Starting to invest is a lot simpler than most people think. It's really just about making your money work for you, letting it grow over time to secure your family's future. The single most important step isn't becoming a Wall Street wizard overnight—it's just getting started with a calm, confident mindset.

Why Investing Is the Smartest Move for Your Family's Future

Let's be clear: investing isn't about chasing risky stocks or trying to time the market. At its core, it's one of the most reliable ways to build a legacy and provide for the people you care about most. It’s the critical difference between simply saving money and actively growing it.

Think of it this way: money tucked away in a savings account is like a parked car. It’s safe, sure, but it isn't actually going anywhere. Investing, on the other hand, puts that car on the road toward a specific destination—maybe a grandchild's college fund, a comfortable retirement, or just a financial cushion that brings peace of mind for decades to come.

A Mindset Shift from Saving to Growing

The real magic of investing comes from compounding, where your earnings start generating their own earnings. This snowball effect is exactly why starting early matters so much more than starting with a huge pile of cash. Even a small, consistent investment made today has decades to grow, potentially turning into a substantial sum for future generations.

This shift in thinking is really starting to catch on, especially with younger folks who are embracing this principle far earlier than their parents or grandparents did.

A global outlook from the World Economic Forum found that 30% of Gen Z started investing in early adulthood, compared to just 9% of Gen X and 6% of Baby Boomers. A staggering 86% of Gen Z learned about investing by the time they entered the workforce, a massive jump from 47% of Boomers. You can dig into this generational shift over at WEForum.org.

This isn't just a fleeting trend; it's a fundamental change in how families are approaching financial security. The message is loud and clear: the sooner you start, the more time becomes your greatest ally.

Investing Is More Than Just Numbers

Every dollar you invest is a powerful message of security and opportunity. It says you’re planning for what’s ahead, building a foundation that can support dreams and withstand unexpected challenges. This approach transforms money from a simple tool for today's transactions into a powerful vehicle for achieving your family's long-term goals.

The journey of how to start investing for beginners kicks off right here, with this understanding. It’s not about being perfect; it’s about being proactive. To see just how powerful this is, check out our guide on why investing is a more powerful wealth-building tool than saving. The small steps you take today are what lay the groundwork for a more secure and prosperous future.

Setting Financial Goals You Can Actually Achieve

Investing without a clear destination is like jumping in the car for a road trip with no map. You might end up somewhere, sure, but it probably won't be where you actually wanted to go. Before a single dollar leaves your bank account, you need a powerful "why" to guide every decision you make. This is what turns vague ideas like "saving for the future" into a real, concrete plan.

Your financial goals are deeply personal. For my wife and me, a big one was making sure our kids could graduate from college without the mountain of debt I had. For you, it might be building a safety net that lets you finally switch careers or retire on your own terms. Defining these milestones is what makes investing feel less like a chore and more like building the life you want.

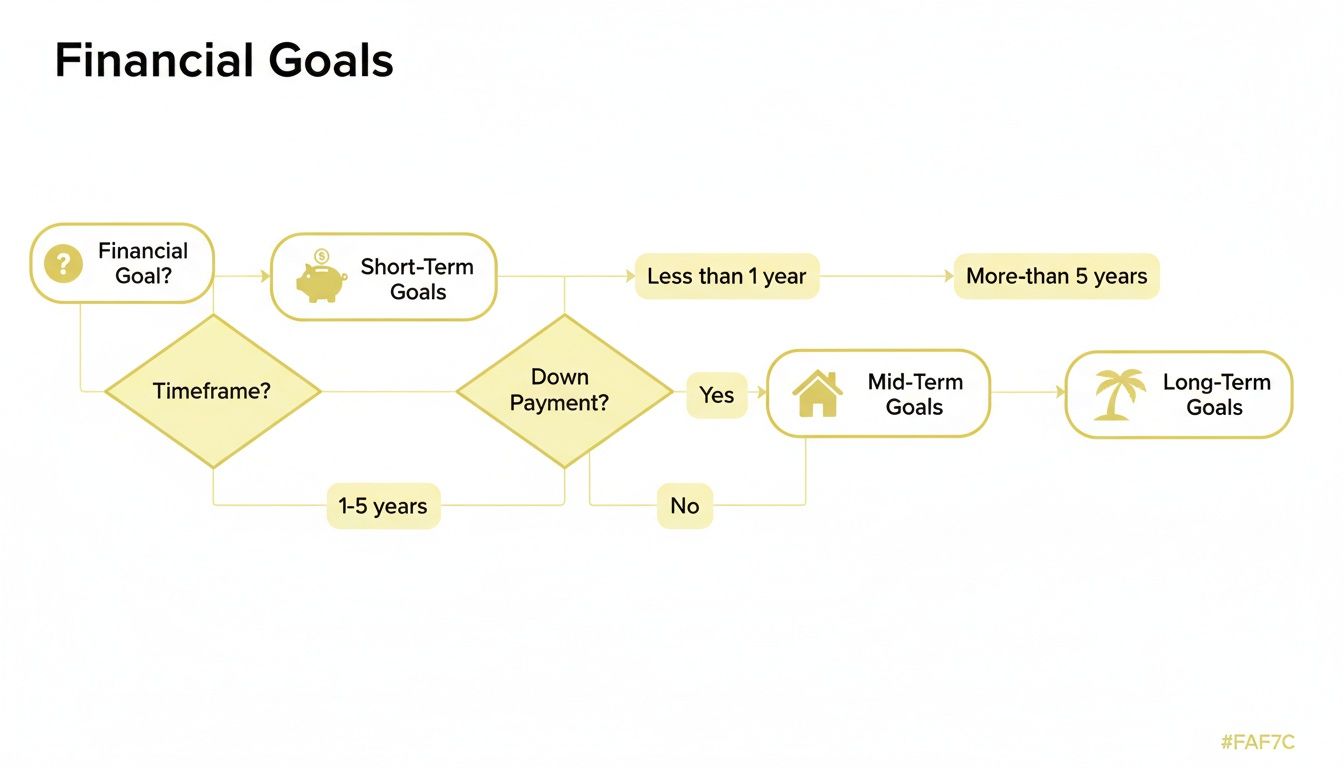

From Vague Ideas to a Clear Roadmap

The first thing you have to do is sort your goals by their timeline. It sounds simple, but this is the absolute foundation of a smart investment strategy. Why? Because the amount of time you have completely dictates how you should invest your money. The further away a goal is, the more you can lean on growth-focused investments that might bounce around in the short term but have much greater long-term potential.

- Short-Term Goals (1-3 years): Think of things you need cash for soon, like a down payment on a new car or beefing up your emergency fund. Here, the name of the game is capital preservation—you can't afford to lose money, so aggressive growth is off the table.

- Mid-Term Goals (3-10 years): This bucket is usually for major life events. Buying your first home, funding a wedding, or finally doing that big kitchen remodel. You've got a little more time on your side, which opens the door for a more balanced approach to risk and return.

- Long-Term Goals (10+ years): This is where the magic of compounding really gets to work. Goals like retirement, your kid's education fund, or building a legacy for the next generation all fall in here. With a long runway, you can confidently ride out market ups and downs in the hunt for higher growth.

Thinking through these timelines is a critical part of figuring out how to start investing for beginners. It gives you the structure you need to make decisions with confidence and steer clear of common mistakes, like taking on way too much risk for a goal that's right around the corner.

Your investment timeline is your single greatest asset. It dictates your strategy, manages your emotions during market swings, and ultimately determines how you turn small, consistent contributions into significant wealth over the years.

Matching Your Timeline to Your Strategy

Once you've got your goals lined up, you can start matching them to the right investment approach. A goal that's only two years away demands a totally different game plan than one that's two decades away. It all comes down to matching your timeline with a risk level you can stomach.

Let's say a couple is saving for a house down payment they'll need in five years. They simply can't afford to see their savings get cut in half by a sudden market dive. But if you're investing for retirement in 30 years, you can ride out that same volatility, knowing you have plenty of time for your portfolio to recover and keep growing.

This table should give you a practical framework for connecting your personal goals to a strategy that actually makes sense.

Before we dive into the table, remember that this is a guide, not a prescription. Your personal comfort with risk plays a huge role. The key is to find an alignment that lets you sleep at night while still making progress toward what matters most to you.

Matching Your Goals to an Investment Timeline

| Financial Goal Example | Time Horizon | Typical Risk Tolerance | Potential Investment Type |

|---|---|---|---|

| Emergency Fund | Short-Term (1-2 years) | Very Low | High-Yield Savings Account |

| Home Down Payment | Mid-Term (3-7 years) | Low to Moderate | Balanced Fund, Short-Term Bonds |

| Child's College Fund | Long-Term (15+ years) | Moderate to High | Diversified ETFs, Index Funds |

| Retirement Savings | Long-Term (20+ years) | High | Stock Market Index Funds, ETFs |

Looking at a clear breakdown like this helps turn the big, intimidating world of investing into a series of manageable, intentional steps. When your goals, timelines, and strategies are all aligned, you have a personalized financial roadmap. It's designed to get you exactly where you want to go, one step at a time.

Choosing the Right Investment Account

Once you’ve mapped out your financial goals, the next step is picking the right vehicle to get you there. The world of investment accounts can feel like a foreign language, with a jumble of acronyms like IRA, 401(k), and brokerage. But it’s much simpler than it sounds.

Think of an investment account as a container for your money. Each container has its own set of rules and benefits, especially when it comes to taxes. Your job is to pick the container that best matches the goal you have in mind.

Retirement Accounts The Long-Game Powerhouses

For long-term goals like retirement, the government offers accounts with powerful tax advantages to encourage you to save. These are the heavy hitters designed to help you build wealth over decades.

The most common one you'll run into is a 401(k), typically offered by your employer. If your company offers a 401(k) "match," this needs to be your first priority. Period. An employer match is free money; they kick in a certain amount based on how much you contribute.

Paul Mauro's Experience: For over 50 years, I've told every single client the same thing: if your employer offers a match, contribute enough to get the full amount before you put a single dollar anywhere else. Not taking advantage of a 401(k) match is like turning down a guaranteed 100% return on your investment from day one. It's the single best deal in the investing world.

Beyond the 401(k), you have Individual Retirement Arrangements (IRAs). You open these on your own, which gives you more control and usually a much wider range of investment options. The two main flavors are:

- Traditional IRA: You might get a tax deduction on your contributions now, which lowers your taxable income today. The trade-off? You’ll pay taxes on the money when you pull it out in retirement.

- Roth IRA: You contribute with after-tax dollars, so there's no upfront tax break. But the massive advantage is that your qualified withdrawals in retirement are completely tax-free. For a lot of people, especially those who think they'll be in a higher tax bracket later in life, this is an incredible tool.

The choice between a Roth and a Traditional IRA really comes down to one question: would you rather pay taxes now or later?

This decision tree shows how your financial goals, from short-term needs to long-term dreams, influence the type of account and strategy you might choose.

As you can see, long-term goals like retirement are a perfect fit for tax-advantaged accounts where your money can grow uninterrupted for decades.

The Flexible Choice A Taxable Brokerage Account

So, what about all the goals that aren't retirement? Buying a house, starting a business, or just building wealth outside of your retirement nest egg? This is where a standard taxable brokerage account shines.

This account is your all-purpose investing tool. It offers the most flexibility, with no contribution limits and no rules about when you can take your money out.

The key difference is right in the name: "taxable." Unlike an IRA or 401(k), you will pay taxes on your investment profits. This usually comes in the form of capital gains tax, which you owe when you sell an investment for more than you paid for it. To get a deeper handle on how this works, check out our guide on what a taxable account is and how it fits into your overall plan.

Where to Start First

Feeling a little overwhelmed by the options? Don't be. Here’s a simple order of operations that works for most people just starting out:

- Contribute to your 401(k) up to the full employer match. Again, this is free money. It's a non-negotiable first step.

- Open and fund a Roth IRA. Try to contribute the maximum allowed each year if you can. The power of tax-free growth and withdrawals in retirement is just too good to pass up.

- Go back to your 401(k). If you've maxed out your IRA and still have money to invest, circle back and increase your 401(k) contributions.

- Open a taxable brokerage account. Use this for any extra savings and for your mid-term financial goals that aren't decades away.

By choosing the right account, you're not just investing; you're creating a smart, tax-efficient plan. This simple bit of strategy ensures more of your hard-earned money stays in your pocket, working for your family's future.

Building Your First Simple Portfolio

Alright, you’ve picked the right account. Now for the fun part: putting your money to work.

The phrase "investment portfolio" can sound pretty stuffy, like something only a Wall Street pro with a fancy suit would manage. But honestly, building a smart, effective first portfolio is way more straightforward than you think.

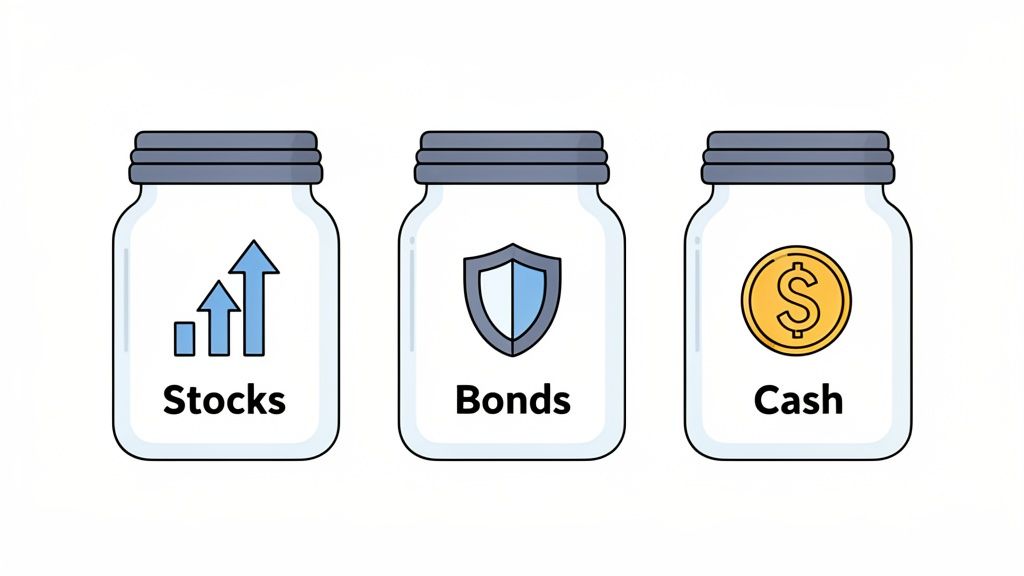

You don’t need to be a genius stock-picker or stare at complex financial charts all day. For beginners, successful long-term investing boils down to two simple but powerful ideas: diversification and asset allocation.

Think of it this way—you’d never bet your entire life savings on a single lottery ticket, right? Investing is the same deal. Diversification is just spreading your money across many different investments. That way, if one of them has a bad year, it doesn’t torpedo your whole plan. Asset allocation is how you decide to split your money between different types of investments, like stocks and bonds, to match how much risk you're comfortable with.

The Beginner’s Best Friends: Index Funds and ETFs

For anyone just starting out, the easiest and most effective way to get instant diversification is with low-cost index funds and Exchange-Traded Funds (ETFs). These are the absolute workhorses of a beginner’s portfolio.

Instead of buying stock in just one company, an index fund or ETF lets you own a tiny piece of hundreds or even thousands of companies all at once. For example, an S&P 500 index fund holds shares in the 500 biggest U.S. companies. With a single click, you’re diversified across the entire U.S. stock market.

This approach gives you two massive advantages:

- Built-in Diversification: You automatically spread your risk across a huge range of companies and industries. No single company's bad news can sink you.

- Extremely Low Costs: These funds just passively track a market index. They don't have an expensive manager trying to pick winning stocks, so their fees (called expense ratios) are incredibly low.

ETFs, in particular, have become wildly popular because they give you all these benefits plus the flexibility of trading just like a stock. Their explosive growth among new investors is all the proof you need of their power and simplicity.

ETFs have become a go-to for beginners, with global midyear flows surpassing $0.9 trillion—a remarkable 25% jump from the previous year’s record. These funds offer instant diversification at a fraction of the cost of traditional mutual funds, with expense ratios often below 0.1%. You can explore more about these market trends in State Street's megatrends report.

The main takeaway here is that you can build a solid, globally diversified portfolio with just a few core ETFs. You can cover everything from U.S. stocks to international markets and bonds without breaking a sweat.

Simple Starter Portfolio Examples

Let's turn all this theory into action. Believe it or not, you can build a fantastic, long-term portfolio with just one to three funds. Here are two of the most popular and effective models for anyone starting out.

1. The All-in-One Target-Date Fund

This is the ultimate "set it and forget it" solution. A target-date fund (sometimes called a "lifecycle fund") is a single fund that already holds a diversified mix of stocks and bonds from all over the world.

You just pick the fund with the year closest to when you think you'll retire (for example, a "Target Retirement 2060 Fund"). The fund handles all the asset allocation for you, automatically getting more conservative by shifting from stocks to bonds as you get closer to that date. For many new investors, this is the perfect hands-off approach.

2. The Classic Three-Fund Portfolio

If you want a bit more control but still want to keep things incredibly simple, the three-fund portfolio is a time-tested classic. It captures all the essential parts of a diversified portfolio using just three low-cost index funds or ETFs:

- A U.S. Total Stock Market Index Fund: This gives you a piece of the entire U.S. stock market, from the big guys to the small-cap companies.

- An International Total Stock Market Index Fund: This diversifies you beyond the U.S., capturing growth from developed and emerging markets around the globe.

- A Total Bond Market Index Fund: This adds a layer of stability to your portfolio, acting as a cushion when the stock market gets bumpy.

From there, you just decide on your asset allocation. A common starting point for a younger investor with decades to go might be 80% in stocks (split between U.S. and international) and 20% in bonds.

For instance, your portfolio could look like this:

- 50% U.S. Total Stock Market ETF

- 30% International Total Stock Market ETF

- 20% Total Bond Market ETF

This simple combination gives you a globally diversified, low-cost portfolio that sets you up for long-term success. It proves you don’t need dozens of investments to build a smart financial future. All it takes is a clear strategy and a few well-chosen funds.

Looking Beyond Our Borders for True Stability

One of the easiest traps for new investors to fall into is something called “home country bias.” It's a natural instinct—we tend to invest in what we know, which usually means companies from our own backyard. But while sticking to the familiar feels safe, it’s a bit like putting all your eggs in one economic basket. To build a portfolio that can truly weather the ups and downs over decades, you have to look beyond your own borders.

Think about it: different economies around the world are always moving at different speeds. When the U.S. market is having a slow year, markets in Europe or Asia might be taking off. Owning a piece of the whole global pie acts as a fantastic stabilizer. It smooths out the ride and opens you up to growth opportunities you’d otherwise miss completely.

Why Investing Abroad Is Just Plain Smart

Going global isn’t just a defensive move to reduce risk; it’s about making sure you’re in the game wherever growth is happening. Companies across Europe, Asia, and other emerging markets are innovating, expanding, and creating massive value. As an investor, you want a piece of that action. It ensures your entire financial future isn’t riding on the coattails of a single country’s economy or political climate.

For a long time, it felt like U.S. stocks were the only game in town, dramatically outperforming everything else. But leadership in the market always, always moves in cycles. Nothing lasts forever.

After lagging U.S. stocks for years, international equities have recently roared back with impressive returns, in some cases crushing the S&P 500. This outperformance has been fueled by factors like cheaper valuations and strong gains in markets across Europe and Asia, leading many experts to forecast continued strength for non-U.S. stocks. You can explore more expert forecasts about why now is a great time to invest in international stocks on Morningstar.com.

This is a perfect example of a core lesson in how to start investing for beginners: what worked yesterday is no guarantee for tomorrow. A globally diversified portfolio prepares you for those inevitable shifts.

Keep It Simple: One Fund Is All You Need

Here's the best part: getting that international exposure is incredibly easy these days. You don't need to become an expert on foreign companies or mess around with currency exchanges. For most beginners, one simple investment can do all the heavy lifting.

You can get instant global diversification by adding just one fund to your portfolio:

- An International Total Stock Market ETF or Index Fund: This works exactly like a U.S. total market fund, but for the rest of the world. It gives you a small slice of thousands of companies from both developed countries and emerging markets—all in one shot.

By pairing this one fund with your U.S. investments, you’ve instantly transformed your portfolio from a one-country bet into a balanced, global powerhouse. It's a simple, powerful step that ensures your family’s future isn’t tied to the fate of just one economy. It’s one of the smartest financial moves you can make for long-term growth and stability.

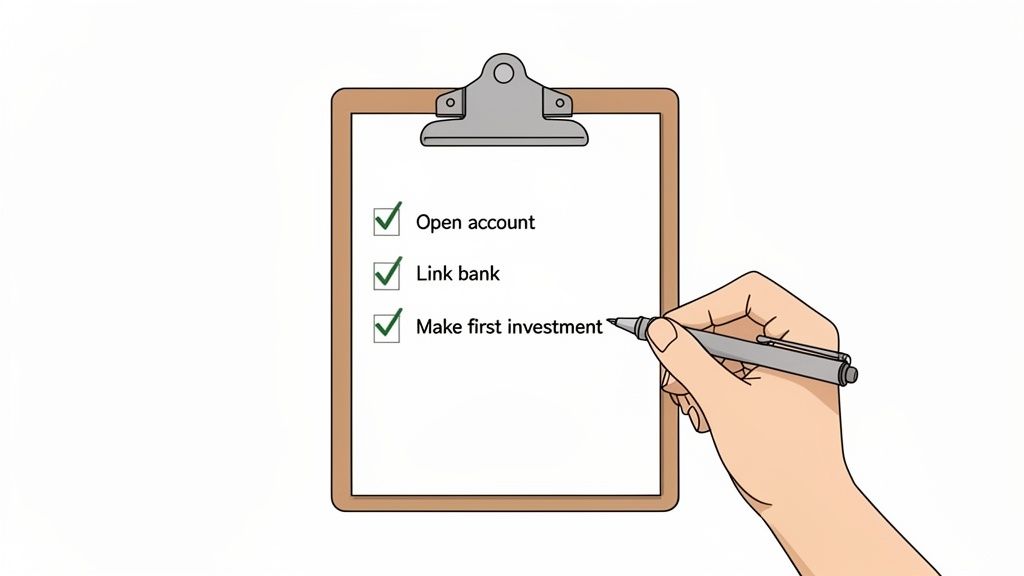

Your Action Plan for Getting Started This Week

Theory is great, but taking action is what actually builds wealth. Let’s turn all this knowledge into real, tangible progress. This simple game plan is designed to get you from reader to investor, one small, manageable step at a time.

The goal isn't to do everything at once. It's about building momentum. You can knock these steps out this week and put your family on a clear path toward its long-term goals.

Gather Your Information

Before you can open an account, you'll need a few key pieces of info on hand. Having everything ready ahead of time makes the process surprisingly quick—usually less than 15 minutes.

You’ll typically need:

- Your Social Security Number or Taxpayer ID Number.

- Your driver’s license or another government-issued ID.

- Your bank account details (routing and account numbers) to link for funding.

Choose a Beginner-Friendly Platform

Next up: pick a brokerage to open your account. For beginners, the best platforms have low (or zero) account minimums, a simple interface, and good educational resources to help you along the way.

Don't get stuck trying to find the "perfect" platform. Honestly, most reputable, low-cost brokerages offer very similar features. Just pick one that feels intuitive to you and move forward. For those interested in automated options, you can learn more about how an AI investing app can simplify the process and help manage things for you.

The single biggest mistake new investors make is waiting too long to start. Every day you wait is a day you lose to the power of compounding. Taking that first small step today is more important than knowing every single detail.

Open and Fund Your Account

With your info and platform picked out, it’s time to open the account. Just follow the on-screen prompts. If you’ve ever set up an online account for anything, you’ll find this is pretty much the same.

Once you’re approved, link your bank account and set up your first transfer. Start with an amount that feels comfortable. It doesn't need to be a huge sum; even $50 or $100 is a fantastic start.

Make Your First Investment

And now for the final step—making your first investment. Go back to those simple starter portfolios we talked about. A great first move is to buy shares in a low-cost, diversified fund like a Total Stock Market ETF or a Target-Date Fund.

This action, no matter how small, is the most important one. You are officially an investor. Your money is now positioned to start working for you and your family’s future.

Common Questions Holding You Back

Even with the best playbook in hand, a few last-minute questions always seem to surface right before you take the leap. Let’s tackle the big ones head-on so you can move forward with confidence.

How Much Money Do I Really Need to Get Started?

This is probably the biggest myth in all of investing. You absolutely do not need a pile of cash to begin. Thanks to things like fractional shares and zero-commission trading, you can genuinely get in the game with as little as $5 or $10.

Forget about starting with a massive lump sum. The real goal is just to start, period. Building the habit of investing consistently is infinitely more powerful than the dollar amount you start with.

What If I Pick the Wrong Thing?

It’s a totally normal fear, but there's a simple strategy that acts as a built-in safety net: diversification.

Instead of trying to find the one "right" stock (which is nearly impossible), you can choose a broad-market index fund or an ETF. When you do that, you aren't just betting on a single company. You're investing in hundreds, sometimes thousands, of companies all at once.

This single move takes all the pressure off. You no longer have to be a stock-picking genius. You just get to grow your wealth right alongside the entire market. For anyone just figuring out how to start investing for beginners, this is the most reliable path forward.

Don't let the fear of making a mistake keep you on the sidelines. A simple, diversified, low-cost portfolio is a fantastic choice that prevents you from having to be a stock-picking expert. Getting started is more important than being perfect.

Is It Too Late for Me to Start?

Short answer: No.

While it’s true that starting earlier gives your money more time to compound, the absolute best time to invest is always right now. Every day you wait is a day of potential growth you can't get back.

It doesn’t matter if you’re 25 or 55. Putting your money to work gives it the chance to grow for you. Someone at 55 still has a multi-decade investing timeline ahead of them for retirement. The core principles—setting goals, diversifying, and staying consistent—work at any age. The only thing that matters is that you begin.

At Smart Financial Lifestyle, we're all about making smart money moves that build a secure future for your family. Our goal is to give you clarity and confidence, helping you build wealth and redefine what's possible. To keep learning, start your journey at https://smartfinancialifestyle.com.