What is financial literacy, really? It’s not about spreadsheets, complex jargon, or giving up everything you enjoy. Think of it as knowing how to handle your money so you can build the life you actually want to live. It’s the practical skill of making your money work for you—not the other way around.

This knowledge is your roadmap. It’s how you learn to budget, save, invest, and use credit to turn a paycheck into real, lasting financial freedom.

Why Your Financial Journey Starts Today

Looking at your finances can feel like a huge, intimidating task. I get it. But what if you saw it not as a chore, but as the ultimate tool for designing your future? This guide isn’t about a bunch of restrictive rules; it’s about giving you the skills to build a life with more choices and fewer worries.

The small, smart money moves you make right now will have a massive impact down the road. I'm talking about everything from traveling the world to buying your first home. Many young people step into adulthood without these essential skills, and the numbers show it. Young Americans owe over $1 trillion in student loan debt alone, a clear sign that getting a handle on this stuff early is more critical than ever. This isn't about placing blame; it's about empowerment.

The Power of Early Action

Starting this journey in your twenties gives you an incredible advantage: time. A dollar you save today has far more power and growth potential than a dollar you save twenty years from now. This is all thanks to the magic of compounding, which is your secret weapon for building wealth over the long haul.

"Money sends messages. The habits you build in your early twenties send a message to your future self about what you value—security, freedom, or short-term gratification. Choose wisely." — Paul Mauro, 50+ Years of Financial Experience

This guide is designed to help you make those wise choices with confidence. We'll draw on the time-tested wisdom from my 50+ years of experience to show you how to navigate your financial path with real purpose.

What You Will Learn

We’re going to turn that feeling of confusion into a feeling of control. We’ll walk through the core topics that form the bedrock of financial literacy for young adults, including:

- Budgeting and Saving: Learn to aim your money at what truly matters to you.

- Credit and Debt: Understand how to build a strong financial reputation.

- Investing Basics: Discover how to make your money work for you, even while you sleep.

- Essential Protections: Navigate insurance and taxes without the headache.

Getting started can be as simple as saving your first dollar with intention. If you need a practical first step to build some momentum, a guided challenge can be a great way to begin. Consider trying this 30-day savings challenge you can start today to get the ball rolling. The goal isn't perfection; it's progress.

Understanding the Pillars of Financial Wellness

Financial wellness isn't some vague, far-off idea. It’s a solid structure you can build, one smart decision at a time. The problem is, most young people are never handed the blueprint. Globally, the situation is pretty serious—among adults aged 18 to 24, the financial literacy rate is a staggering 35.2%, the lowest of any adult age group. If you want to dive deeper, you can read the full research about these financial literacy statistics.

To build a strong financial future, you have to nail the basics first. Let’s break it down into four essential pillars. Think of it like building your dream home from the ground up.

As you can see, big life goals don't just happen by accident. They’re built on a solid foundation of consistent, intelligent money habits.

Earning Your Foundation

The first pillar is Earning. This is the concrete foundation of your financial house. It's your income—the money flowing in from a job, a side hustle, or any other source. Without a sturdy foundation, nothing else you build will last.

The goal here is to maximize your earning potential through your skills, career path, and learning how to negotiate for what you're worth. A strong foundation gives you the raw materials you need to construct the rest of your financial life.

Spending Your Framework

Next up is Spending, which forms the framework of your house—the walls, rooms, and overall layout. This is all about how you decide to use your income to cover your needs and your wants. Just like a poorly designed frame can make a house shaky, uncontrolled spending can throw your entire financial life off balance.

The key here is being intentional. Every dollar you spend should line up with your values and goals. This pillar isn't about pinching every penny; it’s about consciously designing a life you love by putting your money where it truly matters.

Saving Your Roof

The third pillar is Saving. Think of this as the roof over your head. Its main job is protection—shielding you from life’s unexpected storms, like a sudden job loss, a medical emergency, or a car that decides to quit on you. A solid roof provides security and, just as importantly, peace of mind.

This means building an emergency fund and setting money aside for specific short-term goals, like a down payment on a car or that trip you’ve been dreaming about. Without this protective layer, your whole financial structure is left vulnerable.

"The biggest mindset shift for a young person is moving from just earning a paycheck to making that paycheck work for you. Earning is step one, but what you do with it—how you spend, save, and invest it—is what builds real, lasting freedom." — Paul Mauro, 50+ Years of Financial Experience

Investing to Expand and Grow

Finally, we have Investing. This is how you add new rooms, a second story, or that beautiful garden to your home. Investing is about taking the money you’ve saved and putting it to work so it can generate more money over the long run.

This is the pillar that truly builds wealth. While saving protects what you have, investing grows it, allowing your financial house to expand far beyond its original footprint. It’s the engine that powers you toward major long-term goals, like a comfortable retirement or true financial independence.

To help you get started, here's a simple look at these four pillars and a powerful first step you can take for each one.

The Four Pillars of Financial Wellness

| Pillar | Core Objective | Your First Action Step |

|---|---|---|

| Earning | Maximize your income through skills and work. | Research the average salary for your desired job and identify one new skill to learn. |

| Spending | Direct your money toward what matters most. | Track every dollar you spend for one week without judgment to see where it goes. |

| Saving | Create a buffer for emergencies and goals. | Open a high-yield savings account and set up an automatic transfer of just $25. |

| Investing | Grow your money over the long term. | Read a simple guide on what a Roth IRA is and how it helps build wealth tax-free. |

By focusing on strengthening these four pillars, you create a balanced and resilient financial structure. Mastering how they all work together is the heart of financial literacy for young adults—and the key to building a life of security and choice.

Mastering Your Cash Flow with Smart Budgeting

The word “budget” can make you think of restrictions and sacrifice, like a strict diet that cuts out all your favorite foods. But what if we looked at it differently? A smart budget isn't about what you can't have. It’s a powerful tool designed to point your money toward the life you actually want to live.

Think of it as a nutrition plan for your money. Instead of just grabbing whatever’s in front of you, you’re making deliberate choices that fuel your long-term financial health and goals. It’s the single most important step in going from a reactive spender to a proactive builder of your future.

Where Does Your Money Actually Go?

Before you can make a plan, you need to know where you're starting from. That means tracking your expenses. The point isn’t to judge yourself or feel guilty about that daily coffee, but simply to gather the facts. For one full month, track every single dollar you spend.

You can use a simple notebook, a spreadsheet, or a free budgeting app—the tool doesn't matter nearly as much as the habit. This little exercise will show you your real spending patterns and often uncovers "financial leaks." These are those small, recurring expenses you barely notice that add up to a shocking amount over time. Seeing where your money goes is the first step toward telling it where to go.

Practical Budgeting Methods That Actually Work

Once you have a baseline, you can pick a budgeting method that fits your personality. There’s no single “best” way; the right one is the one you’ll actually stick with. For young adults just getting started, a few simple frameworks are incredibly effective.

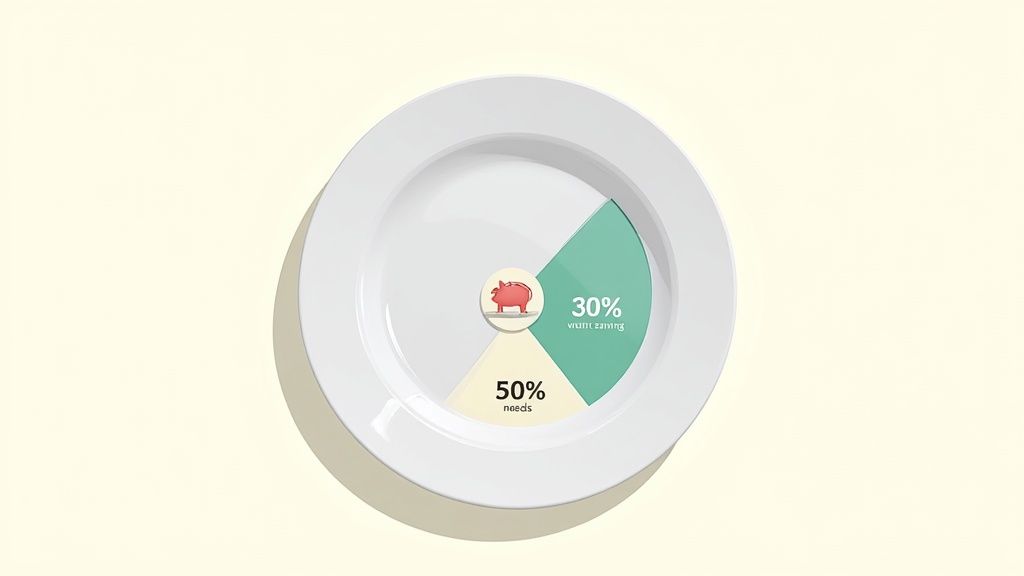

One of the most popular is the 50/30/20 rule. It’s a straightforward guideline for dividing up your after-tax income:

- 50% for Needs: This covers your absolute must-haves—rent, utilities, groceries, and transportation. These are the bills you have to pay every month, no matter what.

- 30% for Wants: This is for lifestyle choices. Think dining out, entertainment, hobbies, and subscriptions. It's the fun stuff that makes life enjoyable.

- 20% for Savings & Debt Repayment: This crucial slice goes directly toward your future. Use it to build an emergency fund, save for a down payment, or attack high-interest debt.

To use this rule, you first need to know your after-tax income, or net pay. If you’re new to the workforce, it's essential to understand the difference between gross pay and net pay so your budget is based on reality.

Another powerful strategy is to "pay yourself first." This flips the usual script. Instead of saving whatever is left over at the end of the month, you treat your savings goal like your most important bill.

Before you pay rent, buy groceries, or spend a dime on anything else, you move a set amount of money from your checking account straight into savings. This simple habit guarantees you are always making progress.

From Budgeting to Building Wealth

The secret to making this work is automation. Set up an automatic transfer from your checking to a high-yield savings account for the day after you get paid. This puts your savings on autopilot and removes the temptation to spend that money.

This isn’t just about hoarding cash; it’s about connecting your savings to real, meaningful goals. Your first target should always be an emergency fund—a safety net of 3-6 months of essential living expenses. This fund buys you something priceless: peace of mind. It means a surprise car repair or an unexpected medical bill is just an inconvenience, not a full-blown catastrophe.

Once that fund is in place, you can start directing your savings toward more exciting goals, like a travel fund, a down payment for a house, or your very first investment.

A Real-World Example of Early Discipline

I once worked with a young client, a recent college grad named Alex. He wasn't earning a huge salary, but he was incredibly disciplined. Every single payday, he had 15% of his check automatically moved into a savings account he never touched. It wasn't a massive amount each month, but it was consistent.

Two years later, a unique opportunity came up—a chance to invest in a friend's promising startup. Because Alex had built that savings habit, he had the capital ready to go. He was able to seize an opportunity that his peers simply couldn't. That small, early discipline completely changed his financial trajectory, proving that mastering your cash flow is the first step to unlocking life-changing possibilities.

How to Build and Protect Your Credit Score

Your credit score is so much more than just a three-digit number. Think of it as your financial reputation—a quick way for lenders, landlords, and even some employers to get a sense of how responsible you are with money.

A strong score opens doors to major life milestones. It can mean the difference between renting your first apartment without a co-signer and getting turned down, or securing a car loan with a great interest rate that saves you thousands over time.

Trying to build a financial life while ignoring your credit is like trying to build a career without a resume. You might get by, but you’ll be missing out on the best opportunities. Building good credit early on is a fundamental piece of financial literacy for young adults. It gives you access to financial tools at a lower cost, which dramatically reduces the friction you'll face as you build your life.

Unfortunately, far too many young people are left to figure this out on their own. The 2025 P-Fin Index survey revealed a tough reality: Gen Z (ages 18–29) correctly answered only 38% of financial literacy questions, while Millennials (ages 29–44) still only hit 46%. You can see more about these financial literacy knowledge gaps and understand why starting your education right now is so powerful.

What Actually Makes Up a Credit Score

The first step to controlling your credit score is pulling back the curtain to see what’s actually in it. While the exact formulas are kept under lock and key, the main ingredients are well-known and surprisingly simple. Lenders really only care about five key things.

- Payment History (35%): This is the big one—the single most important factor. Do you pay your bills on time, every single time? A consistent record of on-time payments is the best way to prove you’re reliable.

- Amounts Owed (30%): You'll hear this called your credit utilization ratio. It just measures how much of your available credit you're using. Keeping this low (ideally below 30%) shows you aren’t over-reliant on debt.

- Length of Credit History (15%): A longer track record of responsible credit use is always better. This is exactly why it’s so important to start building credit early and think twice before closing your oldest accounts.

- New Credit (10%): Lenders look at how many new accounts you've recently opened or applied for. Opening too many in a short time can look like a sign of financial distress.

- Credit Mix (10%): It helps to show that you can responsibly manage different types of credit, like a credit card (revolving debt) and a student or car loan (installment debt).

Your First Steps to Building Good Credit

If you have no credit history at all, you're starting with a blank slate. That’s a great position to be in—much better than starting with a bad score you have to fix.

Here are a couple of proven ways to start building a positive financial reputation from scratch:

- Become an Authorized User: A parent or trusted family member with a long history of on-time payments can add you to their credit card as an authorized user. Their good habits will start to reflect on your credit report, giving you a fantastic head start.

- Open a Secured Credit Card: If becoming an authorized user isn't an option, a secured card is an excellent tool. You put down a small cash deposit (say, $300), and that becomes your credit limit. After 6-12 months of on-time payments, you'll often get your deposit back and can "graduate" to a traditional, unsecured card.

"I've seen young people save tens of thousands of dollars over a lifetime just by starting with a good credit score. I worked with a young man who, because he had built a solid score by his mid-twenties, qualified for a car loan with a 4% interest rate while his friend with no credit was offered 11%. Over five years, that difference saved him over $3,000 on one purchase alone. That’s the real-world power of your financial reputation." — Paul Mauro, 50+ Years of Financial Experience

Protecting Your Score for the Long Haul

Once you've started building credit, protecting it becomes your top priority. The rules are simple, but they are non-negotiable.

First, always pay your bills on time. Set up automatic payments for at least the minimum amount due on every single account. Just one late payment can knock your score down significantly and stays on your report for seven years.

Second, keep your credit utilization low. Don't max out your credit cards. A good rule of thumb is to keep your balance below 30% of your credit limit on each card.

Finally, check your credit report for free at least once a year. You're legally entitled to a free report from each of the three major bureaus (Equifax, Experian, and TransUnion). Go through it carefully, look for any errors, and make sure all the information is accurate. Your credit score is a living number that reflects your habits; treat it with care, and it will become one of your most valuable financial assets.

Investing Your First Dollar for Long-Term Growth

Investing can feel like this big, complicated world reserved for experts in suits, but it's truly the most powerful tool you have for building real, lasting wealth. It’s how you turn the money you’ve worked so hard to save into an engine that works for you, even when you’re sleeping. The secret isn't starting with a fortune; it's starting with a little bit of money as early as you possibly can.

The magic behind all this is a little something called compound growth.

Picture a tiny snowball at the very top of a long, snowy hill. As it starts to roll, it picks up more snow and gets a little bigger. Because it's bigger, it picks up even more snow with every single turn. Over time, that tiny snowball can grow into something massive and unstoppable. Your money works the exact same way—small, steady investments grow, and then the earnings on those investments start growing too, creating a powerful snowball effect of wealth.

The Basic Building Blocks of Investing

To get started, you don't need to become an expert overnight. You just need to get comfortable with a few of the basic building blocks. For a much deeper look at the fundamentals, our guide on investing for dummies in 2025 is a fantastic place to start.

For now, here are the core ideas every young adult should know:

- Stocks: When you buy a stock, you're buying a tiny piece of a company (like Apple or Amazon). If the company does well and grows, the value of your tiny piece can go up. It’s like owning a single brick in a skyscraper that's getting taller.

- Bonds: A bond is basically a loan you make to a government or a big corporation. They promise to pay you back over time, with interest. Think of it as a formal IOU that pays you for your trouble. They're generally considered less risky than stocks.

- ETFs (Exchange-Traded Funds): Instead of trying to pick one winning company, an ETF lets you buy a whole basket of different stocks or bonds all at once. It’s like buying a combo meal instead of just the fries, giving you instant variety and spreading out your risk.

The Power of Starting Early: A Real-World Example

In my 50+ years of experience, I can tell you the biggest investing mistake isn't picking the wrong stock; it’s waiting too long to start. Time is your greatest asset.

Let’s look at two friends, Sarah and Ben. Sarah starts investing $200 a month when she’s 25. Ben thinks he has plenty of time and waits until he’s 35 to start investing the exact same amount. If they both earn a pretty average 7% annual return, the difference is just staggering.

- By age 65, Sarah will have invested for 40 years, and her account will have grown to about $523,000.

- By age 65, Ben will have invested for 30 years and will have just $244,000.

Ben only waited ten extra years, but his nest egg is less than half of Sarah's. That decade of lost compounding cost him over $279,000. That’s the incredible power of giving your money as much time as possible to do its thing.

Your Practical Roadmap to Getting Started

Getting started is so much easier than you think. For most young investors, the best first step is opening a retirement account that gives you some nice tax perks. A Roth IRA is an amazing choice because your money grows completely tax-free, and you can pull it out tax-free in retirement.

Here’s a simple, three-step plan to make your very first investment:

- Open a Roth IRA: Pick a reputable, low-cost brokerage firm that doesn't require a huge initial deposit. You can usually get this done online in less than 15 minutes.

- Fund the Account: Link your bank account and set up a recurring transfer. Honestly, even $50 a month is a fantastic start. Consistency is way more important than the dollar amount.

- Make Your First Investment: You don't have to stress about picking individual stocks. A great first move is to buy a low-cost, broad-market index fund or ETF. With that one purchase, you're instantly diversified across hundreds or even thousands of companies.

Investing is a cornerstone of financial literacy for young adults. By understanding these simple ideas and taking that first small step, you are setting your future self up for a life with so much more freedom and opportunity.

Navigating Taxes and Insurance with Confidence

Once you’ve started to get the hang of budgeting, saving, and investing, it’s time to talk about protecting the financial foundation you’re building. Taxes and insurance can sound intimidating, but they’re just crucial parts of a solid financial plan.

Think of them as the defensive line on your financial team. They aren’t scoring the flashy touchdowns, but they are absolutely essential for preventing devastating losses that could set you back for years. Grasping these concepts is a huge piece of financial literacy for young adults. Without them, everything you've worked for is vulnerable.

Insurance: Your Financial Safety Net

The simplest way to think about insurance is as a safety net. You pay a small, predictable amount called a premium to protect yourself from a massive, unpredictable financial hit. For young adults just starting out, a few types of insurance are pretty much non-negotiable.

- Health Insurance: A single medical emergency can be financially catastrophic. Health insurance is what keeps your out-of-pocket costs for doctor visits, hospital stays, and prescriptions manageable, preventing one bad day from wiping out your entire savings.

- Auto Insurance: If you have a car, you’re required by law in nearly every state to have liability insurance. It protects you financially if you cause an accident that hurts someone or damages their car. It's a must-have.

- Renters Insurance: A common mistake is thinking your landlord's insurance covers your stuff—it doesn’t. For a surprisingly small monthly fee, renters insurance protects your personal belongings (laptop, furniture, clothes, you name it) from things like theft or fire.

"Many young people focus entirely on 'offense'—earning and investing. But a solid 'defense' is just as critical. Insurance is your defense. It’s the plan you make for life’s 'what ifs' so that an accident doesn't undo years of hard work." — Paul Mauro, 50+ Years of Financial Experience

This isn't about being paranoid or expecting the worst. It's about being prepared for reality so you can live your life with confidence, knowing you have a shield in place.

Demystifying Your First Paycheck and Taxes

Taxes can feel like a foreign language at first, but the basics are more straightforward than you think. The moment you land your first job, you're introduced to income tax. This is simply the money you pay to the government to fund public services we all rely on, like roads, schools, and firefighters.

Your employer will have you fill out a Form W-4. It’s a simple document that tells them how much tax to hold back from each paycheck based on your personal situation.

You'll also hear about tax brackets, which is just the system that determines the tax rate you pay on different chunks of your income. The U.S. has a progressive tax system, which means higher earners pay a higher percentage. As a young adult just starting your career, you’ll almost certainly be in one of the lower tax brackets.

And don't forget about deductions and credits! These are your friends. They are specific ways you can lower the amount of income you have to pay tax on. For young adults, common ones include deductions for paying interest on student loans or for putting money into a retirement account. Taking advantage of these is a smart, easy way to keep more of your money each year.

Got Questions? Let's Find Some Answers.

Jumping into the world of personal finance always brings up a ton of real-world questions. Getting clear, direct answers is what builds the confidence you need to actually get started. This is your quick-reference guide for turning those "what ifs" into "what's next."

Think of it as the conversation we'd have if we were sitting down together, sorting through the first few hurdles.

What Is the Single Most Important First Step?

If I had to pick just one thing, it would be this: track your spending for one month. Don't try to change anything, and definitely don't judge yourself. Just watch. Grab a simple notebook or a free app and get an honest picture of where your money is actually going.

This one simple habit replaces guesswork with facts. It's the foundation for building a realistic budget because you’re working with reality, not just a vague idea of your habits. This is your first piece of solid data, and from here, you can start making intentional choices instead of just reacting to your bank balance.

"The habit of consistency is far more powerful than the initial amount. Starting with just $25 a month is better than waiting five years to start with $200. The magic is in the momentum." — Paul Mauro, 50+ Years of Financial Experience

How Can I Start Investing with Little Money?

Let's clear this up right now: you absolutely do not need a lot of money to start investing. The secret isn't to start big, but to start early. Thanks to the power of compound growth, time is your single greatest asset.

A fantastic starting point is opening a Roth IRA with a low-cost brokerage that doesn’t require a minimum deposit. You can get started by investing as little as $25 or $50 a month into a broad-market index fund or an ETF. The key is just to begin.

How Do I Talk to My Family About Money?

If money was a taboo topic in your house growing up, bringing it up now can feel really awkward. The best way to break the ice is to approach it from a place of curiosity and a desire to learn, not as a demand for information.

Instead of asking direct, personal questions about their finances, try framing it as a request for wisdom. You could say something like, "I'm trying to learn more about financial planning for myself, and I was hoping you could share any advice or lessons you learned when you were my age."

This approach turns a potentially tense Q&A into a collaborative conversation focused on your growth, making it a much more comfortable experience for everyone.

At Smart Financial Lifestyle, our mission is to help you build wealth and redefine your American dream through smart, informed decisions. To continue your journey toward financial clarity and freedom, you can explore more of our resources.