve seen that the best first move is no move at all.

This isn't the time for life-altering financial decisions. It's a time for quiet, deliberate organization. Your immediate priority is to get a handle on the logistics with a clear head, making sure everything is accounted for and secured before you even think about the future.

Your First Financial Steps After Receiving an Inheritance

The initial phase requires patience and a systematic approach. Think of it as building a foundation. You need to know exactly what you're working with before you can start drawing up blueprints for your future.

Secure and Organize the Inheritance

First things first: you need a complete picture of what you've inherited. Assets can be scattered across different banks, brokerage firms, and even physical locations. Hunting everything down is a detailed but absolutely essential process.

- Locate the essential documents: Get with an attorney to track down the will, trust documents, and any other legal paperwork. These are your roadmap—they'll define your role as a beneficiary and spell out how the assets should be distributed.

- Create a master list of assets: Make a comprehensive inventory of everything. This includes bank accounts, investment portfolios, real estate, life insurance policies, and retirement accounts like IRAs or 401(k)s.

- Understand the probate process: If it’s required, the estate will go through probate. This is a court-supervised process to validate the will and distribute the assets. It can be a lengthy affair, so having an estate attorney to navigate it is critical.

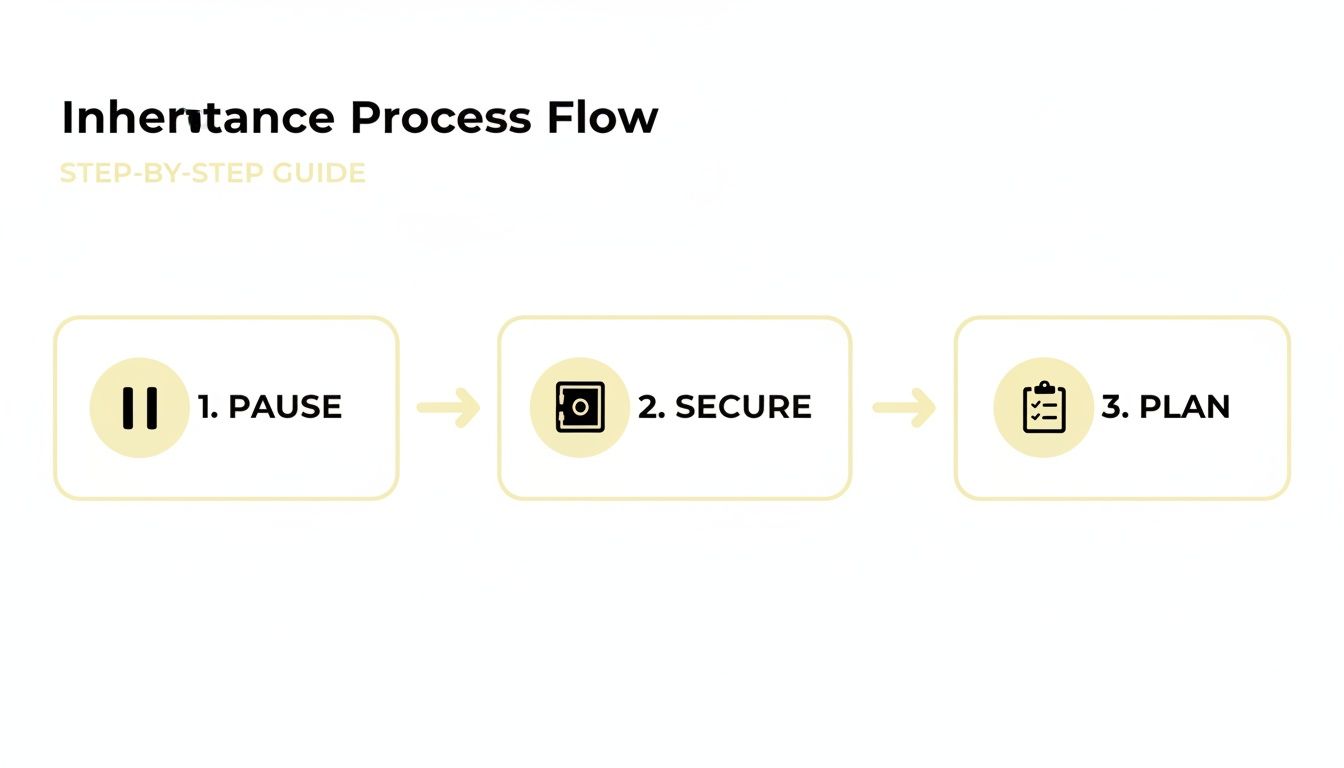

This simple flow chart really captures the three crucial stages: pausing to avoid rash decisions, securing all the assets, and then moving into thoughtful planning.

This graphic drives home the point that managing wealth well starts with patience and organization, not a flurry of activity.

Assemble Your Team of Professionals

You absolutely do not have to do this alone. In fact, building a trusted team of professionals is one of the smartest investments you can make right now. They provide objective advice during an emotional storm and help you sidestep costly mistakes.

Your core team should include a financial advisor, an estate attorney, and a tax professional (like a CPA).

"In most cases, you need to take a little bit of time before you make decisions on those investments. That space to breathe matters—yet some items can be time-sensitive, so knowing what you’re dealing with is step one."

To help you get organized before making any major moves, the table below outlines the immediate priorities.

Immediate Actions for Managing Your Inheritance

This checklist summarizes the first steps you should take to secure and understand your inherited assets. It's all about creating a stable base before you start building your long-term financial plan.

| Action Item | Why It's Important | Key Consideration |

|---|---|---|

| Open a Separate Bank Account | Keeps inherited funds separate from your personal finances, preventing accidental spending and simplifying tracking. | Choose a high-yield savings account to earn some interest while you plan. |

| Locate Legal Documents | The will and trust documents are the legal instructions for how assets must be handled and distributed. | An estate attorney is essential for interpreting these documents correctly. |

| Inventory All Assets | You can't plan for what you don't know you have. A full inventory is crucial for the next steps. | Look for digital assets, collectibles, and insurance policies, not just bank accounts. |

| Consult Professionals | An advisor, attorney, and CPA provide objective guidance on financial, legal, and tax matters. | Interview a few professionals to find a team you trust and feel comfortable with. |

Getting these initial steps right sets the stage for making smart, thoughtful decisions that will honor your loved one's legacy and secure your financial future.

During this initial period, it’s a great idea to open a separate bank account just for the inherited funds. This keeps the money distinct from your everyday finances, which makes it easier to track and prevents you from dipping into it impulsively while you figure things out. Part of this initial planning also involves shoring up your own financial stability, and our emergency fund checklist offers a great framework for making sure you have a solid safety net in place.

With the great wealth transfer now underway, an estimated $83.5 trillion is expected to pass to younger generations by 2048. For anyone inheriting, one of the first things to think about is tax-efficient planning—it's such a big deal that 54% of wealth firms are prioritizing it for intergenerational transfers. Bringing advisors in early helps you use strategies to minimize potential estate taxes, which can be surprisingly significant.

Building a Strong Financial Foundation

Once the initial paperwork is finally behind you, the pressure to do something big with your inherited money can feel intense. You might feel a pull to dive into the stock market, make a huge purchase you've always dreamed of, or start helping family and friends. My advice? Hold off. The smartest thing you can do right now is shift gears from administrative tasks to building a rock-solid financial foundation for yourself.

Think of it as playing defense first. It’s all about creating stability and security that will not only protect this new wealth but also let you make all future decisions from a position of strength, not stress. Before you can even think about growing the money, you have to protect it—and yourself.

Prioritize Eliminating High-Interest Debt

Your first move should be to hunt down and destroy any high-interest debt you're carrying. I’m talking about credit card balances, personal loans, or anything else with a painfully steep interest rate. Paying this stuff off isn't just a smart move; it’s one of the best—and safest—returns you can possibly get on your money. Guaranteed.

Here's why: if you're carrying a credit card balance with a 22% APR, paying it off is the exact same thing as earning a 22% return on your money. No investment out there can promise that kind of risk-free outcome. By wiping out these debts, you immediately free up monthly cash flow that was just being thrown away on interest payments, giving your budget instant breathing room.

This isn’t about depriving yourself. It's about plugging the leaks in your financial bucket. Every dollar you’re no longer sending to a credit card company is another dollar you can put toward your own future.

Construct a Robust Emergency Fund

With high-interest debt out of the picture, the next pillar of your foundation is a fully loaded emergency fund. This isn't just a small savings account; it's a dedicated cash reserve meant to cover three to six months of your essential living expenses. This fund is your financial shock absorber.

So, what counts as an essential expense?

- Housing: Your mortgage or rent payments.

- Utilities: Power, water, internet—the services you can’t live without.

- Transportation: Car payments, insurance, and gas.

- Food: Your normal grocery budget.

- Insurance Premiums: Health, auto, and life insurance.

The whole point of this fund is to insulate your long-term plans from life's curveballs. A sudden job loss, a big medical bill, or a major home repair shouldn't force you into debt or make you sell investments at the worst possible time.

Inherited money provides a rare opportunity to build this safety net without a long, slow savings process. It's the ultimate financial peace of mind, allowing you to handle emergencies without derailing your goals.

Why This Foundation Matters

Taking these two steps—killing toxic debt and building an emergency fund—might not feel as thrilling as buying stocks or real estate. But trust me, they are the most critical actions you can take when figuring out what to do with inherited money. They transform a one-time windfall into lasting financial resilience.

Let's walk through a quick example. Imagine you inherit $75,000. You also have $15,000 in credit card debt, and your essential monthly expenses run about $5,000.

- Debt Elimination: You take $15,000 of the inheritance and completely wipe out that high-interest debt. Gone.

- Emergency Fund: You move $30,000 ($5,000 x 6 months) into a separate high-yield savings account. Don’t touch it unless it's a true emergency.

- Planning Capital: You are now left with $30,000.

That remaining $30,000 is now your true "opportunity fund." With this, you can start making long-term decisions about investing, saving for retirement, or a down payment on a house from a place of total security. Your debts are gone, your emergency buffer is in place, and you’re no longer vulnerable to financial shocks. This foundational work sets the stage for making your money grow for decades to come.

Crafting Your Long-Term Investment Strategy

Alright, you’ve secured your financial foundation. Now it’s time to shift from playing defense to playing offense. This is the moment to start making your inherited money work for you, creating growth that can last for decades.

This isn’t about chasing hot stocks or jumping on fleeting market trends. It’s about building a thoughtful, resilient investment portfolio designed to preserve and grow your new capital over the long haul. The core idea is simple: build a strategy that aligns with who you are. Your investment plan should feel like a natural extension of your financial life, not a source of constant stress.

Aligning Investments with Your Life Goals

Before you even think about buying a single stock or fund, take a step back. What do you want this money to actually do? Your answer will shape every single decision that follows.

- Define Your Timeline: Are you investing for a down payment on a house in five years? Or are you looking toward retirement in 30 years? Short-term goals need more conservative investments to protect what you have, while long-term goals give you the runway to take on more risk for potentially higher returns.

- Assess Your Risk Tolerance: Let’s be honest. How would you feel if your portfolio dropped 20% in a market downturn? Your ability to sleep at night is a critical gut-check on whether your investment mix is right for you.

- Clarify Your Objectives: Is the goal to generate some regular income to supplement your salary? Or is it pure growth, aiming to build a substantial nest egg for the future? These two goals demand completely different approaches.

Thinking through these questions moves you from the vague idea of "investing" to a concrete plan tailored to your life. For a deeper dive into the fundamentals, our guide on investing for beginners provides an excellent starting point.

The Power of Strategic Asset Allocation

Once your goals are clear, the next move is asset allocation—deciding how to divide your money among different investment types, like stocks, bonds, and real estate. This is arguably the most important decision you'll make. It has a greater impact on your long-term returns than trying to pick individual winning stocks.

A diversified portfolio spreads your risk. When one part of the market is down, another may be up, which helps smooth out your returns and protect you from the worst of the bumps. It’s the classic wisdom of not putting all your eggs in one basket.

The goal is to build a portfolio that can weather different economic seasons. Proper allocation is the key to creating a portfolio that is resilient enough to handle market volatility without derailing your long-term financial plan.

Research shows that preserving inherited wealth demands this kind of strategic thinking. With inheritance being the second-largest source of wealth for many, financial firms report that portfolio design is critical. The most favored approaches among professionals are strategic asset allocation (used by 72%) and a long-term, low-turnover approach (62%), which help inheritors aim for stable, consistent returns.

Understanding Common Investment Vehicles

Your portfolio will be built from a mix of different assets. Each has its own risk and return profile, and understanding their roles is essential when you're figuring out what to do with inherited money.

Common Investment Options

| Asset Type | Primary Role in a Portfolio | Typical Risk Level |

|---|---|---|

| Stocks (Equities) | Driving long-term growth through capital appreciation and dividends. | High |

| Bonds (Fixed Income) | Providing stability, income, and a cushion against stock market volatility. | Low to Moderate |

| Real Estate | Offering potential for rental income, appreciation, and diversification. | Moderate to High |

| Mutual Funds / ETFs | Providing instant diversification by holding a basket of stocks or bonds. | Varies by Fund |

For many new investors, Exchange-Traded Funds (ETFs) and mutual funds are a fantastic starting point. They give you broad market exposure without forcing you to become an expert stock analyst overnight. For example, an S&P 500 index fund gives you a piece of 500 of the largest U.S. companies in a single, low-cost investment.

Ultimately, the best strategy is one that is disciplined and patient. Your inheritance offers a powerful opportunity to build a lasting financial legacy. By creating a thoughtful, diversified investment plan based on your unique goals, you can turn this windfall into a source of security and growth for years to come.

Navigating Complex Family Dynamics and Conversations

Inheriting money isn't just a financial transaction; it's a family event. And let's be honest, when money and family mix, things can get messy—fast. A sudden windfall can kick up all sorts of unexpected emotions, old rivalries, and new expectations between spouses, siblings, and children.

The single best tool you have for making sure the inheritance strengthens your family instead of straining it is proactive, honest communication. This isn't about broadcasting the exact dollar amount to everyone. It's about thoughtfully managing conversations and setting clear, healthy boundaries right from the get-go.

The Great Wealth Transfer Communication Gap

It's a common story: many families just don't talk about money. This creates a huge information vacuum when an inheritance suddenly appears, leading to serious misunderstandings and fights down the road.

A study from Fidelity really puts a spotlight on this. It found that while 70% of parents have estate plans, a shocking 52% haven't talked about their net worth with their adult kids. What's even wilder is that 95% of those kids feel ready to manage wealth, but only 25% of their parents agree.

As we're in the middle of the largest wealth transfer in history, this gap highlights just how urgently families need to start talking. It's the only way to ensure a smooth transition of not just assets, but values, too. You can discover more insights about these family financial dynamics directly from the research.

Setting Boundaries and Handling Requests for Money

It's an unfortunate truth, but once word gets out about an inheritance, requests for loans or gifts often start trickling in. This can put you in an incredibly awkward spot, especially when it's someone you love asking. This is where having a plan ahead of time is your best defense.

Decide on your policy before anyone even has a chance to ask. Will you lend money to family? If so, what are the exact conditions? Having a clear, consistent answer ready lets you respond calmly and fairly instead of being caught off guard and making a decision you might regret.

A simple, respectful "no" can sound like this:

"I really appreciate you coming to me, and I want to support you. However, my partner and I have decided not to mix our family finances with loans to protect our relationships. I hope you understand."

This approach acknowledges the other person's situation while firmly holding your boundary. It frames the decision as a policy meant to protect the relationship, not as a personal rejection. It’s a crucial strategy when you’re figuring out what to do with inherited money while trying to keep the peace.

Creating a Unified Approach with Your Spouse

If you're married or in a committed partnership, you are not in this alone. This inheritance is part of your shared financial future, and it's vital that you present a united front.

Sit down with your partner and talk about the inheritance openly before making any decisions. This conversation should cover:

- Shared Goals: How does this money change or speed up your joint life goals? Think about retirement, travel, or paying off the mortgage.

- Feelings and Expectations: Be totally honest about how you're feeling—whether it's gratitude, guilt, or pressure—and really listen to your partner's perspective, too.

- A Joint Policy: Agree on exactly how you'll handle requests from family and friends. When you both use the same language, it reinforces your unity and makes it easier to stick to your plan.

Getting on the same page from the start is the best way to prevent the inheritance from becoming a source of conflict in your relationship. It ensures you’re both working toward the same vision for your family’s future.

Starting these conversations can be the hardest part. The key is to be gentle, clear, and focused on the relationship, not just the money.

| Family Member | Conversation Goal | Example Opening Line |

|---|---|---|

| Spouse/Partner | Align on a unified strategy and shared goals. | "Now that we've had some time to process, I'd love to sit down this weekend and dream a little about what this inheritance could mean for our future." |

| Sibling | Manage expectations and maintain a positive relationship. | "Hey, I wanted to touch base about Mom's estate. It's a lot to navigate, and my main priority is making sure we all get through this supporting each other." |

| Adult Child | Set boundaries around their expectations for the funds. | "This inheritance is a huge blessing for our family's long-term security. While we won't be making any immediate big changes, we're excited about how this will help us plan for the future." |

| Friend/Relative (asking for money) | Politely decline while preserving the relationship. | "Thanks for trusting me enough to ask. We've decided to keep our finances separate from personal loans to family, but I'd be happy to help you brainstorm other options." |

No matter who you're talking to, leading with empathy and clarity will help you navigate these tricky waters successfully.

Defining Your Own Legacy and Estate Plan

Receiving an inheritance has a funny way of making you think about the future—not just your own, but the one you’ll eventually create for others. Suddenly, you're not just a beneficiary; you're the new steward of this wealth. That shift in perspective is the perfect moment to think about the legacy you want to leave behind.

Protecting this inheritance for the next generation means creating your own thoughtful estate plan. This isn't just about documents and legal jargon. It's about defining your values and making sure your assets are passed on in a way that reflects who you are. This process is how a windfall becomes a multi-generational legacy.

The Essential Documents of Your Estate Plan

An estate plan is more than one document. Think of it as a collection of legal tools that work together to manage your affairs if you become unable to, and to distribute your assets after you're gone. Getting these in place is one of the most responsible things you can do with your inheritance.

Your foundational documents will likely include:

- A Last Will and Testament: This is the cornerstone. It spells out who gets your property and names an executor to carry out your wishes. Without a will, the state decides how your assets are divided, which often doesn't line up with what you wanted.

- Power of Attorney (POA): This document lets you designate someone you trust to make financial decisions on your behalf if you can't do it yourself.

- Healthcare Directive (Living Will): This outlines your wishes for medical treatment if you become seriously ill or incapacitated and can't communicate them.

These documents provide clarity and legal authority, saving your loved ones from stressful guesswork and potential legal fights during an already tough time.

Using Trusts to Protect and Guide Your Legacy

Beyond a basic will, trusts are powerful tools for managing your legacy with a lot more control and nuance. A trust is a legal setup where a third party, known as a trustee, holds assets for your beneficiaries.

One of the most common and flexible options is a revocable living trust. This type of trust lets you keep control over your assets during your lifetime and makes transferring them to your heirs a much smoother process. A huge plus? It often avoids the lengthy and public probate court process. You can learn more in our detailed guide on what is a revocable living trust and how it can be a central part of your plan.

An estate plan is your final message to your loved ones. It’s your chance to communicate your values, protect the people you care about, and ensure the assets you've stewarded are passed on with purpose and intention.

Trusts can also be structured to hit specific goals. For instance, you could protect assets for a beneficiary with special needs or set up staggered distributions for a young adult who might not be ready to handle a large sum all at once.

Weaving Philanthropy into Your Plan

Your legacy isn't just about what you leave to your family. It's also shaped by the impact you make on the world. An inheritance gives you a unique opportunity to support causes you care about, making philanthropy a core part of your financial plan.

There are many ways to approach charitable giving, each with different tax benefits:

- Direct Donations: The simplest method is making direct contributions to your favorite charities.

- Donor-Advised Fund (DAF): You can contribute to a DAF, get an immediate tax deduction, and then recommend grants to non-profits over time.

- Charitable Trusts: These are more structured plans that can provide income to you or your heirs for a set period, with whatever is left going to charity.

Thinking about what to do with inherited money forces you to consider what truly matters. By thoughtfully building your own estate plan, you're not just managing wealth—you are designing a legacy. You're ensuring the financial security of your loved ones while also making a meaningful difference, creating a story that will be told for generations.

Common Questions About Managing Inherited Money

When you inherit money, a cloud of questions can gather fast, creating a lot of uncertainty during an already emotional time. Getting clear, straightforward answers is the key to moving forward with confidence. Let's tackle some of the most common concerns people have when they're trying to figure out what to do with an inheritance.

Do I Have to Pay Taxes on My Inheritance?

This is usually the first question on everyone's mind, and the answer is often a comforting one—at least at the federal level. For the most part, you as a beneficiary do not pay federal income tax on the inheritance itself. The estate is the one responsible for paying any federal estate taxes before the assets are distributed, and this only kicks in for very, very large estates.

But the details really matter, and there are some important exceptions to keep in mind:

- State Taxes: A handful of states have their own estate or inheritance tax, and their exemption amounts can be much lower. It's critical to check the laws in the state where the deceased lived.

- Retirement Accounts: Inheriting a traditional IRA or 401(k) is a totally different ballgame. You will owe ordinary income tax on any money you pull out of these accounts, just like the original owner would have.

- Investment Gains: If you inherit assets like stocks or a house and decide to sell them later for a profit, you'll owe capital gains tax. The good news is you only pay tax on the appreciation that happened after you inherited them.

Because the tax rules can get pretty tangled, talking to a tax professional is always the smartest move. They can help you understand exactly what you owe.

How Long Should I Wait Before Making Big Decisions?

Financial advisors are almost unanimous on this one: wait at least six to twelve months. This "cooling-off" period is probably the most valuable piece of advice you'll get. It gives you the space you need to process your grief without the added pressure of making huge, life-altering financial choices.

Rushing into major decisions—like buying a new house, quitting your job, or making a large investment—is one of the most common mistakes inheritors make. An emotional decision is rarely a wise financial one.

Use this waiting period to get your ducks in a row. Focus on the foundational steps we've talked about: get organized, knock out high-interest debt, build a solid emergency fund, and put together your team of trusted professionals. This deliberate pause helps ensure that when you do make big decisions, they come from a place of clarity and stability, not impulse.

Should I Tell Friends and Family About My Inheritance?

This is a deeply personal choice, and there's no single right answer. But a little caution can go a long way. You're under absolutely no obligation to share financial details with anyone.

While being open with a spouse or partner is pretty essential for your shared financial future, broadcasting a windfall to a wider circle can sometimes lead to awkward dynamics, unsolicited (and often terrible) advice, and even strained relationships if people start asking you for money.

Many people find it's best to keep the specific dollar amount private. You can simply say that you're working with professionals to create a long-term plan. It's both true and a polite way to end the conversation.

What Kind of Professional Help Should I Get First?

Navigating an inheritance brings up both legal and financial complexities, so you’ll want two key experts in your corner right from the start.

- An Estate or Probate Attorney: Think of this person as your guide through the legal maze. They'll help you make sense of the will, navigate the probate process if you have to, and make sure all the assets are transferred over to you legally and correctly.

- A Certified Financial Planner™ (CFP®): Once the assets are officially yours, a financial advisor helps you figure out what to do with them. They’ll look at your entire financial picture—your goals, your debts, your own retirement plans—and help you create a solid strategy that makes the most of your inheritance for the long haul.

At Smart Financial Lifestyle, we understand that stewarding an inheritance is about more than just money—it's about honoring a legacy and building a secure future. With Paul Mauro's 50+ years of experience, we help families make smart financial decisions that create lasting peace of mind. To learn more about how we can guide you, visit us at https://smartfinancialifestyle.com.