The big debate over a Rollover vs. Traditional IRA is a lot simpler than it sounds. At the end of the day, it's not really about two different kinds of accounts. It's about where the money comes from.

A Rollover IRA is just a fancy name for a Traditional IRA that holds money you've moved from an old employer's retirement plan, like a 401(k). A standard Traditional IRA, on the other hand, is one you fund with your own new contributions each year.

Rollover IRA Vs Traditional IRA: The Core Distinction

When you switch jobs, you have to decide what to do with the 401(k) you're leaving behind. A popular move is to roll those funds into an IRA. This doesn't invent a new type of account; it just tags an existing IRA based on the money's history.

Think of them as identical twins. A Rollover IRA and a regular Traditional IRA operate under the exact same set of rules:

- They both let your investments grow tax-deferred.

- Withdrawals in retirement are taxed the same way.

- Contribution limits are identical (though the rollover amount itself doesn't count toward your annual limit).

- Required Minimum Distributions (RMDs) kick in at age 73 for both.

So if they're functionally the same, why do we even make the distinction? The "versus" here isn't about which account is better. It’s about the strategic decision behind how you fund it. The source of the money is the key.

Why The Funding Source Matters

Knowing where your IRA money came from is surprisingly important for a couple of reasons. First, some 401(k) plans will only let you roll IRA money back into their plan if that money originally came from another employer's plan. Keeping rollover funds separate from your annual contributions keeps them "clean" in the eyes of a 401(k) administrator.

Second, the choice to roll over is a major strategic one. It often unlocks a much wider world of investment options and potentially lower fees than the limited menu inside your old 401(k). Opting to roll over is a vote for more control and flexibility. This is completely different from the decision to make a yearly contribution, which is all about socking away new savings.

The ideas of pre-tax and post-tax contributions are central here. You can get a deeper understanding of how a Roth IRA uses pretax or post-tax dollars in our detailed guide.

At a Glance: How IRAs Get Their Funding

The primary difference between a Rollover IRA and a standard Traditional IRA really just boils down to the source of the funds. It’s less about the account itself and more about its origin story.

| Feature | Rollover IRA | Traditional IRA (Funded by Contributions) |

|---|---|---|

| Primary Funding Source | Money transferred from a qualified employer plan (e.g., 401(k), 403(b), TSP). | New money contributed directly by the account holder, up to the annual limit. |

| Tax Rules | Identical. Both offer tax-deferred growth and are taxed upon withdrawal. | Identical. Both offer tax-deferred growth and are taxed upon withdrawal. |

| Main Purpose | To consolidate and manage retirement assets from a former job. | To actively save new pre-tax or tax-deductible dollars for retirement. |

Ultimately, one is about managing what you’ve already saved, and the other is about actively building new savings. Both use the same type of account to get the job done.

When you hear people talk about a "Rollover IRA" and a "Traditional IRA," it's easy to think they're two completely different things. They aren't. To really get a handle on the rollover vs. traditional IRA question, we need to clear up what each term actually means. While they end up following the same rules, where the money comes from and how you use them strategically are what set them apart.

Let's start with the basics. A Traditional IRA is a personal retirement account anyone with earned income can open. Think of it as your own private retirement savings bucket, completely separate from whatever your employer offers. You put new money into it each year.

The setup is pretty simple:

- Contributions might be tax-deductible. Depending on your income and whether you have a retirement plan at work, you might be able to deduct what you put in, which lowers your tax bill for the year.

- Your money grows tax-deferred. Inside the IRA, your investments can grow without you having to pay taxes on dividends or gains every year.

- Withdrawals get taxed. Once you start taking money out in retirement (usually after age 59 ½), it’s taxed as regular income.

Again, your ability to contribute—and especially to deduct those contributions—hinges on your income and your access to a workplace plan.

What a "Rollover" Really Is

Now, here's the key distinction: a "rollover" isn't a type of account. It's an action. It’s the process of moving money from one retirement plan to another, like from an old 401(k) into an IRA. The money isn't a new contribution; it's your existing retirement savings finding a new home. And this isn't some niche financial move; it's massive.

Most of the money funding Traditional IRAs in the U.S. comes from rollovers, not new contributions. Out of $616.9 billion that flowed into these accounts in 2020, a whopping $594.8 billion—or 96.4%—came from rollovers. You can dig into more of these trends on PlanSponsor.com.

This just goes to show that most people are using IRAs to consolidate old 401(k)s. Because so much is at stake, you have to understand how to do the transfer correctly to avoid some pretty nasty penalties.

There are two ways to get it done:

1. Direct Rollover (The Smart Way)

This is the safest and simplest method by far. Your old 401(k) administrator sends the money directly to your new IRA custodian. It never even touches your personal bank account, which is great because it eliminates any chance of a tax mishap.

2. Indirect Rollover (The Risky Way)

With this method, your old plan cuts you a check for your balance, but they’re required to withhold 20% for federal taxes right off the bat. You then have just 60 days to deposit the full original amount into your new IRA. That means you have to come up with that missing 20% from your own pocket to complete the rollover.

If you miss that 60-day window, the whole thing blows up. The entire amount is considered a taxable withdrawal, you’ll owe income tax on it, and if you’re under 59 ½, you’ll likely get hit with a 10% early withdrawal penalty. Given the risks, the direct rollover is almost always the better choice. With this foundation, we can now compare the real-world strategies for keeping money in a 401(k) versus rolling it over.

Comparing Your 401k to a Rollover IRA

When you leave a job, what to do with your old 401(k) is one of the most critical financial decisions you'll face. Leaving it with your old employer is an option, sure. But many people find that rolling it over into an IRA gives them far more control and opens up a world of new opportunities.

To make a smart choice that actually lines up with your long-term goals, you need to understand the practical differences between these two accounts. This isn't just about moving money from one bucket to another; it's about fundamentally shifting how you manage your retirement savings. A 401(k) is built for simple, set-it-and-forget-it participation within a company. An IRA, on the other hand, is designed for individual control and customization. Let's break down what really separates them.

Investment Freedom and Flexibility

The single biggest difference you'll notice right away is the universe of investment choices that an IRA unlocks. Your typical 401(k) offers a limited menu—usually a small selection of mutual funds and target-date funds hand-picked by your employer. While this keeps things simple, it can feel pretty restrictive if you want to build a more personalized portfolio.

A Rollover IRA, however, gives you access to nearly anything you can trade through a brokerage. This includes:

- Individual Stocks and Bonds: You can buy shares in specific companies you believe in or purchase government and corporate bonds directly.

- Exchange-Traded Funds (ETFs): Want to invest in an entire market sector, industry, or index? Low-cost ETFs make it easy.

- A Wider Range of Mutual Funds: You get access to thousands of funds from countless different management companies, not just the handful your old company chose for you.

- Alternative Investments: Some custodians even allow you to invest in things like real estate or commodities.

This level of choice lets you fine-tune your investments to perfectly match your risk tolerance and financial goals. For anyone who has already maxed out their 401(k) and is looking for more advanced strategies, this flexibility is a massive advantage. If that sounds like you, our guide on how to save for retirement after maxing out your 401(k) can point you to some valuable next steps.

A Closer Look at Fees

Fees can quietly eat away at your retirement savings over the years, and the fee structures in 401(k)s and IRAs are worlds apart. With a 401(k), you often pay administrative fees, record-keeping fees, and individual fund expense ratios that are negotiated by your employer. Big companies can sometimes get great deals, but smaller company plans often have higher hidden fees that aren't always easy to spot.

An IRA’s fee structure is usually more transparent and puts you in the driver's seat. You can shop around for an IRA provider that fits your budget and avoid unnecessary costs.

Here’s a practical look at how the two stack up when you’re considering a move.

| Consideration | Typical Employer 401(k) | Rollover IRA (Traditional IRA) |

|---|---|---|

| Investment Options | Limited menu of 10-20 mutual funds and target-date funds selected by the employer. | Nearly unlimited access to stocks, bonds, ETFs, and thousands of mutual funds. |

| Fee Structure | Often includes administrative, record-keeping, and advisory fees embedded in the plan. Can be opaque. | More transparent. You choose a custodian with low or no account fees. You only pay for what you use (e.g., trading commissions, advisory fees if you hire someone). |

| Account Control | Limited. You're bound by the plan's rules on withdrawals, loans, and investment changes. | Full control. You decide when and how to invest, rebalance, or take distributions (within IRS rules). |

| Creditor Protection | Very strong federal protection under ERISA. Generally shielded from lawsuits and bankruptcy. | Varies by state law. Federal bankruptcy protection exists, but may be less robust against other creditors depending on where you live. |

| Consolidation | Can't combine with other accounts. Each old 401(k) remains separate. | Easy to consolidate multiple old 401(k)s and other IRAs into a single account for simplified management. |

Moving from a 401(k) to a Rollover IRA is about trading the structured, one-size-fits-all approach for one that gives you complete control over your investments and costs.

A rollover IRA is meant to be a temporary holding place for your retirement funds, not a final destination. The goal is to reconnect you with your money and empower you to make informed decisions about its future, whether that's investing it for growth or consolidating it with other accounts.

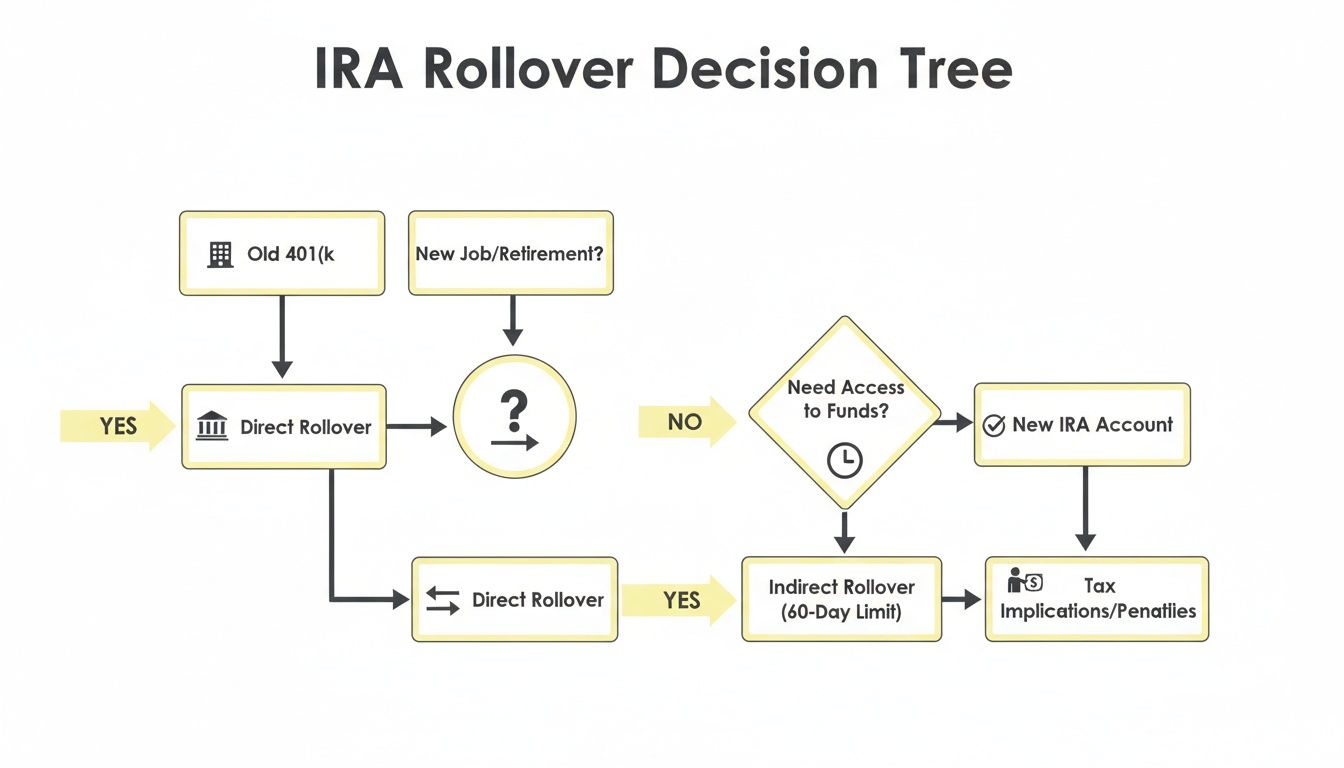

The flowchart below shows the two main ways you can move your money out of an old 401(k), highlighting the critical choice between a direct and an indirect rollover.

As you can see, the direct rollover—where the money goes straight from one financial institution to another—is the safest and simplest route, helping you avoid potential tax nightmares.

Creditor Protection and Other Considerations

One final, vital difference that often gets overlooked is asset protection. The money in your 401(k) is protected from creditors under a powerful federal law called ERISA (Employee Retirement Income Security Act). This gives you a uniform, high level of protection against lawsuits and bankruptcy, no matter which state you live in.

IRA protections, on the other hand, are governed by state laws, which can vary wildly. While federal bankruptcy law offers some protection for IRAs, the safeguards against other types of creditors can be weaker depending on your state. For people in professions with high liability risk, like doctors or small business owners, keeping the money in a 401(k) might offer superior peace of mind.

Ultimately, the decision boils down to what you value most. Do you prefer the simplicity and ironclad creditor protection of a 401(k)? Or are the expanded investment choices, transparent fees, and consolidation benefits of a Rollover IRA more appealing? The right answer depends entirely on your personal financial situation and comfort level.

How to Do an IRA Rollover Without the Headaches

Rolling over an old 401(k) into an IRA can sound like a major financial project, but it's more straightforward than you might think. We're going to break it down into a simple, step-by-step roadmap. The whole point is to guide you through the process so you can avoid common pitfalls and confidently take back control of your retirement funds. We want a clean, seamless transfer that keeps the tax-deferred status of your hard-earned money intact.

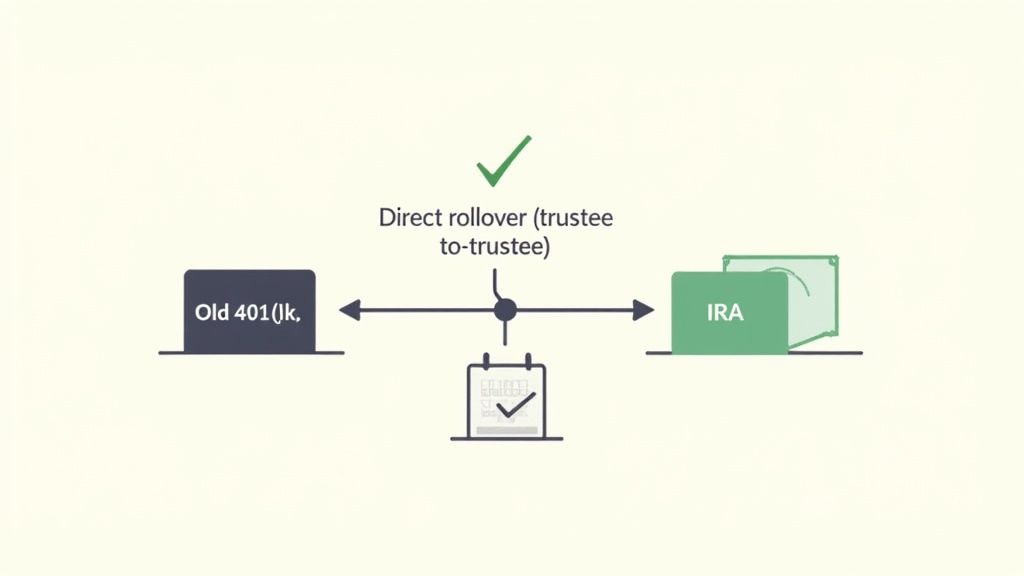

The entire process boils down to one critical decision: a direct vs. an indirect rollover. We always recommend the direct method. This is where your old 401(k) provider sends the money straight to your new IRA custodian. It's a clean, trustee-to-trustee transfer that never lets the money touch your personal bank account, which is exactly what you want to avoid any tax nightmares.

Going the indirect route, where they send you a check, just opens the door to costly mistakes. The biggest one? Missing the strict 60-day deadline to deposit the funds. Mess that up, and you're suddenly looking at a hefty tax bill and early withdrawal penalties. It's just not worth the risk.

Step 1: Pick Your New IRA Provider

Before you can move a dime, you need to know where it's going. Your first task is choosing a brokerage firm or financial institution to open your new Rollover IRA. Don't rush this. This decision will impact your fees, investment choices, and the quality of support you get for years to come.

When you're comparing your options, keep these key things in mind:

- Account Fees: Look for providers that offer low or zero annual maintenance fees. Always read the fine print to spot hidden costs, like fees for paper statements.

- Investment Options: Make sure the provider has a broad selection of investments. You'll want access to the stocks, bonds, ETFs, and mutual funds you need to build the portfolio you envision.

- Customer Support: Good customer service is priceless, especially when you're in the middle of a transfer and have questions. A responsive, helpful team can make all the difference.

Step 2: Open Your New Rollover IRA

Once you've settled on a provider, it's time to open the account. This usually takes just a few minutes online. During the setup, you must be very clear that you are opening a Traditional IRA specifically for a rollover.

That designation is vital. It tells both the provider and the IRS that these are existing retirement funds, not new contributions that are subject to annual limits. You'll need to provide some basic personal information, like your Social Security number and employment details, to get it all set up.

Step 3: Kick Off the Rollover Request

With your new IRA open and waiting, you're ready to contact your old 401(k) plan administrator. You can usually do this through their website or by giving their customer service a call. You’ll need to formally request a direct rollover to your new IRA.

You'll have to give them some information about your new account:

- The name of the firm (e.g., Fidelity, Schwab, Vanguard).

- Your new IRA account number.

- Specific instructions on how the check should be made payable (for example, "Fidelity Management Trust Co. FBO [Your Name]").

Your new IRA provider will have these details posted clearly on their website, or a representative can give them to you. Getting this information exactly right prevents delays and ensures your money lands in the right place without a hitch.

Remember, a rollover IRA is designed to be a temporary holding place for your retirement funds, not necessarily a final destination. The immediate goal is to reconnect you with your money and empower you to make informed decisions about its future.

Step 4: Confirm the Transfer and Invest Your Funds

After you've made the request, the transfer itself can take anywhere from a few days to several weeks. Your old 401(k) administrator will either wire the money electronically or mail a check directly to your new IRA provider. It’s smart to keep an eye on both accounts to confirm when the funds have officially been transferred.

Once the money arrives in your new IRA, it will probably sit in a cash or money market settlement fund. Now comes the final, and most important, step: it's up to you to invest those funds according to your retirement strategy. This is where the real power of a rollover comes into play. You finally have the freedom to build a diversified portfolio that truly aligns with your financial goals.

When a Rollover Is Your Smartest Financial Move

Deciding whether to roll over an old 401(k) isn't just some box to check on a form; it's a strategic decision that hinges entirely on your personal situation. Sure, you could just leave the money with your old employer, but certain moments in life make a rollover an incredibly powerful move. Understanding these scenarios really brings the whole rollover vs traditional ira conversation to life.

For most people, a rollover is about one thing: taking back control. It's about simplifying your financial world by gathering those scattered, often-forgotten accounts and pulling them into one intentional, unified portfolio.

The Job Changer Consolidating for Clarity

Changing jobs is probably the most common trigger for a rollover, and for good reason. It’s so easy to leave a trail of old 401(k) accounts behind as your career progresses, creating a retirement picture that’s fragmented and nearly impossible to manage. Each plan has its own unique fees, investment choices, and rules, making a cohesive strategy a distant dream.

Bringing all those scattered accounts into a single Rollover IRA provides instant relief and clarity.

- Simplified Management: Forget juggling a half-dozen statements and logins. You’ll have one account to monitor, rebalance, and track.

- Reduced Fees: You get to ditch all those redundant administrative fees from old plans, which can quietly eat away at your returns year after year.

- Cohesive Strategy: With everything in one place, you can finally build a unified investment portfolio that actually reflects your true risk tolerance and long-term goals.

This consolidation effect is why Rollover IRAs often hold such large balances. In fact, data shows the median account balance for rollover IRAs has hit $120,000, with the average climbing to a whopping $384,239—far more than a typical IRA funded by annual contributions. This happens because people are moving significant, hard-earned 401(k) balances into a single, focused account. You can dig into these retirement account trends on Plansponsor.com.

If you're wrestling with multiple accounts, our guide on whether you should have multiple retirement accounts offers some more perspective on the power of simplification.

The Retiree Seeking Flexibility

As retirement gets closer, your financial needs pivot from saving money to spending it. A 401(k) is built for the accumulation phase, but an IRA often gives you far more flexibility when it comes time to start taking withdrawals.

For retirees, a Rollover IRA can be a total game-changer. It unlocks more customized withdrawal strategies, helping you manage your income stream and your tax bill. This is especially true when Required Minimum Distributions (RMDs) kick in at age 73.

If you have multiple 401(k)s, you have to calculate and take the RMD from each one separately. But if you have multiple IRAs, you can add up the total RMD amount and take the entire distribution from just one of those IRA accounts if you want. That kind of flexibility simplifies the process and lets you strategically withdraw from the account that makes the most sense.

A rollover empowers you to move from being a passive participant in a company plan to the active CEO of your own retirement. It’s a shift from a one-size-fits-all structure to a customized financial toolkit.

This newfound control helps you manage your money more effectively, giving you a better shot at making it last throughout your retirement years.

The Investor Demanding More Options

Finally, a rollover is the smartest play for anyone who feels boxed in by the short and uninspired investment menu of a typical 401(k). Most employer plans offer a small handful of mutual funds and target-date funds, which is fine if you're a set-it-and-forget-it type of investor.

But what if you want to be more hands-on? A Rollover IRA throws the doors wide open to a huge universe of investment possibilities. You suddenly have the freedom to invest in a much broader range of assets, including:

- Individual Stocks and Bonds: Go beyond pre-packaged funds and invest directly in the companies or debt instruments you believe in.

- Exchange-Traded Funds (ETFs): Get access to thousands of low-cost, diversified funds covering every imaginable market sector or niche.

- Alternative Investments: Depending on your brokerage, you might even be able to put your money into real estate, commodities, or other non-traditional assets.

This level of choice is empowering. It lets you build a truly personalized portfolio that’s tailored to your unique financial philosophy and goals. It’s the ultimate way to take ownership of your investment strategy and steer your own financial future with precision.

Got Questions About Rollover IRAs? Let's Clear Things Up.

Even when the big picture makes sense, it’s the little details that can trip you up. When you're staring down a decision like this, specific questions always pop up, and getting straight answers is what gives you the confidence to move forward. This is where we tackle the most common questions that come up in the Rollover vs. Traditional IRA conversation.

Think of this as the practical FAQ section. We’ll give you concise, no-fluff answers to cut through any lingering confusion and help you make a truly informed decision.

Can You Mix Rollover Funds and New Contributions?

This is a big point of confusion: can you have a Rollover IRA and a regular, contribution-based Traditional IRA at the same time? Simple answer: yes. But for the sake of simplicity, many people just combine them.

When it comes to taxes, the IRS views all your Traditional IRAs as one big pot of money, regardless of where the funds came from. This is a critical detail for things like calculating taxes on your withdrawals (thanks to the pro-rata rule) and figuring out your Required Minimum Distributions (RMDs) down the road.

So, why would you ever keep them separate? The main strategic reason is to keep your options open. Some 401(k) plans will only let you roll IRA money back into their plan if those funds are "clean"—meaning, they've never been mixed with your annual contributions. If there’s even a small chance you might want to move that money into a future employer's 401(k), keeping your rollover funds in their own separate account is a really smart play.

Does a Rollover Affect My Annual Contribution Limits?

Here’s a question that stops a lot of people in their tracks: does rolling over a large 401(k) balance prevent you from contributing to an IRA for the year?

Let me be clear: absolutely not. A rollover is a transfer of existing retirement money, not a new contribution. You can roll over any amount from an old 401(k)—whether it’s $50,000 or $500,000—and it has zero impact on your annual IRA contribution limit.

This means you can finish your rollover and still contribute the maximum amount allowed for that year, assuming you meet the normal eligibility rules. It's like moving money from your left pocket to your right pocket; you haven’t actually added any new cash to your overall savings.

What if I Miss the 60-Day Indirect Rollover Window?

The consequences for missing the 60-day deadline on an indirect rollover are harsh, and they bear repeating. If you get a check from your old 401(k) and don't get it deposited into a new IRA within that two-month window, the IRS reclassifies the whole transaction.

Suddenly, that transfer is treated as a taxable withdrawal. This means two painful things will happen:

- You’ll owe ordinary income tax on the entire pre-tax amount.

- If you're under age 59 ½, you'll almost certainly get hit with an extra 10% early withdrawal penalty.

The IRS might grant a waiver in very specific, rare situations—like a bank error or a true personal catastrophe—but you should never count on it. This massive risk is the single best reason to always choose a direct rollover. That's where the money moves from one institution to the other without ever touching your hands.

A direct rollover is your financial seatbelt. It protects you from the very real and costly risks of an indirect rollover, ensuring your retirement savings arrive at their destination safely and without tax complications.

Should I Roll Over into a Traditional or Roth IRA?

This is one of the biggest strategic decisions you’ll make. Choosing to roll over into a Traditional IRA versus a Roth IRA has major tax implications, and the right answer boils down to your personal finances today and what you expect your tax situation to look like in the future.

Rolling over a pre-tax 401(k) into a Traditional IRA is a non-event for the tax man. You're moving pre-tax money into another pre-tax account, so no taxes are due. Your money keeps growing tax-deferred, and you’ll pay income tax on withdrawals when you take them in retirement.

On the other hand, moving pre-tax 401(k) money into a Roth IRA is called a Roth conversion, and it is absolutely a taxable event. You have to pay ordinary income tax on the full amount you convert in the year you do it. The payoff? Once the money is in the Roth, it grows completely tax-free, and all your qualified withdrawals in retirement are 100% tax-free.

Here’s a quick way to think about it:

- Go with a Traditional IRA Rollover if: You're in a high tax bracket now and believe you’ll be in a lower one in retirement. This lets you kick the tax can down the road to a time when your income (and tax rate) is likely lower.

- Consider a Roth Conversion if: You think you’ll be in a higher tax bracket later, or if you just love the idea of having tax-free income in retirement. Crucially, you need to have cash available outside of your retirement funds to pay that upfront conversion tax bill.

This choice fundamentally shapes when and how you pay taxes on your nest egg, making it a cornerstone of your long-term financial strategy.

At Smart Financial Lifestyle, we believe in making smart financial decisions that build wealth and redefine your American dream. For more guidance on creating a secure future, explore our resources at https://smartfinancialifestyle.com.