At its core, cash value life insurance is a hybrid product. It blends lifelong financial protection for your family with a savings vehicle that grows over time, giving you a pool of money you can tap into while you're still living. This dual purpose, however, means it's more complex and costs more than a straightforward term life policy.

What Exactly Is Cash Value Life Insurance?

Think about the difference between renting an apartment and owning a home. Term life insurance is like renting—you pay for protection for a set period, and when that term ends, you walk away with nothing but the peace of mind you had along the way.

Cash value life insurance, on the other hand, is much more like owning a home. A piece of every premium payment you make goes toward building equity—your cash value—that grows inside the policy.

This structure turns a life insurance policy from just a safety net into a financial asset you can actually use during your lifetime. The cash value part acts like a tax-deferred savings account, steadily building up over the years. You can borrow against it, use it to cover your premiums, or even surrender the policy to get your hands on the cash.

The Two-Part Structure

Every cash value policy is doing two jobs at once. Part of your premium pays for the insurance itself, guaranteeing a payout—the death benefit—to your loved ones. The rest gets funneled into the cash value account to accumulate.

Heads up, though: in the early years, more of your money goes toward fees and the death benefit cost, so cash value growth can feel painfully slow at first. But over time, that balance shifts, and the power of compounding really starts to kick in.

The central idea is that you're not just paying for a death benefit. You are methodically building a private pool of capital that you control, shielded from market volatility and accessible on your own terms.

This dual-purpose design is the key to understanding both the good and the bad of cash value life insurance. It's also why these policies come in a few different flavors, each built for different goals and comfort levels with risk.

Core Types of Cash Value Policies

While the basic concept is the same across the board, the mechanics can vary quite a bit. Here are the main types you'll run into:

- Whole Life Insurance: This is the old-school, traditional option. It comes with fixed premiums, a guaranteed death benefit, and a cash value that grows at a guaranteed minimum rate. It's predictable.

- Universal Life Insurance: This type offers a lot more flexibility. You can often adjust your premium payments and even the death benefit amount as your life changes. The catch is that its growth is tied to current interest rates, which can fluctuate.

- Variable Life Insurance: With this one, you can invest the cash value portion in sub-accounts that work a lot like mutual funds. This gives you the highest potential for growth, but it also means you're taking on market risk.

Each type offers a different route to building wealth within a life insurance policy. Before we get into the nitty-gritty of the pros and cons, it’s worth taking a step back to figure out whether life insurance is worth it for your family in the first place.

The Pros: Building Your Financial Fortress

When you look past the basic death benefit, one of the most compelling things about cash value life insurance is its ability to work as a quiet, powerful financial engine. It's designed to do more than just provide a payout when you're gone; it’s built to create a living asset that can support your family's goals for generations.

This dual role is what really separates it from simpler insurance products. It's a tool for both protection and accumulation, working behind the scenes to build your financial security brick by brick.

Tax-Deferred Wealth Compounding

One of the cornerstone benefits is how the cash value grows: tax-deferred. This means the money accumulating inside your policy isn’t getting hit with taxes year after year. Think of it like a snowball rolling downhill—it just keeps picking up more snow and getting bigger, faster, because nothing is slowing it down.

Without that annual drag of taxes, your money can compound much more effectively over the long haul. This allows the growth to build on itself, creating a significantly larger asset over decades than you could get in a taxable account with the same returns. It’s a patient, steady approach to building wealth.

For grandparents focused on leaving a legacy, this feature is especially powerful. A policy started early can become a major financial resource, growing steadily right alongside the death benefit. In the U.S., the world's largest life insurance market, whole life policies captured 36% of new premiums in a recent year, easily outpacing term life at just 19%. People lean into these policies for the guarantees and steady growth they offer. You can find more details in the NAIC's mid-year industry commentary.

Accessing Your Money Through Tax-Free Loans

Here’s where things get really interesting. Perhaps the most unique advantage of cash value life insurance is the ability to borrow against your accumulated funds without triggering taxes. A policy loan isn't considered a withdrawal, so the IRS doesn't treat it as taxable income.

This creates an incredibly flexible source of cash. You can get to your money without having to sell off other investments, disrupt your retirement accounts, or fill out a mountain of paperwork at the bank.

A policy loan gives you access to your own capital on your terms. There's no credit check, no nosy questions about what you'll use it for, and no rigid repayment schedule enforced by a lender.

Imagine how this plays out in the real world:

- The Situation: A family needs $40,000 to help their child with a down payment on their first home.

- Without Cash Value: They might have to sell stocks (and pay capital gains taxes) or pull money from their 401(k) (getting hit with both taxes and penalties).

- With Cash Value: They take a tax-free loan from their policy. Their policy's cash value keeps growing and earning interest, and the death benefit stays intact (minus the outstanding loan balance).

This move lets them support their child's dream without derailing their own retirement plans—a perfect example of multigenerational wealth planning in action.

The Power Of Forced Savings And Discipline

Let's be honest, we all intend to save, but life has a way of getting in the way. A major, though often overlooked, benefit of cash value life insurance is the disciplined savings habit it creates. Those structured premium payments act as a commitment device.

Because you’re consistently paying premiums, you are also consistently funding your cash value. This "forced savings" mechanism ensures you are building equity, month after month, year after year. For anyone who finds it tough to stick to a savings plan, this built-in discipline can be the key to hitting some serious long-term financial goals.

Guaranteed Growth And Stability

In a world full of market volatility, guarantees are worth their weight in gold. Many types of cash value policies, particularly whole life, come with a guaranteed minimum growth rate on the cash value. This provides a rock-solid foundation for your financial plan.

This guaranteed return means that no matter what the stock market does, your cash value will continue to grow at its contractually agreed-upon rate. For people who are more risk-averse or are getting closer to retirement, that stability can bring incredible peace of mind.

This feature makes it a reliable asset, much like how other stable financial products can provide predictable income. In fact, if you're exploring ways to create dependable income for life, you might want to check out our guide that helps you stop hating annuities and understand their value. The stability of guaranteed growth creates a financial anchor, shielding a portion of your wealth from those unpredictable market swings.

The Cons: Understanding The Costs And Commitments

While the idea of a life insurance policy that doubles as a savings tool sounds great, it's not all sunshine and rainbows. It’s crucial to take a hard, honest look at the drawbacks of cash value life insurance. Think of it like buying a house—you wouldn't just look at the fancy kitchen; you'd get an inspection to check the foundation.

Ignoring the downsides is a recipe for financial regret. This is a long-term commitment with serious costs and complexities, and you need to be sure it's the right fit for your family. Let's pull back the curtain on the challenges you need to weigh.

The Higher Premium Hurdle

The first thing you’ll notice is the price tag. Premiums for cash value policies are way higher than for term life insurance—we're talking 5 to 15 times more expensive for the same death benefit. That's not a typo. You're paying for two things at once: the pure cost of insurance and the investment component.

This bigger monthly payment can put a real strain on a family's budget. It might mean less money for other critical goals, like funding your 401(k) or saving for college. You have to ask yourself if you can comfortably afford these premiums for decades, without fail.

Here's a simple way to think about it: A term policy is like basic car insurance that just covers you in a crash. A cash value policy is like having that same coverage, but you're also making monthly payments on a new car you'll eventually own. Both are legitimate, but the monthly cost and long-term commitment are worlds apart.

The Slow Pace Of Early Growth

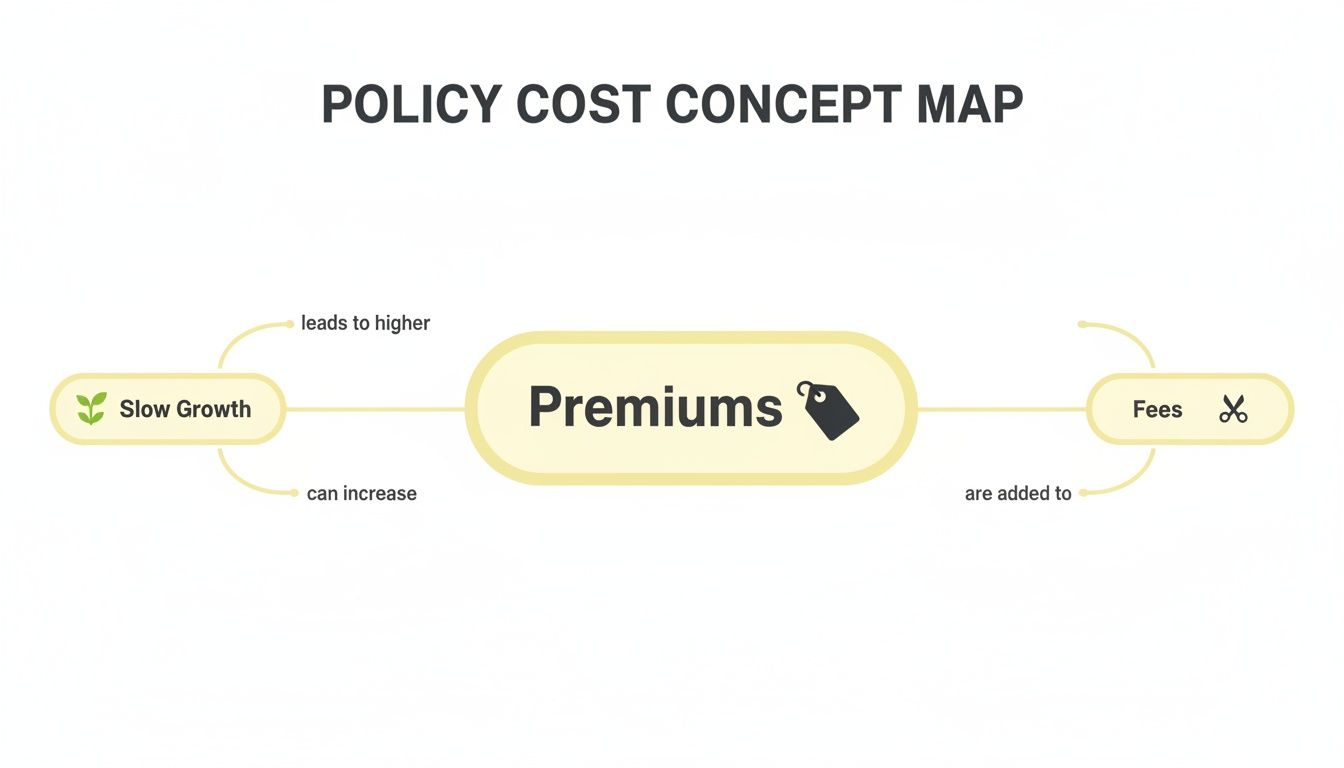

Another reality check: your cash value won't take off like a rocket. It's more of a marathon than a sprint. For the first several years, a big chunk of your premium gets eaten up by agent commissions, administrative fees, and the initial cost of insurance.

Because of these front-loaded costs, your cash value will grow very slowly at the start. It’s totally normal for a policy to have little to no surrender value for the first few years. This slow-burn design is fundamental to the product, which makes it a terrible choice for any short-term savings goals.

Understanding Fees And Surrender Charges

Cash value life insurance comes with a handful of internal costs that can chip away at your returns. These fees aren't always obvious, but they're baked right into the policy's structure.

- Administrative Fees: These are ongoing charges to cover the insurance company's operating costs.

- Cost of Insurance (COI): This is the slice of your premium that pays for the death benefit itself. It usually gets more expensive as you get older.

- Surrender Charges: If you decide to bail on your policy early (often within the first 10-15 years), the insurer will hit you with a hefty surrender charge. It’s basically a penalty for breaking the long-term contract.

Bottom line: if you need to access your money or cancel the policy unexpectedly in the early years, you could end up with a lot less than you paid in.

The Investment Risks Involved

While whole life policies promise guaranteed growth, other types like Variable and Indexed Universal Life bring market risk into the picture. With a variable policy, your cash value is tied to sub-accounts that act like mutual funds. If the market tanks, your cash value can decrease.

This is a deal-breaker for anyone looking for absolute stability. A lot of the appeal for retirees is the policy's reliability, but you have to remember that the underlying investments still carry risk. To generate those returns, insurers have invested heavily in things like private credit, with some estimates showing 45.6% of life insurance portfolios are in private bonds. While this can juice returns, it also introduces liquidity risks you should know about. You can dig into a deeper analysis of these insurer investment strategies from the Chicago Fed if you want to see the mechanics.

At the end of the day, weighing the pros and cons requires matching the policy's structure to your own comfort with risk. These are complex financial products, and you need to fully understand the costs and commitments before you even think about signing on the dotted line.

Exploring Different Types Of Cash Value Policies

Not all cash value policies are created equal. They’re really designed with different financial personalities in mind, so understanding the core types is the first step to figuring out if one makes sense for your family's long-term plan.

Think of it like choosing a vehicle for a cross-country road trip. Some are built for comfort and predictability, while others offer more horsepower and a bit more risk. Let’s look under the hood of the three main engines driving cash value life insurance.

Whole Life Insurance: The Predictable Path

Whole Life insurance is the original, classic model of permanent coverage. It’s built for stability and is perfect for anyone who values guarantees and wants to avoid surprises. With a whole life policy, you lock everything in from day one.

Your premiums are fixed—they will never change for as long as you own the policy. The death benefit is guaranteed, and your cash value grows at a contractually guaranteed minimum rate. Many whole life policies from mutual insurance companies are also eligible for dividends, which can boost your cash value or death benefit, though they aren't guaranteed.

This policy is for the slow-and-steady planner who wants to set it and forget it, knowing exactly what they’ll have decades from now. It’s a foundational tool for legacy planning where predictability is the name of the game.

As you can see, the high initial premiums are a big part of the equation. They have to cover both the insurance costs and fees before the cash value component can begin its slow, steady climb.

Universal Life Insurance: The Flexible Approach

Next up is Universal Life (UL) insurance, which introduces a major dose of flexibility. Life isn’t always a straight line, and UL policies are designed to adapt to its twists and turns.

With universal life, you often have the ability to adjust your premium payments within certain limits. If you have a great financial year, you can pay more into the policy to build cash value faster. If times get tight, you might be able to pay less, using some of the existing cash value to cover the cost of insurance for a while.

The core trade-off with Universal Life is exchanging the iron-clad guarantees of whole life for greater control. It’s a tool for those whose income might fluctuate or who want to be able to tweak their policy as their financial life changes.

The cash value growth in a traditional UL policy is tied to current interest rates, so its performance can be more variable than the fixed rate of a whole life policy.

Variable Life Insurance: The Growth-Oriented Option

For those with a higher tolerance for risk and a longer time horizon, there's Variable Life (VL) insurance. This type puts you in the driver's seat of your policy's investment strategy.

Instead of a fixed or interest-rate-driven growth model, the cash value in a variable policy is invested in sub-accounts. These are essentially mutual funds offered inside the insurance policy, covering everything from stocks to bonds. This structure gives your cash value the potential for much higher, market-driven growth.

Of course, that potential comes with direct market risk. If your chosen investments perform poorly, your cash value—and possibly your death benefit—can go down. This option is best suited for savvy individuals who are comfortable managing investments and understand the risks that come with it.

Comparing The Policy Types

Making a smart financial decision means seeing the options side-by-side. Each of these policies is designed to meet a different need, from guaranteed stability to high-growth potential.

| Policy Type | Premium Flexibility | Growth Potential | Risk Level | Best For |

|---|---|---|---|---|

| Whole Life | None (Fixed) | Low & Guaranteed | Low | Planners who value stability and predictability. |

| Universal Life | High (Adjustable) | Moderate | Moderate | Individuals with fluctuating income needing flexibility. |

| Variable Life | Low to Moderate | High | High | Investors comfortable with market risk for higher returns. |

Choosing the right type is less about which policy is "best" and more about which one fits your personal financial philosophy and long-term goals. Do you prioritize guaranteed outcomes, or are you willing to take on some risk for the possibility of greater rewards? Answering that question is the key to finding the right fit.

Is Cash Value Life Insurance A Smart Move For You?

Figuring out if cash value life insurance belongs in your financial plan is a major decision. After walking through all the pros and cons, one thing is crystal clear: this isn't a product for everyone. Think of it as a highly specialized tool—in the right hands, for the right job, it works beautifully. But for the wrong situation, it can be a clunky, expensive mistake.

So, how do you know if it’s a smart move for you? We have to get practical. This means taking an honest look at your savings habits, your long-term goals, and what you really need your money to accomplish for your family.

Your Personal Decision Checklist

Before you ever sit down with an agent or advisor, spend some time with these questions. Your answers will give you a ton of clarity on whether a cash value policy actually fits your life or if other tools would serve you better.

-

Have I already maxed out other retirement accounts? This is the big one. If you aren't putting the maximum allowed into your 401(k) and a Roth IRA, cash value life insurance probably isn't your next best step. Those accounts are built for more direct investment growth with much lower fees.

-

Do I have a long-term time horizon? Cash value policies are a marathon, not a sprint. They need decades of steady premium payments to really hit their stride and become an efficient financial tool. If you think you'll need access to this money in the next 10-15 years, this is almost certainly the wrong vehicle for you.

-

Do I need a disciplined, forced savings vehicle? Let's be real. If you find it hard to consistently set money aside for the future, the structured nature of paying a premium can be a huge advantage. It creates an automatic system that forces you to build wealth over time.

-

Am I in a high income tax bracket? A huge part of the appeal here is the tax-deferred growth and the ability to access your cash tax-free through loans. These perks deliver the most punch for high-earners who've already used up their traditional retirement account options and are looking for more ways to grow their money efficiently.

-

Is leaving a legacy a primary financial goal? At its core, this is still life insurance. The permanent death benefit guarantees a tax-free payout to your loved ones. If creating that inheritance is a top priority, this feature will align perfectly with your goals. To dive deeper, you can learn about the importance of what a beneficiary designation is and how it locks in your legacy.

Decision Checklist: Is This The Right Tool For Your Family?

This isn't a simple "yes" or "no" decision. It's about matching the right tool to your specific financial situation. Use this checklist to think through the critical factors before moving forward.

| Consideration | Ask Yourself This... | Why It Matters |

|---|---|---|

| Retirement Savings | Have I already maxed out my 401(k) and Roth IRA contributions for the year? | These accounts offer more direct, lower-cost investment growth. Cash value policies are typically for supplemental savings, not primary retirement funding. |

| Time Horizon | Do I have at least 15-20 years before I might need to access the cash value? | These policies take a long time to build significant cash value. Early surrender can result in losses due to high upfront fees and commissions. |

| Financial Discipline | Do I struggle with saving consistently on my own? | The required premium payments can act as a "forced" savings plan, which can be a powerful benefit if you lack the discipline to invest on your own. |

| Tax Situation | Am I in a high tax bracket and looking for additional tax-advantaged growth? | The tax-deferred growth and tax-free loan features are most valuable for those who are trying to minimize their tax burden after exhausting other options. |

| Liquidity Needs | Do I need this money to be easily accessible for emergencies or short-term goals? | Accessing cash value can be slow, and loans come with interest. This is not a substitute for an emergency fund. |

| Legacy Goals | Is guaranteeing a tax-free inheritance for my heirs a top financial priority? | The permanent death benefit is a core feature. If legacy isn't a primary goal, a cheaper term policy might be a better fit. |

Ultimately, a cash value policy makes sense when you've checked most of these boxes—particularly the ones about maxing out other accounts and having a long-term view. If not, there are likely better alternatives.

Real-World Scenario: A Family Steward’s Safety Net

Let's put this into a real-world context. Meet Susan, a 55-year-old small business owner who has been a diligent saver her whole life. Her 401(k) is maxed out, her investment accounts are healthy, but she's anxious about stock market swings and the possibility of higher taxes down the road.

Susan decides to purchase a whole life policy. Fast forward twenty years. Her spouse has a major, unexpected medical emergency. Instead of being forced to sell stocks in a down market and get hit with a hefty capital gains tax bill, she takes a $75,000 tax-free loan against her policy’s cash value.

This loan handles the immediate crisis without wrecking her investment portfolio. She keeps full control of her other assets, her policy's cash value keeps earning its guaranteed interest (and maybe even dividends), and her family's financial security isn't compromised. This is a perfect example of using cash value as your own private source of liquidity.

For the right person, a cash value policy isn't just life insurance; it's a private financial resource that provides stability, liquidity, and control when life throws a curveball.

The Big Debate: Buy Term And Invest The Difference

The most common argument against cash value life insurance is the strategy known as "buy term and invest the difference." The idea is simple: you buy a much cheaper term life insurance policy for pure death benefit protection, then invest the money you saved on premiums into the stock market.

Let's run the numbers for a 40-year-old to see how this might play out:

| Strategy | Monthly Cost | Action | Potential 30-Year Outcome |

|---|---|---|---|

| Cash Value Policy | $800 | Pays premium for a whole life policy with a $500,000 death benefit. | Guaranteed cash value of ~$400,000 and a permanent death benefit. |

| Buy Term & Invest | $50 (Term) + $750 (Invested) | Buys a $500,000 term policy and invests the $750/month difference. | An investment portfolio worth over $1.1 million (assuming an 8% average annual return). |

Looking at the raw numbers, the "buy term and invest" approach often comes out ahead, assuming you actually invest the difference consistently and the market delivers solid returns. But that path doesn't have the guarantees, the tax advantages on accessing the cash, or the forced discipline that comes with a cash value policy. The right choice boils down to your own financial behavior, your priorities, and what helps you sleep at night.

Common Questions About Cash Value Life Insurance

Even after you've weighed the pros and cons, some practical questions usually pop up. This is a complex financial tool, after all, and it’s smart to get every detail straight before you commit. Let's tackle some of the most common questions people ask to help you move forward with confidence.

What Happens If I Can No Longer Afford The Premiums?

This is a totally valid concern, since these policies are a long-term commitment. If you hit a rough patch and can't make a payment, you have several options that don't involve just letting the policy disappear.

Most policies have a built-in feature called an Automatic Premium Loan (APL). If you miss a payment, the insurance company will automatically "loan" the premium amount from your cash value to keep your coverage active. This continues as long as there's enough cash value to cover it.

You can also use accumulated dividends to pay premiums, or in some cases, you can reduce the death benefit to a level that makes your premium more manageable.

The bottom line is you’ve got a safety net. The cash value you've built over the years gives you flexibility, so a temporary financial setback doesn't have to mean losing your policy entirely.

Does A Policy Loan Have To Be Paid Back?

Technically, no. You’re not required to repay a policy loan the way you would a car loan or a mortgage. There are no monthly bills or hits to your credit score if you don't pay it back.

But—and this is a big "but"—you need to understand the consequences. The loan balance racks up interest, which gets added to what you owe. If you pass away with an outstanding loan, the total loan amount (plus all that interest) is simply subtracted from the death benefit paid to your beneficiaries.

It’s a smart move to at least pay the annual interest on the loan. If the loan balance grows so large that it eats up your entire cash value, the policy could lapse. That could create a surprise tax bill and, worse, leave your family without any coverage.

Is The Cash Value Separate From The Death Benefit?

This is probably one of the most misunderstood parts of cash value life insurance. The cash value and the death benefit are not two different pots of money that your family gets.

Think of it this way: the cash value is the portion of the death benefit you have already funded yourself over the years. When you die, your beneficiaries receive the policy's stated death benefit, and the cash value you built up is essentially absorbed back by the insurance company.

Let's break it down with an example:

- Policy Death Benefit: $500,000

- Accumulated Cash Value: $100,000

When you pass away, your family receives the $500,000 death benefit—not $600,000. The insurance company is only really on the hook for the remaining $400,000. This is a fundamental part of how these policies are designed and priced.

Can I Lose Money In A Cash Value Policy?

The answer really depends on the specific type of policy you have.

-

Whole Life Insurance: With a whole life policy, your cash value is contractually guaranteed to grow at a minimum rate. It's impossible to lose money because of a bad day on Wall Street. This makes it the safest, most stable option.

-

Universal Life Insurance: Here, growth is tied to current interest rates. You won't lose your principal due to market drops, but if interest rates are stubbornly low for a long time, your growth could slow to a crawl.

-

Variable Life Insurance: Yes, you can absolutely lose money with this one. Your cash value is invested in sub-accounts that work like mutual funds. If those investments perform poorly, your cash value will go down. This type comes with real investment risk.

Choosing the right policy means being honest with yourself about your risk tolerance. If your top priority is making sure your money is safe, a whole life policy is the only one that completely removes market risk from the equation.

Getting these details right is key to making smart financial decisions. The team at Smart Financial Lifestyle is here to bring the clarity you need to build a secure future for your family. For more insights on creating a financial legacy that lasts, visit us at https://smartfinancialifestyle.com.