When it comes to the "Roth IRA: pretax or post-tax?" debate, it all really boils down to a simple question: Do you want to pay taxes now, or do you want to pay them later?

A Roth IRA is a post-tax account. That means you put in money you’ve already paid taxes on, and in exchange, your withdrawals in retirement are completely tax-free. On the flip side, pre-tax accounts like a Traditional IRA use dollars that haven't been taxed yet. You get a nice tax break today, but you’ll have to pay taxes on every dollar you take out down the road.

Choosing Between Pre-Tax and Post-Tax Retirement Savings

Figuring out the timing of your tax bill is one of the most critical parts of building a solid retirement plan. You can think of it as choosing between two paths to the same destination. One path makes you pay a toll upfront (that’s the post-tax Roth), while the other lets you pay the toll when you get to the end of your journey (pre-tax).

This decision can have a huge impact on your long-term wealth. A pre-tax contribution to an account like a Traditional IRA lowers your taxable income for the current year. That can be a major win if you're in a high tax bracket right now. In contrast, a post-tax contribution to a Roth IRA doesn’t give you that immediate tax deduction, but it secures an incredibly powerful advantage for your future self: 100% tax-free income when you finally retire.

Comparing the Core Concepts

To make this crystal clear, let's break down the mechanics of each approach. The fundamental difference is simply when the IRS takes its cut.

Here's a quick look at how these two account types stack up side-by-side.

Key Differences Pre-Tax vs Post-Tax Contributions

| Feature | Pre-Tax Account (e.g., Traditional IRA) | Post-Tax Account (Roth IRA) |

|---|---|---|

| Tax Impact Today | Lowers your current taxable income. | No immediate tax deduction. |

| Contribution Type | Made with pre-tax dollars. | Made with post-tax dollars. |

| Tax on Withdrawals | Withdrawals are taxed as ordinary income. | Qualified withdrawals are 100% tax-free. |

| Best For | Individuals who expect to be in a lower tax bracket in retirement. | Individuals who expect to be in a higher tax bracket in retirement. |

This table really highlights the core trade-off you're making. You're either getting a tax break now or securing tax-free income later.

Roth IRAs are funded with after-tax dollars, and for 2025, the maximum contribution limit is $7,000, with an additional $1,000 catch-up contribution for those aged 50 or older. Of course, there are income limits and eligibility rules to consider, which you can explore in Fidelity's detailed guide.

This very structure is why so many savvy savers wonder if they should have multiple retirement accounts to balance these different tax strategies.

How Roth and Pre-Tax Accounts Really Compare

Deciding between a Roth (post-tax) and a Traditional (pre-tax) account goes way beyond just when you pay your taxes. Each one has its own unique set of rules that can have a huge impact on your financial flexibility, how much you have to spend in retirement, and even the kind of legacy you leave for your family. Understanding these subtle but critical differences is the key to making a smart choice.

So, let's get past the surface-level stuff and really dig into how these accounts stack up against each other where it counts.

Tax Benefits and Timing

The biggest and most obvious difference is when you get your tax break. With a Traditional IRA, you get your reward right away. Your contributions can lower your taxable income today, which is a pretty powerful tool when you’re in your peak earning years.

A Roth IRA flips that on its head. You pay the taxes on your contributions upfront, but the real magic happens later. All your withdrawals in retirement are 100% tax-free. This is a massive advantage if you think you’ll be in a higher tax bracket down the road—or if you just want the simple peace of mind that comes from knowing the tax man can’t touch that money.

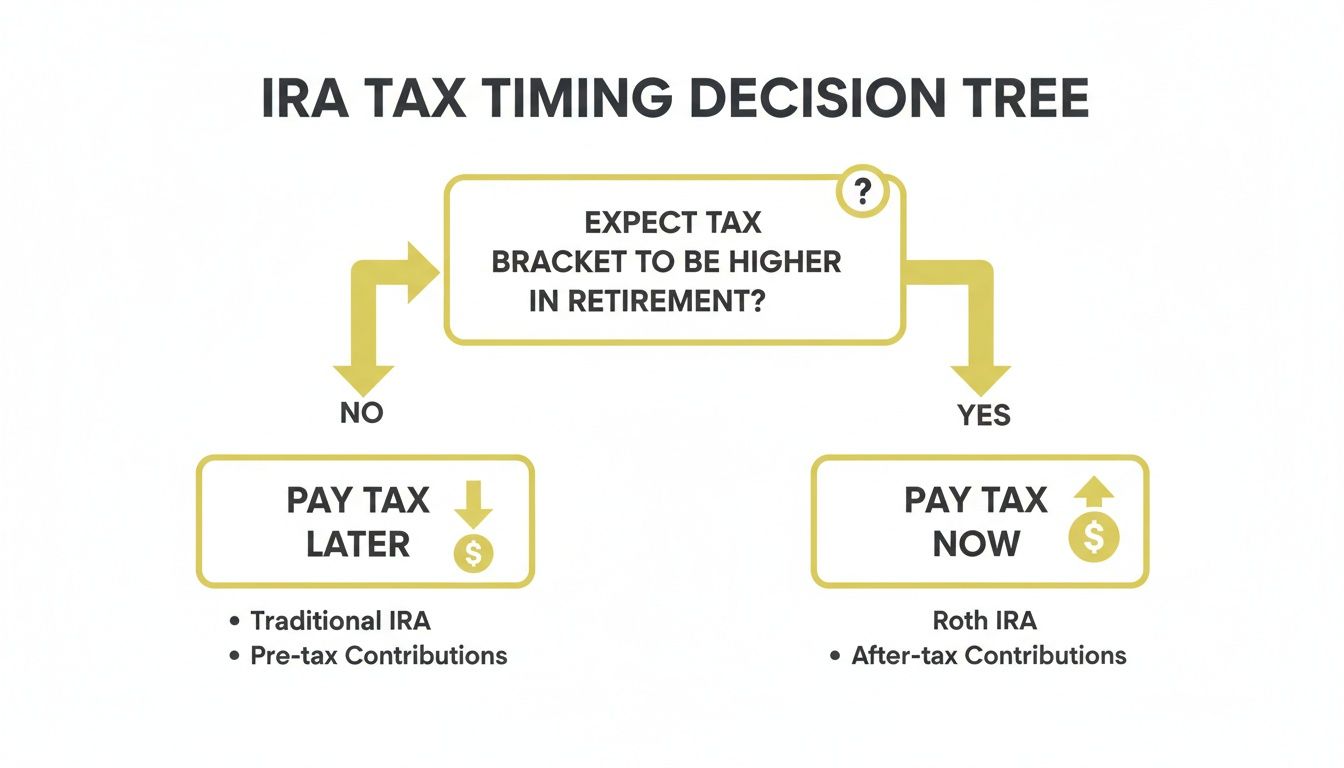

This decision tree helps visualize the core choice: pay taxes now with a post-tax Roth IRA or push them off until later with a pre-tax Traditional IRA.

As the chart shows, your best guess at your future tax rate is really the main driver in deciding whether a Roth IRA pretax or post-tax strategy is the right fit for you.

Contribution and Income Rules

Both accounts share the same annual contribution limits—for 2025, that’s $7,000 (or $8,000 if you're age 50 or older). But who can actually put money in is a totally different story.

- Traditional IRA: Pretty much anyone with earned income can contribute, no matter how much they make. The catch is that the ability to deduct those contributions gets phased out for higher earners who also have a retirement plan at work.

- Roth IRA: This is where income really matters. If your Modified Adjusted Gross Income (MAGI) is over a certain limit, you’re not allowed to contribute directly. This makes the Roth IRA a tool aimed mostly at people below those income thresholds, although savvy high-earners can use strategies like the Backdoor Roth IRA.

Withdrawals Before and During Retirement

How easily you can get to your money is another huge point of comparison, especially when life throws you a curveball.

This is where the Roth IRA really shines. You can pull out your original contributions—not the earnings, just what you put in—at any time, for any reason, completely tax-free and penalty-free. It’s this feature that makes it a fantastic hybrid savings and investment account.

With a Traditional IRA, it’s much harder to get your money out early. Any withdrawals before age 59½ typically get hit with both income tax and a 10% penalty.

One of the most powerful and often overlooked features of a Roth IRA is the complete absence of Required Minimum Distributions (RMDs) during the original owner's lifetime. This allows your investments to continue growing tax-free for as long as you live.

Traditional IRAs, on the other hand, force you to start taking RMDs at age 73. These required withdrawals don't just increase your taxable income every year; they can actually bump you into a higher tax bracket and even impact things like your Medicare premiums. For anyone who doesn't need the money and wants to maximize what they pass on to their heirs, the Roth IRA is the far superior tool.

When a Roth IRA Is Your Strongest Option

The choice between a Roth and a pre-tax account really boils down to one big question: where do you think your income and tax rates will be down the road? A pre-tax account gives you a break today, but a Roth IRA is the clear winner when you want tax certainty for the long haul.

It’s a calculated bet on your future self. If you believe your income will climb significantly throughout your career, paying taxes now while you're in a lower bracket can save you a fortune later on. This makes the Roth IRA an almost automatic choice for young professionals just starting out.

This forward-thinking strategy is catching on. As of mid-2025, Individual Retirement Accounts hold about $18.0 trillion in assets, and a whopping 62% of new contributions in the first quarter went straight into Roth accounts. This trend shows a growing conviction in the power of tax-free retirement income, a topic covered in this detailed analysis of retirement statistics.

Hedging Against Future Tax Uncertainty

Let's be honest: nobody knows what tax rates will look like in 10, 20, or 30 years. Contributing to a Roth IRA is like buying insurance against future tax hikes. By settling your tax bill today at rates we actually know, you lock in a source of completely tax-free income for retirement. It insulates a chunk of your nest egg from whatever Congress decides to do down the line.

This approach offers incredible peace of mind, especially for anyone who wants a predictable income stream without constantly worrying about how much of it the IRS will claim.

Diversifying your retirement savings from a tax perspective—by holding both pre-tax and post-tax accounts—gives you critical flexibility. It allows you to strategically pull from different accounts to manage your taxable income in retirement, potentially keeping you in a lower overall tax bracket.

Maximizing Your Legacy for Heirs

The power of a Roth IRA doesn't stop with you; it’s also a superior tool for estate planning. Unlike Traditional IRAs, Roth IRAs have no Required Minimum Distributions (RMDs) for the original owner. This means your money can keep growing, tax-free, for your entire life.

When you pass on a Roth IRA, your beneficiaries inherit an account that can provide them with tax-free withdrawals. While they will have their own distribution rules to follow, they won't owe a dime of income tax on that money. That’s a profound gift, ensuring the full value of your hard-earned savings is passed to the next generation without a big tax bill diminishing its impact.

When a Pre-Tax Account Makes Better Financial Sense

While the allure of a Roth IRA's tax-free future is strong, it's not a one-size-fits-all solution. There are times when a classic pre-tax retirement account—like a Traditional IRA or 401(k)—delivers a much bigger punch right when you need it. The whole "Roth vs. pre-tax" debate really boils down to one simple question: will you pay more in taxes now or later?

If you're in your peak earning years, a pre-tax account often comes out on top. The strategy is built on a pretty straightforward assumption: you're probably in a higher tax bracket today than you will be once you stop working.

By making pre-tax contributions, you get a tax deduction that lowers your taxable income right now. This can free up a surprising amount of cash, letting you save more aggressively or tackle other financial goals during a time when your expenses might also be at their highest.

Capitalizing on Your Peak Earning Years

For many mid-career professionals, the name of the game is reducing a hefty current tax bill. Every single dollar you put into a pre-tax account is a dollar that isn't taxed at your highest marginal rate.

Think about a professional in the 32% federal tax bracket. A $7,000 contribution to a Traditional IRA could instantly slice $2,240 off their tax bill for the year. That's a direct, tangible benefit you just don't get with a post-tax Roth contribution.

The logic is simple: take the tax break when it saves you the most money. If you expect your retirement income to put you in a lower bracket—say, 22% or 24%—you'll come out ahead. You saved money at a 32% rate and will only pay taxes later at a lower one.

The core idea behind a pre-tax strategy is to contribute at your marginal tax rate—the rate on your last dollar earned—but withdraw at your much lower effective tax rate in retirement. That difference is where the real magic happens.

Scenarios Favoring the Pre-Tax Approach

Several specific situations make a strong case for prioritizing pre-tax savings over a Roth. Seeing if these align with your own financial journey can bring a lot of clarity.

A pre-tax account is often the better fit if you:

- Are a high-income earner: Professionals with substantial salaries benefit the most from chipping away at their current taxable income.

- Plan to retire in a lower-tax state: Moving from a high-tax state like California to a state with no income tax, like Florida or Texas, makes deferring taxes an incredibly powerful move.

- Are pursuing Public Service Loan Forgiveness (PSLF): Pre-tax contributions lower your Adjusted Gross Income (AGI), which can lead to smaller student loan payments under an income-driven repayment plan.

Ultimately, choosing a pre-tax account is a strategic bet that your tax rate will be lower down the road. For anyone in their highest-earning years, it's a bet that often pays off handsomely by maximizing tax savings when they matter most.

Practical Scenarios for Your Financial Journey

Knowing the difference between a Roth IRA pretax or post tax strategy is one thing, but seeing how it plays out for real people is another. The best choice always comes down to your life—your age, your income, and where you're headed.

Let's walk through a few common situations to see how this decision really works.

The Young Professional Just Starting Out

Think about Sarah, a 25-year-old graphic designer making $60,000 a year. Her income is fairly low right now, but she's confident it'll climb throughout her career. For Sarah, the choice is a no-brainer: the post-tax Roth IRA is her best friend.

She pays taxes on her contributions now, while she’s in a lower tax bracket (probably 12% or 22%). Fast forward 40 years to her retirement, and all of that growth—plus every dollar she takes out—will be 100% tax-free. That’s a massive win compared to the small tax deduction a pre-tax account would give her today. She’s betting on herself, and a Roth lets her lock in today’s lower tax rates for good.

The High-Earning Couple in Their Prime

Now, let's look at Mark and Jessica. They're both 45, hitting their peak earning years with a combined income of $250,000. This puts them squarely in a high federal tax bracket, maybe 32% or 35%. Their main goal right now is to shrink their hefty tax bill.

For them, focusing on pre-tax contributions to their 401(k)s just makes sense. Every dollar they put in lowers their taxable income today, giving them a significant, immediate tax break. They expect to be in a lower tax bracket in retirement. By deferring taxes, they save at a high rate now and will pay taxes at a lower rate later. It's a strategy that frees up cash while they're juggling big expenses like a mortgage and college tuition.

The most powerful decision a saver can make is aligning their tax strategy with their anticipated life trajectory. The question isn't just about taxes; it's about whether you believe your financial standing will be stronger in the future or if you're capitalizing on your peak now.

The Retiree Managing Taxable Income

Finally, meet David, who is 68 and newly retired. He has a mix of retirement savings, including a large pre-tax 401(k) and a smaller post-tax Roth IRA. He's still a few years away from having to take Required Minimum Distributions (RMDs) from his 401(k).

David's strategy is all about keeping his taxable income low to manage his Medicare premiums and overall tax hit. His Roth IRA is an incredible tool for this. If a big, unexpected expense pops up, he can pull money from his Roth without adding a penny to his taxable income. This gives him amazing flexibility. He can be strategic about when he touches his pre-tax accounts, keeping his income—and his tax rate—right where he wants it.

For high-earners looking for more advanced savings options, exploring ways to save for retirement after maxing out a 401k can provide even more tax-advantaged opportunities.

Historical data shows that a balanced portfolio in a Roth IRA can yield significant tax-free growth over time, with a 60/40 stock and bond mix averaging around 8.77% annually. This demonstrates how even modest contributions can grow into a substantial tax-free nest egg, a concept you can explore further by reading about average Roth IRA returns.

Using a Roth Conversion to Get the Best of Both Worlds

What if you've spent years diligently saving in a pre-tax account, but the tax-free perks of a Roth IRA are starting to look mighty tempting? Good news: you're not stuck. A Roth conversion is a powerful move that lets you transfer funds from a traditional retirement account, like a 401(k) or Traditional IRA, straight into a Roth IRA.

This strategy essentially lets you have your cake and eat it too, turning your tax-deferred savings into a source of tax-free income down the road. But there's a crucial catch. You have to pay income taxes on the entire amount you convert, and you pay it in the year you make the move. Think of this tax bill as the price of admission for a lifetime of tax-free growth and withdrawals.

Is a Roth Conversion Right for You?

The decision to convert is all about timing. A Roth conversion makes the most sense when you find yourself in a lower tax bracket today than you expect to be in when you retire. Paying the taxes now at a lower rate can save you a bundle compared to paying them at a higher rate later.

So, when are the ideal times to pull the trigger?

- During a low-income year. This could be due to a career change, taking a sabbatical, or even stepping into early retirement.

- When the market takes a dip. A down market allows you to convert more shares for the same tax hit, setting you up for a bigger tax-free rebound.

- Before Required Minimum Distributions (RMDs) kick in. Those mandatory withdrawals can easily push you into a higher tax bracket, making a pre-emptive conversion a smart play.

A Roth conversion isn't just a financial transaction; it's a strategic decision to prepay your taxes. You're taking control of your future tax liability on your own terms, rather than leaving it to chance.

When planned carefully, a conversion can be a cornerstone of your strategy to reduce taxes in retirement, giving you far more flexibility and certainty when it matters most.

Common Questions About Retirement Account Taxes

Once you start digging into the details of retirement accounts, a lot of practical questions pop up. It’s totally normal. Getting a handle on the rules of the road is the first step to figuring out the best path for your family’s savings.

A question I hear all the time is whether you can have both a Roth and a Traditional IRA. The answer is yes, you absolutely can. You can put money into both in the same year, just as long as the total amount doesn’t go over the annual IRA contribution limit. Splitting your contributions like this is a great little strategy for tax diversification.

What If My Income Is Too High for a Roth IRA?

So, what happens if you make too much money to contribute directly to a Roth IRA? Don't worry, you still have a great option. There’s a strategy called the "Backdoor Roth IRA" that many high-earners use.

It works like this: you make a non-deductible contribution to a Traditional IRA and then immediately convert that money into a Roth. It's a completely legal way to get your money into a Roth account where it can grow tax-free. It can get a little tricky, so it’s always smart to run it by a financial advisor first.

At the end of the day, the choice between Roth or pre-tax accounts—whether it’s an IRA or a 401(k)—boils down to one simple question: Do you think your tax rate will be higher now or when you’re retired?

Is a Roth 401(k) a Good Idea?

The Roth 401(k) versus traditional 401(k) debate is pretty much the same as the IRA one. If you have a hunch you’ll be in a higher tax bracket in retirement—maybe your career is just taking off—then the post-tax Roth 401(k) is probably your best bet.

On the flip side, if you think your income will be lower in retirement, grabbing that immediate tax break with the pre-tax 401(k) makes a lot of sense.

Here at Smart Financial Lifestyle, our goal is to help you make these crucial decisions with total clarity and confidence. To see how you can line up your savings with your family’s future, feel free to explore our resources at https://smartfinancialifestyle.com.