Before you even touch a spreadsheet or open a savings account, the path to homeownership starts with a simple conversation. Saving for a house isn't just a numbers game; it's a huge emotional and practical step that will shape your family's future. The strongest motivation you'll have isn't a figure in a bank account—it's a crystal-clear vision of what that home truly means to you.

Defining Your Homeownership Goal

Is it about having a safe backyard for the kids to run around in? A big dining room for holiday gatherings? Or is it about building something tangible, a foundation of security for the next generation? These are the kinds of honest discussions you need to have with your partner or family to get everyone aligned on the "why" behind the sacrifice.

This shared purpose is the anchor that will keep you grounded when you have to pass on an impulse buy or an expensive trip. It reframes saving from a chore into a powerful act of building the life you actually want.

Calculating Your True Savings Target

Once you've got that vision locked in, it's time to put a number on it. A classic mistake I see people make is just focusing on the down payment. The reality is, your actual savings target is much bigger. To avoid a cash crunch right when you're at the finish line, your goal needs to cover three critical things:

- The Down Payment: This is the big one, of course. It can be anywhere from 3% to 20% of the home's purchase price.

- Closing Costs: Don't forget these! Fees for appraisals, inspections, and legal work can easily add another 2% to 5% of the home's price.

- Move-In Fund: This is your buffer for immediate costs like hiring movers, setting up utilities, and handling any small repairs or buying essential furniture right away.

Planning for all three is just smart financial decision-making. Imagine sitting down with your family, mapping out the plan to buy that first home, and feeling the pride of providing that stability for your kids and grandkids. This kind of foresight is more important than ever.

Just look at the numbers: in Q3 2025, the typical down payment was $30,400. That’s a jaw-dropping 117.9% increase from the $13,900 needed back in Q3 2019. This jump happened because home prices climbed nearly 45% in that same window, forcing families to save harder than ever to grab their piece of the American Dream.

As financial expert Paul Mauro, with over 50 years of experience, likes to say, money sends messages. And this one is loud and clear: "plan ahead or get left behind." You can explore more about these market trends to get the full picture.

Your homeownership goal isn’t just a number. It's a statement about your priorities, a commitment to your family’s stability, and the first major step in building a lasting legacy.

Turning Your Goal into a Plan

With a real number in hand, you can start breaking it down into a manageable timeline. Let's say your goal is to save $60,000 in five years. That works out to $1,000 per month. Suddenly, that huge number doesn't seem so intimidating, does it?

This is also the perfect time to take stock of the market and your personal timeline. Our guide on whether it's a good time to buy a house can give you some valuable context here.

This whole initial planning phase does so much more than just set a financial goal. It builds a foundation of discipline and shared purpose. Every single dollar you intentionally put away reinforces that commitment and sends a powerful message of stability to your family. It’s the very first chapter in your homeownership story, and you're writing it with care and intention.

Crafting a Budget That Actually Works

Once you have a clear number in your sights for your future home, it's time to build the financial engine that gets you there. A lot of people stumble at this point, picturing a painful, restrictive diet for their bank account. But a smart budget isn't about starving yourself financially; it’s about being intentional with your money and creating a system that you can actually stick with.

Forget the cliché advice about skipping your morning coffee. Real, meaningful progress comes from focusing on the big wins. A great way to start is by looking at your top three spending categories, not including fixed bills like rent and utilities. For most of us, that's going to be:

- Food (this includes both groceries and dining out)

- Transportation (car payments, gas, ride-sharing, etc.)

- Entertainment (subscriptions, hobbies, and social events)

Zeroing in on just these three areas can uncover some serious savings opportunities, all without making you feel like you've given up everything you enjoy.

Automate Your Savings and "Pay Yourself First"

If there's one golden rule for saving for a house, it's this: pay yourself first. This isn't just a suggestion; it's the most effective strategy out there. Treat your savings contribution like any other non-negotiable bill that gets paid the second your paycheck lands in your account. Waiting to see what’s left at the end of the month is a classic recipe for falling short.

The easiest way to do this is to set up an automatic transfer from your checking account to your dedicated "Future Home" savings account. This simple move takes willpower completely out of the equation. When the money is out of sight, it's out of mind, and you’ll naturally adjust your spending to what’s left. This disciplined approach builds momentum and makes sure you're consistently hitting your savings goals.

Making your savings automatic turns a good intention into a powerful, reliable habit. It’s the difference between merely hoping you'll reach your goal and building a system that guarantees you will.

Protect Your Down Payment with an Emergency Fund

As you watch your down payment fund grow, you have to protect it from life's curveballs. A sudden car repair, an unexpected medical bill, or a temporary job loss can completely derail your progress if you don't have a financial safety net. This is why having a separate emergency fund isn't optional—it's essential.

Your emergency fund should be a totally separate account holding three to six months' worth of essential living expenses. Think of this money as a financial firewall. It stands between a surprise expense and your hard-earned down payment savings, ensuring a short-term problem doesn't crush your long-term dream of homeownership.

If you don’t have an emergency fund yet, make building a small one—even just $1,000—your top priority before you get aggressive with your down payment savings. Once that initial buffer is in place, you can start contributing to both funds at the same time.

Find Savings Without Giving Up Your Life

Budgeting to buy a house doesn't mean your life has to screech to a halt. It’s about making conscious choices and redirecting your money toward the thing that matters most to you right now—your future home.

Start by tracking your spending for a single month. Use a simple app or a spreadsheet to get a clear picture of where your money is actually going. This isn't about judging your past habits; it's about collecting data to make smarter decisions moving forward. You might be surprised to find subscriptions you forgot you were paying for or realize how much those small, mindless purchases really add up. Finding practical tips for smart spending can also reveal what can help you meet your budget when shopping.

The goal here is to create a realistic plan that lines up your daily financial habits with your ultimate vision of walking through the front door of your own home. It’s a process of empowerment, not restriction.

Choosing the Right Savings Accounts

Let's get one thing straight: where you park your down payment savings is one of the biggest calls you'll make on the road to owning a home. It’s tempting to just let that cash pile up in a regular savings account. It feels safe, right? But in reality, it's often a slow-motion way of losing money.

With interest rates on those accounts barely registering a pulse, your savings can't keep up with inflation. That means every month, the money you've worked so hard for loses a tiny bit of its buying power. To actually save for a house the right way, your money needs to be pulling its own weight. This is all about finding that sweet spot—a balance of safety, growth, and access that fits your timeline. You don't need to get risky, just strategic.

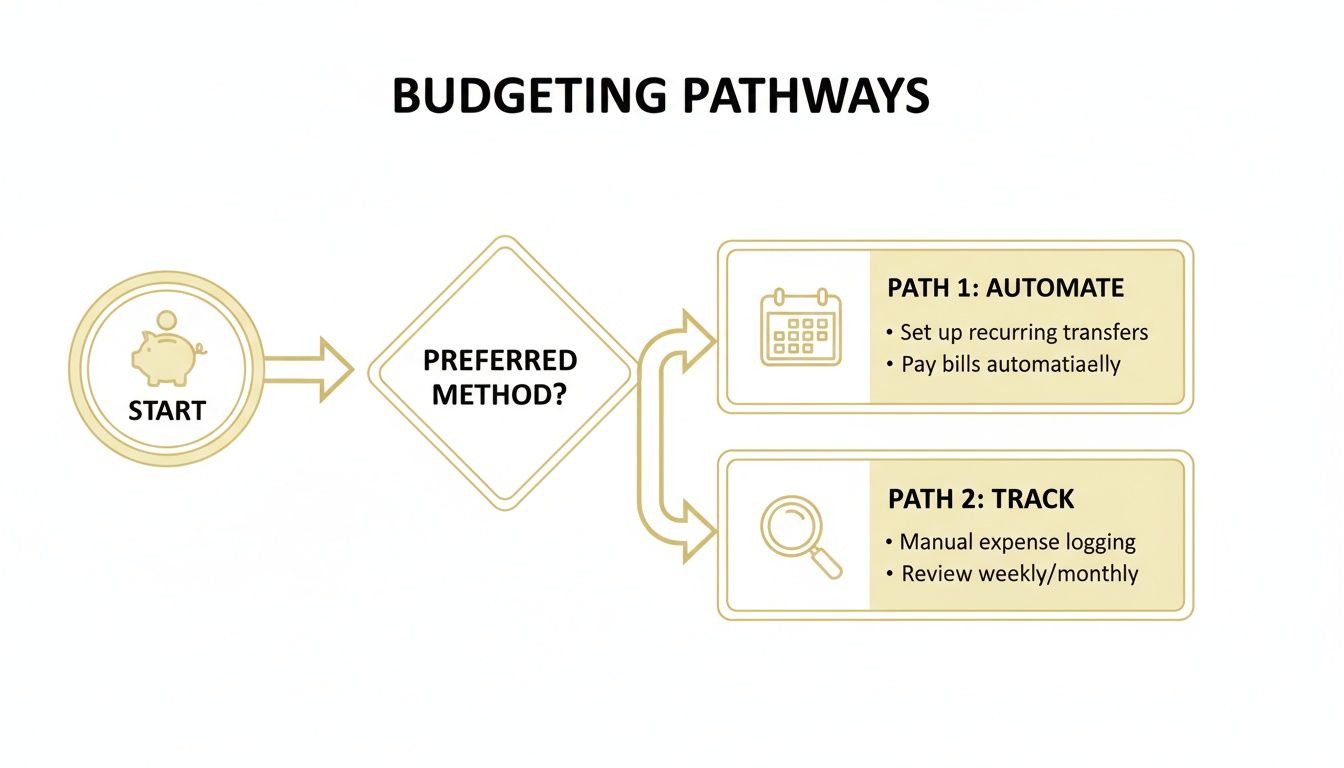

This flowchart lays out the two main approaches for funneling money into your savings: going full-auto or tracking it all by hand.

As you can see, both paths lead to the same destination. But putting your savings on autopilot is almost always the more direct and less stressful route. Picking the right account is the other crucial piece of this puzzle.

High-Yield Savings Accounts (HYSAs)

For most people saving up for a house, the High-Yield Savings Account (HYSA) is the undisputed champ. Think of it as a regular savings account on steroids. HYSAs offer interest rates that are often 20 to 25 times higher than what you'd get at a traditional brick-and-mortar bank. They’re usually offered by online banks that don't have the overhead of physical branches, so they pass those savings on to you.

An HYSA hits the trifecta for a down payment fund:

- Safety: Your money is FDIC-insured up to $250,000, so it’s as safe as it gets.

- Growth: That competitive Annual Percentage Yield (APY) helps your money grow faster, putting up a real fight against inflation.

- Liquidity: You can pull your money out whenever you need it without a penalty. This is a huge deal when you finally find "the one" and need to act fast.

This blend of features makes the HYSA a no-brainer for your primary down payment account, especially if you plan on buying within the next one to five years.

Certificates of Deposit (CDs)

What if your timeline is a little more locked in? Maybe you know for sure you won't be buying for at least two or three years. In that case, a Certificate of Deposit (CD) can be a really smart move to layer into your strategy.

With a CD, you agree to lock your money up for a set period—anywhere from a few months to several years—and in return, the bank gives you a guaranteed, and often higher, interest rate.

The big trade-off is liquidity. If you need to cash out before the CD's term is up, you'll get hit with an early withdrawal penalty, which usually means giving up a few months of interest. This makes them a poor choice for money you might need at a moment's notice.

A savvy move is to build a "CD ladder." You split your savings into several CDs with different maturity dates (like a 1-year, 2-year, and 3-year CD). This gives you periodic access to your cash while still locking in those higher, guaranteed rates on the rest.

Other Low-Risk Options to Consider

While HYSAs and CDs are the heavy hitters, there are a couple of other players worth mentioning. A Money Market Account (MMA) is a hybrid of a checking and savings account. It can offer interest rates competitive with an HYSA but might also come with a debit card or the ability to write checks.

The catch? MMAs sometimes require a higher minimum balance to earn the best rate or to avoid monthly fees, so you have to read the fine print. For most people focused purely on the down payment, the simplicity and consistently high rates of an HYSA usually win out.

To help you visualize the options, here's a quick comparison of the most common savings vehicles for a down payment.

Comparing Down Payment Savings Accounts

This table compares the key features of different savings vehicles to help you choose the best fit for your homeownership goals.

| Account Type | Best For | Typical APY/Return | Risk Level | Access to Funds (Liquidity) |

|---|---|---|---|---|

| High-Yield Savings (HYSA) | Short-to-mid-term goals (1-5 years) needing flexibility. | 4.00% - 5.25%+ | Very Low | High (withdraw anytime) |

| Certificate of Deposit (CD) | Fixed timelines (2-5 years) where funds won't be needed early. | 4.50% - 5.50%+ | Very Low | Low (penalty for early withdrawal) |

| Money Market Account (MMA) | Savers who want high rates plus some checking-like features. | 3.50% - 5.00%+ | Very Low | High (often with check/debit access) |

| Standard Savings Account | Storing emergency funds or very small savings goals. | 0.01% - 0.45% | Very Low | High |

Ultimately, the goal isn't to chase the highest possible return at all costs. It's about making a smart, informed decision that aligns with your timeline and your comfort with risk. By choosing an account that gives your money a meaningful boost without putting it in jeopardy, you're making sure every dollar you save is working hard to build the foundation for your future home.

How to Accelerate Your Savings

Once your savings plan is humming along, you’ll probably start thinking about hitting the fast-forward button. While those steady, automated contributions are the bedrock of any plan to save for a house, you can absolutely find ways to give your fund a serious jolt. This is where you shift from a steady jog to a sprint, using some creativity and strategic timing to shrink your path to homeownership.

Accelerating your savings isn't just about pinching more pennies; it's about actively generating more income and jumping on financial opportunities when they pop up. This proactive mindset not only builds your down payment faster but also makes you more financially resilient overall.

Boost Your Income With a Side Hustle

One of the most direct ways to supercharge your savings is to create a new stream of cash dedicated solely to your house fund. Don’t worry, this doesn't mean you need to burn yourself out with a second full-time job. The real key is finding something that fits your life and uses skills you already have.

Think about these practical options:

- Freelance Your Skills: Are you a writer, graphic designer, or web developer? Sites like Upwork or Fiverr can connect you with short-term projects that pay well.

- Share Your Knowledge: If you’re an expert in a particular subject, you could tutor students online or even create a short course.

- Turn a Hobby into Cash: Love baking, woodworking, or crafting? An Etsy shop or a spot at a local market can turn that passion into profit.

- Embrace the Gig Economy: Services like DoorDash, Instacart, or Rover offer incredible flexibility, letting you earn extra money on your own schedule.

Every dollar earned from these side gigs can go straight into your high-yield savings account, making a visible dent in your goal month after month. For an extra kick of motivation, our guide on the 30-day savings challenge can help you build this new income habit.

Make a Plan for Financial Windfalls

Every now and then, you might get an unexpected chunk of money. These financial windfalls—a work bonus, a tax refund, or even a small inheritance—are golden opportunities to take a giant leap toward your goal. The secret is to have a plan for this money before it even hits your account.

It’s way too easy to see a bonus as "fun money" and let it get swallowed up by everyday spending. Instead, make a pre-commitment: decide that 100% of any unexpected income will go straight to your down payment fund. This single decision can shave months, or even years, off your savings timeline.

When you receive a windfall, resist the urge to spend it. By immediately transferring it to your dedicated house fund, you are sending a powerful message to yourself that your future home is your top priority.

This disciplined approach isn't just smart; it's becoming more common. In fact, 30% of Gen Z homeowners in 2025 funded their down payments with extra jobs, a noticeable jump from 24% before the pandemic. With home prices up 2.2% in the third quarter and 30-year mortgage rates expected to dip, savers who combine consistent habits with strategic windfalls will come out ahead. You can discover more insights about homeownership trends on Redfin.com.

Coordinate With Family for Gifting

For many families, homeownership is a multigenerational milestone. Grandparents and parents often want to contribute to a down payment, seeing it as a way to build a lasting legacy and provide stability for their loved ones. If your family is in a position to help, coordinating these gifts is a brilliant financial move.

Navigating this requires clear, open communication. It’s crucial to understand the rules around gifted funds, as mortgage lenders will require a "gift letter" from the donor. This letter is a simple document stating that the money is a true gift, not a loan that you have to repay.

Discussing inheritances or pooling resources can turn the goal of buying a house into a shared family mission. It’s about more than just the money; it’s about the message it sends—that you're all working together to build a secure foundation for the future. Your home becomes a symbol of that collective effort, a place where you can say, "We planned, and we prevailed."

Don't Let the 20% Down Payment Myth Stop You

One of the biggest myths that stops people from even trying to save for a house is the belief that you absolutely need a 20% down payment. Let's clear this up right now: you don't. While putting down 20% is a great goal because it helps you avoid Private Mortgage Insurance (PMI), it’s far from a requirement.

In reality, there's a whole world of loans and assistance programs designed specifically to help homebuyers get into a home with much less cash upfront.

Understanding these options can be a total game-changer, dramatically lowering the financial hurdle you need to clear. Lenders offer all sorts of loan types, each with different minimums. For example, Conventional loans can go as low as 3% down, and government-backed FHA loans often require just 3.5%. For eligible military members and veterans, VA loans are an incredible benefit, frequently requiring 0% down.

These lower down payment options are fantastic, but the real hidden gems are Down Payment Assistance Programs, often called DPAs. These programs are designed to bridge the gap between what you’ve saved and what you need to close the deal.

Finding and Qualifying for DPAs

Down Payment Assistance Programs are typically offered by state, county, or city housing authorities. They exist to make homeownership more accessible, especially for first-time homebuyers or folks with moderate incomes.

The help they provide isn't just one-size-fits-all, either. It comes in several flavors:

- Grants: This is the best kind—free money you don’t have to pay back.

- Forgivable Loans: These are loans that get forgiven over a set period, often five to ten years. As long as you stay in the home for that long, you won't have to repay it.

- Low-Interest Loans: These act as a second mortgage but come with very low or even zero percent interest. You typically repay this loan either monthly or when you eventually sell or refinance the home.

The rules for qualifying vary by location but usually depend on your income, the home's purchase price, and often your credit score. Many are also targeted specifically at first-time homebuyers, which is usually defined as anyone who hasn't owned a home in the last three years.

The Real-World Impact of Assistance

In a challenging market, these programs are more important than ever. By 2025, monthly housing payments for a typical buyer had climbed to $2,807 in March—a 5.3% jump from the previous year. This was fueled by rising home prices and mortgage rates that were double what they were during the pandemic.

Despite this, down payments remained stubbornly high, with the median hitting $30,400. You can dig into the 2025 housing affordability data on worldpropertyjournal.com for more details.

Imagine you've saved $15,000 for a $300,000 house. A local DPA offers a $10,000 forgivable loan. Suddenly, your effective down payment is $25,000. That could be more than enough to secure a conventional loan and dramatically lower your upfront burden.

So, how do you find these programs? A great first step is to visit your state's housing finance agency website. Your mortgage lender is also a fantastic resource, as they are often well-versed in the local programs their clients can use.

The application process usually runs parallel to your mortgage application, so it’s something to investigate as soon as you start getting serious about buying. Don't let that 20% myth hold you back; explore every avenue available to you.

Answering Your Top Questions About Saving for a House

As you dive into the nitty-gritty of saving for a home, a ton of questions are bound to pop up. That’s completely normal. The road to getting those keys is full of twists and turns, and having clear answers makes the whole thing feel less daunting. Let's tackle some of the most common questions I hear from people just starting out.

How Much Should I Realistically Save Each Month?

There’s no magic number here—it’s going to come down to your income, your big-ticket expenses, and how fast you want to get to the finish line. A great starting point, though, is the 50/30/20 rule. The idea is to put 50% of your take-home pay toward needs (like rent), 30% toward wants (like nights out), and a solid 20% toward savings and paying down debt.

Your goal should be to carve out a big chunk of that 20% for your "Future Home" fund.

Want a more concrete target? Work backward. If you need a $60,000 down payment and your goal is to buy in five years, that gives you a crystal-clear target: save $1,000 every single month.

Should I Pay Off All My Debt Before I Start Saving?

This is a classic financial tug-of-war, and the smartest move is almost always about balance, not absolutes. You should absolutely crush any high-interest debt you have, like credit card balances. The interest rates on those things are brutal, and paying them off is one of the best guaranteed returns you can get on your money.

But for lower-interest debt, like a student loan or a car payment with a decent rate, it often makes sense to do both at once. Try a hybrid approach: keep making the minimum payments on your low-interest loans while funneling cash into a high-yield savings account for your down payment. This way, you’re making progress on two fronts and improving your debt-to-income ratio—a number lenders care about a lot.

What Are the Biggest Savings Mistakes to Avoid?

After years of guiding people through this process, two major pitfalls jump out at me time and time again. The first is not keeping your house fund in a completely separate account. When that money is just sitting in your regular checking account, it’s way too easy to "borrow" from it for other things.

The simple act of opening a separate, high-yield savings account and naming it "Future Home Fund" creates a powerful psychological barrier. It transforms the money from a vague surplus into a fund with a specific, important job.

The second mistake that catches people by surprise is forgetting about closing costs and moving expenses. These can easily tack on an extra 2% to 5% of the home's purchase price. If you only save for the down payment, you’re setting yourself up for a massive, stressful cash crunch right when you should be celebrating. Build this buffer into your savings goal from day one.

How Can My Partner and I Get on the Same Page?

When you and your partner have different approaches to money, it’s not really a financial problem—it’s a communication problem. The key is to start with why you're doing this, not how. Go back to the first section of this guide and talk honestly about what owning a home means to each of you. What are your shared dreams for this place? What kind of life do you see yourselves building there?

Once you’re aligned on the dream, the practical steps get a whole lot easier.

- Set a combined monthly savings goal. Land on a number you both feel is realistic and fair.

- Make it automatic. Set up scheduled transfers from your individual accounts into a new, joint "house fund" account.

- Have regular check-ins. A quick 15-minute chat once a month to see your progress can be a huge motivator and keep you both engaged.

By focusing on the shared vision, you become a team working toward the same goal, not two people fighting over spending habits.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building the life you want. Our resources are designed to provide the clarity and confidence you need to achieve your biggest goals, from homeownership to a secure retirement.

Discover more principles for building wealth and redefining your American dream at https://smartfinancialifestyle.com.