Figuring out how your Social Security benefits are calculated can feel like trying to solve a complex puzzle, but the core idea is actually pretty simple. In short, your benefit is a direct reflection of your lifetime earnings.

The Social Security Administration (SSA) looks at your 35 highest-earning years, adjusts them for inflation to see what they’d be worth today, and uses that average to figure out your basic benefit amount.

Your Social Security Benefit Calculation Explained

Understanding this process is the first step toward making smart financial decisions for yourself and your family. The goal isn't to memorize complicated formulas but to really grasp the main ideas that shape your final monthly payment.

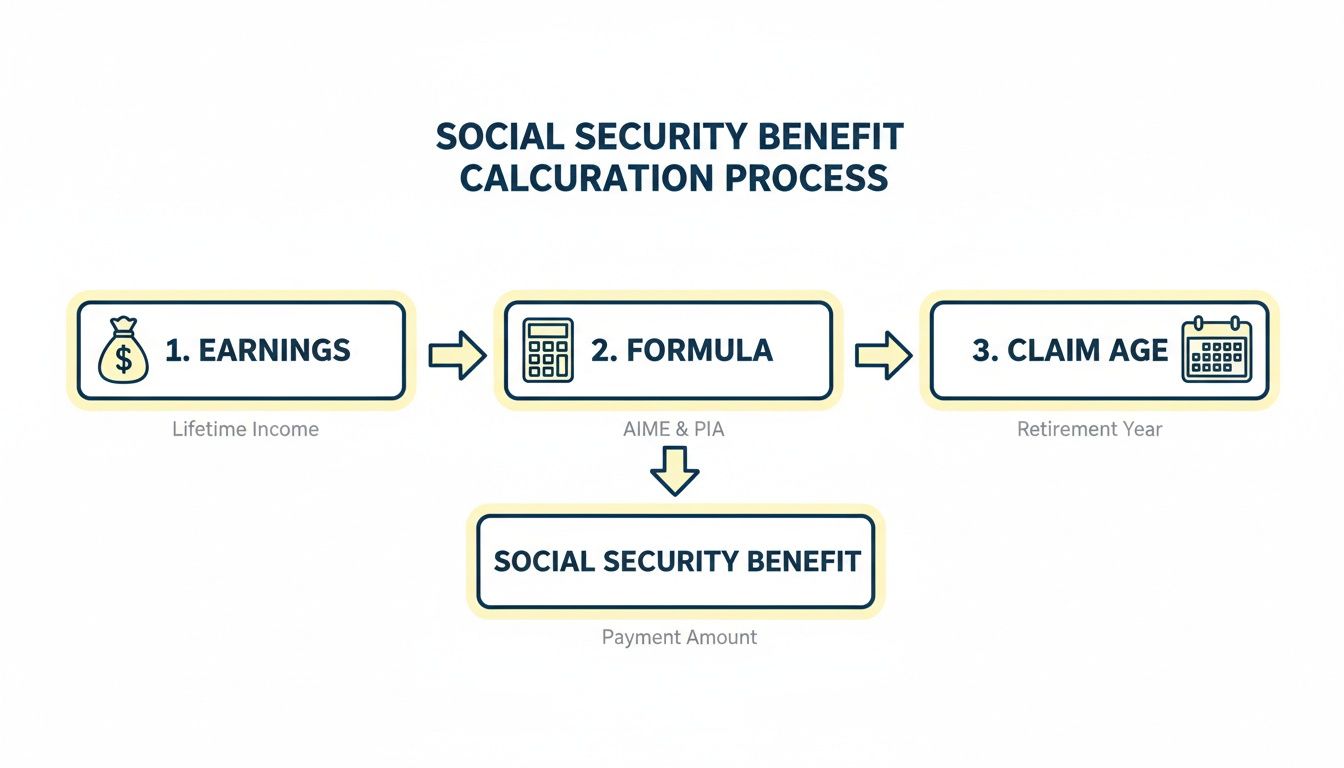

Think of it as a three-part journey. It starts with your work history, runs through a specific formula, and ends with your personal decision on when to start taking benefits. Each stage plays a huge role in shaping the income you’ll rely on down the road.

The Three Pillars of Your Benefit

The whole calculation rests on three fundamental pillars. The first is your earnings record, which is just a summary of your work history. The second is a weighted formula designed to give lower-income earners a stronger safety net. The final pillar is your claiming age, a decision you control that can permanently increase or decrease your payments.

This visual shows how your earnings are turned into a monthly benefit, which is then adjusted by the age you decide to claim.

As you can see, your work history is the foundation, the formula is the engine, and your timing is the final lever you get to pull.

To give you a clearer overview before we dive into the details, the table below breaks down these three core steps. This framework will help you follow along as we explore each part, giving you the "why" behind the numbers so you can plan with more confidence.

Your Social Security statement is more than just a piece of paper; it’s the story of your working life told through numbers. Learning to read it is the first step toward writing a secure final chapter for yourself and your family.

This table summarizes the fundamental process the Social Security Administration uses to determine your monthly payment, providing a clear roadmap for the detailed explanations that follow.

The Three Core Steps to Calculating Your Social Security Benefit

| Step | What It Means | Key Factor |

|---|---|---|

| 1. Calculate Your Earnings | The SSA takes your earnings from your entire career, adjusts them for historical wage growth (indexing), and finds the average of your 35 highest-earning years. | Your Average Indexed Monthly Earnings (AIME) |

| 2. Apply the Benefit Formula | Your AIME is plugged into a tiered formula that calculates your basic benefit, known as the Primary Insurance Amount (PIA). This is your benefit at full retirement age. | The Social Security "Bend Points" |

| 3. Adjust for Claiming Age | Your PIA is adjusted up or down based on when you decide to claim benefits. Claiming early reduces it, while delaying past full retirement age increases it. | Your chosen claiming age (from 62 to 70) |

With this foundation in place, we can now start to unpack what each of these steps really means for your financial future.

Building the Foundation with Your Lifetime Earnings

To get a handle on how Social Security calculates your benefits, it helps to think of your career like building a house. Each year you work and pay into the system is like laying another brick for your retirement foundation. The Social Security Administration (SSA) doesn't just glance at your last few years on the job or your peak salary; they look at your entire work history to get the full picture.

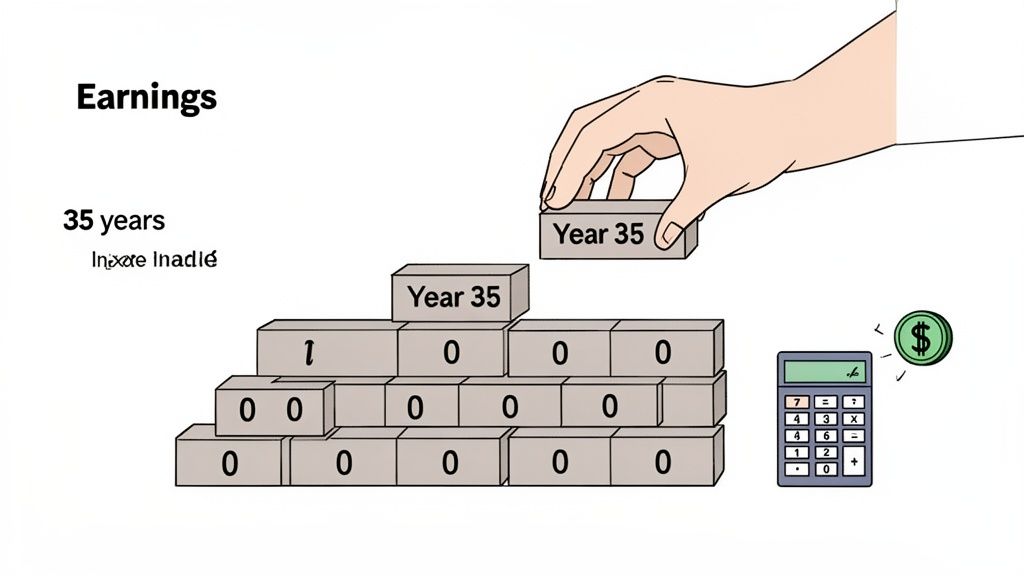

The whole process is designed to reflect a lifetime of contributions fairly. The SSA pulls together your reported earnings for every single year you've worked and paid Social Security taxes. From that long record, they zero in on your 35 highest-earning years to set the stage for your benefit calculation. This 35-year average is the bedrock everything else is built on.

Of course, a dollar you earned back in 1985 bought a lot more than a dollar does today. To make it a fair fight, the SSA uses a clever trick called indexing.

How Indexing Makes Your Earnings Fair

Indexing is really just a way to adjust your past earnings to bring them up to today's wage levels. Think about it like this: if you were comparing the cost of a house built in 1990 to one built this year, you’d have to adjust the 1990 price for inflation to make any sense of it. Indexing does the exact same thing for your wages.

The SSA adjusts all your earnings from past years right up to the year you turn 60. This simple step ensures that the hard work you put in early in your career is given the same weight as your more recent paychecks, which were likely higher. Without indexing, your benefit would be unfairly tilted toward your later work years, shortchanging decades of your contributions.

Indexing makes sure that a worker who earned a good wage back in the 1980s gets a benefit that reflects what that work is worth in today's terms. It’s the system’s way of leveling the playing field across different generations and economic climates.

This all comes together to create a much more accurate and equitable measure of your lifetime earnings, which then becomes the starting point for calculating your actual benefit.

The Critical Importance of 35 Years

The focus on your 35 highest-earning years is the most important part of this whole foundation-building step. If you've worked for more than 35 years, that's great—the SSA will just drop your lowest-earning years from the calculation, which can only help your average. But what if you have some gaps in your work history?

This is where a lot of people get a surprise. If you've worked for fewer than 35 years, the SSA doesn't just average the years you did work. Instead, they plug in a zero for each year you're short of 35.

For example, someone with only 25 years of work history will have 10 zeros added to their record. As you can imagine, those zeros can dramatically pull down the overall average, leading to a much smaller monthly benefit check.

Here's the bottom line: your benefit is calculated using your 35 highest, inflation-adjusted years of earnings. The Social Security Administration adds up the top 35, and then divides that total by 420 (which is 35 years x 12 months) to find your Average Indexed Monthly Earnings (AIME). If you have fewer than 35 years of work, those zero-earning years are still factored into that 420-month average, which can seriously reduce your benefit. You can find a deeper dive into this on the SSA's policy blog.

This rule really highlights a key principle: the most direct way to build a stronger Social Security foundation for yourself is through consistent, long-term participation in the workforce.

Turning Your Earnings into a Monthly Benefit Amount

Once the Social Security Administration has your inflation-adjusted earnings average, the next step is to turn that number into an actual dollar amount for your monthly check. This is where the real magic happens, using a special formula to calculate your Primary Insurance Amount, or PIA.

Just think of your PIA as your baseline monthly benefit—it's what you'd get if you started taking Social Security right at your Full Retirement Age.

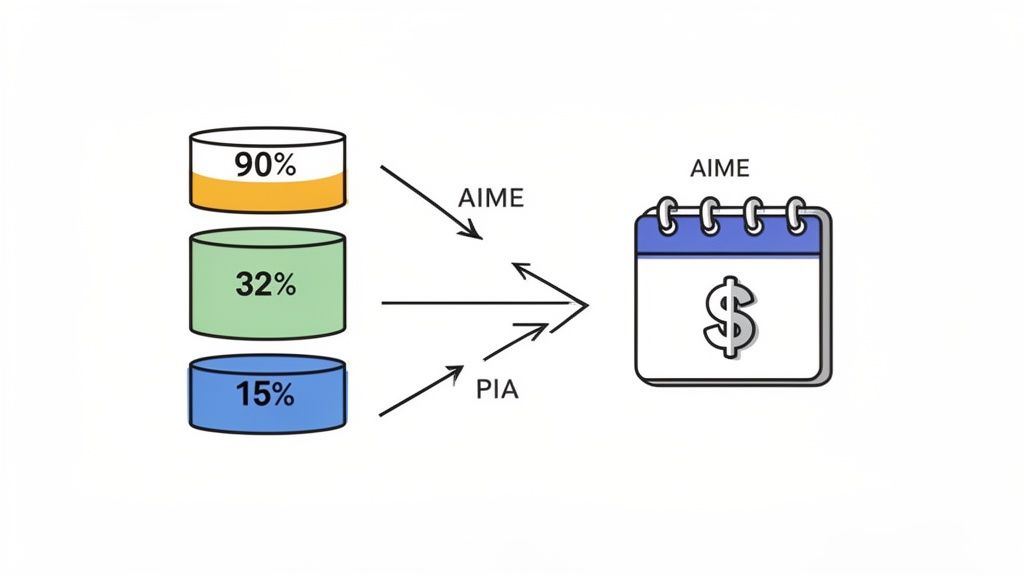

But this calculation isn't just a simple percentage of what you earned. Instead, Social Security uses a progressive, tiered system designed to give a bigger boost to lower-income workers. It works a lot like our income tax brackets, but in reverse. Instead of paying a higher tax rate on higher chunks of income, you get a higher benefit credit on your lower chunks of earnings.

This formula is the engine that drives the whole system. It’s a core part of how Social Security acts not just as a retirement program, but as a true social safety net for the entire country.

Understanding the Bend Points

So, how does this tiered formula work? The SSA separates your average indexed monthly earnings (your AIME) into three distinct portions. The dollar amounts that divide these tiers are called "bend points."

These bend points change every year to keep up with national wage growth, but the percentages applied to each tier are always the same.

For anyone becoming eligible in 2024, the formula gives you:

- 90% credit on the first $1,174 of your AIME.

- 32% credit on your AIME between $1,174 and $7,078.

- 15% credit on any AIME above $7,078.

This structure is completely intentional. That high 90% rate on the first slice of your earnings ensures that workers with lower lifetime wages get a benefit that replaces a much larger chunk of their pre-retirement income. It’s a powerful fairness mechanism built right into the math.

The bend points are the heart of Social Security's weighted formula. They ensure that someone who earned less over their career gets a proportionally larger benefit relative to their earnings than a high-income earner, reinforcing the program's role as a social safety net.

Let's walk through a real-world example to see how this all comes together. This is the best way to demystify how social security benefits are calculated and see the formula in action.

A Step-by-Step Calculation Example

Let's meet Sarah. After the SSA crunched the numbers on her 35 highest-earning years, her AIME (average inflation-adjusted monthly earnings) came out to be $5,000.

Her benefit isn't a flat percentage of that number. Instead, we have to apply that three-tiered formula using the 2024 bend points.

Here’s how we’d break down her $5,000 AIME:

-

First Tier (90%): We take the first $1,174 of her AIME and multiply it by 90%.

- $1,174 x 0.90 = $1,056.60

-

Second Tier (32%): Next, we look at the part of her AIME that falls between $1,174 and $7,078. Since her AIME is $5,000, we just need to figure out how much of it fits in this bracket.

- $5,000 - $1,174 = $3,826

- $3,826 x 0.32 = $1,224.32

-

Third Tier (15%): Sarah’s AIME of $5,000 doesn't reach the top tier, which starts at $7,078. So, the amount of her earnings in this tier is $0.

Now, to find Sarah’s total PIA, we simply add up the results from each tier.

Putting It All Together for the Final PIA

| Tier Calculation | Result |

|---|---|

| Tier 1: 90% of the first $1,174 | $1,056.60 |

| Tier 2: 32% of the next $3,826 | $1,224.32 |

| Tier 3: 15% of earnings over $7,078 | $0.00 |

| Total PIA (Monthly Benefit at FRA) | $2,280.92 |

So, Sarah's Primary Insurance Amount—the monthly benefit she’s entitled to at her full retirement age—is $2,280.92. This amount is the direct result of applying the bend point formula to her lifetime earnings.

This PIA becomes the foundational number for everything that comes next. From here, this figure can be adjusted up or down depending on the most important decision a retiree has left to make: exactly when to start claiming their benefits.

How Your Claiming Age Shapes Your Final Payout

After the Social Security Administration has crunched the numbers on your lifetime earnings and run them through their formula, you get your Primary Insurance Amount (PIA). But don't mistake that number for your final monthly check—it's just the starting line.

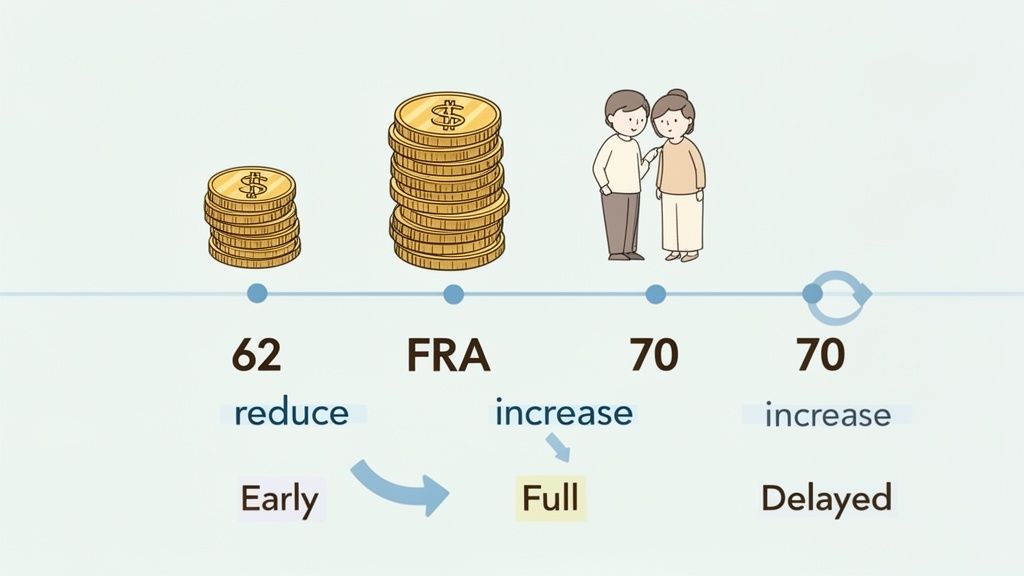

The single most powerful decision you have left is when to start taking your benefits. This choice will permanently lock in your monthly income for the rest of your life, so it's a big one.

This whole decision hinges on a key milestone called your Full Retirement Age (FRA). Your FRA is the age when you're eligible to receive 100% of your PIA. It’s not the same for everyone; it all depends on when you were born. For anyone born in 1960 or later, your FRA is 67.

Knowing your FRA is critical because it's the benchmark. Every adjustment, whether you claim early or late, is measured against this age.

The Trade-Off of Claiming Early

You can start grabbing those Social Security checks as early as age 62. But be warned: this early access comes with a significant and permanent price tag. For every single month you claim before your FRA, your benefit is permanently chopped down.

If your FRA is 67, starting benefits right at age 62 means a 30% reduction from your full PIA. And this isn't a temporary hit. It’s a permanent haircut that will affect every single check you receive for the rest of your life.

Think of it this way: claiming early gets you more checks over your lifetime, but each one will be quite a bit smaller. It’s a classic trade-off between getting cash now versus a bigger payout later.

The Power of Patience and Delayed Credits

On the flip side, if you have the financial runway to wait, the rewards are huge. For every month you hold off claiming past your FRA, your benefit amount gets a little bigger. These are called delayed retirement credits, and they keep adding up until you hit age 70.

These credits boost your benefit by 8% for each full year you wait past your FRA. By delaying from an FRA of 67 all the way to age 70, you can pump up your monthly benefit by a massive 24%. A bigger payment like that can create a much more secure financial floor, especially if you’re planning on a long and healthy retirement.

Delaying benefits from age 62 to 70 can increase your monthly payment by over 75%. This strategic patience is often the most effective way for a healthy individual to boost their guaranteed retirement income.

Let's see how this plays out with a concrete example. Imagine your PIA at your Full Retirement Age of 67 is $2,000 per month. Here's how your claiming age would dramatically change that payout.

Impact of Claiming Age on Your Monthly Social Security Benefit

This table breaks down how your monthly benefit changes based on when you decide to claim, using a baseline PIA of $2,000. The difference is striking.

| Claiming Age | Percentage of Full Benefit (PIA) | Example Monthly Benefit |

|---|---|---|

| Age 62 (Early) | 70% | $1,400 |

| Age 67 (Full Retirement Age) | 100% | $2,000 |

| Age 70 (Delayed) | 124% | $2,480 |

As you can see, the gap between claiming at 62 and 70 is enormous. A strategic choice here could mean an extra $1,080 in your pocket every single month.

For those looking to squeeze every dollar out of their hard-earned benefits, our guide on how to maximize Social Security benefits offers deeper strategies for your family. Ultimately, this isn't just about the numbers; it's about aligning your benefits with your health, financial needs, and what you want your future to look like.

Navigating Special Rules That Can Alter Your Benefit

While the core Social Security formula is pretty standard, the system isn't a one-size-fits-all program. Certain unique work situations can trigger special rules that significantly change your final benefit amount. Understanding these exceptions is crucial, especially if you or a family member has a pension from a job that didn't pay into Social Security.

Think of these rules less as roadblocks and more as detours that require careful planning. They primarily affect people who worked in specific public sector jobs—like some teachers, firefighters, or state employees—or those who have spent part of their careers working outside the United States. Knowing how these provisions work ensures there are no surprises when you file your claim and helps you protect the financial security you've worked so hard to build.

Let’s break down these complex rules into simple, understandable terms so you can see if they apply to your family’s situation.

The Windfall Elimination Provision or WEP

The Windfall Elimination Provision (WEP) is one of the most common special rules you’ll encounter. It comes into play if you receive a pension from a job where you did not pay Social Security taxes—what’s often called "non-covered" work. This is pretty common for careers in state or local government.

So, why does WEP exist? It’s designed to prevent someone from getting a full Social Security benefit—which is weighted to help lower-income earners—on top of a pension from a non-covered job. Without it, the standard formula might mistakenly treat you as a low-wage worker, giving you an unintended "windfall."

WEP adjusts the benefit formula by changing the percentage at the first "bend point." Instead of getting a 90% credit on your first chunk of average earnings, you might only get 40%. As you can imagine, this can lead to a much lower monthly payment.

As of 2025, the WEP affects over 2.5 million beneficiaries, with the average monthly benefit reduction hovering around $500. The standard 90% bend point is lowered to somewhere between 40% and 85%, depending on your years of substantial earnings under Social Security. If you have 30 or more years, you get the full 90%, but with fewer than 20 years, it drops to 40%. You can learn more details about how WEP works from the SSA.

The Government Pension Offset or GPO

While WEP affects your own retirement benefits, the Government Pension Offset (GPO) messes with spousal or survivor benefits. This rule applies if you get a pension from non-covered government work and you apply for benefits as a spouse or widow(er) based on your partner's work record.

The GPO calculation is direct and can be severe. It reduces your spousal or survivor benefit by two-thirds of the amount of your government pension. For many families, this reduction is large enough to completely wipe out any spousal or survivor benefit they might have otherwise received.

Example of GPO in Action:

Let's say Maria has a government pension of $1,200 per month from her teaching career where she didn't pay into Social Security. Her late husband's work record qualifies her for a survivor benefit of $1,500 per month.

- The GPO reduction is calculated: $1,200 (her pension) x 2/3 = $800.

- This reduction is applied to her survivor benefit: $1,500 - $800 = $700.

- Instead of $1,500, Maria's monthly survivor benefit would be $700.

This rule is a huge factor for couples where one partner had a public service career. It’s also good to know that these provisions don't affect other assets. If you're curious about how other financial gifts could impact your benefits, you might be interested in our guide on whether an inheritance will affect your Social Security retirement benefits.

Totalization Agreements for International Work

What happens if you worked abroad? For families who have lived and worked in other countries, totalization agreements are a lifesaver. These are international social security agreements between the United States and 30 other countries.

Their main goal is to help people who have split their careers between countries qualify for benefits. If you don't have enough U.S. work credits to qualify for Social Security on your own, these agreements allow the SSA to count your work credits earned in a partner country.

This doesn't mean your foreign earnings get added to your U.S. record. Instead, the credits from another country simply help you meet the minimum eligibility requirement. Your actual benefit amount is still calculated based only on the earnings where you paid U.S. Social Security taxes. These agreements make sure your international work experience doesn't lock you out of the benefits you earned while in the States.

Understanding Spousal and Survivor Benefits for Your Family

Think of Social Security as more than just your personal retirement fund; it's a family protection plan. It's designed to be a safety net for the people you love most. Beyond the benefits you earn for yourself, the system offers critical financial lifelines for spouses and survivors, making it a cornerstone of security for multiple generations.

Getting a handle on how these benefits work is absolutely key to building a financial plan that can weather any storm. These rules are in place to acknowledge that both partners in a marriage contribute to the household's economic well-being, providing stability when life takes an unexpected turn.

How Spousal Benefits Work

A spousal benefit lets one spouse receive a monthly check based on their partner's work history. This is a huge deal for couples where one person was the main breadwinner or simply earned a lot more over their career. It’s designed to make sure both partners have a reliable stream of income in retirement.

So, how do you qualify? The spouse claiming the benefit needs to be at least 62, and their partner must have already started taking their own retirement benefits. From there, the math is pretty straightforward:

- The most a spousal benefit can be is 50% of the higher-earning spouse's Primary Insurance Amount (PIA).

- But to get that full 50%, the claiming spouse has to wait until their own Full Retirement Age (FRA).

- If they claim early (anytime between 62 and their FRA), that 50% amount is permanently cut.

For instance, if the higher earner's PIA is $2,800 a month, the maximum spousal benefit would be $1,400. That's a significant amount of extra income that can make a real difference.

One of the biggest myths out there is that claiming a spousal benefit shrinks the primary worker's own check. It absolutely does not. The spousal benefit is a totally separate payment that comes in addition to the primary earner's full benefit.

It's also worth noting that if your own retirement benefit is larger than what you'd get as a spousal benefit, Social Security will pay you your own, higher amount. You get one or the other—whichever is bigger—but never both. For a deeper dive into how to coordinate this, check out our guide on Social Security strategies for married couples.

The Lifeline of Survivor Benefits

This is probably the single most important family protection feature Social Security offers. When a worker passes away, their survivor benefit provides monthly payments to the surviving spouse and, in some cases, their dependent kids. It's an essential financial backstop during an incredibly tough time.

A widow or widower can usually claim a full survivor benefit at their own FRA, which can be as much as 100% of what the deceased worker was receiving (or was eligible to receive). They can even start reduced benefits as early as age 60 (or 50 if disabled). This is a huge reason why having the higher earner delay their own benefit can be such a powerful legacy move—it locks in a much larger potential survivor benefit for their spouse down the road.

Frequently Asked Questions About Benefit Calculations

Even with a clear roadmap of how Social Security works, you probably still have a few questions floating around. It's one thing to understand the formulas, but it's another to see how they play out in the real world.

Let's walk through some of the most common questions we hear. Getting these details straight can make a huge difference in your family’s financial security for years to come.

How Do Cost-Of-Living Adjustments Affect My Calculated Benefit?

Once you start receiving your Social Security checks, that monthly amount isn't set in stone for the rest of your life. Thankfully. The Social Security Administration typically applies an annual Cost-of-Living Adjustment (COLA) to help your payments keep up with rising prices.

This yearly tweak is tied directly to inflation, specifically the Consumer Price Index. It’s designed to protect the purchasing power of your benefits so your income doesn't get eroded as the cost of groceries, gas, and healthcare goes up. The COLA is simply applied to whatever your current benefit amount is at the time.

Are My Social Security Benefits Taxable?

For many people, the answer is yes, and it often comes as a surprise. Whether or not your benefits are taxed hinges on your "combined income." This is a specific figure calculated by adding up your adjusted gross income, any non-taxable interest you earned, and half of your total Social Security benefits for the year.

If that total crosses certain thresholds set by the IRS, a portion of your benefits becomes subject to federal income tax. This is a critical detail to factor into your retirement budget to make sure your financial plan is realistic.

A lot of retirees are caught off guard when they learn their benefits are taxable. Planning for this ahead of time helps you avoid a surprise tax bill and ensures your budget reflects what you’ll actually have in your pocket.

Can I Work While Receiving Social Security Benefits?

You absolutely can, but if you claim benefits before your Full Retirement Age (FRA), there are some important rules to know. If you're working and collecting benefits early, your payments might be temporarily reduced if your earnings go over a set annual limit.

For every $2 you earn above that limit, the SSA will hold back $1 from your benefits. The rules get a bit more relaxed in the year you actually reach your FRA, and once you're past that magic date, you can earn as much as you want without any reduction to your benefit checks.

At Smart Financial Lifestyle, we believe that understanding the details is the key to making smart financial decisions.

Learn how to build a retirement plan that works for your entire family.