When you hear "investment account," your mind probably jumps straight to a 401(k) or an IRA. And for good reason—they're the heavy lifters for retirement. But what about all the financial goals you have before you turn 59½? That’s where a taxable account comes in.

Simply put, a taxable account is a flexible investment account you fund with after-tax dollars. Think of it as your all-purpose financial tool. Because you’ve already paid taxes on the money going in, you can pull it out whenever you want, for any reason, without facing the early withdrawal penalties that lock up retirement funds.

The trade-off for this incredible flexibility? Any earnings your investments generate—like interest, dividends, or profits from selling an asset—get taxed each year.

Unlocking Financial Flexibility Beyond Retirement

Let's use an analogy. If your financial plan is a house, your 401(k) and IRA are the foundation. They're essential, incredibly strong, and built for one specific, long-term purpose: supporting you in retirement.

A taxable account, often called a brokerage account, is the rest of the house. It's the living space where you have the freedom to build, renovate, and access your resources for everything else life throws your way—a down payment on a home, starting a business, or funding a major family trip. This is precisely why savvy investors rely on them.

Freedom and Responsibility: The Core Idea

The concept is pretty straightforward: you invest money that you've already paid income tax on. In exchange for that upfront tax bite, the account gives you unparalleled access to your funds. This simple structure is what makes it so powerful for everything from multigenerational planning to achieving personal goals before retirement age.

Here are its defining features:

- No Contribution Limits: Forget the annual caps on IRAs and 401(k)s. You can invest as much as you want, whenever it suits you.

- Complete Liquidity: Need cash? You can sell your investments and withdraw your money at any time, for any reason, without penalties.

- Annual Taxation: Here’s the catch. Any income your investments produce (dividends, interest) or profits you make from selling assets are taxed in the year you receive them.

So, what is a taxable account? It’s an investment account where your earnings are taxed annually, but you get total freedom from contribution limits and withdrawal rules. This makes it a completely different tool from a retirement account like a 401(k) or IRA, which offers tax deferral or tax-free growth in exchange for strict rules. You can learn more about these distinctions between account types on diversification.com.

A taxable account offers a critical advantage for families making smart financial decisions: it provides the capital needed for major life events without disturbing long-term retirement savings. It's the bridge between today's goals and tomorrow's security.

Ultimately, a taxable brokerage account doesn't replace your retirement strategy; it completes it. It's a versatile tool that empowers you to build wealth for a down payment, a child’s education, or just a more robust financial future—all on your own terms.

Taxable Account vs. Tax-Advantaged Retirement Account

To really see the difference, let’s put a taxable account side-by-side with a traditional 401(k). This quick comparison highlights how each account serves a unique purpose in your overall financial plan.

| Feature | Taxable Account | Retirement Account (e.g., Traditional 401(k)) |

|---|---|---|

| Funding | After-tax dollars | Pre-tax dollars |

| Contribution Limits | None | Annual IRS limits (e.g., $23,000 for 2024) |

| Withdrawals | Anytime, for any reason, without penalty | Penalty-free only after age 59½ (with exceptions) |

| Tax on Growth | Taxed annually (dividends, interest, gains) | Tax-deferred; taxed as ordinary income on withdrawal |

| Best For | Medium-term goals, flexibility, excess savings | Long-term retirement savings |

As you can see, they’re designed for different jobs. The taxable account gives you freedom and access, while the retirement account provides powerful tax benefits to help you build a nest egg for the future. Using both is a cornerstone of a well-rounded financial strategy.

How Taxes Really Work in a Brokerage Account

Understanding how taxes work in a brokerage account can feel intimidating, but it really just boils down to three key moments. Think of your account like a garden: you pay taxes when it produces fruit (dividends and interest) and when you harvest and sell that fruit for a profit (capital gains). Let's dig into each of these.

Every year, your brokerage firm will send you a Form 1099 that details all this activity. It's the cheat sheet you'll use for your tax return. And a quick heads-up: even if you automatically reinvest your dividends or interest back into your investments, the IRS still considers it taxable income for that year.

The Three Types of Investment Taxes

The good news is that your money isn't taxed just for sitting in the account and growing. Taxes only kick in when your investments actually generate income or you lock in a profit.

Here are the three main ways you'll run into taxes:

- Interest Income: This one's the most straightforward. If you own bonds or keep cash in a money market fund, any interest you receive is taxed as ordinary income—at the same rate as your paycheck.

- Dividend Payments: Many stocks and funds share a small piece of their profits with shareholders through dividends. Most dividends from U.S. companies are considered "qualified dividends" and get taxed at the much friendlier long-term capital gains rates.

- Capital Gains: This happens when you sell an investment for more than you paid for it. That profit is your capital gain, and the tax rate you pay depends entirely on how long you held onto the investment.

That last one—capital gains—is where you have the most direct control over your tax bill.

The Power of Patience: Short-Term vs. Long-Term Capital Gains

If you only grasp one tax concept for your brokerage account, make it this one: the difference between short-term and long-term capital gains. This simple distinction is a cornerstone of smart financial planning and can save you a serious amount of money.

The tax code actually rewards patience. By simply holding a winning investment for more than a year, you can slice your tax bill on the profits in half—or even more, depending on your income.

Let's walk through a clear example. Say you invest $10,000 in a stock.

- The Short-Term Scenario: You sell it 11 months later for $12,000, making a $2,000 profit. This is a short-term capital gain, and it's taxed at your ordinary income rate. If you're in the 24% federal tax bracket, you owe $480 in taxes.

- The Long-Term Scenario: You decide to wait just one more month, selling it 12 months and one day later for the same $12,000. Now, that $2,000 profit is a long-term capital gain. For most people, the long-term capital gains rate is 15%, making your tax bill just $300.

By holding on for that extra month, you kept $180 that would have otherwise gone to Uncle Sam. This simple act of patience is one of the most powerful tax-saving tools every investor has. Understanding this rule is fundamental to building wealth efficiently.

Exploring Different Types of Taxable Accounts

A "taxable account" isn't just one thing—it’s a whole category of tools, each designed for different stages of life and financial partnerships. Figuring out which one fits your situation is key, whether you’re investing solo, building with a partner, or setting up the next generation for success.

The most straightforward version is the individual brokerage account. This is as simple as it gets: one owner, one account. It’s the perfect launchpad for a solo investor who wants to build wealth beyond their retirement plan or save for personal goals like a new car or a much-needed sabbatical.

Accounts for Shared Goals and Family

For couples or partners building a future together, a joint brokerage account is a fantastic option. These accounts are owned by two or more people and often come with "rights of survivorship." This feature means if one owner passes away, the other automatically inherits the entire account, which is a huge help in simplifying estate planning.

It's the ideal setup for managing shared investments for big goals like a down payment on a house or that dream vacation you've been planning.

When your financial focus shifts to your kids or grandkids, custodial accounts enter the picture. Accounts like the UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act) let an adult invest on behalf of a child, giving them a powerful head start.

A custodial account is more than just a savings vehicle; it's a hands-on tool for teaching a child about investing. While the funds grow for their future education or first big purchase, they get a real-world lesson in how money works.

Here’s what makes custodial accounts unique:

- It's for a Minor: The money legally belongs to the child, but an adult custodian manages it until the child reaches the age of majority in their state (usually 18 or 21).

- It's an Irrevocable Gift: Once you put money in, it's a permanent gift to the minor. You can't take it back.

- Tax Implications: A portion of the earnings can be taxed at the child's lower rate, thanks to a rule often called the "kiddie tax."

Choosing the right type of taxable account is a big step in aligning your investments with your life. Since these accounts are funded with after-tax dollars, it helps to understand how they differ from retirement accounts funded with pre-tax money. You can dive deeper into this with our guide on the pre-tax contribution vs a Roth.

Why a Taxable Account Is Your Financial Plan's Secret Weapon

In a world obsessed with 401(k)s and IRAs, it’s easy to sideline taxable accounts as a "nice-to-have." But thinking that way means missing out on their real power. While your retirement accounts are the foundation for your golden years, a taxable account is the versatile, heavy-duty tool that helps you build the life you want right now.

Think of it as your financial multi-tool. It's the perfect home for goals that just don't fit the rigid retirement timeline. We’re talking about big life milestones like saving for a house down payment, funding a new business, or building that "freedom fund" for a dream sabbatical.

The Bridge Between Today and Retirement

A taxable account offers one thing retirement plans are designed to prevent: liquidity. Your money isn't locked up until you're 59½. That access is absolutely critical for the major financial goals that pop up in your 30s, 40s, and 50s.

Without a flexible place to invest, you might be tempted to borrow against your 401(k) or hit pause on contributions to stockpile cash. Both moves can seriously disrupt the magic of long-term compounding. A taxable account acts as a bridge, letting you chase those pre-retirement goals aggressively without torpedoing your future. It pulls your entire financial picture together.

This flexibility is what making smart financial decisions is all about. It makes sure your money is working for you across all of life's timelines, not just for one distant finish line.

How Americans' Investing Habits Have Shifted

Decades ago, if your family owned stocks, they were almost certainly in a taxable brokerage account. But the explosion of employer-sponsored retirement plans completely changed the game.

A taxable account isn't a replacement for your 401(k) or IRA—it's the essential partner that completes your financial plan. It gives you the power to build wealth for every stage of life, not just retirement.

Over a 50-year period, the shift was massive. Back in 1965, a stunning 83.6% of all U.S. corporate stock was held in taxable accounts. Fast forward to 2015, and that figure had cratered to just 24.2%. This flip-flop shows just how wildly successful tax-advantaged plans like the 401(k) became. You can dig into the historical data behind this shift in research from the Urban Institute.

Why They’re Making a Comeback

Despite that trend, smart investors now realize that relying only on retirement plans creates its own set of limitations. Once you’ve snagged your full employer match and maxed out your annual IRA or 401(k) contributions, what happens to your extra savings? A taxable account is the answer.

It offers a space for unlimited investment potential, totally free from the contribution caps the IRS slaps on retirement plans. This makes it a non-negotiable tool for high-earners and diligent savers who want to keep building wealth after hitting those ceilings, ensuring their financial engine never has to idle.

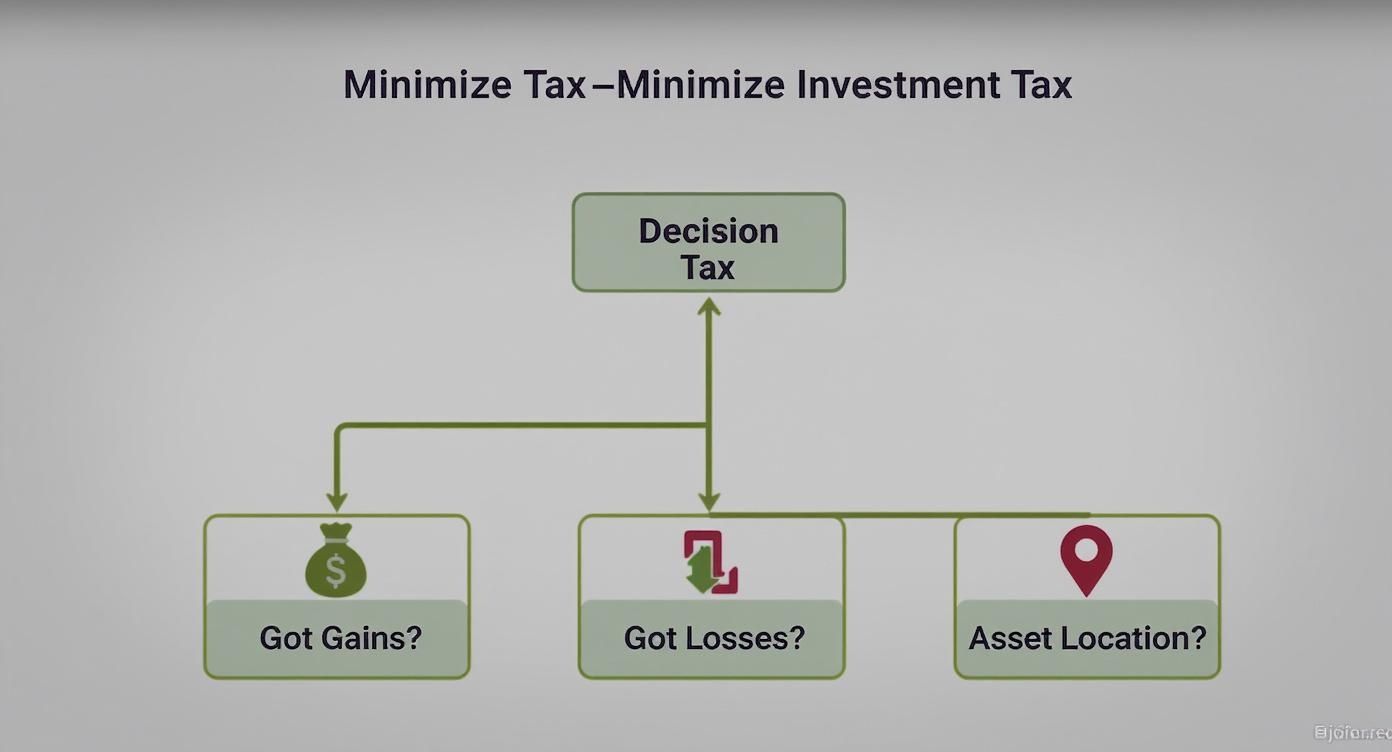

Smart Ways to Lower Your Investment Tax Bill

Having a taxable account gives you a ton of flexibility, but it also means you’ve got to be smart about your tax bill. The good news? You don’t need to be a Wall Street wizard to make a huge difference. With a few intentional moves, you can legally shrink the taxes you owe and let more of your investment returns do their thing.

This isn't about some shady tax dodge. It's about knowing the rules of the game so you can play it better. By getting strategic, you can turn a market dip into a tax win and set up your portfolio to be as efficient as possible, making every single dollar work harder for your family.

Turn Your Losses into an Advantage

One of the most powerful tools in your investing toolkit is tax-loss harvesting. It sounds fancy, but the idea is actually pretty simple: you intentionally sell an investment that's down in value to "realize" the loss. You can then use that loss to cancel out capital gains you’ve made from selling other, more profitable investments.

Think of it this way. Let's say you made a $3,000 profit selling Stock A, but you're sitting on a $3,000 unrealized loss in Stock B. You can sell Stock B to completely wipe out the taxable gain from Stock A. Just like that, your net gain is zero, and so is your tax bill for that trade.

What if your losses are bigger than your gains? The IRS lets you use up to $3,000 in extra capital losses to lower your regular taxable income each year. Any losses left over after that can be carried forward to wipe out gains in future years.

Put Your Assets in the Right Home

Another fantastic strategy is asset location. This isn't about what you own, but where you own it. The goal is to stick investments that create bigger tax bills inside your tax-advantaged accounts (like a 401(k) or IRA) and keep the more tax-friendly ones in your taxable brokerage account.

For instance, things that spit off a lot of ordinary income—like corporate bonds or actively managed mutual funds that are constantly buying and selling—are perfect candidates for a tax-deferred IRA. This move shields their frequent taxable events from your annual tax return.

On the flip side, your taxable account is the perfect home for:

- Growth Stocks: Individual stocks you plan to hold for the long haul don't generate any taxes until you finally sell them.

- Index Funds and ETFs: These are famously tax-efficient. They don't trade securities very often (low turnover), which keeps capital gains distributions to a minimum.

- Municipal Bonds: The interest from these is often exempt from federal taxes (and sometimes state and local taxes, too), making them a natural fit for a taxable account.

By simply assigning each investment to the right type of account, you build a much more tax-efficient machine. This small act of organization can lead to massive savings over a lifetime, letting your wealth compound more powerfully.

Advanced Tax-Saving Moves

Beyond those core strategies, there are other clever ways to manage taxes in your brokerage account. For example, gifting appreciated stock directly to a charity is a classic win-win. You can often deduct the stock's full market value without ever paying capital gains tax on its growth.

For more ideas on how to get the most out of your money, check out our guide on max tax savings strategies for the middle class. Making these smart financial decisions helps ensure your wealth supports both your goals and your values.

When to Open a Taxable Investment Account

Deciding to open a taxable account usually marks a key milestone in your financial journey. It’s the logical next step when you’re ready to invest beyond the limits of your retirement plans. Let's look at the real-world situations where it makes the most sense.

Think of the high-earning professional who has already contributed the maximum to their 401(k) and IRA for the year. What's next? A taxable account offers them an unlimited space to continue building wealth. Check out our guide for more on how to save for retirement after maxing out a 401k.

Another perfect candidate is the diligent saver aiming for a major goal that happens before retirement, like a down payment on a home in five years. The flexibility to pull funds out without a penalty is absolutely essential for these kinds of medium-term goals.

Who Typically Owns These Accounts

Ownership of taxable accounts isn't universal; it often lines up with age and income, which tells us that investors turn to them after building a solid financial base. Recent data shows that just 37% of millennials own a taxable account, compared to 53% of households aged 67 and older.

Income is also a major factor, with ownership jumping significantly in higher-earning households. You can find more of the nitty-gritty details in the FINRA Foundation’s report on investor households.

This decision tree infographic helps visualize how investors can approach tax minimization strategies within these accounts.

The key insight here is that smart decisions about when to sell for gains or losses—and where you hold certain assets—can dramatically reduce your tax bill over time.

Finally, consider the forward-thinking parent or grandparent setting up a custodial account to invest for a child's future. These accounts are a powerful way to give the next generation a financial head start for college, a first car, or other major life expenses.

A taxable account becomes the right choice when your financial ambitions outgrow the structure of traditional retirement plans. It's the tool you use to build wealth for every stage of life, not just the final chapter.

Got Questions About Taxable Accounts?

After diving into what a taxable account is and how it works, it's natural to have a few practical questions pop up. Let's tackle some of the most common ones that come our way. Getting clear, straightforward answers is how you build confidence and start making truly smart financial decisions for your family.

This is where the rubber meets the road—simple answers to your real-world questions.

Common Questions and Simple Answers

Is there a limit to how much I can invest in a taxable account?

Nope, and this is one of their superpowers. Unlike 401(k)s and IRAs, which have annual contribution limits set by the IRS, taxable brokerage accounts have no contribution caps. You can invest as much as you want, whenever you want, which makes them a fantastic tool for anyone serious about building wealth.

Can I lose money in a taxable account?

Yes, you absolutely can. It’s critical to remember that this is an investment account, not a savings account parked at a bank. The value of your assets—like stocks, bonds, and funds—will go up and down with the market. Your holdings are not FDIC-insured, meaning the risk of losing money is very real. That risk, of course, is what creates the potential for higher returns.

People often use "brokerage account" and "taxable account" to mean the same thing, and they're usually right. A "brokerage account" is simply the platform that lets you buy and sell investments. When that account isn't a special retirement plan like an IRA, it's considered "taxable" because any gains, dividends, or interest are subject to taxes.

Should I max out my 401(k) before opening a taxable account?

For most people, that's the smartest move. Financial pros almost always recommend a specific order of operations to make sure you're squeezing every bit of value out of tax benefits first.

- Put enough into your 401(k) to get the full employer match. It’s free money. Don't leave it on the table.

- Next, aim to fully fund a Roth or Traditional IRA, depending on what makes the most sense for your income and goals.

- Once you've maxed out those tax-advantaged accounts, a taxable brokerage account is the logical next place to put your money to work for other goals, whether that's early retirement, a down payment, or just building more wealth.

Following this path ensures you’re using the most powerful wealth-building tools first, before you branch out into the flexibility of a taxable account. It's a foundational strategy for building a truly resilient financial life.

Ready to build a financial strategy that serves every generation of your family? At Smart Financial Lifestyle, we provide the wisdom and tools you need to make smarter financial decisions. Explore our resources to redefine wealth on your own terms. Start your journey with us today.