When you’re staring down a mountain of credit card debt, it’s easy to feel like you’re out of options. But there's a powerful truth most people don't realize: your creditors would often rather get something than risk getting nothing at all.

This isn't charity. It’s a business decision. For them, a smaller, guaranteed payment today is often better than the risk of you defaulting entirely down the road. This simple fact gives you more leverage than you think to negotiate a settlement, a hardship plan, or another arrangement to get your finances back under control.

Why Creditors Are Willing to Negotiate Your Debt

If you're dealing with significant credit card debt, you're not alone. Millions of Americans are right there with you, watching high balances and compounding interest create a seemingly impossible situation. The good news? The system has a built-in release valve: negotiation. Creditors are pragmatic businesses, and their focus is always on the bottom line.

A Business Decision, Not a Favor

Here’s the main reason a credit card company will play ball: they want to minimize their losses. When an account goes unpaid for too long, they eventually have to "charge it off," writing the debt off as a loss on their books. That's a bad outcome for them.

From the creditor's perspective, receiving 50% of what you owe is infinitely better than receiving 0%. This fundamental business reality is the source of all your negotiating power.

When they agree to a lower payoff or a modified payment plan, it's a calculated move to recover some of their money instead of losing it all. Once you grasp this, your request shifts from a plea for help into a sound business proposal that actually works for both sides.

The Scale of the Problem Works in Your Favor

The sheer volume of consumer debt in the U.S. also makes negotiation a common practice. As of the first quarter of 2025, total American credit card debt hit a staggering $1.182 trillion. That’s a huge jump from the pandemic-era low of around $770 billion.

With so many people carrying high balances, credit card issuers are more motivated than ever to work with consumers to prevent a tidal wave of defaults. In fact, people who successfully negotiate their debts often see creditors agree to settlements at discounts averaging 30-50%.

The Most Common Negotiation Outcomes

When you decide to negotiate, you’re not just asking for a random discount. You’re aiming for a specific, structured agreement. Knowing what’s possible helps you set a clear goal before you even pick up the phone.

Here’s a quick look at the main strategies available.

Debt Negotiation Options at a Glance

| Negotiation Option | Primary Goal | Typical Outcome |

|---|---|---|

| Lump-Sum Settlement | Settle the debt for less than the full balance. | Pay a one-time, reduced amount (40-60% of the original debt) to clear the account completely. |

| Hardship Program | Get temporary relief to catch up on payments. | Your interest rate or minimum payment is lowered for a set period, usually 6-12 months. |

| Workout Agreement | Make monthly payments more affordable long-term. | A more permanent adjustment, like a long-term interest rate reduction. |

Each of these options serves a different purpose, so it's important to figure out which one aligns with your financial situation.

The most common possibilities include:

- Lump-Sum Settlement: This is where you offer to pay a single, reduced amount to wipe the slate clean. Creditors often prefer this because they get their money immediately and can close the account.

- Hardship Program: If you're going through a temporary setback, the creditor might agree to lower your interest rate or minimum payment for a limited time (like 6-12 months) to help you get back on your feet. Understanding what factors increase your total loan balance is key here, as even a temporary interest reduction can make a huge difference.

- Workout Agreement: This is a more permanent change to your terms, like a long-term interest rate reduction, that’s designed to make your monthly payments manageable over the long haul.

It’s not about dodging what you owe. It’s about finding a path forward that works. Knowing these options exist is the first step toward making that happen.

Building Your Negotiation Toolkit

Any successful effort to negotiate credit card debt is almost always won before you ever pick up the phone. This is where you do the homework, building a strong case that turns a hopeful plea into a credible business proposal. It’s all about getting your facts straight so you can present a clear, compelling picture of your financial reality.

When you approach this methodically, it does more than just boost your confidence—it shows the creditor you’re serious and professional. With all your information ready, the conversation shifts from one of desperation to one of mutual problem-solving. This is your chance to control the narrative and steer the discussion toward an outcome you can live with.

Gather Your Financial Documents

Before you can even think about making a proposal, you need a crystal-clear understanding of your own situation. Start by collecting every relevant piece of paper. This isn't just about being organized; it's about having immediate access to the facts so you can speak with authority.

Your essential document checklist should include:

- Recent Credit Card Statements: Grab the last three to six months of statements for the account you want to negotiate. Pinpoint your total balance, your current interest rate (APR), and any late fees that have piled up.

- Payment History: Put together a simple summary of your payments for the past year. Did you pay on time? Miss any? This context is crucial.

- Proof of Income: Collect recent pay stubs, bank statements, or anything else that shows your current income. If your income has recently dropped, having proof of your previous, higher earnings helps paint the full picture of your change in circumstances.

- List of All Debts: Don't just focus on this one card. You need to list out all your debts—other credit cards, personal loans, car payments, and your mortgage or rent—along with their monthly payments. This gives everyone a complete view of your financial obligations.

This collection of documents is your evidence. It allows you to ground the negotiation in hard facts, not just feelings, which is far more persuasive to a creditor.

Remember, the person on the other end of the line is likely working from a script. When you have your specific numbers ready—your exact balance, your interest rate, your payment history—you can break through that script and have a real conversation about your unique situation.

Create a Realistic Household Budget

Your most powerful tool in this entire process is a realistic household budget. It's the one document that proves what you can actually afford to pay, which might be very different from what the creditor is demanding. A well-crafted budget shows that your settlement offer isn't some arbitrary number you pulled out of thin air, but a figure based on your genuine financial capacity.

Your budget should clearly lay out all your monthly income sources against all your essential expenses. Think of it as a financial snapshot.

- Income: List all your take-home pay, any side income, and other funds you receive each month.

- Essential Expenses: Include the non-negotiables like housing, utilities, groceries, transportation, and childcare.

- Other Debt Payments: Make sure to account for the minimum payments on any other debts you aren't currently trying to negotiate.

Whatever is left over after subtracting your expenses from your income is your disposable income. This figure is the bedrock of your negotiation strategy, whether you're proposing a lump-sum settlement or a modified monthly payment. This process can also shine a light on opportunities for paying off debt faster even without making more money by showing you exactly where you can trim some spending.

Write a Clear Hardship Letter

Finally, it’s time to distill your situation into a concise, professional hardship letter. This isn't the place for a long, emotional story; it's a brief, factual summary of the circumstances that led to your financial difficulty. A well-written letter can add significant weight to your verbal request.

Your letter should briefly explain the "why" behind your struggle. Common reasons include things like:

- Job loss or a significant reduction in work hours

- A medical emergency that resulted in large, unexpected bills

- Divorce or the death of a spouse

- A sudden disability that impacts your ability to earn an income

Keep it short, respectful, and to the point. State the cause of the hardship, express your desire to meet your obligation, and explain that your current circumstances make it impossible under the existing terms. This letter, combined with your documents and budget, completes your toolkit. Now you’re ready to negotiate from a position of strength.

Choosing the Right Negotiation Strategy for You

Once you’ve got a clear picture of your finances, it’s time to pick your play. There’s no single “best” way to negotiate credit card debt—the right move depends entirely on your situation. Your income, savings, and the story behind your hardship will all point you toward the best path.

This is probably the most important decision you'll make in this whole process. It’s about matching your game plan to your financial reality, so you're aiming for something you can actually stick with. Let's walk through the four main options to see which one feels like the right fit for you.

Lump-Sum Settlements for a Clean Break

For creditors, a lump-sum settlement is often the quickest way to resolve a problem account, which can make it a powerful tool for you. You’re essentially offering to pay a single, large chunk of cash—less than what you owe—to wipe the slate clean.

Because creditors get guaranteed money right away and can close the books on a risky account, they’re often willing to forgive a big piece of the balance.

This is the perfect route if you have access to a chunk of cash, maybe from a tax refund, an inheritance, or some savings you’ve set aside. For instance, if you owe $10,000, you might offer $4,000 to settle it for good. It's fast, it's clean, and the sense of relief is immediate.

Of course, the big catch is that you need the cash on hand. Don't even think about this approach unless the funds are already in your account.

Right now, the economic climate actually gives you a bit of an edge here. We’re seeing a major spike in credit card delinquency rates, especially in lower-income areas. With creditors more worried about getting nothing, they're much more open to a deal. It's not uncommon to see them forgive 40-60% of the balance just to get some cash back in the door. You can dig into consumer credit trends to see how this environment can work to your advantage.

Hardship Programs for Temporary Relief

If your financial trouble feels more like a temporary storm—maybe a short-term job loss or a surprise medical bill—a hardship program could be your anchor. These programs are built to give you some breathing room for a limited time, usually for 6 to 12 months.

Under a hardship plan, your creditor might agree to:

- Temporarily slash your interest rate (sometimes all the way to 0%)

- Lower your minimum monthly payment

- Waive late fees while you’re in the program

This won’t lower what you owe, but it stops the debt from spiraling while you get back on solid ground. Imagine a salaried employee who’s out on temporary disability; a hardship plan could make their payments manageable until they’re back to work full-time.

Workout Agreements for Long-Term Affordability

Think of a workout agreement as a more permanent fix compared to a hardship plan. Instead of just hitting pause, you’re renegotiating the core terms of your account for the long haul. The goal here is to make your payments affordable, permanently.

This usually means locking in a lower interest rate for the life of the balance. It’s a solid option if your income has permanently dropped and you know you can't keep up with the original high-interest payments, but you can still commit to paying something every month.

Key Takeaway: A workout agreement isn't about getting debt forgiven. It's about restructuring what you owe into a payment plan you can actually live with. You're showing the creditor you’re committed to paying them back, just on more realistic terms.

Debt Management Plans for Complex Situations

If you’re juggling multiple high-interest cards and feeling like you're drowning, a Debt Management Plan (DMP) can be a total game-changer. These are typically offered through reputable nonprofit credit counseling agencies.

Here’s how it works: You make one single monthly payment to the agency. They take that payment and distribute it among your creditors, who they’ve already negotiated with to lower your interest rates.

A DMP is a structured, disciplined path out of debt that usually takes three to five years to complete. It simplifies your financial life while you actively pay down what you owe, and it doesn't hit your credit as hard as a settlement. This is the go-to for anyone who needs that structure and is fighting a battle on multiple fronts.

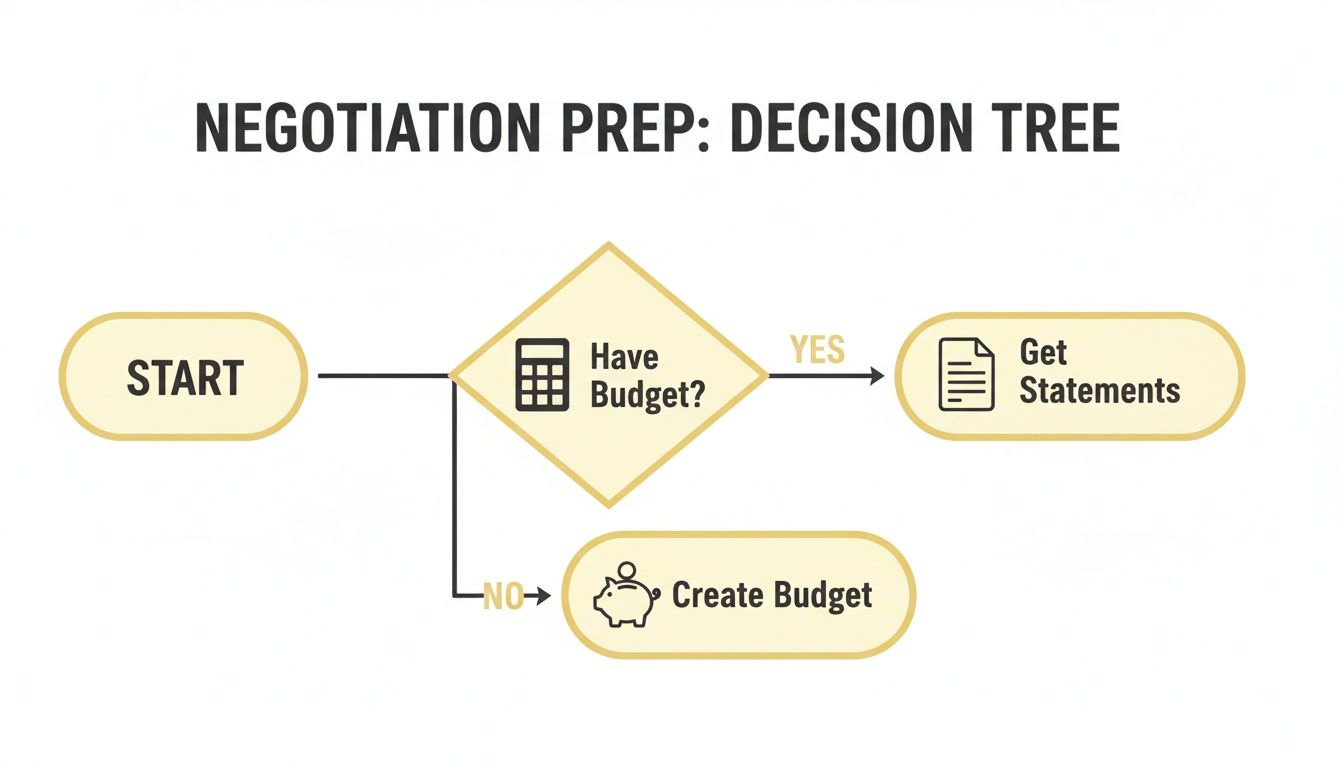

This flowchart can help you visualize where to start. No matter which path you think is right, it all begins with knowing your numbers.

As you can see, having a clear budget isn't just a good idea—it’s the non-negotiable first step before you make any other moves.

How to Talk to Creditors and Secure an Agreement

Okay, you've done the hard work of getting your financial house in order. Now it’s time to pick up the phone and talk directly with your creditors. This is where your preparation really pays off.

Making this call can feel incredibly intimidating, but I want you to reframe it. You aren't asking for a handout. You are proposing a legitimate business solution to a problem that’s costing both of you money. Your goal is to stay calm, professional, and firm. Letting emotion take over can cloud your judgment, but a clear, fact-based approach shows you’re serious.

Opening the Conversation

When you call, you'll probably get a frontline customer service representative first. Be ready to state your purpose clearly and concisely. You don’t need to pour out your entire life story—just the essential facts.

Start with a simple, direct script like this:

"Hello, my name is [Your Name], and my account number is [Your Account Number]. I'm calling today because I'm experiencing a financial hardship and would like to discuss my options for resolving my balance."

This language immediately signals you're being proactive. The rep’s job is to follow a script, so your first task is often just getting to the right person. Politely ask to be transferred to the "loss mitigation" or "hardship" department. These are the teams with the actual authority to negotiate.

Presenting Your Offer and Key Tactics

Once you’re connected with the right department, it’s go-time. This is where your budget and hardship letter become your most powerful tools. Briefly explain your situation and then confidently make your opening offer.

Here’s a crucial piece of advice: always start with an offer that’s lower than your absolute maximum. Let’s say your budget shows you can afford a lump-sum settlement of $5,000 on a $10,000 debt. Don't start there. An initial offer of $3,000 (or 30%) gives you valuable room to negotiate upward.

Expect them to reject your first offer. That's a standard part of the dance. Just stay calm and bring it back to the reality of your budget. You could say something like, "I understand that's lower than you'd like, but based on my income and essential expenses, this is what I can realistically offer to resolve the account now."

A few effective negotiation tactics I’ve seen work:

- Keep Your Cool: No matter how stressful the conversation gets, stay polite. Losing your temper will only work against you.

- Know When to Escalate: If the representative is unhelpful or clearly lacks the authority to make a deal, politely ask to speak with a supervisor.

- Use Silence to Your Advantage: After you make an offer, just stop talking. Don't feel the need to fill the silence. Let them be the first to respond.

The economic reality is on your side here. The average U.S. credit card debt for those with unpaid balances hit $7,321 in early 2025, with APRs soaring to a punishing 24%. For someone with a $9,600 balance at that rate, the monthly interest alone is over $192. You can find more of these eye-opening credit card debt statistics and trends on LendingTree. Proposing a way to stop that bleeding is a compelling argument for creditors who are seeing more and more defaults.

Responding to Pushback

Creditors will almost certainly counter your offer. They might propose a higher settlement or try to push you into a long-term payment plan you know you can't afford. This is where your prep work shines.

If they come back with a counteroffer of $8,000, you can respond firmly but flexibly: "Thank you for working with me on that, but my budget simply cannot support that amount. The absolute most I could possibly manage is $4,500." This shows you’re willing to move, but you're anchored to your financial reality.

The Golden Rule: Get It in Writing

This is, without a doubt, the most critical step in the entire process. Never, ever send a single dollar until you have a signed, written agreement in your hands. A verbal promise over the phone is not legally binding and won't protect you.

The written agreement, whether it comes via email or snail mail, must spell out all the key details:

- The Total Settlement Amount: The exact dollar figure you've agreed to pay.

- The Payment Due Date: The deadline for your lump-sum payment or the schedule for your payment plan.

- The Forgiveness of Remaining Debt: The letter must explicitly state that once your payment is received, the remaining balance will be forgiven and the account will be considered paid-as-agreed or settled-in-full.

- Cessation of Collections: It should confirm that all collection activities will stop immediately.

Once you receive that letter, read every single word. If it all matches what you agreed to on the phone, you can confidently make the payment. This document is your shield—the legal proof you need to show the debt has been resolved once and for all.

Rebuilding Your Finances After a Debt Settlement

Getting that settlement agreement signed is a huge moment. It feels like the finish line, but it’s really more like clearing the slate. The hard part is over, and now it’s time to build something stronger in its place so you never have to go through this again.

This next phase is all about creating new habits and a solid foundation. We'll focus on three key areas: your credit, your budget, and your overall financial mindset. By tackling each one deliberately, you can turn a temporary fix into a permanent, positive shift in your financial story.

The Impact on Your Credit and How to Recover

Let’s be straight about this: settling a debt for less than you owed will cause your credit score to drop. It’s temporary, but it will happen. Your credit report will show the account as "settled for less than the full balance," which lenders see as a red flag. This note can stick around for up to seven years.

But this is not a life sentence for your finances. It's the beginning of a recovery process, and you’re the one in control. Your score will start to heal as you prove you can handle credit responsibly from here on out.

To start rebuilding, consistency is key. Here’s what to focus on:

- Pay Every Single Bill on Time: Your payment history makes up 35% of your credit score, making it the biggest factor. Every on-time payment you make helps push that negative settlement mark further into the past.

- Keep Your Other Balances Low: On any other credit cards you have, try to use less than 30% of your available credit. This shows lenders you aren't stretched too thin.

- Consider a Secured Credit Card: This is a fantastic tool for rebuilding. You make a cash deposit that becomes your credit limit, which makes it low-risk for the bank. Use it for small purchases and pay it off in full each month to build a fresh, positive payment history.

It won't happen overnight, but over months and years, these good habits will begin to outweigh the settlement's impact, and you'll see your score start to climb.

Navigating Potential Tax Consequences

Here’s something that catches a lot of people by surprise: the tax bill. If a creditor forgives $600 or more of your debt, the IRS considers that income, and the creditor is required to send you a Form 1099-C, Cancellation of Debt.

That forgiven debt is generally treated as taxable income. It can be a shock if you’re not prepared for it, so it's critical to plan ahead.

You might not have to pay taxes on this "income," though. If you can prove you were insolvent when the debt was settled—meaning your total debts were greater than the value of your total assets—you may be exempt. If a 1099-C shows up in your mailbox, it's a very smart move to talk to a tax professional to see if you qualify for an exclusion.

Creating a Strong Financial Foundation

With the old debt behind you, your focus can shift from digging out of a hole to building solid ground. This is your chance to create a new financial reality for yourself and your family.

Build Your Emergency Fund First

An emergency fund is your best defense against ever falling back into debt. This is the cash that will cover a sudden car repair or an unexpected medical bill, so you don't have to turn to a credit card in a pinch. Start small with a goal of $1,000, then build it up to cover three to six months of essential living expenses. Our guide offers a detailed emergency fund checklist with 8 must-have steps to help you build true financial resilience.

Create a Forward-Looking Budget

Your old budget was likely built around crisis management. Your new budget is about building your future. The money that used to go toward that debt payment now has a new job. Assign it to your goals, whether that’s beefing up your emergency fund, saving for retirement, or planning for other long-term objectives.

This is how you turn a painful chapter into a powerful catalyst for building wealth and securing the peace of mind you’ve worked so hard to achieve.

Common Questions About Negotiating Credit Card Debt

Even with a solid game plan, it's totally normal for questions to pop up when you decide to negotiate credit card debt. In fact, it's a good sign—it means you're taking this seriously. Getting these common concerns sorted out can give you that final dose of confidence to pick up the phone.

Let's walk through some of the questions I hear most often and get you some direct, practical answers drawn from years of real-world experience.

Can I Negotiate Credit Card Debt Myself, or Should I Hire a Company?

You absolutely can, and for most people, handling it yourself is the best way to go. When you negotiate on your own, you sidestep the hefty fees that for-profit debt settlement companies charge. We're talking fees as high as 15-25% of the very debt they're supposed to be saving you money on. The steps in this guide are designed to give you everything you need to do it successfully.

That said, if you're feeling completely underwater, juggling debts with a dozen different creditors, or you've already tried and hit a wall, a reputable nonprofit credit counseling agency can be a lifesaver. They can set you up with a structured Debt Management Plan (DMP) and provide guidance without the predatory fees.

If you still find yourself looking at for-profit companies, tread very, very carefully. Check them out on the Better Business Bureau (BBB) and run the other way if a company demands big fees before they’ve actually settled a thing. That’s a huge red flag.

How Does Settling Debt Affect My Credit Score?

I won't sugarcoat it: settling a debt for less than you owe will cause your credit score to drop. It’s temporary, but it happens. The account will get marked on your credit report with a note like "Settled for less than full balance," which lenders see as a negative mark. This note can stick around for up to seven years.

But here’s the important part: the damage is almost always less severe than the alternatives, like letting the account get charged off or declaring bankruptcy. The negative impact also fades over time.

Think of it as taking a short-term hit for a major long-term win. As soon as the settlement is done, you can start rebuilding. Your score will begin to recover as you get back to paying your other bills on time and showing you’re back on track.

What Is a Realistic Settlement Amount to Offer?

A smart place to start the conversation is with an offer between 20% and 30% of what you owe. Let’s be real, your first offer is going to get rejected. That's just part of the dance. But starting low gives you the wiggle room you need to negotiate up without immediately blowing past your budget.

Most successful settlements end up landing somewhere in the 40% to 60% range of the original balance. Where you fall in that range depends on a few things:

- How old is the debt? Creditors are often more willing to settle older debts for a lower amount.

- Who is the creditor? Some banks and credit card companies are just known for being more flexible than others.

- How are you paying? A single lump-sum payment is king. It’s far more appealing to them than a payment plan and will almost always get you a better deal.

Will I Owe Taxes on the Forgiven Debt?

There's a good chance, yes. If a creditor forgives $600 or more of debt, the IRS treats that forgiven amount as income. The creditor is required to send you a Form 1099-C for Cancellation of Debt, which you’ll need to report on your tax return.

But there’s a critical exception you need to know about: insolvency. You might be able to avoid paying taxes on that forgiven debt if you can prove that at the time of the settlement, your total liabilities (what you owed) were greater than the fair market value of your total assets (what you owned).

If a 1099-C shows up in your mailbox, don't just ignore it. This is one of those times when it's absolutely worth talking to a qualified tax professional. They can look at your numbers and help you figure out if you qualify for the insolvency exclusion.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building a secure future and a lasting legacy. Taking control of your debt is a powerful step on that journey. For more guidance on building wealth and redefining your American dream, visit https://smartfinancialifestyle.com.