It all boils down to one simple question: do you want a tax break now or later? That’s the core difference between pre-tax and Roth retirement accounts.

With pre-tax contributions, like in a Traditional 401(k), you lower your taxable income today. But, you’ll have to pay taxes on every dollar you pull out in retirement. Roth contributions, on the other hand, use after-tax dollars, so there's no immediate deduction. The payoff comes later with completely tax-free qualified withdrawals.

Pay Taxes Now or Later The Core Retirement Decision

Choosing between pre-tax and Roth is one of the biggest financial decisions you'll ever make. This isn't just about crunching numbers; it's a strategic bet on your financial future and where you think tax laws are headed. The whole thing hinges on a single, powerful question: will your tax rate be higher or lower in retirement than it is today?

Think of it as two different paths. The pre-tax path offers instant gratification. When you contribute to a Traditional 401(k) or IRA, you shrink your adjusted gross income (AGI) for the year. That could mean a bigger tax refund or a smaller tax bill right now, which frees up cash for other things. The catch? Every dollar you withdraw in retirement—your original contributions and all the growth—gets taxed as ordinary income.

The Roth path is a game of patience. You put in money that's already been taxed, so you don't get that upfront break. The magic happens decades down the road. When you retire, all your qualified withdrawals are 100% tax-free. This gives you incredible peace of mind and shields your nest egg from any future tax hikes.

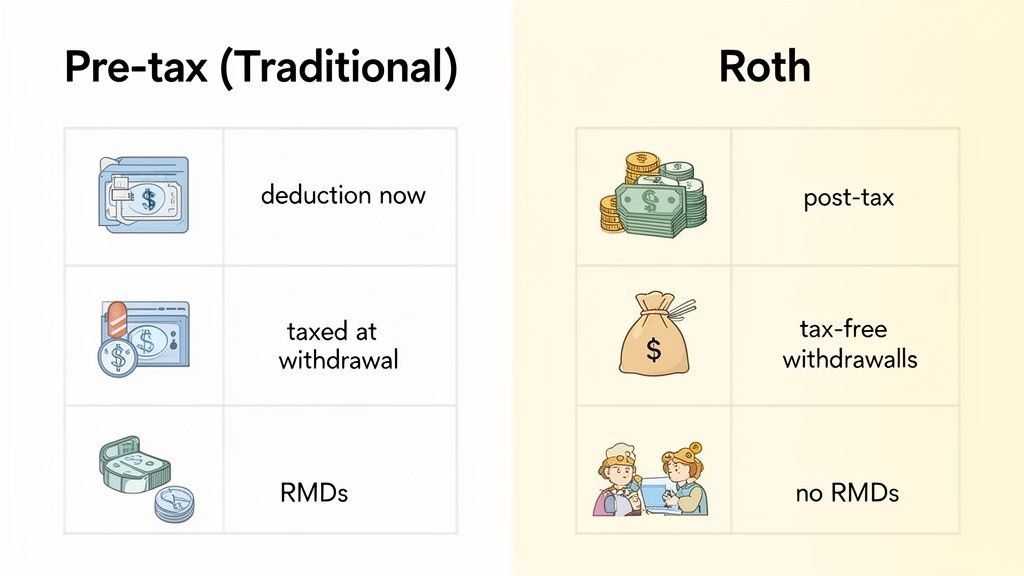

A Foundational Comparison

This initial choice really sets the tone for your entire retirement strategy. To make the fundamental differences crystal clear, let's break down how each account type works in a simple table.

Pre-Tax vs Roth A Quick Comparison

| Feature | Pre-Tax Accounts (Traditional) | Roth Accounts |

|---|---|---|

| Tax Treatment of Contributions | Tax-deductible; lowers your current taxable income. | Made with after-tax dollars; no upfront tax break. |

| Tax Treatment of Growth | Tax-deferred; earnings grow without annual taxes. | Tax-free; earnings are never taxed. |

| Tax Treatment of Withdrawals | Taxed as ordinary income in retirement. | Completely tax-free in retirement (qualified). |

| Primary Benefit | Reduces your tax bill today. | Eliminates your tax bill in retirement. |

Ultimately, this table shows you're either paying the taxman now or paying him later. Your decision depends entirely on when you think you'll get the better deal.

As Paul Mauro often says after 50+ years of experience, "The pre tax vs roth decision is less about saving for retirement and more about deciding when you want to settle your account with the IRS."

Comparing the Mechanics of Each Account

To make a smart pre tax vs roth decision, you have to look past the immediate tax break and dig into the rules that govern these accounts for the rest of your life. These mechanics—from how much you can put in to when you can take money out—shape your financial flexibility and long-term wealth. Think of them less as technicalities and more as strategic levers you can pull.

At a high level, the contribution rules look similar. For 2024, the most you can sock away in a 401(k) is $23,000, with another $7,500 catch-up for those 50 and over. IRA limits are $7,000, plus a $1,000 catch-up. Choosing pre-tax or Roth within those plans doesn’t change these total limits.

But here’s a twist: your income can slam the door on contributing directly to a Roth IRA, a rule that doesn’t apply to Traditional IRAs. That’s a critical difference for higher earners who are chasing tax-free growth.

Who Can Contribute and How Much

While pretty much anyone with earned income can contribute to a Traditional IRA, direct Roth IRA contributions are a different story. They're subject to Modified Adjusted Gross Income (MAGI) phase-outs. For 2024, the window starts to close for single filers with a MAGI between $146,000 and $161,000 and for married couples filing jointly between $230,000 and $240,000.

Workplace plans like 401(k)s and 403(b)s, however, don’t have income limits for making Roth contributions. This creates a fantastic workaround for high-income employees to build a pot of tax-free money, even if they’re shut out of contributing to a Roth IRA directly.

"Your income dictates your options, but your strategy dictates your outcome. Understanding the contribution rules is the first step in building a tax-diversified retirement plan."

This subtle difference in eligibility is a key planning opportunity. Even if you're a high earner, your workplace Roth 401(k) remains a powerful tool.

The Critical Difference in Withdrawal Rules

The biggest mechanical difference really hits home in retirement, and it’s called Required Minimum Distributions (RMDs). The IRS requires you to start taking withdrawals from pre-tax retirement accounts—like Traditional IRAs and 401(k)s—starting at age 73. These forced withdrawals are fully taxable and can easily push you into a higher tax bracket, a nasty surprise many retirees aren't ready for.

Roth IRAs, on the other hand, have no RMDs for the original account owner. This gives you absolute control. You can let your money continue to grow tax-free for your entire life, taking withdrawals only when you actually need or want to. For legacy planning and managing your taxable income in your later years, this flexibility is a total game-changer.

Understanding Early Withdrawals and Penalties

What if you need your money before age 59½? Generally, both account types slap you with a 10% early withdrawal penalty on top of the income taxes you’d owe. But Roth accounts offer a unique escape hatch.

Because you’ve already paid taxes on your Roth contributions, you can withdraw those direct contributions—just the contributions, not the earnings—any time, for any reason, without owing taxes or penalties. This cool feature turns a Roth IRA into a more flexible savings tool that can even double as an emergency fund.

For a Roth withdrawal to be fully qualified (meaning both contributions and earnings are tax-free and penalty-free), you have to meet two conditions:

- Age Requirement: You must be at least 59½ years old.

- The 5-Year Rule: Your first contribution to any Roth IRA must have been made at least five tax years ago.

That 5-year clock starts on January 1st of the tax year you made your first contribution. It’s a crucial detail to keep track of, especially if you're planning a Roth conversion or getting close to retirement. Knowing these mechanics inside and out ensures you can get to your funds when you need them without getting hit by unexpected taxes or penalties.

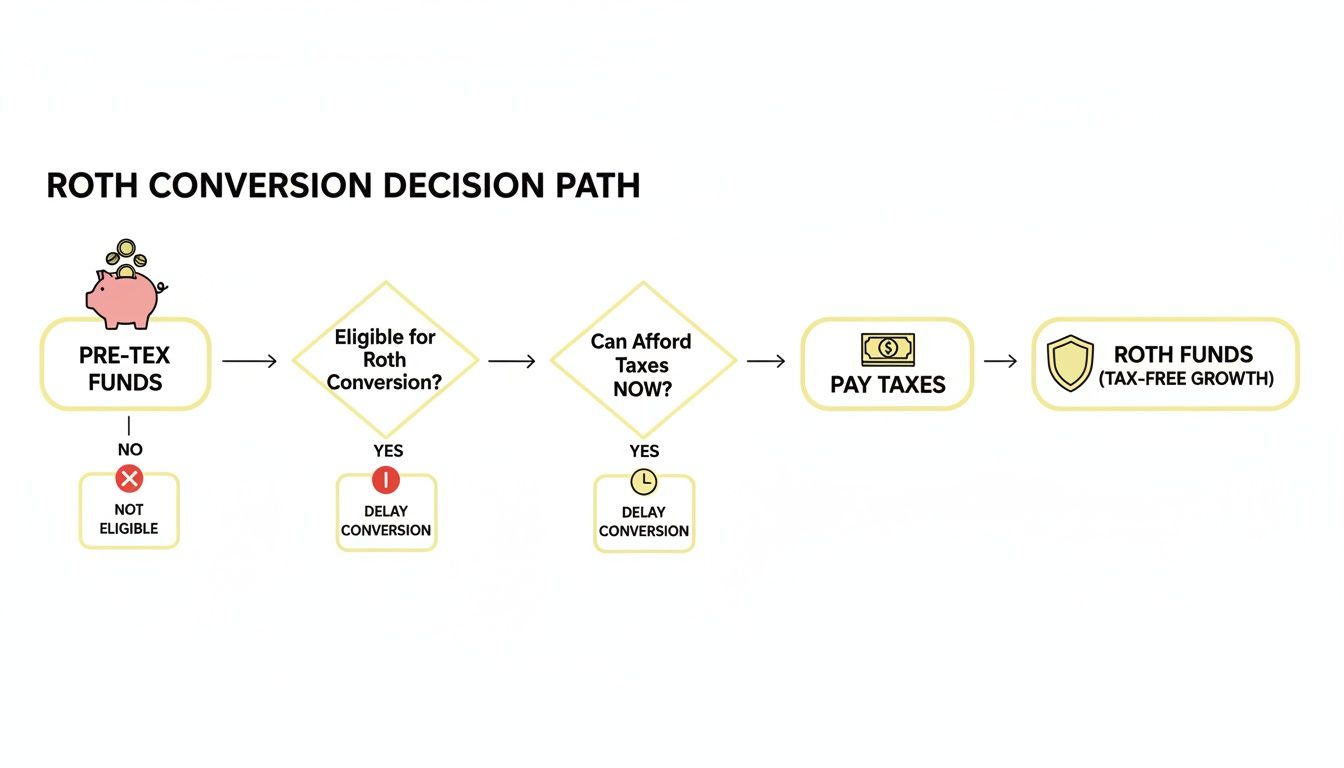

Unlocking the Strategic Power of a Roth Conversion

Beyond just deciding where to put this year's retirement savings, a Roth conversion is a powerful tool for reshaping the money you've already saved. It involves moving funds from a pre-tax account, like a Traditional IRA or 401(k), into a Roth account. The catch? You have to pay income taxes on the converted amount right now.

But here’s the upside: in exchange for that one-time tax hit, you get decades of completely tax-free growth and, most importantly, tax-free withdrawals down the road. This isn't just a simple transfer; it's a profound strategic decision. You're essentially turning a future tax IOU to the IRS into a tax-free asset for yourself and your family. It’s one of the best ways to grab the reins and take control of your tax destiny, especially when nobody knows what future tax laws will look like.

Why Timing Your Conversion Is Crucial

The entire strategy hinges on one critical factor: the tax rate you pay today versus the rate you (or your kids) might face tomorrow. One of the biggest reasons to think about a conversion right now is the current tax environment we're in.

Having guided families for over 50 years, Paul Mauro always emphasizes that tax laws create windows of opportunity. The 2017 Tax Cuts and Jobs Act (TCJA) is a perfect example. It lowered federal income tax brackets across the board—the 25% bracket dropped to 22%, 28% to 24%, and the top rate from 39.6% to 37%. But here's the thing: these lower rates are set to expire after 2025, which could mean a quick snap back to higher taxes.

This looming deadline creates a strategic window. Converting funds now allows you to lock in today's known, and potentially lower, tax rates. It’s a proactive move that can shield a big chunk of your nest egg from future tax hikes and secure its real, after-tax value for the long haul.

A Roth conversion is an irreversible decision to prepay your retirement tax bill. The goal is to settle that bill when you believe the price is lowest, giving you more control over your financial future.

This move is a cornerstone of a much broader strategy for managing your taxes throughout retirement. For a deeper dive into this topic, take a look at our guide on how to reduce taxes in retirement.

Breaking Down the Math of a Conversion

Let’s walk through a real-world example to see how this plays out. Meet Sarah, a recent retiree with $200,000 in a Traditional IRA. She's currently in the 22% federal tax bracket and has a strong feeling that tax rates are only going up from here.

- Step 1: The Conversion. Sarah decides to move the full $200,000 from her Traditional IRA into a new Roth IRA.

- Step 2: The Tax Bill. Because the money was pre-tax, she now owes income tax on the entire amount. Her tax bill for the conversion comes to $44,000 ($200,000 x 22%). The key here is that she pays this tax using money from a separate checking or savings account, which leaves the full $200,000 to start growing in the Roth.

- Step 3: The Future Growth. That $200,000 is now officially in her Roth IRA. Over the next 15 years, it grows to $450,000.

- Step 4: Tax-Free Withdrawals. When Sarah decides to start taking distributions, the entire $450,000 is hers to keep, 100% tax-free. If she had left that money in her Traditional IRA, every dollar she pulled from that $450,000 would have been taxed as ordinary income at whatever her future tax rate was.

By paying $44,000 in taxes upfront, Sarah locked in $250,000 of pure, tax-free growth and completely wiped out any future tax uncertainty on that part of her savings.

This isn't just a win for her, either. It’s a powerful legacy move. If she passes that Roth IRA to her children, they'll inherit a substantial asset that they can also withdraw from tax-free, preserving the full value of what she built. It’s a forward-thinking decision that can pay dividends for generations.

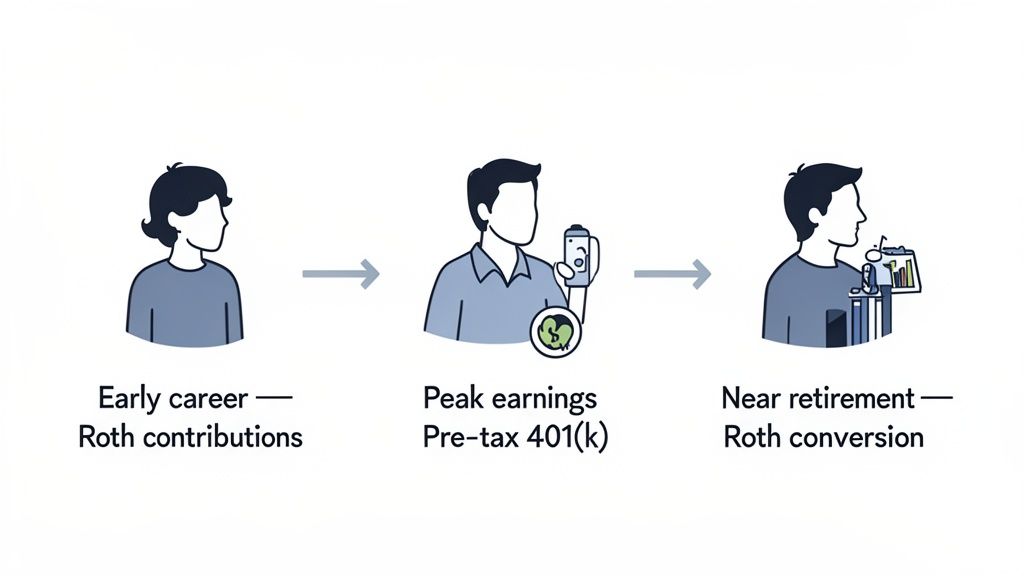

Matching Your Account Choice to Your Life Stage

The right answer in the pre-tax vs. Roth debate is never one-size-fits-all; it changes as your life and priorities evolve. A strategy that works perfectly for a young professional just starting their career will look very different from the one that best serves a grandparent focused on their legacy. Smart financial planning means matching your account choice to your unique circumstances, not just chasing a generic rule of thumb.

The decision to convert funds from a pre-tax account to a Roth isn't just about taxes—it's about trading a tax bill today for tax-free certainty tomorrow. This flowchart breaks down the basic path.

It’s a simple concept: you take money from a traditional account, settle up with the IRS now, and in exchange, you get a future of tax-free growth and withdrawals in a Roth.

Guidance for Family Stewards

For families juggling a mortgage, college savings, and their own retirement goals, cash flow is king. The immediate tax deduction from a pre-tax 401(k) or IRA can be a powerful tool, freeing up hundreds or even thousands of dollars in your annual budget. This breathing room makes it easier to hit all your savings targets without feeling stretched too thin.

But don't overlook the flexibility of a Roth IRA. Knowing you can withdraw your direct contributions tax-free and penalty-free at any time can provide a valuable psychological safety net. It offers peace of mind when your financial life is at its most complex, acting as a last-resort emergency fund you hope you'll never need.

Strategies for Women in Transition

Financial transitions—whether from divorce, widowhood, or a career change—demand both security and control. For women navigating these pivotal moments, the clarity and predictability of Roth accounts can be especially empowering. Building a pool of tax-free funds gives you an income source that won't shrink due to future tax hikes, making it much easier to budget and plan with confidence.

In my 50+ years of experience, I’ve seen how a strategic Roth conversion can be a game-changer, especially for widows rebuilding their financial footing. Paying the tax now, during a potentially lower-income year, can yield massive long-term gains if tax rates rise in the future. This single move can transform a source of tax uncertainty into a bastion of financial independence.

Planning for Those Near Retirement

As you get closer to retirement, your focus naturally shifts from accumulation to distribution. This is where tax diversification becomes absolutely critical. Having a mix of both pre-tax and Roth assets gives you incredible flexibility to manage your taxable income from year to year. You can strategically pull from different accounts to stay in a lower tax bracket, which can also help reduce taxes on Social Security benefits and lower your Medicare premiums.

"The goal in your final working years isn't just to save more; it's to save smarter. Building a tax-diversified portfolio with both pre-tax and Roth funds is like giving your future self a set of financial shock absorbers."

This blend of accounts is also your best defense against Required Minimum Distributions (RMDs). By converting some pre-tax funds to a Roth IRA before retirement, you shrink your future RMDs and the tax bill that comes with them. This preserves more of your wealth for you and your family. Understanding how to use multiple account types is key; for more on this, check out our guide on if you should have multiple retirement accounts.

A Legacy for Grandparents

When your financial goals expand to include passing wealth to the next generation, Roth accounts are undeniably the superior choice. If you leave a pre-tax IRA to your heirs, you're also leaving them a tax liability. Every dollar they withdraw will be taxed as their ordinary income.

A Roth IRA, on the other hand, passes to your beneficiaries completely tax-free. Under current rules, they'll have to empty the account within ten years, but they won't owe a single penny of income tax on any of it. This ensures your legacy is delivered with maximum impact and minimum tax friction, allowing them to receive the full value of what you worked so hard to build.

To make these decisions easier, here's a quick guide that matches different life stages to the most suitable retirement account strategy. It provides clear recommendations to help you navigate your specific situation.

Situational Recommendations for Pre-Tax vs Roth

| Life Stage / Goal | Primary Consideration | When Pre-Tax Makes Sense | When Roth Makes Sense |

|---|---|---|---|

| Early Career Professional | Maximizing long-term growth | When you need the tax deduction to afford higher contributions. | Almost always; you’re likely in a low tax bracket with decades of tax-free growth ahead. |

| Mid-Career Family | Balancing competing financial goals (mortgage, college) | The immediate tax deduction provides critical cash flow flexibility. | Contributions create a tax-free emergency fund; good for tax diversification. |

| High-Income Earner | Minimizing current tax burden | Your current tax bracket is likely higher than it will be in retirement. | If you've maxed out pre-tax options and can do a Backdoor Roth IRA. |

| Nearing Retirement | Tax diversification and managing RMDs | If you expect your tax bracket to drop significantly in retirement. | To create a tax-free income stream and reduce future RMDs through conversions. |

| Business Owner | Maximizing savings and tax control | SEP IRA or Solo 401(k) contributions can significantly lower taxable income. | A Solo Roth 401(k) allows for large tax-free contributions. |

| Legacy Planning | Maximizing wealth transfer to heirs | Less ideal, as heirs will inherit a tax liability on withdrawals. | The superior choice; provides a completely tax-free inheritance for beneficiaries. |

Ultimately, the best strategy often involves a combination of both account types. The goal is to build a flexible financial future that can adapt to whatever life throws your way.

Putting the Numbers into Action with Real-World Scenarios

Theory is one thing, but seeing how the pre tax vs roth decision plays out in real life is where the rubber meets the road. To make these concepts stick, let’s follow a hypothetical person named Alex through three distinct stages of their career.

You’ll see how the “right” choice is never static; it changes based on income, tax bracket, and what you’re trying to accomplish long-term. Alex's story shows that smart financial planning isn't a one-and-done decision. It's about adapting your strategy as your life evolves to make sure you're always making the most of the moment you're in.

We'll run the numbers for each scenario to show the immediate and future financial impact. By following Alex, you can get a better feel for how to apply these principles to your own financial life.

Scenario 1: Alex in Their Early Career

In their 20s, Alex is just getting started, earning $50,000 a year. This lands them in the 12% federal tax bracket. At this point, their income is still relatively low, and every dollar saved feels like a big win. The main goal is simple: get that retirement nest egg started and let the power of compounding work its magic for decades.

Since they’re in a low tax bracket, the immediate deduction from a pre-tax contribution wouldn’t be very impressive.

- Alex’s Choice: Contribute to a Roth 401(k).

- The Math: A $5,000 contribution costs Alex $600 in taxes today ($5,000 x 12%). But here’s the kicker: that entire investment and all its future growth can now become completely tax-free in retirement.

- The Logic: Alex is making a smart bet that their income—and therefore their tax rate—will be much higher down the road. Paying a little tax now at a 12% rate is a far better deal than paying a potentially higher rate on a much bigger pile of money later.

This one move early in their career sets a powerful foundation for future tax-free wealth. It's a classic case of paying a small price today for a massive benefit tomorrow.

Paul Mauro often advises young investors, "Your lowest earning years are your greatest opportunity to buy a lifetime of tax-free growth at a discount. A Roth contribution when you're young is one of the best investments you'll ever make."

Scenario 2: Alex in Peak Earning Years

Let’s fast forward 20 years. Alex is now 45, a successful manager pulling in $150,000 annually. That income puts them squarely in the 24% federal tax bracket. Between a mortgage, family expenses, and a higher tax burden, Alex's priority has shifted. Now, it's about minimizing their current tax bill while still saving aggressively for the future.

At this stage, the immediate tax savings from a pre-tax contribution start looking a lot more attractive. The goal is to knock down that significant tax liability during their highest-income years.

- Alex’s Choice: Max out a pre-tax (Traditional) 401(k).

- The Math: By putting $20,000 into their pre-tax 401(k), Alex instantly shaves that amount off their taxable income. This translates into an immediate federal tax savings of $4,800 for the year ($20,000 x 24%).

- The Logic: Alex is correctly assuming their income in retirement will be lower than their current peak earnings. This means their retirement tax bracket will likely be lower than 24%. This strategy gives them substantial and immediate financial relief, freeing up cash for other family goals.

Scenario 3: Alex Nearing Retirement

Now 60, Alex is getting ready to retire. They’ve built up a healthy pre-tax 401(k) balance of $1 million but are starting to worry about future tax rates and the looming threat of Required Minimum Distributions (RMDs). As they scale back at work, Alex’s income has dipped slightly to $120,000, putting them in the 22% tax bracket.

The game has changed again. The new goal is to get some control over future taxes and create a flexible, tax-free source of cash for retirement.

- Alex’s Choice: Execute a partial Roth conversion.

- The Math: Alex decides to convert $50,000 from their pre-tax 401(k) to a Roth IRA. This strategic move creates a tax bill of $11,000 today ($50,000 x 22%), which they pay from a separate account.

- The Logic: By paying the taxes now, Alex moves that $50,000 into a completely tax-free environment. This converted money will now grow tax-free, it won't be subject to RMDs, and every penny can be withdrawn without future tax hits. This gives Alex crucial tax diversification, letting them manage their taxable income in retirement and leave a much more tax-efficient legacy for their kids.

Building Your Personal Retirement Action Plan

Knowing the difference between pre-tax and Roth is one thing. Turning that knowledge into a real-world decision is where the rubber meets the road. This isn't about theory anymore; it's about building a concrete, personalized roadmap for your own financial life.

Instead of getting bogged down in all the what-ifs, the best approach is to break it down into a few manageable steps. The goal isn't to find some mythical "perfect" answer, but to make the smartest choice for you, right now. Work through these key areas, and you'll build a strategy you can feel good about.

Evaluate Your Income Trajectory

First, get real about your money. Take an honest look at your current income and what tax bracket you're in today. Now, think about the future. Are you just starting out with your biggest earning years ahead of you? Or are you at the peak of your career right now?

This one comparison is the bedrock of the entire pre-tax vs. Roth decision. If you have good reason to believe you'll be in a higher tax bracket when you retire, a Roth is a powerful tool. If you think your income (and tax bracket) will drop in retirement, a pre-tax account is often the smarter play.

As Paul Mauro has been telling clients for over 50 years, "Your best guess about your future self is your most powerful financial planning tool. Plan for the life you're building, not just the one you have today."

Conduct a Comprehensive Account Review

Next up, it's time for an inventory check. Make a list of every single retirement account you own. What's in the mix? Are they mostly pre-tax, like a Traditional 401(k), or have you already started building up some Roth assets? You can't know where you're going until you know where you stand.

Having a blend of both pre-tax and Roth accounts gives you incredible flexibility down the line. If you look at your portfolio and see it’s leaning heavily one way, your action plan might be as simple as contributing to the other type to create a healthier balance. For a solid blueprint on how to structure your savings, a well-defined retirement plan example can show you what this looks like in practice.

Calculate the Potential Benefits

Don't just rely on gut feelings—run the numbers. Fire up a retirement calculator and actually model the long-term difference between making Roth contributions or doing a conversion. What’s the tax hit now versus the potential tax savings on decades of compound growth?

Sometimes, seeing the hard dollar figures makes the decision crystal clear. When you calculate the upfront tax cost of a conversion and weigh it against the future value of a completely tax-free nest egg, abstract ideas suddenly become very concrete financial outcomes.

Know When to Seek Professional Guidance

Finally, know when to call in a pro. If you’re dealing with a more complex financial picture—maybe you have a high income, own a business, or have significant assets—a good financial advisor can be your best friend. They can help you make sense of the intricate rules and make sure your retirement plan fits with your bigger estate and legacy goals.

That expert second opinion can give you the final shot of confidence you need to stop analyzing and start acting.

Got Questions? We’ve Got Answers.

Even after you’ve got the big picture, the little details can still trip you up. It’s completely normal. Nailing down these final questions is what gives you real confidence in your retirement plan. Let’s tackle some of the most common ones that come up.

Can I Really Contribute to Both a Pre-Tax and a Roth Account?

Absolutely, and honestly, it’s one of the smartest moves you can make for tax diversification. For instance, you could be contributing to your pre-tax 401(k) at work and, at the same time, funding a Roth IRA on your own—as long as your income doesn't phase you out.

Just remember, the annual IRA contribution limit ($7,000 in 2024) is a combined total for all your Traditional and Roth IRAs. Having a foot in both camps gives you incredible flexibility down the road. You’ll be able to pull from either taxable or tax-free pools of money, which is a powerful way to manage your income and stay in a lower tax bracket during retirement.

What if I Make Too Much Money for a Roth IRA?

This is a classic hurdle for high-income earners, but it's not a dead end. If your income is above the direct contribution limits for a Roth IRA, you can turn to a well-known strategy called the “Backdoor Roth IRA.”

Here’s how it works: you make a non-deductible contribution to a Traditional IRA and then, shortly after, convert that money into a Roth IRA. It's a perfectly legal way to build up that tax-free nest egg. You do have to be mindful of certain rules, like the pro-rata rule if you have other pre-tax IRA money, but it’s a proven path.

A common mistake is thinking high income completely locks you out of a Roth. With the right strategy, there is almost always a path to tax-free savings.

Does a Roth Conversion Make Sense if I’ll Be in a Lower Tax Bracket Later?

Conventional wisdom says to stick with pre-tax accounts if you expect your tax bracket to drop in retirement. While that’s often true, a Roth conversion can still be a game-changer. The decision is about more than just comparing today's tax rate with a future one.

Think about the other advantages a conversion brings to the table:

- No More RMDs: Roth IRAs don’t have Required Minimum Distributions for the original owner. That puts you back in the driver's seat.

- A Tax-Free Cash Fund: You’re creating a bucket of money you can tap for big expenses—like a new roof or a dream trip—without triggering a massive tax bill.

- A Cleaner Legacy: Your beneficiaries will thank you. They inherit a tax-free asset, which is far more efficient and straightforward to handle.

Ultimately, this choice depends on your entire financial picture. It's about your legacy goals and your need for flexibility, not just a simple tax bracket calculation.

At Smart Financial Lifestyle, we believe in empowering you to make smart financial decisions that secure your family’s future. To build a plan that aligns with your unique life stage and goals, explore our resources and start redefining your American dream. Learn more at https://smartfinancialifestyle.com.