Medicare Supplement Insurance, often called Medigap, is a special type of private insurance designed to help pay for healthcare costs that Original Medicare doesn't cover. Think of it as a financial safety net that fills in the "gaps" in your primary Medicare coverage, making your medical expenses far more predictable.

Decoding Medigap and Its Role in Your Healthcare

If you think of Original Medicare (Part A and Part B) as the solid foundation of your healthcare in retirement, a Medigap policy is the sturdy framework that reinforces it. While Medicare covers a huge portion of your hospital and medical bills, it was never designed to cover 100% of the costs. This is exactly where many retirees and their families face unexpected financial shocks from out-of-pocket expenses.

A Medigap plan works hand-in-hand with your Original Medicare. You pay a separate monthly premium to a private insurance company, and in return, the plan takes care of costs that would otherwise come directly out of your pocket. This simple step can transform unpredictable medical bills into a stable, manageable monthly expense—a crucial move for protecting your retirement savings.

Why Medigap Was Created

Understanding where these plans came from really clarifies their purpose. Created in 1990 and later standardized, Medigap policies were designed for one reason: to fill the gaps in Original Medicare. They cover the copays, coinsurance, and deductibles that can quickly drain a nest egg. Fast forward to today, and these plans remain a lifeline for millions of retirees navigating healthcare costs that can average over $13,000 annually for those 65 and older. Learn more about the average costs of these plans on CBS News.

The biggest benefits of adding a Medigap plan are straightforward:

- Financial Predictability: By covering most out-of-pocket costs, you can budget for your healthcare with much greater certainty. No more guessing games.

- Freedom of Choice: You can see any doctor or visit any hospital in the U.S. that accepts Medicare. There are no restrictive networks to worry about.

- Peace of Mind: Knowing you're protected from large, unexpected medical bills provides immense emotional and financial security for you and your family.

The core value of a Medigap policy is its simplicity and reliability. It’s not about adding complex new benefits; it's about making the benefits you already have through Medicare more complete and affordable.

Medigap vs. Original Medicare at a Glance

Let’s put this into a simple side-by-side comparison. It really highlights how a Medigap plan enhances your existing coverage.

Here’s a quick look at what Original Medicare covers on its own versus how it looks with a Medigap plan stepping in to help.

Original Medicare vs Medicare with a Supplement Plan

| Healthcare Cost | Covered by Original Medicare (Part A & B) | How a Medigap Plan Helps |

|---|---|---|

| Part B Coinsurance | Typically covers 80% of doctor visit costs. | Pays the remaining 20% for you, so you owe nothing for the visit. |

| Part A Deductible | You pay a deductible for each hospital stay. | Covers the entire hospital deductible, eliminating a major expense. |

| Doctor Network | You can see any doctor who accepts Medicare. | You keep this freedom; there are no restrictive networks. |

As you can see, a Medigap plan doesn't replace your Medicare—it just makes it work better for your budget by picking up the costs that Medicare leaves behind.

Finding Your Way Through the Medigap Plan Options

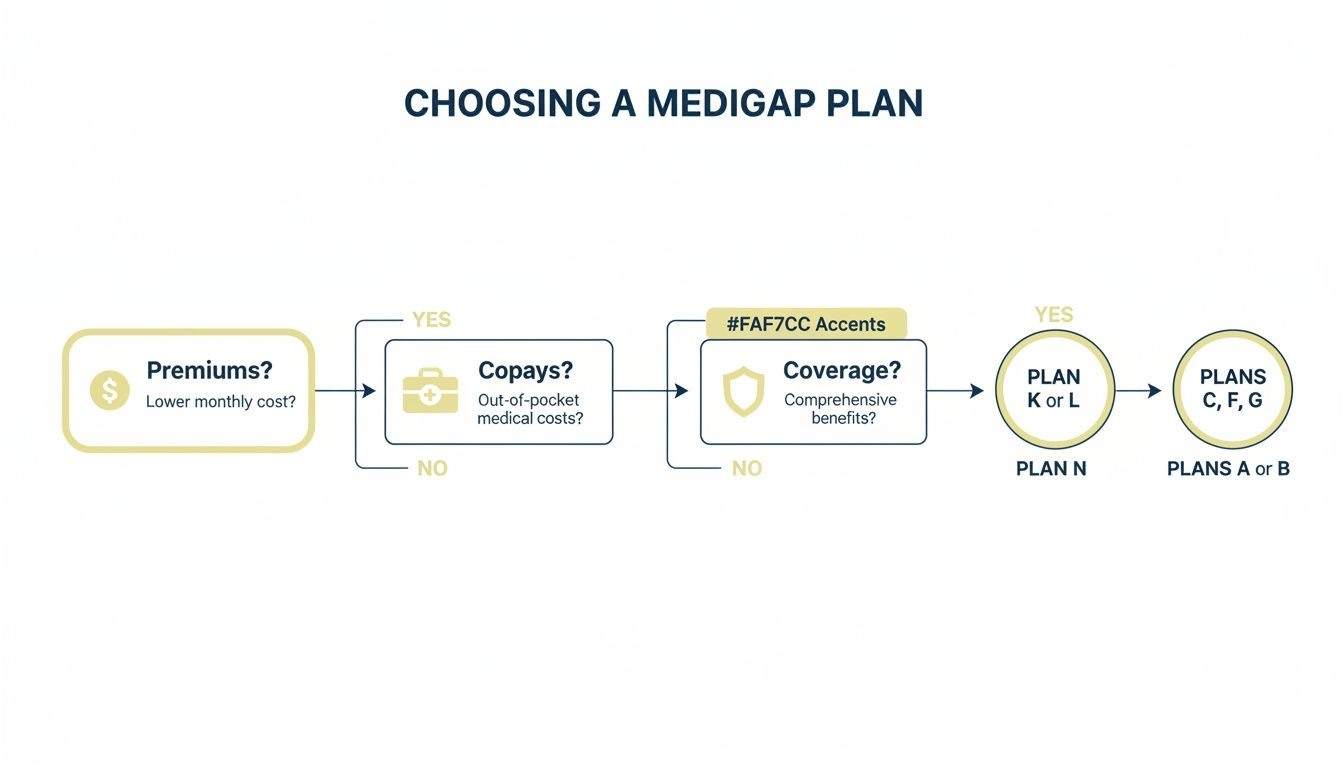

Choosing a Medicare Supplement plan can feel like you're trying to order from a menu in another language, with options labeled with nothing but letters. But once you get the hang of the basic structure, it’s much easier to spot the plan that fits your life.

All Medigap plans are standardized. That’s a huge deal. It means a Plan G from one insurance company has the exact same core benefits as a Plan G from another. The only real differences are the monthly premium and the company's customer service. This lets you focus on the coverage level you need for your health and budget, without getting lost in confusing fine print between insurers.

The Most Popular Medigap Plans Today

For folks just getting started with Medicare, two plans almost always rise to the top for their solid value and comprehensive coverage: Plan G and Plan N. They’ve become the go-to choices for a good reason, offering strong protection against the most common—and costly—gaps in Original Medicare.

Let's break down what makes each one a winner:

-

Medigap Plan G: The Gold Standard. People often call this the most complete option you can get as a new enrollee. Once you’ve paid your annual Medicare Part B deductible, Plan G jumps in to cover just about everything else for Medicare-approved services. This includes your 20% coinsurance for doctor visits and those hefty hospital deductibles, leaving you with very predictable healthcare costs.

-

Medigap Plan N: The Smart Alternative. Plan N is a fantastic choice if you'd rather have a lower monthly premium and don't mind a little bit of cost-sharing here and there. It covers the big stuff just like Plan G, but you'll have a small copay (up to $20) for some doctor's visits and a $50 copay for an ER trip that doesn't lead to a hospital stay.

It really comes down to a strategic choice for your financial future. Do you prefer Plan G's total predictability, or Plan N's lower monthly premium with a few minor copays? You're deciding whether to pay a little more each month for near-total coverage or save on premiums by handling small, occasional costs yourself.

Why You Can’t Buy Plans F and C Anymore

You might hear friends or family who've been on Medicare for a while talk about their Plan F. It used to be the most popular plan out there, hands down. But as of January 1, 2020, a federal law changed the game. It stopped insurance companies from selling Medigap plans that cover the Medicare Part B deductible to anyone newly eligible for Medicare.

This change meant that Plan F and Plan C were effectively phased out for new members.

The idea behind the law was to give beneficiaries a little "skin in the game" by having them pay the Part B deductible themselves. Policymakers hoped it would encourage people to be more conscious of their healthcare spending. This one move totally reshaped the Medigap market.

While a lot of people still have their old Plan F policies, this shift pushed Plan G right into the top spot for new enrollees. In fact, by the end of 2024, Plan G enrollment is expected to soar past 5.7 million people. It’s a natural fit, since it mirrors Plan F’s amazing benefits in every single way except for covering that one deductible. You can explore detailed enrollment trends on Mark Farrah Associates.

For many, this transition has actually made the decision simpler. With Plan G now offering the highest level of coverage available, it’s a clear benchmark. You can decide if its near-complete coverage is right for you, or if a plan like N, with its lower premiums and small copays, is a better match for your financial strategy.

Medigap vs. Medicare Advantage: Making the Right Choice

Deciding between a Medigap plan and a Medicare Advantage plan (often called Part C) is easily one of the biggest healthcare choices you'll make. These two options are built completely differently, and the right one for you really boils down to your personal needs, your budget, and how you live your life. Getting a handle on how they differ is the first step to feeling confident in your decision.

Here’s a simple way to think about it: a Medigap plan is like ordering à la carte at a restaurant. You have the freedom to pick any doctor or hospital in the country that takes Medicare, which gives you incredible flexibility. On the other hand, a Medicare Advantage plan is more like a prix fixe menu. You operate within a local network of providers and often get extra perks bundled in, but your choices are pretty much limited to that network.

Freedom of Choice vs. All-in-One Convenience

With a Medigap plan, your healthcare coverage is clean and simple. You hold onto Original Medicare as your main insurance, and the Medigap policy steps in to pay for the costs that Medicare leaves behind. This setup gives you the freedom to see specialists and get care anywhere in the U.S. without needing a referral, as long as the provider accepts Medicare. For anyone who travels a lot or has specific doctors they want to see, this is a massive advantage.

Medicare Advantage plans, however, actually replace your Original Medicare. They’re offered by private insurance companies and are required to cover everything that Medicare Part A and Part B do. But they often toss in extra benefits that Original Medicare won't touch, such as:

- Routine dental and vision check-ups

- Hearing aids

- Prescription drug coverage (Part D)

- Gym memberships and wellness programs

The trade-off for these bundled goodies is that you have to use the doctors and hospitals inside the plan's specific network, which is almost always regional. If you go out-of-network, you'll usually face higher costs or get no coverage at all, unless it's an emergency.

This decision tree gives you a great visual of the key things to weigh, like whether you prefer predictable premiums over lower copays and what level of coverage really fits your needs.

As you can see, the choice really hinges on finding the right balance between your monthly costs, the freedom to choose your providers, and how much coverage you truly want.

Comparing Costs and Financial Predictability

The way you pay for care is also completely different between the two. A Medigap plan usually comes with a higher monthly premium, but it offers amazing predictability when it comes to costs. Once you pay your premium and the yearly Part B deductible, you’ll have very few out-of-pocket expenses for services Medicare covers, if any at all. That stability can be a huge comfort, especially when you start thinking about future care needs. For a deeper dive, you might find our guide on long-term care insurance explained helpful.

Medicare Advantage plans often look attractive with their low or even $0 monthly premiums. The catch is that you'll have copayments, coinsurance, and deductibles for most services you use. While these plans do have an annual out-of-pocket maximum to protect you from a financial catastrophe, your yearly healthcare spending can swing wildly depending on how much medical care you end up needing.

The choice boils down to a trade-off: higher, predictable monthly costs with Medigap versus lower monthly premiums but less predictable out-of-pocket expenses with Medicare Advantage.

In the end, there’s no single "best" answer that fits everyone. It all comes down to what you prioritize. If having your choice of doctors and knowing exactly what you'll spend are your top concerns, a Medigap plan is probably the better fit. But if you'd rather have an all-in-one plan with extra benefits and you're fine staying within a local network, a Medicare Advantage plan could be the right path for you.

How Medigap Plan Costs Are Figured Out

Trying to pin down the exact cost of a Medicare Supplement plan can feel a bit like chasing a moving target. The reality is, there’s no single price tag. Your monthly premium is a unique number that gets shaped by a few key things, like where you live, your age, and the specific plan you end up choosing.

Getting a handle on these factors is the first real step toward budgeting for your healthcare in retirement. While the core benefits of a standardized plan—say, Plan G—are the same no matter who you buy it from, the price you pay for that coverage can swing wildly between insurance companies. This is exactly why it pays to shop around.

The Main Things That Influence Your Premium

Insurance carriers look at a few pieces of your personal puzzle when they calculate your monthly premium. While you can't control all of them, knowing what they are helps you understand why you might get two very different quotes for the same plan.

- Your Location: Where you live makes a huge difference. Healthcare costs aren't the same everywhere—they vary by state and even by zip code. Insurance companies have to adjust their rates to match those local costs, so a plan in a big city is almost always going to cost more than the exact same one in a rural town.

- Your Age: Your age when you first sign up is a major driver of your initial cost. In most cases, the younger you are when you enroll, the lower your starting premium will be. This is a big reason why signing up during your Medigap Open Enrollment Period right at 65 is such a smart move.

- Tobacco Use: If you use tobacco, expect to pay more. Most carriers have separate, higher rates for smokers. The good news? If you've quit for a while, you can often qualify for non-smoker rates and lock in some serious long-term savings.

- Plan Choice: It stands to reason that the more a plan covers, the more it costs. A comprehensive Plan G, which takes care of nearly all your out-of-pocket costs, will have a higher monthly premium than a Plan N, where you’re responsible for some small copayments.

We’re starting to see some upward pressure on rates. Filings for 2025 show major carriers are pushing for premium hikes of 2.5% to 3.0% more than in past years. Popular plans like G and N are even seeing double-digit increases in some areas as claims costs rise. Still, the value is undeniable—most people pay between $90 and $300 a month, a cost that pales in comparison to what a single surprise hospital stay could set you back. You can discover more insights about these 2025 rate actions on telosactuarial.com.

How Insurance Companies Price Their Plans

Okay, this is where we get into the nitty-gritty, but it’s super important for your long-term financial planning. Insurance companies use one of three methods to price their Medigap policies. The method they use is the secret sauce that determines how your premium might change as you get older.

Understanding a policy's pricing model is just as important as the premium you see on day one. A low starting price isn't much of a deal if it's designed to jump up sharply every single year.

Let’s pull back the curtain on these three pricing systems so you can make a choice that works for you now and for your future self.

The Three Medigap Pricing Models

| Pricing Method | How It Works | What It Means for You |

|---|---|---|

| Community-Rated | Everyone in a certain area pays the same premium, no matter their age. | Your premium won't climb just because you have a birthday. It can still go up for other reasons, like inflation, but your age won't be a factor. |

| Issue-Age-Rated | Your premium is based on your age when you first buy the policy. It's "locked in" based on that starting age. | You’ll get a lower premium if you buy at 65. Your rate won't increase just because you get older, but it can still rise with inflation. |

| Attained-Age-Rated | Your premium is based on your current age. It starts out low but goes up as you get older. | This is often the cheapest plan out of the gate, but it will get more expensive over time, which could make it harder to afford later in retirement. |

Picking a policy isn’t just about finding the cheapest premium today. It’s about finding a plan with a pricing structure that fits your financial game plan for the next 20 or 30 years. An issue-age or community-rated plan usually offers more predictable, stable costs down the road—which is exactly what a good Medigap plan is supposed to do.

When and How to Enroll in a Medigap Plan

When it comes to picking up a Medicare Supplement plan, timing isn't just important—it's everything. Unlike other types of insurance you can grab whenever you want, Medigap has a very specific window of opportunity. It's a window where you hold all the cards.

Miss this window, and you could face some serious, long-term headaches with your healthcare costs and choices.

The Golden Ticket: Your Medigap Open Enrollment Period

Think of your Medigap Open Enrollment Period as your one-time golden ticket. It's a six-month period that kicks off on the very first day of the month you are both 65 or older and signed up for Medicare Part B. This is a protected timeframe designed just for you.

During these six months, you have something incredibly powerful called "guaranteed issue rights." This is a massive advantage. It means insurance companies are legally required to sell you any Medigap policy they offer, no matter what your health history looks like.

The Power of Guaranteed Issue Rights

This is a big deal. With this protection, insurance carriers absolutely cannot:

- Deny you coverage because of pre-existing conditions like diabetes, heart disease, or cancer.

- Jack up your premiums because of your health status.

- Make you wait for your coverage to start, even if you have pre-existing conditions.

This is the only time in your life you'll have this much freedom and control in the Medigap marketplace. It is your single best shot at getting the exact plan you want at the best possible price, without your health being a factor at all.

Your Medigap Open Enrollment Period is your one and only opportunity to enroll with no health questions asked. Once this six-month window closes, it doesn't come back.

What Happens If You Miss This Window?

So, what if you decide to wait and apply for a Medigap plan down the road? Well, things get a lot trickier. Once your Open Enrollment Period is over, insurance companies can use medical underwriting to decide if they even want to offer you a policy.

This means they'll ask you to fill out detailed health questionnaires, pull your medical records, and look at your prescription history. Based on what they find, they have every right to deny your application flat out. And even if they do approve you, they could charge you a much higher premium for the exact same plan you could have gotten easily just a few months earlier.

This is a critical point, especially if you're helping older family members manage their healthcare. Making sure they act during this initial period can prevent huge financial and logistical problems later on. For those navigating these conversations, our article on how to help aging parents with finances offers some practical tips for these important discussions.

Are There Any Exceptions?

While that initial six-month window is the clearest path, there are a few specific situations that might give you guaranteed issue rights outside of that period. These are often called Special Enrollment Periods.

For instance, you might get another shot if:

- Your Medicare Advantage plan is leaving your area.

- You move out of your current plan’s service area.

- The group health plan from your employer that supplements Medicare is ending.

But these situations are pretty specific and don't apply to most people. Relying on a special circumstance to enroll later is a risky bet. The safest, smartest approach is to treat your six-month Medigap Open Enrollment Period as the can't-miss deadline it is. Acting during this time secures your peace of mind for years to come.

Securing Your Financial Future with the Right Plan

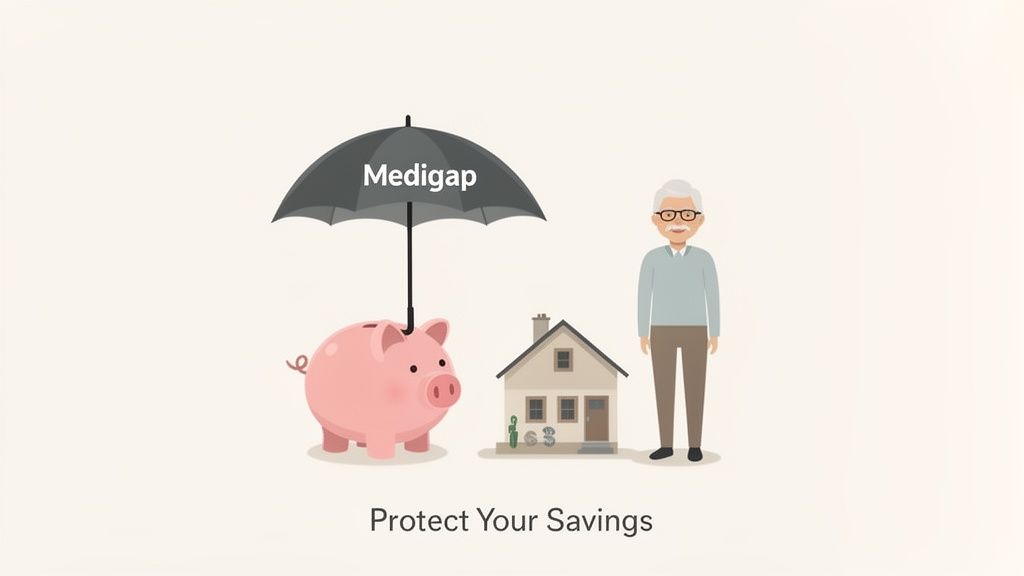

Picking a Medicare Supplement plan is about so much more than just healthcare. It's a fundamental move to protect your financial stability for the rest of your life. Think of it as building a firewall around the assets you've worked so hard to accumulate.

This isn't about just another monthly bill; it's about trading unpredictable, potentially catastrophic medical costs for one single, manageable premium. That’s the first core benefit: financial predictability. A Medigap policy takes the guesswork out of your healthcare budget, which is the cornerstone of a stress-free retirement.

The second huge benefit is freedom of choice. Medigap plans give you the power to see any doctor or visit any hospital in the country that accepts Medicare. No referrals needed. This flexibility is critical, ensuring you can get the right care, wherever you happen to be.

Protecting Your Legacy and Easing Family Burdens

For anyone thinking about the legacy they want to leave behind, a Medigap plan is an essential tool. A single major health crisis can wipe out savings that you intended for your spouse or your kids. Medigap acts as a shield for your nest egg, protecting it from those sudden financial shocks.

At the end of the day, the greatest benefit might just be peace of mind. It’s that quiet confidence you get from knowing you have a reliable partner covering your back, safeguarding both your health and your financial future.

This kind of planning is also a profound gift to your adult children or caregivers. When a parent's healthcare costs are stable and known, it removes a massive layer of stress from the already challenging task of caregiving. It allows everyone to focus on what really matters—health, family, and quality time.

Making this choice now can prevent your family from facing agonizing financial decisions down the road, which is a key part of protecting assets from nursing home costs and other long-term care expenses.

Making a Decision for a More Secure Retirement

By now, you see what Medicare Supplement Insurance is all about and the powerful role it can play. It’s a strategic decision that brings certainty to an uncertain world. It’s what allows you to walk into your retirement years with your head held high, knowing you’ve got a solid plan for whatever healthcare costs come your way.

Taking this step is about ensuring your retirement is defined by freedom and security, not by financial anxiety. It’s about taking control, protecting what’s yours, and giving yourself and your family a less stressful, more fulfilling life. The right Medigap plan is truly an investment in your future well-being.

Medigap: Your Questions Answered

As you start to explore Medigap, it's totally normal for a bunch of practical questions to pop into your head. Making a smart choice for your retirement means getting clear, straightforward answers. Let's walk through some of the most common things people ask when they're trying to figure out Medigap.

Do Medigap Plans Cover My Prescriptions?

This is one of the biggest points of confusion, so let's clear it up: no, today’s Medigap plans do not cover prescription drugs. Think of them as being built for one specific job: to fill the holes in Original Medicare Part A and Part B. They step in to pay for things like your hospital deductibles and the coinsurance on your doctor visits.

For your medications, you'll need to sign up for a separate, standalone Medicare Part D plan. It helps to picture your retirement healthcare like a team. Original Medicare is your starting player, Medigap is the defender handling out-of-pocket costs, and Part D is your specialist for prescriptions.

Can I Switch My Medigap Plan Later On?

Yes, you can apply to switch your Medigap plan anytime you want. But—and this is a big "but"—it comes with a major catch. Once that initial six-month Medigap Open Enrollment Period you get when you first turn 65 is over, your special "guaranteed issue" rights usually vanish.

What does that mean for you? If you apply for a new plan down the road, the insurance company will almost certainly put you through medical underwriting. They'll comb through your health history and can legally deny you coverage or charge you a whole lot more based on pre-existing conditions. This is exactly why picking the right plan from the get-go is so critical for your long-term financial health.

Your best shot at switching Medigap plans is during your one-time Open Enrollment Period. After that, your health status becomes the main event, which can make it much harder—and more expensive—to change your mind.

Does Medigap Cover Dental, Vision, or Hearing?

Standard Medigap plans don't cover routine dental, vision, or hearing care. That's because their job is to supplement Original Medicare, which also doesn't cover these routine services. A good rule of thumb is that if Medicare Part A or B doesn't cover something in the first place, your Medigap plan won't pay for it either.

If those benefits are a priority for you, you have a couple of solid options:

- Buy Standalone Policies: Plenty of insurance companies offer separate dental, vision, and hearing plans that you can buy to round out your coverage.

- Look into Medicare Advantage: Another route is to consider a Medicare Advantage (Part C) plan. Many of them bundle these extra benefits into an all-in-one package, but be aware that this means you would be leaving Original Medicare and Medigap behind entirely.

Getting a handle on these key details helps you build a complete picture of what Medigap is and how it fits into your bigger healthcare strategy. It’s all about making sure you have the coverage you actually need, without any unwelcome surprises later on.

At Smart Financial Lifestyle, we believe making smart financial decisions is the key to a secure retirement. Our goal is to provide the clarity you need to protect both your health and your wealth. For more insights and guidance, visit us at https://smartfinancialifestyle.com.