Deciding whether a reverse mortgage is right for you means weighing the immediate relief it can offer against some pretty serious long-term consequences. You're essentially balancing the pros of getting rid of monthly mortgage payments and accessing tax-free cash against the cons of interest piling up and eating away at your home's equity.

Is a Reverse Mortgage the Right Tool for Your Retirement?

Choosing a reverse mortgage is one of the biggest financial decisions you can make in retirement. It touches everything, from how you manage your day-to-day expenses to the legacy you leave for your family. This guide is here to cut through the jargon and give you a straight, balanced look at the pros and cons. We'll go beyond the simple lists to walk through real-world situations, helping you see how this tool could either be a lifeline or a financial trap.

Think of this less like a simple loan and more like a strategic choice about your future. We're going to weigh the instant benefit of tapping into your home's value against the long-term costs and what it means for your estate. The goal is to give you a clear, detailed picture so you can make a choice that feels right for you.

Key Considerations at a Glance

Before we get into the weeds, it helps to see the big picture. A reverse mortgage works in the opposite way of a traditional one. Instead of you paying the bank each month, the bank pays you, and the loan balance gets bigger over time. For more on how different income sources can work together, The Definitive Guide to Retirement Income offers some great context on building a solid financial plan.

This table breaks down the core differences, showing why a reverse mortgage is a very specific tool designed for retirement.

| Feature | Traditional Mortgage | Reverse Mortgage (HECM) |

|---|---|---|

| Payment Flow | You pay the lender every month. | The lender pays you (or the loan balance just grows). |

| Loan Balance | Goes down over time as you pay it off. | Goes up over time with interest and fees. |

| Primary Goal | To buy a home and build equity. | To use your existing home equity for retirement income. |

| Repayment Trigger | Paid off over a set period (like 30 years). | Paid back when you sell the home or permanently move out. |

The Central Question of Home Equity

Ultimately, this whole decision boils down to one simple question: how do you see your home equity? Is it a nest egg you want to protect for your kids, or is it a financial resource you need to tap into to live comfortably and stay in your home?

A reverse mortgage fundamentally changes your relationship with your largest asset. It shifts home equity from a future inheritance into a present-day income stream, a trade-off that requires careful family discussion and professional guidance.

There’s no one-size-fits-all answer here. Every family's financial picture and goals are different. This guide will give you the clarity you need to figure out if this financial tool actually lines up with your vision for retirement.

How a Reverse Mortgage Actually Works

Before we can really get into the reverse mortgage pros and cons, we have to pull back the curtain on how these things actually work. At its core, a reverse mortgage lets homeowners who are 62 or older tap into their home equity, turning a chunk of it into cash. The best part? You don't have to sell your home or start making monthly loan payments.

Think of it as flipping a traditional mortgage on its head. Instead of you paying the lender every month, the lender pays you. Your loan balance goes up over time, not down. This is the key difference that makes it such a unique tool for retirement, but it's also where the complexity comes in. And don't worry—the title to your home stays right where it is, in your name.

The most common flavor of these loans is the government-insured Home Equity Conversion Mortgage (HECM). It’s become a go-to for many seniors, and with the global reverse mortgage market valued at USD 1.83 billion in 2023, it’s clear more retirees are looking at their homes as a financial resource.

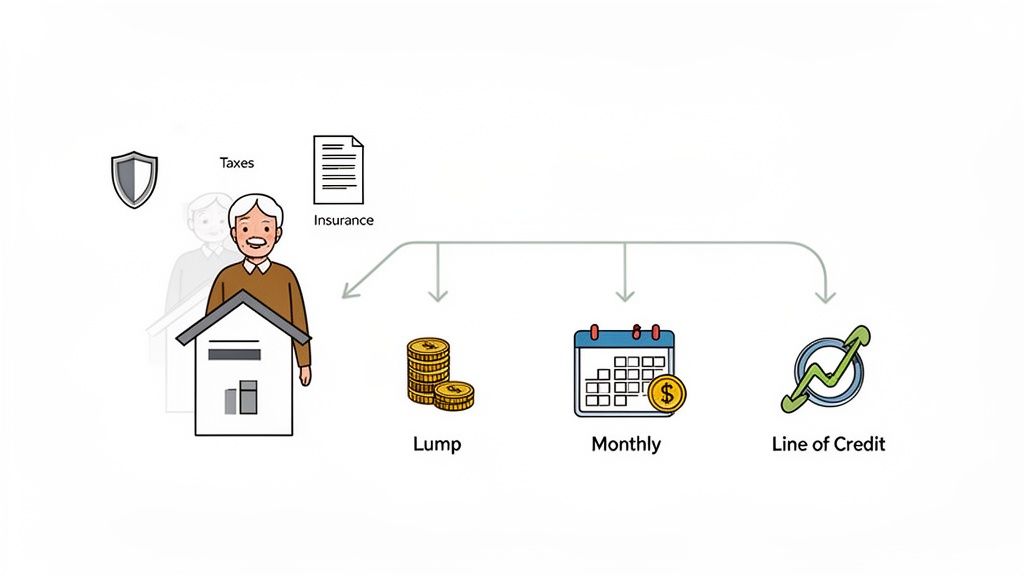

The Three Ways You Get Paid

One of the first big decisions you'll make is choosing how you want to receive your money. It's not a one-size-fits-all deal. Each option is built for different financial goals, giving you a surprising amount of control over your cash flow.

Let's break down how you can get your funds and what each option is really good for.

Comparing Reverse Mortgage Payout Options

| Payout Option | How It Works | Ideal Use Case |

|---|---|---|

| Lump Sum | You get all the money in one single payment right after closing. | Perfect for big, immediate needs. Think paying off your old mortgage, wiping out major medical bills, or funding a long-overdue home renovation. |

| Monthly Payments | The lender sends you a fixed check every month, either for a set number of years or for as long as you live in the home. | Great for creating a steady, predictable income stream. It can supplement Social Security and make monthly budgeting feel much more stable. |

| Line of Credit | You get access to a credit line you can draw from whenever you need it, up to a set limit. The best part? The unused portion grows over time. | An excellent financial safety net. It’s there for emergencies, but you only pay interest on what you actually use. |

Choosing the right payout is all about matching the tool to your personal financial situation. There's no single "best" option—only the one that's best for you.

Your Ongoing Responsibilities as a Homeowner

Getting cash without a monthly payment is a huge relief, but it doesn't mean you're free of all financial obligations. You're still the homeowner, and you have to keep up your end of the bargain. Not doing so can have serious consequences, including foreclosure, which is a critical point to consider.

You absolutely must continue to:

- Pay Property Taxes: All your local and state property taxes must be paid on time, every time.

- Maintain Homeowner's Insurance: Your home has to stay insured against things like fires, storms, and other hazards.

- Keep the Home in Good Repair: You're required to handle basic maintenance to protect the home's value, which is the lender's collateral.

A reverse mortgage is not a free pass on homeownership costs. It’s a loan that uses your home as collateral, and protecting that collateral is a non-negotiable part of the agreement.

The loan balance—which is the cash you've taken out plus all the interest and fees that have piled up—only comes due when you sell the house, move out for good, or pass away. To get a clearer picture of how these costs add up, you can learn more about what increases your total loan balance in our detailed guide.

The Pros: A Pathway to Financial Flexibility

When you dig into the reverse mortgage pros and cons, the benefits often boil down to one powerful outcome: financial breathing room. For a lot of retirees, this isn't just about having extra cash. It’s about getting back a sense of control and cutting down the stress in a chapter of life that’s supposed to be for enjoyment.

A reverse mortgage can take the equity you've built in your home—something that’s just a number on paper—and turn it into a real, usable resource. It lets you stay in the home you love, surrounded by memories, while unlocking its value. The best part? The title stays in your name. You still own your home.

Say Goodbye to Monthly Mortgage Payments

Maybe the biggest, most immediate win is wiping out that monthly mortgage payment. If you've spent decades sending a check to a lender, this one change can completely reshape your budget and your entire financial outlook.

Imagine freeing up hundreds, or even thousands, of dollars every single month. This isn't a small tweak; it's a major boost to your cash flow. That money can now go toward healthcare, travel, or just quiet the daily anxiety of trying to make ends meet.

Think about a real-world scenario. A couple has an $80,000 mortgage balance and a budget that's stretched thin. A reverse mortgage could pay off that loan entirely. Just like that, their monthly mortgage payment is gone, instantly improving their quality of life and giving them more room to handle unexpected costs.

Receive Funds That Are Tax-Free

Here’s a critical detail: the money you get from a reverse mortgage is considered loan proceeds, not income. Because of this, the funds are not subject to federal income tax. This lets you supplement your income without bumping up your tax bill, which is a huge advantage over pulling money from taxable retirement accounts.

You also have total freedom in how you use the money. There are no strings attached. You can direct the funds to whatever matters most, whether that’s a big home renovation, covering in-home care, or helping a grandchild with college tuition.

The tax-free nature of reverse mortgage funds provides a strategic advantage, allowing retirees to access their home equity without pushing them into a higher tax bracket or affecting Social Security benefits.

The Power of a Growing Line of Credit

One of the most strategic—and often overlooked—perks of a reverse mortgage is the line of credit option. This isn't like a traditional Home Equity Line of Credit (HELOC). With a HECM line of credit, the unused portion actually grows over time, completely independent of your home's value. The growth rate is tied to the loan's interest rate, creating a unique financial safety net that gets stronger as the years go by.

This feature is a powerful tool for navigating financial uncertainty. Let's walk through an example:

- Initial Setup: A homeowner is approved for a $200,000 line of credit. They draw $20,000 for an immediate need, leaving $180,000 available.

- Strategic Growth: That unused $180,000 starts to grow. A few years down the road, their available credit could be well over $200,000, even if their home's value hasn't increased at all.

This growing credit line can be a buffer against a volatile stock market. Instead of selling investments at a loss to cover an expense, a retiree can simply draw from their HECM line of credit and give their portfolio time to recover. It's a smart way to protect your long-term wealth while still meeting your short-term needs.

Protect Your Heirs with a Non-Recourse Loan

A big worry for many families is the thought of leaving debt behind for their kids. Most reverse mortgages, especially HECMs insured by the FHA, include a critical protection called a non-recourse feature. This is one of the most important pros to understand.

This feature guarantees that you or your heirs will never owe more than the home is worth when the loan comes due. Even if the loan balance balloons past the property's market value because of a housing downturn, the lender can only be repaid from the proceeds of the home's sale. They can’t touch your other assets or go after your heirs' finances.

This provides incredible peace of mind. It means that while you're using your home's equity to live more comfortably, you aren't creating a financial nightmare for the next generation. Your family can choose to repay the loan and keep the home, or they can sell it to pay off the debt, knowing they’re fully protected from any shortfall.

The Cons: Understanding the Costs and Long-Term Impact

While tapping into your home's equity sounds great on paper, it's crucial to look at a reverse mortgage with your eyes wide open. The drawbacks aren't just minor footnotes; they're significant financial and personal trade-offs that can ripple through your estate and your family’s future for years to come.

The biggest issue is how the loan balance works. Unlike a regular mortgage that you chip away at over time, a reverse mortgage balance grows every single month as interest and fees pile on. This creates a snowball effect that can be tough to predict and even harder to manage down the road.

The High Price of Entry: Upfront Costs

One of the first things that catches people off guard is the steep upfront cost. We're not talking about small administrative fees here. These charges can take a serious chunk out of the money you receive, shrinking the net benefit of the loan right from the start.

Here are the main fees you'll likely face:

- Origination Fees: This is what the lender charges for setting up the loan. It can be a percentage of your home's value, but it's capped at $6,000.

- Third-Party Closing Costs: Just like a traditional mortgage, you'll have to cover things like the appraisal, title search, and recording fees.

- Initial Mortgage Insurance Premium (MIP): This is a mandatory fee for FHA-insured HECM loans. It’s a hefty 2% of your home's appraised value.

These costs are almost always rolled into the loan balance, which means you start paying interest on them immediately. That eats into the equity you were hoping to use for living expenses.

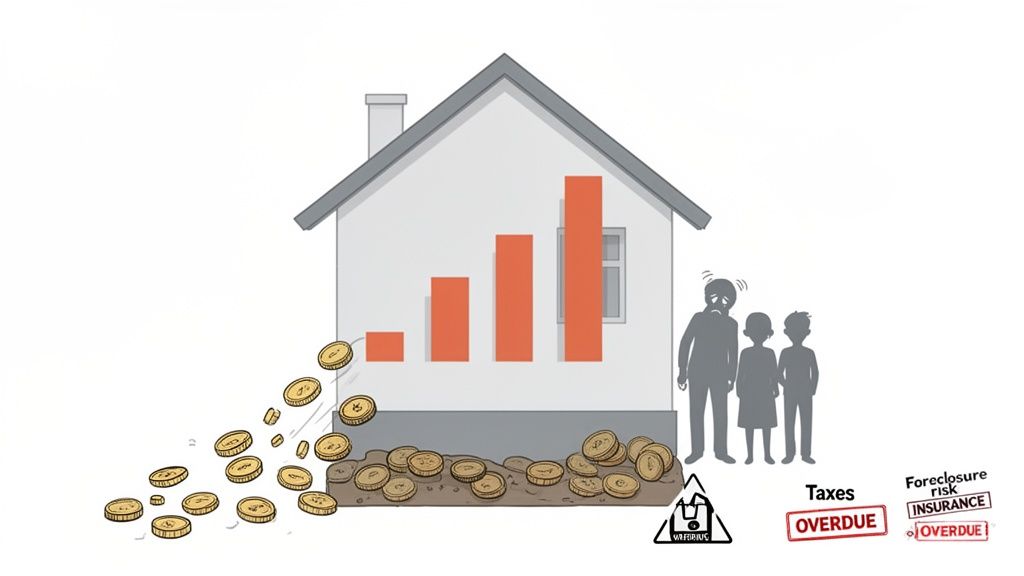

The Erosion of Home Equity and Your Heirs’ Inheritance

This is probably the biggest long-term consequence: the slow but steady disappearance of your home equity. As interest, ongoing MIP, and servicing fees compound, your loan balance climbs, chipping away at the value you’ve spent decades building. This has a direct impact on what you can leave to your kids or other heirs.

Because of accruing interest and fees, it’s not uncommon for the loan balance to grow by 8-10% each year. This completely changes the legacy you leave behind; your family could inherit a substantial debt instead of a valuable asset.

The central trade-off of a reverse mortgage is brutally simple: you are essentially spending your children's inheritance to fund your retirement. This might be the right call for your situation, but it has to be a conscious choice made with everyone in the loop.

Let's run a quick example. Say you have a $400,000 home and take out a $200,000 reverse mortgage. After just 10 years, with all the compounding interest and fees, that loan balance could easily balloon to over $300,000, leaving much less for your heirs.

The Real Risk of Foreclosure

There's a dangerous myth that you can't lose your home with a reverse mortgage. That's completely untrue. You don't have to make monthly payments, but you are still on the hook for three critical homeowner responsibilities:

- Paying your property taxes on time.

- Keeping adequate homeowner's insurance.

- Maintaining the home in reasonably good condition.

If you fail to meet any of these obligations, you're in default. If you can't fix the problem, the lender can—and will—start foreclosure proceedings. For seniors on a fixed income, a sudden spike in property taxes or insurance premiums can create a financial crisis that puts their home in jeopardy.

Navigating Means-Tested Benefits

Another landmine can be government assistance programs like Medicaid or Supplemental Security Income (SSI), which have strict limits on income and assets. While the money from a reverse mortgage is technically a loan, not income, how you manage it is critical.

If you take a lump sum and don't spend it all within the same month you receive it, the leftover cash can be counted as a liquid asset. This could push you over the eligibility threshold, potentially kicking you off benefits you depend on for healthcare. This is especially vital when it comes to long-term care planning. Understanding how to handle these funds is essential, and it's wise to learn about strategies for https://smartfinanciallifestyle.myshopify.com/blogs/news/protecting-assets-from-nursing-home-costs. Sitting down with a financial advisor is the best way to avoid accidentally disqualifying yourself from crucial support.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following all your specific instructions and stylistic examples.

Is a Reverse Mortgage Your Only Option? Let’s Look at the Alternatives

While a reverse mortgage can feel like a lifeline for accessing your home’s equity without a monthly payment, it's definitely not the only game in town. Making a smart financial move means laying all your cards on the table, and for many homeowners, a more traditional tool might offer better flexibility or lower costs over the long haul.

It's crucial to see how alternatives like a Home Equity Line of Credit (HELOC), a cash-out refinance, or even selling your home stack up. Each path has its own set of rules, payment demands, and, importantly, different implications for your family and your estate. The right choice really boils down to your personal situation—from your credit and income to whether your heart is set on aging in place or you're ready to simplify your life.

Home Equity Lines of Credit (HELOCs)

Think of a HELOC as a credit card that’s secured by your house. You get approved for a certain credit limit and can pull money out as you need it, usually over a 10-year "draw period." The big plus here is that you only pay interest on what you actually borrow, which makes it a great option for handling unexpected expenses or funding projects over time.

But here’s the catch: the repayment. Unlike a reverse mortgage, you have to start making payments (often interest-only at first) as soon as you tap into the line of credit. When that draw period ends, you’re on the hook for both principal and interest, which can introduce a hefty new monthly bill into your retirement budget. This makes a HELOC a much better fit for homeowners who still have a reliable income and need flexible cash for shorter-term goals, not for steady income replacement.

Cash-Out Refinance

With a cash-out refinance, you’re essentially trading in your old mortgage for a new, bigger one. You pocket the difference between the two loans as a tax-free lump sum. This can be a fantastic way to get a large chunk of cash at once, often at a pretty good interest rate if your credit is solid.

The most significant drawback, however, is that you’re signing up for a brand-new, traditional mortgage that comes with mandatory monthly payments. This is the complete opposite of a reverse mortgage's main appeal, which is getting rid of that monthly payment. A cash-out refi generally makes more sense for younger retirees or those with a solid pension or investment income who can comfortably handle a new 15- or 30-year loan payment.

When you're weighing these alternatives, the real question to ask yourself is: "Can I comfortably afford a new monthly payment?" If the answer is no, a reverse mortgage stands out as a unique solution. A HELOC or cash-out refi, on the other hand, could add serious financial strain.

Downsizing Your Home

For some folks, the best strategy isn't another loan at all—it's selling the family home. Moving to a smaller, less expensive place can unlock the most equity from your property. You convert that value into cash that can fund your retirement, buy a new home outright, and seriously slash your monthly living expenses.

This approach offers a clean financial slate, totally free from new debt. It also cuts down on costs like property taxes, insurance, utilities, and all the maintenance that comes with a larger house. The tradeoff, of course, is the emotional and physical work of moving. It means leaving a home full of memories and possibly a neighborhood you’ve known for years.

Comparing Home Equity Strategies for Retirement

Choosing the right path forward requires a clear-eyed comparison based on what truly matters to you and your family. The table below is designed to help you do just that—a side-by-side look at a Reverse Mortgage, HELOC, and Downsizing to help align your choice with your retirement goals.

| Decision Factor | Reverse Mortgage (HECM) | HELOC | Downsizing |

|---|---|---|---|

| Monthly Payments | None required (must pay taxes & insurance) | Required once funds are drawn | None (potential HOA fees) |

| Impact on Heirs | Reduces inheritance as loan balance grows | Loan must be repaid, may require selling | Heirs inherit remaining cash or new property |

| Upfront Costs | High (origination, MIP, closing costs) | Low (often minimal or no closing costs) | High (realtor commissions, closing costs) |

| Best Use Case | Aging in place with no monthly payments | Short-term projects with flexible fund access | Maximizing equity & reducing living expenses |

At the end of the day, a reverse mortgage has to be weighed not just on its own, but against these very real alternatives. Each strategy serves a different purpose for a different season of life, and only you can decide which one fits your story best.

Your Decision Checklist: Is a Reverse Mortgage Right for You?

Making the final call on a reverse mortgage isn’t about looking for a simple “yes” or “no.” It's really about weighing the immediate financial relief against the long-term ripple effects on your family and your home. This checklist is designed to turn the complex reverse mortgage pros and cons we've talked about into real, actionable questions. It's a starting point for a thoughtful conversation with your family, a financial advisor, and a certified HECM counselor.

Your goal here is to find that perfect alignment between this financial product and your unique vision for retirement. Answering these questions with total honesty is the most important step you can take toward a decision that brings peace of mind, not future headaches.

Assessing Your Financial Health

The first pillar of this decision is whether you can handle the non-negotiable terms of the loan for the long haul. Sure, a reverse mortgage gets rid of monthly loan payments, but it doesn’t wipe away the fundamental costs of owning a home.

- Can I reliably afford property taxes, insurance, and home maintenance? And don't just think about next year. Look ahead 10, 20, or even 30 years. These costs only go up, and failing to pay them puts you on a path to foreclosure.

- Do I have other assets to cover unexpected emergencies? While a reverse mortgage can free up cash flow, leaning on it for every single surprise expense is a fast way to burn through your home's equity.

This decision tree infographic can help you visualize the core choices you're facing when thinking about how to fund your retirement.

As the visual shows, the right path really depends on what matters most: staying put in your home or unlocking its full financial value.

Clarifying Your Long-Term Goals

Next up, you have to get crystal clear about what you truly want out of your retirement years. This isn't a small choice; it will shape your lifestyle for the rest of your life.

The most powerful question you can ask is: "What does a successful retirement look like to me?" Is it staying in my beloved home at all costs, or is it maximizing my financial freedom, even if that means moving?

- Is my number one goal to age in this specific home, no matter what? If you have a gut-level, resounding "yes," then a reverse mortgage is one of the very few tools built specifically for that purpose.

- Could my needs change in the near future? If you have a feeling you might want to move closer to family or downsize within the next 5-10 years, the high upfront costs of a reverse mortgage probably aren't worth it.

Defining Your Legacy

Finally, take a moment to think about the message your financial choices will send to the next generation. A reverse mortgage has a direct impact on what your heirs will inherit.

- How important is it to leave the full value of my home to my heirs? Be honest with yourself about this. For some, passing on a debt-free home is the ultimate gift. For others, making sure their own financial security is taken care of is the bigger priority.

- Have I had an open conversation with my family about this? Surprising your kids with a massive loan on the family home can create a world of stress. Bringing them into the discussion builds understanding and helps head off conflict down the road.

At the end of the day, this checklist—combined with the mandatory, unbiased counseling from a professional—will give you the power to make a choice that secures your present without putting your family’s future at risk.

Frequently Asked Questions

When you start digging into the details of a reverse mortgage, a lot of practical questions pop up. It's only natural. Let's tackle some of the most common concerns that come up in family conversations and financial planning meetings.

Can I Really Lose My Home With a Reverse Mortgage?

Yes, foreclosure is a real possibility, but only if you don't hold up your end of the deal. It's different from a traditional mortgage where you'd be in trouble for missing loan payments—because with a reverse mortgage, there are none.

Instead, your responsibilities are to pay your property taxes and homeowner’s insurance on time and, just as importantly, keep the house in good shape. As long as you handle these core duties and the home is still your main residence, you can live there for the rest of your life. The real risk creeps in when folks on a fixed income find it hard to keep up with rising taxes or insurance premiums.

What Happens if My Spouse Is Not on the Loan?

This is a critical point and one you absolutely need to plan for carefully. For HECMs, there's a protection called an “eligible non-borrowing spouse,” which allows them to stay in the home after the borrowing spouse passes away or moves into a long-term care facility.

But it's not automatic. They have to be named as a non-borrowing spouse from the very start of the loan and meet some specific rules. It's also key to understand that while they can remain in the home, they won't get any more money from the loan. You have to discuss this scenario in detail with your lender to make sure your spouse is fully protected down the road.

The non-borrowing spouse rules are a vital safeguard, but they aren't a given. Proactively sorting this out with your lender during the application is non-negotiable if you want to prevent a future housing crisis for your surviving partner.

What Do My Heirs Inherit When the Home Is Sold?

After the last borrower permanently leaves the home, the loan balance—which includes all the interest and fees that have built up over the years—becomes due. In most cases, the family sells the home to pay off that debt.

Here’s the good news: any money left over after the loan is paid off belongs completely to your estate or your heirs. For example, if the home sells for $450,000 and the total loan balance is $300,000, your heirs will receive the remaining $150,000.

And thanks to a key feature called the "non-recourse" clause, if the home sells for less than what's owed, your heirs will never have to pay more than the home's sale price. The lender takes the loss, which protects your family’s other assets from being touched.

At Smart Financial Lifestyle, we believe in making smart financial decisions that secure your present and protect your family's future. To explore more strategies for a secure retirement, visit us at https://smartfinancialifestyle.com.