Getting divorced can feel like navigating a storm without a map. Emotions are high, and the sheer number of financial tasks can feel completely overwhelming. The first 90 days are absolutely critical, but don't try to fix everything at once.

Instead, the immediate goal is financial triage—stopping the bleeding and establishing control. This isn't about long-term wealth building just yet. It’s about creating the stability you need for the long road to recovery.

Your Financial Triage Plan for the First 90 Days

Think of this initial phase as securing your own financial lifeboat before you start rowing toward your destination. It's all about gaining clarity, severing financial ties that could become liabilities, and building a solid foundation from which to grow.

Secure Your Essential Documents

First things first: you need to gather and organize every single critical piece of paper related to your finances and the divorce settlement. You can't build a new plan without knowing exactly where you stand. This paperwork is your proof of ownership, your legal standing, and your financial history.

Get a secure digital folder and a physical binder ready for these items:

- Final Divorce Decree: This is the most important document of all. It legally outlines the division of assets, debts, and any support obligations.

- Property Deeds and Titles: Collect the deeds for any real estate and titles for vehicles that are now solely in your name.

- Account Statements: Grab recent statements from all your bank accounts, investment portfolios, retirement funds (like 401(k)s and IRAs), and credit cards.

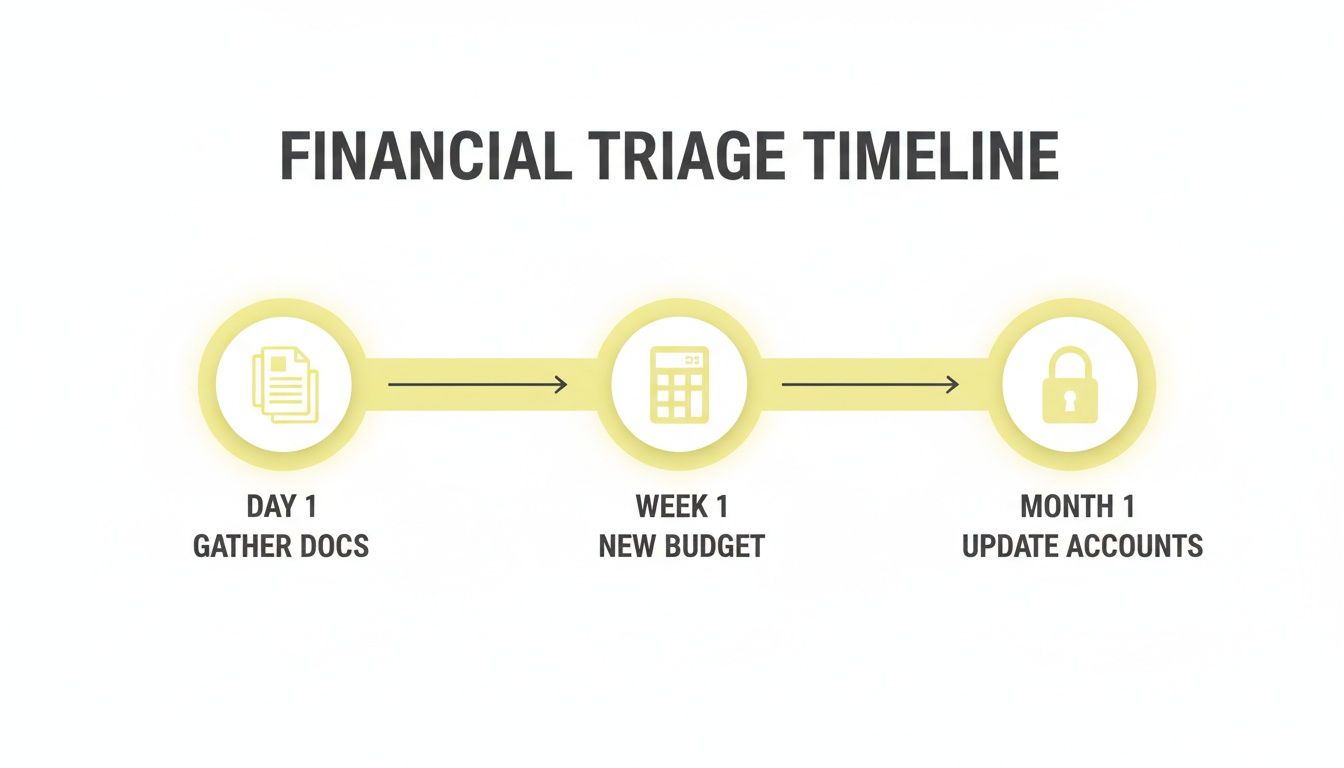

This simple timeline breaks down these essential first steps. You gather your documents, create a new budget, and then update your accounts. It's a sequential process where each step builds on the last.

Create a Temporary Budget and Open New Accounts

With your documents in hand, the next move is to get a crystal-clear picture of your new cash flow. This means creating a temporary, "bare-bones" budget. For at least 30 days, track every single dollar coming in and going out. Don’t aim for perfection; the goal here is simply visibility.

This is a stark reality check for many, especially women. Women initiate 70% of divorces and often face a much steeper financial decline. Research has shown that a woman's household income can plummet by as much as 41% post-divorce, a significantly harder hit than the typical 23% dip for men.

Key Takeaway: Budgeting right after a divorce isn’t about restriction; it's about gaining control through information. Knowing your numbers is the first step toward making empowered, rather than reactive, financial decisions.

At the same time, you need to establish your financial independence.

- Open a new checking and savings account in your name only.

- Redirect your direct deposit to this new account immediately.

- Close any remaining joint bank accounts and credit cards to prevent any surprise debts down the road.

Update Beneficiaries and Secure Your Digital Life

One of the most overlooked but critical steps is updating who inherits your assets. Chances are, your ex-spouse is still listed as the beneficiary on your life insurance policies, retirement accounts, and maybe even your will. This has to change to reflect your new reality.

You can learn more about why this is so critical in our guide on what a beneficiary designation is. Protecting your legacy starts now.

Finally, lock down your digital financial life. Change the passwords on all your financial, email, and social media accounts. This small act is a powerful way to create a clean break and protect your personal information, giving you the peace of mind needed to focus on rebuilding.

Crafting Your Post-Divorce Freedom Budget

Once you've navigated the immediate chaos of the first few months, you can finally start to breathe and look forward. This is where you get to shift from pure survival mode to becoming the architect of your new life.

And the most powerful tool you have for this job isn't just a budget; it's what I like to call a Freedom Budget. Think of it as a conscious plan that aligns every single dollar with the future you actually want to build for yourself.

Forget those rigid, restrictive budgets that felt like a punishment. This is about empowerment. It's about looking at your income and expenses not as limitations, but as choices you now get to make, on your own terms.

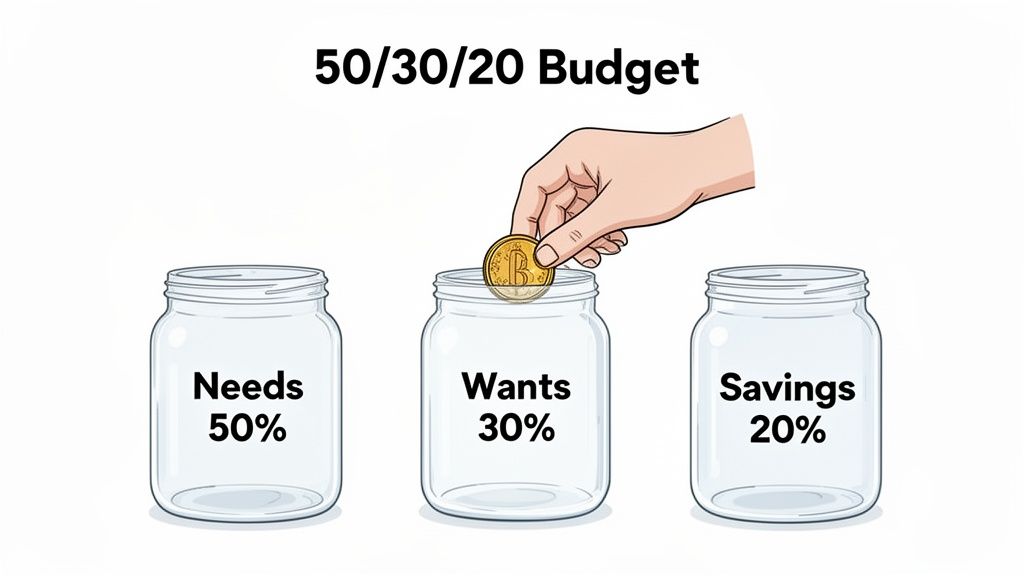

The 50/30/20 Framework: A Simple Start

A fantastic, no-fuss starting point is the 50/30/20 framework. It’s simple, effective, and gives you clear guardrails as you figure out your new financial rhythm.

Here’s the breakdown:

- 50% for Needs: This chunk covers your absolute must-haves. Think housing, utilities, groceries, transportation to work, and insurance premiums. These are the non-negotiable costs to live safely and securely.

- 30% for Wants: This is for your lifestyle—the stuff that makes life enjoyable. This includes dining out, hobbies, streaming services, travel, and entertainment. Don't skip this part; finding joy again is a huge piece of long-term financial health.

- 20% for Savings & Debt: This is your future-building category. It’s all about paying down debt faster (especially high-interest credit cards) and aggressively building your savings, including that all-important emergency fund and retirement accounts.

This approach flips budgeting from a chore into a clear, value-driven exercise. It gives you permission to live your life while making sure you're always moving toward long-term security.

Understanding Your New Financial Reality

The first real step is getting an honest picture of your new single-income household. This means tracking your spending for a full month to see where your money is actually going, not just where you think it is.

You might be surprised by new expenses you hadn't fully considered, like shouldering the entire cost of healthcare or childcare on your own.

Financial strain is a silent killer in 45% of US marriages that end in divorce, so this journey is one many people have to take. The good news? Victory is absolutely possible. Data shows that divorced households that adopt the 50/30/20 rule can see their net worth grow by 15-20% annually. For more insights, Wilmington Trust has some solid data on the financial impacts of divorce.

Your budget is not a judgment on your past. It is a roadmap for your future, drawn by you, for you. It's the ultimate act of self-reliance.

With this newfound clarity, you can start making intentional changes. Maybe you realize that three different streaming services aren't as important as building a safety net. Perhaps packing a lunch for work frees up a couple of hundred bucks a month that you can throw at a high-interest credit card balance. It's all about making conscious choices.

To see how this works in the real world, let's look at a sample budget. This isn't a one-size-fits-all plan, but it's a great illustration of how you can put your money to work with intention.

Sample Freedom Budget Breakdown on a $4,000 Monthly Income

| Category | Percentage | Monthly Amount | Example Expenses |

|---|---|---|---|

| Needs | 50% | $2,000 | Rent/Mortgage, Utilities, Groceries, Insurance, Car Payment, Gas |

| Wants | 30% | $1,200 | Dining Out, Hobbies, Streaming, Shopping, Weekend Trips |

| Savings & Debt | 20% | $800 | Emergency Fund, Credit Card Debt, Retirement (401k/IRA) |

This table shows that even on a modest income, you can cover your essentials, enjoy life, and still make significant progress toward your financial goals. The key is giving every dollar a job.

Building Your Financial Fortress: The Emergency Fund

One of your absolute highest priorities within that 20% savings slice should be building a rock-solid emergency fund. After the instability of divorce, having a cash reserve that can cover 6 to 12 months of essential living expenses is non-negotiable.

This isn't just about money; it's about buying yourself peace of mind. It’s knowing that a surprise car repair or an unexpected medical bill won't send you spiraling back into a financial crisis.

This fund acts as a protective wall around your financial life, letting you handle life’s curveballs without derailing all your hard-earned progress. For a detailed guide, check out our emergency fund checklist with 8 must-have steps.

Starting this fund, even with small, consistent contributions, is one of the most powerful moves you can make toward genuine financial resilience.

How to Tackle Debt And Rebuild Your Credit

Divorce doesn't just divide assets; it can absolutely wreak havoc on your credit and leave you staring at a new, unfamiliar pile of debt. It’s incredibly common for a credit score to take a nosedive during this transition, especially if your ex handled the joint accounts or if payments got missed in the chaos.

But this isn't just about numbers on a report. Taking back control of your debt and credit is a powerful way to reclaim your financial identity. It's about building a future where you call the shots, making smart financial moves that serve your new life.

Conduct a Thorough Credit Investigation

Before you can make a plan, you need to know exactly what you’re up against. Your very first move should be to pull your credit reports from all three major bureaus—Equifax, Experian, and TransUnion. You can get a free report from each one every year.

Don’t just glance at them. Go through every single line with a fine-tooth comb.

- Pinpoint All Joint Accounts: Make a list of every single credit card, loan, or mortgage that still has both of your names on it. These are your biggest vulnerabilities right now.

- Hunt for Inaccuracies: Look for any errors, accounts you don't recognize, or late payments that aren't yours. The confusion of a separation can sometimes open the door to identity theft.

- Confirm Account Status: Make a note of which accounts have been closed as required by your divorce decree and which are still open.

Once you have this information, your mission is to systematically untangle your financial lives. Start contacting creditors to close those joint accounts. If you can, refinance joint debts like a car loan into your name only. This severs that financial link for good and protects your credit from anything your ex does—or doesn't do—in the future.

Create a Strategic Debt Payoff Plan

With a clear inventory of your debts, it’s time to attack them with a strategy. While there are a few ways to do this, the "debt snowball" method is often incredibly effective, mostly for the psychological boost it provides—which is exactly what you need when you're feeling emotionally drained.

Here’s the game plan:

- List Your Debts: Write down all your individual debts from the smallest balance to the largest, ignoring the interest rates for now.

- Make Minimum Payments: Pay the minimum amount due on every single debt to keep everything current.

- Target the Smallest Debt: Throw every extra dollar you can squeeze out of your budget at the smallest debt on your list until it's completely gone.

- Roll It Over: Once that first debt is paid off, take the entire amount you were paying on it (the minimum plus all the extra) and "snowball" it onto the next-smallest debt.

This approach gives you quick wins that build momentum and keep you motivated. You get to feel that powerful sense of progress. For bigger, more complex debts like high-interest credit cards, you might want to explore other options. You can learn more by checking out our complete guide on how to negotiate credit card debt, which walks you through strategies that can seriously reduce what you owe.

Paying off your first post-divorce debt—no matter how small—is a declaration of independence. It's a tangible victory that proves you are fully capable of managing your finances on your own.

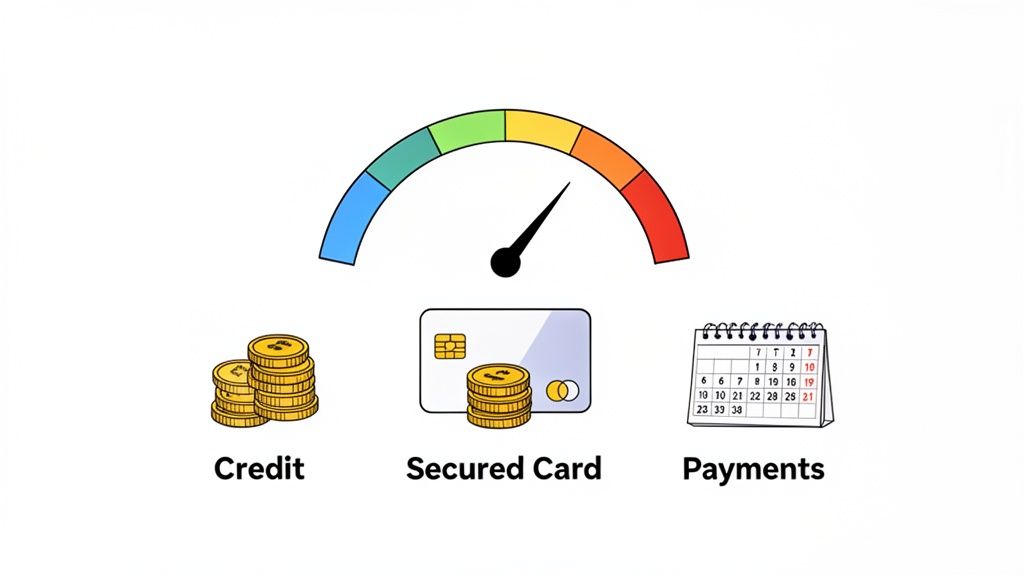

Proactively Rebuild Your Credit Score

Paying down debt is only half the battle. The other half is actively building a new, positive credit history that’s in your name alone. A good credit score is your key to better interest rates on future car loans or a mortgage, which can save you thousands of dollars down the road.

A fantastic tool for this is a secured credit card. You put down a small cash deposit, maybe $300, and that amount becomes your credit limit. It’s a low-risk way for banks to give you a chance to prove yourself.

Use it for a small, recurring bill—like Netflix or Spotify—and set up automatic payments to pay off the balance in full every single month. After 6-12 months of consistent, on-time payments, you'll start to see your credit score climb. This simple, steady action shows creditors you’re financially responsible and is a cornerstone of rebuilding your financial life after divorce. It proves you’re a reliable borrower, paving the way for a much stronger financial future.

Redesigning Your Retirement and Investment Strategy

The retirement plan you built as a couple? It’s time for a complete teardown. This isn’t about making small tweaks; it’s about redesigning your financial future from the ground up to support one person—you. A huge part of rebuilding your finances after a divorce is shifting your focus to the long game and making smart, deliberate moves to secure your future on your own terms.

The assets you were awarded in the divorce settlement, like a slice of a 401(k) or an IRA, are the raw materials for your new plan. The absolute first and most critical step is making sure that money gets into your name the right way. Mess this up, and you could face devastating tax penalties.

The Power of a QDRO

When a workplace retirement plan like a 401(k) or pension gets split in a divorce, it has to be done with a special legal document: a Qualified Domestic Relations Order (QDRO). This isn't optional. The QDRO is a court order that tells the plan administrator to divide the account and move your share into a new retirement account under your name.

Without a QDRO, any money taken from your ex-spouse's 401(k) is just an early withdrawal in the eyes of the IRS. That means an immediate 20% mandatory tax withholding and another 10% early withdrawal penalty if you're under 59½. A properly executed QDRO allows you to bypass all of that, preserving every penny of your settlement.

Crucial Insight: Think of the QDRO as a protective shield for your retirement funds. It's the only legally recognized way to split a workplace retirement plan without triggering immediate, costly taxes and penalties. Do not skip this step.

Once those funds land in your new rollover IRA, you're in the driver's seat. You get to choose the investments that fit your new goals and comfort level with risk, which officially kicks off your journey as an independent investor.

Reassessing Your New Retirement Timeline

Let's be real: your vision for retirement has probably changed. Maybe you need to work a few years longer, or maybe you've decided you'd rather retire earlier with a simpler lifestyle. Now is the time to get brutally honest with yourself about your new reality.

Ask yourself these questions:

- What's my new income? How much can you realistically afford to save each month now that you're on a single income?

- What's my time horizon? How many years are left until you want to stop working?

- What's my risk tolerance? Your comfort with market swings might be totally different now that you're the sole person responsible for your financial security.

The answers will help you build a new investment strategy from scratch. For many people starting over, a simple and incredibly effective approach is to invest in low-cost index funds or target-date funds. These give you broad diversification across the market without needing you to become a stock-picking genius. You'd be amazed how even a modest settlement, when invested wisely, can grow into a substantial nest egg thanks to the power of compounding.

From Settlement to Secure Future

I've seen so many clients completely change their outlook when they start seeing their settlement not as a consolation prize, but as a launchpad. One client, for example, received what felt like a pretty small portion of her ex-husband's 401(k). Instead of cashing it out, she followed the process and rolled it into a low-cost S&P 500 index fund.

Then, she committed to adding just $200 a month to that account. It wasn't a lot, but it was consistent. Over the next decade, that small, steady investment combined with market growth turned her modest starting pot into a significant retirement fund. For the first time, she felt a sense of financial security she never thought she'd have again.

Rebuilding your finances after a divorce is all about making a series of smart, deliberate moves. By handling your divided assets correctly, getting real about your long-term goals, and sticking to a consistent investment strategy, you can build a strong, secure financial future that is entirely your own.

Protecting Your Family And Building a New Legacy

Rebuilding after a divorce is about so much more than your personal bank account. It’s about laying down a completely new foundation—one that protects the people you love, no matter what happens down the road. This is where your money starts to tell a new story of resilience, thoughtful planning, and enduring care for your family.

Let’s be honest: the financial stability you create now sends ripples into the next generation. Divorce doesn't just split assets; it reshapes family legacies. Research has shown that a child’s long-term earnings can drop by 2.4 percentile points by age 25 if their parents divorce when they are young. That single statistic makes it crystal clear just how critical it is for parents to get their new financial house in order. For a deeper look at this, check out the economic impacts of divorce at mcooperlaw.com.

Your first, most urgent task? A complete overhaul of your estate plan. The documents you signed while married are now dangerously outdated and almost certainly don’t reflect where you want your assets to go.

Updating Your Core Estate Documents

Think of your will, trusts, and powers of attorney as the legal blueprint for your legacy. If you leave them untouched, you could be unintentionally giving your ex-spouse legal control over your assets or even your life-and-death medical decisions. This isn’t something to put on the “someday” list; it needs to happen now.

- Your Will: This is the document that directs who gets what. Without an update, your ex could still be listed as your primary heir, which is probably the last thing you want.

- Trusts: Whether it’s a living trust or a trust set up for your kids, you have to review the trustee and beneficiaries. They must be updated to align with your new family reality.

- Powers of Attorney: You absolutely need to name a new, trusted person to handle your financial and healthcare decisions if you become incapacitated. Leaving your ex-spouse in that role is a massive, unnecessary risk.

As soon as the ink is dry on your divorce decree, schedule a meeting with an estate planning attorney. It’s one of the best investments you can make to protect your new financial life.

Securing Your Children’s Financial Future

Once your own estate is buttoned up, shift your focus to creating financial safeguards specifically for your children. This is about giving them a solid launchpad, completely separate from your former marriage. Two areas need your immediate attention.

First, go through every single one of your beneficiary designations. These are powerful. In many cases, they can completely override what your will says. You need to call the plan administrators for your:

- Life insurance policies

- Retirement accounts (like 401(k)s and IRAs)

- Annuities

- Bank and brokerage accounts with "Payable on Death" (POD) or "Transfer on Death" (TOD) instructions

Make sure your children, a trust for their benefit, or another person you choose is officially named the beneficiary. Get your ex-spouse’s name off there.

Second, think about their education. A 529 college savings plan is a fantastic tool for this. You can open a new 529 as the sole owner, giving you total control over the money and how it’s used for your child’s future schooling. It’s a powerful, proactive way to build a legacy of opportunity.

A Proactive Tip: When you're updating your life insurance, don't just swap out the beneficiary. Re-evaluate the coverage amount. Is it enough to get your kids through college and into young adulthood if something happens to you? This is a cornerstone of the new financial safety net you're building.

Shielding Multigenerational Wealth

If you're part of the "sandwich generation"—caring for your kids and your aging parents—divorce adds a whole new layer of complexity. You have to protect the financial support you give your parents and ensure your own inheritance isn't at risk.

If you give money to your parents, formalize the arrangement. A simple documented loan or a dedicated account can keep those funds from being viewed as marital property down the line.

And if you expect to receive an inheritance, have a frank conversation with your parents. Talk to them about updating their own estate plans to make sure assets pass directly to you or into a trust for your benefit. This simple step can shield that wealth from any future claims and helps you build a resilient legacy that lasts for generations.

Common Questions About Finances After Divorce

Figuring out your money after a divorce brings up a ton of questions. Let's be honest, the legal jargon, the tax rules, and the sheer emotional weight of it all can feel completely overwhelming. Here, we’re going to tackle some of the most pressing questions I hear from clients, with clear, direct answers to help you start rebuilding with confidence.

How Soon Should I Change My Will And Beneficiaries?

Yesterday. Okay, not literally, but this is an immediate, top-priority task. The second your divorce is legally final is the moment you need to be updating your estate plan.

Forgetting to update these crucial documents is a recipe for disaster. It could easily mean your ex-spouse inherits your assets—something I’m almost certain you don’t want. This is a foundational step in protecting your new financial life and making sure your legacy goes to the people you actually choose.

Here's your action plan:

- See an estate planning attorney. This is non-negotiable. You need to update your will, any trusts, and your powers of attorney for both your finances and your healthcare.

- Call your providers directly. Don't assume the attorney handles this part. You need to personally contact your retirement account administrators (like Fidelity or Vanguard), life insurance companies, and banks to formally change the beneficiary on every single account.

My Credit Score Dropped. What’s The Fastest Way To Rebuild It?

The single fastest way to get your credit score moving in the right direction is to start building a new, positive credit history that's entirely in your name. Lenders want to see recent proof that you're a reliable borrower.

One of the most effective tools for this job is a secured credit card. You put down a small cash deposit, say $300, and that deposit becomes your credit limit. It’s a fantastic, low-risk way for you to prove your creditworthiness to the credit bureaus.

Pro Tip: Use that new secured card for one small, recurring monthly charge, like your Netflix or Spotify subscription. Then, set up automatic payments to pay the balance in full every month. This simple, consistent action screams financial responsibility and can start improving your score in as little as 6-12 months.

Don't forget about your old joint accounts. You need to stay on top of those. Make sure they are officially closed and follow up to confirm your ex is making their required payments on any debt assigned to them in the divorce decree. Their missed payment can still hurt your score if your name is on the account.

I Received a Lump Sum Settlement. Should I Pay Off Debt Or Invest It?

First off, congratulations. This is a great position to be in, but it demands a smart, deliberate strategy. Before you even think about paying off debt or investing, your absolute first priority is to build yourself a safety net.

Take a portion of that settlement and create a solid emergency fund in a high-yield savings account. This isn't just a "nice-to-have"; it's your financial firewall. It needs to cover at least 3-6 months of your essential living expenses.

Once that firewall is built, the rest of the decision comes down to a simple math problem: comparing interest rates.

- High-Interest Debt: If you're sitting on credit card debt with a 20%+ APR, paying it off is a no-brainer. Think of it this way: you're getting a guaranteed 20% return on your money by eliminating that massive interest expense. You can't beat that in the market.

- Low-Interest Debt: Now, for debt with a low interest rate, like a mortgage under 5%, the math often flips. It usually makes more sense to invest the money in a diversified portfolio, where the long-term historical returns have been significantly higher than the interest you're paying.

A good financial planner can help you run the specific numbers for your situation, ensuring you make the most informed decision possible.

How Do I Handle Taxes On Alimony And Assets?

The tax rules around divorce can be incredibly tricky, and a mistake here can be expensive. For any divorce agreements finalized after January 1, 2019, the federal tax law on alimony changed in a big way.

The new rule is straightforward: alimony is no longer tax-deductible for the person paying it, and it's not considered taxable income for the person receiving it.

When it comes to splitting up assets, the transfer itself is usually not a taxable event. For example, if you receive the family home in the settlement, you won't owe taxes on that transfer. But—and this is a big but—you will be on the hook for capital gains taxes on all the appreciation when you eventually sell the property.

For retirement funds, a QDRO (Qualified Domestic Relations Order) is used to transfer the money without any immediate tax hit. You will, however, pay the standard income tax on withdrawals when you take that money out in retirement, just like you would with any 401(k) or IRA. My best advice? Always, always consult a CPA who specializes in divorce to navigate the specific tax consequences of your unique settlement.