When you hear the term “trust fund,” it’s easy to picture a spoiled heir living off a bottomless bank account. But that's mostly movie stuff. In reality, a trust fund is a practical and powerful tool for everyday families, not just the ultra-wealthy.

Think of a trust not as a pot of gold, but as a detailed instruction manual for your assets—a personalized ‘financial care package’ you create for the people you love most. It’s all about giving you control and protection over your financial legacy, making sure your wishes are followed to the letter long after you're gone.

Understanding What a Trust Fund Really Is

So, what is it exactly? A trust is a legal entity you create to hold and manage assets—like cash, property, or investments—on behalf of your chosen beneficiaries. This structure lets you set very specific rules for how and when those assets are distributed, giving you a level of clarity and peace of mind that a simple will often can’t match.

The Three Key Players in Every Trust

At its heart, every trust fund is built around three essential roles. Getting a handle on who does what is the first step to understanding how this all works. No matter how big or small the trust, these three parties are always involved.

Here’s a quick look at the people who make a trust fund tick.

The Three Key Roles in a Trust Fund

| Role | Who They Are | Primary Responsibility |

|---|---|---|

| The Grantor | The creator of the trust (that's you!) | Sets the rules and transfers assets into the trust. |

| The Trustee | The manager of the trust | Manages the assets and follows the grantor's instructions. |

| The Beneficiary | The person receiving the assets | Receives the benefits from the trust according to the set rules. |

This simple three-part structure is what gives a trust its incredible power and flexibility. The grantor provides the vision, the trustee executes it, and the beneficiary receives the support as intended. It’s a clean, clear chain of command for your financial legacy.

Picking the right trustee is one of the biggest—and most important—decisions you’ll make. It's a common mistake to appoint someone without fully thinking through the long-term duties and the potential for family drama. To help you navigate this critical choice, you can learn more about the biggest mistakes parents make when setting up a trust fund in our detailed guide.

Choosing Your Path: Revocable vs. Irrevocable Trusts

When you decide to set up a trust, one of the first and most important forks in the road is the choice between revocable and irrevocable. This one decision sets the tone for everything else—how much control you keep, how flexible the plan is, and what kind of tax and asset protection you get.

Think of a revocable trust like a financial plan written in pencil. You can erase parts, add new instructions, and change your mind whenever you want. An irrevocable trust is more like having that plan carved in stone. Once it’s set, it’s permanent.

The Flexible Power of a Revocable Trust

A revocable trust, which you’ll often hear called a “living trust,” is the go-to for most people starting their estate plan. Its biggest draw? Flexibility. As the person creating the trust (the grantor), you have total control over the assets you put into it.

You can name yourself the trustee, manage the assets just like you always have, and even completely undo the trust if your circumstances change. The main goal here is to make managing your affairs easier and to help your estate skip the probate court process, which can be long, expensive, and public.

But that flexibility comes with a trade-off. Because you still have full control, the law sees those assets as yours. That means a revocable trust won’t shield your money from creditors or lawsuits, and the assets are still counted as part of your estate for tax purposes.

The Protective Strength of an Irrevocable Trust

An irrevocable trust is a whole different ballgame. When you move assets into one, you’re legally giving up ownership and control for good. You can’t just change the terms, pull the assets back out, or shut it down on a whim. It becomes its own separate legal entity.

That sounds pretty restrictive, and it is—but that rigidity is exactly where its power comes from. By giving up control, you create a powerful protective wall around those assets. Money and property inside a properly set-up irrevocable trust are generally safe from creditors, untouchable in a lawsuit, and removed from your taxable estate. This can lead to massive estate tax savings for your family down the road.

Key Takeaway: The whole game comes down to control. A revocable trust lets you keep the reins, giving you flexibility but not much protection. An irrevocable trust means you hand over control, but in return, you get powerful asset protection and tax advantages.

A Head-to-Head Comparison

So, which one is right for you? It really boils down to what you’re trying to accomplish. Is your top priority having the freedom to adapt as life throws you curveballs? Or are you more focused on protecting your assets and cutting down the estate tax bill for your kids?

To make it clearer, let's put them side-by-side. The table below highlights the key differences to help you see which path lines up with your goals.

Revocable Trust vs. Irrevocable Trust

A direct comparison of the two main categories of trusts to help you understand the key differences.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | High. Can be amended or revoked by the grantor. | Low. Cannot be changed by the grantor once created. |

| Asset Control | The grantor retains full control over the assets. | The grantor permanently gives up control over assets. |

| Probate Avoidance | Yes. Assets bypass the probate process. | Yes. Assets bypass the probate process. |

| Asset Protection | No. Assets are vulnerable to creditors and lawsuits. | Yes. Assets are generally protected from creditors. |

| Estate Tax Reduction | No. Assets are included in the grantor's estate. | Yes. Assets are removed from the grantor's estate. |

For most people, the estate planning journey starts with a revocable trust. It’s a fantastic tool for managing your assets while you’re alive and making sure things go smoothly for your family after you’re gone.

Later on, as your wealth grows or your situation gets more complex, you might bring in irrevocable trusts for specific jobs, like protecting a family business or setting up care for a loved one with special needs. This choice isn't just a legal box to check—it’s a strategic move that will shape your financial legacy for generations to come.

The Step-by-Step Process of Setting Up a Trust

Turning the idea of a trust into a legal reality might seem intimidating, but it’s a journey you can manage when you break it down into clear steps. Understanding what a trust fund is and how it works is one thing; actually creating one is the next. This process makes sure your financial wishes are written down and legally binding.

It all starts with your "why." Are you trying to skip probate court, provide for a child with special needs, protect your assets from creditors, or simply make sure your wealth passes smoothly to the next generation? Your goals will steer every decision from here on out.

Defining Your Goals and Assembling Your Team

Before a single document gets drafted, you need a clear vision. What, exactly, are you trying to accomplish? Who do you want to benefit from your assets, and are there any specific conditions you want to attach?

Once you have that picture in your head, the first practical step is finding an experienced estate planning attorney. While there are DIY options out there, a good lawyer ensures your trust is structured correctly under your state's laws and that it genuinely fits your unique family situation. Think of this as an investment that can save your loved ones from expensive legal messes later.

Choosing the Right People for the Job

With your goals set, you have two huge decisions to make about the people involved.

- Beneficiaries: These are the people or organizations who will ultimately receive the assets from the trust. Be crystal clear about who they are and what they're meant to get.

- Trustee: This is the person or institution you put in charge of managing the trust's assets and handing them out according to your rules. This job demands someone with financial smarts, total integrity, and a real commitment to doing what's best for the beneficiaries.

A trustee has what's called a fiduciary duty—the highest standard of care recognized by the law. This means they are legally required to manage the trust’s money prudently and only for the benefit of the beneficiaries. Picking your trustee is one of the most important choices you'll make.

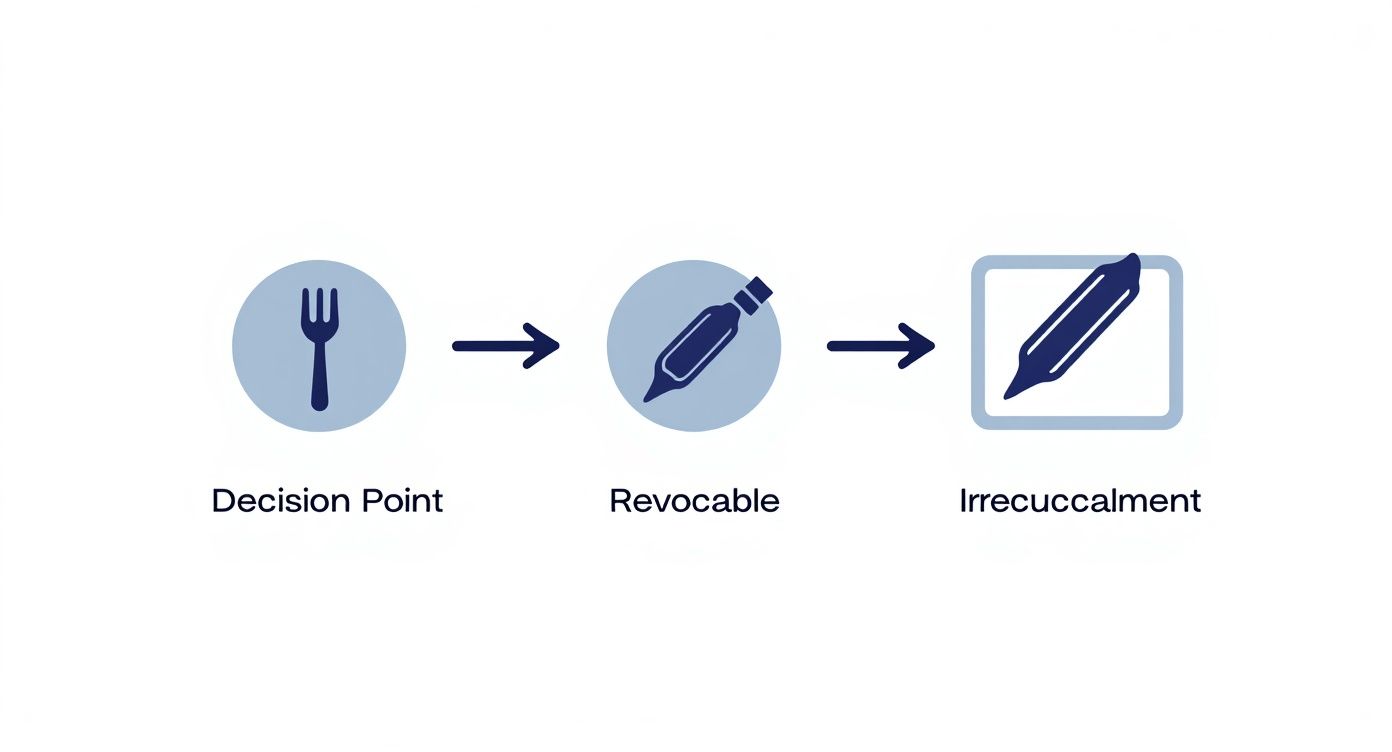

The infographic below shows the very first decision you'll face when you start this process.

This visual gets right to the heart of the matter: do you want flexibility (a revocable trust) or permanence (an irrevocable one)? That choice shapes everything that follows.

Drafting the Trust Document

Next up, you and your attorney will create the official trust agreement. This legal document is the core of your trust and lays out all of your instructions in detail.

This is where you spell everything out:

- Distribution Instructions: State exactly how and when beneficiaries get their inheritance. Should they get a lump sum when they turn 30, or smaller payments over time?

- Trustee Powers: Define what your trustee can and can't do with the trust's assets, like making investment decisions or managing property.

- Successor Trustee: Name a backup person to take over as trustee if your first choice can't or won't do the job. You always need a plan B.

This document is your instruction manual, so make it as clear and thorough as possible to avoid any arguments or confusion down the road.

The Critical Step of Funding Your Trust

Just creating the trust document isn't enough. A trust is basically an empty box until you actually put your assets into it. This process is called "funding the trust," and it's absolutely vital for the trust to do its job.

Funding means legally changing the ownership of your assets from your name to the trust's name. This could be re-titling your house, changing the name on your brokerage account, or making the trust the beneficiary of your life insurance policy. For a deeper look, check out our guide on the 6 essential steps for how to set up a trust fund.

If an asset isn't properly moved into the trust, it won't be covered by the trust's rules. Instead, it might get stuck in the public, and often lengthy, probate process—which is exactly what most people create trusts to avoid.

Navigating the Costs and Tax Implications

Let's get into the practical side of things—money. Setting up a trust fund isn't free, but it's helpful to think of the costs as an investment in your family's financial security and your own peace of mind.

You'll have initial setup fees paid to an estate planning attorney to get the ball rolling. This can range from a few thousand dollars for a simple revocable trust to quite a bit more for complex irrevocable trusts designed for specialized tax planning. This cost covers the expert legal advice you need to make sure the document is airtight and actually does what you want it to do.

The Ongoing Costs of Trust Administration

Beyond the initial setup, there are some ongoing costs to keep the trust running smoothly. If you hire a professional, like a bank's trust department, to act as trustee, they'll charge an annual fee. This is usually a small percentage of the assets they're managing for you, often around 1% to 2%.

These pros handle everything—from investing the assets and filing taxes to making sure distributions get to your beneficiaries according to your rules. For a lot of people, that fee is well worth it for impartial, professional management.

You can also name a family member as a trustee, and it's a good idea to let them be compensated for their work. Outlining a fair payment structure in the trust document itself can prevent squabbles down the road and ensures your trustee is properly paid for their significant responsibilities.

Understanding the Tax Landscape

How a trust is taxed boils down to one crucial question: is it revocable or irrevocable? The answer completely changes the financial picture for both you and your beneficiaries.

A revocable trust is pretty straightforward from a tax perspective. Because you keep full control over the assets, the IRS still sees them as yours.

- No Separate Tax ID: All the trust's financial activity is reported right on your personal tax return, using your Social Security number.

- No Gift Tax: When you move assets into the trust, it's not considered a gift, so you don't have to worry about gift tax filings.

- Part of Your Estate: When you pass away, the assets in the trust are included in your estate for estate tax purposes.

This kind of trust is all about making your life easier to manage, not about fancy tax maneuvers.

Key Insight: Just think of a revocable trust as a pass-through for tax purposes. You're still in charge, so you report the income just like you always did.

An irrevocable trust, on the other hand, is a whole different ballgame. It's treated as its own separate legal and tax entity. Once you put assets in, you've legally given them away. It's this separation that gives it powerful tax and asset-protection benefits.

- Separate Tax ID: The trust needs its own Employer Identification Number (EIN) from the IRS.

- Trust Tax Returns: It has to file its own annual income tax return, called a Form 1041.

- Gift and Estate Tax Implications: Moving assets into the trust is a gift, which might mean you need to file a gift tax return. The huge upside is that those assets are now generally removed from your taxable estate, potentially saving your family a ton in estate taxes later on.

The costs are a big piece of the puzzle, and it's natural to ask what it takes to even get started. To get a better feel for the numbers, check out our guide on how much money you need to start a trust fund for a child. Getting these cost and tax details right is the key to making a trust a powerful tool for your family's legacy.

Seeing Trusts in Action: Real-World Scenarios

Understanding what a trust fund is and how it works is one thing, but seeing it solve real-life problems is where it all clicks. These aren't just dry legal structures; they're personalized solutions for very human situations, giving families clarity and security when it matters most.

Let's move past the theory and dive into a few stories that show just how powerful trusts can be for protecting legacies and taking care of loved ones.

Protecting Young Children and Grandchildren

Think about a young couple, Maya and Ben, with two small children. Their biggest worry is what would happen to the kids if something unexpected happened to both of them. A simple will could name a guardian, but it wouldn't offer a financial roadmap for their future.

This is a classic case where a revocable living trust is a game-changer.

- Their Solution: They set up a trust and name a trusted sister as the successor trustee.

- The Assets: They fund the trust with their home, savings accounts, and life insurance policies.

- The Instructions: The trust document clearly lays out that the money is for the children’s health, education, and general well-being. It even specifies that each child will get their share in stages—a chunk at age 25 for a down payment, and the rest at 35 when they're more financially mature.

This setup makes sure their money is managed by a responsible adult and used exactly as they wanted, preventing it from being squandered by a young adult.

A trust acts as a financial guardian for your children, ensuring your hard-earned money supports them in the way you would have if you were still there. It replaces guesswork with a clear plan.

Ensuring a Smooth Business Succession

Now, consider David, a small business owner who has poured his life into his construction company. He's ready to retire and pass the business to his daughter, who has worked with him for years, but his son isn't interested. Just handing over the business could trigger hefty gift taxes and family drama.

So, David uses an irrevocable trust to create a smooth, tax-efficient transition.

- His Strategy: He works with an attorney to move his company shares into an irrevocable trust, naming his daughter as the beneficiary who will take over when he retires.

- The Benefit: This move legally separates the business from his personal estate, which helps minimize estate taxes and protects it from personal creditors.

- The Outcome: The trust provides a clear, legally binding path for succession. It prevents family squabbles and makes sure the business he built keeps thriving without him.

This kind of forward-thinking is becoming more common. The global trust fund market was valued at about USD 184.49 billion in 2025 and is projected to hit USD 228 billion by 2029. This growth shows just how essential trusts are for complex financial situations, from business handovers to philanthropy. You can dive deeper into the rise of trusts and foundations in this detailed market report.

Providing Lifelong Care for a Loved One with Special Needs

Finally, let's look at Sarah, a single mother to her adult son, Leo, who has a disability requiring lifelong care. Leo depends on critical government benefits like Supplemental Security Income (SSI) and Medicaid, which have very strict income and asset limits. A direct inheritance would disqualify him from this essential support.

To solve this, Sarah sets up a Special Needs Trust.

- The Setup: She creates a trust designed specifically to hold assets for Leo’s benefit without messing up his eligibility for government aid.

- How It Works: The trustee (her brother) can't just hand cash to Leo. Instead, he can pay for things that improve Leo’s quality of life—like medical treatments Medicaid doesn’t cover, specialized equipment, vacations, or personal care attendants.

- Peace of Mind: Sarah knows that after she’s gone, the money she leaves will be used to give Leo a comfortable and enriched life, without ever threatening the government assistance he relies on.

These stories show that a trust isn't about hoarding wealth; it’s about using it with purpose and care. Whether it's protecting the next generation, securing a business legacy, or providing for a vulnerable family member, a well-crafted trust is one of the most powerful tools you have for managing your financial life with intention.

Of course. Here is the rewritten section, crafted to sound like it was written by an experienced human expert, following all the provided guidelines and matching the example blog post's style.

Your Top Trust Fund Questions, Answered

As you start to wrap your head around what a trust is and how it actually works, a bunch of practical questions are bound to pop up.Of course. Here's the rewritten section, crafted to sound like it was written by an experienced human expert and matching the provided style.

Your Top Trust Fund Questions, Answered

As you start to wrap your head around what a trust is and how it actually works, a bunch of practical questions are bound to pop up. Let's be honest, it's a lot to take in. Getting clear, straightforward answers is the best way to feel confident about your next steps in estate planning.

So, let's dive into some of the questions I hear most often.

How Much Money Do I Need to Start a Trust Fund?

There’s this persistent myth floating around that you need to be a millionaire to even think about setting up a trust. Let me be clear: that's just not true. In reality, there is no official minimum amount required. The decision should be driven by what you want to accomplish, not the size of your bank account.

You might set up a trust to manage a family home, a modest investment portfolio, or even just the payout from a life insurance policy. The real goal is often about achieving specific outcomes—like keeping your family out of probate court or making sure a minor child is cared for properly. The main cost you’ll face upfront is the legal fee to get the document drafted, which is really an investment in making sure your wishes are followed to the letter.

A trust is a tool for control and protection, not just a container for immense wealth. It’s about achieving your specific financial and family goals, regardless of your net worth.

Can I Be the Trustee of My Own Trust?

Yes, you absolutely can. For a revocable living trust, it's not just possible—it’s actually very common and often makes the most sense. When you create a revocable trust, you can, and probably should, name yourself as the initial trustee. This setup gives you complete and total control over your assets for as long as you live.

You can manage, buy, and sell assets inside the trust just like you did before. The crucial part, though, is that the trust document must also name a successor trustee. This is a person or financial institution you trust to step in and manage things if you become incapacitated or after you pass away. It’s what ensures a seamless, no-hiccup transition of control.

Does a Trust Fund Protect Assets from Lawsuits?

This is a big one, and the answer really depends on the kind of trust you choose. The difference between revocable and irrevocable trusts is everything here.

- Revocable Trusts: Think of this as an extension of yourself. Since you keep full control and ownership of the assets, a revocable trust offers no protection from creditors or lawsuits. Legally, the assets are still seen as yours.

- Irrevocable Trusts: Now, this is a different story. A properly structured irrevocable trust can provide serious asset protection. By legally transferring ownership of your assets to the trust and giving up control, you effectively place them beyond the reach of your personal creditors in most situations.

Setting up an irrevocable trust for asset protection is a pretty sophisticated strategy. It's not a DIY project—it requires careful planning with an experienced estate planning attorney to make sure it's structured correctly to give you the legal shield you're looking for.

At Smart Financial Lifestyle, we believe that understanding these financial tools is the first step toward building a secure legacy. Our approach combines decades of experience with clear, practical guidance to help you make smart financial decisions for your family. To continue your journey, explore more resources at https://smartfinancialifestyle.com.