When it comes to teaching kids about money, the best advice I can give after 50 years in this field is simple: start early and keep it tangible. For kids between 3 and 6 years old, this isn’t about abstract financial theories. It's about hands-on experiences, like using a clear jar to watch savings grow or talking about "needs" versus "wants" during a grocery run. The whole point is to build a positive, stress-free foundation, making money a normal part of life from the very beginning.

Building a Healthy Money Mindset in Early Childhood

A child’s financial habits start taking shape long before they ever get a paycheck or open a bank account. Believe it or not, those early years between three and six are a golden window of opportunity. This is when you can introduce core money concepts in a positive, totally pressure-free way.

Learning at this age isn’t about spreadsheets or big numbers. It’s about helping them connect the dots between effort, money, and the things we value. Your role here is to be their guide, turning everyday moments into simple but powerful lessons that will stick with them for life.

Making Money Tangible for Young Minds

To a preschooler, money is pure magic. They see you tap a card or a phone, and poof—you walk out of the store with a cart full of goodies. The first step is to make it real and visual for them.

Over my 50+ years, one of the most effective tools I’ve seen isn't a fancy app, but a simple clear jar. Unlike a piggy bank that hides the money away, a clear jar lets a child physically see their savings grow. Every coin that clinks inside is a visible step toward their goal, turning the fuzzy idea of "saving" into something concrete and exciting.

When a kid can actually watch their collection of quarters and dollars pile up, the concept of saving for something special becomes a real-time experiment they can get excited about. That simple visual is often more powerful than any lecture you could give.

This isn’t just a nice idea; it’s a strategy recognized worldwide for building stronger futures. Investing in early childhood development, which includes the foundational skills for financial literacy, shows measurable benefits. For example, a World Bank initiative saw $18.7 billion invested in early childhood programs, which helped enroll 31 million children in quality preschool education. A standout case was Morocco, which boosted its preschool enrollment from 45% to 76% in just five years as part of this effort. This just goes to show the global emphasis on the power of early learning.

To give you a clearer picture, here’s a quick summary of the core concepts you can introduce at this age.

Key Money Concepts for Young Children (Ages 3-6)

| Concept | What It Means for a Child | Simple Activity Example |

|---|---|---|

| Earning | Money comes from work or effort. | Doing a small, age-appropriate chore (like putting toys away) to earn a coin for their jar. |

| Saving | Setting money aside to buy something bigger later. | Putting coins in a clear jar to save up for a specific, desired toy. |

| Spending | Exchanging money for something you want or need. | Using their own saved money to buy a small item at the store, like a gumball or a sticker. |

| Needs vs. Wants | Some things we must have (needs), and others are just nice to have (wants). | On a grocery trip, explain that milk is a "need" but the candy at checkout is a "want." |

These simple ideas, introduced through play and daily routines, lay the groundwork for a lifetime of smart financial decisions.

Turning Play into Powerful Lessons

Kids learn best when they're playing, so use that to your advantage. A pretend store at home is a fantastic and fun way to introduce the idea of buying and selling.

- Gather Your Inventory: Use their favorite toys, snacks, or crafts.

- Set Simple Prices: Make little price tags (1 penny, 5 cents, 1 dollar).

- Use Play Money: Give them a small stash of play money to be the "shopper."

As they "buy" things from you, they start to grasp that money is exchanged for goods. This game also introduces the idea of scarcity in a gentle way—once their money is gone, they can't buy anything else. It's a low-stakes introduction to making choices and understanding opportunity cost, which are fundamental skills in personal finance. Plus, it’s a fun way to practice counting!

The First Steps in Budgeting: Needs vs. Wants

Your regular trip to the grocery store is the perfect real-world classroom. Before you even leave the house, talk about the shopping list and explain that these are the things you need to buy, like milk, bread, and vegetables.

Once you’re in the aisles, your child will inevitably spot things they want, like that brightly colored box of cereal or a toy strategically placed at eye level. This is your chance to start a conversation.

You can say something like, "I know you really want that toy, but today we're only buying the things on our 'needs' list. How about we add that toy to your savings goal jar when we get home?" This simple exchange does two things: it teaches them to tell the difference between a need and a want, and it reinforces the critical skill of delayed gratification. Learning they can’t have everything the moment they see it is a huge life lesson. It's also a great moment to learn more about your own financial tendencies by understanding if you're a natural saver or a spender.

Connecting Work and Money with School-Aged Kids

Once your kids hit those school years, roughly between ages seven and ten, you'll notice their minds are ready for bigger ideas. This is the golden window to introduce one of the most important financial lessons they'll ever learn: money comes from work.

It's time to connect the dots between effort and earning. The abstract idea of money can now be tied to real, tangible responsibilities. We're moving beyond simple tasks and into a system that gives them their first taste of financial independence. This is where you introduce a commission or allowance—not as a handout, but as a powerful teaching tool for managing their first real "income."

Allowance vs. Commission: Which Is Right for Your Family?

Over my 50+ years, one of the most common questions I get is whether to give a straight allowance or pay commissions for chores. There’s no single right answer, but each method sends a very different message.

- An allowance is typically a fixed amount of money given each week, regardless of chores. The lesson here is all about managing a budget. They learn to make a set amount of money last, which is a fantastic skill for practicing basic budgeting.

- A commission system, on the other hand, pays kids for specific jobs they complete. No work, no pay. This model directly teaches that money is earned through effort.

A lot of families I've worked with find a hybrid approach is the sweet spot. You could provide a small, base allowance for being a contributing member of the family (things like keeping their own room tidy) and then offer commissions for "above-and-beyond" jobs. Think raking leaves, washing the car, or helping with a big weekend project. This way, they learn both budgeting and the value of a strong work ethic. If you're looking for ideas, we have a great guide on how to make money as a kid.

The Four Jars: A Visual Budgeting System

Okay, so your child is starting to earn money. What now? Just handing them cash without a plan usually leads to it disappearing on candy and trinkets. This is where the simple—but profound—"four jars" system comes into play.

Forget the single piggy bank. Get four clear jars and label each with a specific purpose: Spend, Save, Give, and Invest.

- Spend: This is their "fun money" for immediate wants, like a small toy or an ice cream cone. It teaches them to make spending decisions within a set limit.

- Save: This jar is for bigger goals that require patience. They learn delayed gratification by watching their savings grow for that one special thing they really want.

- Give: This jar builds empathy and a philanthropic spirit. They can choose a charity, support a local cause, or even help a friend in need, learning that money is also a tool for doing good.

- Invest: For young kids, this can be a "long-term growth" jar. It plants the seed for the idea that some money is set aside to grow over a long, long time, paving the way for future conversations about investing.

The four-jar system turns a lecture about money management into a hands-on activity. It gives them a visual, tangible way to see where their money is going, empowering them to make intentional choices.

Setting Fair Pay and First Savings Goals

So, how much should you actually pay them? This can feel tricky. A good rule of thumb I've always recommended is somewhere between $0.50 to $1.00 per year of age, per week. An eight-year-old, for example, might earn between $4 and $8 a week. You want to give them enough to make real choices, but not so much that they never have to prioritize.

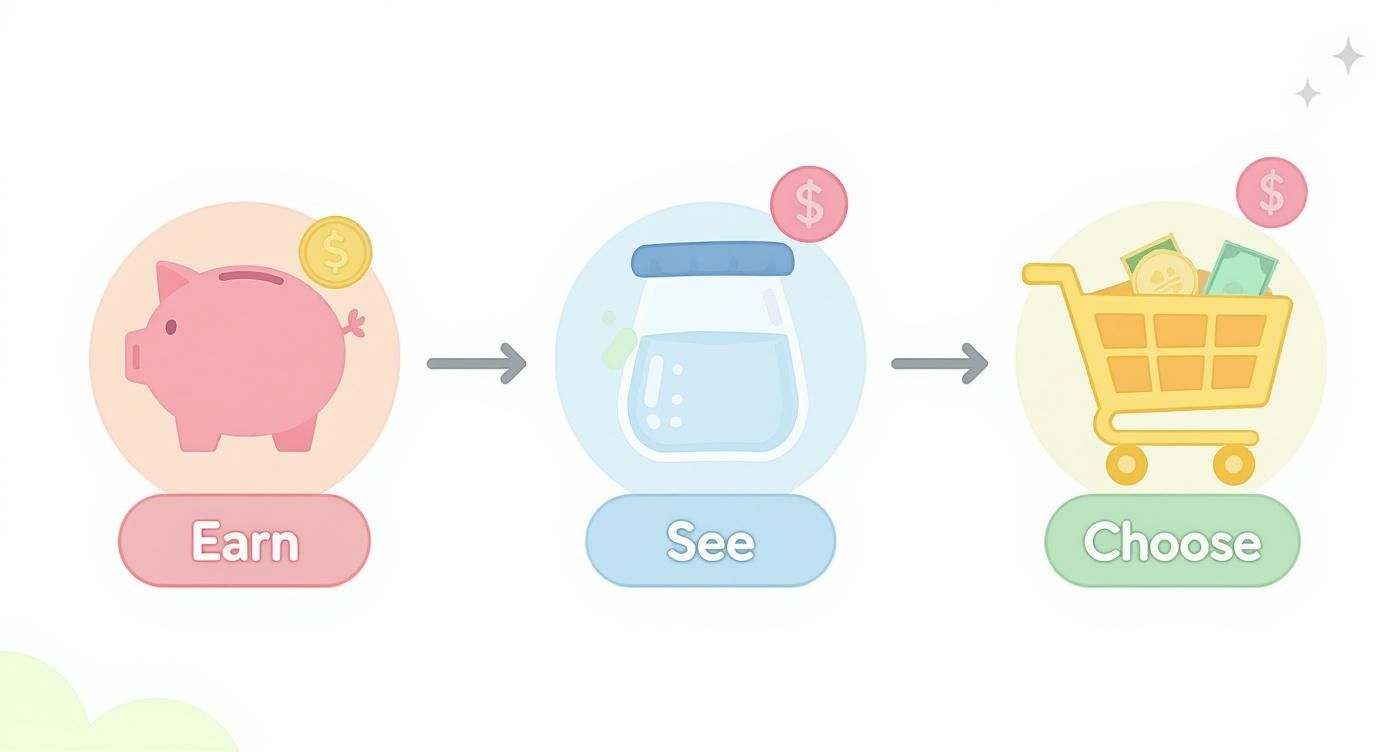

This infographic lays out the simple journey from earning to smart spending.

It’s a great visual that reinforces how money flows: from the effort of earning it, to being managed in the jars, to finally being used for a conscious spending choice.

Now for the really exciting part: helping them set their first big savings goal. Sit down with them and pick something meaningful—a new bike, a video game, that big Lego set they've been eyeing. Then, do the math together. Figure out exactly how many weeks of saving it will take to reach that goal. This little exercise teaches patience, persistence, and the incredible satisfaction of achieving something you've worked hard for. It’s a lesson that will stick with them for life.

Guiding Tweens Through Smart Spending and Giving

The tween years, that tricky window between ages 11 and 13, are a whirlwind of change. Kids are figuring out new social circles and carving out a stronger sense of who they are. This is a golden opportunity to take your money talks to the next level—moving beyond the basics of earning and saving into the more nuanced worlds of smart spending and real-world giving.

As they start wanting more independence, tweens need the right tools to make their own buying decisions. Your role has to shift here. You're less of a manager and more of a mentor, helping them navigate the jungle of advertising and peer pressure. The goal isn't to control their spending but to empower them to be conscious consumers who actually think before they buy.

Empowering Smart Spending Choices

At this age, the pressure is intense. Having the "right" shoes or the newest phone can feel like everything. This is where impulse buys and feeling left out can really start to take hold. Your job is to help them hit the pause button and think critically about their choices, teaching them to see the difference between lasting value and a passing fad.

One of the most effective ways they learn is, frankly, by making a few mistakes. If your tween blows their entire monthly budget on a video game they get bored with in a week, fight the urge to rescue them. The natural consequence—having no money left for that movie with friends—is a lesson that will stick far longer than any lecture you could ever give.

In my experience, letting a tween feel the mild sting of buyer’s remorse is an invaluable teaching moment. It’s not about judgment; it’s about allowing them to learn that money, once spent, is gone. This low-stakes failure builds a foundation for much wiser decisions when the stakes are higher.

Help them look beyond the price tag to understand true value. A cheap, trendy shirt that falls apart after two washes is a bad deal compared to a slightly more expensive one that lasts the whole year. Encourage them to become a bit of a detective before they pull out their wallet.

- Teach Comparison Shopping: Show them how to check prices at different stores or online for the exact same item. It can be an eye-opener.

- Read Reviews: Help them look up what other people are saying. Is that gadget really as good as the ad claims? Is it worth the money?

- Introduce the 24-Hour Rule: For any non-essential purchase over a certain amount (say, $20), have them wait 24 hours before buying. This simple pause is surprisingly effective at separating a real want from a fleeting impulse.

The Art of Intentional Giving

Beyond just buying things for themselves, this is a fantastic age to deepen their understanding of giving back. The "Give" jar can transform from a simple collection box into a tool for making a real, tangible impact. The key is to tie their giving to things they genuinely care about.

Kick things off with a conversation. Ask questions that get them thinking: What problems in the world make you sad? What kinds of causes do you wish you could help with? Their answer might be animals, the environment, or helping other kids. Once you know what moves them, you can help them research where their money can do the most good.

Putting Compassion Into Action

Now, help your tween find a reputable charity that lines up with their passions. This isn't just a lesson in generosity; it teaches them critical thinking and the importance of doing their homework.

- Research Together: Use websites like Charity Navigator to look up different organizations. Show them how to check what percentage of a donation goes directly to the cause versus running the office.

- Explore Different Ways to Give: Explain that giving isn't just about money. They can also give their time by volunteering at a local animal shelter or food bank.

- Plan the Donation: Let them take the lead. Whether it’s making an online donation with your supervision or mailing a check from their own savings, putting them in charge makes the act of giving feel powerful and real.

This whole process turns them from passive donors into active, engaged philanthropists. They learn that their money, no matter how small the amount, can be a powerful force for good when it's used thoughtfully. These are vital lessons, especially when you consider that UNICEF estimates about 272 million children worldwide are out of school, limiting their access to fundamental education—including financial literacy. You can discover more insights about this global challenge on UNESCO's official site. By teaching your kids now, you're not just raising smart spenders; you're preparing them to be financially capable and compassionate adults.

Preparing Your Teen for Financial Independence

As your child hits the teen years, the financial training wheels are ready to come off. This is a huge transition period—a bridge between the simple lessons of childhood and the complex realities of adulthood. Your role naturally shifts from instructor to financial coach, guiding them through bigger milestones like saving for a car, managing a real paycheck, and thinking about life after high school.

The conversations get deeper and the stakes get higher. Now is the time to introduce the tools and ideas that will set the foundation for their entire financial future, from their first real bank account to the incredible power of investing.

Beyond the Jar: Banking Basics

The clear jar was a fantastic visual tool, but it's time to graduate to a real financial institution. Opening a teen checking or savings account is a monumental step toward independence. It’s a safe space for them to practice managing money with the safety net of your guidance.

This first account is their real-world classroom. They'll learn how to use a debit card responsibly, check their balance online, and track spending digitally. This hands-on experience is absolutely crucial for building confidence.

In my 50+ years of experience, one of the biggest pitfalls I've seen is parents controlling a teen's account too tightly. The goal is to observe and guide, not to micromanage. Let them make small mistakes, like blowing their budget on pizza one week. They’ll learn the natural consequence of a low balance far better that way.

Decoding Their First Paycheck

Getting that first job is a rite of passage, but so is the shock of seeing their first pay stub. Suddenly, that hourly rate they were so excited about doesn't quite match what landed in their account. This is the perfect moment to explain the realities of taxes, FICA, and other deductions.

Sit down with them and walk through each line item. Explain that taxes are how we all chip in for public services like roads, schools, and parks. This conversation takes the mystery out of it and stops them from feeling like their money is just vanishing into thin air. A great way to help them grasp the key terms is by exploring the difference between gross pay and net pay together. It’s a fundamental lesson in how employment income really works.

Introducing the Power of Investing

Investing can sound intimidating, but it can be incredibly exciting for a teen when you frame it the right way. Forget complicated charts and jargon. Instead, connect it to the brands they already know and love.

Explain that buying a stock means owning a tiny piece of a company they use every day, like Apple, Nike, or Spotify. This makes the concept of ownership feel real and relatable.

- Fractional Shares: You don't need hundreds of dollars to get started. Many platforms now let you buy fractional shares for just a few dollars, allowing your teen to invest in their favorite companies without a huge upfront cost.

- Custodial Accounts: Open a custodial brokerage account (like an UTMA/UGMA) where you can guide their choices. Let them do the research and pick a few companies with a small amount of money to start.

- The Long Game: Stress that this isn't about getting rich quick. It's about letting their money work for them over a very long time. This is your chance to introduce compound interest—how their money can earn money, and then that new money starts earning money, too. It's the closest thing to real-world magic.

Understanding Debt and Credit

Before they turn 18 and the credit card offers start rolling in, you need to have a serious talk about debt. Make it clear that a credit card isn't free money. It's a loan that has to be paid back, usually with painfully high interest.

Share stories—even your own past mistakes—to show how quickly debt can spiral out of control. Talk about why a good credit score is so important and how it impacts their ability to get a car loan, rent an apartment, or even get certain jobs down the road. This conversation prepares them to make smart choices when they're finally on their own.

A Comparison of Financial Tools for Teens

Choosing the right financial tool can feel overwhelming, but it doesn't have to be. Each option serves a different purpose, from daily spending to long-term growth.

This table breaks down the most common financial tools for teenagers, helping you decide which one is the right next step for your family.

| Tool/Account Type | Best For | Key Features | Parental Controls |

|---|---|---|---|

| Teen Checking Account | Everyday spending and direct deposit from a job. | Debit card access, online/mobile banking, no/low fees. | Spending limits, account alerts, joint access for monitoring. |

| Custodial Savings Account | Saving for large goals like a car or college. | Higher interest rates than checking, teaches long-term saving. | Parents are the custodian until the teen reaches legal age. |

| Custodial Brokerage Account | Introducing long-term investing concepts. | Ability to buy stocks/ETFs, teaches compound growth. | Parent must approve all trades and manage the account. |

| Secured Credit Card | Building credit history under strict supervision. | Requires a cash deposit as collateral, low credit limit. | Helps teach responsible credit use with minimal risk. |

Ultimately, the goal is to match the tool to your teen's current needs and your family's financial goals. Starting with one or two of these can build a powerful foundation for their future.

Making Money a Normal Family Conversation

Financial literacy isn’t something you can check off a list after one big, serious lecture. After more than 50 years of guiding families, I can tell you it's a living, breathing part of your family’s culture. It’s built through hundreds of small, ongoing conversations that make money a normal topic, not a source of stress or mystery.

The real goal here isn't just to teach budgeting or saving in a vacuum. It's about connecting those practical skills to your family's core values. That’s how the lesson transforms from "how to manage money" into "how to use money to build a life you're proud of."

Establishing Regular Money Check-Ins

One of the most powerful things you can do is set aside a regular time for a family money meeting. This doesn't need to be a formal, stuffy affair. Just make it a relaxed, regular check-in—maybe for 15 minutes every Sunday evening.

The whole point is to create a safe space where everyone can talk about finances openly. This simple ritual demystifies money and shows your kids that it's something your family manages together, as a team.

Here are a few prompts to get the ball rolling:

- For younger kids: "What's one thing you saved for this week? Did you add anything to your 'Give' jar?"

- For tweens: "Did you see anything this week that you thought was a really good or bad value? Why?"

- For teens: "Let's look at your savings goal for the car. How's the progress looking? Are there any extra jobs you could pick up to get there faster?"

These quick, regular chats build a powerful habit of financial communication that will stick with them for life.

Sharing Your Own Financial Journey

One of the best tools in your toolbox is your own story. Kids, especially teens, are surprisingly open to hearing about your financial wins and—maybe even more importantly—your mistakes.

Sharing a time you fell into debt or made a bad investment doesn't make you look weak. It humanizes you. It shows them that financial missteps are survivable and are actually valuable learning moments, not shameful secrets.

Over my career, I've seen families transform when parents get vulnerable. Admitting, "I once bought a car I couldn't really afford, and it was stressful for years," is a far more impactful lesson on debt than any textbook definition. It teaches resilience and shows that financial wisdom is a journey, not a perfect record.

By opening up, you give your kids permission to be imperfect, too. You create a dynamic where they feel comfortable coming to you for help when they eventually face their own money troubles. That open dialogue is the bedrock of lifelong financial wellness.

Connecting Money to Your Family Values

Every family has a set of core values, whether you talk about them or not. These might be things like hard work, generosity, community, or independence. The most crucial step in teaching kids about money is tying every lesson back to these principles.

- When you talk about saving, it's not just about hoarding cash. It’s about practicing patience and discipline to achieve a goal that matters.

- When you discuss giving, it's about reinforcing your family’s commitment to compassion and looking out for others.

- When you explain investing, it’s about the value of long-term thinking and building a secure future for themselves and their own families one day.

This approach elevates money from a simple tool for transactions to a powerful vehicle for living out your values. It instills a deep-seated financial philosophy, making sure your children learn not just how to count their money, but how to make their money count.

And the impact doesn't stop with your family. Financial education for children can have a profound ripple effect. A study in Peru revealed that when kids received financial literacy training, they became teachers at home, influencing their parents' behavior. This led to a 40% increase in parents' use of credit, which signaled better, more strategic financial management and empowerment for the entire household. You can read the full research about these powerful findings.

Of all the questions I've gotten over my 50+ years in finance, the ones about teaching kids money are some of the most common. Every family is different, of course, but you’d be surprised how many of us run into the same hurdles.

Let's cut through the noise. Here are some straightforward, practical answers to the questions that pop up most often. Think of this as your quick-reference guide for those tricky spots we all hit eventually.

When Is the Right Age to Start an Allowance?

Lots of parents find that the magic window for starting an allowance opens up around age five or six. This is right about the time when kids can get their heads around basic numbers and understand the simple exchange of money for something they want at the store.

But here’s the secret: the exact age isn't what matters most. Consistency is everything.

Start with a small, fixed amount each week. It’s perfect for practice. As they grow, you might switch things up to a commission-based system. That means they earn money for chores that go above and beyond their normal family duties, like washing the car or helping with a big yard project.

The most important thing to remember is that an allowance isn't a handout; it's a teaching tool. It's your child's first opportunity to practice making real financial decisions in a safe, low-stakes environment.

Ultimately, the goal is to give them a regular "income" to practice with their Spend, Save, Give, and Invest jars.

What Are the Biggest Mistakes Parents Make?

Even with the best of intentions, it's easy to stumble into a few common traps when talking to kids about money. Just being aware of these pitfalls is the first step toward sidestepping them and keeping your lessons on the right track.

- Making Money a Taboo Subject: One of the biggest mistakes is simply not talking about it. When money is only discussed in whispers or during stressful moments, kids learn to connect it with anxiety and secrecy.

- Being Inconsistent with Rules: If you set up a system—like paying commissions every Saturday morning—but then only remember to do it half the time, the message gets muddled. Consistency is what cements the habit.

- Bailing Them Out of Money Mistakes: It's tough to watch your kid feel that sting of buyer's remorse, but swooping in to rescue them robs them of a crucial lesson. Letting them experience the natural consequence of a bad purchase is one of the most valuable things you can do.

- Not Modeling Healthy Behavior: This one is the big kahuna. Your kids learn way more from watching how you manage your money than from any lecture you could ever give. If your actions don't line up with your words, the lesson is lost.

How Can I Explain Investing to My Teenager?

The thought of introducing investing to a teenager can feel like a heavy lift, but the trick is to make it tangible and connect it to their world. You can forget all the complicated financial jargon for now.

Kick things off by talking about companies they already know and love—think Nike, Apple, or Spotify. Explain that buying a stock means owning a tiny piece of that company. This simple idea, that they can actually own a slice of a brand they use every day, is often the spark that gets them interested.

From there, you can take a few practical steps:

- Open a Custodial Account: Set up a custodial brokerage account where you have oversight. This gives them a real platform to learn on, but with a safety net in place.

- Start Small: They don't need a lot of money to get started. Let them invest a small amount, maybe $50 or $100, in one or two companies they've done a little research on.

- Emphasize the Long Game: Make it crystal clear that this isn't about getting rich quick. This is your chance to teach them about the incredible power of compound interest and a "buy and hold" mindset.

Using modern apps designed for young investors, like Greenlight or Fidelity Youth, can also make the whole experience feel less intimidating and a lot more engaging. It turns a complex topic into an exciting first step toward building real, long-term wealth.

At Smart Financial Lifestyle, we believe that these conversations are the building blocks of a secure future. Our mission is to provide the wisdom and tools your family needs to make smart financial decisions across generations. Explore our resources to continue your journey at https://smartfinancialifestyle.com.