Reducing your capital gains tax bill is about more than just numbers on a form. It involves smart, strategic planning—things like holding assets for more than a year to get those lower long-term rates, using tax-advantaged accounts to your benefit, or even harvesting losses to offset your gains.

You can also explore gifting and estate planning strategies to minimize the tax hit and protect your family’s wealth for the long haul.

A Smarter Approach to Capital Gains Tax Planning

Thinking about capital gains shouldn't just be a dry, technical exercise. For me, it’s a conversation about family and legacy.

When my father-in-law passed away, my wife and her siblings inherited the stock portfolio he’d spent decades carefully building. That initial joy was quickly followed by a really tough question: How in the world do we handle the taxes when we eventually sell? This wasn’t just a financial puzzle; it was an emotional one, tied directly to preserving a lifetime of hard work.

That whole experience drove home a lesson I learned from Paul Mauro over his 50+ years in financial planning: money sends messages. A thoughtful approach to capital gains sends a powerful message of foresight and security. It shows you’re not just building wealth, but you’re also building a shield around it for the next generation.

This guide is designed to shift your perspective—to see tax strategy not as a burden, but as an essential tool for multigenerational planning.

Your Path to Tax Efficiency

We're going to walk through several proven methods to lower your tax obligations. My goal is to give you the knowledge to make intentional, confident decisions that protect what you’ve built.

We'll cover a few core strategies:

- Timing Your Sales: Understanding the huge difference between short-term and long-term gains is the first step.

- Using Tax-Advantaged Accounts: We'll look at how to properly shelter your investments in accounts like IRAs and 401(k)s.

- Strategic Gifting and Estate Planning: This is where you can use powerful tools like the "step-up in basis" to pass on assets efficiently.

- Charitable Giving: You can turn your philanthropic goals into some significant tax-saving opportunities.

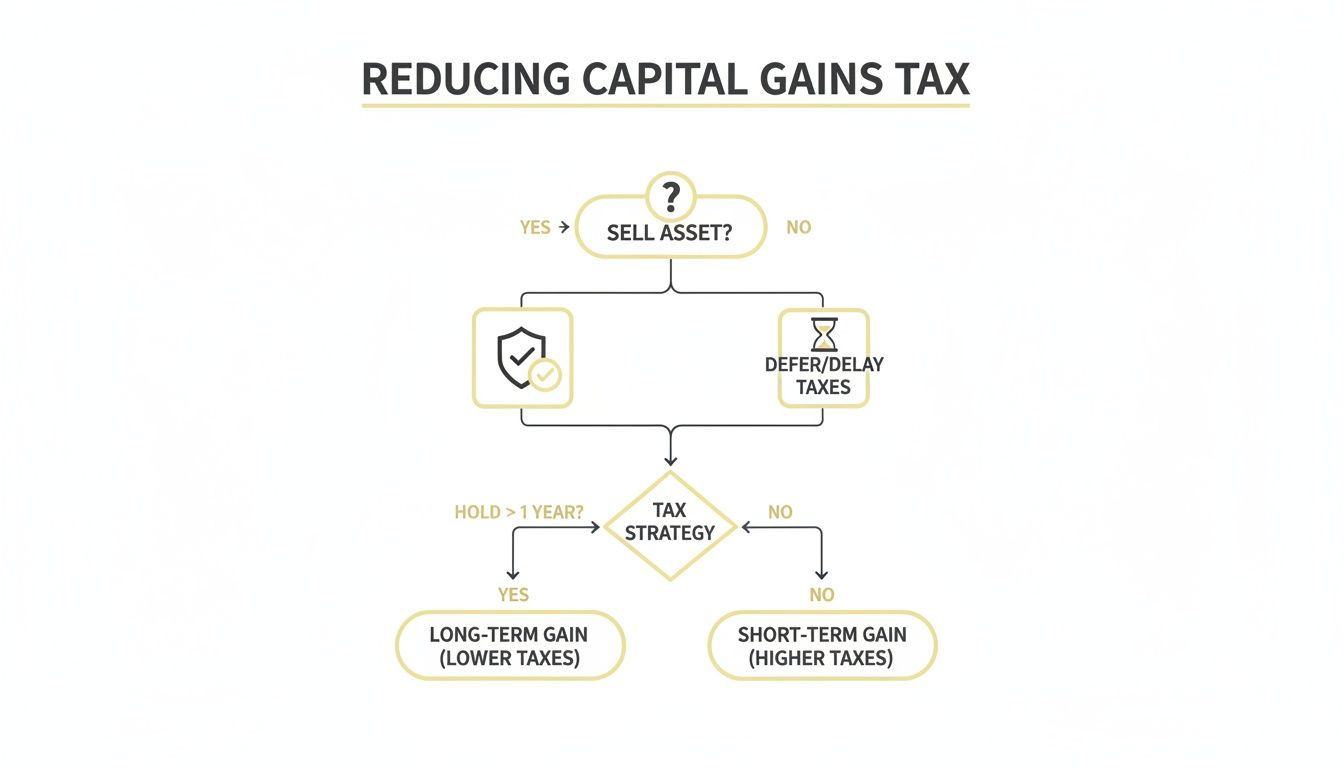

This decision tree gives you a simple visual for the very first question you should ask yourself when thinking about selling an asset.

As the flowchart shows, sometimes the most powerful strategic move is simply to wait. Holding on often opens up far more tax-saving opportunities than selling right away.

Before we dive into the details, here's a quick look at the most effective methods we'll be discussing.

Key Strategies for Reducing Capital Gains Tax at a Glance

This table offers a quick summary of the most effective methods to legally lower your capital gains tax bill, providing a quick overview before diving into the details.

| Strategy | Best For | Key Benefit |

|---|---|---|

| Long-Term Holding | Investors with patience and a timeline of over one year. | Access to significantly lower tax rates (0%, 15%, or 20%). |

| Tax-Loss Harvesting | Investors with a diversified portfolio that has some losses. | Offsetting capital gains with investment losses to lower taxable income. |

| Tax-Advantaged Accounts | Anyone saving for retirement or other long-term goals. | Tax-deferred or tax-free growth, eliminating annual capital gains tax. |

| Gifting & Step-Up in Basis | Individuals focused on legacy and estate planning. | Transferring assets to heirs tax-efficiently, often eliminating gains tax. |

Now, with that foundation in place, let's get into the specifics of how each of these powerful strategies works.

The Power of Patience and Timing Your Asset Sales

In a world that seems to reward speed, one of the most powerful ways to reduce capital gains tax is actually rooted in a timeless virtue: patience. When it comes to your investments, timing isn't just about catching the market's peaks and valleys; it’s a fundamental lever you can pull to dramatically lower your tax bill. The difference between selling an asset after 11 months versus 13 months can literally mean thousands of dollars saved.

This all comes down to the critical distinction between short-term and long-term capital gains. The IRS keeps it simple:

- Short-Term Capital Gains: These are your profits from any asset you’ve held for one year or less.

- Long-Term Capital Gains: These are profits from assets you’ve held for more than one year.

So why does this single day matter so much? Because the tax rates are worlds apart. Short-term gains get taxed at your ordinary income tax rate, which can climb as high as 37%. Long-term gains, on the other hand, enjoy much friendlier rates of 0%, 15%, or 20%, all depending on your taxable income.

Turning Time into a Tax-Saving Tool

Let’s walk through a real-world family scenario. Imagine a grandparent, Sarah, who bought some growth stock ten months ago. Her goal was to help her grandson, Alex, with his college tuition. The stock took off, and she's now sitting on a nice $20,000 gain.

If Sarah sells right now, that $20,000 is a short-term gain. Let's say she’s in the 24% federal income tax bracket. She'd owe $4,800 in taxes, which would leave just $15,200 for Alex’s education fund.

But what if she just waits? By holding on for another two months and a day, her gain officially becomes long-term. This one simple decision completely changes her financial picture.

Paul Mauro often says, "The best financial moves are rarely rushed." Waiting just a little longer allows your holding period to cross that crucial one-year threshold, unlocking a much more favorable tax treatment and preserving more of your hard-earned wealth for the people you care about.

By exercising a bit of patience, Sarah transforms a potentially costly tax event into a strategic financial win. More of her investment’s growth goes exactly where she intended it to go.

How to Potentially Pay Zero Tax on Your Gains

This is where things get really interesting. The most powerful part of the long-term capital gains rules is the 0% tax bracket. This isn't some hidden loophole; it's a feature of the tax code designed to benefit investors at certain income levels. But it requires a bit of proactive planning around your income for the year.

Here’s a look at the 2024 federal income thresholds for long-term capital gains tax rates:

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 0% | Up to $47,025 | Up to $94,050 | Up to $63,000 |

| 15% | $47,026 to $518,900 | $94,051 to $583,750 | $63,001 to $551,350 |

| 20% | Over $518,900 | Over $583,750 | Over $551,350 |

This means that if your total taxable income—including your long-term gains—falls inside that 0% bracket, you could owe nothing in federal tax on those profits. For many families, especially those in retirement or with fluctuating incomes, this is a massive opportunity.

Take a retired couple, for example. They might have a taxable income of $70,000 from pensions and Social Security. They could then sell an asset and realize up to $24,050 in long-term gains ($94,050 - $70,000) and pay $0 in federal capital gains tax on that amount. That’s more than $24,000 they can use for travel, home repairs, or gifting to their grandchildren, completely tax-free. You can find more details by reviewing the official capital gains tax rates.

Thinking about your investment timeline isn’t just about market cycles. It's about strategically aligning your sales with your income to create the best possible tax outcome. This simple act of patience is a cornerstone of how to reduce capital gains tax effectively.

Using Tax-Advantaged Accounts to Shelter Your Gains

Timing your sales is a powerful strategy, but where you hold your investments can be just as important for knocking down your capital gains tax bill. Think of tax-advantaged accounts as a financial greenhouse, protecting your investments from the annual "weather" of taxes and letting them grow bigger and stronger over time.

This strategy shifts the focus from when you sell to where you invest. By using accounts like 401(k)s, IRAs, and others, you can create a powerful shield against capital gains taxes, either putting them off for years or, in some cases, wiping them out completely.

The Power of Tax-Deferred Growth

The magic of traditional retirement accounts like a 401(k) or a Traditional IRA really comes down to one thing: tax-deferred growth. Inside these accounts, you can buy and sell stocks, mutual funds, and other assets all day long without triggering a capital gains tax bill each time a sale happens.

You won't get a Form 1099 for capital gains at the end of the year from these accounts. Instead, your investments get to grow without being slowed down by taxes. You'll only pay tax when you start taking money out in retirement, and at that point, it’s treated as ordinary income.

This lets your money compound much more effectively. Every dollar that would have gone to the IRS stays in your account, working for you and your family's future. It’s a simple concept, but over a long investing career, the difference is absolutely massive.

Roth Accounts for Tax-Free Gains

While traditional accounts are great for deferring taxes, Roth IRAs and Roth 401(k)s take it a step further—they can get rid of capital gains tax altogether on your investments. The catch is that you contribute with after-tax dollars.

But the trade-off is incredible. Your investments grow completely tax-free, and when you take qualified withdrawals in retirement, you pay zero federal tax on all that growth. This means every single dollar of capital gains you’ve earned over the decades is yours to keep.

For families thinking about their legacy, a Roth IRA is one of the most powerful wealth transfer tools available. Beneficiaries who inherit a Roth IRA can often receive a stream of tax-free income, making sure your financial message of care and planning is passed on without a tax bill attached.

Figuring out which account is right for you can be tricky since it depends on your income now versus what you expect it to be in the future. For a deeper look, our guide on pre-tax vs. Roth contributions can help you make a smart call.

Expanding Your Toolkit Beyond Retirement Accounts

Tax-advantaged growth isn't just for retirement savings. A handful of other accounts offer unique benefits that can fit perfectly into a broader family financial plan, helping you slash capital gains taxes in other areas of your life.

Two of the best examples are Health Savings Accounts (HSAs) and 529 Plans.

-

Health Savings Accounts (HSAs): I often call these "triple tax-advantaged" accounts, and for good reason. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. What many people don't realize is that you can invest the funds in an HSA, letting you grow money in stocks and mutual funds without paying capital gains tax. It's a fantastic vehicle for long-term healthcare savings.

-

529 Plans: These accounts are built specifically for education savings. While you might get a state tax deduction on your contributions, their real strength is in the tax-free growth and tax-free withdrawals for qualified education expenses. You can invest the money, and all the capital gains are shielded from federal (and usually state) taxes, as long as the funds are used for things like tuition, books, or room and board.

By strategically placing your investments across these different account types, you can line up your assets with your specific goals—retirement, healthcare, education—while shrinking your tax liability at the same time. This kind of intentional planning is a hallmark of building true, lasting multigenerational wealth.

Strategic Gifting and Estate Planning for Your Legacy

When we talk about financial planning, it's easy to get caught up in accumulation—growing the numbers. But a truly complete strategy looks beyond that, to how you'll one day pass that wealth to the next generation. This is where your financial plan becomes a legacy.

Two of the most powerful tools in your legacy-building kit are strategic gifting and the "step-up in basis." Both are incredibly effective ways to lighten the capital gains tax burden for your family down the road. This isn't just about saving on taxes; it's about protecting what you've worked so hard to build so it can support your loved ones' dreams, not get chipped away by the IRS.

The Annual Gift Tax Exclusion in Action

One of the simplest ways to start transferring wealth is by using the annual gift tax exclusion. It's a fantastic, straightforward tool.

For 2024, you can give up to $18,000 to any single person without even having to file a gift tax return. If you're married, you and your spouse can combine your exclusions to give up to $36,000 to one person. While this is great for cash, it becomes a brilliant capital gains move when you gift appreciated assets, like stocks.

Here's a scenario I see all the time:

Grandparents, let's call them Mark and Susan, bought stock in a tech company years ago for just $5,000. Today, it's soared to $35,000. That's a $30,000 unrealized capital gain just sitting there. They want to help their granddaughter, Emily, who just graduated college, with a down payment on her first home.

If Mark and Susan sell that stock, they're on the hook for capital gains tax on the $30,000 profit. But instead, they gift the stock directly to Emily. The value is under their combined $36,000 annual exclusion, so no gift tax is due.

Now Emily owns the stock. When she sells it for her down payment, she’s the one responsible for the tax. But here's the key: as someone just starting her career, her income is much lower than her grandparents'. She's very likely in the 0% long-term capital gains tax bracket.

By simply gifting the asset, Mark and Susan shifted the tax event to someone in a lower tax bracket, potentially wiping out the tax bill entirely. You can learn more about how to gift money tax-free in our detailed guide.

Understanding the Step-Up in Basis

Gifting during your lifetime is powerful, but the step-up in basis is arguably one of the most significant legacy-preserving tools in the entire tax code. If you're thinking about multigenerational wealth, you absolutely need to understand this concept.

Here’s the breakdown:

- The cost basis is what you originally paid for an asset.

- When you pass away and leave an appreciated asset to an heir, the asset's cost basis gets "stepped up" to its fair market value on the date of your death.

What this does is completely erase the built-in capital gain you accumulated over your lifetime, at least for tax purposes. Your heir inherits the asset as if they bought it that day for its current market price. This allows them to sell it immediately with little to no capital gains tax to worry about.

This single rule is a cornerstone of effective estate planning. It’s the tax code’s way of ensuring that a lifetime of patient investing can be passed on to the next generation without a significant tax penalty, preserving the full value of your legacy.

Let's go back to my father-in-law's portfolio for a real-world example. Decades ago, he bought some shares of stock for $100,000. By the time my wife and her siblings inherited them, those same shares were worth $1.1 million. That’s a $1 million unrealized capital gain.

If he had sold those shares the day before he passed, he would have triggered a massive tax bill. But because the family inherited them, the cost basis was stepped up to $1.1 million.

When they later sold the shares for $1.15 million, they only owed capital gains tax on the $50,000 of growth that happened after they took ownership. The step-up in basis saved them from paying taxes on $1 million in gains—a move that preserved hundreds of thousands of dollars and secured the very legacy he intended to leave behind.

Protecting Your Most Important Asset: Your Home

For most families I work with, their home is more than just four walls and a roof. It’s the centerpiece of their financial world, often their single largest asset. So when it's time to sell—maybe you're downsizing, relocating for a new job, or helping a parent transition into care—the last thing you want is a massive tax bill eating away at that hard-earned equity.

Thankfully, the tax code offers one of its most generous provisions specifically for this moment. It’s called the primary residence exclusion, and it’s a powerful tool designed to protect the gains you’ve built in your home over the years. This lets you turn your home's equity into a tax-free foundation for whatever comes next.

Unpacking the Home Sale Exclusion

The numbers here are significant and can provide immense peace of mind. If you qualify, the IRS lets you shield a huge chunk of your profit from capital gains tax.

Here’s the breakdown:

- An individual filer can exclude up to $250,000 of capital gains.

- A married couple filing a joint return can exclude up to $500,000 of capital gains.

Let that sink in. I’ve seen this play out many times. A couple bought their family home for $200,000 decades ago and sells it today for $650,000. That's a $450,000 gain. Because of the exclusion, they can walk away from that sale paying zero federal capital gains tax on their profit. It's an incredibly valuable benefit that directly supports families during major life transitions.

With home values soaring in recent years, this provision saves families tens of thousands of dollars. A couple excluding the full $500,000 could dodge a federal tax bill of $75,000 at a 15% tax rate. This is one of the most direct and impactful ways to reduce your tax burden when dealing with real estate.

Meeting the Key Requirements

Now, to claim this fantastic benefit, the IRS has two main tests you have to pass. It’s often called the "two out of five years" rule, and it’s there to make sure this tax break goes to actual homeowners, not real estate investors flipping properties.

1. The Ownership Test: You must have owned the home for at least two of the last five years leading up to the sale date.

2. The Use Test: You must have lived in the home as your primary residence for at least two of those same five years.

The good news is that these two years don't have to be continuous. For instance, you could live in the home for a year, rent it out for two years, and then move back in for another year before selling. You'd still meet the use test.

I always tell my clients that this rule has some built-in flexibility. Paul Mauro often emphasizes this point, too. It recognizes that life happens—you might take a temporary job in another city or move to care for a relative—without you automatically losing this significant tax benefit.

Think about a common scenario: a family steward is helping her mother sell the home she's lived in for 40 years to move into an assisted living facility. Her mother clearly meets both the ownership and use tests. This allows for a smooth, tax-efficient sale that preserves the home's equity to help fund her ongoing care.

What If You Don't Meet the Full Two Years?

Life can throw curveballs that force a sale before you meet the full two-year requirement. If you have to move for a new job, for health reasons, or because of other unforeseen circumstances, you might still be able to claim a partial exclusion.

Instead of the full $250,000 or $500,000, you could get a prorated amount. Let’s say you're a single individual who lived in your home for just one year (50% of the two-year requirement) before a job transfer made you sell. You could potentially exclude up to $125,000 (50% of the $250,000) of your gain.

This provision acts as a safety net, ensuring you aren't unfairly penalized for circumstances beyond your control. It's a way the tax code protects a portion of your home's value even when plans change.

Advanced Strategies and Final Considerations

Once you’ve got the fundamentals down, it's worth looking at some more specialized tools. These aren’t for everyone, of course, but knowing they exist opens up a deeper conversation with your financial advisor about how to really fine-tune your approach to capital gains.

One of the most powerful techniques is something called tax-loss harvesting. It sounds complicated, but the idea is simple. You sell investments that have lost value, which creates a capital loss on paper. You then use that loss to cancel out capital gains you’ve made elsewhere in your portfolio. It’s a smart way to find a silver lining when the market takes a dip, effectively lowering your overall tax bill for the year.

And for those of us with significant real estate holdings, a whole other set of tools comes into play.

Specialized Real Estate Strategies

Real estate investors have some unique opportunities to defer or reduce taxes. These definitely require careful planning and professional guidance, but the payoff can be massive.

- 1031 Exchange: This lets you sell an investment property and roll the proceeds directly into a new, "like-kind" property, kicking the capital gains tax down the road. It’s a fantastic way to upgrade or reposition your portfolio without taking an immediate tax hit.

- Opportunity Zones: By investing your capital gains into a Qualified Opportunity Fund, you can get some really significant tax breaks. This includes deferring the tax and potentially eliminating it entirely on the new investment, provided you hold it for at least 10 years.

These aren't simple moves—they come with strict rules and tight deadlines—but they're a perfect example of how proactive planning can protect and grow your assets.

The most effective financial plan is one that evolves with you. As your portfolio grows and your family’s needs change, your strategies for managing capital gains tax should adapt as well. This is not a set-it-and-forget-it exercise but an ongoing conversation.

For instance, trusts can play a huge role in more sophisticated estate and tax planning. They give you control over how your assets are distributed long after you're gone and can unlock tax advantages that go way beyond simple gifting. If you're curious, you can learn more about what a grantor trust is and see how it might fit into a larger strategy.

Your Path Forward

My goal here was never to turn you into a tax expert overnight. It was to give you the knowledge and perspective to feel confident about your financial decisions.

We’ve covered everything from the power of patience in timing your sales to the legacy-preserving magic of the step-up in basis. Think of each strategy as a tool in your belt—one you can pull out to build a more secure financial future for your family.

Now, you can walk into a meeting with your advisor not just with questions, but with ideas. You're equipped to build a plan that sends a clear message of foresight and care to the next generation.

Frequently Asked Questions About Capital Gains Tax

When we talk about reducing capital gains taxes, a lot of the same questions tend to pop up. It makes sense—this stuff can get complicated. Let's walk through some of the most common questions my clients ask when we're mapping out their family's financial future.

Can I Avoid Capital Gains Tax If I Reinvest?

This is probably the number one misconception I hear. People assume that if they sell a stock and immediately buy another one, they're off the hook for taxes. Unfortunately, it doesn't work that way.

The moment you sell an appreciated asset—whether it's a stock, a mutual fund, or something else—you've triggered a taxable event. The gain is considered "realized" at that point, and the IRS wants its cut, regardless of what you do with the money next.

The big exception here is in real estate, with something called a 1031 exchange. This is a powerful tool that lets you sell an investment property and roll the proceeds into a new, "like-kind" property, deferring the capital gains tax. It doesn't erase the tax bill forever, but it kicks the can down the road, which can be a huge strategic advantage.

What Is the Difference Between Realized and Unrealized Gains?

Understanding this distinction is absolutely fundamental to smart tax planning. It’s simple, but it’s everything.

-

An unrealized gain is just a "paper profit." Let's say you bought some stock for $100 and now it's trading at $150. You have a $50 unrealized gain. As long as you hold onto that stock, you don't owe any tax on that growth.

-

A realized gain is what happens the second you hit the "sell" button. When you sell that stock for $150, your $50 gain becomes real, and it officially lands on your tax return for that year.

The real power here is that you control the timing. By choosing when to sell, you decide when to pay the tax. This is the whole idea behind long-term investing—letting your assets grow year after year without taking an annual tax hit.

Do I Pay Capital Gains on an Inherited Home?

This is a huge relief for many families: usually, you don't. Thanks to a provision in the tax code called the step-up in basis, the value of inherited assets gets adjusted to their fair market value on the date of the original owner's death.

Here’s a real-world example. Say your parents bought their home decades ago for $100,000. By the time you inherit it, it's worth $600,000. Your new cost basis isn't what they paid; it's the current market value of $600,000.

If you turn around and sell the house immediately for that price, your taxable gain is zero. You owe nothing. It's one of the most significant wealth transfer tools available, and it’s a cornerstone of multigenerational planning.

At Smart Financial Lifestyle, we believe that understanding these details is the first step toward building a secure financial legacy for your family. Explore more strategies and insights at https://smartfinancialifestyle.com to make confident, informed decisions.