The real difference between being rich and being wealthy boils down to one simple thing: Rich is about high income and what you spend, while wealthy is about owning assets that make money for you. It's a choice between a temporary lifestyle upgrade and lasting financial freedom.

The Core Difference Between Rich and Wealthy

At its heart, the whole rich vs. wealthy conversation is about cash flow versus asset ownership. Being rich often feels temporary; it's tied to a big paycheck from a demanding job. Think about a top surgeon or a professional athlete—they earn a ton of money, which fuels an impressive lifestyle full of luxury cars, sprawling homes, and five-star vacations.

But here’s the catch: that lifestyle is completely dependent on their ability to keep earning. If the income spigot turns off, the spending has to stop, too. This is the fundamental vulnerability of being rich. It's an active chase that requires constant effort.

Being wealthy, on the other hand, is all about sustainability and independence. Wealth isn’t measured by a salary slip but by the value of the assets that are working for you. These assets—stocks, real estate, businesses—generate passive income. That means your money is making money, whether you're actively working or not.

This single distinction creates a massive shift in financial security. A wealthy person's lifestyle isn't funded by their own labor, but by the returns their investments kick off.

"Wealth is a measurement not of your capital, but of the growth of your capital. Either your capital is growing at a pace greater than that which you are withdrawing from it... or it's not. And if it's not, I don't care how shiny it looks from the outside—it's not wealth."

This perspective completely reframes the end goal. It shifts the focus from just earning more to owning more, which is the bedrock of building a real, lasting legacy for your family.

Rich vs Wealthy At a Glance

To put it in simple terms, here's a quick side-by-side look at the key differences between being rich and truly wealthy.

| Characteristic | Rich | Wealthy |

|---|---|---|

| Primary Metric | High Annual Income | High Net Worth |

| Financial Focus | Spending and Consumption | Investing and Asset Accumulation |

| Source of Money | Active Labor (Salary, Bonuses) | Passive Income (Dividends, Rent) |

| Sustainability | Dependent on Continued Work | Self-Sustaining and Grows Over Time |

| Mindset | "How much can I spend?" | "How can I make my money work?" |

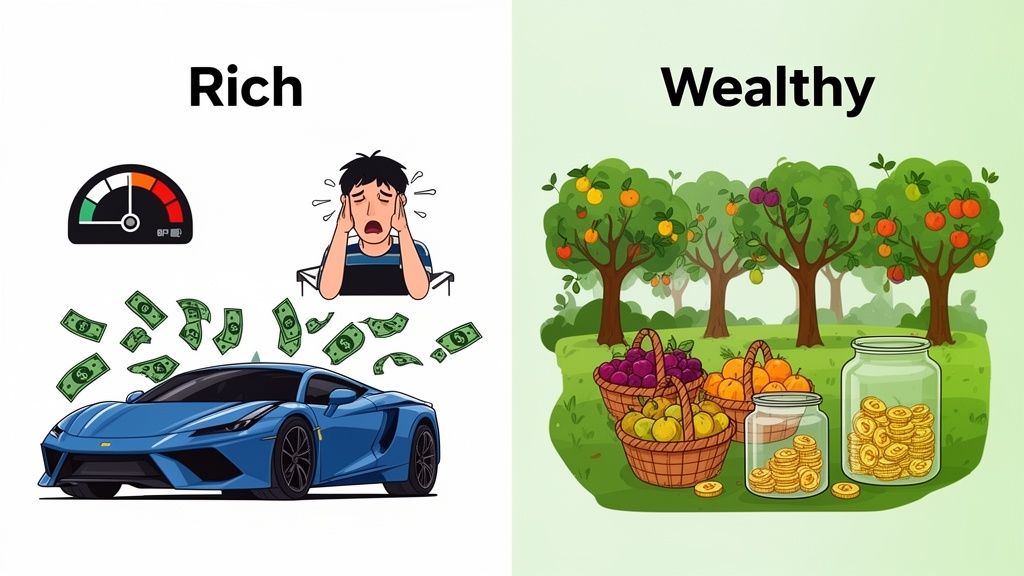

Ultimately, being rich is like having a high-performance sports car that needs constant, expensive fuel (your income) to run. In contrast, being wealthy is like owning a self-sustaining orchard. It produces fruit year after year, feeding you and future generations without demanding your daily labor.

Beyond Income: Comparing Key Financial Metrics

When we talk about being "rich," we're almost always talking about income. But relying on income alone to gauge someone's financial reality is like trying to understand a book by only reading the first page—it's a dangerously incomplete picture.

Real financial stability, the kind that lasts, is revealed by looking deeper. There are a few critical numbers that separate fleeting riches from genuine wealth. These are the metrics that tell the true story.

The most obvious starting point is income. This is what most people chase: the salary, bonuses, and commissions flowing in from a high-powered job. Think of a surgeon pulling in $600,000 a year. On paper, that person looks undeniably rich.

But income doesn't tell you anything about security. What if that same surgeon is drowning in massive student loans, a huge mortgage, and a lifestyle that eats up every dollar earned? Their financial foundation could be incredibly fragile. High income often just fuels high consumption, creating a treadmill that’s hard to get off.

The True Scorecard: Net Worth

This brings us to the metric that truly matters to the wealthy: net worth. It’s a simple calculation—your total assets minus your total liabilities—but it's the real scorecard of your financial position. Income measures what you earn, but net worth measures what you own.

For example, a small business owner might only pay themselves a modest salary of $80,000 a year. But if their business is valued at $2 million and they also own $1.5 million in investment properties with very little debt, their net worth completely eclipses the high-earning surgeon's.

This is the fundamental difference in thinking. The wealthy prioritize growing their balance sheet, not just their paycheck. A crucial piece of this is distinguishing between total net worth and what's actually available. To dig deeper, check out our guide on the difference between liquid net worth vs net worth.

The wealthy understand that income is temporary, but ownership is permanent. They focus on building a strong balance sheet that can withstand economic shocks and provide for generations to come.

Cash Flow and Financial Sustainability

Finally, the wealthy are obsessed with two interconnected metrics: cash flow from assets and financial sustainability. The goal isn't just to pile up assets for the sake of it. The real aim is to own assets that generate a steady, passive stream of income—think dividends from stocks, rent from real estate, or profits from a business they don't have to run day-to-day.

This asset-generated cash flow is what funds their lifestyle, making their wealth self-sustaining. The rich use their labor to pay their bills; the wealthy use their assets.

This distinction is massive on a global scale. The world’s total wealth recently hit a record $600 trillion, but a lot of that was just paper gains. In fact, for every $1 of actual new investment over the last 25 years, $3.50 in household wealth was created, often pumped up by debt instead of actual savings. The wealthy are the ones who own the assets that benefit from this system, creating a legacy that will long outlast them. You can dive into more on these global wealth dynamics in this detailed analysis.

The Mindset and Habits That Build True Wealth

Beyond the numbers on a balance sheet, the real difference between being rich and truly wealthy comes down to your mindset. It's a collection of habits and perspectives that shape how you see and use money. This psychological divide is often the single biggest factor determining whether a family's financial success is just a temporary phase or something built to last for generations.

A rich mindset is almost always tied to consumption. High income becomes a way to broadcast success by spending on luxury goods, extravagant vacations, and a lifestyle that barely keeps pace with earnings. It's a short-term focus, fueled by the immediate gratification that a fat paycheck can buy.

In contrast, a wealthy mindset prioritizes accumulation and preservation. It’s built on the discipline of delayed gratification, where today's earnings are seen as seeds for tomorrow's financial forest. This perspective completely reframes the purpose of money from a means of spending to a tool for building genuine freedom.

Spending Versus Investing

The most obvious difference in behavior boils down to one simple question asked before any big purchase. Someone with a rich mindset asks, "How much does it cost?" Their decision is based purely on whether they can afford the monthly payment or the sticker price. The entire focus is on the expense.

A wealthy mindset flips the script completely, asking, "What is the return on this investment?" And this question isn't just for stocks and bonds; it applies to every major financial decision. Whether it's buying real estate, funding a business, or even purchasing art, the first thought is whether the item will appreciate in value or generate future income.

The core idea is that the rich play defense with their money, constantly trying to out-earn their expenses. The wealthy play offense, turning their earnings into an army of income-producing assets.

This infographic breaks down the primary financial metrics that each mindset focuses on.

As you can see, the rich are fixated on income, whereas the wealthy concentrate on net worth and the cash flow generated by their assets.

Active Income Dependence Versus Passive Income Pursuit

This brings us to the final behavioral split. The rich often become dependent on active income—the salary they earn from their job. While it can be substantial, it requires them to perpetually trade their time for money. If they stop working, the money stops flowing. It's a golden handcuff situation.

The wealthy, however, are relentless in their pursuit of passive income. They systematically convert their active earnings into assets that work for them 24/7. Their goal is to reach a point where their passive income covers all their living expenses, effectively buying back their time and achieving true financial independence. This is the ultimate difference between rich and wealthy, and it is the foundation of a lasting legacy.

Understanding the Global Landscape of Wealth

To really get the difference between being rich and being wealthy, you have to zoom out and look at how money works on a global scale. When you do, the picture is crystal clear: true, lasting wealth is concentrated in the hands of a tiny group who have mastered the art of ownership. This isn't about envy; it's about understanding a fundamental truth.

Wealth isn't just about a high income; it’s about owning the assets that produce that income. While millions of people could be called "rich" because they earn a lot, the genuinely wealthy are the ones who control a massive share of the world’s assets—stocks, real estate, and businesses.

This concentration of ownership creates a powerful, self-fueling cycle. Assets generate returns like dividends, rent, and capital gains, which almost always outpace both inflation and wage growth. This means people who own assets see their net worth grow much faster than those who just rely on a paycheck, widening the gap year after year.

The Ultra-Wealthy Elite

A quick look at the data shows just how small this club of asset owners really is. The world has millions of high-net-worth individuals, but the truly wealthy—the ultra-high-net-worth (UHNW) population—are in a league of their own.

At mid-year, there were 41.3 million high-net-worth individuals globally with over $1 million each. However, the ultra-high-net-worth group—just 510,810 people with $30 million or more—represents only 1.1% of all millionaires yet holds 32.4% of their total wealth, a staggering $59.8 trillion. This means that 1% of millionaires control nearly a third of their entire wealth pool. You can explore more of this data in the complete World Ultra Wealth Report.

That statistic perfectly nails the core distinction. The rich might be among the millions with a high net worth, but the wealthy are the tiny fraction whose assets give them commanding financial power and unshakable security.

Why Asset Ownership Is the Only Path

This global picture isn’t just some interesting economic fact; it's a practical lesson for any family trying to build lasting financial security. Relying on income alone, no matter how high, is like running on a treadmill. You have to keep working just to hold your ground.

Owning a piece of the asset pie, on the other hand, is how you actually get ahead. It’s how your family’s financial foundation can grow stronger every year, completely independent of your active labor. The formula for building real wealth has been proven on a global scale:

- Acquire income-producing assets: Systematically buy things that will pay you, like dividend stocks, rental properties, or shares in a profitable business.

- Reinvest the returns: Use the income your assets generate to buy even more assets. This creates a powerful compounding effect.

- Hold for the long term: Wealth is built through patience. It’s about letting your ownership stakes appreciate and generate income over decades.

By shifting your focus from earning to owning, you adopt the same strategy used by the world’s wealthiest families. It’s the move that puts you on the path from being temporarily rich to becoming genuinely and sustainably wealthy.

Actionable Steps to Transition From Rich to Wealthy

Knowing the difference between being rich and being wealthy is one thing. Turning that knowledge into a real plan is how you actually secure your family’s future. Making the jump from a high-income earner to a true wealth-builder calls for deliberate action and a fundamental shift in your financial habits. This isn't about some complex Wall Street theory; it's about putting a straightforward, sustainable strategy into practice.

The journey really begins when you start thinking less like an employee and more like an owner. Below are four practical steps you can take today to kickstart this transition and lay the groundwork for a legacy that actually lasts.

Conduct a Financial Health Audit

You can't build a solid financial house on a shaky foundation, and you can't even know if it's shaky without looking. For the wealthy, the single most important metric isn't income—it’s net worth. That’s simply what you own minus what you owe. A financial audit gives you that number in black and white.

Start by making a list of everything you own that holds value (your assets):

- Liquid Assets: Cash in the bank, money market accounts.

- Investments: Stocks, bonds, mutual funds, 401(k)s, and IRAs.

- Real Property: Your home, rental properties, or any other real estate.

- Other Valuables: Equity in a business, cars, or valuable collectibles.

Next, list all your debts (your liabilities). This includes your mortgage, car loans, student debt, and any credit card balances. Subtract your total liabilities from your total assets. That final number is your true net worth. This is the number you need to obsess over growing.

Prioritize Investing Over Spending

Once you have a crystal-clear picture of your net worth, the next move is to make accumulating assets your default setting. The simplest way to pull this off is to pay yourself first by putting it on autopilot. Before you even get the chance to spend that income on lifestyle creep, automatically send a percentage of it straight to your investment accounts.

This means setting up recurring, automatic transfers from your checking account every time you get paid. This one simple action forces a shift from a consumption mindset to an ownership mindset, guaranteeing that your asset base grows consistently without you having to rely on daily willpower.

The wealthy don't just save what's left after spending; they invest first and live on what remains. This discipline is the engine of wealth creation.

Focus on Acquiring Income-Producing Assets

Not all assets are created equal. While your primary home is technically an asset, genuine wealth comes from acquiring things that generate passive income. This is money that finds its way to you without you having to actively trade your time for it.

Your goal should be to systematically buy assets that put money back into your pocket. Think of things like:

- Dividend-paying stocks: Owning shares in solid companies that share their profits with you.

- Rental real estate: Buying properties that generate monthly rental income.

- Business equity: Investing in or building businesses that can run without your day-to-day involvement.

Building these income streams is what ultimately paves the road to financial independence. For a deeper look at this strategy, check out our guide on how to create multiple income streams.

Educate the Next Generation

At the end of the day, true wealth is multi-generational. It’s not just about what you manage to build, but about the financial wisdom you pass down. The greatest inheritance you can give your kids is a healthy relationship with money.

Teach them the very principles you're putting into practice: the importance of ownership over consumption, the incredible power of compounding, and the underrated value of delaying gratification. Bring them into age-appropriate financial talks. When you do this, you're not just building assets; you're building a foundation that ensures your hard work becomes a launchpad for future generations, not a source of conflict. This is how financial success transforms into a lasting family legacy.

Preserving Your Legacy as the Ultimate Goal of Wealth

The journey from earning a high income to building lasting wealth isn’t just about accumulating money. It’s ultimately a journey toward legacy.

This is where the core difference between being rich and being wealthy truly comes to light—in the ability to create security that outlives you. It’s about so much more than numbers on a spreadsheet; it’s about intentionally providing for future generations and giving them a foundation of opportunity.

Richness buys a luxury car. Wealth funds a grandchild’s education without a second thought. Richness pays for a lavish vacation, while wealth ensures your aging parents receive the best care imaginable without causing a ripple of financial strain. That’s the real end game.

The ultimate goal is not a specific number, but a state of being: secure, free, and able to provide for loved ones long after you are gone.

This pivot from personal consumption to multi-generational support is what defines a true legacy. It's built by owning assets that grow over time, not just earning a high salary that disappears as soon as it comes in. Global data from the first global database of wealth accumulation confirms this, showing that assets generate returns that consistently outpace income growth, securing wealth for the long term.

A Legacy of Peace of Mind

Think about a family that successfully made this shift. The parents, both high-earning professionals, were rich by any standard. But they lived with the constant, grinding pressure to maintain their income stream.

After taking a hard look at their finances, they pivoted. They moved from funding a high-consumption lifestyle to aggressively acquiring income-producing assets like rental properties and dividend stocks.

Within a decade, their passive income completely covered their core expenses. The profound peace of mind this brought them was immeasurable. They were no longer just rich; they had become genuinely wealthy, with a system in place to support their children and grandchildren for years to come.

Of course, a crucial part of cementing this legacy was careful estate planning. Understanding these tools is essential, and our guide on what is a living trust vs will is a great place to start.

Common Questions About Being Rich vs. Wealthy

Let's tackle some of the questions that come up most often when talking about the difference between being rich and truly wealthy. Getting these concepts straight can make a huge difference in how you plan your family's financial future.

Can Someone Be Rich Without Being Wealthy?

Absolutely, and it’s more common than you’d think. Picture a top surgeon pulling in $700,000 a year. They have all the markers of a rich lifestyle—luxury cars, a huge house, expensive vacations. But if they’re spending every dime and carrying a mountain of debt to fund it all, they aren’t wealthy.

Their financial life is built on income, not assets. If that high-powered job disappeared tomorrow, the whole house of cards would come tumbling down. Wealth isn't about what you earn; it's about what you own and what's left after you pay your debts.

How Long Does It Take to Become Wealthy?

Building real wealth is a long game, not an overnight jackpot. For most families, it’s the result of decades of patient work: consistently investing, living below their means, and letting the magic of compounding do its thing.

There’s no magic number or fixed timeline. How long it takes depends entirely on your savings rate, how your investments perform, and what your ultimate financial goals are. It's a marathon, not a sprint.

The secret ingredient is consistency. Wealth is built brick by brick through patient, strategic decisions made over many years, not in a mad dash fueled by a big salary.

What Is the First Step to Building Wealth?

The single most important first step is a mental one: shift your focus from spending money to owning assets.

In practical terms, it starts with one simple but powerful action: automating your investments. Before a single bill gets paid, before you even think about discretionary spending, have money automatically transferred to your investment accounts. This “pay yourself first” strategy is the foundational habit of every successful wealth-builder. It guarantees you’re always acquiring assets that can grow for you.