Here's the rewritten section, designed to sound like an experienced human expert and match the provided examples.

The biggest point of confusion I see with IRAs isn't about complicated tax rules—it's about a simple labeling issue. When we talk about a Traditional IRA versus a Rollover IRA, we're not really comparing two different types of accounts. The real difference is just where the money came from in the first place.

A Rollover IRA is simply a Traditional IRA that holds money from an old employer-sponsored plan, like a 401(k) or 403(b). That’s it. The tax treatment, growth potential, and withdrawal rules are identical.

Understanding the Core Difference Between IRA Types

Think of it like this: a Traditional IRA is the account you fund with your own annual contributions. A Rollover IRA is the special container you use when you move your old 401(k) money after leaving a job.

So, why bother with the separate "rollover" label? It's all about financial organization and preserving certain strategic advantages. Keeping those old 401(k) funds separate from your regular IRA contributions is one of the smartest organizational moves you can make.

Key Functional Distinctions

Segregating your rollover funds in their own dedicated IRA isn't just about being tidy; it protects the money's unique history, which unlocks a few key benefits down the road.

- Future Flexibility: Some 401(k) plans let you do a "reverse rollover," meaning you can move money from an IRA back into a new employer's 401(k). This is usually only allowed for funds that originally came from another workplace plan. Mix them with your regular IRA contributions, and you could lose this option.

- Asset Protection: Money that came directly from a 401(k) often gets stronger protection from creditors under federal law (ERISA). While state laws vary, keeping those funds in a pure Rollover IRA helps maintain that higher level of protection.

- Legacy Planning: If you're consolidating a lifetime of retirement savings from multiple jobs, keeping it all in a distinct Rollover IRA makes the accounting much cleaner. This is especially helpful for simplifying estate planning and managing required minimum distributions (RMDs) later on.

The key takeaway is simple: A Rollover IRA isn't a different kind of account in terms of tax treatment. It's a Traditional IRA with a specific job—to house and protect assets from a former workplace retirement plan.

Let’s put the main functional differences side-by-side to make it crystal clear.

At-a-Glance Traditional IRA vs Rollover IRA

This table breaks down the core purpose and strategic value of each account, cutting through the jargon to show you what really matters.

| Feature | Traditional IRA (Contribution-Based) | Rollover IRA (Transfer-Based) |

|---|---|---|

| Primary Funding Source | Annual contributions you make directly, subject to IRS limits. | Funds transferred ("rolled over") from an employer plan (e.g., 401(k), 403(b)). |

| Tax Rules | Identical. Pre-tax contributions (often), tax-deferred growth, taxed withdrawals. | Identical. Pre-tax funds remain pre-tax, with tax-deferred growth and taxed withdrawals. |

| Core Purpose | Building retirement savings through consistent, annual investments. | Consolidating and preserving retirement savings when you change jobs or retire. |

| Key Strategic Benefit | A straightforward way for individuals to save for retirement with tax advantages. | Preserves flexibility for future reverse rollovers and may offer enhanced creditor protection. |

Ultimately, using a Rollover IRA is less about following a rule and more about smart financial strategy. It keeps your options open and your assets organized, which is always a good move.

How Money Moves Into Your IRA

The real difference between a Traditional IRA and a Rollover IRA isn't buried in some obscure tax code or withdrawal rule. It all comes down to how the money gets into the account in the first place. This origin story is what defines each account's job in your long-term financial plan.

Think of it this way: a Traditional IRA is typically built over time with your own money, while a Rollover IRA is designed to give a new home to assets you’ve already saved somewhere else.

A standard Traditional IRA is funded through your annual contributions. Each year, the IRS lets you put in a certain amount of money, letting you build your retirement savings piece by piece. This is all about ongoing, active saving.

Funding a Rollover IRA

A Rollover IRA, on the other hand, gets its start when you move a chunk of money from a former employer's retirement plan, like a 401(k). You're not adding new savings here; you're just moving an existing nest egg. There are really only two ways to get this done.

- Direct Rollover (Trustee-to-Trustee): This is by far the safest and smartest way to do it. Your old 401(k) provider sends the money straight to your new IRA custodian. The cash never even touches your personal bank account, which completely sidesteps any risk of tax headaches or penalties.

- Indirect 60-Day Rollover: With this method, your old company cuts you a check for your 401(k) balance. You then have a strict 60-day window to deposit that full amount into your Rollover IRA. If you miss that deadline for any reason, the entire amount could be treated as a taxable distribution, and you might get hit with a 10% early withdrawal penalty on top of it. It’s a risky move.

This difference in funding is a huge deal. In fact, rollovers have become the main way money flows into IRAs. Back in 2020, traditional IRAs saw inflows of $616.9 billion. A staggering $594.8 billion (96.4%) of that came from rollovers, while only $22.1 billion (3.6%) came from new contributions. These numbers show why rollover accounts often hold much larger balances right from the start.

The core difference is simple: a Traditional IRA grows with your annual contributions, while a Rollover IRA is funded by moving a lump sum you've already accumulated in a workplace plan.

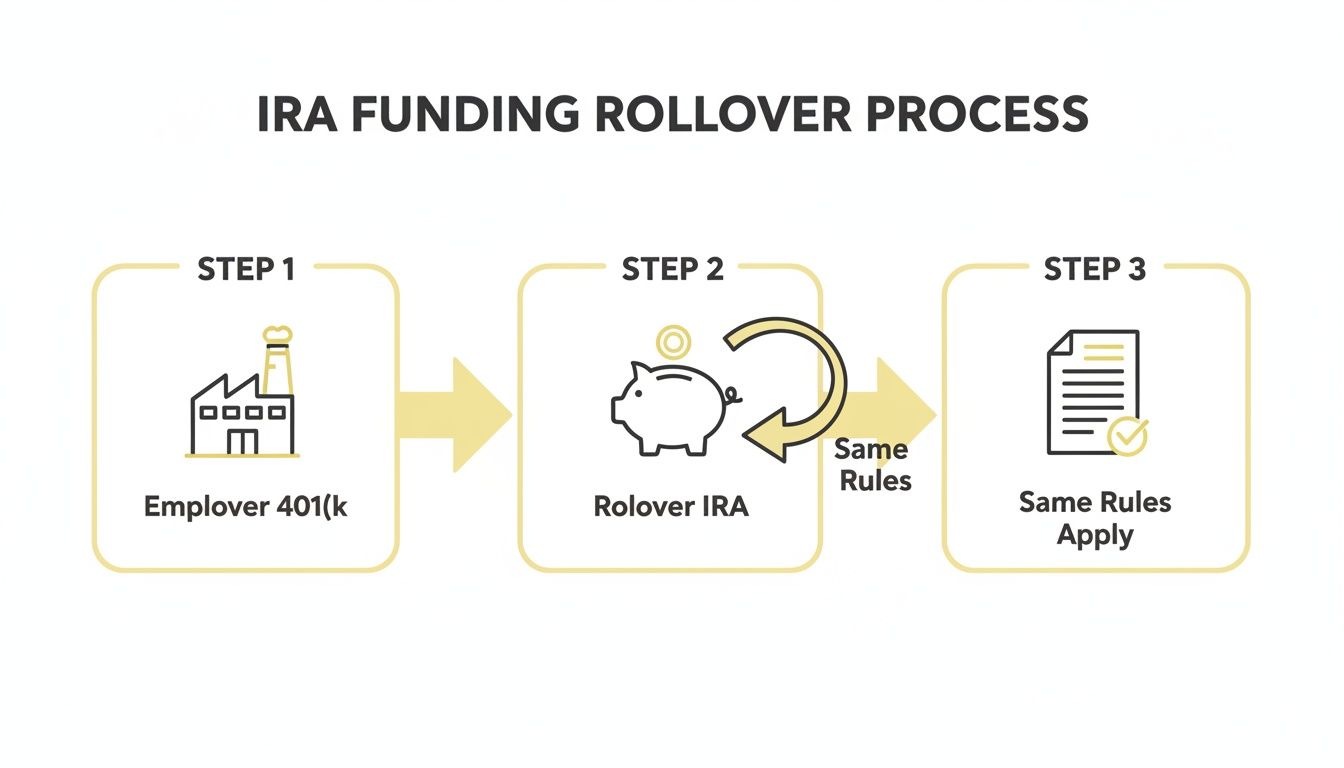

This graphic shows just how smooth a direct rollover from a 401(k) can be.

This direct process ensures your retirement funds keep their tax-deferred status without any hiccups. Moving and consolidating assets is a common step when you change jobs—a move that can also impact other benefits. You can find out more in our guide on what happens to your pension if you change jobs. Sticking with a direct rollover is the best way to protect the savings you've worked so hard for.

Why the Rollover Distinction Matters Strategically

At first glance, a Rollover IRA and a Traditional IRA look like twins—they operate under the exact same tax rules. But digging a little deeper, you'll see why the distinction is more than just a name. It's not about memorizing complex tax codes; it’s about making smarter moves during big life changes.

Think of the "rollover" label as an organizational tool. It's there to protect and preserve what is often a lifetime of accumulated wealth, keeping it separate for strategic reasons.

And we're talking about a lot of money here. Data shows that 60–62% of all traditional IRA owners have rollover assets mixed in. These accounts are also significantly larger. The median balance for a traditional IRA that includes rollover funds is a hefty $150,000, while one funded only by regular contributions sits at just $55,000. That's a nearly threefold difference, highlighting just how much is at stake. You can see more of the numbers in the Investment Company Institute's 2023 report.

Consolidating Your 401k at Retirement

When you leave a job or finally retire, you have a big decision to make about your 401(k). Moving those funds into a dedicated Rollover IRA is often the smartest play you can make. By keeping those assets completely separate from your regular, contribution-based Traditional IRAs, you create a clean financial slate.

This separation is a huge deal for a couple of key reasons:

- Better Creditor Protection: Money that comes from a 401(k) is often shielded by federal law (ERISA), which can offer much stronger protection against creditors than the state laws that govern most IRAs. Keeping those funds in their own Rollover IRA maintains a clear paper trail, preserving their protected status.

- Keeps Future Options Open: Some new employers’ 401(k) plans let you do what's called a "reverse rollover," which is moving IRA money back into their plan. This option is almost always restricted to funds that originally came from another employer's plan. If you mix your rollover money with regular contributions, you could lose this valuable option forever.

Navigating Divorce and Financial Independence

During a divorce, retirement assets are frequently divided using a legal document called a Qualified Domestic Relations Order, or QDRO. A QDRO is a powerful tool that allows money to be moved from one spouse's 401(k) to the other without triggering immediate taxes or penalties.

For the spouse receiving the funds, a Rollover IRA is an absolute necessity. It provides a clean, designated account to receive the money, establishing a brand-new foundation for their financial independence. This simple move consolidates the awarded assets, gives them full control over how the money is invested, and helps them get started on their own retirement strategy.

A Rollover IRA isn't just a financial account; in situations like divorce, it’s a vehicle for empowerment, enabling a fresh start with a secure retirement foundation.

Planning for a Reverse Rollover

The ability to move IRA funds back into a new 401(k) plan is a niche strategy, but it can be incredibly powerful. Some 401(k) plans offer unique investment options you can't get elsewhere, better loan rules, or even simpler RMD calculations when you hit retirement age.

Here's the catch: most 401(k) plans will only accept pre-tax funds that came from another qualified employer plan. If you’ve already mixed your rollover money with after-tax funds or your regular annual contributions in a single Traditional IRA, your entire account might be ineligible. By keeping a "pure" Rollover IRA—one that only contains funds from old workplace plans—you keep this strategic door wide open for the future.

Navigating Tax Rules and Withdrawal Nuances

When it comes to taxes and withdrawals, any distinction between a Traditional IRA and a Rollover IRA vanishes. They operate under the exact same set of IRS rules. Why? Because a Rollover IRA is, at its core, just a Traditional IRA with a specific funding history.

Think of it this way: all the money inside either account, whether it's from your annual contributions or a 401(k) rollover, is considered pre-tax. You haven't paid income tax on it yet. This is a huge advantage while you're saving, as your investments get to enjoy tax-deferred growth. Your entire balance compounds without getting chipped away by annual taxes on gains.

How Withdrawals Are Taxed

Of course, the tax bill eventually comes due. When you start taking money out, every dollar you withdraw from either a Traditional or Rollover IRA is taxed as ordinary income, just like your salary. It doesn't matter if you take a small distribution or a large one; the rule is the same.

This structure is designed to encourage long-term saving. By pushing taxes down the road, the government gives you an incentive to let your money grow untouched until retirement. The thinking is that your income—and possibly your tax bracket—will be lower then. It's a system built on delayed gratification, but you absolutely have to plan for the future tax hit. For more on that, check out our guide on how to reduce taxes in retirement.

Understanding Key Withdrawal Rules

Beyond the standard tax treatment, a few other critical regulations govern when and how you can access your funds. Again, these rules are identical for both account types.

- Early Withdrawal Penalty: If you take money out before age 59½, you'll typically get hit with a 10% penalty on top of the regular income tax. There are some exceptions for things like a first-time home purchase, certain medical expenses, or disability.

- Required Minimum Distributions (RMDs): Once you hit a certain age (currently 73), the IRS says you must start taking annual withdrawals. This ensures that the government eventually collects the taxes it deferred for all those years. The specific amount you have to take is based on your account balance and a life expectancy factor.

The identical application of tax and withdrawal rules reinforces a core idea: The true difference between a Traditional IRA and a Rollover IRA is not in their daily operation but in their strategic purpose for organizing and protecting your assets.

This table gives you a clean breakdown of the shared rules governing both accounts.

Tax and Withdrawal Rule Comparison

| Rule | Traditional & Rollover IRA Application |

|---|---|

| Fund Status | All funds are considered pre-tax, meaning income tax has not yet been paid. |

| Investment Growth | Tax-deferred, allowing gains to compound without annual taxation. |

| Standard Withdrawals | Taxed as ordinary income at your current rate during retirement. |

| Early Withdrawals | Subject to a 10% penalty if taken before age 59½, plus income tax. |

| RMDs | Mandatory annual withdrawals begin at age 73. |

Ultimately, whether your money is in a Traditional IRA or a Rollover IRA, the IRS treats it the same once it's time to take it out.

Common Rollover Mistakes and How to Avoid Them

Executing a rollover sounds simple enough, but a few small administrative errors can trigger some seriously costly and irreversible consequences. Knowing the difference between a Traditional IRA and a Rollover IRA isn't just about definitions; it's about protecting the unique status of your hard-earned retirement money during a critical transition.

Two common missteps stand out, and either one has the potential to undo years of careful saving. Thankfully, avoiding them is pretty easy with a little foresight.

Mistake 1 Commingling Your Funds

The most frequent error is commingling. This happens when you mix rollover funds from an old 401(k) with the money in your regular, contribution-based Traditional IRA. Even though both accounts play by the same tax rules, combining them effectively erases the special history of your rollover assets.

This seemingly harmless action can come with significant drawbacks:

- Losing the Reverse Rollover Option: Many 401(k) plans let you roll IRA money back into their plan, but there's a catch—they only accept funds that originally came from another employer's plan. Once you commingle your assets, the entire IRA becomes ineligible.

- Weakened Creditor Protection: Money coming from a 401(k) often gets stronger federal protection under ERISA. Mixing those funds into a standard IRA can dilute these protections, leaving your assets potentially exposed to state-level rules that might not be as robust.

The easiest fix? Just keep your rollover funds in a dedicated, separate Rollover IRA. This preserves all those strategic advantages for the future.

Mistake 2 Mishandling an Indirect Rollover

The second major pitfall involves the indirect 60-day rollover. This is the method where you get a check for your old 401(k) balance and are responsible for depositing it into your new IRA. The IRS is incredibly strict about the 60-day deadline. Miss it by even one day, and the entire amount is treated as a taxable distribution.

A missed 60-day deadline can trigger a devastating financial event. You could be staring at a massive income tax bill on the full rollover amount, plus a 10% early withdrawal penalty if you're under age 59½.

Another common trap is failing to redeposit the full amount. Your old employer is required to withhold 20% for taxes right off the top of the check they send you. To complete the rollover correctly, you must deposit the entire original balance—meaning you have to come up with that missing 20% from your own pocket until you can get it back on your next tax return.

The safest path is always a direct, trustee-to-trustee transfer. The money moves directly between financial institutions without ever passing through your hands. This completely sidesteps all the risks tied to the 60-day rule. The strategic difference is clear: rollover IRAs are typically funded by large, single transfers, distinguishing them from Roth IRAs, where 38.8% of inflows in 2020 were from active contributions. You can learn more about how these contribution patterns differ on Planadviser.com.

Choosing the Right IRA Strategy for You

Knowing the difference between a Traditional IRA and a Rollover IRA is what separates basic saving from smart, strategic financial planning. The choice isn't about which account is "better" in a vacuum; it’s about picking the right tool for where you are in your financial life right now.

Think of it this way: are you building a house from the ground up, brick by brick, or are you moving an entire wing of a house to a new foundation? Both get you a home, but the purpose and the process couldn't be more different.

Your Next Move Based on Your Situation

Let your current circumstances guide your decision. It's the simplest way to know you're making the right move.

- Just starting to save for retirement? You'll be opening a Traditional IRA and funding it with your own money each year. This is your primary tool for actively building wealth from scratch.

- Leaving a job with a 401(k)? A dedicated Rollover IRA is the perfect vehicle. It preserves the tax-deferred status of your hard-earned money and gives you a world of investment options you didn't have before.

- Juggling several old 401(k)s from past jobs? A Rollover IRA is your best friend. It lets you bring all those scattered accounts under one roof, simplifying your financial life and making your investments far easier to track.

The right IRA strategy isn't a single, one-time decision. It's a series of smart choices that align with your life's milestones. Every action you take should bring more clarity and control to your financial future.

This clarity becomes crucial as your savings grow, and you start asking whether you should have multiple retirement accounts for different financial goals.

A Checklist for Smart Financial Action

Before you pick up the phone or fill out a form, run through these quick steps. This ensures you’re acting with confidence.

- Identify Your Goal: Is your purpose to save new money or move old money?

- Choose the Right Account: Open a Traditional IRA for new contributions from your income. Open a Rollover IRA to house funds from an old 401(k).

- Prioritize Direct Transfers: If you're rolling money over, always, always insist on a trustee-to-trustee transfer. It sends the money directly to your new account and keeps you clear of any potential tax headaches or penalties.

Got Questions? We've Got Answers

Even with the best plan, you're bound to run into a few specific questions as you manage your retirement accounts. Getting the practical, day-to-day rules right is what keeps your financial house in order. Let’s tackle some of the most common questions that pop up when dealing with Traditional and Rollover IRAs.

Can I Add New Money to a Rollover IRA?

Technically, yes, you can. Since a Rollover IRA functions just like a Traditional IRA, it will happily accept your annual contributions up to the IRS limit.

But just because you can doesn't mean you should. In fact, it's usually a strategic mistake. Adding new contributions commingles the funds, which means you’re mixing your old 401(k) money with your new personal savings. This simple act can wipe out your ability to do a "reverse rollover" back into a 401(k) down the road and might even weaken the strong creditor protections those 401(k) funds originally came with. It’s almost always smarter to open a separate Traditional IRA for any new contributions.

Can I Have Both a Traditional IRA and a Rollover IRA?

Absolutely. Not only is it possible, but it's often the smartest way to go. Keeping these accounts separate is a core principle of good financial organization and precisely why the "rollover" distinction exists in the first place.

Don’t think of it as a complicated rule you have to follow. Keeping one account for rollovers and another for new contributions is a simple, powerful move to protect your assets and keep your options open for the long haul.

This two-account approach makes it crystal clear where all your money came from, which is a huge advantage for things like estate planning and gives you much more flexibility later on.

What Happens to My Rollover IRA When I Die?

When you pass away, your Rollover IRA is treated just like a Traditional IRA—it goes directly to the beneficiaries you’ve named. They'll have a few choices, like cashing it out in a lump sum, moving the money into their own inherited IRA, or simply disclaiming (refusing) the inheritance.

Generally, funds inside an inherited IRA must be withdrawn within ten years, though there are some exceptions to that rule. The single most important takeaway here? Make sure your beneficiary designations are up to date. It’s a critical piece of any solid estate plan.

At Smart Financial Lifestyle, our mission is to empower you with the clarity to make smart financial decisions, build lasting wealth, and redefine what's possible for your family's future. Learn more at https://smartfinancialifestyle.com.