Living off of interest is the dream, isn't it? It's the point where you've built up enough capital that the income it spins off covers your living expenses—forever. You never even have to touch the original nest egg.

It’s the ultimate financial freedom. Your money is officially working for you, not the other way around.

What Living Off of Interest Really Means

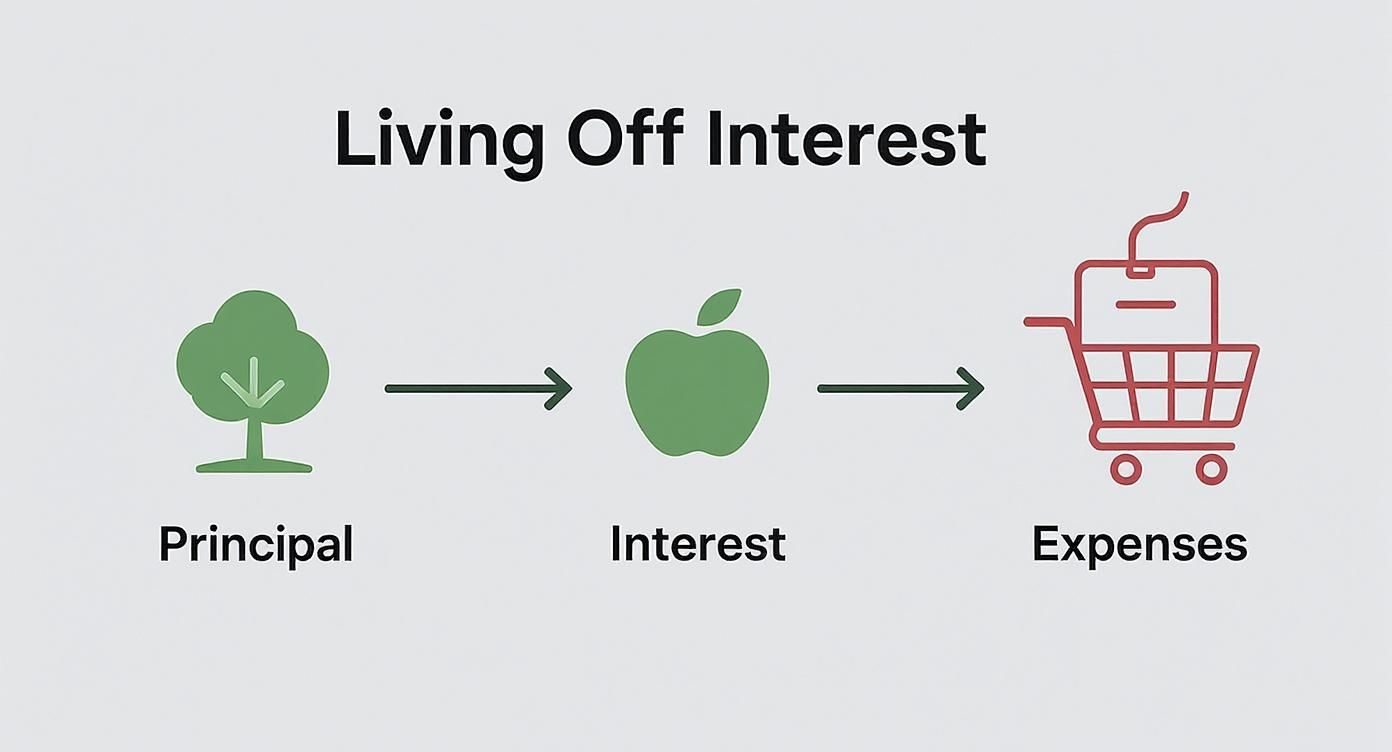

Think of your savings and investments as a thriving apple orchard. Each tree is your principal, the money you've painstakingly saved over the years. The apples that grow every season? That's the interest your money earns.

Living off of interest means you're just eating the apples, leaving the trees completely untouched. This way, they can keep producing more fruit, year after year, without fail.

This entire strategy is built on one powerful idea: preservation. Instead of slowly chipping away at your savings in retirement, you create a system where your capital becomes a permanent, income-generating machine. It’s a game-changer for anyone looking for true financial security, whether that's for retirement, leaving a legacy, or just breaking free from the 9-to-5 grind.

The Core Mechanics of Your Financial Orchard

To turn this idea into reality, you have to get comfortable with the relationship between three key numbers:

- Your Principal: This is the total sum of your invested capital. It's the orchard itself.

- Your Interest Rate: This is the average annual return your investments generate. It dictates how many "apples" your orchard produces.

- Your Annual Expenses: This is what you need to live on each year. It's your personal finish line.

The goal is to grow your principal to the point where the interest it kicks off is more than enough to cover your annual expenses. For example, if you need $60,000 a year to live comfortably and your portfolio reliably earns a 4% interest rate, you’d need a principal of $1.5 million ($60,000 / 0.04).

The premise is to never kill the golden goose and live off the golden eggs. Not everyone can accomplish that, but it’s a great target to shoot for.

Now, this strategy requires a laser focus on assets you can actually access. It’s one thing to have a huge portfolio on paper, but it’s another to have enough of it in cash or easily sellable investments. Understanding the difference between your total net worth and your spendable assets is critical. You can get a better handle on this in our guide comparing your liquid net worth vs net worth.

To bring it all together, let's look at the core principles that make this entire financial strategy work.

Core Principles for Living Off of Interest

This table breaks down the foundational concepts you'll need to master to make your money work for you, not the other way around.

| Principle | Description | Key Takeaway |

|---|---|---|

| Capital Preservation | Your primary goal is to never spend your initial investment capital. | The principal is the engine; protect it at all costs. |

| Sustainable Income | The interest earned must be sufficient to cover all living expenses. | Your lifestyle is funded by returns, not your savings account. |

| Inflation Awareness | Your interest earnings must outpace inflation to maintain purchasing power. | A 3% return is a net loss if inflation is 4%. |

Ultimately, these principles aren't just rules; they're the pillars supporting a lifetime of financial independence. Getting them right is the key to making the dream of living off interest your reality.

How to Calculate Your Freedom Number

So, how do we turn the dream of living off interest into a real, achievable plan? It all starts with one number. I call it your "Freedom Number"—the exact pile of cash you need to generate enough income to cover your life, forever, without ever working again.

Getting this number down on paper is the first real step. It takes an abstract goal and makes it a concrete target you can actually aim for.

The Foundational Formula

At its core, the math is refreshingly simple. All we’re doing is connecting what you spend in a year with what you expect your investments to earn.

Annual Living Expenses ÷ Assumed Interest Rate = Your Freedom Number

Let's put it into practice. Say you need $75,000 a year to live comfortably, and you feel confident you can earn a 4% average annual interest rate on your portfolio. Your Freedom Number is $1,875,000.

($75,000 / 0.04 = $1,875,000)

This is the bedrock of your entire strategy. It’s your finish line. It’s the tangible goal you’re working toward as you build your capital.

This visual really helps bring the concept to life.

Think of your principal as the tree. It’s big, strong, and meant to last forever. The interest is the fruit it produces—the apples. A big enough tree can drop enough apples into your shopping cart to fund your entire lifestyle without ever having to chop down the tree itself.

Running the Numbers for Different Lifestyles

Your Freedom Number is deeply personal because it’s tied directly to your spending. Someone living a frugal life will need a much smaller nest egg than someone with more expensive tastes.

Let’s look at a few common scenarios to see how this plays out.

Freedom Number Scenarios

| Annual Expenses | 3% Interest Rate | 4% Interest Rate | 5% Interest Rate |

|---|---|---|---|

| $50,000 | $1,666,667 | $1,250,000 | $1,000,000 |

| $75,000 | $2,500,000 | $1,875,000 | $1,500,000 |

| $100,000 | $3,333,333 | $2,500,000 | $2,000,000 |

Notice how a seemingly small change in the interest rate has a massive impact on the principal you need? Bumping your return from 3% to 5% means you need 40% less capital to generate the same income. This is why building a portfolio that can produce a reasonable, sustainable return is so critical.

Of course, these numbers are a bit too perfect. They don’t account for two of the biggest financial headwinds we all face: taxes and inflation.

Adjusting for Real-World Factors

For a plan to be truly resilient, it has to stand up to the forces that chip away at your returns. Your "real return" is what’s left after they take their cut.

- Factoring in Taxes: You have to pay taxes on most interest income. If your portfolio earns a 4% return but you’re in a 25% effective tax bracket on that income, your after-tax return is really just 3%. That simple adjustment makes a huge difference in how much you need.

- Accounting for Inflation: Inflation is the silent thief that makes your money worth less over time. If your investments earn 4% but inflation is running at 3%, your real gain is only 1%. Your income might stay the same, but you’ll be able to buy less with it each year.

A much more realistic formula looks like this:

Annual Expenses ÷ (Interest Rate - Tax Rate - Inflation Rate) = Adjusted Freedom Number

Let’s go back to our $75,000 income goal with a 4% interest rate. But this time, let's plug in a 15% tax rate and 2% inflation. The real-world return in our formula shrinks from a healthy 4% down to just 1%.

All of a sudden, your needed principal skyrockets from $1.875 million to a staggering $7.5 million.

This is why ignoring taxes and inflation is one of the most dangerous mistakes you can make in your planning. Now that you see their impact, we can dive into the strategies for managing them. Understanding the threat is always the first step.

Building Your Interest-Generating Portfolio

So, you’ve figured out your Freedom Number. Now for the fun part: building the financial engine that will actually churn out that income for you.

This isn’t about chasing flashy, high-risk stocks. Not at all. We’re talking about assembling a solid, durable portfolio of assets chosen specifically to generate a steady, predictable stream of interest. This collection of investments is the absolute core of your plan to live off of interest.

Think of yourself as the architect of an income machine. Every component you select has a specific job, carefully balancing safety with the potential for a decent return. A well-built portfolio is diversified, resilient, and—most importantly—aligned with your personal comfort level for risk. Let’s look at the essential building blocks.

The Foundation of Safety

The safest assets in your portfolio are your bedrock. They provide stability and give you immediate access to cash when you need it. They won't make you rich overnight, but they’re absolutely critical for preserving your capital.

-

High-Yield Savings Accounts (HYSAs): These are FDIC-insured bank accounts that offer much higher interest rates than your typical savings account. They are completely liquid—meaning you can pull your money out anytime—which makes them perfect for an emergency fund or your immediate cash reserves.

-

Certificates of Deposit (CDs): A CD is a savings certificate with a fixed end date and a locked-in interest rate. You agree to leave your money untouched for a set period, maybe a few months or several years, and in return, the bank pays you a better interest rate than a standard savings account. CDs are also FDIC-insured up to $250,000 per depositor, per bank.

These foundational assets are your first line of defense, making sure a portion of your principal is always secure. But to generate enough income to truly live on, you’ll often need to look beyond just these options.

Expanding into Bonds for Higher Yields

To really boost your interest income, you'll need to step into the world of bonds. A bond is basically a loan you make to a government or a corporation. In return, they pay you interest over a set period and then give you your original investment back at the end.

-

Government Bonds: Issued by the U.S. Treasury, these are considered some of the safest investments on the planet because they're backed by the full faith and credit of the U.S. government. They come in different flavors, like Treasury Bills (T-bills), Notes (T-notes), and Bonds (T-bonds), each with different timeframes. If you want to dive deeper into a specific type, our article exploring when a savings bond is the best investment has some great details.

-

Corporate Bonds: These are issued by companies looking to raise money. They almost always offer higher interest rates than government bonds to make up for a slightly higher level of risk. Bonds from big, stable companies are called "investment-grade," while those from less secure companies are known as "high-yield" or "junk" bonds (and carry more risk, as the name implies).

The interest rate environment plays a huge role in all of this. Back in the early 1980s, when the U.S. Federal Reserve jacked up rates to fight inflation, rates hit a staggering 20%. At that time, a $100,000 CD could spit out $20,000 in annual income, enough to cover an average family's expenses.

Fast forward to 2020, and the average 1-year CD was yielding a paltry 0.15%. That same $100,000 investment would have only generated $150 for the year. This dramatic shift shows just how much more capital is needed today to achieve the same income.

Your portfolio should always reflect your personal timeline and risk tolerance. An investor getting close to retirement will naturally lean toward capital preservation with government bonds, while a younger investor might take on a bit more risk with corporate bonds to chase a higher yield.

Comparing Interest-Bearing Assets

Choosing the right mix of assets is a classic balancing act. You have to weigh the potential return against the risk involved and how easily you can get your hands on the money (its liquidity).

This table gives you a clear side-by-side comparison to help guide your thinking.

| Asset Type | Typical Interest Rate | Risk Level | Liquidity |

|---|---|---|---|

| High-Yield Savings | Low to Moderate | Very Low | Very High |

| Certificates of Deposit | Low to Moderate | Very Low | Low (until maturity) |

| Government Bonds | Moderate | Low | High (can be sold) |

| Corporate Bonds | Moderate to High | Low to Moderate | High (can be sold) |

Building your interest-generating portfolio is an intentional process, not a guessing game. By combining safe, liquid assets with higher-yielding bonds, you can construct a diversified and resilient income stream that gets you that much closer to your goal of financial freedom.

Protecting Your Income from Inflation and Taxes

It’s one thing to build a portfolio that finally spins off enough income to live on. That's a huge milestone. But actually keeping that income? That’s the real trick. Two silent partners are always ready to take their cut: inflation and taxes.

Think of it this way: your interest income is a stream of water filling up a bucket you need to live on. Inflation is a slow, steady leak at the bottom, while taxes are someone who shows up every so often to dip their cup in and take a share. If you ignore them, you'll eventually find your bucket emptier than you planned, forcing you back to the drawing board when you least expect it.

Building a financial plan that can stand the test of time means actively defending your income stream. It’s what separates a fragile setup from a truly resilient one, ensuring your goal of living off of interest is sustainable for the long haul.

Taming the Silent Threat of Inflation

Inflation is that sneaky rise in the cost of everything over time. It’s a silent tax that slowly eats away at the purchasing power of every single dollar you make. A 4% interest rate might sound great, but if inflation is humming along at 3%, your real return—what you can actually buy with your money—is just 1%.

Your income statement might show the same number year after year, but you'll notice you can buy less with it. This is precisely why any strategy that focuses only on nominal interest rates is doomed to fail over the long run.

To keep your lifestyle from shrinking, your interest income needs to do more than just cover your bills; it has to grow faster than inflation. Luckily, you can build this defense right into your portfolio.

- Treasury Inflation-Protected Securities (TIPS): These are special government bonds designed to do one thing: fight inflation. The bond's principal value actually increases with inflation, which means the interest payments it kicks off rise, too. It’s a built-in buffer for your spending power.

- I Bonds: Another tool from the U.S. Treasury, Series I savings bonds earn interest from two sources: a fixed rate plus an inflation-adjusted rate that changes twice a year. This gives you direct, powerful protection against rising costs.

When you weave assets like these into your portfolio, you're not just earning interest. You're making sure that income holds its value year after year, protecting the financial independence you worked so hard to achieve.

Minimizing the Impact of Taxes

Just as inflation reduces what your money can buy, taxes reduce how much of that money you actually get to keep. Most interest income—from savings accounts, CDs, and corporate bonds—is taxed as ordinary income. Depending on your bracket, that can take a serious bite out of your returns.

Your most powerful tool here is strategic asset placement. It’s not just about what you own, but where you own it.

- Tax-Advantaged Accounts: Retirement accounts are your first line of defense. A Traditional IRA or 401(k) lets your money grow tax-deferred, meaning you don't pay a dime in taxes until you take it out in retirement. A Roth IRA, which you fund with after-tax money, is even better—all your earnings and withdrawals in retirement are completely tax-free.

- Municipal Bonds: Often called "munis," these are bonds issued by state and local governments. Their big selling point? The interest they pay is typically exempt from federal income tax. For investors in higher tax brackets, a muni bond can often provide a better after-tax return than a corporate bond with a higher interest rate.

Getting the hang of these different account types is a game-changer for your long-term strategy. To dive deeper, you can explore the key differences between a pretax contribution vs a Roth in our detailed guide. Protecting your income isn't a one-time fix; it's an ongoing process of smart planning around both inflation and taxes to ensure your financial freedom is built to last.

Achieving Your Goals at Different Life Stages

The dream of living off interest isn’t a one-size-fits-all finish line. It’s a goal that looks completely different depending on where you are in life. A young professional’s strategy is miles apart from what a retiree needs, or what someone navigating an unexpected life event requires.

Your financial roadmap has to mirror your unique circumstances, your timeline, and what you’re ultimately trying to achieve. By tailoring your approach, you can build a plan that delivers not just income, but real security, confidence, and peace of mind. Let’s walk through how this powerful concept adapts to three distinct stages of life.

For Retirees and Pre-Retirees

As you get closer to retirement, the entire game changes. Your financial mindset has to make the critical pivot from accumulation to preservation. The main objective is no longer about growing your nest egg at all costs; it’s about protecting what you’ve so carefully built and turning it into a reliable income stream that will last the rest of your life.

Your focus narrows to creating a stable financial "floor" that covers all your essential expenses, no matter what the stock market is doing.

- Capital Preservation is Everything: Your portfolio should now lean heavily toward lower-risk, income-producing assets. This is the time to prioritize things like government bonds, high-quality corporate bonds, and CDs that provide predictable, steady interest payments.

- Building an Income Floor: Use a portion of your portfolio to construct a guaranteed income stream. This might involve creating a bond ladder or considering an annuity to cover those non-negotiable costs like housing, healthcare, and utilities.

- Managing Withdrawal Risk: An interest-only approach is the ultimate form of capital preservation. By living strictly off the earnings, you ensure your principal remains untouched. This is your best defense against the risk of drawing down your funds too quickly, especially during a market downturn.

For Family Stewards Building Generational Wealth

For those whose focus is on legacy, "living off interest" takes on a much grander meaning. It becomes a powerful tool for creating lasting financial security that can support your family for generations to come. The goal isn't just to fund your own life, but to build a financial engine that keeps providing for your children and grandchildren long after you're gone.

This approach is about building something permanent. The principal you’ve accumulated is no longer just your nest egg; it becomes a family asset, a perpetual resource that can help fund education, assist with home down payments, or simply provide a safety net for decades.

"The premise is to never kill the golden goose and live off the golden eggs. Not everyone can accomplish that, but it’s a great target to shoot for."

To make this a reality, your focus has to extend beyond simple portfolio management. It must include clear communication and a commitment to educating the next generation.

- Foster Financial Literacy: You have to teach your heirs about the principles of capital preservation and sustainable income. Help them understand the difference between the "orchard" (the family's legacy capital) and the "fruit" (the income that is theirs to use wisely).

- Establish Clear Governance: Consider using trusts or other legal structures to protect the principal. These tools can provide clear, enforceable guidelines for how the interest income can be used by future generations, ensuring your intentions are honored.

For Women Navigating Major Life Transitions

Life can change in an instant. For women navigating a divorce, the loss of a spouse, or a major career shift, financial stability often rockets to the top of the priority list. In these moments, the goal of living off interest becomes a powerful anchor, offering a clear path toward renewed confidence and independence.

This isn't just about the numbers on a spreadsheet; it's about rebuilding a sense of control over your own future. The very act of creating a sustainable income stream from existing assets or an inheritance can be an empowering step toward self-reliance. The focus is on creating a secure foundation from which to build a new life.

Key steps in this journey often include:

- Gain Absolute Clarity: The first step is always to take a full inventory of your assets and expenses. You can't make a plan until you know exactly what you have and what you truly need.

- Prioritize Security: Your initial portfolio should be built for stability, not aggressive growth. Focus on secure, interest-bearing investments that generate predictable cash flow while you map out your longer-term goals.

- Seek Trusted Guidance: Work with a financial professional who understands your unique situation and can provide empathetic, clear advice. This partnership is crucial for building the confidence you need to make smart financial decisions for your new future.

The True Meaning of Financial Freedom

Hitting your "Freedom Number" and actually living off the interest is a massive financial win. But the real prize isn't just watching the numbers work on a spreadsheet; it's the huge shift in how you experience life itself. Financial freedom was never about piling up wealth for its own sake—it's about buying back your time.

This transition is a move away from an identity wrapped up in a job or a career. For decades, many of us are defined by work schedules, professional duties, and the chase for a paycheck. When all that structure suddenly vanishes, you're handed a blank canvas and the freedom to answer a really powerful question: what actually matters to you?

Redefining Your Purpose

Without the need to work for money, your days are no longer run by necessity. They're run by choice. This opens up some incredible doors to explore passions, hobbies, and projects you might have shelved for years.

- Deeper Family Connections: You finally have the time to really invest in relationships, whether that means being fully present for your grandkids or strengthening the bonds with your spouse and kids.

- Pursuing Passion Projects: You can get to work on that book you always talked about, learn a new language, master the guitar, or travel without a fixed return date.

- Giving Back: Financial freedom unlocks the ability to make a real philanthropic impact, letting you pour both your time and your resources into causes that you truly believe in.

This new autonomy is the very core of what it means to be truly wealthy. It’s the ability to line up your daily actions with your deepest values, creating a life rich with purpose and meaning that goes far beyond your net worth.

The ultimate goal of building wealth is not to have more money, but to have more choices. It's the freedom to design a life that reflects who you truly are.

The Power of Enough

This journey also forces a conversation about "enough." We live in a culture that is constantly screaming for more, but living off of interest teaches you the quiet confidence that comes from knowing you have what you need to live well. It's a peaceful state of being, free from the constant hum of anxiety about the next raise or a bigger portfolio.

This mindset is the bedrock for creating a lasting legacy. It allows you to think beyond your own lifetime, building a financial foundation that can support your family for generations. It sends a powerful message about security, stewardship, and what a well-lived life really looks like.

Common Questions About Living Off of Interest

Once you start seriously considering the idea of living off of interest, a bunch of practical questions pop up. It’s only natural. Understanding the real-world details is what turns this from a financial dream into a workable plan that can handle whatever life throws at it.

Let's dig into some of the most common concerns I hear all the time.

Can You Live Off Interest During Market Volatility?

Absolutely, but your portfolio has to be built for it. When the stock market gets choppy, it’s easy to get nervous. While that volatility mainly hits stock prices, it can definitely ripple out and affect bond values and interest rates, too.

The key is having a smart mix of assets with different timelines and risk profiles. Think of your safest assets—things like high-yield savings accounts, CDs, and short-term government bonds—as your stable income floor. During a downturn, this is the money that covers your bills, so you aren't forced to sell other investments when they're down. A bond ladder, where your bonds mature at staggered intervals, is another fantastic tool. It ensures you always have cash coming in, no matter what the rest of the market is doing.

Is Living Off of Interest Possible with a Smaller Principal?

It's a challenge, for sure, but it’s not impossible. If you're working with $500,000 instead of $2 million, your margin for error is just much, much smaller. You have to be incredibly disciplined with your spending and structure your portfolio for slightly higher, yet still sustainable, yields.

To make it work, you’ll likely need to:

- Trim your annual expenses: This is the fastest and most direct way to lower the income you need to generate.

- Take on slightly more risk: This doesn't mean chasing speculative returns. It might just mean allocating a bit more to high-quality corporate bonds instead of relying only on government debt.

- Add another income stream: Combining interest income with part-time work or another form of passive income can help bridge any gaps.

The fundamental rule never changes: your lifestyle has to match what your capital can safely generate. With a smaller principal, that alignment just needs to be razor-sharp.

Interest vs. Dividends: Which Is Better?

This is a classic point of confusion. Both are types of passive income, but they’re completely different animals with very different risk profiles.

Think of interest as rent you get for lending out your money. It's a contractual promise from a borrower (like a bank or the government) to pay you back. It’s generally predictable and stable.

Dividends, on the other hand, are a slice of a company's profits shared with its shareholders. They are not guaranteed. A company can slash or even eliminate its dividend anytime, especially when the economy gets rocky. While dividend stocks offer the potential for both income and growth, they bring a level of uncertainty that you just don't get with interest payments from high-quality bonds.

For anyone whose top priority is preserving their capital, an interest-focused strategy almost always offers more peace of mind.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building a life of purpose and security. To continue your journey toward financial freedom, explore more insights and strategies on https://smartfinancialifestyle.com.