Splitting an inheritance fairly kicks off with a step you absolutely cannot skip: creating a complete and transparent inventory of everything. All the assets, all the liabilities. This isn't just about numbers; it's about making sure every decision is based on facts everyone can agree on, not guesswork or assumptions.

When you catalog everything—from bank accounts and investments to the old family home and sentimental heirlooms—you build a foundation of trust that's essential for getting through this.

Creating a Transparent Foundation for Fairness

Before anyone even whispers about who gets what, the entire family needs to be looking at the same, clear picture of the whole estate. Think of it as establishing a baseline of truth. It’s what keeps misunderstandings and emotional arguments from derailing the entire process.

This foundational stage really breaks down into two main jobs: figuring out what is owned (assets) and what is owed (liabilities). You can't know the true value of the estate until all the debts are settled.

Compiling a Comprehensive Asset Inventory

First things first, you’ve got to locate and list every single asset. This can feel like a bit of detective work, since things can be spread out across different banks, brokerage houses, and even physical locations. A thorough inventory gives you that complete financial snapshot and is the cornerstone of a fair split.

Your list should cover:

- Financial Accounts: This means all checking and savings accounts, certificates of deposit (CDs), and any money market accounts.

- Investment Portfolios: Document every stock, bond, mutual fund, and brokerage account.

- Retirement Plans: Don't forget the 401(k)s, IRAs, and pensions. Be aware, some of these might pass directly to a named person and skip the estate altogether. It’s critical to check what is a beneficiary designation to see how these specific assets are handled.

- Real Estate: List out all properties, including the primary residence, vacation homes, or any rental units.

- Tangible Personal Property: This is the physical stuff—cars, furniture, art, jewelry, and any valuable collectibles.

The Critical Role of Accurate Valuations

Okay, so you have your list. Now what is everything actually worth? For cash in the bank or stocks, it's pretty easy—you just look at the account balance or market price on a specific day. But for other assets, it gets a lot trickier.

Getting a professional, third-party appraisal for big-ticket items like real estate, a family business, or valuable art isn't just a good idea—it's a must. An unbiased valuation takes all the guesswork and potential for disagreement off the table. Everyone agrees on the numbers from the start.

For example, two siblings might have completely different ideas about the value of their parents' house. One might be thinking about its hot market potential, while the other is focused on its sentimental value. A licensed appraiser provides an objective number that both can accept, heading off a major potential conflict right at the pass.

Accounting for All Debts and Liabilities

An inheritance isn’t just the sum of the assets. It's what’s left over after all the debts are paid off. It's so easy to overlook this part, but doing so can create huge financial and legal messes down the road. The estate is legally responsible for settling these obligations before a single dollar can be distributed to the heirs.

Common liabilities to hunt down include:

- Mortgages and Loans: Any outstanding balances on property or personal loans.

- Credit Card Debt: All credit card balances must be paid off from the estate.

- Taxes: This includes the final income tax return for the person who passed, plus any potential estate or inheritance taxes.

- Final Expenses: Funeral costs, burial expenses, and any final medical bills are also paid by the estate.

By first creating a transparent ledger of everything owned and owed, you establish an undisputed starting point. This careful, methodical process ensures that when it’s time to talk about who gets what, the conversation is grounded in reality, paving the way for a truly fair outcome that honors your loved one’s legacy and keeps family relationships intact.

Defining What “Fair” Truly Means to Your Family

Once you have a clear, transparent picture of the estate’s finances, the conversation naturally shifts from numbers on a spreadsheet to something far more personal: what does "fair" actually mean to your family? This is where the real work—and the real heart—of splitting an inheritance lies.

Fairness isn't some universal formula you can just plug numbers into. It’s a deeply personal concept, shaped by your family’s unique history, individual circumstances, and shared values. Getting this part right means moving beyond a simple mathematical split. The goal is to land on a solution that feels just and right to everyone involved, honoring both the loved one you’ve lost and the living realities of each heir.

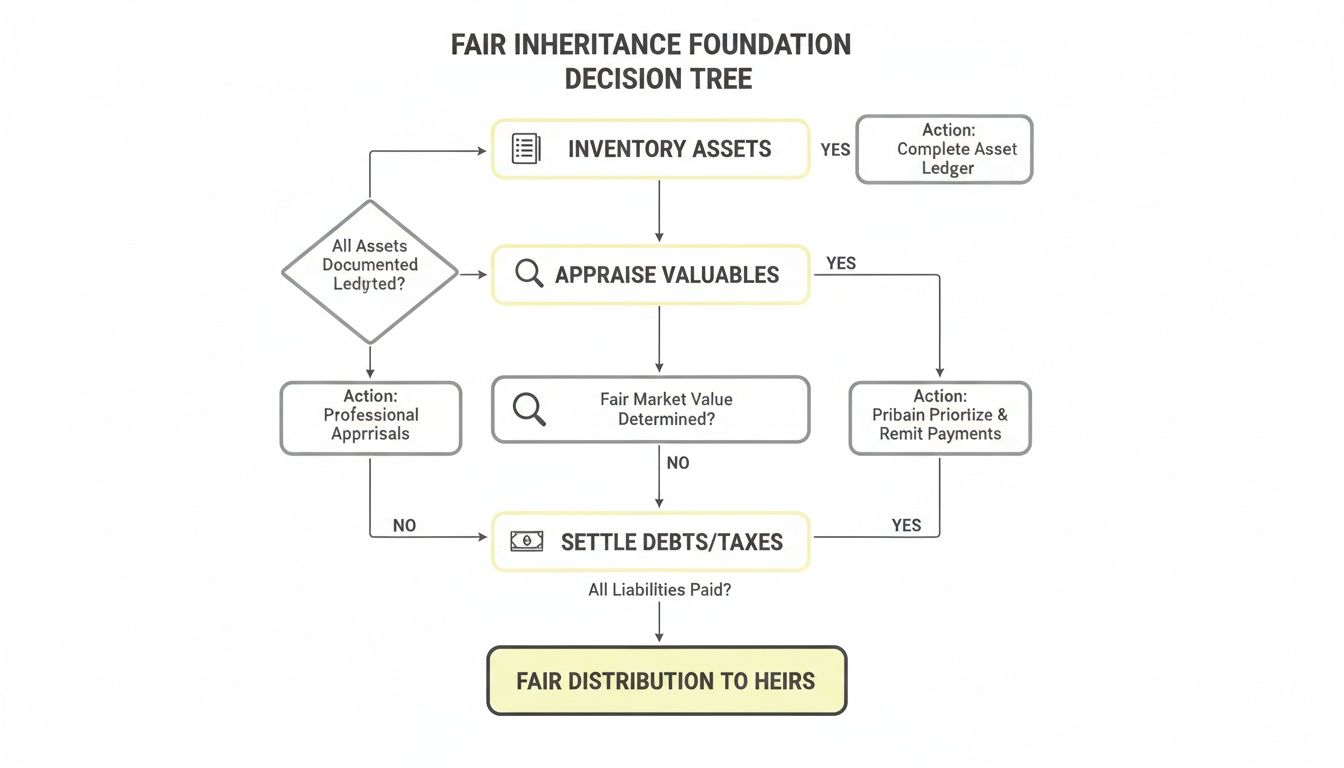

This flowchart maps out the crucial groundwork that has to be done before you can even begin this conversation. It reinforces just how important it is to have a clear financial starting point.

As you can see, you can only really start talking about fair distribution once the full inventory is complete, assets have been professionally appraised, and all debts have been settled. Only then do you know the estate’s true net value.

Three Common Models for Fair Distribution

From my experience, families tend to gravitate toward one of three main approaches when they start talking about how to divide things fairly. Each has its own logic, and any of them can be the "right" choice depending on your family's dynamics and what the person who passed away intended.

- Strict Equality: This is the most straightforward path. The estate is divided into equal monetary shares. If there are three kids, each gets exactly one-third. Simple.

- Equity Based on Need: This model is less about equal shares and more about allocating resources where they’re most needed. A child with significant medical expenses or much lower earning potential might receive a larger portion than a sibling who is already financially secure.

- A Balanced or Contribution-Based Approach: This is a hybrid model that tries to adjust the distribution to account for past events. It might factor in things like a large financial gift one child received years ago or the unpaid labor of another child who served as a primary caregiver.

Choosing the right path isn't easy. It requires some really honest reflection on your family’s history and what you all value most.

A Deeper Look at Each Inheritance Model

To really understand these models, let’s look at how they play out in the real world. The best choice often becomes much clearer when you apply it to a family’s actual story.

To help visualize the differences, here’s a quick comparison of the three main distribution models.

Comparing Inheritance Distribution Models

| Distribution Model | Core Principle | Best For... | Potential Pitfall |

|---|---|---|---|

| Strict Equality | Every heir receives an identical monetary value. | Families where siblings have similar financial needs and received comparable support over the years. | Can feel unfair if one heir has significantly greater needs or made substantial personal sacrifices. |

| Equity Based on Need | Assets are allocated based on individual financial or life circumstances. | Situations with significant disparities in wealth, health, or opportunity among heirs. | Can be seen as "punishing" success or creating resentment if the criteria for "need" aren't clear. |

| Balanced/Contribution | Distribution is adjusted to account for past gifts, loans, or significant non-financial support. | Families where one child was a caregiver or received substantial financial help during the parent's lifetime. | Quantifying the value of past contributions can be emotionally charged and difficult to agree upon. |

Each model aims for a version of fairness, but as you can see, the definition changes depending on the lens you use.

A strict equality approach often works best when siblings are on similar financial footing and have received comparable support from their parents throughout their lives. It keeps things simple and reduces the room for arguments over subjective judgments, which is why it’s a common default.

But life isn’t always equal, and that’s where an equity-based model comes in. A parent might intentionally leave more to a child who is a single parent just scraping by, while leaving less to a sibling who is a highly successful surgeon. This approach defines fairness as giving support where it will make the most difference.

The most challenging, yet often most equitable, path is the balanced approach. It’s all about leveling the playing field by looking at the whole picture. For example, if one child received a $50,000 down payment for a house years ago, that amount might be treated as an advance on their inheritance to ensure the final split is truly fair to everyone else.

Addressing Past Contributions and Support

The balanced model is especially crucial when a family member has made significant personal sacrifices. Think about a daughter who moved back home to care for an ailing parent for five years, putting her career and savings on hold. A strictly equal split in that situation would likely feel profoundly unfair to her.

In a scenario like that, the family could sit down and agree to:

- Assign a monetary value to her caregiving, paying her for her time from the estate before the rest is divided.

- Give her a larger percentage of the inheritance to acknowledge her immense contribution.

- Grant her the family home or another key asset outright as compensation.

These are sensitive conversations, no doubt about it. But they are absolutely necessary. It’s about recognizing that contributions of time, love, and care have real, tangible value, even if they don't show up on a balance sheet. By facing these discussions head-on, families can create a plan that reflects a much deeper, more meaningful definition of fairness.

Navigating the Legal and Tax Implications of Inheritance

A thoughtful inheritance plan can fall apart surprisingly fast if the legal details and tax obligations are overlooked. Getting the rules of the road right isn't just about compliance—it's about making sure your family's idea of "fair" actually becomes a reality. Without that clarity, what each heir receives can end up looking very different from what you intended.

The key is to get ahead of it. By using the right legal tools and anticipating tax hits before they happen, you protect the estate’s value and prevent the kinds of costly mistakes that can cause serious friction between family members.

Essential Legal Tools for a Fair Split

Three main legal instruments work together to direct where your assets go after you're gone. Each has a specific job, and getting them right is fundamental to splitting an inheritance the way you want.

-

Wills: Your last will and testament is the foundational document. It spells out who gets what, names an executor to manage everything, and can appoint guardians for minor children. If you don't have one, the state steps in and divides your assets using its own rigid formulas, which almost certainly won't match your wishes.

-

Trusts: A trust is a legal setup where you place assets to be managed for your beneficiaries. A huge advantage of a trust is that it can help your estate avoid the probate process, which is often long, expensive, and very public. The two most common types are revocable trusts, which you can change anytime, and irrevocable trusts, which are generally set in stone but can offer better protection from creditors and estate taxes.

-

Beneficiary Designations: Some of your most valuable assets—like life insurance policies, 401(k)s, and IRAs—pass directly to the person named as the beneficiary on the account paperwork. This is critical: these designations override whatever is written in your will. That's why you absolutely have to review and update them after big life events like a marriage, divorce, or the birth of a child.

Here’s a classic real-world trap: Imagine a will that clearly states all assets should be split equally among three children. But years ago, the parent named only the oldest child as the beneficiary on a massive life insurance policy and forgot to update it. Legally, that one child gets the entire payout, completely upending the intended "equal" split.

Demystifying Inheritance and Estate Taxes

Taxes can take a significant bite out of an inheritance, so it’s vital to understand how they work. People often use "inheritance tax" and "estate tax" interchangeably, but they are two totally different things.

An estate tax is levied on the total value of a deceased person's estate before it’s distributed. An inheritance tax, on the other hand, is paid by the heirs themselves after they receive their share.

The federal government has an estate tax, but the exemption threshold is so high that it only affects the wealthiest families. The real catch is at the state level. Several states have their own estate taxes with much lower exemption amounts. You can get the details in our guide on the what is estate tax exemption. On top of that, a handful of states also have an inheritance tax, where the rate often depends on how closely related the heir is to the person who passed away.

Heirs might also have to think about capital gains tax. If you inherit an asset like stock or a piece of real estate and sell it later for a profit, you'll owe taxes on the increase in value from the date you inherited it.

The Modern Challenge of Global Wealth

Splitting an inheritance fairly gets even trickier when assets and heirs are scattered across different countries. Every country has its own inheritance laws and tax rules, creating a complex web of legal obligations that can easily trip you up.

The sheer concentration of global wealth adds another layer to this. For example, about 35% of the world’s wealth is held in the United States, which is also home to nearly 40% of the world's millionaires. This gives U.S. tax laws and legal frameworks an outsized impact on how large, international estates are handled. As wealthy individuals move around the world, their legal residence can change, which dictates which country's laws apply and makes a "fair" split that much harder to achieve for a global family. You can dig into these trends in the latest global wealth report research.

For families with an international footprint, getting advice from legal and tax pros with cross-border experience isn't a luxury—it's an absolute necessity. They can help you structure a plan that minimizes taxes and holds up legally in every relevant country, truly safeguarding the fairness of the inheritance for everyone involved.

How to Handle Tough-to-Split Assets

Let’s be honest. Some of the biggest inheritance battles aren’t over cash in the bank. They’re about the assets you can't just slice into equal pieces—the family home filled with memories, a business built from the ground up, or that treasured art collection. These are called illiquid assets, and they bring a unique set of challenges to the table.

You can't just give one child the house and another its equivalent value from a bank account that doesn't have the cash. This is where you have to get creative to keep the peace. The mission is to find a solution that gives everyone their fair share without forcing the sale of something that holds deep sentimental or practical value.

Setting Up a Sibling Buyout

One of the most practical solutions is an heir buyout. It’s pretty simple in concept: one sibling who wants to keep an asset, like the family home, compensates the other heirs for their shares. But getting the details right is crucial for it to feel fair.

Here’s how it usually works:

- Get a Pro Appraisal: First things first, hire an independent, third-party appraiser to pin down the asset's fair market value. This is a non-negotiable step. It creates an objective number that everyone can work from.

- Figure Out Each Share: Once you have the value, the math is easy. If the house is appraised at $600,000 and there are three heirs, each share is worth $200,000.

- Line Up the Financing: The sibling keeping the property has to find the money to pay the others. This could come from personal savings, a home equity loan, or a new mortgage.

- Draft a Payment Plan: If paying a lump sum isn't realistic, the family can draw up a formal payment plan. This needs to be a written, legally binding agreement that spells out the total amount, any interest, and the payment schedule to prevent any "he said, she said" down the road.

Using Life Insurance to Create Fairness

Here's a brilliant strategy parents can use ahead of time: use life insurance to create liquidity. It’s a proactive way to make sure a tricky asset can be split fairly without any drama when the time comes.

Imagine a family with a $2 million farm. One child has spent their life working it, while the other built a career in the city. The parents want the farm to stay in the family, but they also want to be fair to both children.

The solution? The parents take out a $1 million life insurance policy and name the non-farming child as the beneficiary. When they pass away, the farming child inherits the $2 million farm, and the other child gets $1 million in tax-free cash. The distributions aren’t identical, but they're equitable.

Wealth-transfer studies consistently show that a lack of clarity is what fuels family disputes. That's why estate planners often lean on tools like life insurance to provide fixed-dollar amounts for equalization, as seen in wealth report analyses on theprudentspeculator.com.

Exploring Other Creative Solutions

What if a buyout or life insurance won't work? Families have other options, each with its own pros and cons.

- Sell and Split the Proceeds: This is the cleanest route. You sell the asset on the open market and divide the cash among the heirs as the will directs. It’s simple and final, but it also means losing a sentimental family asset for good.

- Create a Family LLC or Partnership: If multiple heirs want to keep an asset together, like a vacation home or rental property, they can form a legal entity like a Limited Liability Company (LLC) to own it. A rock-solid operating agreement is essential here—it needs to spell out rules for usage, how costs are split, and what happens if one owner decides to sell their share.

- Use a Trust for Long-Term Management: Placing a complex asset into a trust can create a clear framework for managing it. A trust can dictate how a family business should be run or how a property can be used for generations to come. You can dig deeper into this by reading our guide on what is a revocable living trust.

At the end of the day, dealing with these unique assets comes down to honest conversation and a willingness to find a solution that fits your family's definition of fair.

Tackling Family Conversations to Prevent Disputes

After you've waded through the assets, taxes, and legal paperwork, you get to the most delicate part of the entire process: talking with your family. Dividing an inheritance can be a massive stress test for even the closest relationships. It’s rarely the money itself that creates lasting damage; it's how families talk—or don’t talk—about it.

The real secret to splitting an inheritance fairly is mastering these sensitive conversations. The goal isn't just to divide up stuff; it’s to do it in a way that keeps family bonds intact for generations to come. Proactive, respectful dialogue is the only tool that gets you there.

Setting the Stage for Productive Conversations

Before you jump into the numbers, you have to create a safe space for the discussion. Just bringing this up at a holiday dinner is a recipe for disaster. Instead, you need to schedule a dedicated family meeting with a clear purpose and some ground rules everyone agrees on.

This isn’t about being overly stiff or formal; it's about showing respect for each other and the gravity of the topic.

- Pick a Neutral Time and Place: Choose a time when nobody feels rushed and a spot where everyone feels comfortable enough to speak freely. Avoid someone's home if it might feel like they have "home-field advantage."

- Share a Simple Agenda: Send out a basic agenda a few days before. This lets everyone know what to expect and gives them time to gather their thoughts. No surprises.

- Set Ground Rules for Respect: This is non-negotiable. Establish a few key rules like "no interrupting," "use 'I' statements to explain how you feel," and "focus on finding solutions, not placing blame."

A truly fair outcome is one where relationships are still strong long after the assets have been handed out. That all starts with how you treat each other in these crucial talks.

By setting up this simple framework, you turn a potential battlefield into a productive meeting. It sends a clear message that everyone's voice matters and that the family is committed to figuring this out together.

Using Scripts to Get the Ball Rolling

Sometimes, the hardest part is just knowing what to say. Emotions are running high, and it's easy for old family dynamics or past grievances to derail the conversation. Having a few conversation starters in your back pocket can help keep the dialogue focused and constructive.

Here are a few starters you can adapt:

- "I know this is a tough conversation for all of us. Before we get into the details, I'd love to hear what 'fair' means to each of you, beyond just the numbers."

- "Mom and Dad always really valued ______. How can we make sure the plan we create honors that value?"

- "Can we all agree that our main goal here is to make sure we’re still a family when this is over? Everything else is secondary."

These kinds of openers immediately set a collaborative tone. They shift the focus from "what I'm going to get" to "what we can build together."

When to Bring in a Professional

Let's be real: sometimes, even with the best intentions, families get stuck. Deep-seated rivalries, overwhelming emotions, or just a fundamental disagreement on what's fair can grind everything to a halt. If you hit this point, bringing in an outside professional isn't a sign of failure—it's a sign of wisdom.

A professional mediator or a family counselor can offer the impartial guidance needed to break the logjam. A mediator doesn't make decisions for you. Their job is to facilitate communication, make sure every person feels heard, and guide the family toward finding its own solution that everyone can live with.

These professionals are experts at de-escalating conflict. They can help you separate the emotional baggage from the financial decisions, which is often the key to finding a fair path forward. If you find your family is just going in circles or arguments are getting personal, hiring a professional might be the smartest investment you can make—for both the inheritance and your family's future.

Finalizing the Plan and Preserving Family Bonds

You've made it through the tough conversations and the hard decisions. Now it’s time to make everything official and ensure a smooth handoff. This last part is all about turning those agreements into concrete actions, giving everyone legal certainty and, just as importantly, emotional closure. By getting every last detail formalized, you’re building a shield against future misunderstandings and protecting the family harmony you’ve worked so hard to keep intact.

I can't stress enough how critical this final step is, especially with the massive wealth transfer on the horizon. Over the next couple of decades, a staggering USD 83 trillion in global private wealth is set to pass to heirs, with nearly $29 trillion of that in the U.S. alone. History shows that transfers of this scale often lead to more contested estates, which is exactly why a formal agreement is a non-negotiable for any family wanting to split an inheritance fairly. These numbers aren't just statistics; they're a clear signal that fairness requires a clear, legally sound process to manage it all. You can get more insights on these record-high wealth transfers at spearswms.com.

The Power of a Family Settlement Agreement

A handshake and a verbal agreement just won't cut it. You need a Family Settlement Agreement. Think of it as a legally binding contract that puts every single piece of your inheritance plan down on paper. It becomes your ultimate safeguard, the go-to reference point if memories get fuzzy or disagreements pop up years down the road.

This document should spell out everything, leaving no room for interpretation:

- Who is getting which specific asset.

- The agreed-upon values for all the big-ticket items.

- Clear terms for any buyouts, including payment schedules and interest rates.

- Who is responsible for any leftover estate debts or expenses.

Having this in writing isn't about mistrust; it’s about protecting everyone and giving the whole family peace of mind.

Your Final Inheritance Checklist

With the agreement in hand, it's time to execute. This part involves a lot of administrative legwork, and a checklist is your best friend for making sure nothing slips through the cracks. It turns a potentially overwhelming process into a methodical one.

- Draft and Sign the Agreement: Get an attorney to draw up the formal Family Settlement Agreement. Make sure every single heir signs it.

- Retitle Assets: This is the official ownership transfer. You'll need to file paperwork with county recorders for property, banks for financial accounts, and the DMV for vehicles to get them into the correct heir's name.

- Distribute Personal Items: Time to physically hand over the heirlooms and other personal belongings as you all agreed.

- Settle Final Bills: Use estate funds to pay off any remaining expenses, like legal or accounting fees, before you close out the accounts.

- File Final Tax Returns: Make sure the estate's final tax returns are filed correctly and on time. You don't want to deal with penalties later.

This isn't just about dividing stuff. A structured, transparent process honors your loved one’s legacy by showing unity, respect, and a real commitment to keeping your family bond strong for years to come.

Moving Forward with Respect and Closure

Once the last asset is transferred and the final document is signed, the emotional work can truly begin. Let’s be real—this process was probably draining. It's so important to acknowledge the journey and give each other a little grace.

Remember the whole point was to get through a difficult time together. By handling the inheritance with care and empathy, you've reinforced a foundation of trust that will support your family's relationships for the rest of your lives.

Tackling the Tough Questions

Even the best-laid plans can hit a few snags. Family dynamics are complex, and certain questions pop up time and again when it comes to dividing an inheritance fairly. Here’s a look at a couple of the most common issues and how you can navigate them.

What About Items That Are Priceless to Us but Worthless on Paper?

This is where things get personal. For those sentimental items—grandma’s rocking chair, dad’s old watch collection—the emotional value far outweighs any dollar amount.

A great way to handle this is to create a list of all these cherished items. Then, let each family member take turns choosing one piece in a rotational draft. It's a fair and simple system. If two people have their heart set on the same thing, you could try a private family auction where "bids" are made against their share of the estate. Or, if you want to keep it simple, just draw names out of a hat.

How Do We Factor in a Large Financial Gift Someone Received Years Ago?

Ah, the classic "But you gave him money for his down payment!" scenario. This comes up all the time.

To keep everything equitable, many families decide to treat that past gift as an "advancement" on that person's inheritance. It’s pretty straightforward: you add the value of that gift back into the total estate value before anything is divided. Then, once you've calculated everyone's share, you simply subtract the gift amount from the recipient's final portion. This ensures the final distribution feels fair to everyone involved.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building lasting family harmony and wealth. Explore our resources to guide your family’s journey.