Dreaming about leaving the 9-to-5 behind before you hit 60 is one thing, but making it happen requires a real, actionable roadmap—not just wishful thinking. The old rules don't always apply anymore. A modern approach has to account for a constantly shifting economy, and it's not just about you; it’s about multigenerational well-being, legacy, and long-term security for your entire family.

This is your starting point for building a future where financial freedom isn't just a dream, but a reality you can touch.

The New Reality of Early Retirement Planning

The desire to leave the workforce early is more popular than ever, but let's be honest—the path to get there has gotten a lot more complicated. Traditional retirement timelines are being put to the test by economic uncertainty, inflation, and the simple fact that we're living longer. This isn't a reason to give up on the goal, but it is a wake-up call to get smarter and more resilient with your strategy.

Today’s early retirement plan has to be more than a savings calculator. It's a full-blown family strategy that thinks about the bigger picture:

- Multigenerational Needs: How will your plan support not just your future, but also your kids' ambitions and the potential needs of aging parents?

- Economic Headwinds: What moves can you make to shield your nest egg from market swings and the rising cost of, well, everything?

- A Redefined Purpose: What are you going to do all day without a career to fill your time? True fulfillment comes from planning for your time, not just your money.

Shifting Timelines and Growing Caution

The data backs this up. People are getting more realistic, and the goal of retiring before 65 is becoming a little less common as families adjust their expectations.

The Global Retirement Reality Report found an 8% drop in people planning to retire before 65. Meanwhile, those targeting their late 60s and even 70s has actually increased. With all the market volatility, 33% of folks have decided to retire later, and another 30% are now looking at partial retirement instead. You can dig into more of these trends in the full report from State Street Global Advisors.

This shift highlights something crucial: successful early retirement isn't about hitting a magic number and just walking away. It’s about building a flexible financial foundation that can bend without breaking. A smart plan accepts these new realities and builds in backup plans so your family’s security isn’t left up to chance.

From Aspiration to Actionable Plan

So how do you get from a vague dream to a concrete plan? It starts with asking the right questions and having honest conversations with your partner and kids about what a happy, fulfilling life looks like for everyone. When you do that, your financial decisions start to connect with your deepest values.

That’s exactly what this guide is designed to help you do. We're going to move past the wishful thinking and lay out a clear roadmap. We'll show you how to make smart financial moves that can turn your family’s vision for early retirement into something tangible and, most importantly, achievable.

Your journey toward financial independence starts now.

Defining Your Family's Early Retirement Vision

Before we even touch a calculator or talk about a single investment, the journey to planning to retire early kicks off with a far more important question: Why?

When you answer this as a family, a dry financial target transforms into a shared, living vision. This vision becomes the fuel that keeps you going when the path gets tough.

Without a clear picture of what you're working toward, "early retirement" is just a vague, distant concept. A powerful, shared vision, however, acts as your North Star. It guides every single decision, from how you spend your weekends to how aggressively you stash away savings. It’s the difference between saving for some abstract future and actively building a specific, exciting new chapter of your life.

This first conversation isn't about spreadsheets; it's about dreaming together and making sure everyone's hopes are woven into the fabric of your family’s future.

Moving Beyond the Financial Numbers

Too many families jump straight into calculating their "number." That’s putting the cart way before the horse. The real goal isn't a specific account balance—it's the lifestyle that balance makes possible. What does a fantastic early retirement actually look like for you and your loved ones?

Get started by scheduling a family meeting. Make it fun and low-pressure, not a chore. The whole point is to dream together and get really specific about what "freedom" means to each of you. This conversation is what connects your money to what truly matters in life: security, purpose, and genuine peace of mind.

A financial plan without a life vision is like a map without a destination. Knowing your "why" gives every financial sacrifice a purpose and turns the hard work of saving into a joyful pursuit of a shared dream.

This shared understanding becomes the emotional bedrock for your journey, especially when you face challenges or have to make difficult financial choices.

Key Questions to Spark the Conversation

To build this shared vision, you have to ask the right questions. These prompts are designed to get you past generic answers and uncover what a fulfilling, post-career life really means for your family.

Here are some crucial topics to get you started:

- Daily Life and Passions: What does an ideal Tuesday look like when you're no longer working? Will you travel the world, volunteer locally, start that passion project you've always talked about, or simply spend more time with the grandkids?

- Family Commitments: How do you envision supporting your children’s goals, like helping with college or a down payment on a home? What role will you play in supporting aging parents, both financially and with your time?

- Health and Well-being: What activities will keep you healthy and engaged? This could be anything from joining a hiking club and hitting the trails to finally taking those gourmet cooking classes.

- Location and Lifestyle: Are you staying put in your current home? Downsizing? Or maybe even moving to a new city or country altogether? Think about how that choice impacts your budget and your social life.

Answering these questions honestly creates a detailed blueprint. For instance, a vision packed with international travel is going to need a very different financial strategy than one centered on local community involvement and gardening.

By defining these details now, you ensure your financial plan is built to support the life you actually want to live—not just some generic idea of retirement. This clarity is the foundation of any successful plan.

To help you get this conversation rolling, we've put together a checklist. Use this as a guide during your family meeting to make sure you cover the big stuff and get everyone's dreams on the table.

Early Retirement Vision Clarification Checklist

| Life Area | Key Questions to Discuss | Our Family's Vision |

|---|---|---|

| Daily Activities & Hobbies | What will we do every day? Will we pursue hobbies, travel, volunteer, or start a business? How much time will we dedicate to leisure versus structured activities? | |

| Location & Housing | Where will we live? Will we stay in our current home, downsize, or move? Do we want a second home or an RV for travel? | |

| Family & Relationships | How will we support children/grandchildren (e.g., college, weddings)? What role will we play in caring for aging parents? How will we stay connected with friends and family? | |

| Health & Wellness | What are our health goals? What activities will keep us active (e.g., gym, hiking, yoga)? How will we manage healthcare costs and insurance before Medicare? | |

| Travel & Exploration | How often and where do we want to travel? What's our travel style (e.g., budget backpacking, luxury resorts)? What's on our bucket list? | |

| Personal Growth & Purpose | What new skills do we want to learn? Is there a cause we want to dedicate time to? What will give us a sense of purpose and fulfillment outside of work? | |

| Financial Legacy | What financial legacy do we want to leave for our children or charities? How important is leaving a large inheritance versus spending our resources? |

Working through these questions together will give you a tangible, emotional connection to your financial goals. It turns a number on a page into a vibrant picture of your future, making the entire process more meaningful and achievable.

Figuring Out Your Financial Independence Number

Alright, with your family's big-picture vision in place, it’s time to get down to brass tacks and put a real number on those dreams. This is where we take the idea of retiring early and turn it from a fuzzy goal into a concrete financial target. This magic number is often called your Financial Independence (FI) number—it's the total amount you need invested to live off the returns for good.

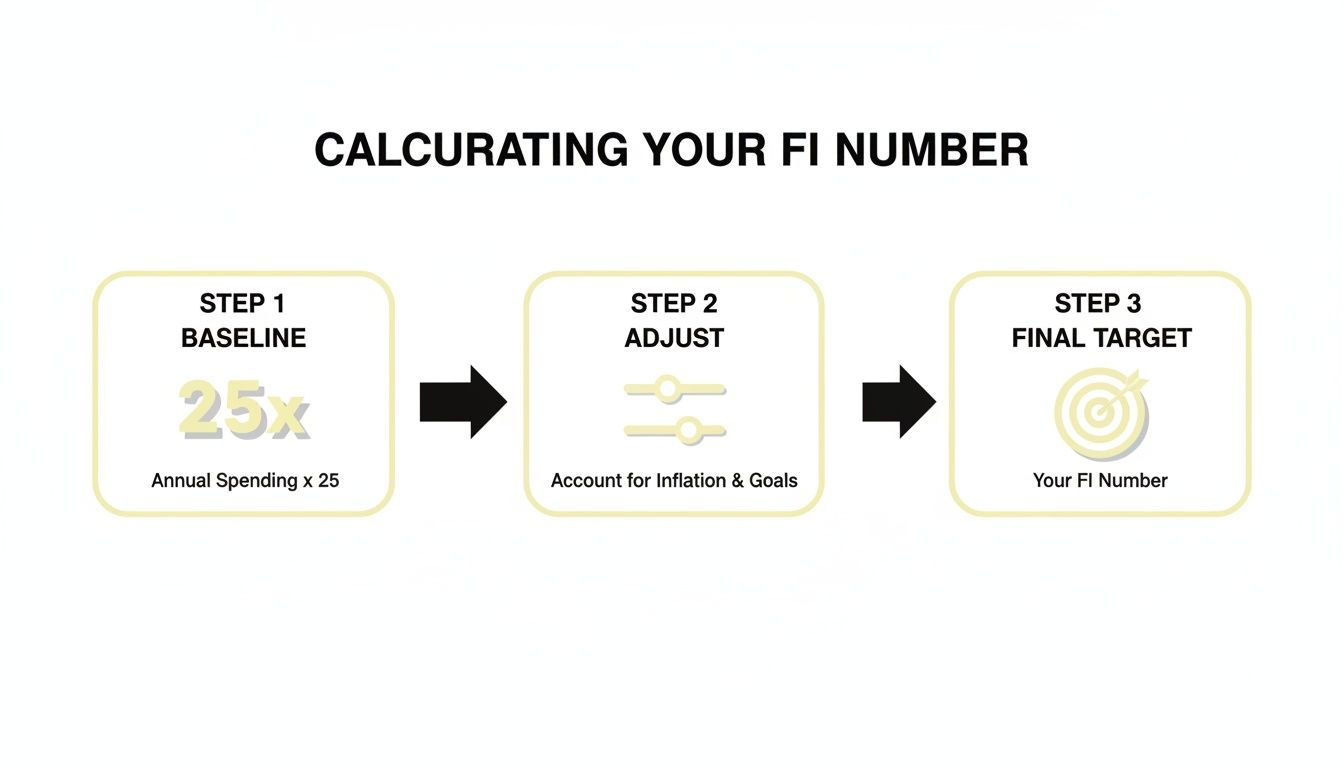

A great place to kick things off is the "Rule of 25." It’s a simple but surprisingly powerful guideline. You just multiply your estimated annual retirement expenses by 25. The logic behind this comes from the well-known 4% safe withdrawal rate, which suggests you can pull 4% from your portfolio every year without running out of money over a long retirement.

Let's say your family figures you'll need $80,000 a year to live comfortably. Based on the Rule of 25, your FI number would be $2,000,000 ($80,000 x 25). It’s a fantastic baseline to get your head around the scale of things, but it's just that—a starting point. For families, especially those staring down a very long early retirement, we need to get a bit more granular.

Moving Beyond the Basic Formula

The Rule of 25 is a brilliant back-of-the-napkin calculation, but it doesn't really factor in the messy, unpredictable realities families face over a retirement that could last decades. To build a plan that won't crumble under pressure, you have to dig deeper and stress-test your numbers.

Your FI number needs to be tough enough to handle whatever life throws at it. It’s not just about a simple expense multiplier; it’s about layering in the big, often unexpected costs that can pop up over 30, 40, or even 50 years. This is exactly where a generic calculator falls short and a personalized, family-first approach becomes absolutely essential.

A true Financial Independence number isn't just about covering today's bills. It's about building a financial fortress that can withstand the tests of time, inflation, and unexpected family needs, ensuring your peace of mind for decades to come.

Accounting for Major Future Expenses

When you're planning to hang it up early, you're not just budgeting for groceries and the electric bill. You have to prepare for massive life events and rising costs that traditional retirement plans often gloss over. The simple truth is that the cost of living doesn't sit still.

A recent Goldman Sachs survey really drives this home, revealing that essential expenses have blown past wage growth since 2000. Think about this: the cost of home ownership as a slice of after-tax income has shot up from 33% to 51%, and college expenses have exploded from 65% to 85%. As you fine-tune your FI number, you can't ignore these trends. You can see the details for yourself in the full retirement survey findings.

Here are the big-ticket items you need to project and bake into your calculations:

- Healthcare and Long-Term Care: This is the giant unknown for most people. Before Medicare is an option at 65, you'll be on the hook for private health insurance, likely through the ACA marketplace. Even more critical, you need a plan for the staggering potential costs of long-term care—not just for you, but possibly for your aging parents, too. These costs can easily climb into the six figures each year.

- College Tuition: Got kids? Funding their education is a huge financial hurdle. Are you planning to cover the full ride at a private university, pay for a state school, or just contribute a fixed amount? The answer can swing your FI number by hundreds of thousands of dollars.

- Supporting Aging Parents: Many of us find ourselves in the "sandwich generation," juggling the needs of our kids and our parents. Will you need to provide financial help, or will you contribute your time? Both have real financial implications that need to be part of the plan.

- Lifestyle Inflation and Hobbies: Your dream retirement probably involves some fun stuff—travel, hobbies, new adventures. Get real about what these things cost. A vision that includes three months of international travel every year demands a much bigger nest egg than one centered on local volunteering.

Refining Your Target with a Realistic Withdrawal Rate

Once you've got a much clearer picture of your future expenses, it’s time to circle back to that withdrawal rate. While 4% is the classic benchmark, a lot of early retirees play it safer, opting for a more conservative rate between 3% and 3.5%.

Why? A lower withdrawal rate gives you a much bigger cushion against a market downturn, especially right after you retire. This is what the experts call sequence of returns risk, and it can seriously derail a new retiree's plan.

Picking the right withdrawal rate is one of the most important decisions you'll make. To really get a feel for how different rates would play out for your family, you need a tool built for the job. You can get a better handle on your ideal percentage by using a retirement withdrawal rate calculator to model different outcomes.

This whole process—starting with the Rule of 25, layering in future family costs, and choosing a smart, conservative withdrawal rate—is what turns a rough guess into a reliable, personalized FI number. That's the real target that will anchor your entire early retirement strategy.

Building Your Aggressive Savings and Investment Strategy

Alright, you've got your family's Financial Independence (FI) number locked in. Now comes the fun part: building the powerful financial engine that will actually get you there. This is where the spreadsheets and dreams turn into real, tangible action.

An aggressive savings and investment strategy is the heart and soul of any early retirement plan. It’s a two-pronged attack. First, you dramatically ramp up how much you save. Second, you make sure those savings are working just as hard as you are. This isn’t about pinching pennies until they scream; it's about making deliberate, strategic choices that line up your spending with your family's biggest goals.

Forging an Aggressive Savings Rate

If you want to retire ahead of schedule, the typical 10-15% savings rate just isn't going to cut it. Not even close. Families serious about early retirement are often aiming to save 20%, 30%, or even 50% or more of their after-tax income.

That number might make you a little dizzy, but it's more achievable than you think. It comes down to a mix of smart expense management and finding ways to boost your income.

The first step is to track every dollar for a couple of months. You need to know exactly where your money is going before you can tell it where to go instead. Once you have a clear picture, you can hunt for the "big wins"—your housing, transportation, and food costs. Trimming these major expenses frees up way more cash than skipping your morning latte ever will.

One of the best tricks in the book is to immediately save any new money that comes your way.

- Salary Increases: Got a raise? Don't even let that extra cash hit your checking account. Automate a transfer to your investment account before you get used to a bigger paycheck.

- Bonuses or Windfalls: Treat these as pure rocket fuel for your savings. A single bonus, invested wisely instead of spent on a vacation, can shave months or even years off your timeline.

This is how you sidestep "lifestyle inflation"—that sneaky habit where your spending grows right alongside your income, keeping you stuck on the financial treadmill.

Building Your Investment Portfolio

Saving is only half the battle. You have to invest that money so it can grow and compound its way toward your FI number. For most families chasing early retirement, a portfolio built on a foundation of low-cost, diversified index funds and exchange-traded funds (ETFs) is the gold standard.

These funds give you a slice of the entire market without the high fees that come with actively managed funds, which can seriously drag down your returns over the long haul. Your asset allocation—the mix of stocks and bonds in your portfolio—should be tailored to your family's timeline and comfort with risk. Younger families with decades to go can usually afford to be more aggressive (more stocks), while those getting closer to the finish line might want to dial back the risk a bit.

The goal isn't to time the market or pick the next hot stock. It’s to build a resilient, diversified portfolio that captures the market's long-term growth while you focus on what you can actually control: your savings rate and your investment costs.

This simple, disciplined strategy has proven time and again to be one of the most reliable ways to build serious wealth.

Maximizing Tax-Advantaged Accounts

Some of your most powerful wealth-building tools are the retirement accounts that come with major tax breaks. Before you even think about opening a standard taxable brokerage account, you should be maxing these out.

Here are the key players to have on your team:

- 401(k) or 403(b): At the bare minimum, contribute enough to get the full employer match. It’s literally free money. After that, your goal should be to hit the annual contribution limit.

- Roth IRA: You contribute with after-tax dollars, but every penny you withdraw in retirement is completely tax-free. This gives you incredible tax diversification down the road.

- Health Savings Account (HSA): This is the undisputed MVP of retirement accounts—a triple-tax-advantaged powerhouse. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

Once you've maxed out these accounts, any extra savings can go into a taxable brokerage account. If you're a high-income earner, there are even more advanced strategies to explore. Check out our guide on how to save for retirement after maxing out your 401k for some ideas.

The infographic below breaks down how to set the financial target that this whole strategy is designed to help you hit.

As the visual shows, nailing down your final FI number starts with a baseline calculation, which you then fine-tune for all the things that make your family unique.

Solving for Healthcare and Market Uncertainty

Even the most carefully crafted financial plan can feel like it’s built on shaky ground when you stare down two giant unknowns: healthcare costs and a sudden market downturn. These are the twin anxieties that keep plenty of aspiring early retirees tossing and turning at night.

The secret isn’t to just cross your fingers and hope for the best. It's about building a plan that fully expects these challenges and is ready to absorb the impact without wrecking your family’s future. This is what separates a fragile dream from a durable, lifelong reality.

Let’s tackle these head-on and turn potential weak spots into sources of strength.

Navigating Healthcare Before Age 65

For anyone planning to retire early, the years between that last day at the office and turning 65 for Medicare eligibility can feel like a healthcare no-man's-land. Losing your employer's health plan is a big deal, but you have several solid options to bridge this critical gap.

- ACA Marketplace: The Affordable Care Act (ACA) marketplace is the go-to for many. Leaving your job kicks off a qualifying life event, meaning you can sign up outside the normal open enrollment window. The big win here is the potential for premium tax credits, which can seriously slash your monthly costs based on your new, lower retirement income.

- COBRA: With COBRA (Consolidated Omnibus Budget Reconciliation Act), you can keep your exact same work-based health plan for up to 18 months. The upside is total continuity—same doctors, same network. The downside is steep: you’ll pay 100% of the premium plus a small admin fee. It's an expensive stopgap.

- Private Plans: You can also buy a plan directly from an insurance company. This might give you more choices, but these plans don't qualify for the premium tax credits you’d get on the ACA marketplace, often making them a much pricier option.

Whatever you do, don't go without coverage. Even a few uninsured months could expose your entire nest egg to a single catastrophic medical event. That's a risk no one should take.

Your health is the most valuable asset you have in retirement. Protecting it with solid insurance coverage isn't just a good idea—it's a non-negotiable part of a sound financial plan. It's the ultimate safety net that stops one bad medical bill from undoing decades of hard work.

Building a Bulletproof Financial Plan

Just like you need a plan for your health, your portfolio needs to be fortified against the market's wild swings. Retiring early means your money might need to last for 30, 40, or even 50 years. This long timeline makes your portfolio especially vulnerable to a poorly timed market crash right at the start.

Your best defense is to build resilience directly into your financial structure. This all starts by accepting that markets go up and down.

One of the biggest threats is something called sequence of returns risk—the danger of hitting a stretch of bad market returns in your first few years of retirement. Pulling money from a portfolio that's shrinking can permanently cripple its ability to support you long-term. You can dig deeper into how sequence of returns risk works and learn how to defend your money.

Creating Your Financial Safety Net

To shield your family from this and other financial shocks, you need to build multiple layers of defense. This isn't about being pessimistic; it's about being prepared. That preparedness is the foundation of genuine peace of mind.

Here are a few proven strategies we use with clients:

- Establish a Large Cash Cushion: I always recommend having at least one to two years of living expenses in cash or something very close to it, like a high-yield savings account or short-term bonds. This "cash bucket" lets you pay the bills without being forced to sell stocks when the market is down, giving your investments precious time to recover.

- Consider a "Bond Tent": In the few years leading up to and immediately after you retire, you can temporarily shift more of your portfolio into less volatile assets like bonds. This creates a "tent" of stability. As you move further into retirement and away from that initial danger zone, you can gradually ease back into a higher stock allocation.

- Secure Adequate Insurance: Beyond health insurance, take another look at your life and disability coverage. If anyone still relies on your ability to generate some income (maybe you plan to consult or run a small business), these policies are still crucial. Long-term care insurance is another strategic tool that can protect your assets from being wiped out by extended care costs down the road.

By proactively planning for healthcare costs and market risk, you transform your retirement plan from a hopeful guess into a robust, all-weather strategy designed to protect your family's financial freedom for decades.

Your Next Chapter: From Financial Freedom to a Fulfilling Life

Hitting your financial independence number is a huge deal—but it's the starting line of a new race, not the finish line. Honestly, the money part of early retirement is a math problem. It’s about spreadsheets, savings rates, and discipline. The next part, actually living in retirement, is a challenge of the heart and mind.

Lots of people are blindsided by how tough the adjustment can be. The daily structure, the water cooler chats, the sense of purpose you get from your career—that all leaves a pretty big hole when it's gone. A truly successful transition means being just as deliberate with your time and happiness as you were with your investments.

What Are You Retiring To?

The trick is to actively design your new life instead of just letting it happen. For years, your identity was probably wrapped up in your job title. Now you get to redefine yourself based on what actually lights you up.

And this isn't about just cramming your calendar to feel "busy." It's about filling your life with meaning. What truly gives you energy?

- Passion Projects: Ever wanted to get good at woodworking, learn to paint, or finally become fluent in Spanish? Now's the time. Dive in.

- Volunteering: Giving your time to a cause that matters to you is an incredible way to stay plugged into your community and find a real sense of purpose.

- Keep Learning: Take that history class at the local college you always thought sounded interesting. Attend workshops. Finally tackle that pile of books on your nightstand. An engaged mind is a happy one.

Early retirement isn't about escaping a job you hate. It's about earning the freedom to do the work you love, entirely on your own terms. True fulfillment comes from engagement, not just endless relaxation.

The Rise of the "Encore Career"

For many early retirees, stopping work completely isn't the goal. An "encore career" can be a fantastic middle ground. It gives you structure and a little extra income without the 9-to-5 grind.

This could be anything from consulting a few hours a week in your old field to starting a small Etsy shop based on a hobby you love. Maybe you'll work part-time for a local non-profit. An encore career keeps you sharp and socially connected while giving you a ton of flexibility. It’s the perfect off-ramp from a high-stress career into a more balanced, purposeful chapter.

Ultimately, your financial plan is the engine that makes this new life possible. But your life plan is the steering wheel that makes it fulfilling. When you intentionally replace the non-financial perks of work—purpose, structure, and community—you're setting yourself up to make your next chapter the best one yet.

Still Have Questions About Retiring Early? Let's Tackle Them.

Even with the best roadmap, you're going to have questions pop up along the way. That's not just normal; it's a good sign you're taking this seriously. Let's walk through some of the most common things that come up for families on this path.

What’s a “Safe” Withdrawal Rate When Retirement Could Last 50 Years?

The old “4% Rule” is a familiar starting point. It suggests you can pull 4% from your portfolio in year one of retirement, then adjust that amount for inflation each year after. It's not a bad rule of thumb.

But when you're retiring early, your timeline isn't the standard 25 or 30 years. We could be talking 40, or even 50 years of living off your investments. For that kind of marathon, a lot of financial planners (myself included) feel much more comfortable with a conservative rate.

Pulling back to a 3% or 3.5% withdrawal rate gives you a much bigger cushion. It helps protect your nest egg from a nasty market downturn in those crucial first few years of retirement—something pros call "sequence of returns risk." Basically, it dramatically improves the odds that your money will outlive you.

The right number for you comes down to your portfolio size, how you feel about market swings, and what you plan to spend. But the most important thing? Pick a rate that lets you sleep soundly at night, knowing you’ve built in a buffer for whatever life throws your way.

How Do I Keep Taxes From Eating Up My Retirement Income?

This is where the real strategy comes in. For early retirees, tax planning isn't an afterthought; it's everything. Since you’ll be pulling money from different account types, the goal is to create the smoothest, most tax-efficient income stream possible.

A popular and effective way to do this is with a multi-bucket approach:

- Taxable Brokerage Accounts: You'll often tap these first. Why? Because qualified dividends and long-term capital gains are taxed at much friendlier rates than ordinary income.

- Tax-Deferred Accounts (like a Traditional 401(k) or IRA): Money from these is taxed as ordinary income, so you want to be strategic about when you pull from them.

- Tax-Free Accounts (like a Roth IRA or HSA): This is your secret weapon. Every dollar you take from a Roth is completely tax-free. It’s a powerful way to get cash without bumping up your tax bill.

By carefully choosing which account to draw from each year, you can actively manage your taxable income. This can help you stay in a lower tax bracket and might even help you qualify for valuable healthcare subsidies.

What's the Single Biggest Mistake Early Retirees Make?

Hands down, it's underestimating healthcare costs. It’s so easy to get laser-focused on hitting that magic investment number and completely forget to budget for health insurance before Medicare starts at age 65.

I've seen it happen. A family does everything right, saves aggressively, invests wisely... and then an unexpected medical emergency completely blows up their plan because they weren't adequately insured.

You absolutely must build a realistic, well-funded healthcare budget into your Financial Independence number. Check out the options on the ACA Marketplace. If you've structured your retirement income correctly, you may qualify for subsidies that make the premiums much more affordable.

Whatever you do, never go without coverage. It's a gamble you simply cannot afford to lose.

At Smart Financial Lifestyle, we're dedicated to helping families build lasting wealth and redefine their American dream. We blend practical financial steps with timeless wisdom to guide you toward making smarter financial decisions for every generation. Explore more insights and start your journey at https://smartfinancialifestyle.com.