The core difference between a Rollover IRA and a Traditional IRA is simpler than you might think: it’s all about where the money came from. A Rollover IRA is just a Traditional IRA that holds funds you’ve moved over from a former employer’s retirement plan, like a 401(k). The "rollover" label just tells the story of how the account was funded, not what it fundamentally is.

Understanding the Core Difference

Think of it like gathering scattered family heirlooms and putting them all into one secure safe. You might have had a few valuable items stored with different relatives (your old 401(k)s). A rollover is simply the act of bringing those items together into a single, well-managed vault—your Rollover IRA. The vault itself is a standard safe; the "rollover" part of its name just explains how those heirlooms got there.

This is a crucial distinction because it clears up a lot of confusion. You don't go out and open a special "Rollover IRA" account. Instead, you open a standard Traditional IRA and fund it by directly transferring—or "rolling over"—money from a 401(k), 403(b), or another workplace retirement plan. Once the funds are in, the account operates under the exact same rules as any other Traditional IRA.

Key Functional Similarities

At their heart, both accounts share the same DNA. This means they're governed by the same IRS regulations when it comes to the important stuff:

- Tax Treatment: Contributions are generally tax-deductible, and your investments get to grow tax-deferred. You only pay income taxes when you pull the money out in retirement.

- Contribution Limits: The annual amount you can put in is the same for both. For 2024, that limit is $7,000 (or $8,000 if you're age 50 or over).

- Withdrawal Rules: You typically need to wait until age 59½ to take money out without facing a 10% early withdrawal penalty. Required Minimum Distributions (RMDs) usually kick in at age 73.

The question of whether you should have multiple retirement accounts often comes up here. A rollover is a fantastic tool for consolidation, but there can be strategic reasons to keep certain accounts separate.

Quick Comparison Table

| Feature | Traditional IRA | Rollover IRA |

|---|---|---|

| Account Type | Individual Retirement Arrangement | A Traditional IRA funded by a rollover |

| Primary Funding | Annual contributions from personal income | Funds transferred from an employer plan |

| Tax Growth | Tax-Deferred | Tax-Deferred |

| Annual Limits | Subject to IRS annual contribution limits | Same annual limits apply for any new money |

With over 50 years of experience, Paul Mauro emphasizes that viewing a rollover as a consolidation strategy is key. It's not about choosing a different type of account, but about making a smart administrative move to centralize your assets for better control and clarity.

Comparing the Core Mechanics and Rules

When you look past the names, the operational playbook for a Rollover IRA and a Traditional IRA is identical. The "rollover" designation is a label of origin, not a signal of different rules or mechanics.

Once funds from an old 401(k) land in a Traditional IRA, that account behaves exactly like one funded with annual contributions. This alignment is a source of relief for many, especially those simplifying their financial lives. You don't need to learn a new set of regulations.

The Shared Foundation of Tax-Deferred Growth

Both accounts are powerful tools for building wealth, primarily because they offer tax-deferred growth. This means your investments—stocks, bonds, mutual funds—can grow over time without being eroded by annual taxes on dividends or capital gains.

Think of it as planting a tree in a protected greenhouse. Inside, it can grow taller and stronger without the harsh weather of annual taxation slowing it down. You only pay taxes on the "harvest" when you begin taking distributions in retirement, allowing decades of uninterrupted compounding to work in your favor.

This shared feature is central to the long-term strategy of using either account. It ensures that more of your money stays invested and working for you, which is a key principle for building a secure retirement.

Contribution Limits: A Point of Clarification

A common point of confusion in the Rollover IRA vs. Traditional IRA discussion is how contribution limits work. It's simple: the act of rolling over money does not count toward your annual IRA contribution limit.

You could roll over $250,000 from an old 401(k) and, in the same year, still contribute the maximum annual amount to that same IRA. For 2024, the IRS allows you to contribute up to $7,000, with an additional $1,000 catch-up contribution if you are age 50 or older.

- Rollover Amount: This is a transfer of existing retirement assets. It is not considered a new contribution and has no limit.

- Annual Contribution: This is new money you are adding to your retirement savings. It is subject to the strict annual limits set by the IRS.

This distinction is important for those who are still actively saving. A rollover consolidates past savings, while annual contributions build future wealth. Your Rollover IRA can accept both.

Required Minimum Distributions (RMDs)

Another area where both accounts march in lockstep is with Required Minimum Distributions, or RMDs. The IRS requires you to start taking withdrawals from your tax-deferred retirement accounts to ensure taxes are eventually paid.

Currently, RMDs must begin once you reach age 73. The amount you must withdraw each year is calculated by the IRS based on your account balance and life expectancy. This rule applies equally to a standard Traditional IRA and a Rollover IRA.

The only fundamental difference between a Rollover IRA and a Traditional IRA is the source of the initial funds. One is funded by transferring assets from a workplace plan; the other is funded by direct annual contributions. Operationally, they are one and the same.

This means your withdrawal strategy in retirement will be the same regardless of how the money originally entered the IRA. Planning for RMDs is a critical part of a sustainable retirement income plan, and the rules are consistent across these accounts.

Key Differences at a Glance: Traditional vs Rollover IRA

To make the similarities perfectly clear, let's put them side-by-side. This table really underscores that once the rollover is complete, the account is simply a Traditional IRA with a different origin story.

| Feature | Traditional IRA | Rollover IRA |

|---|---|---|

| Funding Source | Funded with direct annual contributions from your personal savings. | Funded by transferring, or "rolling over," assets from a workplace retirement plan like a 401(k) or 403(b). |

| Primary Use Case | Building retirement savings year by year with new money. | Consolidating old workplace retirement accounts into a single, manageable IRA. |

| Key Consideration | Annual contribution limits are set by the IRS. | The rollover amount itself doesn't count against annual contribution limits. You can still contribute new money up to the limit. |

As you can see, the core rules governing taxes, withdrawals, and growth are identical. The difference is all about how the money gets into the account in the first place. Understanding this parity is the first step toward making a confident decision. You aren't choosing between two complex, competing systems; you're just deciding on the best way to organize your retirement savings.

How Rollovers Can Amplify Your Retirement Savings

Moving your old 401(k) or other employer plan into a Rollover IRA is more than just a bit of financial housekeeping. It’s a strategic decision that can seriously boost your retirement savings. The biggest win? Consolidation. It brings all your scattered retirement funds into one place, giving you a much larger, more manageable account to build from.

This isn't just about tidying up your finances. It's about creating a powerful, centralized nest egg that can better serve you and your family’s legacy.

The Power of Consolidated Balances

A key reason rollovers amplify savings comes down to sheer scale. Think of it like this: a Rollover IRA is just a Traditional IRA that's been funded with money from an old employer plan. Because those plans allow for much bigger contributions, the balances tend to be much larger.

The numbers don't lie. Congressional data shows that IRAs containing rollover funds had median balances of $120,000 and average balances of $384,239—completely dwarfing the figures for traditional IRAs without rollovers. An employer 401(k) lets you put away up to $23,000 in 2024, plus catch-up contributions, which is way more than the $7,000 annual IRA cap. In 2023, the average balance for a Traditional IRA holding rollover money was $294,900, compared to just $137,600 for those without. For families juggling everything from elder care to college funds, that difference is huge.

"Consolidating your retirement funds through a rollover is one of the most effective organizational steps you can take. It shifts your mindset from managing scattered pieces to directing a unified portfolio, which is where real growth begins."

This consolidation isn't just for neatness; it unlocks strategic advantages. With a larger pool of capital, you suddenly have access to a wider world of investment opportunities and can build a much more cohesive growth strategy.

Unlocking Greater Investment Freedom

One of the best reasons to do a rollover is the incredible expansion of your investment choices. Most 401(k)s offer a pretty limited menu, usually just a handful of mutual funds picked by the plan administrator. A Rollover IRA blows those walls down.

You’re suddenly free to invest in a vast universe of options.

- Individual Stocks: You can invest directly in the companies you believe in, from established blue-chip giants to promising growth stocks.

- Bonds: Choose from a huge variety of government, municipal, and corporate bonds to balance out your portfolio.

- Exchange-Traded Funds (ETFs): Gain access to thousands of ETFs tracking different indexes, sectors, or commodities.

- Real Estate Investment Trusts (REITs): Add real estate to your portfolio without the hassle of being a landlord.

- Alternative Investments: Depending on your brokerage, you might even be able to invest in things like precious metals or private placements.

This freedom lets you build a portfolio that truly reflects your own goals, risk tolerance, and timeline. For those who want to keep building their nest egg, it’s worth exploring how to save for retirement after maxing out a 401(k).

Reducing Fees to Preserve Your Capital

Finally, executing a rollover can be a smart way to cut costs. Employer 401(k) plans often come saddled with administrative fees, record-keeping charges, and investment management fees that silently eat away at your returns. They might look small year-to-year, but over decades, the damage can be substantial.

By rolling your money into a low-cost IRA, you can often slash these fees. Many modern brokerages offer commission-free trading and a huge selection of low-expense-ratio funds. Saving even an extra 0.5% a year can mean tens of thousands of extra dollars in your account by the time you retire. It's a simple move that keeps more of your hard-earned money working for your family's future.

When a Rollover Is the Right Financial Move

Deciding to roll over an old 401(k) isn't about following a universal rule—it’s about what’s happening in your life right now. While a Rollover IRA vs. Traditional IRA function almost identically once the money is in them, the choice to start that rollover is a strategic one. Most of the time, it comes down to wanting more control, simplicity, or better investment options.

By looking at a few real-world situations, you can see how this move lines up with specific goals. Each scenario has its own trigger, but the motivation is always the same: building a more secure and manageable financial future for you and your family.

For the Person Changing Jobs

This is the classic reason for a rollover. Picture this: you’re leaving a company after several years. Your 401(k) has grown into a significant nest egg, but leaving it behind can feel like leaving a piece of your financial life in someone else's hands.

A direct rollover puts you squarely back in the driver's seat. Instead of being stuck with your old employer's plan and its limited menu of investments, you can pull all those hard-earned savings into an IRA that you control completely. This simple move keeps you from collecting a trail of "orphan" 401(k)s from past jobs, which can become a real headache to track over a long career.

- Key Goal: To gain control and consolidate assets for easier management.

- Actionable Insight: Kicking off a direct rollover right after you change jobs makes sure you don't forget about the account and helps you maintain a clear, single picture of your retirement savings.

For the Near-Retiree Seeking Simplicity

As you get closer to retirement, your focus naturally shifts from saving money to spending it wisely. You might have several accounts from a long career—a 401(k), maybe a 403(b), and a couple of old IRAs. Just thinking about managing withdrawals and Required Minimum Distributions (RMDs) from all those different places can be exhausting.

This is where consolidation into a single Rollover IRA makes life so much easier. You’ll have one account to watch, one set of statements to read, and one RMD calculation to worry about each year. Streamlining is a huge step toward creating a predictable retirement income stream and cutting down on administrative busywork. It lets you focus on enjoying retirement, not juggling paperwork. It's also a smart move when looking into how to reduce taxes in retirement, since one consolidated account gives you more strategic withdrawal options.

Paul Mauro often tells his clients that financial simplicity is a form of wealth in retirement. Cutting down the number of accounts you have to manage can dramatically lower your stress and make your income strategy far more effective.

For the Family Steward Managing an Inheritance

Inheriting a retirement account, like a 401(k) from a parent, comes with its own set of very specific rules and deadlines. As a beneficiary, you’ll likely have the option to move those assets into a special "Inherited IRA." This move gives you some clear advantages over just leaving the money in the deceased's old company plan.

An Inherited IRA opens up a much wider world of investment choices and often comes with lower fees. More importantly, it puts you in direct control of the assets, which makes it easier to manage distributions according to the IRS's strict 10-year rule for most non-spouse beneficiaries. For a family steward tasked with managing this legacy, a rollover provides the clarity and control you need to honor the original owner's wishes while navigating a maze of regulations. It ensures the inherited funds are managed thoughtfully for the family's future.

Executing a Seamless Rollover, Step by Step

Initiating a rollover is really just an administrative task, but it’s a critical one for moving your retirement savings safely. The whole point is to get the money from your old plan into your new IRA without it ever hitting your personal bank account.

You have two ways to do this, but one path is dramatically safer and simpler for protecting your nest egg.

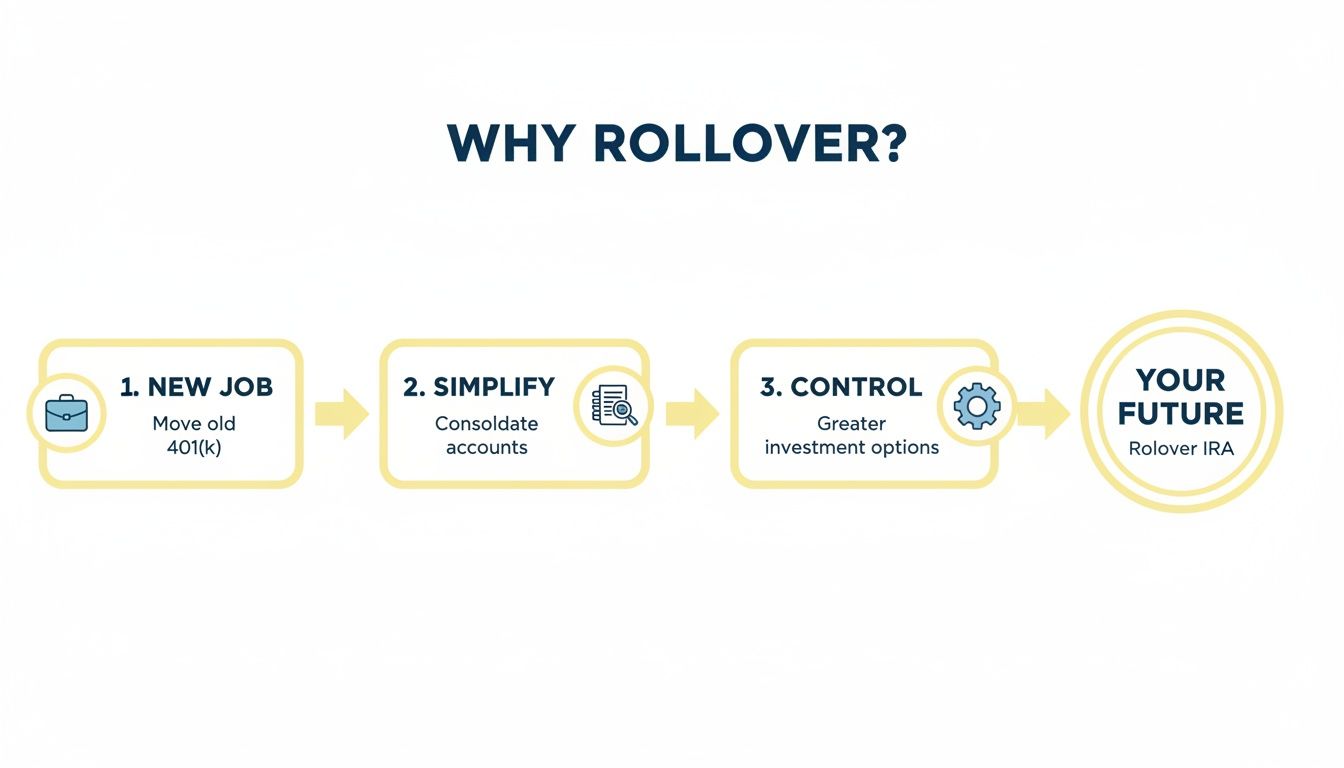

The flowchart below shows you why most people decide to make this move in the first place—maybe it's a new job, or they just want to simplify their finances and get more control over their investments.

As you can see, a rollover is often a strategic response to a major life event. It’s all about consolidating your assets so you can manage them more effectively and help them grow.

The Superior Method: Direct Rollover

A direct rollover is the gold standard for moving retirement funds, plain and simple. In this process, your old 401(k) provider sends the money straight to your new IRA custodian. The funds are transferred from one institution to another without you ever touching them.

This method completely sidesteps any potential tax headaches or penalties. Because the money never lands in your hands, the IRS just sees it as a transfer of assets, not a distribution. It's clean, efficient, and pretty much eliminates the risk of human error.

With over 50 years of experience, Paul Mauro advises that a direct rollover is the only method you should ever consider. It prevents mandatory tax withholding and removes the risk of missing critical deadlines, protecting the integrity of your retirement savings.

The Risky Alternative: Indirect Rollover

An indirect rollover, on the other hand, introduces a whole lot of unnecessary complications and risks. Here, your former employer cuts you a check for your 401(k) balance. But by law, they are required to withhold 20% of the total amount for federal taxes right off the top.

You then have a strict 60-day window to deposit the full original amount into your new IRA. That means you have to come up with that withheld 20% out of your own pocket to complete the rollover. If you fail to deposit the full amount or miss that 60-day deadline, the entire withdrawal can be treated as a taxable distribution and could even be subject to a 10% early withdrawal penalty. It’s a messy, high-stakes game you don't need to play.

A Step-by-Step Guide to a Direct Rollover

To make sure the process is smooth and error-free, just follow these simple steps for a direct rollover. This is the path we’re talking about when we discuss the practical side of the Rollover IRA vs. Traditional IRA decision.

- Open Your New IRA: First things first, open a Traditional IRA with the brokerage firm of your choice. Make sure the account is set up and ready to receive funds before you start the transfer.

- Contact Your Old 401(k) Administrator: Get in touch with the company that manages your old employer's plan. Let them know you want to perform a direct rollover to your new IRA.

- Complete the Necessary Paperwork: You'll need to fill out a distribution request form. Be very clear and specify that you want a direct rollover. You'll also need to provide the account details for your new IRA.

- Confirm the Transfer: The administrator will either mail a check directly to your new custodian or transfer the funds electronically. It’s a good idea to follow up with both institutions to confirm the money has arrived safely in your new account.

By sticking to this direct rollover process, you can consolidate your retirement savings with confidence and ensure a seamless transition without any costly mistakes.

A Simple Checklist for Your Rollover Decision

Trying to decide between a rollover IRA vs. traditional IRA isn't about finding a one-size-fits-all answer. It’s about taking a hard look at your own financial story. The right choice really comes down to your personal goals for simplicity, control, and growth.

To cut through the noise, just walk through these straightforward questions. Your answers will shine a light on whether combining your old retirement plans into a single IRA is the right move for you and your family right now. This isn't just about moving money around; it's about thoughtfully designing a financial future that’s easier to manage and far more powerful.

Questions to Guide Your Decision

Think about where you are today and what you want to accomplish. Each question below gets to the heart of why a rollover can be a smart step toward securing your financial legacy.

-

Are you leaving an employer or switching jobs? If the answer is yes, a rollover is often the most sensible next step. It keeps you from leaving an "orphan" 401(k) behind and puts you in the driver's seat of your retirement savings from day one.

-

Do you have several old 401(k) accounts scattered around? Juggling multiple accounts from past jobs can be a real headache. If you're tired of tracking different statements and investment strategies, consolidating them into one IRA will bring immediate simplicity.

-

Are you looking for more investment choices? Most 401(k) plans give you a pretty limited menu of funds to choose from. A rollover opens up a whole world of stocks, bonds, ETFs, and other assets, giving you the freedom to build a portfolio that truly matches your goals.

-

Do you want to cut down on administrative fees? Old 401(k)s can have hidden fees that slowly eat away at your returns over the years. If your current plan's costs are on the high side, moving to a low-cost IRA can keep more of your hard-earned money working for you.

-

Is making your financial life simpler a top priority? As you get closer to retirement, having fewer accounts makes everything easier—from figuring out RMDs to setting up a reliable income stream. If a streamlined financial life is what you're after, a rollover is a powerful way to get there.

Paul Mauro’s 50+ years of experience really drive home a key truth: The best financial decisions come from knowing yourself. Answering these questions honestly gives you the personal insight you need to act with confidence.

If you answered "yes" to one or more of these questions, that’s a strong sign that starting a rollover is a solid financial move. It's all about taking control to build a secure, organized foundation for the years ahead.

A Few Common Questions I Hear

When navigating the world of retirement accounts, a few specific questions always seem to pop up. Let's tackle some of the most common ones I've heard over the years about the rollover IRA vs. traditional IRA to clear up any confusion and help you manage your savings with confidence.

Can I Still Make Annual Contributions to My Rollover IRA?

Yes, you absolutely can. Think of the "rollover" label as just a description of how the account got its start. Once the funds from your old 401(k) are settled in the new account, it behaves just like any other Traditional IRA.

That means you're free to contribute to it every year, as long as you stay within the annual IRS limits for your age. This is great news because it lets you bring your old retirement savings under one roof and continue to build on that foundation with new contributions, all in the same place.

What Is the Difference Between a Direct and Indirect Rollover?

Understanding this distinction is one of the most critical parts of the process, and getting it wrong can be costly. There are two ways to move your money, and one is far safer for your savings than the other.

- Direct Rollover: This is the clean, simple, and secure way to do it. Your old plan administrator sends the money straight to your new IRA custodian without you ever touching it. This process avoids any automatic tax withholding or the risk of penalties.

- Indirect Rollover: With this method, your old plan cuts you a check directly. The problem? The law requires them to withhold 20% for federal taxes right off the top. You then have 60 days to deposit the entire original amount into a new IRA. To do that, you'll have to come up with that missing 20% from your own pocket and wait for a tax refund to get it back. If you miss that 60-day window, you could face hefty taxes and penalties.

After more than 50 years of guiding families through these decisions, I can tell you that Paul Mauro always, always recommends a direct rollover. It's the simplest way to protect your hard-earned savings and avoid unnecessary risks and headaches.

Are There Protections I Lose When Rolling Over a 401(k)?

This is a fantastic question, and it's something many people overlook. While a Rollover IRA gives you a world of new investment choices, you might be giving up a couple of important protections that come with a 401(k).

First, 401(k) plans fall under a federal law called ERISA, which offers very strong protection from creditors. Protections for IRAs, on the other hand, are determined by state law and can be less comprehensive. It's always a good idea to check your state's specific rules on this.

Second, many 401(k) plans let you take out a loan against your balance, which can be a useful feature in an emergency. That option completely disappears with any type of IRA, including a Rollover IRA. Thinking through these trade-offs is a key part of making a wise decision for you and your family.

At Smart Financial Lifestyle, we're committed to helping you make clear, informed decisions that build a secure legacy for your family. Our approach is grounded in decades of real-world experience, empowering you to navigate complex financial choices with confidence. To learn more about our philosophy, please visit us at https://smartfinancialifestyle.com.