Picture this: you take a portion of your hard-earned savings and, almost overnight, turn it into your own personal pension. That’s the simple, powerful idea behind a Single Premium Immediate Annuity (SPIA). It’s a straightforward deal you make with an insurance company—you hand them a lump sum, and they start sending you a guaranteed check every month, for life.

Understanding a Single Premium Immediate Annuity

At its core, a SPIA is you buying your own private pension plan. You make one single payment—the "single premium"—and the insurance company starts sending you regular income almost right away, usually within a month. That's the "immediate" part.

This tool was built for one main reason: to create a rock-solid, predictable stream of income that you absolutely cannot outlive. For anyone near or in retirement, that kind of certainty brings incredible peace of mind. Instead of watching the stock market’s every move or worrying about draining your nest egg too fast, a SPIA creates a stable financial floor you can count on.

The Core Exchange: A Lump Sum for a Paycheck

The transaction couldn’t be simpler. You might use a chunk of your 401(k), money from a home sale, or other savings and give it to an insurer. In return, they calculate a fixed payment they guarantee to send you for a set period—often, for the rest of your life. This move effectively puts a shield around that portion of your money, protecting it from market volatility.

This setup presents a very clear trade-off: you give up access to a large pile of cash (liquidity) in exchange for the security of a guaranteed income stream. For many retirees, this is a brilliant way to cover essential living expenses like housing, food, and healthcare, ensuring the core bills always get paid, no matter what.

How Much Can You Expect in Return?

The real value of a SPIA comes from its insurance element—the promise that payments will continue no matter how long you live. Research from MIT Economics found that for an immediate annuity bought at age 65, the value of the payouts averages about 87 cents per premium dollar for someone with an average life expectancy. Now, that might sound like you're losing money, but that number doesn't capture the priceless benefit of protecting yourself against outliving your savings. You can learn more about the growing role of annuities in retirement from recent industry reports on annuity sales trends.

A SPIA is fundamentally about shifting risk. You transfer the risk of market downturns and the risk of living longer than expected from your shoulders to an insurance company.

To make it even clearer, here’s a quick summary of what a SPIA is all about.

SPIA at a Glance: Your Personal Pension Plan

This table breaks down the key features of a SPIA and what they mean for your retirement plan.

| Feature | What It Means for You |

|---|---|

| Single Premium | You make one upfront payment; no ongoing contributions are needed. |

| Immediate Payouts | Your income stream begins right away, usually within a month to a year. |

| Guaranteed Income | Payments are fixed and predictable, no matter how the market performs. |

| Longevity Protection | You can lock in an income stream that lasts for your entire life. |

Ultimately, a SPIA offers a simple solution to one of retirement's biggest challenges: creating a reliable paycheck from your savings.

How a SPIA Turns Your Savings Into a Guaranteed Paycheck

Think of a Single Premium Immediate Annuity, or SPIA, as a personal pension you create for yourself. It’s a pretty straightforward concept: you take a lump sum of your savings and hand it over to an insurance company. In return, they promise to send you a steady, reliable paycheck for a set period—often, for the rest of your life.

It's a powerful switch to flip. You go from managing a pile of cash that might fluctuate with the market to receiving a predictable stream of income you can count on. Let's walk through how this actually works.

Imagine a couple, David and Sarah, both 65 and ready to hang up their work hats. They’ve done a great job saving $500,000 for retirement, but they’re nervous about market swings eating into their nest egg. To create a solid income floor they can’t outlive, they decide to use $200,000 of their savings to buy a SPIA.

They give that single premium of $200,000 to a highly-rated insurance company. Almost immediately, the insurer starts sending them a monthly check. But how big is that check? It’s not a random number; it’s calculated based on a few key things specific to David and Sarah.

The Four Pillars of Your Paycheck Calculation

The insurance company doesn't just guess your payout amount. They act like a sophisticated risk manager, using hard data to figure out how much they can guarantee you. Four main factors come into play:

- Your Premium Amount: This one's the most obvious. The more money you put in, the bigger your monthly payments will be. David and Sarah’s $200,000 premium will generate a much larger paycheck than if they had only used $100,000.

- Your Age and Gender: Insurers rely on actuarial tables to estimate life expectancy. Because women tend to live longer than men, a 65-year-old woman might get a slightly smaller monthly payment than a 65-year-old man for the same premium, simply because the payments are expected to last longer.

- Prevailing Interest Rates: When you buy a SPIA, the insurance company invests your premium to generate returns. If interest rates are high when you buy, the insurer can earn more on your money, and they pass some of that along to you in the form of higher guaranteed income.

- Your Chosen Payout Option: This is a huge decision. A "Life Only" option pays the highest possible monthly amount, but the payments stop when you pass away. David and Sarah might choose a "Joint and Survivor" option, which ensures the checks keep coming as long as either one of them is alive. The trade-off? The monthly payment will be a bit lower to account for the longer potential payout period.

After weighing these factors, the insurance company draws up a contract that guarantees a specific monthly income. For David and Sarah, this might be $1,250 per month, every month, for the rest of their lives.

This kind of certainty is exactly why so many retirees have been turning to annuities. The annuity market has seen explosive growth, with total sales topping $1.1 trillion between 2022 and 2024. This isn't just a small trend; it signals a major shift in how Americans are securing their income in retirement. For a deeper dive into this, you can check out the annuity sales trends on Bankrate.com.

A SPIA essentially removes the guesswork from a portion of your retirement income. The insurance company takes on the complex risks of market performance and longevity, providing you with the simple certainty of a monthly check.

This transition from being a saver to being an income-receiver is one of the most critical parts of retirement planning. Instead of constantly watching their portfolio and managing withdrawals, David and Sarah have now created their own private pension. This guaranteed income stream can cover their essential bills—like the mortgage, utilities, and groceries—which frees up their remaining savings for the fun stuff like travel, hobbies, or leaving a legacy for their family.

If you're intrigued by this idea, it's worth learning more about getting retirement income for life and seeing how annuities might fit into your own strategy. At the end of the day, this mechanical, data-driven process provides a deeply human benefit: peace of mind.

Exploring Your SPIA Payout and Legacy Options

Deciding to turn a lump sum into a guaranteed income stream with a SPIA is a big move. But the next choice you make is just as important: how, exactly, do you want that income paid out? A SPIA isn't a one-size-fits-all product; it comes with several payout structures that directly affect the size of your monthly check and what, if anything, is left for your family.

This decision is deeply personal. It's a balancing act between your own need for the highest possible income and your desire to provide for your loved ones after you're gone. The right answer depends on your marital status, your health, your other financial resources, and your ultimate legacy goals.

H3: The Life Only Payout: Maximizing Your Personal Income

The most straightforward option is Life Only, sometimes called "straight life." It does exactly what the name suggests: the insurance company sends you a steady check for as long as you live. The moment you pass away, the payments stop. Simple as that.

This option delivers the highest possible monthly payout for whatever premium you put in. Why? Because the insurer's risk ends when your life does, so they don't have to factor in the possibility of paying out to a beneficiary.

- Who It's Best For: A single person without financial dependents, or someone whose spouse is already financially secure with their own retirement income. It's also a great fit for anyone who wants to maximize their personal cash flow to cover essential living costs and has other assets earmarked for their heirs.

- Legacy Impact: With this choice, there is no legacy component. Any remaining value in the annuity contract stays with the insurance company.

H3: Life with Period Certain: Guaranteeing a Minimum Payout

What if you want that lifetime income but you're worried about passing away just a year or two after buying the annuity? The Life with Period Certain option was created to solve that exact problem. It guarantees payments for your entire life, but also for a minimum specified time, like 10, 15, or 20 years.

If you pass away before that "certain period" ends, your chosen beneficiary keeps receiving the payments until the term is complete. If you outlive the period, your checks just keep coming for the rest of your life. It's a valuable safety net for your initial investment.

A "period certain" feature is like an insurance policy on your premium. It ensures that either you or your family will receive payments for at least a set number of years, protecting you against the financial sting of an early death.

The trade-off for this protection is a slightly smaller monthly payment compared to the Life Only option. For many families, that modest reduction is a small price to pay for peace of mind. To see how these products can fit into your broader retirement strategy, check out our guide on using an annuity in an IRA.

H3: The Joint and Survivor Payout: Protecting Your Spouse

For married couples, the number one goal is often making sure the surviving spouse will be okay financially. This is where the Joint and Survivor payout option truly shines. It provides a guaranteed income stream that continues for as long as either spouse is alive.

When one spouse passes away, the surviving partner continues to receive payments. You can usually structure the survivor's benefit, choosing between options like 100%, 75%, or 50% of the original payment. A 100% survivor benefit means the check amount never changes, while a 50% option would cut the payment in half for the survivor.

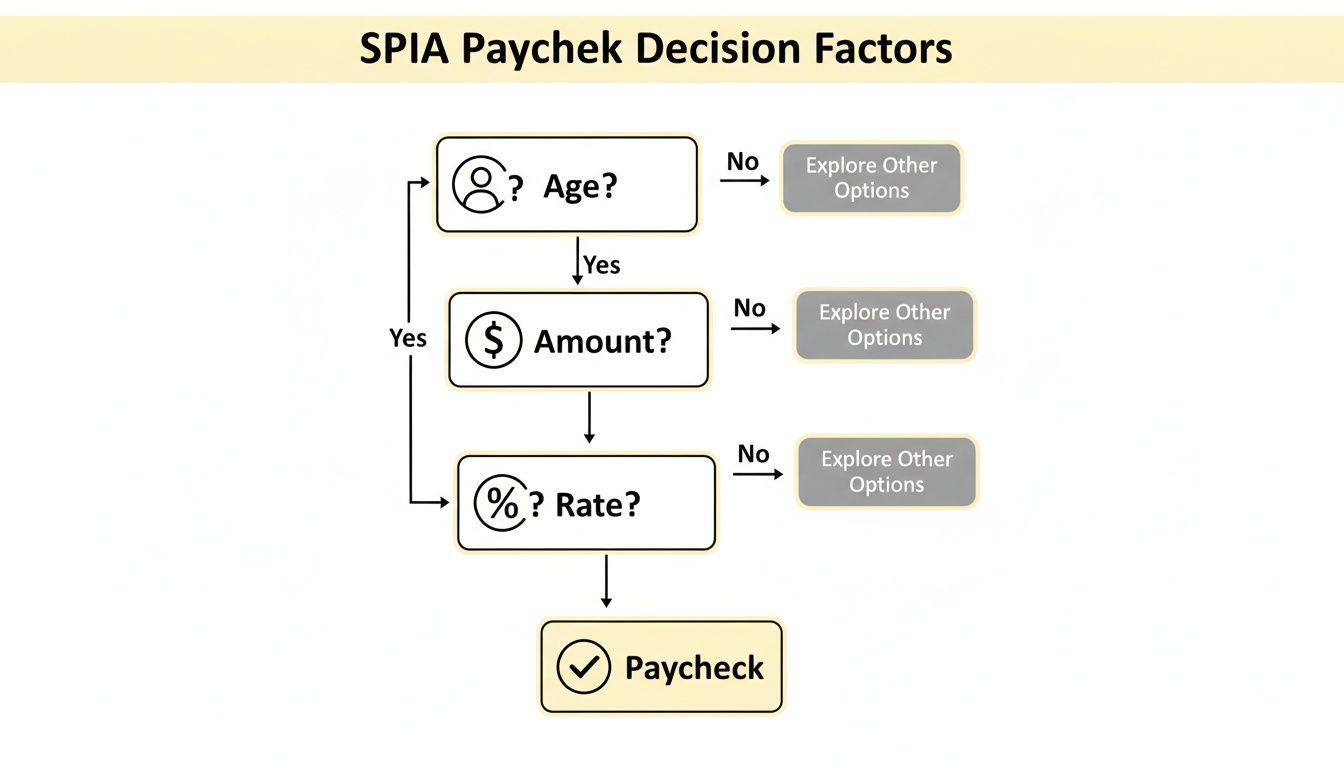

This flowchart shows how your personal details can influence the SPIA paycheck you build.

As you can see, factors like your age and current interest rates are key inputs, but the payout structure you select is the critical choice that truly shapes your financial future.

Because the insurance company is now covering two lifespans instead of one, the initial monthly payment for a Joint and Survivor annuity will be lower than a Life Only option. However, it provides an unbreakable financial lifeline for the surviving spouse, making it an incredible tool for multigenerational planning.

Here’s a quick comparison to help you weigh these critical choices.

Comparing SPIA Payout Options for Your Family's Future

| Payout Option | How It Works | Best For | Impact on Legacy |

|---|---|---|---|

| Life Only | Payments last for your lifetime and stop upon your death. | Individuals without financial dependents who want the absolute highest monthly income. | None. The insurance company keeps any remaining funds in the contract. |

| Life with Period Certain | Payments last for your lifetime but are guaranteed for a minimum term (e.g., 10, 20 years). | Those who want lifetime income but also want to protect their premium from an early death. | Guaranteed. A beneficiary receives remaining payments if death occurs before the "certain period" ends. |

| Joint and Survivor | Payments continue as long as either you or your spouse is alive. | Married couples who want to ensure the surviving spouse has a continuous, guaranteed income. | Protected. The income stream itself becomes the legacy for the surviving spouse. |

Ultimately, choosing the right payout is a profound decision. It’s where you align your money with your message of care for your family, ensuring both your security and their future.

A Practical Example of SPIA Payouts

Theory is one thing, but seeing the numbers in black and white is what really makes a concept click. To get a feel for what a single premium immediate annuity can actually do, let's walk through a real-world scenario. This example will show you exactly how a lump sum of savings can be turned into a reliable, lifelong paycheck.

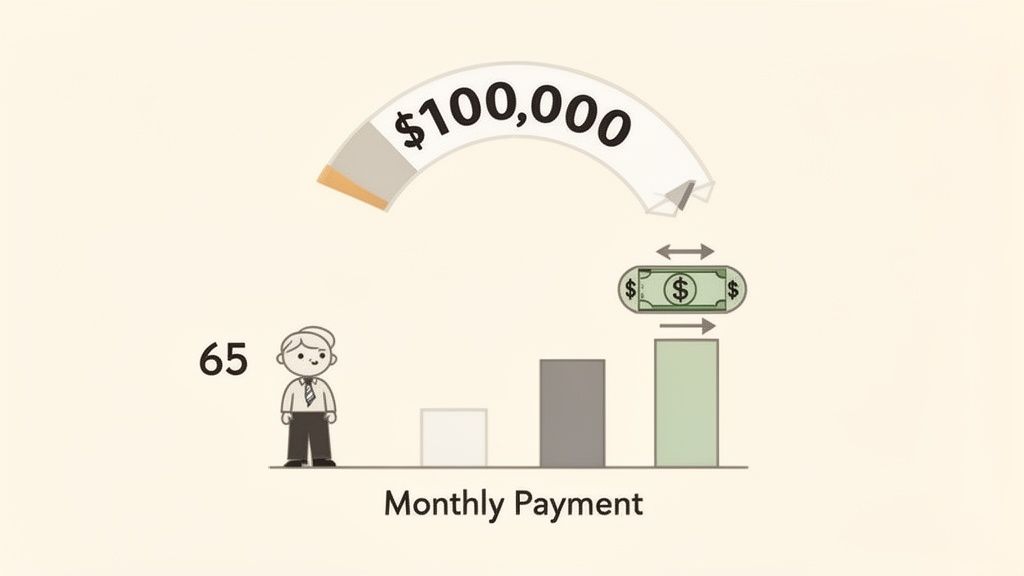

Let’s meet James, a 65-year-old who just retired. He's built a healthy retirement portfolio but wants to create a foundational layer of income that won't get tossed around by market swings. His goal is simple: make sure his essential living expenses are always covered, no matter what.

James decides to put $100,000 of his savings into a SPIA, choosing a "Life Only" payout to get the highest possible monthly income.

Turning the Lump Sum Into a Paycheck

James hands over his $100,000 premium to a financially solid insurance company. In return, the insurer calculates a guaranteed monthly payment based on his age, gender, premium amount, and the current interest rate environment. They are, in effect, making a contractual promise to pay him a set amount for the rest of his life.

So, what does that paycheck actually look like? Using real-world numbers from May 2024, a 65-year-old man investing $100,000 in a SPIA could expect a monthly payout of around $638. Payouts from different insurance carriers might range from $624 to $649—a variation of just under 4%. This really drives home the consistency of these products and why it pays to shop around. You can explore more about these annuity market trends and figures.

This means James will receive $638 every single month. That's a guaranteed $7,656 per year. This income isn’t tied to stock performance or bond yields; it's a firm obligation from the insurer.

The Power of Predictability

This simple example gets right to the heart of a SPIA’s value: its predictability. James now has a financial bedrock. He can count on this income to cover core expenses like property taxes, utilities, and groceries, month in and month out.

Here’s a breakdown of what this means for his financial plan:

- Income Certainty: James knows that $7,656 of his annual income is locked in. This makes budgeting a breeze and reduces his need to sell off other investments just to pay the bills.

- Reduced Stress: He no longer has to sweat a market downturn, worrying that he might have to sell assets at a loss. This peace of mind is one of the most valuable returns a SPIA can offer.

- Portfolio Longevity: By covering his essential needs with the annuity, James can let his remaining investment portfolio grow with a much longer-term perspective, potentially leaving a larger legacy behind.

A SPIA doesn't replace other retirement accounts; it complements them. It creates a stable floor of income that allows your other assets the freedom to work for long-term growth and discretionary spending.

James’s story shows how a SPIA translates from a financial product into a practical tool for a more secure retirement. It’s not about hitting a home run with your investments; it’s about making sure you can always stay in the game.

Is a Single Premium Immediate Annuity the Right Move for You?

A single premium immediate annuity is a powerful tool, but it's definitely not a one-size-fits-all solution. Its real value comes to life when it lines up perfectly with specific goals, personalities, and stages of life. Deciding if a SPIA belongs in your retirement plan means looking beyond the product itself and getting honest about what you want your money to do for you and your family.

This financial tool is built for certainty, not for aggressive growth. It’s for the person who sleeps better at night knowing a slice of their income is unshakable, completely walled off from the market's wild swings. Let’s walk through a few profiles of retirees who often find a SPIA is the perfect answer to their unique needs.

The Near Retiree Looking for Stability

Picture this: you’re just a few years out from retirement. Your main focus has shifted from growing your wealth to protecting what you’ve spent decades building. The absolute last thing you want is a surprise market crash right as you’re about to turn on the income spigot. This is a classic worry known as sequence of returns risk, where a bad market in early retirement can do oversized damage to how long your portfolio will last.

For this person, a SPIA acts as a powerful de-risking tool. By moving a portion of their savings into an annuity, they can build a reliable income floor to cover the non-negotiable bills. This strategy makes sure that no matter what the stock market is doing, the mortgage, utilities, and healthcare premiums get paid.

This simple move delivers two huge benefits:

- It creates a financial buffer. The guaranteed income stream means you don’t have to sell other investments when the market is down, giving the rest of your portfolio more time to recover and grow.

- It brings psychological comfort. Just knowing your core needs are covered takes a massive amount of stress off the table, which leads to more confident decisions with the rest of your assets.

The Conservative Investor Who Puts Guarantees First

Some people are just wired to value a sure thing over the potential for higher returns. The conservative investor isn’t trying to chase the next hot stock; they’re all about preserving their capital and generating predictable cash flow. For them, the idea of a product that works like a personal pension is incredibly appealing.

This person sees a SPIA not as an investment, but as an insurance policy for their income. They're making a very clear trade: giving up access to a lump sum of cash (liquidity) and any potential market upside in exchange for an unbreakable promise of a monthly check. The simplicity is a huge plus—no ongoing investment decisions, no portfolios to rebalance. The money just shows up.

For the conservative investor, a SPIA isn't about maximizing wealth; it's about maximizing certainty. The peace of mind that comes from a guaranteed income stream is the primary return on their investment.

This approach is perfect for covering the non-discretionary part of a retirement budget. It provides a rock-solid foundation, letting them approach other, more modest investments with a lot less pressure.

The Legacy Planner Locking Down Their Own Future

Finally, let's think about the family steward or grandparent whose main goal is to leave a meaningful legacy. It might seem odd to use a tool that often stops payments at death, but a SPIA can be a brilliant strategic play for legacy planning.

Here’s how that works: by buying a SPIA to cover their own lifetime income needs, the legacy planner effectively liberates their other assets. They no longer have to worry about outliving their savings. This frees up their investment portfolio, real estate, and other valuables to be specifically earmarked for heirs, charities, or other multigenerational goals.

This strategy lets them enjoy their retirement years with total confidence, knowing their own needs are met without ever having to touch the assets they plan to pass on. It locks in their financial independence while preserving the wealth for the next generation, creating a clear and thoughtful financial story for their family.

Navigating the Pros, Cons, and Tax Implications

Like any financial tool, a single premium immediate annuity comes with a set of trade-offs. To make a smart decision for your family, you have to look at the complete picture—the powerful benefits, the clear limitations, and how the income is treated at tax time. A SPIA offers incredible peace of mind, but that peace comes at the cost of giving up some flexibility.

The biggest win is creating a guaranteed, predictable income stream you simply can't outlive. This feature tackles one of retirement's biggest fears head-on. By turning a lump sum into a lifelong paycheck, you shield that portion of your nest egg from market swings, making sure your essential expenses are covered no matter what the economy does.

The Upsides of a SPIA

The real benefits of a SPIA boil down to simplicity and security, which together build a rock-solid financial foundation for your retirement.

- Longevity Protection: Think of it as insurance against living a very long life. It guarantees you won’t outlive your money because the payments keep coming, no matter how old you get.

- Market Insulation: Your income is contractual. It’s not tied to the stock market's wild rides, removing the stress of managing investments just to generate cash for your core needs.

- Simplicity: Once it's set up, a SPIA is a "set it and forget it" solution. You don't have to make any ongoing investment decisions; the checks just show up on schedule.

The Downsides and Key Considerations

Of course, that security comes with some important limitations you need to weigh carefully.

The main drawback is the lack of liquidity. Once you hand over your premium to the insurance company, that money is no longer yours to access as a lump sum. You've traded a large pile of cash for a stream of smaller payments, so you should never fund it with money you might need for an emergency.

Another huge factor is inflation risk. Most standard SPIAs pay a fixed amount that doesn't increase over time. During a long retirement, the buying power of that fixed income will slowly get eaten away. While some insurers offer inflation-protection riders, they come at a price—a lower initial payout.

Finally, it's important to understand the value exchange. Research from MIT Economics suggests that payouts for immediate annuities bought at age 65 average about 87 cents for every dollar of premium. That might sound like a bad deal, but it overlooks the immense value of the insurance itself—the guarantee that the payments will last for the rest of your life.

How SPIA Income Is Taxed

When you buy a SPIA with non-qualified funds (that's money you've already paid taxes on), the tax treatment is actually quite favorable. The IRS lets you use what’s called an exclusion ratio.

The exclusion ratio is a formula that separates each payment you receive into two parts: a tax-free return of your original principal and a taxable portion representing interest earnings. This means a big chunk of your SPIA income isn't taxed at all.

For example, if the exclusion ratio determines that 80% of each payment is a return of your premium, you would only pay income tax on the remaining 20%. This can make income from a SPIA far more tax-efficient than withdrawals from other retirement accounts. For more ideas, you might want to check out our guide on how to reduce taxes in retirement.

Getting a handle on this balance of pros, cons, and tax benefits is the final step in deciding if a SPIA truly fits with your family's financial goals.

Your Top Questions About SPIAs, Answered

Even after getting the basics down, you’ll probably have a few more specific questions about how a Single Premium Immediate Annuity works in the real world. That’s perfectly normal. Let's tackle some of the most common ones that come up, so you can decide if a SPIA is the right tool for your family’s financial security.

What Happens to My Money if I Pass Away Early?

This is probably the most important question people ask, and the answer comes down to the choices you make upfront. It all depends on the payout option you select when you set up the annuity.

If you go with a "Life Only" option, the payments stop when you pass away. Simple as that. This choice gives you the highest possible monthly income stream, but there’s no leftover value for your heirs.

But what if you want to make sure your initial investment is protected? You have options for that, too:

- Life with Period Certain: This option guarantees payments for a set number of years (say, 10 or 20). If you pass away before that "certain period" is over, your beneficiary gets the rest of the payments until the term is up.

- Cash Refund: With this feature, if you die before your payouts have added up to your original premium, your beneficiary gets the difference back in a lump sum.

These features let you strike a balance between maximizing your own income and securing a legacy for the next generation.

How Does Inflation Affect My SPIA Income?

This is another big one. A standard, no-frills SPIA gives you a fixed payment that never changes. That means its real-world buying power can shrink over the years as the cost of living goes up. It's a key risk you need to think about, especially if you’re planning for a long retirement.

To get ahead of this, many insurance companies offer an inflation-protection rider, often called a Cost-of-Living Adjustment (COLA). This feature will bump up your payments each year, usually by a fixed rate like 2% or 3%.

Choosing a COLA means your first few checks will be smaller than they would be with a fixed SPIA. The trade-off is that your income grows over time, helping you keep up with rising costs and maintain your lifestyle.

How Do I Know the Insurance Company Is Safe?

The income guarantee from your SPIA is only as solid as the company writing the check. That's why it's absolutely essential to pick an insurer with rock-solid financials.

Before you even think about signing anything, dig into the company's financial strength ratings. Look at what the big independent agencies like A.M. Best, Moody’s, and Standard & Poor’s have to say. You’re looking for top-tier ratings—think A or higher—which signal that the company is very likely to meet its promises for the long haul.

On top of that, every state has a guaranty association that acts as a safety net, protecting your annuity up to certain limits if an insurer ever fails. Doing this homework is a non-negotiable step in locking down your retirement income.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building a secure future. Our goal is to provide you with the clarity and confidence to create a retirement plan that protects you and provides for your loved ones. Explore our resources to learn more. https://smartfinancialifestyle.com