Opening a Roth IRA for kids is hands-down one of the most powerful gifts you can give. It takes a child's small earnings from a summer job or side hustle and gives it the potential to grow into an absolute fortune. This special retirement account lets their money grow completely tax-free for decades, planting a seed of financial security that can blossom into an incredible legacy.

The Ultimate Gift for Your Grandchild: A Roth IRA

Imagine giving a gift that keeps growing long after the wrapping paper is gone—one that quietly works for decades, building a foundation of financial security for your grandchild. A Roth IRA for kids isn't just another savings account. It's a profound expression of love and a forward-thinking tool for building multigenerational wealth.

Think of it like planting a small sapling. With a little time, sunlight, and care, that tiny tree matures into a mighty oak, providing shade and shelter for generations. In the same way, a small contribution to a child's Roth IRA today can grow into a substantial, life-changing sum by the time they retire. This is easily one of the smartest decisions you can make, creating a bedrock for your grandchild's future.

More Than Just Money

This isn't just about the numbers on a statement. It’s about connecting with the deeper "why" behind your financial decisions. By helping set up a Roth IRA, you're sending powerful messages that will shape their entire life.

- You're teaching financial wisdom. You show them the value of saving, investing, and long-term thinking from an early age.

- You're providing profound security. You give them a head start that few of their peers will ever have, reducing future financial stress.

- You're building a lasting legacy. Your gift becomes a testament to your love and foresight, impacting their life in ways a toy or gadget never could.

This isn't just a financial transaction; it's a transfer of wisdom. You're not only funding an account but also instilling the principles of smart financial stewardship that will serve them for a lifetime.

Ultimately, the emotional rewards are immeasurable. You get to watch the seed you planted grow, knowing you’ve helped shape your grandchild’s long-term success and handed them a tool to build their own American Dream.

How a Custodial Roth IRA Actually Works

So, how does one of these accounts actually work in the real world? It's much simpler than it sounds.

Think of a custodial Roth IRA as a special retirement account opened in your grandchild's name. Because they're a minor, a responsible adult—the custodian—manages it until they legally come of age. This setup ensures the money is invested wisely and also serves as a fantastic, hands-on financial lesson.

But there’s one non-negotiable rule that makes it all possible: the child must have legitimate earned income. This is the key that unlocks the door. Gifting them cash or giving them an allowance doesn’t cut it, but plenty of common childhood jobs do.

Let's break down exactly what this means.

Key Features Of A Custodial Roth IRA

Before we dive deeper, here's a quick summary of the essential rules for a custodial Roth IRA. This table gives you a bird's-eye view of what makes these accounts tick.

| Feature | Description |

|---|---|

| Eligibility | The child must have legitimate earned income from a job. |

| Contribution Limit | Contributions are limited to the child's total earned income for the year, up to the annual IRA maximum ($7,000 in 2024). |

| Custodian | An adult (usually a parent or grandparent) opens and manages the account until the child reaches the age of majority in their state. |

| Account Ownership | The account is legally owned by the minor, but controlled by the custodian. |

| Tax Treatment | Contributions are made with after-tax money, meaning qualified withdrawals in retirement are 100% tax-free. |

| Investment Control | The custodian is responsible for selecting and managing the investments within the account. |

Having these core features in mind helps frame the conversation as we get into the nitty-gritty of earned income and the custodian's specific duties.

What Counts as Earned Income

"Earned income" is simply money your grandchild gets paid for work they actually do. The IRS wants to see a real connection between their labor and their paycheck.

It's a great habit to help them keep a simple log of their work—who they worked for, what they did, and how much they got paid. This creates the exact kind of documentation you need.

Here are some common examples of work that qualifies:

- Babysitting for neighbors and family friends.

- Mowing lawns or doing other yard work around the community.

- Working a summer job as a lifeguard or camp counselor.

- Holding a part-time job at a local shop or restaurant.

- Freelancing with skills like coding, graphic design, or even dog walking.

Basically, if they get a W-2 from an employer or can document self-employment income, they're good to go. This rule is what makes the Roth IRA for kids such a powerful, real-world lesson in finance.

The Custodian's Role

The custodian, who is usually a parent or legal guardian, acts as the manager of the account. They are in charge of all the important decisions until the child hits the "age of majority" in their state, which is typically 18 or 21.

Here's what the custodian's job involves:

- Opening the Account: They’ll handle all the paperwork with a brokerage like Fidelity, Schwab, or Vanguard.

- Choosing Investments: They pick the stocks, bonds, or mutual funds inside the account, setting the strategy for its growth.

- Making Contributions: They make sure deposits don't go over the child's earned income for the year or the annual IRA limit—whichever is less.

- Overseeing the Transfer: When the child becomes a legal adult, the custodian helps transfer control, officially handing over the reins.

This role is a fiduciary duty, which is a fancy way of saying every single decision must be made in the child's best interest.

Think of the Roth IRA as a financial greenhouse. The custodian tends to the young plants (investments), protecting them from harsh weather (taxes) and ensuring they get the right nutrients (sound investment choices) to flourish. Inside this greenhouse, growth happens tax-free, allowing the investments to compound into something truly substantial over time.

The Future of Early Savings: The Trump Account

While Roth IRAs have been available for kids with earned income since 1998, a big change is on the horizon that will make early saving even more accessible. Starting in 2026, the introduction of "Trump Accounts" will mark a significant shift.

These accounts are a new type of tax-advantaged savings vehicle for children under 18 who are U.S. citizens with a Social Security number. For kids born between January 1, 2026, and December 31, 2028, the federal government will kickstart their savings with a one-time $1,000 deposit.

This initiative is designed to create a legacy of compound growth from day one for millions of newborns. You can find more details about the 2026 Roth retirement account changes over on finopsinfo.com. It effectively removes that initial barrier of earned income, jumpstarting a child's financial journey from the moment they are born.

The Power of Compounding Starting Early

The single greatest weapon a young investor has isn't a stock tip or a pile of cash—it's time. Opening a Roth IRA for a kid unleashes the incredible magic of compound interest over a ridiculously long time horizon. We're talking about turning small, early contributions into a potentially massive, tax-free nest egg.

Think of it like a snowball rolling down a very, very long hill. At the top, it’s tiny. But as it rolls, it picks up more snow, getting bigger and faster. Soon, its own size and momentum make it grow exponentially. Money in a Roth IRA works the exact same way: the earnings it generates start generating their own earnings, kicking off a cycle of accelerating growth.

A child who starts investing at 15 has a 50-year head start on someone who waits until they're 65. That enormous runway is the secret sauce that allows even a modest summer job paycheck to multiply like crazy.

The Million-Dollar Snowball Effect

Let's put some real numbers on this. Imagine a 16-year-old earns $4,000 lifeguarding one summer. You help them open a custodial Roth IRA and pop that full amount in. Now, for the sake of the example, let's say no one ever adds another penny to that account.

If that one-time $4,000 investment earns an average of 8% a year (a totally reasonable historical average for the stock market), just watch what happens:

- By age 26 (10 years): It’s already grown to nearly $8,600.

- By age 46 (30 years): It sails past the $40,000 mark.

- By age 66 (50 years): It could be worth over $187,000.

That’s what one summer of work can turn into, all thanks to time and compounding. Now, what if they contribute $4,000 for just three summers in high school? That $12,000 total contribution could balloon to well over half a million dollars by retirement—all of it growing completely tax-free.

More Than Just Retirement Savings

But the power of a Roth IRA for kids goes way beyond that final number. It’s a multi-purpose tool that offers serious flexibility and teaches priceless lessons along the way.

This isn't just about saving for retirement; it's about building financial capability. A Roth IRA gives a child a tangible stake in their own future, transforming abstract concepts like saving and investing into a real, growing asset they can watch and understand.

Let’s dig into the other key advantages that make this account such a game-changer for a young person.

Key Benefits Beyond Compounding

-

Completely Tax-Free Growth: This is the main event. Once money is in a Roth IRA, it grows without getting hit by taxes on dividends or capital gains each year. Better yet, when the child reaches retirement age (59½), all qualified withdrawals—both the original contributions and every single dollar of earnings—are 100% tax-free.

-

Flexibility to Access Contributions: Life happens. One of the best features of a Roth is that the original contributions (the actual money put in) can be pulled out at any time, for any reason, without owing taxes or penalties. If a child contributes $5,000, that same $5,000 can be withdrawn to help with a car or an emergency, acting as a built-in safety net.

-

Penalty-Free Withdrawals for Major Life Events: The rules offer even more wiggle room. Up to $10,000 of earnings can be withdrawn penalty-free to help buy a first home. Funds can also be used for qualified higher education expenses, though it’s often smarter to keep the account growing for retirement if you can.

-

Invaluable Financial Education: This might just be the most important benefit of all. By participating in their own financial future, kids learn about saving, setting goals, market ups and downs, and the power of patience. They aren't just building wealth; they're building financial wisdom. That hands-on experience is an education that will pay dividends for their entire lives.

Opening and Funding Your Grandchild's Account

Alright, let's move from the "why" to the "how." This is where the magic really happens, turning your good intentions into a tangible, growing asset for your grandchild. Setting up a custodial Roth IRA is surprisingly straightforward, and I'll walk you through every step. Think of it as an active partnership in their journey to building wealth.

First things first, you need to decide where to open the account. You're looking for a reputable brokerage firm that offers custodial IRAs, and the good news is, most of the big names have fantastic, low-cost options perfect for a Roth IRA for kids.

Three of the most trusted players in the game are:

- Fidelity: Known for its incredibly user-friendly platform and great research tools. It’s a solid choice whether you're a seasoned investor or just starting out.

- Charles Schwab: Offers a huge range of investment options and top-notch customer support, which is perfect if you appreciate having a little guidance.

- Vanguard: Famous for pioneering low-cost index funds and ETFs. This is often the ideal fit for a long-term, set-it-and-forget-it strategy.

Gathering the Necessary Paperwork

Once you’ve picked a brokerage, it's time to gather the paperwork. The process is a lot like opening any other financial account, but with a small twist since it involves a minor. You'll need information for both the adult custodian (that’s the parent or legal guardian) and the child.

You'll typically need to have this info handy:

- For the Custodian (the Adult): Their full name, date of birth, Social Security number, and a government-issued ID like a driver's license.

- For the Minor (the Grandchild): Their full name, date of birth, and Social Security number.

The brokerage’s online application will guide you through the whole process. Just remember, the custodian is legally on the hook for managing the account until the grandchild reaches the age of majority in their state.

The Rules of Funding the Account

Pay close attention here, because this is the most critical part. A custodial Roth IRA can only be funded with money the child has legitimately earned from a job. The amount you contribute can't be more than what they earned for the year or the annual IRA contribution limit—whichever amount is less.

For 2024, that annual IRA contribution limit is $7,000. So, if your grandchild makes $3,000 mowing lawns over the summer, the most anyone can contribute to their Roth IRA for the year is $3,000. If they have a great year and earn $8,000, their contribution is capped at the $7,000 limit.

Key Takeaway: The money going into the account must be tied to the child's real-world work. Your gift isn't the contribution itself; your gift is what enables the contribution. You're essentially replacing the money they earned, freeing it up to be invested for their future.

A great habit to start is keeping a simple log of their earnings—what they did, who they did it for, and how much they got paid. It provides the proof of income you need and, just as importantly, teaches them a priceless lesson in financial record-keeping.

Creative Gifting Strategies for Grandparents

This is where you, the grandparent, get to be the catalyst. Your financial gift makes it possible for the child to invest their hard-earned cash instead of spending it on the latest video game. A simple holiday check is suddenly transformed into a powerful engine for their future.

Here are a few ideas to make your gift really count:

- The Earnings Match: This one is a classic. Offer to match every dollar they earn from their job, up to the annual IRA limit. It’s a powerful incentive for them to work and save.

- Birthday and Holiday Contributions: Instead of another toy or gift card, give them a check specifically for their "Roth IRA contribution." Frame it as an investment in their dreams, whether that’s a down payment on a home, starting a business, or just having a ridiculously comfortable retirement.

- A "Paycheck for an A" Bonus: Reward their hard work in school with money they can put toward their contribution goal. Just remember, they still need to have earned income from an actual job to make the contribution legitimate.

These strategies make you an active, engaged part of their financial education. You're not just handing over money; you're teaching them about the incredible power of investing.

For more ideas on how to structure these gifts in a tax-smart way, you can learn more about how to gift money tax-free in our detailed guide. By turning your gift into a legacy, you are making one of the most impactful Smart Financial Decisions you possibly can.

How A Teen's Summer Job Can Fuel A Secure Retirement

Abstract concepts like "compound interest" can feel a little fuzzy, but they snap into focus with a real-world example. Let's see how a teenager's summer job can become the launchpad for a secure retirement, turning a few months of work into a lifetime of financial security.

Imagine a 15-year-old who spends their summer working as a lifeguard. They're learning responsibility, gaining work experience, and, most importantly, earning their own money. This earned income is the key that unlocks the power of a Roth IRA for kids.

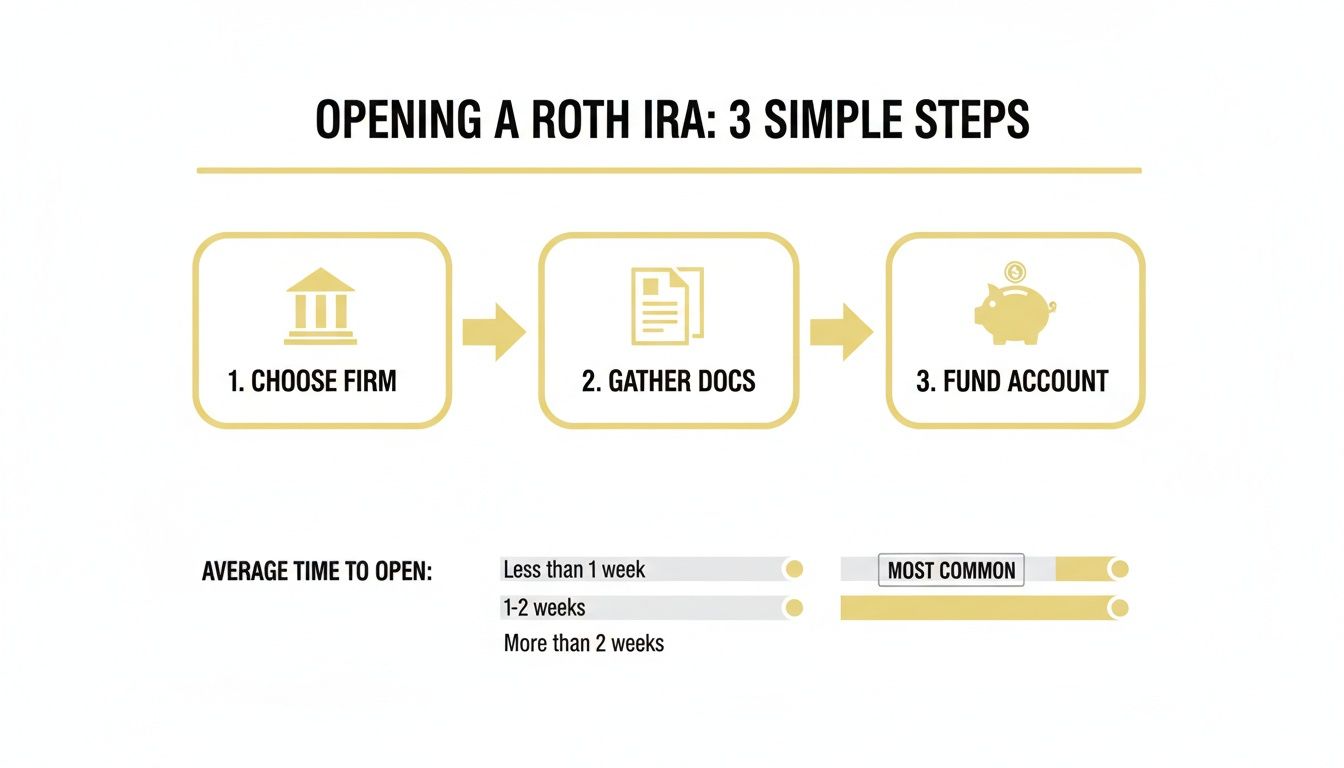

Getting an account started isn't some complicated, drawn-out affair. In fact, it's a pretty manageable process that most families can tackle quickly.

As you can see, it really just boils down to a few straightforward steps.

From Summer Job To Seven Figures

Let's say our 15-year-old lifeguard earns $7,500 in a single summer. Under the current rules, this means they can contribute the full annual Roth IRA limit. The results are staggering, even if they invest that single contribution and never add another dollar.

This isn't just a fantasy scenario; it's a mathematical reality based on historical market performance. Take that $7,500 invested at age 15. Assuming a conservative 7% average annual return, by the time they hit 30, it could balloon to over $30,000. By 50, it could surpass $130,000, and it can approach a mind-boggling $570,000 by retirement age.

The table below breaks down this incredible journey, showing how one summer's work can multiply over and over again.

Growth Of A $7,500 Roth IRA Contribution Over Time

This table illustrates the power of compound interest on a single contribution made at age 15, assuming a 7% average annual return.

| Age | Account Value (Approx.) |

|---|---|

| 15 | $7,500 |

| 30 | $31,689 |

| 45 | $134,161 |

| 60 | $567,975 |

These numbers really drive home the immense impact of starting early. Every single dollar has decades to work, grow, and generate its own earnings—all inside a tax-free environment. This is exactly how small, strategic financial decisions become the bedrock of lasting wealth.

Income Limits And Staying Compliant

Of course, there are a few rules to follow. Roth IRA contributions are subject to income limits, though they're quite high and unlikely to affect a teenager's summer earnings. For 2024, a single filer needs to have a Modified Adjusted Gross Income (MAGI) under $146,000 to make a full contribution.

The most important takeaway is this: the child's earned income is the fuel. Without it, the Roth IRA engine cannot start. Keeping meticulous records of their work—what they did, for whom, and how much they were paid—is non-negotiable.

This documentation serves as proof of eligibility and happens to be a fantastic first lesson in financial discipline. If your teen is looking for ways to generate that initial income, check out our guide on how to make money as a kid for dozens of practical ideas. This early effort is the small seed that grows into a mighty financial oak.

Common Questions About Roth IRAs for Kids

When you start digging into the details of a Roth IRA for kids, a few practical questions always seem to pop up. Let's walk through the most common ones so you can move forward with confidence and make the smartest financial decisions for your family’s legacy.

Each question here tackles a real-world concern, giving you the straightforward info you need.

Does a Child Need to File a Tax Return to Contribute?

Not usually. If your grandchild's total earned income for the year is less than the standard deduction amount, they probably won't need to file a federal tax return.

But—and this is a big but—you absolutely must keep meticulous records of their earnings. A simple logbook or spreadsheet detailing what they did, who paid them, when, and how much is non-negotiable. Think of it as their first business ledger; it’s the proof the IRS needs and a fantastic first lesson in financial discipline.

Can I Open the Account Directly for My Grandchild?

While your generosity is the spark, you typically can't open the custodial account yourself unless you're the child's legal guardian. In nearly all cases, one of the parents has to be the official custodian on the account.

That said, your role as the funder is what makes this all possible. You can gift money to your grandchild or their parent to match the child's earnings, which then gets contributed to the IRA. This approach turns your gift into a collaborative family effort and a powerful legacy investment.

What Happens When My Grandchild Becomes an Adult?

This is the best part—the moment the gift truly becomes their own. Once your grandchild reaches the "age of majority" in their state (usually 18 or 21), full control of the Roth IRA transfers from the custodian to them.

The account is then retitled in their name only. They become the owner, free to manage their investments and make their own future contributions. The foundation you helped pour is now theirs to build upon, giving them a massive head start on their financial goals.

The transfer of control is more than just a legal step; it's a financial rite of passage. The discipline and understanding they gained while you guided them now empower them to be wise stewards of their own wealth.

Can This Money Be Used for College Expenses?

Yes, and this is where the account’s incredible flexibility shines. The original contributions—the money you actually put in—can be withdrawn at any time, for any reason, completely tax-free and penalty-free. So if $6,000 was contributed over a few years, that same $6,000 can be pulled out to help with tuition.

Withdrawing the investment earnings before age 59.5, however, is a different story and may trigger taxes and penalties. While there are some exceptions for higher education, it’s usually best to leave the Roth IRA untouched to preserve that powerful tax-free growth for retirement. For dedicated education savings, you might want to explore a side-by-side strategy. You can see a full breakdown by comparing a 529 vs. Roth IRA in our complete guide, which explains how each account is built for different long-term goals.

At Smart Financial Lifestyle, we believe in making financial decisions that build a lasting legacy. Helping a child start a Roth IRA is one of the most impactful choices you can make, creating a foundation for their future success.