When you’re staring down the choice between Roth and pre-tax retirement contributions, it all boils down to one simple question: Do you want to pay taxes now or later?

It’s a straightforward trade-off. With a Roth contribution, you use after-tax money—meaning you pay the taxman today. The reward? Your withdrawals in retirement are completely tax-free. A pre-tax (or traditional) contribution, on the other hand, gives you an immediate tax break by lowering your taxable income now, but you’ll owe taxes on every dollar you pull out later.

Understanding the Core Financial Tradeoff

Picking between Roth and pre-tax isn't just a simple accounting choice; it's a strategic bet on your future. You’re essentially forecasting whether your income tax bracket will be higher while you’re working or when you’re retired. This one factor is often the pivot point that determines which path gives you the biggest long-term financial win.

H3: The Upfront vs. Deferred Tax Benefit

A pre-tax contribution delivers an immediate, tangible benefit. By reducing your adjusted gross income (AGI) for the year, you pocket some real tax savings right now. This is especially powerful for people in higher income brackets. The logic is simple: save on taxes today while your income is high, and pay them in retirement when you expect your income to be lower.

On the flip side, a Roth contribution offers zero immediate tax deduction. You’re putting away money that has already been taxed. But the real magic happens down the road—your investments grow completely tax-free, and every qualified withdrawal in retirement is 100% tax-free. This gives you incredible certainty and acts as a shield against the risk of higher tax rates in the future.

The decision isn't just about saving money; it's about when you save it. Pre-tax contributions front-load your tax savings, while Roth contributions back-load them, giving you tax-free income when you might need it most.

A Quick Look Roth vs Pre Tax at a Glance

To make these fundamental differences crystal clear, let's break down how each approach handles your money at every stage.

| Feature | Roth Contributions | Pre-Tax Contributions |

|---|---|---|

| Contribution Tax Treatment | Made with after-tax dollars; no upfront tax deduction. | Made with pre-tax dollars; lowers your current taxable income. |

| Investment Growth | Grows completely tax-free. | Grows tax-deferred. |

| Withdrawals in Retirement | Qualified withdrawals are 100% tax-free. | Withdrawals are taxed as ordinary income. |

This table cuts through the noise. With Roth, you pay the piper upfront for tax-free freedom later. With pre-tax, you get the break now but settle the tab in retirement.

The Impact of Tax Law on Your Decision

Tax legislation can dramatically tilt the scales. For instance, the Tax Cuts and Jobs Act (TCJA) of 2017 temporarily lowered individual tax rates, creating a strategic window for high earners to double down on pre-tax contributions. A saver in a 35% bracket contributing the 2025 maximum of $23,500 pre-tax immediately saves over $8,225 in federal taxes.

If that upfront savings is reinvested, it can compound significantly over time, sometimes even outperforming a Roth contribution made during the same low-tax period. But with the TCJA set to expire in 2026, rates may snap back to higher levels, making the timing of your contributions more critical than ever. You can learn more by digging into the detailed financial modeling of these contributions.

Comparing the Long Term Financial Implications

Choosing between Roth and pre-tax contributions isn't just about your next tax return; it's a strategic decision that echoes for decades. At its heart, the choice is a bet on your future: will your income tax rate be higher now, during your peak earning years, or later, when you finally start tapping into your retirement funds?

Get this wrong, and you could end up with a significantly higher lifetime tax bill. A pre-tax contribution feels great today because it lowers your taxable income right now. But what you're really doing is kicking a tax can down the road—a tax liability that grows right along with your investments. On the flip side, a Roth contribution means paying taxes now to secure a future of completely tax-free income, no matter how much tax rates might climb.

How Required Minimum Distributions Change the Game

One of the biggest long-term differences between these two strategies doesn't show up until much later in life, and it's called Required Minimum Distributions (RMDs). Starting at age 73 (or 75 for those born in 1960 or later), the IRS forces you to start taking a certain percentage out of your pre-tax retirement accounts, like a traditional 401(k) or IRA.

These forced withdrawals are fully taxable as ordinary income. For many retirees, this creates an unwelcome "tax bomb" that can push them into a higher tax bracket than they ever anticipated and can even jack up their Medicare premiums.

Roth IRAs completely sidestep this issue. They have no RMDs for the original account owner. This gives you incredible flexibility and control, letting your money keep growing tax-free for as long as you live. You take money out when you want to, not because the IRS says you have to.

This distinction is a game-changer for anyone who plans to work past retirement age, expects a pension, or has other income streams later in life. Pre-tax RMDs can throw a wrench into your tax planning, while Roth accounts offer a predictable, tax-free buffer. If you're looking for ways to get ahead of this, understanding how to reduce taxes in retirement is a critical next step.

Estate Planning and Legacy Building Implications

The choice you make today doesn't just affect your own life; it directly impacts the legacy you leave behind for your family. The difference in how Roth and pre-tax assets are inherited is stark.

When beneficiaries inherit a traditional, pre-tax account, they also inherit the tax bill. Under current rules, most non-spouse beneficiaries have to drain the entire account within 10 years of your death, paying income tax on every single withdrawal. That can seriously eat into the net value of what you intended to leave them.

A Roth IRA, on the other hand, is a powerful estate planning tool.

- Tax-Free Inheritance: Your heirs get the money from a Roth IRA completely tax-free.

- Continued Tax-Free Growth: Even though they still have to withdraw the funds within that 10-year window, the account can keep growing, tax-free, during that time.

- Simplified Planning: There are no complicated tax calculations for your beneficiaries to worry about. What they see is what they get.

This makes the Roth vs. pre-tax debate a central piece of multi-generational wealth planning. By paying the taxes during your lifetime, you're essentially giving your loved ones a tax-free gift that offers more financial security and far fewer headaches. It’s a thoughtful way to make sure your legacy is passed on efficiently, preserving more of the wealth you worked so hard to build.

How to Choose Your Contribution Strategy by Career Stage

Deciding between Roth and pre-tax contributions isn't a "set it and forget it" choice. It's a decision that should evolve right along with you. Your income, career path, and what you want out of life are going to change, so your retirement strategy needs to keep up. What makes perfect sense for you today might be the wrong move a decade from now.

Let's walk through the Roth contribution vs pre tax decision based on where you are in your professional life. This way, you can line up your savings strategy with your current financial reality and your future goals.

Early Career: Go with Roth Contributions

For most people just kicking off their careers, the case for Roth contributions is incredibly strong. When you're in your 20s or early 30s, you're probably in one of the lowest tax brackets you'll ever see. Your income has a long runway for growth as you rack up experience and climb the ladder.

This is the absolute best time to pay your taxes. By making Roth contributions with after-tax money, you're locking in today's lower tax rate for good. That money then has decades to grow completely tax-free, building a massive tax-free nest egg for your future self.

Think of it like this: you're prepaying your tax bill at a serious discount. When you retire, you could be in a much higher tax bracket, but you'll get to pull every single dollar out of your Roth account without owing the IRS another dime.

Take a 25-year-old earning $55,000 a year. They're in a relatively low federal tax bracket. A $6,000 Roth contribution costs them their current tax rate on that income, but every penny of growth over the next 40 years is shielded from future taxes, no matter how high tax rates climb.

Mid Career: Shift Your Focus to Pre-Tax

As you hit your peak earning years—usually from your late 30s to early 50s—the math often starts to favor pre-tax contributions. At this stage, your income is likely at an all-time high, pushing you into a higher tax bracket. This is when the immediate tax deduction from a traditional 401(k) or IRA delivers the biggest punch.

Every dollar you contribute pre-tax shaves that much off your taxable income for the year, which can lead to some serious tax savings right now. For instance, a professional making $150,000 who puts $20,000 into a pre-tax 401(k) instantly drops their taxable income to $130,000. That could easily save them thousands on their current tax bill.

This strategy is built on one simple bet: you expect your income, and thus your tax bracket, to be lower in retirement than it is today. By deferring taxes, you're banking on paying a lower rate on that money when you eventually withdraw it. For many high-earning professionals, that’s a pretty solid bet to make.

Near Retirement: Time for a Blended Approach

When retirement is on the horizon, your strategy needs to shift once more. The new goal is tax diversification. You want to give yourself flexibility and control over your taxable income once the paychecks stop rolling in. A blended approach, using both pre-tax and Roth assets, is almost always the smartest play.

Having both types of accounts lets you strategically pull money to keep your retirement tax bill as low as possible.

- Pre-Tax Funds: You can withdraw from your traditional 401(k) or IRA just enough to fill up the lower tax brackets.

- Roth Funds: For any extra cash you need, you can dip into your Roth account completely tax-free. This keeps you from accidentally bumping yourself into a higher tax bracket.

This kind of flexibility is priceless. It can help you manage your income to avoid paying higher Medicare premiums or reduce the taxes you owe on your Social Security benefits. If you don't have a Roth account yet, your late-career years are the perfect time to start one, even if you only contribute a small amount. You're building a pool of tax-free money that can act as a financial shock absorber in retirement. This deliberate balance between a Roth contribution vs pre tax savings is what gives you the power to shape your financial future.

Navigating Special Financial Situations and Life Events

Life rarely moves in a straight line, and major events can completely reframe your financial strategy. The standard advice on Roth vs. pre-tax contributions can shift dramatically when you're going through a big transition. A sudden change in your income, marriage, or family calls for a hard look at your savings plan to make sure it still fits your new reality.

These situations often create unique tax scenarios where one type of contribution suddenly becomes far more valuable than the other. Knowing how to adapt is the key to making smart money moves when life throws you a curveball.

Sudden Changes in Tax Status for Widows and Divorcees

Losing a spouse or going through a divorce is emotionally taxing, and it brings huge financial adjustments, too. One of the most immediate impacts is a change in your tax filing status, which can shove you into a completely different income tax bracket. For many, this means moving from the more favorable "married filing jointly" status to "single" or "head of household."

This shift often results in a higher effective tax rate, even on the same income. If that's your situation, the immediate tax deduction from a pre-tax contribution can become much more valuable. It's a direct way to lower your newly inflated taxable income during a period of financial uncertainty.

But the opposite can also be true. If your income drops significantly after a divorce or the loss of a partner, you might find yourself in a lower tax bracket. This presents a golden opportunity to favor Roth contributions, paying taxes now while your rate is low to secure tax-free income down the road.

The core question stays the same, but the context is new: Is your tax rate higher now, in this new life stage, or is it likely to be higher in retirement? A careful assessment is crucial.

Advanced Strategies for High Income Earners

As your income climbs, you may find yourself phased out of making direct Roth IRA contributions. The IRS sets annual income limits on who can contribute. For 2024, single filers earning $161,000 or more and married couples earning $240,000 or more cannot contribute directly.

But that doesn't mean high earners are locked out of Roth savings. This is where the Backdoor Roth IRA strategy comes in. It’s a two-step process:

- Contribute to a Traditional IRA: First, you make a non-deductible contribution to a traditional IRA, which has no income limits.

- Convert to a Roth IRA: Soon after, you convert those funds into a Roth IRA. You'll owe income tax on any earnings that popped up before the conversion, but the contribution itself isn't taxed again.

This perfectly legal move allows high-income individuals to build a source of tax-free retirement income. It's a critical tool for anyone looking to diversify their tax situation but who is otherwise barred from direct Roth contributions.

There’s another rule high earners over 50 should know about. New regulations kicking in for 2026 will require individuals who earned over $145,000 in the prior year to make all their 401(k) catch-up contributions on a Roth (after-tax) basis. This change forces a Roth component into the savings plans of many high-income professionals.

Using Roth Accounts for Legacy Planning

Beyond your own retirement, the Roth contribution vs pre tax decision has huge implications for the wealth you leave behind. Roth accounts are incredibly powerful tools for estate and legacy planning, offering a major leg up over pre-tax accounts.

When your children or other beneficiaries inherit a traditional, pre-tax 401(k) or IRA, they also inherit the tax bill. They have to withdraw all the funds within 10 years and pay ordinary income tax on every dollar. In contrast, an inherited Roth IRA is passed on completely tax-free. Your heirs get the full value without having to worry about a future tax bill.

This feature makes the Roth a clear winner for anyone focused on multi-generational wealth. It’s also useful for specific goals, like funding a grandchild’s education. While a 529 plan is built for college savings, a Roth IRA offers more flexibility. You can see a detailed comparison in our guide on the 529 vs. Roth IRA for college savings. By paying the taxes now, you’re essentially giving a tax-free gift to the next generation, making sure your legacy is passed on as efficiently as possible.

A Practical Framework For Making Your Decision

Putting financial theory into practice requires a clear, personal framework. The whole Roth contribution vs pre-tax debate isn’t about some universal right answer; it’s about finding the right answer for you, right now. This choice comes down to an honest look at your current income, your best guess about future earnings, and how you feel about the wild card of future tax laws.

To build a truly resilient retirement plan, many savvy savers aim for tax diversification. This simply means you contribute to both pre-tax and Roth accounts over your career. Think about it—you wouldn't put all your money into a single stock. In the same way, relying on just one type of tax treatment can be a risky bet. Having both gives you the flexibility to manage your taxable income down the road when you're retired.

Key Questions To Guide Your Choice

Before you commit your hard-earned cash, take a minute to think through your own financial landscape. Your answers here will point you toward the strategy that best fits your goals.

-

Where is your income headed? Are you early in your career with plenty of room for salary growth? If that's the case, your future tax bracket will probably be higher, making Roth contributions a brilliant move today. On the other hand, if you're at or near your peak earning years, grabbing that immediate tax break from pre-tax contributions might make more sense.

-

How much control do you want in retirement? Pre-tax accounts come with a catch called Required Minimum Distributions (RMDs). These force you to start taking taxable withdrawals at age 73 or 75. Roth IRAs, however, have no RMDs for the original owner, giving you total control over when—or even if—you touch the money.

-

What does your family’s legacy look like? If passing on wealth with the smallest possible tax hit is a priority, the Roth is an incredibly powerful tool. Your heirs will inherit Roth accounts completely tax-free. Traditional accounts, by contrast, pass along a pretty hefty tax bill.

-

How do you feel about future tax rates? Nobody has a crystal ball, but it's worth thinking about the direction of government spending and national debt. If you believe tax rates are more likely to go up than down over the next few decades, paying your taxes now with a Roth contribution acts as a powerful hedge against that uncertainty.

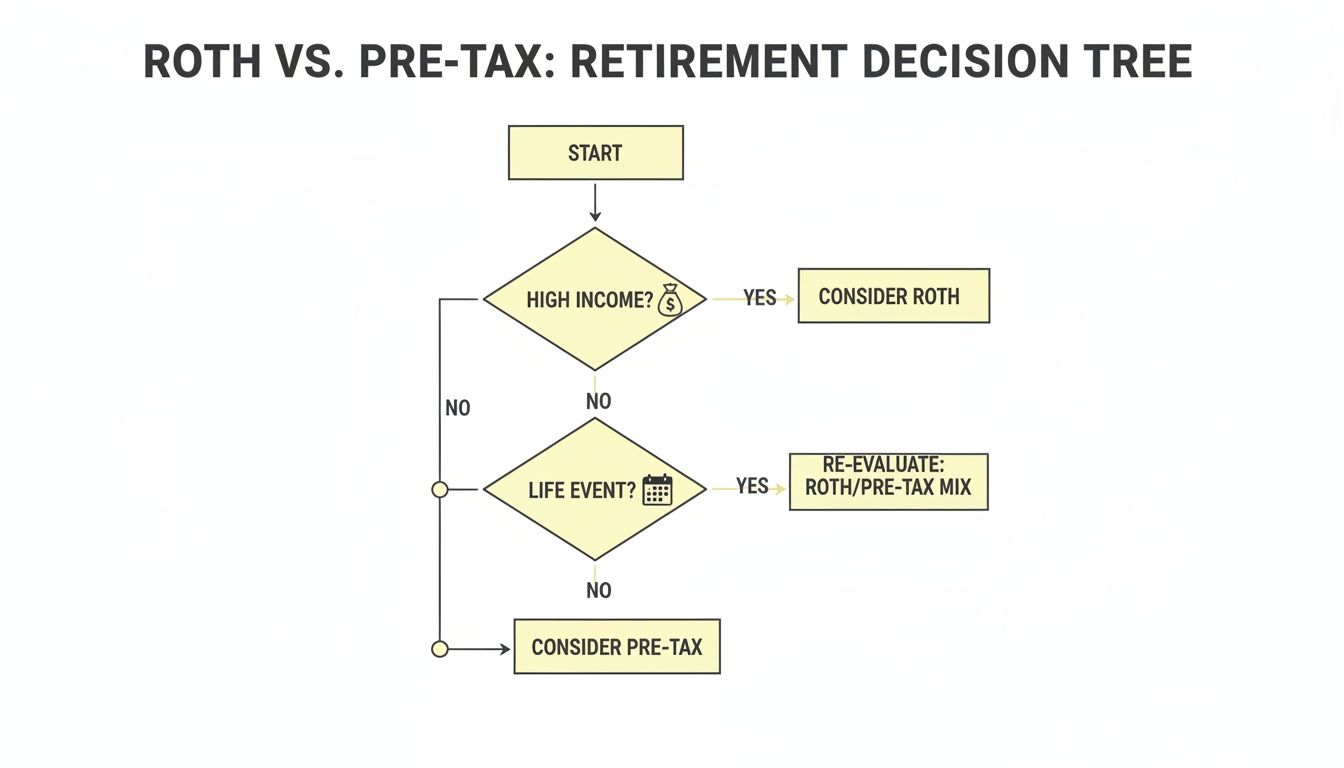

This decision tree gives you a visual way to see how different factors like income and life events can steer your choice.

As the flowchart shows, higher current income often favors pre-tax savings for that immediate deduction. But if you’re anticipating big life changes or focusing on legacy, the tax-free perks of a Roth become much more attractive.

To help you walk through these factors for your own situation, I've put together a simple decision framework.

Decision Framework Roth vs Pre Tax

| Consideration | Favors Pre-Tax If... | Favors Roth If... |

|---|---|---|

| Current vs. Future Income | You're at or near your peak earning years and expect a lower tax bracket in retirement. | You're early in your career and expect your income (and tax bracket) to rise significantly. |

| Future Tax Rate Outlook | You believe tax rates will be lower in the future when you withdraw the money. | You believe tax rates are likely to be higher in the future. |

| Need for Control in Retirement | You don't mind being forced to take taxable withdrawals (RMDs) starting in your 70s. | You want complete control over when and how much you withdraw, with no RMDs. |

| Estate Planning & Legacy Goals | Leaving a tax-free inheritance is not a primary goal. | You want to pass on wealth to your heirs completely tax-free. |

| Flexibility for Early Withdrawals | Not a primary concern; you plan to keep funds invested until retirement. | You want the option to withdraw your contributions (not earnings) tax and penalty-free at any time. |

| Access to Roth at Work | Your employer plan doesn't offer a Roth 401(k) option. | Your employer offers a Roth 401(k), giving you an easy way to get tax diversification. |

This table isn't about finding a perfect score, but about seeing which column your personal situation leans toward.

Model Your Future With Online Calculators

Guesswork will only get you so far. To really get a feel for the long-term impact of your decision, you have to run the numbers. Luckily, there are some excellent online tools that can model different scenarios based on your specific situation.

These calculators let you plug in variables like your current age, income, contribution amount, and expected investment returns. More importantly, you can play around with different assumptions for your tax rate in retirement. Seeing the potential difference in your final take-home amount—which can easily be tens or even hundreds of thousands of dollars—often makes the choice crystal clear.

A financial plan is a living document, not a one-time decision. Using a calculator annually to check your assumptions helps ensure your strategy remains aligned with your evolving life and financial situation.

Actionable Steps To Build Your Plan

With your self-assessment done and a clearer picture from the modeling tools, it's time to put your plan into action. Don't let "perfect" be the enemy of "good." Making a thoughtful choice today is far better than putting off your contributions because of uncertainty.

-

Review Your Employer's Plan: First, check if your 401(k) or 403(b) even offers a Roth option. If it does, you can easily split your contributions between pre-tax and Roth right there in your payroll settings.

-

Start Small and Diversify: Still on the fence? Consider a 50/50 split. This automatically gives you tax diversification and hedges your bets no matter what future tax rates do. You can always tweak the allocation later.

-

Consider an IRA: Even if your workplace plan is limited, you can always open a personal Traditional or Roth IRA to supplement your savings and get the tax mix you're looking for.

-

Plan Beyond the Maximum: If you're a high-income earner who is already maxing out your main retirement accounts, you need a strategy for what comes next. For those looking to continue building wealth efficiently, our guide on how to save for retirement after maxing out your 401k offers some practical next steps.

Ultimately, the choice between a Roth and pre-tax contribution is a personal one. By using this framework, you can move from confusion to clarity and build a retirement strategy that serves you well for decades to come.

Got Questions? Roth vs. Pre-Tax FAQs

Even after you've got the basics down, a few tricky questions always pop up when deciding between Roth and pre-tax contributions. Let's run through some of the most common ones to clear up any lingering confusion. Think of this as a final check-in before you lock in your retirement strategy.

Can You Contribute to Both Roth and Pre-Tax Accounts?

Yes, you absolutely can! In fact, for many people, it's the smartest way to go. This strategy is often called tax diversification, and it's all about hedging your bets against whatever tax rates the future might hold.

By putting money into both a pre-tax 401(k) and a Roth 401(k) or IRA, you're building incredible flexibility for retirement. Down the road, you can pull from your pre-tax accounts to fill up those lower tax brackets, then draw from your Roth accounts for any extra income you need, completely tax-free.

How Are Employer Matching Contributions Treated?

This is a big one, and it trips a lot of people up. No matter if you make Roth or pre-tax contributions to your 401(k), your employer's matching funds will always go into a pre-tax account. You’ll owe ordinary income tax on that match and its earnings when you withdraw them in retirement.

The bottom line is your personal contributions can be Roth, but the company match is always treated as traditional, pre-tax money. You can’t tell your employer to make their match a Roth contribution.

This is a critical detail for your long-term tax planning. Even if you go 100% Roth with your own contributions, you'll still have a separate, pre-tax balance growing from the company match that will be subject to taxes and RMDs later on.

What Is a Roth Conversion and When Should You Consider It?

A Roth conversion is simply the process of moving money from a pre-tax retirement account (like a traditional IRA or 401(k)) over to a Roth account. The catch? You have to pay ordinary income tax on the entire amount you convert, and you pay it in the year you make the move.

So, why would anyone volunteer for a big tax bill? A conversion can be a powerful move in a few specific scenarios:

- During a Low-Income Year: If you're between jobs, on a sabbatical, or just had a year with unusually low income, your tax bracket might be much lower than usual. This creates a perfect window to convert pre-tax funds to Roth at a "discounted" tax rate.

- To Avoid Future RMDs: If you have a massive pre-tax balance and are worried about the "tax bomb" from Required Minimum Distributions later, converting some of those funds now can shrink your future RMD liability.

- For Estate Planning: Converting to a Roth means you're paying the tax bill now on behalf of your heirs. They can then inherit the funds completely tax-free, which can be a tremendous gift.

A conversion is a big decision and you can't undo it. It’s crucial to plan for the tax hit and make sure you have money set aside outside of your retirement accounts to pay the IRS.

Do New Rules Affect High-Income Earners?

Yes, some new legislation is changing the game for high-income savers. Starting in 2026, a new rule kicks in that will require participants who earned more than $145,000 in the prior year to make all of their 401(k) catch-up contributions on a Roth (after-tax) basis.

This change essentially forces a Roth component into the retirement plans of many older, high-earning professionals. If you're over 50 and fall into this category, you'll soon lose the choice to make those extra catch-up contributions pre-tax. This makes understanding the nuances of the roth contribution vs pre tax debate even more critical for squeezing the most out of your final working years.

At Smart Financial Lifestyle, we believe that making smart financial decisions is the key to building lasting wealth and redefining your family's future. Our goal is to provide the clarity and confidence you need to navigate these important choices. Learn more and continue your journey at https://smartfinancialifestyle.com.