Ever notice how the words ‘rich’ and ‘wealthy’ get tossed around like they’re the same thing? They’re really not. The difference is massive, and it’s all about income versus assets.

Being rich means a lot of money is flowing in, usually from a hefty paycheck. But if that paycheck stops, so does the lifestyle. Real wealth, on the other hand, comes from owning things that make money for you. That’s the secret to lasting financial freedom.

Decoding the Difference Between Rich and Wealthy

At its core, this whole rich vs. wealthy thing is about how your money shows up and how long it sticks around. Take a surgeon raking in $500,000 a year. By any measure, she’s rich. That kind of cash flow buys the nice cars, the big house, and the fancy vacations.

But what if that income is tied directly to her working long hours in the operating room? It’s a vulnerable position to be in. Stop working, and the money dries up.

Wealth is a different game entirely. It’s measured by the power of your assets to do the heavy lifting for you. It’s not just about what you earn; it’s about what you own. Wealthy people are obsessed with buying assets that kick off cash—think rental properties, a solid stock portfolio, or a stake in a business.

Income Versus Assets

This is the fundamental split. Being rich is about chasing high, active earnings. Being wealthy is about patiently accumulating assets that can support you forever. This isn't just a personal finance quirk; it has huge implications for families and even the global economy. As you can see from research on inequality.org, wealth is what truly creates long-term stability, far more than a temporarily high salary.

A rich person might feel like they’re on a hamster wheel, working harder and harder to keep the lifestyle going. A wealthy person, meanwhile, has an army of assets working around the clock for them. Their financial world is built to withstand storms like a job loss, a market downturn, or even retirement without falling apart.

This infographic does a great job of breaking down the core differences at a glance.

As you can see, it boils down to breaking free from the paycheck-to-paycheck cycle, even if those paychecks are huge. Making that mental shift from earning to owning is the single most important step you can take toward building real, lasting financial independence.

In the end, it’s not just about the income you bring home. The real goal is to build a solid net worth, which gives you a much truer picture of your financial health. If you're curious to learn more about this, it's worth exploring the key differences between liquid net worth vs net worth.

Moving Beyond a Paycheck to Build Real Wealth

A big salary feels great, but it doesn't tell the whole story of your financial strength. Not even close. Real financial power comes from the metrics that work for you long after the paycheck is spent. This is where we get into the real engine room of wealth building: net worth, cash flow, and owning the right assets.

Think of your finances like a tree. Your income is the fruit you pick each year, but your net worth is the tree itself—the trunk, the branches, and the deep roots. A rich person is focused on harvesting as much fruit as possible right now. A wealthy person, on the other hand, is obsessed with growing a bigger, stronger, healthier tree.

This is more than just a subtle difference; it's a fundamental shift in mindset. The wealthy prioritize buying assets that generate positive cash flow, creating a financial ecosystem that eventually sustains itself.

The True Scorecard: Net Worth and Cash Flow

If you really want to understand the difference between being rich and being wealthy, you have to look past the W-2. The wealthy are dialed in on two numbers above all others:

-

Net Worth: This is the most honest look you can get at your financial reality. It’s simply what you own (your assets) minus what you owe (your liabilities). When your net worth is consistently rising, you’re building real, durable financial muscle.

-

Cash Flow: This is the money that’s left over after all your bills are paid, often coming from assets you own like a rental property or a portfolio of dividend stocks. Positive cash flow means your assets are working for you, adding to your wealth even when you aren't.

“The rich work for money. The wealthy have money work for them.”

This old saying hits the nail on the head. It perfectly captures the move from being a high-earning employee to becoming a strategic owner. This focus on ownership over earnings is exactly why we see such significant wealth disparities across the globe.

Why Asset Ownership Matters Most

The gap between the rich and the poor looks stark when you look at income, but it's an absolute chasm when you look at wealth. That's because wealth concentration means a tiny fraction of the population holds a massive share of the assets—real estate, stocks, businesses—not just the high-paying jobs. You can find some eye-opening data on wealth inequality across countries on worldpopulationreview.com.

The wealthy are always on the hunt for assets that fit their long-term vision. They get that every dollar they invest in an asset is like planting a seed for future growth. Their financial decisions aren't driven by, "How much can I spend this month?" but by a much more powerful question: "How can I make this money grow?"

Adopting the Mindset That Makes Money Work for You

The biggest gap between the rich and the wealthy isn't in a bank statement—it’s between their ears. This fundamental difference in mindset completely changes how money is seen and used. It’s the critical shift from just earning money to making your money work for you.

A 'rich' mindset often leads straight to lifestyle inflation. As the paychecks get bigger, so does the spending on things that lose value—luxury cars, designer clothes, and five-star vacations. It’s a treadmill where you have to keep running faster just to stay in the same place.

The wealthy, on the other hand, operate on a totally different mental framework. Their mindset is built around delayed gratification, a commitment to continuous financial learning, and the relentless acquisition of assets.

The Offensive vs. Defensive Game of Money

Think of it like a sports game. A rich mindset plays pure offense, always chasing a bigger salary or a higher-paying client. While that’s impressive, this strategy is exhausting and leaves you incredibly vulnerable. An injury, like a job loss, or simply getting older can take you right out of the game.

In contrast, a wealthy mindset plays both offense and defense. The defense is all about accumulating and protecting assets that generate their own income, independent of your labor. This builds a financial fortress that doesn't depend on your ability to show up to work every day.

This defensive game involves a few key shifts in day-to-day thinking:

- From Spending to Investing: Every dollar is seen as a soldier you can send out to capture more prisoners (generate returns).

- From Immediate Gratification to Long-Term Vision: A decision isn't based on what it gets you today, but on how it builds security for your family tomorrow.

- From Chasing Income to Building Equity: The goal isn't just to earn more, but to own more of the systems that produce income.

This proactive approach is precisely why learning why investing is a more powerful tool to build long-term wealth than saving is so critical for anyone looking to make this leap.

"The rich work for money; the wealthy have money work for them."

This isn’t just a clever saying; it’s the core philosophy separating temporary riches from lasting financial freedom. It requires a profound mental shift—seeing your money not as a tool for consumption but as a tool for production. When you adopt this perspective, you stop being an employee of your own lifestyle and become the CEO of your financial future, making calculated moves that ensure growth and stability for generations to come.

How the Wealthy Build a Lasting Legacy

A high income can disappear in a flash, but real wealth is built to last for generations. This long-game perspective is one of the starkest differences between being rich and being wealthy. For the truly wealthy, money isn't just about personal comfort—it's a tool to build a secure future for their family, long after they're gone.

Think of it like building a massive stone bridge. The first generation doesn't just build a path for themselves; they lay a solid foundation and start raising the arches, knowing full well they're creating something that will carry their kids and grandkids safely across whatever lies ahead. That simple shift changes every financial decision from a short-term win into a long-term strategic move.

Designing a Multigenerational Plan

The rich might plan for their retirement. The wealthy? They're planning for what happens 100 years from now. This requires a far more intricate and thoughtful approach to how assets are managed and passed down. It's less about dodging taxes and more about making sure the family’s values and financial stability are set in stone.

This kind of forward-thinking strategy involves a few key pieces:

- Strategic Estate Planning: This is so much more than a simple will. We're talking about creating structures like trusts that shield assets from creditors, lawsuits, and even from the irresponsible spending of future heirs.

- Business Succession: For family business owners, it means having a crystal-clear plan for who takes the reins next. It's about ensuring the business continues to thrive and provide for the generations to come.

- Philanthropic Endeavors: Many wealthy families set up foundations or charitable trusts. This does more than just good in the world; it gives their descendants a shared sense of purpose and social responsibility, turning financial success into a truly meaningful impact.

The man who dies thus rich dies disgraced. - Andrew Carnegie

This powerful line from industrialist Andrew Carnegie really gets to the heart of a legacy mindset. Wealth isn't meant to be stockpiled until the end. It's meant to be put to work—for society and for your family's future—while you're still around to see it happen. This is the ultimate expression of making your money work for you, not the other way around.

Investing in Financial Wisdom

Here’s the thing, though. Maybe the most critical part of a lasting legacy isn't the money at all. It's the financial wisdom that gets passed down with it. Wealthy families get this. They know that without knowledge and discipline, even a staggering fortune can be wiped out in a single generation.

So, they actively teach their children and grandchildren about investing, budgeting, and the immense responsibility that comes with having wealth. They're taught to be good stewards of the family's resources, not just entitled consumers. This investment in education is the real glue that holds a financial legacy together, ensuring that stone bridge they started building will stand strong for centuries.

Learning the 8 ways to build a strong financial legacy is a fantastic place to start if you're looking to make this shift yourself. This focus on education ensures the family’s assets keep growing, guided by the very same principles that created the wealth in the first place.

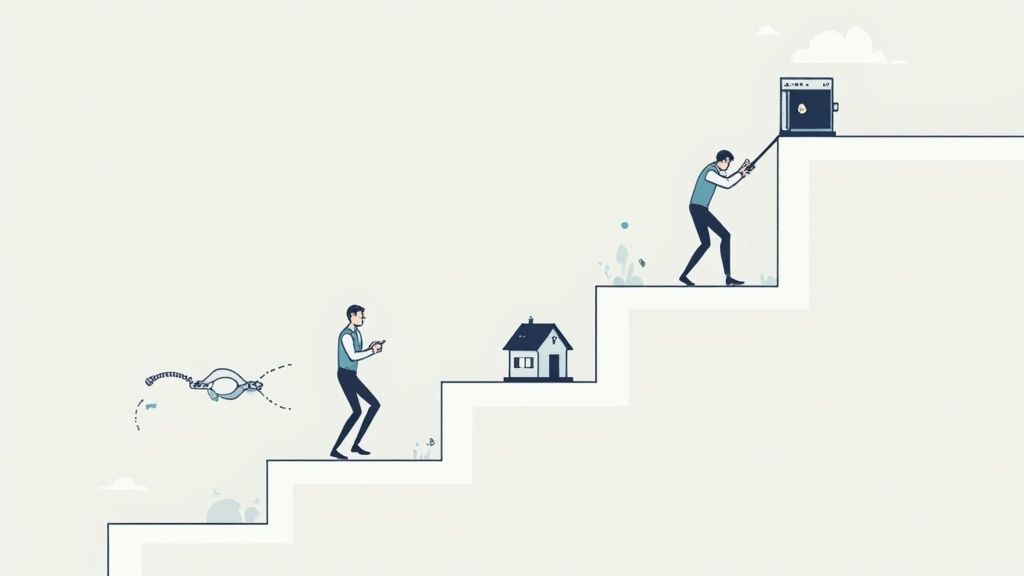

Your Action Plan: From Rich to Wealthy

Knowing the difference between rich and wealthy is a great first step, but insight without action is just trivia. This is where the rubber meets the road—where you stop being just a high earner and start building the systems that make you a true owner of your financial future. Making this shift isn't about luck; it's about deliberate, intentional habits.

The whole journey kicks off with one profound change in perspective: paying yourself first. This means a chunk of every single dollar that comes in gets automatically sent to your investments before you even get a chance to think about spending it. This isn't just a clever savings trick; it's a statement. It declares that your future is a non-negotiable expense.

Fire Up Your Wealth Engine and Set It to Autopilot

Let's be honest, willpower is a finite resource. It gets tired, distracted, and tempted. That's why the most effective way to build wealth is to take willpower out of the equation. You need to build a financial machine that grows your net worth in the background, 24/7.

Here’s how you can start bolting that machine together today:

- Set Up Automatic Transfers: Schedule a recurring transfer from your checking account to your brokerage or retirement account. The key is to have it happen the same day you get paid. The money is gone before you can miss it.

- Enroll in a DRIP: If you're investing in solid, dividend-paying companies, make sure you're enrolled in a Dividend Reinvestment Plan (DRIP). This little trick automatically uses your dividends to buy more shares of the company, creating a powerful compounding snowball over time.

- Use Tax-Advantaged Accounts: You have to max out your contributions to accounts like a 401(k) or Roth IRA. The automated payroll deductions and the massive tax benefits are like getting a head start in a race you can't afford to lose.

This hands-off system ensures you're consistently buying assets, which is the absolute core of what the wealthy do. They don't just work for their money; they put their money to work.

Cut the Financial Anchors Holding You Back

High-interest debt is like trying to swim with an anchor chained to your leg. It drags you down, exhausts you, and makes every bit of progress a struggle. A rich person might carry debt to finance a certain lifestyle, but a wealthy person sees it for what it is: a destructive force that must be systematically destroyed.

Your mission is to hunt down and eliminate consumer debt—credit cards, personal loans, car payments—with relentless focus. Every dollar you throw at high-interest debt gives you a guaranteed, risk-free return equal to that interest rate. Think about that. Paying off a credit card with a 22% APR is the same as earning a 22% return on your money, with zero risk. You can't find that in the stock market.

Moving from rich to wealthy is all about a fundamental shift. You stop acquiring liabilities that eat your income and start acquiring assets that protect and grow it.

Acquire Your First Cash-Flowing Asset

Once your wealth engine is humming along on autopilot and you've cut the anchors of bad debt, it's time for the main event: acquiring assets that generate passive income. This is the endgame. Owning things that pay you to own them.

This doesn’t have to be some overly complicated venture. Your first real cash-flowing asset could be something as simple as:

- A hand-picked portfolio of high-quality dividend stocks.

- A real estate investment trust (REIT) that cuts you a check every month or quarter.

- A rental property that generates positive cash flow after all the bills are paid.

The specific asset you choose first isn't as important as the principle behind it. With that first purchase, you've officially made the leap. You are now an owner, not just an earner. Each new asset becomes another pillar supporting your financial freedom, moving you decisively from the temporary status of being rich to the lasting security of being truly wealthy.

To put this all together, here's a simple framework to guide your actions. Think of it as a phased approach to building a financial fortress that can stand the test of time.

Your Action Plan From Rich to Wealthy

| Phase | Action Step | Primary Goal |

|---|---|---|

| Phase 1: Foundation | Pay Yourself First. Automate a minimum 15% transfer from every paycheck into an investment account. | Make wealth-building a non-negotiable habit and remove willpower from the equation. |

| Phase 2: Elimination | Create a Debt Hit List. Target your highest-interest debt (e.g., credit cards) and pay it off aggressively. | Achieve a guaranteed return by eliminating negative cash flow and freeing up capital for assets. |

| Phase 3: Acquisition | Buy Your First Income Stream. Purchase a simple, cash-flowing asset like a dividend ETF or a REIT. | Shift your identity from earner to owner by acquiring something that pays you. |

| Phase 4: Optimization | Maximize Tax-Advantaged Accounts. Fully fund your 401(k), Roth IRA, and any other tax-sheltered accounts available. | Use the government's own rules to accelerate your compounding and legally reduce your tax burden. |

| Phase 5: Expansion | Diversify Your Income Streams. Add a second, unrelated cash-flowing asset (e.g., a rental property if you started with stocks). | Build financial resilience so that a downturn in one area doesn't jeopardize your entire plan. |

This isn't an overnight fix; it's a blueprint for a lifelong structure. By focusing on these concrete steps, you're not just managing money—you're methodically building a legacy.

Common Questions About Building Wealth

Once you start looking beyond a high income and towards building real, lasting financial security, a lot of questions pop up. It’s a shift that’s not just about spreadsheets and numbers, but about tackling deep-seated habits and mindsets. Here are some straightforward answers to the questions we hear most often from people making the journey from rich to truly wealthy.

Can I Become Wealthy Without a High Income?

Absolutely. This is probably the biggest misconception out there. Wealth is a product of financial discipline, not a giant salary. The difference between wealthy and rich isn't about the size of your paycheck; it's about what you do with the money you have.

Someone with a modest income who consistently saves and invests a good chunk of it can easily become wealthier than a high-earner living paycheck to paycheck. Your savings rate and your investment strategy are far more powerful than your gross income. It’s not about how much you make. It's about how much you keep and put to work for you.

What Is the First Step to a Wealthy Mindset?

The single most powerful first step is to start tracking your net worth. That’s it. Shift your entire focus away from your monthly income and instead get obsessed with one simple calculation: your assets (what you own) minus your liabilities (what you owe).

This one number is the true scorecard of your financial health. When you start monitoring it every month, it forces a profound change in perspective. You stop thinking about short-term earning and start thinking about long-term ownership and growth.

The game changes entirely when the primary question is no longer, "How much did I earn this month?" but rather, "How much did my asset base grow?" This shift is the very foundation of a wealthy mindset.

Once you start measuring what actually matters, your financial decisions naturally start to align with the goal of increasing that number. That’s the core of building lasting wealth.

What Are the Biggest Mistakes to Avoid?

Building wealth is often less about making brilliant moves and more about consistently avoiding a few critical errors. Three common traps can derail even the most promising financial journey.

- Lifestyle Inflation: This is the big one. It’s the tendency to upgrade your spending every single time your income increases, which keeps you running on a hamster wheel. A new car, a bigger house, pricier vacations—these things devour the very capital you need to be investing for your future.

- Financial Ignorance: So many people fall into one of two camps here. They either chase risky, speculative investments they don't really understand (like the latest crypto fad) or they avoid investing altogether out of fear. Both paths lead to the same poor outcome. Wealth is built on a foundation of continuous learning and prudent, informed decisions.

- A Lack of Clear Goals: Without a compelling "why," discipline is nearly impossible to maintain. Your reason could be financial independence by 50, funding your grandchildren’s education, or creating a charitable legacy. Whatever it is, a clear and emotionally resonant goal provides the fuel to stay the course when the market gets rocky.

Avoiding these pitfalls is crucial when navigating the difference between wealthy and rich outcomes.

At Smart Financial Lifestyle, we believe in making smart financial decisions that build a legacy of security and purpose. Our approach is designed to give you the clarity and confidence to manage your family's future. Discover how you can start building your legacy today.