Actionable financial advice for women starts with building a solid foundation, focusing first on a spending plan, debt management, and an emergency fund.

Building Your Financial Foundation with Confidence

Jumping into your finances can feel like standing at the base of a mountain, wondering where to even begin. But here's the secret: the most powerful first steps are often the simplest.

Building a strong financial foundation isn't about mastering complex market formulas or taking big risks. It’s about creating clear, sustainable habits that put you firmly in the driver's seat. Think of it like building a house—get the foundation right, and everything you add on top will be that much stronger.

This is especially critical because women often face unique financial headwinds. A 2025 Global Financial Wellbeing Report revealed a stark reality: 25% of women report poor financial health, compared to just 18% of men. Even more telling, 13% of women have zero sources of financial education, versus only 8% of men. Getting these foundational pieces in place is the first real step toward closing that gap.

Create a Spending Plan, Not a "Budget"

Let's be honest, the word "budget" makes most of us want to run for the hills. It sounds restrictive, like a fad diet you know you'll abandon in a week. So let's ditch it.

Instead, think of it as a spending plan. This isn't about what you can't have; it's a tool to intentionally direct your money toward what you truly value. Whether that's saving for a down payment, planning an incredible trip, or just sleeping better at night, a spending plan gives every dollar a purpose.

To get started, just track your expenses for 30 days. Don’t judge, just observe. Use an app, a notebook, whatever works for you. This simple act of awareness is where the magic begins.

Tackle Debt With a Clear Strategy

Debt can feel like an anchor, weighing you down emotionally and financially. But you can absolutely lighten the load with a focused plan. Two of the most effective methods are the debt snowball and the debt avalanche.

- The Debt Snowball: You knock out your smallest debt first, regardless of the interest rate. Once it's gone, you roll that payment into the next-smallest debt. This strategy is fantastic for building momentum and getting those quick, motivating wins.

- The Debt Avalanche: You target the debt with the highest interest rate first. While it might take a bit longer to pay off your first account, this method nearly always saves you more money in interest over the long haul.

Which one is better? The one you'll actually stick with. The key is making consistent, extra payments that attack the principal balance and shrink the interest you'll pay over time.

"Both parties lose financially in a divorce, but the best way to adjust is to create a budget and stick to it. Make sure you do the budget before the divorce is final because you only get one chance at a property settlement."

This advice from Paul underscores just how vital a spending plan becomes during major life transitions. When everything else feels chaotic, having control over your money provides an incredible sense of stability.

Build Your Financial Safety Net

Life is full of surprises, and not all of them are good. An emergency fund is your financial safety net, the buffer that keeps a sudden car repair or an unexpected medical bill from becoming a full-blown crisis.

Your first goal is simple: save $1,000. It's a manageable target that can cover a lot of common hiccups.

Once you hit that milestone, your next goal is to build up 3 to 6 months of essential living expenses. Park this money in a separate high-yield savings account—somewhere it's easy to get to in a pinch but not so easy that you'll dip into it for everyday spending.

For a detailed walkthrough, check out our emergency fund checklist with steps for true financial resilience. This is a non-negotiable step for any woman seeking true financial security.

Ready to get started? This simple checklist can help you prioritize your first moves and track your progress as you build a solid financial footing.

Your Financial Foundation Checklist

| Action Step | Why It Matters | First Action to Take |

|---|---|---|

| Create a Spending Plan | It gives you control and aligns your spending with your actual goals and values. | Track every dollar you spend for the next 30 days without judgment. |

| Choose a Debt Payoff Method | A clear strategy provides focus and motivation to eliminate high-interest debt faster. | List all your debts, their balances, and interest rates to decide between the snowball or avalanche method. |

| Start an Emergency Fund | This is your buffer against unexpected life events, protecting your long-term goals. | Set up an automatic transfer of just $25 per week to a separate high-yield savings account. |

Building these three pillars—a spending plan, a debt strategy, and a safety net—isn't just about numbers. It’s about building confidence, reducing stress, and giving yourself the freedom to create the life you want.

How to Negotiate Your Salary and Advocate for Your Worth

Advocating for your financial worth is one of the most direct ways to build wealth, yet so many of us hesitate to negotiate our salary. This isn't just about a single paycheck; it's about the compounding gains you’ll see over your entire lifetime. Gaining the confidence and skills to ask for what you deserve is a crucial piece of financial empowerment for women at every stage of their careers.

Closing the gender pay gap takes individual action, and that action starts long before you walk into the room. Try to think of a salary negotiation not as a confrontation, but as a business conversation. You're simply presenting a clear, compelling case for the value you deliver. The key is to shift your mindset from hoping for more to demonstrating why you've earned it.

Do Your Homework First

Before you can ask for more, you need to know what “more” actually looks like. The very first step is to arm yourself with objective data on your market value. Don't rely on guesses or what you think a colleague might be making.

Use reliable, data-driven resources to establish a realistic salary range for your specific role, experience level, and geographic location. This instantly turns a subjective, emotional request into an objective, data-backed proposal.

- Online Salary Tools: Websites like Glassdoor, Salary.com, and PayScale offer free, industry-specific data. Aim for the 50th to 75th percentile for your role to set an ambitious but totally reasonable target.

- Industry Reports: Your professional organization likely publishes compensation surveys for its members. These can offer incredibly specific insights into what your peers are actually earning.

- Talk to Recruiters: Even if you aren't looking for a new job, having a few casual conversations with recruiters in your field provides invaluable, real-time data on current compensation trends. It’s their job to know this stuff.

Build Your Brag Book

Once you know your market value, you need to prove you’re worth it. This means moving beyond your official job description and documenting your specific accomplishments. I always tell my clients to create a "brag book"—a simple document where you track your wins throughout the year.

This isn't about arrogance; it's about evidence. Your goal is to quantify your achievements whenever possible to show your tangible impact on the business.

Your value isn't just about the tasks you complete; it's about the results you generate. Frame your contributions in terms of money saved, revenue earned, processes improved, or problems solved. This transforms your accomplishments from a list of duties into a powerful business case for a raise.

For example, instead of saying, "Managed the social media accounts," you could say, "Grew social media engagement by 35% in six months, leading to a 15% increase in inbound leads from those channels." The second statement demonstrates clear, measurable value that is pretty hard to ignore.

Master the Conversation

With your research and evidence in hand, the final piece of the puzzle is walking into that conversation with confidence. Whether it's during a performance review or when you've just received a new job offer, your approach really matters.

Practice your opening lines so they feel natural, not rehearsed and robotic. You can start with a simple script like this:

- Express Enthusiasm: Start on a positive note. "Thank you so much for this opportunity. I'm really excited about the direction of the team and my role in it."

- State Your Case: This is where your homework comes in. "Based on my research into the market rate for this position and considering my contributions over the past year, such as [mention 1-2 key achievements], I believe a salary of [Your Target Number] is appropriate."

- Pause and Listen: After you've made your request, stop talking. Just pause. This can be the most challenging part, but it's absolutely essential for a successful negotiation. Give them the space to process and respond.

Remember, negotiation is a dialogue, not a demand. Be prepared for a counteroffer and know your absolute minimum, walk-away number in advance. Advocating for yourself is a skill, and just like any other skill, it gets easier and a whole lot more effective with practice.

Investing for Your Future Without the Jargon

Let’s be honest, the word "investing" can feel intimidating. It often brings up images of Wall Street chaos and complicated charts, making it seem like a high-stakes game only experts can play.

But that’s just not true. Investing is the single most powerful way to build real, long-term wealth. It’s not about high-risk stock picking; it’s simply about making your money work for you, creating a future with more security and a whole lot more choices.

Here's how I think about it: saving is like putting your money in a safe. It's secure, sure, but it’s not growing. Investing, on the other hand, is like planting a tree. You start with a small seed, but with a little time and patience, it grows into something strong and substantial that can provide for you for years to come.

This difference is so important, especially for us. Women often live longer and are more likely to take career breaks to care for family, which makes putting our money to work an absolute must. The goal here is to shift from just earning an income to building lasting wealth.

The Building Blocks of Your Investment Portfolio

You absolutely do not need a finance degree to get started. All it takes is understanding a few core ideas, which are way simpler than they sound. Let's break them down without the jargon.

- Stocks: Owning a stock just means you own a tiny piece—a "share"—of a company. If you’re a fan of a brand like Target or Apple, you can actually become a part-owner. When the company does well, the value of your share can go up. Simple as that.

- Bonds: Think of a bond as an IOU. You’re essentially loaning money to a government or a big corporation. In return, they promise to pay you back in full, with interest, over a set amount of time. Bonds are generally seen as less risky than stocks and can provide a nice, steady income stream.

- Mutual Funds & ETFs: These are my favorite for beginners. Imagine a basket that holds hundreds or even thousands of different stocks and bonds. Instead of buying just one "egg," you get the whole carton. This automatically diversifies your money, spreading the risk out so you’re not banking on just one company’s success.

By mixing and matching these simple building blocks, you create what's called a portfolio—a collection of investments designed for steady, long-term growth. If you want to dive a little deeper, our guide on investing for beginners in 2025 is a great next step.

Where to Start Your Investing Journey

Knowing what to invest in is the first piece of the puzzle. Knowing where to put that money is the next. The good news is, there are accounts designed specifically for this, and many come with some pretty powerful tax advantages.

Two of the best places to start are a workplace 401(k) and an Individual Retirement Account (IRA). If your employer offers a 401(k) with a company match, that should be your number one priority. An employer match is literally free money—it's the best return on your investment you will ever find.

Don't have a 401(k), or already contributing enough to get the full match? An IRA is an excellent next move. You can open one up online at almost any brokerage firm in just a few minutes, giving you total control over what you invest in.

Overcoming the Confidence and Risk Gap

Studies have shown that women can be more hesitant to invest than men, often pointing to a fear of risk. It's completely understandable, especially when financial education hasn't always been accessible to everyone. For example, in Europe, a staggering 60% of people with low financial literacy are women, a gap that can lead to feeling financially fragile. This really highlights how critical it is to build confidence through clear, straightforward knowledge. You can find more on this at internationalwomensday.com.

But here’s the thing: the biggest risk isn't making a "wrong" investment choice. The biggest risk is not investing at all. When your money just sits in a savings account, it's actually losing value year after year because of inflation.

The secret to investing isn't trying to avoid all risk; it's about managing it intelligently. Diversification—spreading your money across different types of investments—is your best friend. It helps ensure that if one part of your portfolio has a rough year, another part can help pick up the slack.

You don't need a huge pile of cash to get started. You can begin with as little as $50 a month in a low-cost index fund or ETF. The most important thing isn't how much you start with, but when you start. Thanks to the magic of compounding, even small, consistent investments you make today have decades to grow into something truly substantial. That’s how you build the financial freedom you deserve.

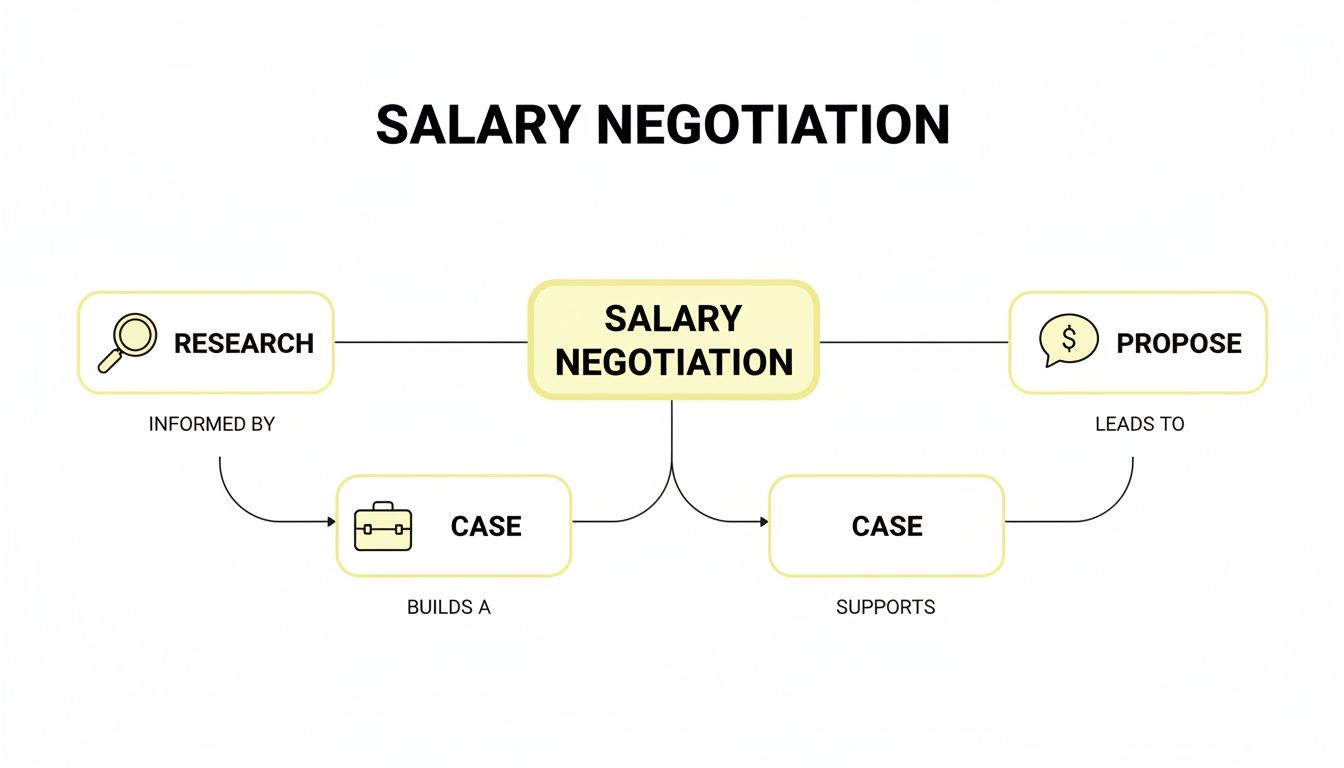

The flowchart below breaks down the steps for another key financial move—salary negotiation—which directly impacts how much you can set aside to invest.

Just like with investing, a successful negotiation isn’t about luck; it’s about a logical process of research, building your case, and then making your ask with confidence.

How to Navigate Major Life and Financial Transitions

Life isn’t a straight line. It's a series of chapters, and each new one—whether happy or heartbreaking—brings major financial shifts with it. Having a clear plan acts as an anchor in choppy waters, helping you navigate these changes with confidence instead of uncertainty. The key is to be proactive when you can and have a simple checklist ready for when you can't.

This kind of forward-thinking is a huge part of the financial advice we give to women. It’s not just about managing money day-to-day. It’s about building a resilient financial life that can handle career breaks, new relationships, and unexpected loss.

Navigating Marriage and Shared Finances

Joining your life with a partner is one of the biggest moves you’ll ever make. It’s easy to get swept up in the romance of it all, but having open, honest money talks before walking down the aisle is a powerful act of love and true partnership.

Start by laying it all out on the table—your financial histories, goals, and core beliefs about money. What does "financial security" mean to each of you? How do you really feel about debt? These conversations build the foundation for a strong financial union. From there, you can get into the practical side of things.

- Joint vs. Separate Accounts: There’s no single "right" way to do this. Many couples thrive with a "yours, mine, and ours" system. You each keep individual accounts for personal spending, but you both contribute to a joint account for shared household bills and goals.

- Aligning on Goals: Talk about your shared vision for the future. Do you want to buy a house, see the world, or retire on a beach somewhere? Getting on the same page about your big dreams makes all the little financial decisions along the way so much easier.

Managing Divorce or Widowhood with a Clear Plan

Losing a partner, whether through divorce or death, is emotionally shattering. The financial chaos that follows can feel just as overwhelming. In these moments, a simple, actionable checklist can give you a sense of control when nothing else makes sense. Just focus on one step at a time.

Women often face a much steeper financial decline after a divorce than men do. This is usually because of income gaps, career breaks taken to raise a family, and the emotional toll that makes it incredibly difficult to advocate for a fair settlement. Your number one priority is to get your financial footing back.

"Both parties lose financially in a divorce, but the best way to adjust is to create a budget and stick to it. Make sure you do the budget before the divorce is final because you only get one chance at a property settlement."

This advice from Paul Mauro really underscores the urgency of getting a clear financial picture. Your first moves need to be tactical and focused on pure security.

Your Immediate Financial Checklist:

- Locate All Important Documents: Start gathering everything: wills, trusts, insurance policies, bank statements, tax returns, and property deeds.

- Update Your Beneficiaries: This is critical. Immediately review and change the beneficiaries on all your retirement accounts, life insurance policies, and other financial accounts.

- Secure Your Credit: Close any joint credit accounts right away. This prevents an ex-spouse from racking up new debt that you could be responsible for.

- Re-evaluate Your Budget: Create a brand-new spending plan based on your individual income and expenses. This is the foundation of your new financial life.

Planning for Career Breaks and Caregiving

So many women step away from their careers, often to care for children or aging parents. While this work is beyond valuable, it comes with long-term financial consequences, affecting everything from lifetime earnings and Social Security benefits to your retirement savings.

If you see a career break on the horizon, planning ahead can make a world of difference. Start saving aggressively in the years leading up to it, and if you can, build a dedicated "career break" fund.

While you're on your break, make a point to stay connected to your professional network. Keep your skills sharp with freelance projects or new certifications. When you’re ready to jump back into the workforce, all that preparation will make the transition smoother and far more successful.

Getting through these major life transitions is a true test of your resilience. A solid financial plan is the most powerful tool you have to protect your security and independence every step of the way.

Planning for a Secure Retirement and Lasting Legacy

This is the big one. Planning for retirement and what you’ll leave behind is the ultimate act of taking control of your financial life. It’s about building a future where you aren’t just getting by, but are truly independent and secure.

For women, this stage requires special attention. We often live longer and navigate career breaks for caregiving, both of which can throw a wrench into our savings plans if we aren’t prepared.

The real goal isn't just to pile up a big number in a retirement account. It’s about turning that nest egg into a reliable income stream that will support you for decades. Think of it less like a static pile of cash and more like a garden you’ve tended for years—now it’s time to plan the harvest so it feeds you year after year. This is a huge mental shift: from saving for retirement to planning how you’ll spend in retirement.

Creating a Retirement Income Stream

Once the paychecks stop, your portfolio becomes your new source of income. This is where a sustainable withdrawal strategy becomes absolutely essential to make sure your money lasts as long as you do.

A common rule of thumb you’ll hear about is the 4% rule. The basic idea is that you can withdraw 4% of your portfolio in your first year of retirement and then adjust that amount for inflation each year after.

But let’s be clear: this is just a starting point. Your personal strategy needs to be tailored to your life, considering things like:

- Longevity: Since women tend to live longer than men, our retirement funds simply need to stretch further.

- Healthcare Costs: It’s critical to factor in the potential for higher medical bills as you get older.

- Social Security: When you decide to claim Social Security can make a huge difference in your lifetime benefits. If you can hold off, delaying your claim often results in a much bigger monthly check.

Feeling like you’re behind is a common worry, but it’s truly never too late to make a real difference. If you're looking for actionable steps, we have a detailed guide on how to catch up on retirement savings.

Globally, women's financial inclusion is advancing, but usage lags. Only 36% of women in low- and middle-income countries saved formally last year (vs. 43% of men), highlighting a gap in active participation. Discover more insights about this gap in women's financial inclusion and resilience.

Crafting Your Legacy and Protecting Your Loved Ones

Legacy planning sounds like something reserved for the ultra-wealthy, but that’s a huge misconception. It’s for everyone, no matter the size of your bank account. At its heart, it’s about making sure your wishes are respected and your loved ones are cared for—not left with a mess of confusion and legal bills.

Think of it as the ultimate love letter to your family. It provides clarity and peace during what will already be an incredibly difficult time.

Essential Legacy Planning Documents

Here are the non-negotiable documents every woman should have squared away:

- A Will: This is the absolute baseline. It spells out who gets your assets and, crucially, who would become the guardian for any minor children. If you don't have a will, the state gets to make those decisions for you.

- Durable Power of Attorney: This document lets you appoint someone you trust to handle your financial affairs if you become incapacitated and can't manage them yourself.

- Healthcare Directive (Living Will): This outlines your wishes for medical treatment if you’re unable to communicate them. It’s an incredible gift to your family, sparing them from having to make agonizing decisions on your behalf.

Taking these steps isn't about dwelling on the end. It's about empowering yourself to live more fully today, knowing you've put a thoughtful plan in place for your future and for the people you love the most.

Common Financial Questions Women Ask

When it comes to money, it’s incredibly easy to feel like you’re the only one who doesn’t have it all figured out. But I can tell you from years of experience that most women are asking the exact same questions behind closed doors. This is a judgment-free zone, a place to get clear, direct answers to those nagging financial concerns.

My goal isn’t to turn you into a financial planner overnight. It’s simply to give you the confidence that comes from a straight answer and a single, clear next step. Let's tackle these questions together.

I Feel So Overwhelmed. Where Do I Even Start?

Feeling overwhelmed is the most normal part of this process. The sheer volume of financial “gurus” and conflicting advice online can be paralyzing. The secret? Ignore almost all of it and focus on one thing.

Your best first step is to simply track your spending for one month. That’s it. No budget, no drastic cuts, no pressure. Just observe.

Grab a notebook, open a spreadsheet, or use a free app to get a real, honest look at where your money is going. This one simple, non-judgmental exercise does two powerful things: it demystifies your finances and gives you the hard data you need to make every other decision down the road. It’s the foundational step that puts you back in the driver’s seat.

How Much Should I Have in an Emergency Fund?

Think of your emergency fund as your financial safety net. It’s the buffer that keeps life’s inevitable curveballs—a sudden car repair, an unexpected medical bill—from completely derailing your long-term goals.

The standard advice is to save 3 to 6 months of essential living expenses. This isn’t your total income; it’s just the bare-bones costs like your mortgage or rent, utilities, groceries, and car payment. The absolute must-haves.

If that number makes your head spin, don't get discouraged. Start with a much smaller, more manageable goal: $1,000. Hitting this first milestone creates incredible momentum and can cover a surprising number of common emergencies.

Keep this money in a separate high-yield savings account. This is a non-negotiable. It keeps the funds liquid enough for a true emergency but out of sight from your daily checking account, so you aren't tempted to dip into it. Plus, it earns you a little extra interest.

This simple separation is one of the cornerstones of a resilient financial life. It’s a dedicated fund for a dedicated purpose, always standing guard.

Is It Too Late to Start Investing in My 40s or 50s?

This is one of the questions I hear most often, and my answer is always an emphatic, resounding NO. It is never, ever too late to start investing. While starting in your 20s is ideal, the years you have ahead of you in your 40s and 50s are still an incredibly powerful runway for growth.

Please don’t fall into the trap of thinking you need to take on massive risks to "catch up." The fundamentals of smart, disciplined investing are the same at any age. Your focus should be on consistency, not risky bets.

- Contribute Consistently: Automation is your best friend. Set up automatic contributions to your retirement accounts, like a 401(k) or an IRA, and let the system do the work for you.

- Get the Employer Match: If your company offers a 401(k) match, contribute at least enough to get the full amount. This is an immediate, 100% return on your money. It’s the closest thing to free money you’ll ever find.

- Focus on Diversification: You don't need to be a stock-picking genius. A simple strategy built around low-cost, diversified index funds or ETFs is incredibly effective. It lets you participate in the growth of the entire market.

The most critical factor isn’t timing the market; it’s your time in the market. Every dollar you invest today is a dollar working for your future self.

How Can My Partner and I Get on the Same Page About Money?

Money is a top cause of stress in relationships, and it's usually because we all come to the table with different habits, fears, and dreams. Getting aligned isn't about one person winning an argument. It’s about creating a shared vision for your life together.

The key is to reframe the conversation. Before you ever open a spreadsheet, talk about your values.

Schedule a "money date"—a relaxed, dedicated time with no distractions. Put the phones away, pour a glass of wine, and ask each other big, open-ended questions:

- What does financial security truly mean to you?

- What did you learn about money growing up?

- What's one big dream you'd love to achieve together?

Understanding the "why" behind your partner’s money habits builds empathy and turns you into a team. Once you have that foundation, the practical stuff gets easier. Many couples find a "yours, mine, and ours" account structure works beautifully. It provides individual autonomy for personal spending while ensuring shared goals are funded together—a system that honors both independence and partnership.

At Smart Financial Lifestyle, we believe that asking questions is the first step toward financial empowerment. Our goal is to provide clear, actionable guidance that helps you build wealth and redefine what financial security means for you and your family. Explore more resources and start your journey at https://smartfinancialifestyle.com.