Building wealth when you have nothing to start with is a game of disciplined habits. It’s about mastering your cash flow, crushing high-interest debt, finding ways to systematically boost your income, and consistently investing for the long haul.

This path isn’t about some overnight windfall. Forget that. It’s about making deliberate, strategic moves that build on each other over time, even when you’re starting from scratch.

The Reality of Building Wealth From Zero

Let's be honest: trying to build wealth with no financial safety net can feel totally overwhelming. You see stories about people making fortunes, but the advice feels like it's for someone else—someone who isn't living paycheck to paycheck. Most traditional financial guidance assumes you already have a foundation, which is zero help when you're the one who has to dig it.

This guide is different. We’re laying out a realistic, family-centered roadmap that gets the challenges you're up against. This isn't about chasing risky trends or crypto moonshots. It’s about laying a solid groundwork for your family's future, one intentional step at a time.

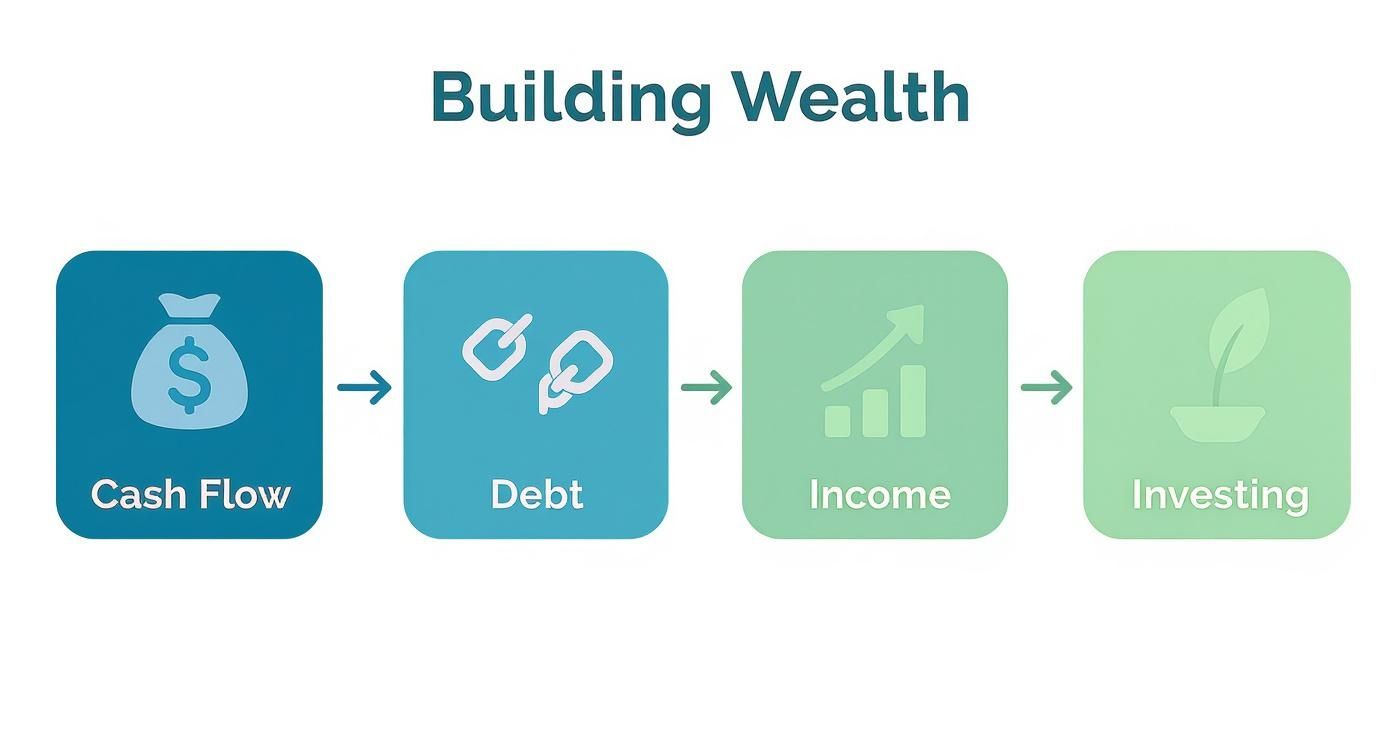

This entire approach is built on four essential pillars. Get these right, and you're on your way.

Your Four-Step Game Plan

Building wealth from nothing happens in a specific order. Each step creates the stability you need for the next one, so you don't get ahead of yourself and risk the progress you've worked so hard to make.

Think of it as a logical progression: first, you gain control of your money, then you make it grow.

Each of these stages builds on the last, creating a financial structure for your family that's both stable and sustainable. This isn't just about piling up money; it’s about creating a system that keeps generating wealth for the long haul.

To give you a clear picture of the journey ahead, here are the four core pillars we'll be diving into throughout this guide.

The Four Pillars of Wealth Creation From Zero

| Pillar | Core Action | Why It's Critical When Starting from Nothing |

|---|---|---|

| Cash Flow | Know where every dollar goes and create a budget that works. | You can't direct your money toward goals until you control where it's going right now. This is ground zero. |

| Debt | Aggressively pay down high-interest debt like credit cards. | High-interest debt is a wealth killer. Eliminating it frees up your most powerful tool: your income. |

| Income | Actively increase your earnings through raises, side hustles, or a small business. | A single paycheck is risky. Multiple income streams build financial resilience and speed up everything. |

| Investing | Consistently invest in low-cost, diversified funds for long-term growth. | This is where your money finally starts working for you, creating true wealth through compounding. |

Getting a handle on these four areas is the key to moving from zero to a place of financial strength.

The journey from zero is won through discipline, not luck. Your daily financial habits—how you spend, save, and earn—are the building blocks of your future wealth.

The economic reality can make this climb even tougher. Between December 2019 and December 2021, while $42 trillion of new wealth was created globally, the richest 1% grabbed an astounding 63% of it.

These numbers, highlighted in a report you can read on Oxfam.org, show the systemic challenges we’re all up against. That just makes it even more critical to follow a disciplined plan. Success demands a clear strategy and an unwavering focus.

Mastering Your Money to Build a Strong Foundation

Before you can even think about investing or building a legacy, you have to get a firm grip on the money you have right now. This is the bedrock of your entire financial life. It's not about restriction; it’s about being intentional with every single dollar. This is where you plug the leaks, build discipline, and create a stable launchpad for everything that comes next.

When you're starting from scratch, every dollar is precious. You can't afford to let money just slip through your fingers. The goal here is to build a system that points your income toward what really matters: stability, freedom from debt, and future growth.

Create a Budget That Breathes

A budget isn’t a financial straitjacket; it’s your roadmap. For families, the secret ingredient is flexibility. Life is unpredictable, and a super-rigid budget is almost guaranteed to fail. A fantastic starting point is the 50/30/20 rule.

This simple framework gives you a solid structure you can tweak for your family's own needs. Here’s how it works:

- 50% for Needs: This slice covers the absolute essentials. We're talking about housing, utilities, groceries, and getting to work. These are the non-negotiable costs of living.

- 30% for Wants: This is for everything that makes life more enjoyable but isn't strictly necessary—think dining out, hobbies, Netflix, and family vacations.

- 20% for Savings & Debt Repayment: This is your wealth-building engine. Every dollar in this category goes toward your emergency fund, knocking out debt, or investing for the future.

The beauty of this rule is its simplicity. It forces you to prioritize while still giving you permission to spend, as long as it fits the plan. If your "Needs" are eating up more than 50% of your income, it's a flashing red light telling you to either cut costs or focus hard on bringing in more money.

Build Your Financial Firewall

An emergency fund is your absolute top priority when you're learning how to build wealth from nothing. It is the one thing that stands between you and financial disaster. Without it, an unexpected car repair or a surprise medical bill can send you spiraling into high-interest debt, setting you back months, if not years.

Start with a small, achievable goal: $1,000. Getting that first grand saved up covers minor emergencies and, just as importantly, gives you a massive psychological win. Once you hit that, aim for a bigger cushion of 3 to 6 months of essential living expenses. This is the real safety net that protects you from a job loss or another major life event.

For a detailed guide, our emergency fund checklist provides 8 must-have steps for building true financial resilience.

Your emergency fund isn't an investment; it's insurance. It’s the money you hope you never have to use, but it’s what gives you the confidence to take calculated risks and invest for the long term later on.

Keep this money in a separate high-yield savings account. You need to be able to get to it, but not so easily that you're tempted to dip in for non-emergencies. That separation is key to building the discipline to leave it alone.

Choose Your Debt-Crushing Strategy

High-interest debt, especially from credit cards, is an anchor dragging you down. The interest rates are so punishing that they actively work against every effort you make to get ahead. You need an aggressive plan to wipe it out.

Two of the most effective methods are the Debt Snowball and the Debt Avalanche. They come at the problem from different angles, so the "best" one is whichever one keeps you motivated.

| Strategy | How It Works | Best For |

|---|---|---|

| Debt Snowball | You list your debts from smallest to largest balance. Pay the minimum on everything except the smallest debt, which you attack with every spare dollar. Once it's gone, you roll that payment into the next smallest debt. | People who need quick wins to stay motivated. That psychological boost from paying off an entire account—no matter the size—is incredibly powerful. |

| Debt Avalanche | You list your debts from the highest interest rate to the lowest. You pay minimums on all but the highest-interest debt. Once that one is paid off, you attack the next one on the list. | People who are driven purely by the numbers. This method will save you the most money on interest payments over the long haul. |

For many families just starting this journey, the Debt Snowball is the way to go. When I was getting started, seeing that first credit card balance drop to zero gave me the momentum and belief I needed to tackle the rest. Those early wins are pure fuel.

Ultimately, you just have to choose the strategy you know you'll stick with. Consistency is what gets you to the finish line.

Growing Your Income Beyond a Single Paycheck

Once you've got your financial foundation starting to feel solid, it's time to switch from playing defense to playing offense. Seriously, relying on a single paycheck is one of the biggest risks you can take when you're building wealth from scratch. One unexpected layoff can wipe out years of your hard work. The mission now is to intentionally boost your family's earning power and build real financial resilience.

This whole phase is about opening up new channels for money to flow into your household. Think of it this way: every extra dollar you bring in is pure fuel for your wealth-building engine. It can dramatically speed up your timeline to financial freedom. This isn't about working yourself into the ground; it’s about strategically using your time and skills to get paid what you're truly worth—and then some.

Maximize Your Primary Income Source

Before you start looking for brand-new income streams, make sure you're squeezing every last drop out of your main job. So many people leave money on the table just because they're afraid to ask for it. Negotiating a raise is often the single fastest way to increase your earnings without tacking on more hours to your week.

But you can't just storm in and demand more cash. You need to build a rock-solid case. For the next 90 days, I want you to track your accomplishments with obsessive detail.

- Did you knock a project out of the park ahead of schedule? Write it down.

- Did your work lead to a 15% jump in team efficiency? Document it.

- Did a client or your boss send you a glowing email? Save it.

This data turns your request from a hopeful ask into a compelling business case. When you can walk in and show your manager, "My work on the Q3 initiative directly saved the company $50,000," you're no longer just an employee asking for more. You're an asset proving your value. Frame it as a strategic conversation, not a confrontation.

Launch a Practical Side Hustle

A side hustle is your secret weapon for hitting the accelerator on wealth creation. Even an extra $500 a month makes a massive difference when you're just starting. That's an extra $6,000 a year you can throw at debt or use to finally get your investments off the ground. The key is picking something that doesn't demand a huge upfront investment or a fancy degree.

Start by looking at the skills you already have. Are you super organized? Offer virtual assistant services to frazzled small business owners. Do you have a way with words? Freelance content writing is always in demand. Maybe you're great with pets or kids—that opens up everything from dog walking to tutoring.

Your side income is pure financial oxygen. It allows you to build your emergency fund faster, pay down debt with incredible speed, and start investing years earlier than you otherwise could. It’s the ultimate accelerator.

The best side hustles often solve a real problem for people right in your own community. What do your neighbors complain about? Overgrown lawns? Dirty windows? The nightmare of assembling IKEA furniture? These are all simple service businesses you can launch with next to nothing. The goal right now isn't to build a corporate empire; it's to create a second, reliable stream of income.

If you need more ideas, checking out a guide on how to create multiple income streams can give you a ton of other strategies to explore.

From Side Hustle to Small Business

Every now and then, a great side hustle starts to grow into something much bigger. My own journey started this way, turning a small side project into a full-fledged business over several years. This evolution usually happens when your side income stops being sporadic and becomes consistent and substantial.

Don't rush this step. Treat your side hustle like a lab experiment. It’s your chance to learn about pricing, marketing, and customer service on a small scale with almost zero risk. Once you’ve built up a steady base of clients and you have a model that clearly works, then you can think about making it official by registering the business and setting up a more formal structure.

This gradual, step-by-step approach is a cornerstone of building wealth from the ground up. You start small, prove the idea works, and then reinvest your profits to grow. It’s a low-risk, high-reward path to increasing your income in a huge way.

Putting Your Money to Work Through Smart Investing

Okay, you've built your foundation and started bringing in more money. This is where the real magic happens—where your money finally starts generating more money all on its own. This is how you build true, lasting wealth from the ground up.

For a lot of people, investing feels like a complex, intimidating world reserved for the Wall Street crowd. Let's just dismantle that myth right now.

The goal here is simple to understand but incredibly powerful in practice: make your money work harder than you do. You're not going to achieve this by gambling on hot stocks or trying to time the market. Instead, we're going to embrace a disciplined, long-term strategy built on the power of compound interest. This is where your investment earnings start earning their own money, creating a snowball effect that turns small, consistent contributions into a serious nest egg over time.

The Power of Starting Small and Staying Consistent

The single most important factor in your investing success isn't picking the perfect stock; it's time. The sooner you start, the more runway your money has to grow. Even $100 a month can balloon into a significant sum when you give it decades to do its thing.

Let’s run the numbers. Imagine you start investing just $200 per month at age 25. Assuming an average annual return of 8%, by the time you're 65, that simple, steady habit could grow to over $620,000. That's the life-changing power of consistency.

The key is to automate it. Set up automatic transfers from your checking account to your investment account every payday. That way, you’re not tempted to skip a month.

Your First Steps Into the Investing World

Getting started doesn't require a finance degree. In fact, keeping it simple is often the best approach. For beginners, the best tools in the box are low-cost index funds and exchange-traded funds (ETFs).

Think of an index fund as a basket that holds tiny pieces of hundreds of different companies, like the entire S&P 500. Instead of betting on one company to succeed, you're betting on the broad success of the entire market over the long term. This strategy gives you instant diversification, which is your best defense against risk.

If you're looking for a great starting point, our guide on investing for dummies in 2025 breaks these concepts down even further.

Investing isn't about being a genius; it's about having the discipline to stick with a simple, proven plan through market ups and downs. Your behavior is far more important than your brilliance.

Use Tax-Advantaged Accounts to Supercharge Growth

Before you open a standard brokerage account, you absolutely need to take advantage of accounts that offer powerful tax breaks. These are specifically designed for retirement and are the most efficient way to build wealth.

- 401(k) or 403(b): If your employer offers one, especially with a matching contribution, this is your first stop. An employer match is literally free money. You must contribute at least enough to get the full match—not doing so is like turning down a raise.

- Roth IRA: This is an individual retirement account you fund with after-tax dollars. The magic here is that your investments grow completely tax-free, and you pay zero taxes on withdrawals in retirement. It's an incredibly powerful tool, especially when you're in a lower tax bracket now than you expect to be in the future.

These accounts put a turbocharger on your investment returns by shielding your growth from taxes, allowing your money to compound even faster. It's also critical to understand just how much wealth is tied up in assets these days. The total value of all global assets soared from $440 trillion in 2000 to $1,540 trillion in 2020, mostly driven by rising prices rather than new investments. This underscores why financial literacy is no longer optional if you want to get ahead.

Beginner Investment Options Compared

Choosing where to put your first investment dollars can feel overwhelming. Here’s a simple breakdown of some of the best options for someone just starting out.

| Investment Vehicle | Best For | Typical Risk Level | How to Start |

|---|---|---|---|

| S&P 500 Index Fund | Hands-off investors seeking broad market exposure and long-term growth. | Medium | Open an IRA or brokerage account and buy a fund like VOO or FXAIX. |

| Target-Date Fund | A "set it and forget it" approach that automatically adjusts its risk level as you get closer to retirement. | Starts higher, becomes more conservative over time. | Often the default option in a 401(k); also available in an IRA. |

| Total Stock Market ETF | Gaining exposure to the entire U.S. stock market, including small and mid-size companies. | Medium-High | Purchase an ETF like VTI through any major online brokerage. |

Honestly, the most important thing is simply to start. Pick a strategy that makes sense to you, automate your contributions, and then get back to living your life. This is the pillar that turns your hard-earned savings into a real legacy.

Protecting Your Assets and Building a Legacy

Building up your assets is a huge win, but now the game changes. Protecting what you've worked so hard for is just as important as earning it in the first place.

As your net worth climbs, so does your exposure to risk. A single curveball—a bad accident, a surprise lawsuit, a serious illness—can wipe out years of progress. This is the moment you have to pivot from playing pure offense to a smarter, more balanced strategy of growth and defense.

This phase is all about making sure the wealth you create actually sticks around. It means building a financial moat around your family and thinking beyond your own retirement. Now, you get to think about the opportunities you can create for the next generation. This is how you turn savings into a real, lasting legacy.

Your Financial Safety Net

Think of insurance as the non-negotiable backstop for your family's financial plan. It's not an investment; it's a way to transfer risk. You pay a small, predictable amount to an insurance company to shield yourself from a massive, unpredictable financial hit. It's the ultimate defensive move.

Without the right coverage, your emergency fund and your investments are suddenly on the front lines, a job they were never meant for. Let's break down the absolute essentials.

- Life Insurance: If anyone—a spouse, kids—relies on your income, term life insurance is a must-have. It's surprisingly affordable and makes sure your family can pay the mortgage, cover bills, and fund their goals if you're gone.

- Disability Insurance: Your ability to get up and earn a paycheck is your single greatest financial asset, hands down. Disability insurance replaces a chunk of that income if you get too sick or injured to work, protecting your family from a total loss of cash flow.

- Liability Insurance: This is usually tucked into your homeowner's or auto insurance. It protects your assets if you're responsible for an accident that injures someone or damages their property. For a relatively low cost, an umbrella policy adds another layer of liability protection on top of those policies.

Planting the Seeds of Multigenerational Wealth

Once you’ve secured your own financial footing, you can start doing something incredibly rewarding: giving your kids a head start. This is about giving them a foundation that you might not have had yourself, setting them up for a lifetime of financial well-being.

You don’t need a fortune to do this. You can start small with some powerful tools designed to let time and compounding do the heavy lifting.

"True wealth is about more than money. It's about providing the next generation with options, knowledge, and a starting line that is further ahead than our own."

A fantastic way to get started is by opening a custodial investment account for your children, like a UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act) account. You can put money into these accounts, invest it for them in simple, low-cost index funds, and just let it grow for decades.

The First Steps in Estate Planning

"Estate planning" can sound intimidating, like it's only for the super-rich. But it’s really just a plan for what happens to your stuff—and more importantly, your kids—if something happens to you. For a young family, two documents are absolutely critical.

- A Will: This is the legal document where you spell out your wishes for who gets what. Crucially, it's also where you name a guardian for your minor children. If you don't have a will, a judge who doesn't know you or your family will make these deeply personal decisions.

- Powers of Attorney: These documents let you appoint someone you trust to make financial and healthcare decisions for you if you're ever incapacitated and can't make them yourself.

Globally, wealth continues to grow, hitting an all-time high of $305 trillion, a number largely pushed up by strong market performance. Research shows that over the past two decades, North America was responsible for more than half of that growth. This just goes to show that plugging into growing economic sectors is a proven path for anyone, even starting from zero, to build their own piece of that wealth. You can dig deeper into these global wealth dynamics and their implications.

Taking these protective steps ensures that the wealth you build serves its ultimate purpose: providing security, opportunity, and a lasting legacy for the people you love.

Got Questions? Let's Get Them Answered.

Whenever you start a journey like this, especially from square one, questions are going to pop up. It's only natural. When you’re figuring out how to build wealth from nothing, it’s really easy to get bogged down in the “what-ifs” and “how-longs.” I want to tackle those head-on with some straight-up, practical answers to give you some clarity and, hopefully, a dose of encouragement.

These aren't just hypotheticals; they're the real roadblocks that can kill your momentum before you even get started. Let's clear them out of the way.

How Long Does This Actually Take?

This is always the first question, and the honest-to-goodness answer is: it depends. But it's probably longer than you hope and a lot shorter than you fear. Building real, meaningful wealth from scratch is not a five-year project. For most families, we're talking about a commitment of 10, 20, or even 30 years of doing the right things, day in and day out.

Your personal timeline really boils down to three things:

- Your Income: The more you make, the more fuel you have for the fire. A bigger shovel moves more dirt, faster.

- Your Savings Rate: This is even more crucial than your income. I've seen families earning $60,000 a year who save 25% blow past families earning $100,000 who only manage to save 5%. It's all about the gap between what you earn and what you spend.

- Your Investment Returns: You can't control the market, but history has shown that consistently investing in broad, low-cost funds over the long haul is an incredibly powerful engine for growth.

Instead of staring at a finish line that's decades away, get excited about the milestones. Hitting your first $1,000 in an emergency fund is a huge win. Paying off that nagging credit card is a victory. Setting up your first automated investment? That’s proof the system works. Celebrate those moments.

What's More Important: Earning More or Saving More?

When you are starting from absolute zero, with nothing in the bank, saving more is everything. It's your immediate, non-negotiable priority. You have to get a handle on your cash flow and plug the leaks in your financial boat before you can even think about going faster.

Aggressive saving is what lets you build that first buffer—your emergency fund—and start attacking the high-interest debt that is actively working against you every single day. You simply cannot out-earn disastrous spending habits.

But once you’ve built a stable foundation—you have a budget, cash for emergencies, and the worst of your debt is gone—the game changes. At that point, earning more becomes the ultimate accelerator.

In the beginning, defense (saving) keeps you in the game. Later on, offense (earning) is how you win it.

Think about it: there’s a hard limit to how much you can save. You can only cut your expenses down to zero. But there is theoretically no limit to how much you can earn. A higher income supercharges your ability to invest, turning your wealth-building crawl into a confident run.

I'm Over 40... Is It Too Late for Me?

Absolutely not. It is never, ever too late to start making your financial life better. While you might have a shorter runway for compound interest to do its thing compared to a 20-year-old, you have some serious advantages they don't.

If you’re starting this in your 40s or 50s, you likely have:

- Higher Earning Power: You're probably at or near your peak career earnings. This means you can shovel a lot more money toward your goals than you could in your 20s.

- Life Experience: You’ve made financial mistakes. We all have. But you've learned from them and have a much clearer picture of what truly matters to you.

- A Healthy Sense of Urgency: Knowing you have less time can be an incredible motivator. It lights a fire under you to be disciplined and focused.

You might need to be more aggressive, aiming to save 20-25% of your income or even more, but building a secure future is completely within your grasp. The worst thing you can do is let your age become an excuse to do nothing. Remember the old saying: The best time to plant a tree was 20 years ago. The second-best time is today.

How Do I Stay Motivated When Progress Feels So Slow?

This is a tough one. Motivation comes and goes, especially in the early days when it feels like you're making a lot of sacrifices for very little reward. The secret is to stop relying on feeling motivated and instead build a system of unbreakable habits.

- Automate. Automate. Automate. Set up automatic transfers from your checking account to your savings and investment accounts the day you get paid. You can't spend what you never see. This removes willpower from the equation entirely.

- Track Your Net Worth. Every single month, update a simple spreadsheet or use an app to track your net worth. Even if it only goes up by $100, that is tangible proof that you're moving forward. Seeing that number climb over time is one of the most powerful motivators there is.

- Find Your "Why." Get brutally honest about why you're doing all this. Is it to give your kids a head start you never had? To travel without worrying about money? To have the freedom to walk away from a job you hate? Write it down. Put it on a sticky note on your bathroom mirror. Your "why" is the fuel that will carry you through when motivation fades.

Building wealth is a marathon, not a sprint. By building systems, watching your progress, and staying connected to your real purpose, you’ll find the discipline to go the distance.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building a legacy of security and opportunity. To continue your journey with clear, actionable guidance, explore the resources at https://smartfinancialifestyle.com.