Giving money to loved ones is a powerful way to support their dreams, and doing it tax-free is simpler than most people think. The secret lies in a strategy that's both straightforward and incredibly effective: the annual gift tax exclusion.

This is a generous allowance from the IRS that lets you give a specific amount of money to anyone you choose, every single year, without having to file any extra paperwork. Best of all, it resets every January 1st, giving you a consistent opportunity to be generous without creating a tax headache.

Your Foundation for Smart Gifting

When people first hear "gift tax," they often imagine some complicated penalty for helping out family and friends. But the reality is quite different. The U.S. tax system is actually designed to allow for significant wealth transfer between individuals before any tax is due.

Your most important tool for this is the annual gift tax exclusion. Think of it as your yearly free pass for financial support. It’s a specific dollar amount you can give to any number of people each calendar year without needing to report it or pay a dime in tax. You can give this amount to your son, your niece, a close friend, and a neighbor—all in the same year—and each gift is treated separately.

The Annual Exclusion Limit Explained

The IRS adjusts this limit every so often to keep up with inflation, making sure its value doesn't get eroded over time. For 2025, the annual gift tax exclusion allows an individual to give up to $19,000 per recipient without any tax consequences.

That's a jump from the $18,000 limit in 2024 and marks the highest exclusion amount we've ever seen, which is great news for strategic gifting. You can read more about the 2025 IRS adjustments to see how they might factor into your financial plans.

Here’s a quick summary of what the annual exclusion looks like in practice.

Annual Gift Tax Exclusion at a Glance

| Giver Status | Annual Tax-Free Gift Limit Per Recipient | Reporting Required to IRS |

|---|---|---|

| Individual | Up to $19,000 (for 2025) | No |

| Married Couple (Gift-Splitting) | Up to $38,000 (for 2025) | Yes, Form 709 is required |

This table makes it easy to see how powerful this tool is, especially for couples who want to combine their gifting power.

The real beauty of the annual exclusion is its simplicity and how you can use it year after year.

- Per Person, Per Year: The limit applies to each individual recipient. You aren't capped by the total number of people you give to.

- No Paperwork Needed: As long as your gifts to any one person stay at or below the annual limit, you don't have to file a gift tax return (Form 709). It's that simple.

- Annual Reset: This opportunity resets every January 1, making it a foundational strategy for long-term family financial support.

A common misconception is that the person receiving the money has to pay tax on it. In the vast majority of cases, the responsibility for any potential gift tax falls entirely on the giver, not the recipient.

Why This Matters for Your Family

Getting a handle on this basic rule is the first step toward building a truly thoughtful gifting strategy. It gives you the power to help family members with huge life events—a down payment on a home, college tuition, or starting a business—in a direct and tax-smart way.

By consistently using the annual exclusion, you can transfer a significant amount of wealth over time. This not only makes a real, tangible impact on your loved ones' lives today but also helps reduce the size of your future taxable estate. This simple principle is the bedrock of all the other tax-free gifting methods we'll explore.

Maximizing Your Impact with the Annual Exclusion

The annual gift tax exclusion is one of the most straightforward and powerful tools in your financial toolkit. Think of it less as a dry tax rule and more as your green light to make a real, immediate difference in the lives of your loved ones, all without any complicated paperwork or tax headaches.

This is where theory meets reality. For 2025, you can give up to $19,000 to any individual, and the IRS doesn't need to hear a thing about it.

Imagine your adult child is trying to scrape together a down payment on their first home. That $19,000 gift could be the boost that gets them over the finish line, potentially years ahead of schedule. It's a direct, tax-free way to help without touching your lifetime estate exemption.

Double Your Gifting Power with Gift Splitting

This is where things get really interesting for married couples. The IRS allows you to combine your individual annual exclusions for a single person through a strategy called gift splitting. It’s a simple concept that effectively doubles your impact.

In practice, this means a married couple can give up to $38,000 to one person in 2025 without triggering any gift tax filings or consequences. For families trying to help with major life expenses, this is an absolute game-changer.

Real-World Scenario: Helping a Young Couple Buy a Home

Let's go back to that down payment. Your daughter and her husband are saving up. Using gift splitting, you and your spouse can provide a truly substantial amount of help, completely tax-free. Here’s how it breaks down:

- You give $19,000 to your daughter.

- Your spouse also gives $19,000 to your daughter.

- You give $19,000 to your son-in-law.

- Your spouse also gives $19,000 to your son-in-law.

Just like that, your family has transferred a grand total of $76,000 to the young couple in a single year. That kind of targeted support can be the difference between them dreaming of a home and actually holding the keys.

If you and your spouse give more than $19,000 to a single person, you’ll need to file IRS Form 709 to formally elect gift splitting. No tax will be due, but this form simply tells the IRS you’re combining your exclusions.

The Compounding Effect of Consistent Gifting

While a one-time gift is great, the real magic of the annual exclusion happens when you make it a consistent part of your financial plan. By gifting regularly, you can transfer significant wealth over the years, creating a legacy of support that literally compounds over time.

Think about funding a grandchild’s education. If you and your spouse start gifting $38,000 a year into a dedicated account when they’re born, that sum can grow into a massive educational fund.

Let’s just look at the first five years:

- Year 1: $38,000

- Year 2: $38,000

- Year 3: $38,000

- Year 4: $38,000

- Year 5: $38,000

In just five years, you've gifted $190,000 tax-free—and that's before accounting for any investment growth. If you keep that up for 18 years, you’ve provided a life-changing sum for college without ever having to touch your lifetime gift tax exemption.

Smart Strategies for Timing and Gifting to Minors

To really get the most out of the annual exclusion, a couple of pro tips can make all the difference. These are simple things, but they ensure your gifts are effective and trouble-free.

First, watch the calendar. The annual exclusion is a "use it or lose it" benefit that resets every calendar year on December 31. Any unused portion of your exclusion for the year vanishes at midnight on New Year's Eve. My advice? Plan your gifts well before the end-of-year holiday rush to make sure checks clear and transfers are fully completed in time.

Second, when you're gifting to minors, you have to make sure the gift is legally considered "complete." Just dropping money into a regular savings account with your name on it might not cut it. Instead, you'll want to use a proper vehicle:

- UTMA/UGMA Custodial Accounts: These are the go-to for many families. They allow you to make an irrevocable gift to a minor, with an adult custodian managing the funds until the child comes of age (usually 18 or 21, depending on the state). The key is that the money legally belongs to the child from day one.

- 529 Plans: We’ll dive deeper into these later, but contributions to a 529 education savings plan are a fantastic way to use the annual exclusion. They direct the funds specifically toward future educational expenses.

By strategically using gift splitting, staying consistent over time, and knowing the rules around timing and minor accounts, you can turn the annual exclusion from a simple tax code line item into one of your most powerful tools for building your family's financial future.

Navigating the Lifetime Gift Tax Exemption

So, you’ve given a gift that sails past the annual exclusion limit. For a lot of people, the first thought is a flash of panic, picturing a nasty tax bill from the IRS.

But hold on. This is exactly where your next, much larger layer of tax protection kicks in: the lifetime gift tax exemption.

Think of it as a massive, multi-million dollar backup fund for your generosity. Going over the annual limit for one person doesn't automatically mean you owe tax. It just means you’ve started to dip into this lifetime credit, and you need to let the IRS know.

What Is the Lifetime Exemption?

The lifetime gift tax exemption is a unified credit that shields a huge amount of your assets from both gift taxes during your life and estate taxes after you pass away. For 2025, this exemption is a staggering $13.99 million per person. For a married couple, that effectively doubles to nearly $28 million.

Honestly, that number is so high that the vast majority of Americans will never even get close to using it all up. It’s designed to give you tremendous peace of mind, ensuring your financial support for loved ones won't get hit with taxes.

When you give a gift that exceeds the annual exclusion, the extra amount is simply subtracted from your lifetime exemption. You don't actually pay a dime in tax until this entire multi-million dollar amount has been exhausted.

Filing Form 709 The Right Way

The key step you need to take when you exceed the annual exclusion for any single person is filing IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return.

Don’t let the name intimidate you. This form isn't a bill; it's just a tracking sheet.

Filing Form 709 has one main purpose: it tells the IRS how much of your lifetime exemption you've used in a given year. It’s the official paperwork that keeps a clear record of your taxable gifts over time.

Real-World Scenario: A Major Gift for a Business Startup

Let's walk through an example. Imagine you want to help your son launch his first business and you give him $119,000 this year. Here’s how the math breaks down using the 2025 limits:

- Total Gift: You give your son $119,000.

- Apply Annual Exclusion: The first $19,000 of that gift is covered by your annual exclusion. It’s completely tax-free and doesn't require any reporting.

- Calculate the Taxable Gift: The remaining $100,000 ($119,000 - $19,000) is considered a "taxable gift." This is the amount that counts against your lifetime exemption.

- Report on Form 709: You would file Form 709 to report this $100,000 taxable gift.

- Update Lifetime Exemption: This $100,000 is then subtracted from your $13.99 million lifetime exemption, leaving you with $13.89 million for future gifts or for your estate.

The bottom line? In this scenario, you pay $0 in gift tax. The form just keeps the official score.

The Unified Gift and Estate Tax System

One of the most important concepts to get your head around is that the gift tax and estate tax are linked. They aren't two separate taxes but part of a single, unified system. The same lifetime exemption amount applies to both.

This unified credit means that every taxable gift you make during your lifetime reduces the exemption amount available to your estate after you die. For a deeper dive, our guide on the what is estate tax exemption breaks down exactly how these two systems work together.

A Critical Heads-Up: The current high exemption levels are set to expire at the end of 2025. Unless Congress acts, the exemption will revert to its pre-2018 level, essentially cutting the current amount in half. This makes strategic gifting now, while the exemption is high, a potentially powerful move.

Understanding this system gives you incredible freedom. It confirms that you can be exceptionally generous—providing life-changing sums for education, a down payment on a home, or a new business—without worrying about an immediate tax bill. For the overwhelming majority of people, the lifetime exemption ensures that the only thing you need to do is keep good records, not write a check to the IRS.

Exploring Gifts That Are Always Tax-Free

Beyond the annual exclusion and lifetime exemption, some types of financial support are always tax-free. The IRS doesn't put a dollar limit on these gifts, and they don't chip away at your other exemption amounts. This is a powerful way to directly help with some of life's biggest expenses.

This special category is built around what the IRS calls "qualified transfers." These are payments you make directly on someone's behalf for two specific things: education and medical care. The key here—and it's a big one—is that the money must go straight to the institution, not to the person you're helping.

Direct Payments for Education

Helping a loved one fund their education is one of the most impactful gifts you can give. When you make a direct tuition payment to a college, university, or even a private K-12 school, that gift is completely tax-free, no matter how much it costs.

Let's say your grandchild is heading to a university where tuition is $50,000 a year. You can write a check for the full amount directly to the school's bursar's office. This incredibly generous gift is 100% exempt from gift tax.

- It does not count against your $19,000 annual exclusion for that grandchild.

- It does not reduce your $13.99 million lifetime gift tax exemption.

This is a huge advantage. Because the payment is a qualified transfer, you could still give that same grandchild another $19,000 in cash that same year, and that gift would also be tax-free under the normal annual exclusion rules.

Important Note: This unlimited exclusion is strictly for tuition. It doesn't cover other educational costs like dorm fees, books, supplies, or living expenses. For those, you'd dip into your annual exclusion.

Covering Medical Expenses Tax-Free

The same principle applies to medical expenses. You can pay a hospital, doctor's office, or dental clinic directly for someone's medical care, and that payment is entirely tax-free. This can be a massive relief for family members dealing with unexpected health issues or daunting medical bills.

For instance, if a family member needs a surgical procedure that costs $30,000, you can pay the hospital directly for the full amount. Just like with tuition, this gift is unlimited and doesn't touch your annual or lifetime exemptions.

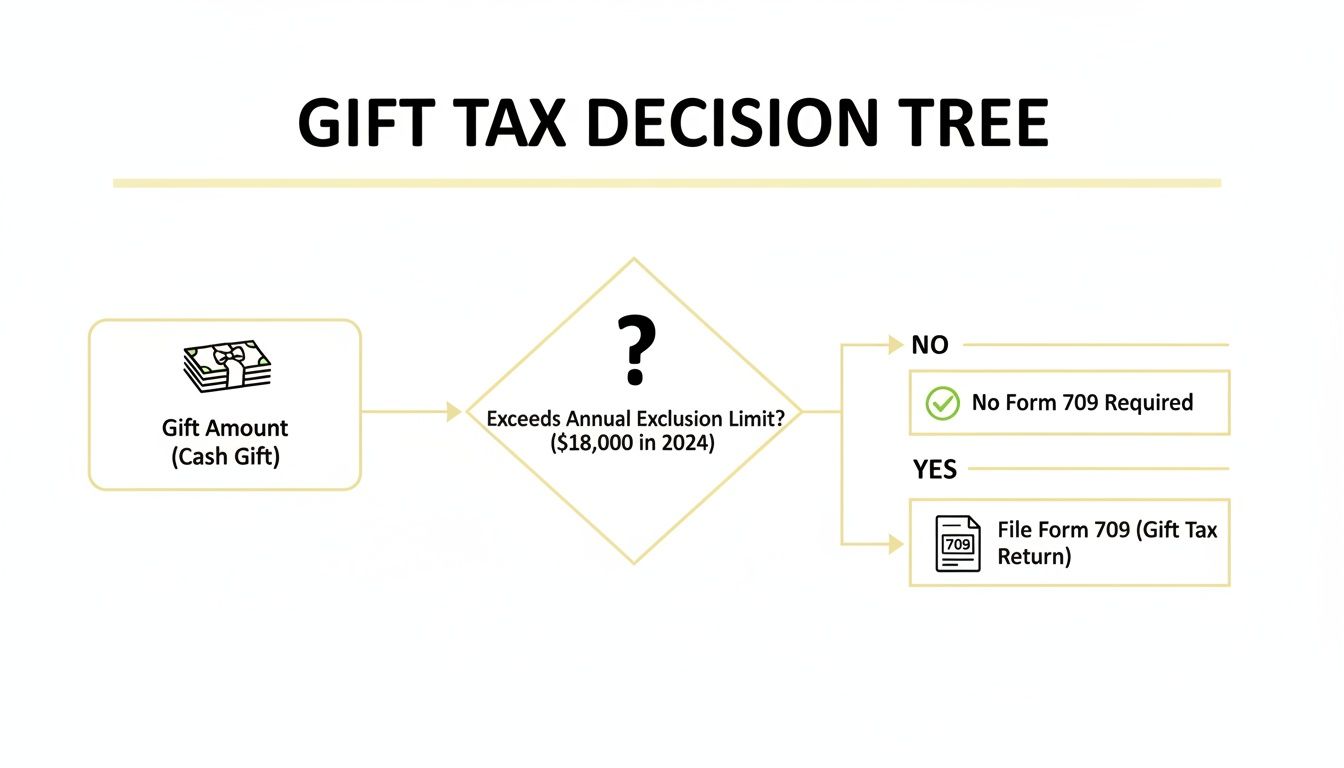

This infographic helps clarify when you need to think about filing a gift tax return for gifts that don't fall into these special categories.

As the flowchart shows, it's only when a standard cash gift goes over the annual limit that you need to consider filing Form 709 to use your lifetime exemption.

To help you decide which gifting strategy is best for your situation, here’s a quick comparison of the different tax-free methods we've covered.

Comparison of Tax-Free Gifting Methods

| Gifting Method | Tax-Free Limit | Who Can Receive It | Best For |

|---|---|---|---|

| Annual Exclusion | $19,000 per person, per year | Anyone | Flexible gifting for any purpose without filing a tax return. |

| Lifetime Exemption | $13.99 million (in 2025) | Anyone | Large gifts that exceed the annual exclusion, like helping with a down payment. |

| Qualified Transfers | Unlimited | Anyone (paid directly to the institution) | Covering tuition or medical bills without impacting other exemptions. |

| 529 Plan Superfunding | $95,000 per person (or $190,000 for couples) | A designated beneficiary | Jump-starting a college savings fund to maximize tax-deferred growth. |

Each of these methods serves a different purpose, so understanding the nuances can help you make the most of your generosity while staying on the right side of the IRS.

Smart Strategies Using 529 Plans

While direct tuition payments are great, 529 college savings plans offer another strategic route for educational gifting. Contributions to a 529 plan count as completed gifts and qualify for the annual gift tax exclusion.

This opens the door to a unique strategy known as "superfunding." The IRS lets you make a lump-sum contribution of up to five years' worth of annual exclusions all at once to a 529 plan.

- For an individual in 2025, that means you can put up to $95,000 ($19,000 x 5) into a beneficiary's 529 in a single year.

- For a married couple, you can contribute up to $190,000 ($38,000 x 5).

This front-loads the account, giving the money more time to potentially grow tax-deferred. You will have to file a gift tax return (Form 709) to make the five-year election, but no gift tax will actually be due.

Gifting to Spouses and Charities

The gifting rules are most flexible for those closest to home. Any gift to your U.S. citizen spouse is always unlimited and tax-free, thanks to the unlimited marital deduction. You can transfer any amount of money or property to your spouse without any tax implications.

For a non-U.S. citizen spouse, the rules are different but still quite generous. While the unlimited marital deduction doesn't apply, there's a special, much higher annual exclusion. In 2025, the exclusion for gifts to non-citizen spouses is set to rise to $190,000, up from $185,000 in 2024. You can discover more insights about gift-giving statistics and trends on giftafeeling.com to see how these specific limits get adjusted over time.

Finally, any donation you make to a qualified charity or non-profit isn't considered a taxable gift. These contributions are completely tax-free and might even get you an income tax deduction, letting you support the causes you care about while benefiting your own financial situation.

Of course. Here is the rewritten section, crafted to sound human-written, natural, and expert-driven, following all your specific instructions.

Avoiding Common Pitfalls and State Tax Hurdles

You've got a handle on the federal rules for gifting money tax-free, and it feels pretty straightforward. But it's the little details that can trip you up, especially when state laws and informal family agreements get involved. Keeping an eye on these potential issues is the key to making sure your generosity actually helps without creating a mess later on.

One of the most common mistakes I see involves informal "loans" to family members. You might lend your child money for a car with a vague idea they'll pay you back someday. But if there’s no formal promissory note, no set interest rate, and no repayment schedule, the IRS can step in and call it what it is: a gift. If that "loan" is more than the annual exclusion, you’ve just created a taxable event you should have reported.

Proper documentation is your best friend here. A clear paper trail protects both you and the recipient from any future headaches with the tax man.

The Overlooked Issue of State Taxes

Most of the chatter is about federal gift tax, but it’s a mistake to think Uncle Sam is the only one with a say. The good news is that most states don't have their own gift tax, which definitely simplifies things. However, a handful of states do impose their own taxes, and their rules can be completely different from the federal ones.

Right now, only one state—Connecticut—has its own separate gift tax. But several others have what’s called an inheritance tax, which is a tax on the person receiving the money or assets. These state-level taxes often have much lower exemption amounts than the federal government's massive multi-million dollar credit.

For instance, a state inheritance tax might kick in for amounts far below the federal threshold. This adds another layer you have to think about, especially if you or your beneficiaries live in one of these states. For anyone doing serious estate planning, understanding these local rules is non-negotiable. Our guide on how to avoid probate court can also offer some valuable context for making wealth transfer simpler.

The takeaway here is simple: Never assume the federal rules are the only ones that matter. A quick check of your state’s specific tax laws can save you and your loved ones from a huge, unexpected tax bill.

Indirect Gifts and Other Common Mistakes

Another area where people get tripped up is with indirect gifts. You can't get around the annual exclusion limit by giving money to a friend with the understanding that they'll turn around and give it to your kid. The IRS looks at the substance of a transaction, not just how you structure it, and they will almost certainly see that as a gift coming directly from you.

Here are a few other common pitfalls to watch out for:

- Forgetting to File Form 709: If you use gift splitting with your spouse or give more than the $18,000 annual exclusion to one person in 2024, you must file a gift tax return. Even if you don't owe any tax, failing to file can result in penalties.

- Joint Bank Account Mishaps: Adding a child to your bank account as a joint owner doesn’t count as a gift. The gift officially happens the moment they withdraw funds for their own use that exceed whatever amount they might have contributed themselves.

- Improper Valuation of Assets: When you're gifting things other than cash, like stocks or real estate, you have to use the fair market value on the date of the gift. Getting this wrong can lead to major tax complications down the line.

By thinking ahead about these common errors, you can structure your financial gifts with confidence. Keeping clean records and understanding both federal and state rules ensures your generosity is remembered for the right reasons—not for creating a tax problem.

Building Your Gifting Legacy With Confidence

Smart gifting goes way beyond tax codes and dollar signs. When you get down to it, it’s a huge part of the legacy you're building. Every gift you give carries a message, one that reflects your values and helps shape your family’s financial future.

This is why aligning your financial moves with your personal goals is so crucial. It’s what ensures your generosity leaves a lasting, positive mark.

It really all starts with a conversation. Talking about the why behind a gift can head off misunderstandings and help your loved ones appreciate its true purpose, which is a great first step toward fostering financial responsibility. Your intention matters just as much as the money, whether you're helping with a down payment on a house or funding an education.

For bigger, more complex strategies, looking into things like trusts can add structure and clarity that lasts for generations. You can dive deeper into what is a trust fund explained simply in our detailed guide.

Knowing when to ask for help is a sign of wisdom. A financial advisor or tax professional can help you weave these strategies into a cohesive plan, ensuring your legacy is built with confidence and care.

Their expertise brings a level of peace of mind you just can't get on your own. It confirms your gifting plan is not only tax-smart but also true to the vision you have for your family. This final check transforms good intentions into a powerful, enduring legacy.

Your Top Questions About Gifting Money, Answered

Even after you get the hang of the main strategies for gifting, specific questions always pop up. It's only natural. Here are some clear, straightforward answers to the most common queries we hear from families looking to give generously and wisely.

Do I Need to File a Gift Tax Return for Small Gifts?

In most cases, no. If your gift to any single person in one year is at or below the annual exclusion limit—that’s $19,000 for 2025—you don’t have to file a gift tax return (Form 709).

That’s the beauty of the annual exclusion; it keeps everyday gifting simple and free of paperwork. You only need to think about filing Form 709 if you give more than that annual limit to one person, or if you're splitting gifts with your spouse to combine your annual exclusions.

Can I Give Gifts to Multiple Family Members?

Yes, absolutely. This is where the strategy really gets powerful. The annual exclusion is applied on a per-recipient basis, which gives you incredible flexibility.

There is no limit to the number of people you can give to in a single year. You can give up to the $19,000 limit to each of your children, their spouses, and all of your grandchildren in the same year. Each gift is its own separate, tax-free transfer. It's a fantastic way to provide widespread support across your entire family.

The real power of the annual exclusion is its scalability. Gifting $19,000 to five different family members allows you to transfer $95,000 tax-free in one year, all without touching your lifetime exemption or filing a single piece of paperwork.

What if I Forget to File a Gift Tax Return?

Forgetting to file Form 709 for a gift that exceeds the annual limit can lead to unwanted attention from the IRS, including potential penalties and interest. The key is to act as soon as you realize the oversight.

If you discover you should have filed a return for a previous year, don’t just ignore it. The best move is to work with a tax professional to prepare and file the late Form 709. Addressing the mistake proactively is the surest way to minimize any potential penalties and keep your financial records in good standing.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building a meaningful legacy. Paul Mauro’s 50+ years of experience have shown that clear, principled guidance helps families redefine what wealth means to them. To continue learning and empower your financial journey, explore our resources at https://smartfinancialifestyle.com.