A custodial Roth IRA for minors is one of the most powerful financial gifts you can give a child. At its heart, it's a retirement savings account that an adult—usually a parent or guardian—opens and manages for a kid who has earned income.

Think of it as planting a financial seed. You’re taking small earnings from a summer job or a weekend gig and giving them the potential to grow tax-free for decades. It’s a brilliant way to give a young person a massive head start on their financial future.

Unlocking a Lifetime of Financial Growth

Let's say your teenager mows lawns all summer and pulls in a few thousand dollars. Instead of that cash just sitting in a savings account earning next to nothing, you can help them put it into a custodial Roth IRA.

The account is legally owned by your child, but you, as the custodian, call the shots on the investments until they're legally an adult in your state (that's usually 18 or 21). Once they reach that age, the keys are handed over, and the account is all theirs.

The Real Magic: Tax-Free Compounding

The secret sauce here is compound growth. When a kid starts investing in their teens, their money has an incredibly long runway to grow—we’re talking 50 years or more. This long timeline allows even small, early contributions to snowball into a seriously impressive nest egg by the time retirement rolls around.

But it gets better. Unlike a regular brokerage account or a traditional IRA, the money in a Roth IRA grows completely tax-free. When your child is ready to retire, they can pull out every single dollar, including all those decades of earnings, without owing a cent in federal taxes on the gains. That's a huge deal.

The core idea is simple but incredibly powerful: you're using your child's earliest paychecks and their greatest asset—time—to build a foundation of tax-free wealth that can set them up for life.

To make things crystal clear, here's a quick summary of what a custodial Roth IRA brings to the table.

Custodial Roth IRA at a Glance

| Feature | Description |

|---|---|

| Account Type | Retirement savings account for a minor with earned income. |

| Ownership | Legally owned by the minor, but managed by an adult custodian. |

| Contributions | Made with post-tax money, up to the minor's earned income for the year. |

| Growth | Investments grow 100% tax-free. |

| Withdrawals | Qualified withdrawals in retirement are 100% tax-free. |

| Flexibility | Contributions (not earnings) can be withdrawn anytime, tax and penalty-free. |

| Control Transfer | Custodian transfers control to the child at the age of majority (18 or 21). |

As you can see, this isn't just another savings account; it's a strategic tool for long-term wealth building.

More Than Just a Retirement Account

A custodial Roth IRA is surprisingly flexible and can do a lot more than just fund retirement. It's a multi-purpose tool that can help your child navigate some of life's biggest moments.

Here’s a look at the key benefits:

- A Massive Financial Head Start: This account puts them on a path toward financial security long before most of their friends even start thinking about saving. It's a tangible advantage.

- Flexibility for Big Purchases: Because the contributions (the money you put in) can be withdrawn tax-free and penalty-free at any time, the account can serve as an emergency fund for major expenses like a down payment on a house.

- A Perfect Teaching Tool: This is your chance to teach real-world financial literacy. By getting your child involved in the process, you can deliver priceless lessons on saving, investing, and long-term planning. For more ideas, check out our guide on how to teach kids about money.

When you open a custodial Roth IRA, you're doing more than just saving money. You’re giving your child the tools, knowledge, and a concrete head start to build a secure financial life of their own. Next up, we’ll get into the specific rules you need to know to get started.

The Earned Income Rule for Kids Explained

Let's cut right to the chase: the single most important rule for a custodial Roth IRA for minors is the earned income requirement. Think of it as the golden ticket. Without legitimate, taxable income from actual work, your child simply isn't eligible to contribute.

This is a common sticking point for parents, but the idea is pretty simple once you draw a hard line between money your child earns and money they're given. The IRS needs to see that the cash going into the account came directly from your child's own effort.

This isn't just a minor detail—it’s the legal foundation of the entire account. It's what makes a custodial Roth a powerful tool for young workers, not just another piggy bank.

What Counts as Earned Income

So, what kind of work actually qualifies? The good news is, the definition is broader than you might think. Earned income really boils down to two main buckets: traditional W-2 jobs and self-employment. Both are perfectly valid ways for a minor to get in the game.

A traditional W-2 job is the most straightforward. If your teenager snags a summer gig as a lifeguard or works the register at a local shop, the wages on their W-2 form are the cleanest example of earned income you can get.

But self-employment is where many younger kids find their opportunity. This covers all those classic childhood hustles that involve real work for real pay.

- Babysitting or Pet Sitting: Getting paid to watch the neighbor's kids or walk their dog is absolutely considered self-employment.

- Lawn Care and Yard Work: Mowing lawns, shoveling snowy driveways, or raking leaves for cash all count.

- Tutoring or Coaching: Is your kid great at math? Helping younger students with their homework for an hourly rate is a legitimate gig.

- Creative Hustles: Selling handmade crafts online, monetizing a YouTube channel, or even earning money from photography all qualify as valid income sources.

The bottom line is that the work has to be real, and the pay needs to be reasonable for the job done. If you're hunting for more ideas, check out our guide on how to make money as a kid.

What Does Not Count as Earned Income

Just as crucial as knowing what qualifies is knowing what doesn't. The IRS is crystal clear here: money a child receives without working for it is not earned income.

Getting this wrong is a big deal. Mistaking gift money for earned income can lead to penalties from the IRS for making improper contributions, and nobody wants that headache.

Here’s a quick breakdown of what is not considered earned income:

- Allowances: Cash given for routine household chores is generally seen as part of family life, not a "job."

- Cash Gifts: Birthday money from Grandma or a crisp bill tucked into a holiday card, unfortunately, does not count.

- Investment Income: Any dividends or capital gains from a brokerage account are considered investment income, not earned income.

Key Takeaway: The money must be a direct payment for a service your child performed or a product they sold. If they didn't work for it, it can't be used to fund their Roth IRA.

The Importance of Good Record-Keeping

When your child has a W-2 job, the paperwork is done for you. But for all those self-employment gigs, the responsibility of tracking that income falls squarely on you and your child. This part is non-negotiable.

Just imagine trying to prove your child's income to the IRS five years from now. A simple, well-kept log is your best friend. It doesn't need to be fancy—a basic spreadsheet or even a dedicated notebook works perfectly.

For every single job, make sure you log:

- Date of Work: When the job was done.

- Description of Service: Exactly what your child did (e.g., "Mowed Mr. Smith's lawn").

- Client Name: Who paid them for the work.

- Amount Paid: The total cash received.

Keeping these simple records ensures you can contribute up to their earned income limit with confidence and stay on the right side of the rules. With about 4.8 million U.S. teens aged 16 to 19 currently working, a huge number of kids are eligible to start saving. Proper documentation is the first and most important step.

How Much Can Your Child Contribute and How Fast Can It Grow?

Once you’ve nailed down that your child has legitimate earned income, you can get to the exciting part: seeing how powerful their contributions can be. The rules for a custodial Roth IRA for minors are refreshingly simple, but they’re the key that unlocks decades of explosive financial growth. This is where the magic of starting young really shines.

The framework is straightforward: your child can contribute up to 100% of whatever they earned that year, as long as it doesn’t exceed the annual IRA limit. This design forges a direct link between their summer job and their future wealth, making the concept of saving feel tangible and rewarding.

The Annual Contribution Limit

Every year, the IRS sets the maximum amount anyone can put into an IRA. For kids and teens, the limit is $7,000 for the current year, or their total earned income for the year—whichever is less. This gives them a massive head start. Any money they make from babysitting, mowing lawns, or even a part-time retail job can go straight into this powerful tax-free account, up to that yearly cap. You can get more details on the specifics by checking out the official custodial Roth IRA guidelines.

This "lesser of" rule is the most important part. For instance, if your 16-year-old earns $4,000 from a summer lifeguarding gig, their maximum contribution for the year is $4,000. But if they have a blockbuster year and pull in $8,000, their contribution is capped at the $7,000 annual limit.

Now, here’s a fantastic feature that makes this tool incredibly family-friendly. While the contribution limit is tied to the child's earnings, the actual cash doesn't have to come from them.

Parents, grandparents, or a generous aunt can gift the money for the contribution. As long as the amount deposited doesn't exceed what the minor earned, the IRS doesn't care where the funds came from.

This is a game-changer. It means you can help your teen build a nest egg without them having to sacrifice their hard-earned spending money. Many parents choose to "match" their child's earnings by funding the Roth IRA contribution themselves, which teaches an incredible lesson about saving while letting the teen enjoy the fruits of their labor.

The Power of a 50-Year Head Start

To really get your head around the impact of a custodial Roth IRA, let's run through a real-world scenario. The numbers tell a story of how a few small actions today can create life-altering wealth, all thanks to tax-free compounding over a very, very long time.

Example: The Teen Investor

Imagine a 15-year-old named Maya who works weekends at a local shop, earning $3,000 a year. Her parents decide to contribute that full amount to a custodial Roth IRA on her behalf each year until she turns 19.

- Total Contribution: $3,000 a year for 4 years = $12,000

- Investment: The money is put into a simple, low-cost S&P 500 index fund.

- The Critical Decision: After she turns 19, Maya stops contributing completely. She never adds another dime to the account. She just lets that initial $12,000 ride.

So, what happens to Maya's initial investment? Assuming an average annual market return of 8%, the growth is staggering.

| Age | Account Value (Approximate) |

|---|---|

| 25 | $25,700 |

| 35 | $55,500 |

| 45 | $119,700 |

| 55 | $258,500 |

| 65 | $558,000 |

By the time Maya is ready to retire at 65, the $12,000 from her teenage job has morphed into over half a million dollars—all of it completely tax-free. This happened without her having to contribute a single penny during her adult working years. It’s a powerful testament to giving her money the one thing most of us wish we had more of: time. That simple act of saving early provides a financial foundation that can completely redefine her retirement.

Comparing Account Options for Your Child

Choosing the right way to save for your child’s future is a big decision, and it’s easy to get stuck when you’re staring at a menu of account options. A custodial Roth IRA for minors is an incredible tool, but its true power really shines when you see how it stacks up against other popular choices.

Each account is designed for a different purpose, much like choosing between a specialized tool and a multi-tool. Getting these differences is key to matching your savings strategy with what your family actually wants to achieve. Let’s break down the three main players: the Custodial Roth IRA, the 529 Plan, and the UTMA/UGMA account.

The Core Purpose of Each Account

First things first, what’s the main goal? Are you focused on your child's retirement, their education, or just providing a flexible financial gift? Each account is built to nail one of these jobs.

- Custodial Roth IRA: This is a retirement account, plain and simple. Its primary mission is to grow wealth tax-free over a very long time, giving your child a massive head start on their golden years.

- 529 Plan: This is an education savings plan. Its tax benefits are specifically built to help families pay for qualified education expenses, from college tuition to K-12 private school.

- UTMA/UGMA Account: This is a general-purpose custodial account. Think of it as a flexible investment gift with no strings attached—once the child takes control, the money can be used for anything they want.

Tax Treatment Contributions and Withdrawals

How your money is taxed going in and coming out is a huge deal. The differences here are stark and can dramatically change the account's long-term value.

A Custodial Roth IRA is funded with after-tax dollars, so you don't get a tax deduction on contributions. Its superpower, however, is on the back end: all qualified withdrawals in retirement, including decades of investment growth, are 100% tax-free.

529 Plans offer a different kind of tax advantage. While contributions aren't deductible on your federal return, many states offer a state income tax deduction or credit. The real win is that the money grows tax-deferred, and withdrawals for qualified education expenses are completely tax-free. For a deeper dive, check out our detailed comparison of the 529 plan versus the Roth IRA.

UTMA/UGMA accounts have the least favorable tax treatment of the three. There are no special tax breaks on your contributions. Investment earnings are taxed each year according to the "kiddie tax" rules, where the first slice of gains is tax-free, the next is taxed at the child’s lower rate, and anything above that gets hit at the parent's higher rate.

Impact on Financial Aid Eligibility

This is a critical, and often overlooked, piece of the puzzle. How an account affects your child's ability to get college financial aid is a major consideration, and this is where a custodial Roth IRA has a clear advantage.

Retirement accounts, including a Roth IRA, are not typically reported as assets on the FAFSA (Free Application for Federal Student Aid). This means the account balance generally doesn't reduce your child's eligibility for need-based aid.

A 529 Plan owned by a parent has a minimal impact because it's considered a parental asset. UTMA/UGMA accounts, on the other hand, are considered assets of the student, which can significantly reduce financial aid eligibility by a much larger percentage.

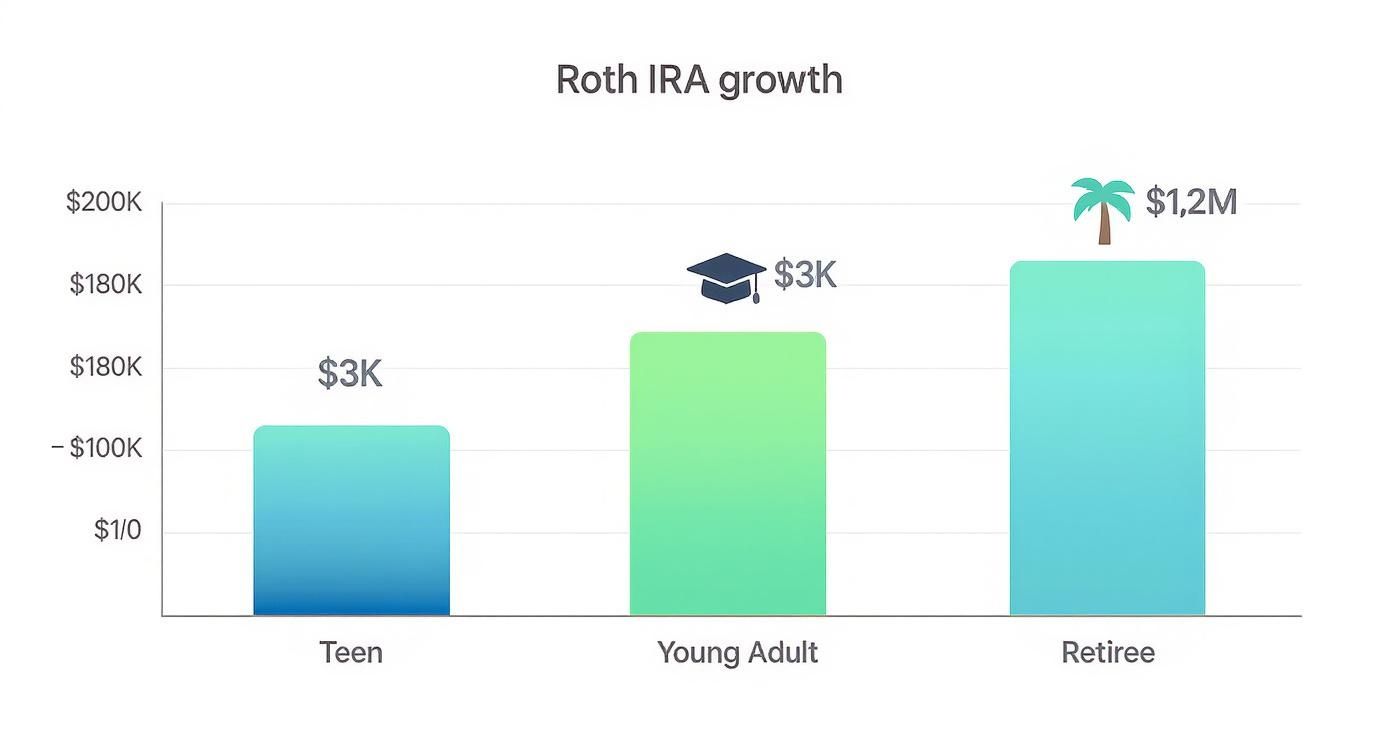

To really see the magic of starting early, look at this chart. It shows the incredible growth potential of turning a teenager's small earnings into a serious retirement fund.

This image brings it to life: an initial $3,000 contribution made during the teen years can explode to over a million dollars by retirement. That’s the power of long-term, tax-free compounding at work.

Custodial Roth IRA vs 529 Plan vs UTMA/UGMA

To make it even clearer, here’s a side-by-side look at the key features of these three powerful accounts for minors. Seeing them all together helps highlight which one best fits your family's financial goals.

| Feature | Custodial Roth IRA | 529 Plan | UTMA/UGMA Account |

|---|---|---|---|

| Primary Goal | Retirement Savings | Education Savings | General Gifting |

| Contribution Type | After-Tax Dollars | After-Tax (State tax breaks may apply) | After-Tax Dollars |

| Tax on Growth | Tax-Free | Tax-Deferred | Taxed Annually ("Kiddie Tax") |

| Withdrawal Rules | Tax-free for qualified retirement use | Tax-free for qualified education expenses | Unrestricted use by the child |

| Financial Aid Impact | Not reported as an asset on FAFSA | Treated as a parental asset (low impact) | Treated as a student asset (high impact) |

| Who Can Contribute | Anyone, up to the child's earned income | Anyone | Anyone |

| Control Transfer | At age of majority (varies by state) | Remains with the account owner | At age of majority (varies by state) |

Ultimately, the best choice really boils down to what you want the money to do. If the goal is a massive, tax-free retirement nest egg, the Custodial Roth IRA is tough to beat. For dedicated education funding, the 529 plan is custom-built for the job. And for a flexible gift, the UTMA/UGMA works, as long as you understand the tax and financial aid implications.

How to Open and Manage the Account

Taking the leap from learning about a custodial Roth IRA for minors to actually opening one is a game-changer. This is the moment you move from theory to action, building the real-world vehicle that will carry your child's wealth for decades to come.

Getting started is surprisingly straightforward, but you’ll want to pay close attention to the details to get everything right from day one. Think of yourself as the architect of your child’s financial foundation—you choose the firm, gather the materials, and oversee the initial setup. From there, you'll manage it until they're ready to take the keys.

Your Step-by-Step Setup Guide

Getting the account up and running involves a few simple stages. From picking the right financial institution to making that first investment, each step builds on the last. Just follow this roadmap to get it done smoothly and with confidence.

-

Choose the Right Brokerage Firm: Not every financial institution offers custodial Roth IRAs, so the first step is finding one that does. I'd recommend looking at established, low-cost providers like Vanguard, Fidelity, or Charles Schwab. Focus on what matters: low fees, a great selection of investments (especially index funds), and an easy-to-use platform.

-

Gather the Essential Documents: To open the account, you'll need personal information for both you (the custodian) and your child (the account owner). This part is non-negotiable, so have everything handy before you start.

- For the Minor: Full name, date of birth, and Social Security number.

- For the Custodian: Your full name, date of birth, Social Security number, and contact info.

- Proof of Income: You need to have records of your child's earned income. This could be a W-2 from a summer job or just a detailed logbook if they're self-employed (think babysitting or mowing lawns).

-

Complete and Submit the Application: Most applications are online and pretty simple. You'll fill out the forms, identifying yourself as the custodian and your child as the beneficiary. You'll also need to link a bank account to make that first contribution.

Managing the Account and Making Investments

Once the account is open, your role shifts from builder to portfolio manager. Your main job is to invest the money wisely for long-term growth. Since we’re talking about a time horizon of 50 years or more, you can—and should—focus on growth.

The simplest and most effective strategy for this is using low-cost, diversified index funds. These funds automatically spread your investment across hundreds or even thousands of companies, which dials down the risk while capturing the market's overall growth. An S&P 500 or total stock market index fund is a fantastic, set-it-and-forget-it choice for a minor's account.

The goal isn't to pick winning stocks. It's to harness the relentless power of the market over decades. A simple, disciplined approach with index funds is almost always the most successful path to building serious long-term wealth.

The potential here is just staggering. For example, a teen who starts putting away $3,000 a year at age 15 could see their account grow to around $1.22 million by age 65, assuming average market returns. It’s a powerful illustration of why starting early is so critical, and you can explore more of these head-start retirement savings strategies.

The Transfer of Control

One of the most important parts of managing a custodial Roth IRA is knowing how it ends: the transfer of control. When your child reaches the "age of majority" in your state—usually 18 or 21—you are legally required to hand over the account to them.

At that point, the "custodial" label falls away, and it becomes a standard Roth IRA in your child's name. They get full control over everything—the investments, contributions, and withdrawals. This transition is a massive milestone. It’s why your financial stewardship must go hand-in-hand with ongoing financial education, ensuring they're ready and responsible enough to manage the incredible gift you’ve given them.

Got Questions? Let's Get Them Answered.

Even when you're sold on the benefits, stepping into the world of a custodial Roth IRA for minors can feel like learning a new language. You'll naturally have questions about the specific rules for contributions, withdrawals, and even how it plays with financial aid down the road.

Think of this section as your practical, no-nonsense guide. We’ve pulled together the most common questions and sticking points we hear from parents to help you manage this incredible account with confidence.

What Happens If My Kid Contributes More Than They Earned?

This is probably the single most important rule to get right, and messing it up can lead to some annoying penalties. If you contribute more than your child’s actual earned income for the year (or the annual IRA limit, whichever is less), the IRS flags it as an excess contribution.

That extra money gets hit with a 6% penalty tax for every single year it stays in the account. As you can imagine, that can add up fast, so it’s a mistake worth avoiding.

The good news? It’s fixable. You just need to withdraw the excess amount, plus any earnings it generated, before that year’s tax-filing deadline. This is exactly why keeping detailed records of your child’s income isn't just a good idea—it's essential for staying on the right side of the rules.

Can We Tap Into This Money Before Retirement?

Yes, you can, and this is where the Roth IRA's flexibility really stands out. The key is understanding how the IRS sees the money inside the account: it splits it into two buckets—the money you put in (contributions) and the investment growth (earnings).

Your original contributions can be pulled out at any time, for any reason, with zero taxes and zero penalties. This powerful feature lets the account double as a fantastic long-term emergency fund for your child, giving them a serious financial safety net.

The earnings, however, are a different ballgame.

Pulling out investment earnings before age 59 ½ usually triggers both ordinary income tax and a 10% early withdrawal penalty. The government put this rule in place to make sure the account is used for its main purpose: retirement.

But there are a few important exceptions to that 10% penalty for big life events, like:

- Buying a First Home: They can withdraw up to $10,000 penalty-free (though they’ll still owe income tax on the earnings) to help with a down payment.

- Paying for College: The money can be used for qualified education expenses like tuition and books without facing the penalty.

While it’s great to have these options, the real magic of a custodial Roth happens when you let it sit untouched for decades. That’s how you unleash the full, uninterrupted power of tax-free compound growth.

What Are Some Smart Investments for a Kid's Roth IRA?

With a time horizon that could easily stretch over 50 years, the investment strategy for a child's Roth IRA can be beautifully simple: focus on long-term growth. You don't need to get fancy with complicated stock-picking. In fact, for most families, the best path is often the easiest one.

You really can't go wrong with low-cost, broadly diversified index funds. These funds give you a slice of the entire market in one shot, which is a great way to manage risk while capturing overall economic growth.

Here are a few fantastic, set-it-and-forget-it options:

- S&P 500 Index Fund: This fund invests in 500 of the biggest, most stable companies in America. It’s a simple, effective way to own a piece of the U.S. economy's engine.

- Total Stock Market Index Fund: Want to go even broader? This fund holds thousands of U.S. companies of all sizes—large, medium, and small—offering maximum diversification.

- Target-Date Fund: This is the ultimate "autopilot" choice. You just pick a fund with a date far off in the future (like a 2070 fund). The fund manager handles the rest, automatically shifting from aggressive to more conservative investments as your child gets closer to retirement.

The name of the game is keeping fees low and staying invested for the long haul. A simple, disciplined strategy is the most proven way to build serious wealth over a lifetime.

How Does This Account Affect College Financial Aid?

This is a huge question for families planning for college, and it's an area where the custodial Roth IRA completely outshines other accounts. When it comes to financial aid calculations, this account is treated incredibly well.

Retirement accounts, including Roth IRAs, are not reported as assets on the FAFSA (Free Application for Federal Student Aid). This is a game-changer. The entire balance in your child’s account generally won’t count against them when colleges are figuring out their eligibility for need-based aid.

Compare that to something like a UTMA/UGMA account, which is considered a student asset and can seriously reduce the amount of aid they receive.

There is one little catch to be aware of, though. While the account balance is ignored, any money withdrawn from the Roth—even the tax-free contributions—counts as student income on the FAFSA for the following year. Student income is weighed very heavily in aid formulas, so the best strategy is to avoid taking any money out during the college years if possible. That way, you get the best of both worlds: maximizing retirement growth and potential financial aid.

At Smart Financial Lifestyle, we believe that making smart financial decisions is about understanding the details and planning with intention. A custodial Roth IRA for minors is more than just a savings account—it’s a tool for building a legacy and teaching timeless lessons about wealth. Start building your family’s financial future today by exploring more of our insights at https://smartfinancialifestyle.com.