A good rule of thumb I often share with families is the ‘1/3rd Rule’. It’s a simple guideline that suggests aiming to cover about one-third of future college costs from your savings. The idea is that the rest can come from your income during the college years and financial aid, which makes the whole goal feel much more achievable.

This simple framework helps break down a massive number into a realistic target without getting bogged down by those overwhelming sticker prices.

How Much College Really Costs and What to Aim For

Before you can build a solid savings plan, you need a realistic number to aim for. The first step is to get past the scary headlines and really understand what goes into the total cost of college. It's not just tuition—the full "sticker price" is a bundle of expenses that add up fast.

When you're projecting costs, you have to account for:

- Tuition and Fees: This is the core price tag for instruction and university services.

- Room and Board: Housing and meal plans can easily be as expensive as tuition itself.

- Books and Supplies: Think textbooks, lab gear, and all the other required learning materials.

- Personal Expenses and Transportation: This covers everything else, from daily living costs to trips home.

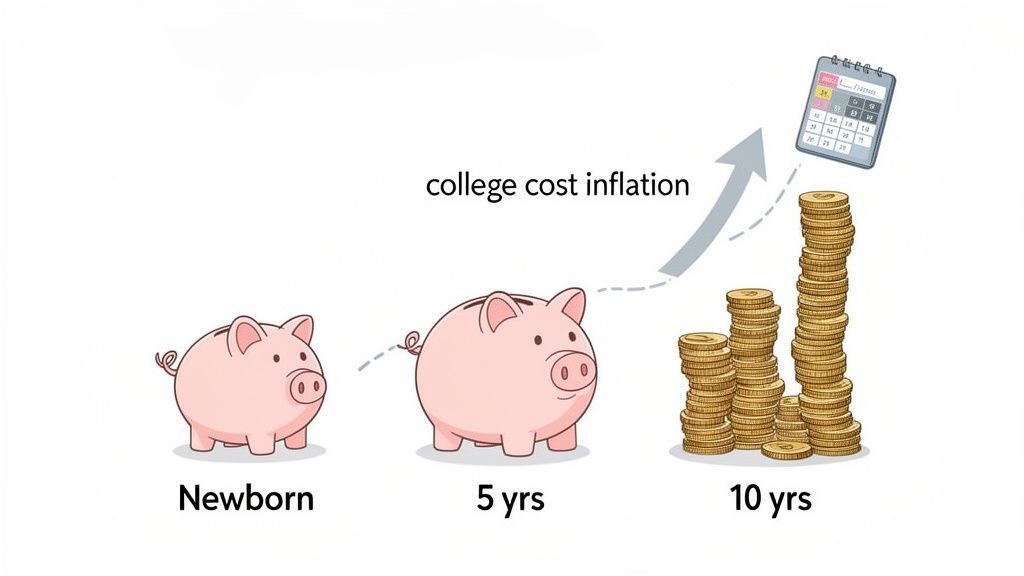

The Unseen Factor: College Cost Inflation

One of the biggest mistakes I see parents make is underestimating how quickly these costs climb. College tuition has a long history of outpacing regular inflation. This trend can turn today's prices into a much, much larger number by the time your child is ready to enroll.

For the 2024–2025 academic year, the average total cost for one year at an in-state public university was around $24,920. That puts the rough cost of a four-year degree at $99,680 if prices magically stood still.

Of course, they don't. Financial planners typically use an assumption of 4% college cost inflation each year to project future needs. It’s a daunting figure, but understanding it is the only way to set an accurate savings goal. The cost of a degree can nearly double in 18 years.

If you want to go deeper, we've broken down the true cost of a bachelor's degree in 2025 and smarter alternatives.

The goal isn't necessarily to save for 100% of the inflated future cost. It’s to build a savings fund that, combined with other resources, makes college affordable without derailing your own financial security.

How Your Child’s Age Impacts Your Savings Goal

The earlier you start saving, the more time you give your money to grow. Time is truly your greatest asset here, letting smaller, consistent contributions multiply into a significant nest egg thanks to the power of compounding.

Let's look at how a child's age changes the game. This table shows the total projected cost of a four-year public degree, assuming today's price is around $100,000 and costs inflate by 4% annually.

Projected 4-Year College Costs by Child's Age

| Child's Current Age | Years Until College | Estimated Future Cost (4-Year Degree) |

|---|---|---|

| Newborn | 18 years | ~$202,582 |

| 5-Year-Old | 13 years | ~$166,507 |

| 10-Year-Old | 8 years | ~$136,857 |

As you can see, waiting just five years significantly increases the financial mountain you need to climb. A family starting for a newborn has a much longer runway for their investments to grow compared to a family with a pre-teen.

But this doesn't mean it's too late if your child is older! It just means your strategy might need to be a bit more aggressive.

Ultimately, remember that college costs what you are willing to pay. There are countless paths to a great education, from community colleges and in-state universities to scholarships and work-study programs. Your savings goal is a target, not a barrier.

Choosing the Best College Savings Accounts for Your Family

Knowing how much to save is just the first step. The real strategic decision is where you put that money. The right account can seriously accelerate your savings with incredible tax benefits, while the wrong choice might come back to bite you when it’s time to apply for financial aid.

Let's cut through the jargon and get into the real-world pros and cons of the top college savings vehicles.

The Powerhouse: 529 Plans

There’s a reason the 529 plan is the undisputed champion of college savings. These state-sponsored plans are built from the ground up for education expenses, and they deliver a powerful combination of tax advantages that’s hard to beat.

First, your contributions might give you a state tax deduction or credit right off the bat. Then, your investments grow completely 100% tax-deferred. But the real magic happens when you withdraw the money for qualified education expenses—it’s 100% tax-free. That tax-free growth lets your money compound so much faster than it ever could in a normal brokerage account.

Plus, recent rule changes have made 529s more flexible than ever:

- K-12 Tuition: You can now pull up to $10,000 a year to cover tuition for private elementary or high school.

- Student Loan Repayment: A lifetime limit of $10,000 can be used to pay down student loan debt for the beneficiary or even their siblings.

- Roth IRA Rollovers: This is a game-changer for anyone worried about overfunding. Starting in 2024, beneficiaries can roll over up to $35,000 from a 529 into their own Roth IRA over their lifetime, as long as a few conditions are met.

As of December 2024, Americans held a staggering $525.1 billion in 17.0 million different 529 accounts. But here's the interesting part: the average account size is only around $20,000–$20,500. This tells me most families are smartly using these plans to tackle a piece of the college bill, not the whole thing. For a closer look at the numbers, check out the Investment Company Institute's latest 529 plan research.

The Flexible Alternative: Custodial Accounts (UGMA/UTMA)

Custodial accounts, often called UGMA or UTMA accounts, offer one big thing 529s don't: total flexibility. The money isn't restricted to just education; it can be used for anything that benefits the child. That’s their main selling point.

But that freedom comes with some serious strings attached.

Once you put money into a custodial account, it's an irrevocable gift. Legally, that money now belongs to your child. When they hit the age of majority in your state (usually 18 or 21), they get full control. They can use it for tuition... or a sports car, or a trip to Bali. You no longer have a say.

The biggest drawback, in my experience, is the impact on financial aid. Since the money is considered the child's asset, it's assessed at a much higher rate on the FAFSA. This can dramatically reduce the amount of aid your child is eligible for.

The Back-Pocket Play: A Roth IRA

A Roth IRA is a retirement account, first and foremost. But its unique rules make it a clever, if unconventional, option for college savings. Here’s the deal: you can withdraw your direct contributions (not the earnings) at any time, for any reason, completely tax-free and penalty-free.

This gives you an incredible safety net. If your child gets a full scholarship or decides college isn't for them, the money just stays put, growing for your own retirement. No harm, no foul. The major downside, of course, is that you're raiding your own retirement nest egg—a decision that should never be made lightly.

For a deeper comparison of these two powerful accounts, take a look at our complete guide on the 529 vs Roth IRA for your college savings plan.

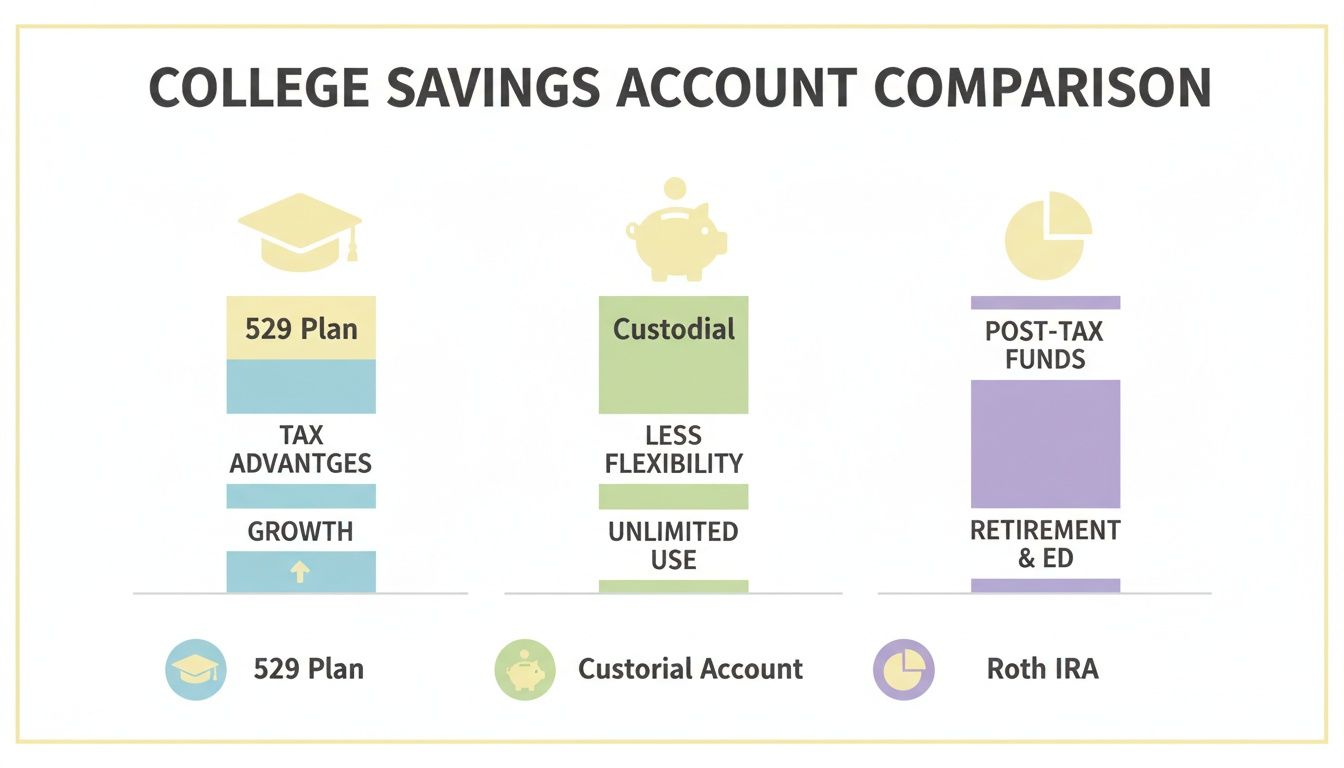

Comparing Your College Savings Options

So, how do you choose? It really comes down to what your family values most—tax breaks, flexibility, or control. Seeing them side-by-side makes the decision much clearer.

Comparing College Savings Accounts 529 vs Custodial vs Roth IRA

| Feature | 529 Plan | Custodial Account (UGMA/UTMA) | Roth IRA |

|---|---|---|---|

| Primary Purpose | Education Savings | Gifting to a Minor | Retirement Savings |

| Tax Treatment | Tax-deferred growth, tax-free withdrawals for qualified expenses | Earnings taxed at the child's rate ("kiddie tax" may apply) | Tax-deferred growth, tax-free withdrawals in retirement |

| Control | Account owner (parent) retains control | Child gains control at age of majority (18 or 21) | Account owner (parent) retains control |

| Financial Aid Impact | Treated as a parent asset (minimal impact) | Treated as a child asset (high impact) | Not reported as an asset on the FAFSA |

| Flexibility | Primarily for education, with some new flexible uses | Can be used for any purpose that benefits the child | Contributions can be withdrawn anytime; primarily for retirement |

When all is said and done, the 529 plan is simply the most powerful and purpose-built tool for most families saving for college. That one-two punch of tax advantages and minimal impact on financial aid makes it the clear front-runner in almost every scenario.

Building a Savings Plan That Actually Works for Your Budget

This chart gives a great side-by-side look at the big three savings vehicles: the 529 Plan, a Custodial Account, and a Roth IRA. As you can see, the 529 plan’s tax perks and minimal hit to financial aid usually make it the heavy hitter for this specific goal.

Now for the real work: turning that giant savings number into a practical, sustainable plan that doesn't blow up your monthly budget. It’s one thing to know what you need to save; it's another thing entirely to figure out how to do it consistently.

The secret is to break it down. If you need $100,000 over 18 years, that’s not one impossible task. It’s a series of small, manageable steps. Assuming a conservative 6% average annual return on your investments, you’d only need to save about $260 per month. That feels a lot more doable, right?

Calculating Your Monthly Contribution

So, how do you find your magic number? It all comes down to a simple calculation based on three key things: your target, your timeline, and a realistic guess on investment returns.

- Savings Target: The total amount you’re aiming for by enrollment day.

- Time Horizon: How many years you have until your kid heads off to college.

- Expected Return: A conservative estimate of how your investments will grow, usually in the 5-7% range.

Let’s run the numbers on a real-world example. Say your goal is $150,000 for your 8-year-old, which gives you 10 years to get there. With a 6% return, you’d need to put away around $920 per month. But if you started for a newborn with the same goal? That monthly contribution drops to just $390. Time is your most powerful asset here.

The goal isn’t to predict the future perfectly but to create a consistent habit. Even if you can’t hit your "ideal" monthly number right away, starting with something is far better than doing nothing.

Automating Your Success

The single most effective strategy I’ve seen for hitting any savings goal is to put it on autopilot. Manually moving money every month takes willpower, and let's be honest, willpower is a finite resource. Automation removes that decision point and ensures you pay your future self first.

It’s as simple as setting up an automatic transfer from your checking account to your college savings account (like a 529 plan) for the day after you get paid. This "set it and forget it" approach turns saving into just another bill, like your mortgage or car payment. It becomes a non-negotiable part of your financial life.

Finding Extra Cash for College Savings

"That sounds great," you might be thinking, "but where is that extra money supposed to come from?" It's a totally fair question, especially when budgets are tight. Often, the answer isn’t about earning more, but about being smarter with what you already have.

Here are a few practical strategies that have worked for countless families:

- The "Raise" Method: Every time you get a pay raise or a bonus, immediately earmark a portion of it for the college fund. Send it there automatically before it ever has a chance to get spent.

- Redirecting Expenses: As your child outgrows certain costs—think daycare or diapers—funnel that money directly into their 529 plan instead of letting it get absorbed back into your general spending.

- The Side Hustle Fund: If you have a side gig or do some freelance work, dedicate a specific percentage of that income to the college savings account.

Financial advisers often suggest families aim to save somewhere between one-third and two-thirds of the total expected cost. For a newborn facing a future bill of around $198,000, a 50% target would be about $99,000. This is exactly why a consistent plan of saving $300–$600 a month in a tax-advantaged account becomes so incredibly powerful over 18 years. You can see more on this in an in-depth analysis from the Investment Company Institute.

Life will inevitably throw you curveballs—a job change, another baby, an unexpected expense. Your plan needs to be flexible. You might need to dial back your contributions during tight months. In good times, you might make a lump-sum deposit. The key is to stay committed to the long-term goal, even if the path isn’t a perfectly straight line.

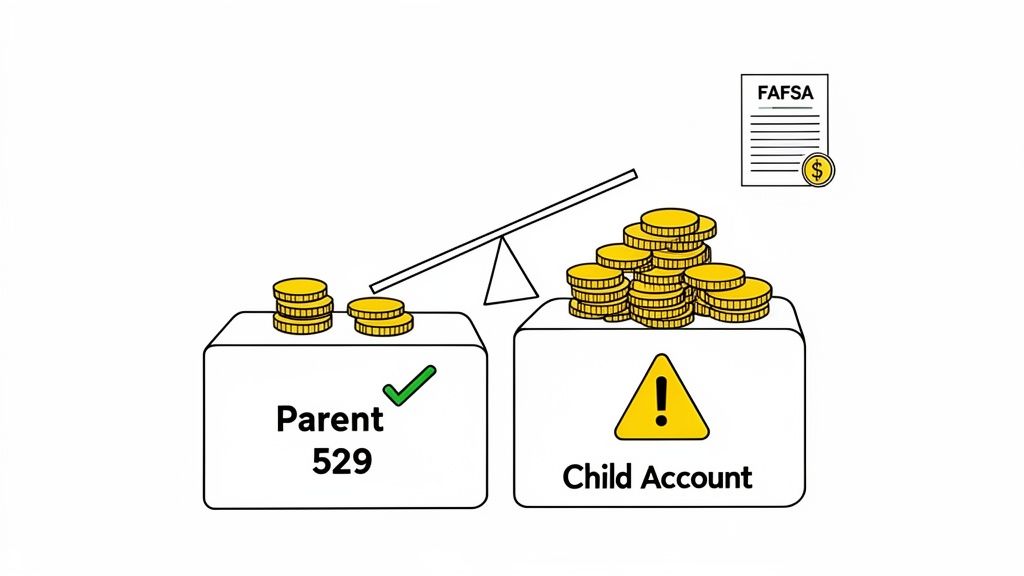

How Your Savings Affect Financial Aid Eligibility

It's one of the biggest anxieties I hear from parents. You save diligently for years, only to worry that your hard work will actually penalize you when it's time to apply for financial aid. It feels like a classic Catch-22.

Let's clear this up right now, because where you save your money is just as important as how much you save. The key is understanding how the FAFSA (Free Application for Federal Student Aid) looks at different types of accounts. Not all dollars are created equal, and this is where smart planning can make a huge difference.

Parent Assets vs. Student Assets

The financial aid system works under a simple assumption: a larger chunk of a student's own money should go toward college compared to their parents' money. Grasping this distinction is probably the single most important concept in strategic college saving.

-

Parent-owned assets, like a 529 plan where you are the owner and your child is the beneficiary, are assessed at a very low rate. Only up to 5.64% of these assets are counted toward the Student Aid Index (SAI), which is the new number that determines aid eligibility.

-

Student-owned assets, on the other hand, are treated very differently. Think of a custodial UGMA/UTMA account. A whopping 20% of the money in these accounts is considered available to pay for tuition.

What does that look like in the real world? A $50,000 fund in a parent-owned 529 might only reduce potential aid by about $2,820. But that same $50,000 in a custodial account under your child's name could slash it by $10,000. That's a massive difference and shows exactly why the 529 plan is such a powerful tool.

The FAFSA is designed to get a snapshot of a family's financial strength, but the formula heavily favors assets held in the parents' names. By keeping college savings in your name, you are positioning your family for the best possible aid outcome.

The Grandparent 529 Advantage

For years, there was a tricky rule attached to 529 plans owned by grandparents. While the account itself didn't show up on the FAFSA, any money they gave the student for college was counted as untaxed student income. This could torpedo a student's aid eligibility by up to 50% of the amount they received—a huge penalty.

Thankfully, the recent FAFSA Simplification rules have changed the game completely.

Starting with the 2024-2025 school year, cash support from grandparents (or anyone other than the student's parents) is no longer required to be reported on the FAFSA. This is a massive win. Grandparents can now contribute directly from their 529 plans without hurting their grandchild's financial aid package one bit.

Putting It All Together for a Smarter Strategy

When you understand these rules, you can save for college without shooting yourself in the foot. The takeaway is simple and clear: prioritize saving in accounts that are legally owned by the parent, with the 529 plan being the gold standard.

This strategic placement ensures your hard-earned savings have the smallest possible impact on the aid calculation. It allows you to build a substantial college fund while still keeping your child in the running for need-based grants, scholarships, and federal loans. With the right approach, saving for college isn't a penalty; it's just smart planning.

Involving Family in Your College Savings Journey

Figuring out how much to save for college can feel like a solo mission, but it doesn’t have to be. So often, grandparents, aunts, and uncles are eager to contribute to your child's future—they just don't know the best way to help.

By opening up the conversation, you can transform their goodwill into a powerful, coordinated effort. This is about building a true family legacy. It's about inviting them to be part of a meaningful journey, turning one-off birthday checks into a structured plan that makes a real, lasting impact.

Making It Easy for Grandparents to Chip In

The simplest and most effective way for family to help is by contributing directly to a 529 plan. Many state 529 plans have online gifting platforms that generate a unique link you can share. Grandparents can click the link, contribute whatever amount they wish, and the money goes straight into the account. No fuss.

This method also packs a huge tax advantage. An individual can gift up to $18,000 in 2024 to any number of people without needing to file a gift tax return. A married couple can combine their exclusions to gift a hefty $36,000 per year.

There's also a powerful but lesser-known strategy called "superfunding." This allows a contributor to make five years' worth of gifts at once—up to $90,000 for an individual or $180,000 for a couple—into a 529 plan without triggering gift taxes. It's an incredible way to jump-start a college fund.

How to Start the Conversation

Let's be honest, talking about money can be awkward, even with the people you're closest to. The key is to frame it around a shared goal: your child's future. Instead of making a direct ask, try sharing your progress and your passion for the goal.

Here are a few conversation starters that feel natural and work well:

- "We just opened a 529 plan for Lily and we're so excited about getting a head start on her education savings. We're hoping to make college a reality for her without a mountain of debt."

- "For Jack's birthday this year, we're focusing on gifts that will grow with him. If you were thinking of getting him something, a small contribution to his college fund would mean the world to us."

This approach invites them into the process rather than putting them on the spot. If you're looking for more ideas on how to navigate these financial talks, we have some great tips for gifting money to family members in a thoughtful way.

Market data shows that families are increasingly relying on 529 plans. Total assets in these accounts are projected to grow to about $588 billion across 17.4 million accounts by late 2025. Yet, despite steady inflows, the typical account balance is still well below the full cost of a degree. This highlights the reality that most families are saving for a portion of future costs, not the whole thing. You can learn more about these college savings account trends and insights on PlanSponsor.com.

Ultimately, involving family transforms college savings from a financial task into a collaborative act of love and support. It sends a powerful message to your child that their entire family is invested in their success.

Answering Your Top College Savings Questions

Navigating the world of college savings always brings up a bunch of "what if" scenarios. You've set a goal, picked an account, and built a plan—but life is rarely a straight line. Here, we'll dig into some of the most common and pressing questions I hear from parents, giving you the clarity to move forward with confidence.

What Happens if the Market Crashes Right Before College?

This is a fear that keeps many parents up at night. After almost two decades of disciplined saving, the thought of a market downturn erasing a chunk of your hard-earned funds is terrifying. The key here isn't to avoid the market—it's to get smarter with your investments as your child gets older.

When your child is young, you can and should be more aggressive. A portfolio heavy in stocks has the highest potential for growth and, most importantly, has plenty of time to recover from any dips. It's a long game.

As your child enters high school, it’s time to start dialing back the risk. This doesn’t mean yanking everything out of the market. Instead, you'll slowly reallocate the funds within your 529 plan to more conservative options like bonds and money market funds. Most 529 plans offer age-based portfolios that handle this transition for you automatically, shifting to a preservation-focused mix as the enrollment date gets closer.

By the time your child is a junior or senior in high school, a good portion of their college fund should be in less volatile investments. This strategy helps lock in the gains you've made over the years and protects the principal from a sudden market shock right when you need it most.

How Should We Adjust Our Savings Plan for Multiple Kids?

Saving for one child’s college education is a challenge; saving for two, three, or more can feel like climbing a mountain. While the core principles don't change, your strategy needs to be efficient. The 529 plan has a fantastic feature for families with multiple kids: the ability to change the beneficiary.

You can open a 529 for your oldest child and pour everything you can into it. If they don't use all the funds—maybe they get great scholarships or choose a less expensive school—you can simply change the beneficiary to a younger sibling, tax-free.

This flexibility lets you consolidate your savings efforts without the pressure of managing and funding multiple accounts at the same level from day one. You can focus on one main account initially and then branch out as your budget allows, knowing the funds can be easily re-designated to another family member down the line.

What if My Child Decides Not to Go to College?

This is another huge "what if" for parents. What happens to all that money if your child chooses a different path, like entering a trade, starting a business, or joining the military? The good news is you have several excellent options, and your money is far from lost.

- Change the Beneficiary: You can change the beneficiary to another eligible family member. This includes another child, a grandchild, a niece or nephew, or even yourself if you decide to go back to school.

- Hold the Funds: There's no time limit on a 529 account. You can leave the money in the account in case your child changes their mind later in life.

- Use the Roth IRA Rollover: A powerful new rule allows up to $35,000 to be rolled over from a 529 plan into the beneficiary's Roth IRA over their lifetime, as long as a few conditions are met. This is a fantastic way to give your child a massive head start on retirement savings.

- Withdraw the Money: You can always pull the funds for non-qualified expenses. You'll have to pay income tax and a 10% penalty, but only on the earnings portion of the withdrawal, not your original contributions.

Do We Really Need to Save the Full Amount?

Absolutely not. In fact, trying to save 100% of a projected future cost of $200,000 or more is an unrealistic and unnecessary burden for most families. The goal isn't to have a giant pot of cash on day one but to build a fund that makes college affordable when combined with other resources.

Think back to the "1/3rd Rule" we talked about. Saving for a third or even half of the total cost is a much more manageable and realistic target. The rest can come from a mix of sources:

- Current Income: Using a portion of your cash flow during the college years.

- Financial Aid and Scholarships: Maximizing eligibility for grants and encouraging your child to hunt for scholarships.

- Student Contributions: Having your child contribute through summer jobs or work-study programs.

- Sensible Loans: Using federal student loans as a tool to bridge any remaining gap.

Parent and student expectations also play a big role in this. For example, many high-school students already anticipate graduating with some debt. In a recent study, parents reported adjusting their savings strategies due to market uncertainty, with 45% reducing savings and 31% reallocating investments to be more conservative. These behaviors directly influence whether a family shoots for full or partial funding. You can explore more about these trends in Fidelity’s 2025 College Savings & Student Debt Study.

Planning for college is about creating possibilities, not covering every single dollar in advance.

At Smart Financial Lifestyle, we believe in building wealth with wisdom and purpose. Our approach helps you make smart financial decisions that create a lasting legacy for your family. Discover our resources and start redefining your American dream today at https://smartfinancialifestyle.com.