Deciding between pretax and Roth contributions boils down to one simple question: when do you want to pay your taxes?

A pretax contribution is exactly what it sounds like—money you put away before taxes are taken out, which lowers your taxable income today. It’s an immediate tax break. On the flip side, a Roth contribution is made with after-tax dollars, which means your qualified withdrawals in retirement are completely tax-free.

Comparing Pretax vs Roth Contributions

Choosing the right contribution strategy is a foundational step in building long-term wealth, but the decision can feel paralyzing. At its core, the choice really hinges on a single, educated guess: will you be in a higher tax bracket during your peak earning years or during retirement?

Your answer to that question is your guide. It tells you whether you should pay taxes now (Roth) or kick the can down the road and pay them later (pretax).

Getting this trade-off right is essential for anyone managing family finances, planning for retirement, or navigating a big career transition. Each path has a different impact on your take-home pay today, how your money grows, and how you’ll access it in the future. Let's break it down.

Pretax (Traditional) vs Roth Contributions at a Glance

To make this comparison crystal clear, let's start with a high-level look at the fundamental differences. This table hits the most important distinctions you need to know before we dive deeper into the nuts and bolts.

| Feature | Pretax (Traditional) Contribution | Roth Contribution |

|---|---|---|

| Current Tax Impact | Lowers your current taxable income, providing an immediate tax deduction. | No immediate tax deduction; contributions are made with after-tax money. |

| Take-Home Pay | Increases your current take-home pay due to lower taxes withheld. | Decreases your current take-home pay slightly compared to a pretax contribution. |

| Taxation in Retirement | All withdrawals (contributions and earnings) are taxed as ordinary income. | Qualified withdrawals (contributions and earnings) are 100% tax-free. |

| Required Minimum Distributions (RMDs) | Required for 401(k)s and Traditional IRAs, typically starting in your 70s. | Not required for Roth IRAs for the original owner, offering more flexibility. |

| Best For You If... | You expect to be in a lower tax bracket during retirement than you are today. | You expect to be in the same or a higher tax bracket during retirement. |

This side-by-side view gives you a quick reference for the main differences. Now, let’s get into the mechanics of how each choice actually impacts your finances—both today and for decades to come.

How Pretax and Roth Contributions Are Taxed

The heart of the pretax contribution vs. Roth debate comes down to one simple question: Do you want to pay the tax man now, or do you want to pay him later? Your answer directly shapes your take-home pay today and how much of your nest egg you actually get to keep in the future.

Let’s get into the nuts and bolts of how each option works. It’s a choice between a tax break now and a tax-free finish line.

The Pretax Contribution: An Immediate Tax Break

A pretax contribution, which you'll often see called a "traditional" contribution, is money you invest before any federal or state income taxes are calculated on your paycheck. This tactic immediately lowers your taxable income for the year, meaning you pay less in taxes right now. It feels good.

Think of it this way: if your salary is $80,000 and you put $5,000 into a traditional 401(k), the IRS only taxes you on $75,000 of income for that year. Your tax bill shrinks, which can mean more money in your pocket today.

But here’s the catch: this tax break is really just a deferral. It’s not a free pass. When you start taking that money out in retirement, every dollar—your original contributions and all the growth—gets taxed as ordinary income. The government eventually gets its share.

Key Takeaway: Pretax contributions hand you a tax deduction today, which is especially powerful when you’re in a high tax bracket. The trade-off? You're setting up a future tax bill on your withdrawals.

The Roth Contribution: A Tax-Free Future

A Roth contribution flips the script entirely. You contribute money that has already been taxed, so you don’t get an upfront tax deduction. Your taxable income for the year stays the same, and your take-home pay will be a bit lower compared to making an identical pretax contribution.

So, if you earn $80,000 and contribute $5,000 to a Roth 401(k), you're still paying income tax on the full $80,000. It might sting a little at first, but the long-term benefit is where the magic happens.

The real payoff comes in retirement. All qualified withdrawals from a Roth account are 100% tax-free. That’s not just your contributions; it’s every penny of compound growth and investment earnings over the decades. This provides incredible peace of mind when you're living on a fixed income. This tax treatment is also central to understanding the difference between traditional and rollover IRA accounts, where Roth conversions are a popular strategy.

A Tale of Two Contributions

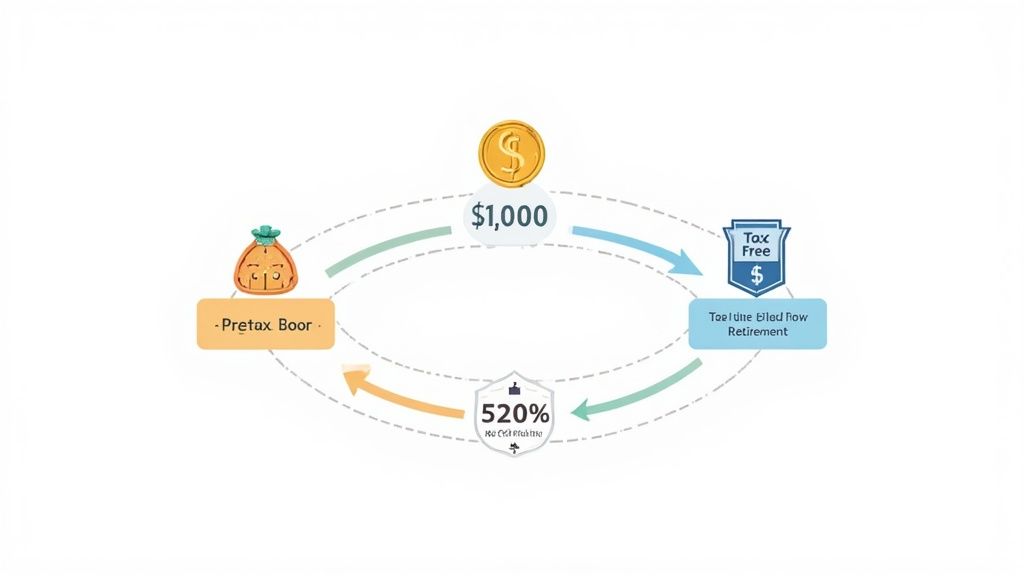

Let’s put some real numbers to this. Imagine you want to contribute $1,000 to your retirement, and your combined federal and state marginal tax rate is 25%.

Here’s how the pretax contribution vs. Roth decision breaks down:

-

Pretax Contribution:

- You contribute the full $1,000 before any taxes are withheld.

- This reduces your taxable income by $1,000.

- You get an immediate tax savings of $250 ($1,000 x 25%).

- The actual hit to your take-home pay is only $750.

-

Roth Contribution:

- Your $1,000 contribution is made after taxes.

- To have $1,000 left to contribute, you needed to earn about $1,333 before taxes ($1,333 - 25% tax of $333 = $1,000).

- There are no immediate tax savings.

- Your take-home pay is reduced by the full $1,000.

While the pretax option certainly feels better in the short term, the Roth path secures a future where your retirement income isn't at the mercy of whatever tax rates might look like down the road.

Why Your Future Tax Rate Is the Deciding Factor

Choosing between pretax and Roth contributions isn't really about today. It's about a calculated guess on where you'll stand tomorrow. The whole decision hinges on one simple, yet tricky, question: will your tax rate be higher or lower in retirement than it is right now? Get this educated guess right, and you're well on your way to maximizing your long-term wealth.

Think of it as placing a strategic bet on your financial future.

With a pretax contribution, you’re betting that your tax rate will be lower in retirement. You grab the tax deduction today, saving money at your current (and presumably higher) marginal rate, with the plan to pay taxes on withdrawals later at a lower rate.

On the flip side, a Roth contribution means you're betting your tax rate will be the same or even higher down the road. You bite the bullet and pay taxes now to lock in completely tax-free withdrawals later. It’s a way to protect yourself from the uncertainty of where tax rates might be headed.

Projecting Your Retirement Income and Tax Bracket

Nobody has a crystal ball, but you can definitely make an informed projection. Your retirement tax bracket won't just materialize out of thin air; it’s the sum of all your income streams and financial moving parts.

To get a clearer picture, you need to consider a few key things:

- Your Career Path: Are you just starting out with a lot of income growth ahead of you? If so, your tax bracket will likely climb, making a Roth contribution today look pretty smart. But if you're at the peak of your earning years, a pretax contribution might offer more immediate bang for your buck.

- All Your Retirement Income Streams: Your retirement income is so much more than just your 401(k). You have to factor in everything else that will count as taxable income, like pensions, income from rental properties, dividends from your brokerage account, or even part-time work.

- The Social Security Tax Surprise: This one trips a lot of people up. Depending on your "combined income," up to 85% of your Social Security benefits can be taxable. This alone can easily push you into a higher tax bracket than you ever planned for.

- The Wildcard of Future Tax Laws: Tax laws are anything but permanent. With current national debt levels, it's not a stretch to think tax rates could be higher in the future. Paying your taxes now with a Roth acts as a kind of insurance against that possibility.

Key Insight: Your retirement tax rate isn't based on your 401(k) withdrawals alone. It's a cumulative calculation of all your income sources, which often lands people in a surprisingly high bracket.

The Math Behind the Tax Rate Bet

The financial impact of this choice is huge, and you can actually quantify it. It all comes down to how tax rates now versus later affect the final value of your savings.

For example, let's say you're in a 25% tax bracket today but expect your rate to jump to 35% in retirement. A pretax investment of $5,000 would shrink to just $3,250 after you pay taxes on it at withdrawal. A Roth contribution of that same amount, however, would be worth the full $5,000 because you already paid the taxes.

But what if your tax rate fell to 15% in retirement? In that case, the pretax account would give you $4,250 after tax, making it the clear winner. Interestingly, research suggests only about 20-30% of high earners actually see their marginal tax rate drop significantly after they stop working, which really highlights how valuable the Roth option can be. You can find more great insights on these tax dynamics over at Kitces.com.

Putting It All Together: A Practical Framework

You don't need a perfect prediction to make a good decision—just a reasonable one. Use this simple framework to guide your thinking in the pretax vs. Roth debate.

- Figure Out Your Current Marginal Tax Rate: This is the tax you pay on your very next dollar of income. It's your baseline for the "pay now" Roth scenario.

- Project Your Future Annual Income: Add up everything you expect to bring in during retirement—pensions, Social Security, investment income, and planned withdrawals from your pretax accounts.

- Estimate Your Future Tax Bracket: Use that projected income number and today's tax brackets (as a conservative starting point) to figure out your likely retirement tax rate.

-

Compare and Decide:

- If your Future Rate > Current Rate, you should lean heavily toward Roth.

- If your Future Rate < Current Rate, then Pretax is probably your best bet.

- If Future Rate ≈ Current Rate, consider splitting your contributions for tax diversification.

This simple exercise shifts the decision from a vague guess to a structured estimate. It empowers you to choose the path that makes the most sense for your financial future.

Comparing Withdrawal Rules and Inheritance Benefits

The pretax vs. Roth decision ripples far beyond your own lifetime. The rules governing how you can access your money—and how it gets passed to the next generation—are where you’ll find some of the starkest differences. These rules directly shape your financial freedom in retirement and the kind of legacy you leave.

A huge difference kicks in later in life with something called Required Minimum Distributions (RMDs). These are mandatory withdrawals the IRS makes you take from pretax retirement accounts, like Traditional 401(k)s and IRAs, once you hit a certain age (currently 73 or 75, depending on your birth year).

This rule forces you to pull money out and pay income taxes on it, whether you actually need the cash or not. These forced distributions can bump up your taxable income, possibly pushing you into a higher tax bracket and even raising your Medicare premiums.

The Roth Advantage in Retirement Flexibility

This is where Roth accounts, especially the Roth IRA, really pull ahead. Roth IRAs have no RMDs for the original owner. This puts you in the driver's seat.

If you don't need the money, you can just leave it in the account to keep growing completely tax-free for the rest of your life. That flexibility is a game-changer for retirees who have other income sources and want to preserve their nest egg for as long as possible or for their heirs.

It's worth noting that Roth 401(k)s do have RMDs. But there’s a simple fix: you can roll your Roth 401(k) funds into a Roth IRA. This one move eliminates the RMD requirement, giving you the same freedom. Crafting smart retirement withdrawal strategies often involves moves like this to maximize your control.

Key Difference: Pretax accounts force you to take taxable withdrawals in retirement through RMDs. Roth IRAs offer the freedom to let your money grow tax-free indefinitely, without any required distributions during your lifetime.

How Your Choice Impacts Your Heirs

The legacy you pass on is also deeply shaped by your choice. When your loved ones inherit your accounts, the tax treatment they face is night and day depending on whether the account is pretax or Roth.

When beneficiaries inherit a traditional, pretax account, they also inherit a tax bill. Under current rules, most non-spouse beneficiaries have to drain the entire account within 10 years, paying ordinary income tax on every dollar they take out. A $1 million pretax IRA could easily shrink to $700,000 or less after taxes, all depending on the heir's own tax bracket.

In sharp contrast, inheriting a Roth account is a much cleaner and more powerful gift. Beneficiaries get the money completely tax-free, as long as the account was open for at least five years. They still have to withdraw the funds within 10 years, but they get to keep 100% of the value without owing a dime in income tax.

Let's break down the inheritance implications side-by-side:

-

Pretax Account Inheritance:

- Heirs pay ordinary income tax on every withdrawal.

- The entire account must be emptied within a 10-year window.

- This can create a massive, and often unexpected, tax burden.

-

Roth Account Inheritance:

- Heirs pay zero income tax on all withdrawals.

- The 10-year withdrawal rule still applies to most non-spouses.

- Your loved ones receive the full, untaxed value of your legacy.

This is a critical distinction for anyone focused on building multigenerational wealth. By choosing Roth, you're essentially prepaying the tax bill for your heirs, making sure they receive the maximum possible benefit from the wealth you worked so hard to build.

Real-Life Scenarios for Choosing Your Strategy

Theory is one thing, but seeing the pretax vs. Roth decision play out in the real world is where it all starts to click. The right choice really comes down to your personal situation—your age, income, career path, and what you see for yourself down the road.

To make this tangible, let's walk through three different life scenarios. By seeing how each strategy lines up with their unique financial lives, you can get a much clearer picture of which path makes the most sense for you.

This decision tree gives a great visual for how different life stages can shape whether a pretax or Roth strategy is the better fit.

As you can see, folks just starting their careers often get more mileage out of Roth contributions, while those closer to retirement might lean toward pretax. Of course, the best strategy is always in the details.

Scenario 1: The Young Professional

Meet Maya, a 25-year-old software developer at the beginning of her career. She’s earning $70,000 a year, which puts her in a relatively low federal tax bracket for now. Her income potential is massive, and she fully expects to be earning a lot more—and sitting in a much higher tax bracket—in her 30s and 40s.

For someone like Maya, the Roth strategy is a total game-changer. By making Roth 401(k) contributions today, she pays taxes at her current, lower rate. She misses out on the immediate tax break from a pretax contribution, sure, but she’s essentially locking in a future of completely tax-free growth and withdrawals.

The Logic: Maya is making a smart bet that her future tax rate will be higher than her current one. Paying taxes now at a 12% or 22% marginal rate is a whole lot better than paying them at a potential 32% or 35% rate when she retires. Every dollar she puts into her Roth will grow and eventually come out tax-free.

Her choice puts long-term tax savings ahead of a small bump in her take-home pay today.

Scenario 2: The Mid-Career Family Steward

Now let’s look at David and Sarah. Both are 45 and right in the middle of their peak earning years. With a combined household income of $250,000, they are squarely in a higher federal tax bracket. Life is busy—they're juggling a mortgage, two kids who are getting close to college age, and trying to save aggressively for their own retirement.

For this couple, a pretax contribution strategy is often the most logical move. The immediate tax deduction provides some serious relief, lowering their taxable income right now and freeing up cash flow for other big goals, like saving for college.

If they each contribute $23,000 to their traditional 401(k)s, they could slash their taxable income by $46,000. That could save them over $10,000 in federal taxes for the year, money that can be put to work somewhere else.

Their bet is that their income in retirement—and by extension, their tax bracket—will be lower than it is during these high-earning years. Once they stop working, their income will likely be a mix of withdrawals and Social Security, probably putting them in a lower tax bracket.

Scenario 3: The Pre-Retiree

Finally, we have Linda, who is 62 and just three years away from retirement. She’s built up a substantial nest egg, but most of it is sitting in pretax accounts like a traditional 401(k) and an IRA. She’s starting to worry about Required Minimum Distributions (RMDs) and the tax bomb they could create down the line.

Linda's main focus is on damage control—minimizing her future tax bill and giving herself more flexibility. While she might still make some pretax contributions to lower her current income, her big strategy now involves looking into Roth conversions. By moving chunks of her pretax savings into a Roth IRA during her first few lower-income retirement years, she can strategically pay taxes at a more manageable rate.

This gives her a bucket of tax-free money to pull from later in retirement, which helps her control her taxable income and could lessen the hit from RMDs on her Social Security taxes and Medicare premiums. It's a savvy move that balances paying some tax now to dodge a much bigger tax bill later. These advanced tactics are essential for anyone figuring out how to save for retirement after maxing out a 401k.

Even with the clear advantages of Roth in some cases, pretax contributions are still the default for most Americans. Nationally, around 85% of 401(k) deferrals are pretax, with only 15% going to Roth options in large company plans. The lure of that immediate tax break is strong, even though research suggests that having both options can lead to higher savings rates overall.

A Framework for Making Your Contribution Decision

Deciding between pretax and Roth contributions isn’t a one-time guess. It’s a strategic choice you can—and should—revisit over time. Let's boil everything down into a simple, four-step framework that moves beyond generic advice to help you pick the right path for your specific situation.

1. Assess Your Current Marginal Tax Rate

First things first, you need to know exactly where you stand today. Your marginal tax rate is the tax you pay on your next dollar of income. This number is your baseline. It tells you the immediate tax savings you get from a pretax contribution or the upfront cost you'll pay for a Roth contribution.

Don't forget to add your federal and state tax rates together to get the full picture. If you live in a high-tax state, your total marginal rate could be steep, making that pretax deduction today look a lot more attractive.

2. Project Your Likely Retirement Tax Rate

Next, you have to look into the crystal ball a bit. This step involves making an educated guess about all your potential income sources in retirement, which will ultimately determine your tax bracket down the road.

Be sure to consider all the moving parts:

- Pension or Annuity Income: Do you have any guaranteed income streams from a former employer?

- Social Security Benefits: Keep in mind, up to 85% of your benefits could be taxable.

- Investment Income: Factor in any dividends, capital gains, or rental income you expect.

- Required Minimum Distributions (RMDs): Those pretax account balances will eventually force taxable withdrawals, whether you need the money or not.

Once you have a rough annual income figure, you can estimate your future tax bracket. If it looks like it'll be higher than your current rate, Roth is the clear winner. If you expect it to be lower, pretax has the edge.

Psychological Insight: Many people just prefer the certainty of a Roth contribution. Paying taxes now eliminates any future anxiety about rising tax rates and RMDs. It offers real peace of mind, knowing that a dollar saved is truly a dollar you get to keep.

3. Align with Your Legacy Goals

Your choice also sends a ripple through the next generation. A pretax account passes a tax liability on to your heirs, but a Roth account transfers wealth completely tax-free.

If leaving a clean, tax-efficient inheritance is a top priority, the Roth option is hands-down the better choice. It effectively prepays the tax bill for your beneficiaries, making sure they receive the full value of your savings without any tax headaches.

4. Embrace Tax Diversification

Finally, remember this isn't an all-or-nothing game. You don't have to pick just one. Splitting your contributions between pretax and Roth accounts gives you incredibly valuable tax diversification. This strategy creates flexibility in retirement, letting you pull from different tax buckets each year to carefully manage your taxable income.

This kind of balanced approach has been much easier since the Roth 401(k) became available in 2006. Even so, most savers still default to pretax contributions, often because of their plan's auto-enrollment settings. You can learn more about how plan defaults have shaped saving habits in this in-depth white paper. By consciously choosing how to allocate your savings, you're taking active control of your financial future.

Common Questions About Pretax vs. Roth

When you start digging into the details of pretax and Roth contributions, a few key questions always come up. Let’s clear up some of the most common points of confusion.

Can I Contribute to Both a Pretax and a Roth 401(k)?

Yes, and it’s actually a great strategy. Most employer plans that offer a Roth 401(k) option will let you split your contributions however you like between the traditional (pretax) and Roth buckets.

Just remember, your total combined contributions can’t go over the annual IRS limit. For 2024, that limit is $23,000. So you could put $11,500 into your pretax 401(k) and $11,500 into your Roth 401(k), or split it any other way that adds up to the limit.

How Is My Employer's 401(k) Match Taxed?

This is a critical detail that trips a lot of people up. No matter how you contribute your own money—pretax, Roth, or a mix of both—your employer’s matching funds will always be deposited on a pretax basis.

That means even if you’re contributing 100% to a Roth 401(k), the company match lands in a separate pretax account within your 401(k). When you eventually withdraw those matching funds and their earnings in retirement, you’ll owe ordinary income tax on them.

Important Clarification: Your decision to use a Roth 401(k) only changes the tax treatment for your own contributions. The employer match is always treated as traditional, pretax money.

What Exactly Is a Roth Conversion?

A Roth conversion is simply the process of moving funds from a traditional, pretax retirement account (like a 401(k) or a Traditional IRA) over to a Roth IRA. It sounds simple, but there's a catch: you have to pay ordinary income taxes on the entire amount you convert, and you pay it in the year you make the move.

So, why would anyone do this? It's a powerful strategy if you find yourself in a lower-income year—maybe you're between jobs, taking a sabbatical, or just starting retirement before Social Security kicks in. By converting when you're in a lower tax bracket, you can shift a big chunk of your savings into a completely tax-free growth environment for a much smaller tax hit.

At Smart Financial Lifestyle, we believe in making smart financial decisions that secure your family's future for generations. Our approach is built on clarity and timeless wisdom to help you build wealth and redefine your American dream. Discover a calmer, more confident path to financial independence by exploring our resources at https://smartfinancialifestyle.com.