A durable power of attorney is a legal document that lets you appoint a trusted person—known as an agent—to manage your financial and legal affairs. The key feature is right there in the name: durability. It means the document stays in effect even if you become mentally incapacitated.

This simple but powerful document ensures someone you choose can protect your assets and pay your bills when you can no longer do so yourself.

Decoding Your Durable Power of Attorney

Think of a Durable Power of Attorney (DPOA) as your financial co-pilot, ready to take the controls if you're unable to fly the plane. It’s a foundational piece of legacy planning that grants specific legal authority to someone you select—and only someone you select.

Without one, your family might face a lengthy, public, and expensive court process just to get a guardian appointed to manage your affairs. This document is a proactive step that gives you control over who makes decisions for you, rather than leaving that choice to a judge.

A DPOA is exclusively for financial matters. Your agent can handle tasks like:

- Paying your mortgage, utilities, and medical bills

- Managing your investments and retirement accounts

- Filing your taxes

- Operating your small business

- Buying or selling property on your behalf

The person you name as your agent has a fiduciary duty to act in your best interests, making this decision one of the most important in your entire estate plan.

While a DPOA is powerful, it works best when it complements other essential documents. To understand how it fits with broader strategies, you can explore our guide on what is a revocable living trust.

Key Players and Their Roles

Understanding the terminology is the first step to feeling confident about this process. There are two primary roles involved in every DPOA, and it's important not to get them mixed up.

Durable Power of Attorney at a Glance

Here's a quick summary of the key roles and functions involved in a Durable Power of Attorney.

| Term | Who It Is | What They Do |

|---|---|---|

| Principal | You, the person creating the DPOA. | You grant the authority and define the powers your agent will have. |

| Agent | The person you choose to act for you. | They make financial and legal decisions on your behalf as specified in the document. |

Choosing the right agent is absolutely critical, as they will be entrusted with significant responsibility over your financial life.

This document provides true peace of mind, knowing your affairs will be managed according to your wishes, by someone you trust completely, no matter what the future holds.

Why the Word 'Durable' Is So Important

That single word, durable, is what gives a durable power of attorney its real power. It’s the key ingredient that turns this document from a simple convenience into a critical shield for your future.

To really get why, let’s think about it like this.

A standard, or non-durable, power of attorney is like an umbrella that only works when it's sunny out. It’s handy for very specific, temporary situations—say, letting someone sell your car while you're traveling abroad. But the moment a real storm hits (in this case, your incapacitation), that sunny-day umbrella automatically snaps shut and becomes totally useless.

This is the fatal flaw of a non-durable POA. Its authority vanishes at the exact moment you and your family need it most. If you become unable to make your own decisions, the non-durable POA is immediately void, leaving your loved ones with zero authority to act on your behalf.

The High Cost of Lacking Durability

Without a durable document in place, your family often has no choice but to enter a public, costly, and emotionally draining court process to have a guardian or conservator appointed. That means a judge—not you—gets to decide who manages your affairs.

A properly executed durable power of attorney dramatically reduces the need for court-appointed guardianship. It helps families avoid lengthy and expensive conservatorship proceedings that can take months or even years to resolve, preventing court fees that often run into the thousands of dollars and reducing administrative delays. Learn more about why these documents are essential.

A durable power of attorney is your storm-proof umbrella. It's specifically designed to stay open and effective even in the face of incapacity. This durability is the absolute bedrock of any solid life and legacy plan.

When Does a DPOA Become Active?

So, "durable" means the document survives incapacity, but you still get to decide when your agent's authority actually kicks in. You generally have two choices for how a DPOA is structured:

-

Effective Immediately: The agent’s power begins the moment you sign the document. This is often the simplest route because it sidesteps any potential delays or arguments over proving you're incapacitated down the road. It just requires an enormous amount of trust in the agent you choose.

-

Springing DPOA: This type "springs" into effect only after a specific event happens—usually when one or more doctors certify in writing that you are incapacitated. While this adds a layer of protection, it can sometimes create hurdles. Your agent might have to jump through hoops to get financial institutions to accept the document if they demand extensive proof of your condition.

Ultimately, that 'durable' clause ensures your chosen agent can step in seamlessly to manage your finances, protecting your assets and carrying out your wishes without missing a beat, right when you can't do it yourself.

Choosing the Right Person as Your Agent

Of all the decisions you’ll make in the durable power of attorney process, selecting the person who will act as your agent—also called an “attorney-in-fact”—is without a doubt the most important. This isn't just about picking someone you love. It’s about choosing someone who can responsibly handle significant control over your financial life.

Think of it like hiring the most critical employee of your life. This person will be in charge of protecting your assets, paying your bills, and making decisions that hit close to home if you’re ever unable to do it yourself. This role demands a special mix of integrity, practical skill, and a bit of backbone.

The person you choose absolutely must be unquestionably trustworthy. While they have a legal duty—a fiduciary duty—to act in your best interests, the document itself gives them the power to do otherwise. You have to be completely confident in their moral compass.

Core Qualities of a Great Agent

Beyond absolute trust, your ideal agent should have a specific set of skills. Don't let emotion be your only guide here; you need to look at potential candidates with a clear, practical eye. It’s about finding someone who is both capable and truly willing to take on this serious role.

Your agent should be:

- Financially Competent: They don't need to be a Wall Street wizard, but they must be organized and responsible with their own money. Can they handle paying bills on time, managing a bank account, and understanding a basic financial statement? That's the level of skill we're talking about.

- Assertive and Organized: This person might have to advocate for you with banks, insurance companies, or even government agencies. They need the confidence to stand firm on a decision and the organizational chops to keep meticulous records of every single action they take on your behalf.

- Available and Willing: Let’s be realistic—this role can take up a lot of time. Make sure the person you choose actually has the capacity to take on these duties and genuinely agrees to the responsibility. Never just assume they’ll say yes.

Choosing your agent is a profound act of trust. It's giving someone the authority to protect your legacy when you can't. The right choice brings peace of mind; the wrong one can lead to conflict and financial devastation.

Evaluating Your Options

It's natural to first consider close family, but it's crucial to weigh the pros and cons of each person objectively. The best decision isn't always the most obvious one.

For example, naming an adult child can be a great choice, particularly if you need to provide some direction on managing the family’s finances. Our guide on how to help aging parents with finances offers some valuable wisdom for these kinds of conversations. However, you have to consider the potential for conflict if you have more than one child.

- A Spouse: Often the default choice, and for good reason—you already share a financial life. The main drawback is simply age. If you're both older, your spouse could face their own health challenges, leaving no one in charge of your affairs.

- An Adult Child: This is a common pick, but be brutally honest about their financial skills and temperament. If choosing one child over another is likely to cause family friction, you need to think long and hard about whether it's the right move.

- A Professional Fiduciary: A licensed professional, like an attorney or an accountant, can be a fantastic neutral option. This is especially true in complex situations or if family dynamics are tense. They do charge for their services, but they bring expertise and total impartiality to the table.

No matter who you pick, always name at least one successor agent as a backup. Life is unpredictable. If your first choice is unable or unwilling to serve when the time comes, your successor can step in without missing a beat, ensuring your plan stays intact.

Defining the Powers Your Agent Will Hold

Giving someone a durable power of attorney isn’t like handing over a blank check. Think of yourself as the architect of this agreement. You, the principal, have total control to spell out exactly what authority your agent can—and can’t—have. This ensures the power they hold lines up perfectly with your wishes.

This is one of the most important features of a DPOA. You can grant broad authority to handle every financial detail, or you can keep it narrow, limiting your agent to very specific tasks. The choice is yours, allowing you to tailor the document to your unique financial life and how much trust you place in your agent.

Financial Powers Versus Healthcare Decisions

It is absolutely critical to understand that a financial DPOA and a healthcare power of attorney are two completely separate documents. They cover different parts of your life and you can't use one for the other's job. Mixing them up is a common—and serious—mistake.

A Durable Power of Attorney for Finances gives your agent the authority to manage your assets and legal affairs. These powers often include:

- Real Estate Transactions: Buying or selling property on your behalf.

- Banking and Investments: Managing bank accounts, making investment decisions, and accessing safe deposit boxes.

- Government Benefits: Applying for and handling benefits like Social Security or Medicare.

- Tax Matters: Filing and paying your income taxes.

- Business Operations: Keeping your small business running if you own one.

On the other hand, a Medical Power of Attorney (sometimes called a healthcare proxy) lets your agent make medical decisions for you. Think consenting to surgery or choosing a long-term care facility. These two documents work together, providing a complete shield for both your money and your health.

A financial DPOA is the tool that ensures your bills get paid and your investments are managed if you can't do it yourself. A healthcare POA makes sure your medical wishes are followed. For a complete plan, you really need both.

Understanding Different Types of POAs

The world of estate planning has several kinds of power of attorney documents, and each one has a specific job to do. Knowing where a DPOA fits in helps make its unique value crystal clear. For a deeper look at the specific duties involved, check out our article on an agent's power of attorney financial responsibilities.

Let's break down how the main types of power of attorney stack up against each other. Each one serves a different purpose and is designed for specific situations.

Types of Power of Attorney Compared

| Type of POA | Primary Purpose | When It Ends |

|---|---|---|

| Durable Power of Attorney | Manages financial affairs; stays valid even if you become incapacitated. | Upon your death. |

| General Power of Attorney | Manages financial affairs but often becomes void if you're incapacitated (laws vary by state). | Upon your incapacitation or death. |

| Medical Power of Attorney | Manages healthcare decisions when you can't communicate your wishes. | Upon your death. |

Ultimately, a well-drafted durable power of attorney gives you the power to decide exactly who can do what. It creates a clear and legally binding roadmap to protect your financial legacy, no matter what happens.

How to Create and Activate Your DPOA

Putting a durable power of attorney in place isn't something you do on a whim. It’s a thoughtful process that turns your wishes into a legal document that can stand up in court. While every state has its own little quirks and rules, the basic steps are pretty much the same everywhere, giving you a clear roadmap to follow.

First things first, you have to actually create the document. This means spelling out exactly who you are (the principal), who you’re appointing to act for you (the agent), and at least one backup (successor agent). You also need to be crystal clear about what powers you're giving them. Fuzzy language is a recipe for disaster; if it's too vague, a bank or hospital might refuse to honor it.

You can find templates online, but this is one of those times where getting professional advice is worth its weight in gold. An estate planning attorney will make sure the document uses the specific legal phrasing required in your state and is built around your unique financial life.

Executing the Document Correctly

Once the document is drafted, you have to "execute" it to make it official. This isn't just a matter of scribbling your signature at the bottom. It’s a formal ceremony with specific legal hoops to jump through, all designed to prove you’re signing it willingly and know exactly what you're doing.

Most states will require you to sign your durable power of attorney in front of:

- Two disinterested witnesses who aren't named in the document.

- A notary public to verify your identity and watch you sign.

Thanks to the rise of digital legal services, this has gotten a lot easier. Legal platforms have reported that over 1.4 million DPOA-style documents were created online in recent years. Many states now accept digital signatures and even remote notarization, which can really simplify the whole process. You can see more on the rise of online DPOA creation at Ironcladfamily.com.

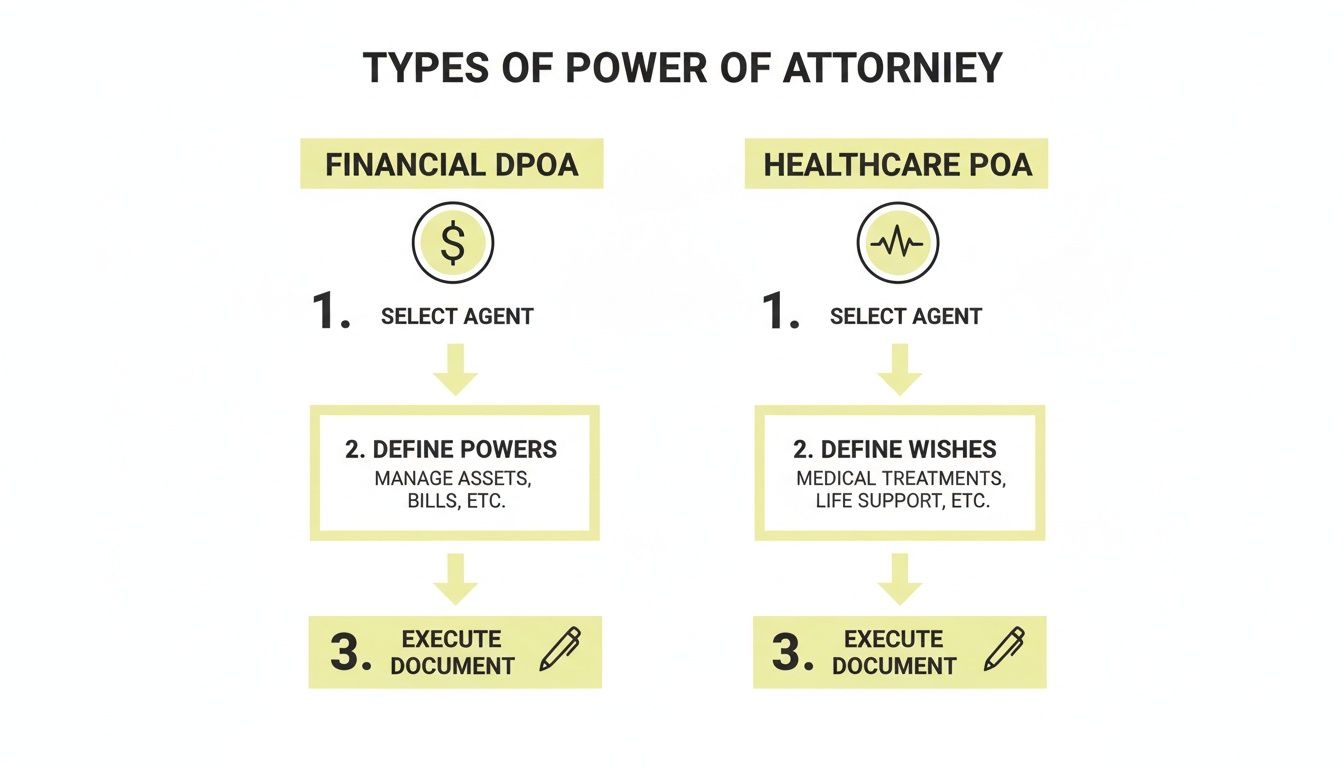

This flowchart shows how the paths for creating financial and healthcare powers of attorney are distinct but follow similar steps.

The big takeaway here is that even though the signing process looks similar, these are two completely separate documents for two very different parts of your life.

Activating the DPOA

So when does it "turn on"? That all depends on what you wrote in the document. If your DPOA is effective immediately, your agent has the power to act for you the moment you sign it.

If you set it up as a "springing" DPOA, it only kicks in after a doctor officially certifies that you've become incapacitated. Either way, you absolutely must give a copy to your agent and have a real conversation with them about their duties. The last thing you want is for them to be unprepared when you need them most.

Common Pitfalls to Avoid

Creating a durable power of attorney is a huge step toward securing your future, but a poorly drafted document can cause more problems than it solves. Sidestepping a few common mistakes is crucial to ensure your wishes are followed and your family is protected from confusion, conflict, and potential abuse.

One of the most frequent errors I see is using vague language. If the powers you grant aren't crystal clear, you can bet that financial institutions will reject the document, leaving your agent powerless when you need them most.

For instance, instead of just saying your agent can "handle finances," you need to get specific. Spell out that they can "access bank accounts, sell real estate, and manage investment portfolios." Specificity is your best defense against bureaucratic delays.

Another danger is granting overly broad powers without thinking through the consequences. While you absolutely must trust your agent, unchecked authority can be a recipe for disaster. It's wise to include some limitations or require your agent to keep detailed records and share them with a third party, like another family member or your attorney.

Keeping Your DPOA Relevant and Effective

Your durable power of attorney is not a "set it and forget it" document. Life changes, and your DPOA should change right along with it. A document that's years out of date might not reflect your current wishes or family situation at all.

It's absolutely essential to review your DPOA after any major life event:

- Marriage or divorce

- The death of a named agent or successor

- A significant change in your financial situation

- A major shift in your relationship with the agent

Finally, you need to understand that your DPOA may face challenges if it's used across state lines or internationally. The recognition of a durable power of attorney is highly dependent on local laws, and a document that's perfectly valid in one state may require extra hoops to jump through elsewhere.

International use, for example, often requires additional legal hurdles like apostilles or even re-signing the document locally to be honored by foreign institutions. You can explore more about these international considerations for a power of attorney to get a better sense of the complexities involved.

Frequently Asked Questions

Even with a solid plan, a few practical questions almost always pop up. Let's walk through some of the most common concerns people have after they've created a durable power of attorney.

When Does a Durable Power of Attorney End?

A durable power of attorney is a powerful tool, but it doesn't last forever. The agent's authority to act on your behalf automatically ends the moment you pass away. It's an immediate stop.

At that point, the executor named in your will steps in to manage your estate. You can also end a DPOA yourself by revoking it in writing, as long as you're still mentally competent.

Can My Agent Change My Will?

Absolutely not. Your agent has zero authority to alter your will. The power granted in a DPOA is strictly for managing your financial and legal affairs during your lifetime.

Your will is a completely separate document that only you can change while you are of sound mind. An agent's role is to protect your assets while you're here, not to decide how they're handed out after you're gone.

An agent's job is to execute your financial wishes while you're alive. An executor's job is to execute the wishes in your will after you've passed. These roles are distinct and should never overlap in authority.

What if a Bank Rejects My DPOA?

Unfortunately, this does happen sometimes. A financial institution might refuse to honor a DPOA if their internal legal policies are especially strict or if they feel the document's language isn't specific enough for their comfort.

The best prevention is to have an attorney draft the document using language that banks and other institutions are used to seeing. If it still gets rejected, your agent may need a lawyer to step in and communicate directly with the bank’s legal department to get things moving.

At Smart Financial Lifestyle, we believe in making smart financial decisions that protect your family and your legacy. To build a comprehensive plan that gives you true peace of mind, visit us at https://smartfinancialifestyle.com.