The biggest difference between pre-tax and Roth contributions boils down to one simple question: Do you want to pay taxes now or later?

With pre-tax contributions, you get a tax break today by lowering your current taxable income. With Roth contributions, you pay the tax upfront, which allows for completely tax-free withdrawals in retirement. It's a strategic choice that impacts not just your retirement savings but your long-term wealth and financial flexibility.

The Core Choice: Pre-Tax Or Roth Contributions Explained

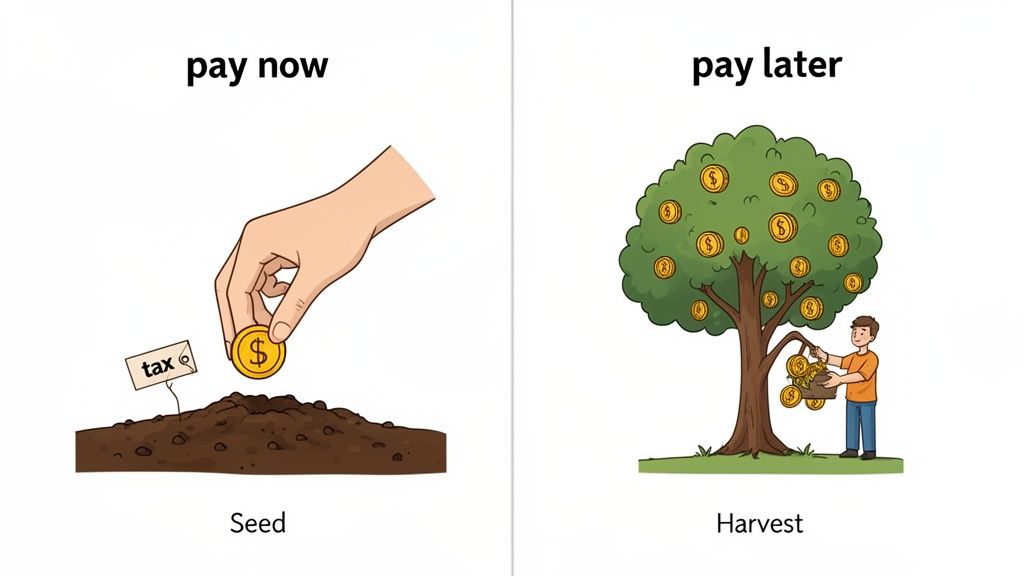

Deciding between pre-tax (Traditional) and Roth contributions is one of the most critical financial moves you'll ever make. Think of it like this: are you going to pay tax on the "seed" you plant today or on the "harvest" you collect years from now?

This isn't just a math problem; it's about aligning your tax strategy with your actual life goals. The "better" option hangs entirely on one thing: your current income tax rate versus what you expect it to be in retirement.

Key Takeaway: If you expect to be in a higher tax bracket in retirement than you are today, Roth contributions are often the smarter choice. Conversely, if you are in your peak earning years and expect a lower tax bracket in retirement, pre-tax contributions can provide a powerful, immediate tax break.

Understanding The Trade-Off

The core logic is surprisingly simple. If your tax rate is higher when you contribute than when you withdraw, pre-tax wins. If the opposite is true, Roth comes out ahead.

For instance, a high-earning professional in the 35% federal bracket during their peak career might see their rate drop after they retire. Research shows a taxpayer’s rate could shift from 35% before retirement to 28% once Required Minimum Distributions (RMDs) from pre-tax accounts begin, effectively saving 7 percentage points in tax.

This highlights a key strategy: fill up your pre-tax buckets when your tax bracket is high, then you can potentially convert slices of that money to Roth when your income drops later on. For a deeper dive into this tax-planning approach, check out this full analysis from Kitces.com.

To make this crystal clear, let’s quickly break down the essential differences side-by-side.

At A Glance Pre Tax vs Roth Contributions

This table gives you a quick, scannable summary of the core differences between the two account types to help you see how they stack up.

| Feature | Traditional (Pre-Tax) | Roth (After-Tax) |

|---|---|---|

| Tax Treatment of Contributions | Contributions may be tax-deductible, lowering your current taxable income. | Contributions are made with money you've already paid taxes on; no upfront deduction. |

| Tax on Growth | Investments grow tax-deferred. | Investments grow completely tax-free. |

| Tax on Qualified Withdrawals | Withdrawals are taxed as ordinary income in retirement. | All qualified withdrawals are 100% tax-free. |

| Required Minimum Distributions | RMDs are mandatory, typically starting in your 70s. | No RMDs for the original owner of a Roth IRA. |

Ultimately, choosing between Pre-Tax and Roth isn't just about saving for retirement—it's about smart tax planning that can save you a significant amount of money over your lifetime.

How Your Tax Strategy Shapes Retirement Wealth

The choice between pre-tax and Roth contributions goes way beyond the simple "pay taxes now or pay later" debate. This decision sends ripples across your entire financial life, hitting not just your retirement savings but also your current tax bill and your flexibility down the road. Getting these nuances right is the key to making a truly smart financial move.

Each contribution type offers a distinct strategic edge, acting as a different tool for building your long-term wealth. The immediate payoff of a pre-tax contribution is its power to lower your Adjusted Gross Income (AGI)—that's the magic number the IRS uses to figure out what you owe and what financial perks you qualify for.

The Immediate Impact of Pre-Tax Contributions

When you make a pre-tax contribution to a Traditional 401(k) or IRA, you’re effectively shrinking your income in the eyes of the tax code for that year. For instance, if you earn $100,000 and contribute $10,000 on a pre-tax basis, you only get taxed on $90,000 of income. Simple as that.

This AGI reduction can be incredibly powerful. It might drop you into a lower tax bracket, saving you real money on your annual return. More subtly, a lower AGI could suddenly make you eligible for other valuable tax credits and deductions that come with income phase-out limits.

These can include perks like:

- The Child Tax Credit

- Student loan interest deductions

- Certain education credits

By choosing pre-tax, you're not just putting off taxes on your retirement savings; you might be cutting your overall tax burden today in other significant ways.

The Long-Term Power of Roth Contributions

On the flip side, Roth contributions are all about locking in your future. By paying taxes on your contributions now, you buy yourself an invaluable asset for retirement: tax certainty. Every qualified withdrawal from a Roth account—both your original contributions and all the earnings—is 100% tax-free.

This creates a pool of predictable, spendable income that’s completely shielded from future tax rate hikes. If you think tax rates will climb between now and when you retire, a Roth account acts as a powerful fortress, preserving the full value of your nest egg.

This tax-free nature is especially critical for legacy planning. For family stewards or grandparents focused on intergenerational wealth, leaving behind a Roth account means heirs receive assets without an embedded tax liability, simplifying estate matters significantly.

A Roth account offers more than just tax-free cash flow. For the original owner, a Roth IRA has no Required Minimum Distributions (RMDs). This gives you superior control, allowing your assets to keep growing tax-free for as long as you live—a crucial benefit for anyone who doesn't need the funds right away.

Why Tax Diversification Is a Winning Strategy

At the end of the day, the most sophisticated approach often isn't choosing one over the other, but strategically using both. Holding both pre-tax and Roth accounts creates tax diversification, which gives you the flexibility to actively manage your tax bill throughout retirement.

In any given year, you can choose to pull income from your taxable pre-tax accounts or your tax-free Roth accounts. This allows you to control your taxable income, potentially keeping yourself in a lower tax bracket and helping manage costs like Medicare premiums, which are tied to your income. This kind of flexibility is a cornerstone of any resilient, tax-efficient retirement plan.

The Strategic Case For Roth Contributions

While a pre-tax contribution gives you that satisfying, immediate tax break, the real long-term power often lies with the Roth. For a lot of people, especially those with decades of earning potential still ahead of them, paying the tax now is a brilliant strategic move. It unlocks a future of tax-free wealth, predictability, and a kind of flexibility you just don't get with traditional accounts. Think of it as prioritizing what your money can do for you in retirement, not just the upfront deduction.

The gut-level appeal of a Roth is simple: you get to shield your entire nest egg—both what you put in and everything it earns—from future taxes. Every single dollar you pull out of a Roth in retirement (assuming you follow the rules) is yours to keep. No federal income tax, and often no state tax either. This gives you a stable, known amount of spendable money, which is a huge advantage when you're trying to budget for the rest of your life.

Maximizing Your Spendable Retirement Income

When you run the numbers over the long haul, the math frequently tips in favor of Roth contributions. This is especially true for younger or mid-career folks who are in a modest tax bracket today. The difference can be pretty striking.

One study looked at investors putting $1,000 per year into either a Roth or a Traditional IRA. Assuming a steady 25% tax rate and a 7% annual return, the 25-year-old who chose the Roth account ended up with nearly 20% more spendable income in retirement than the person who went the traditional route. For most families, that's not just a small bump—it's the difference between a comfortable retirement and a truly secure one. You can dig into the full T. Rowe Price analysis on Roth effectiveness to see their detailed assumptions.

This is exactly why making these decisions early in your career pays off so handsomely. Paying a 12% or 22% tax on your contributions now feels a lot more manageable than facing potentially higher rates down the road, especially once you add in state taxes and future Medicare surcharges that are tied to your income.

The real magic of the Roth is that it completely separates your retirement savings from the whims of future tax policy. You're effectively pre-paying your tax bill at today's known rates, which locks in a tax-free future for your investments, no matter what happens in Washington.

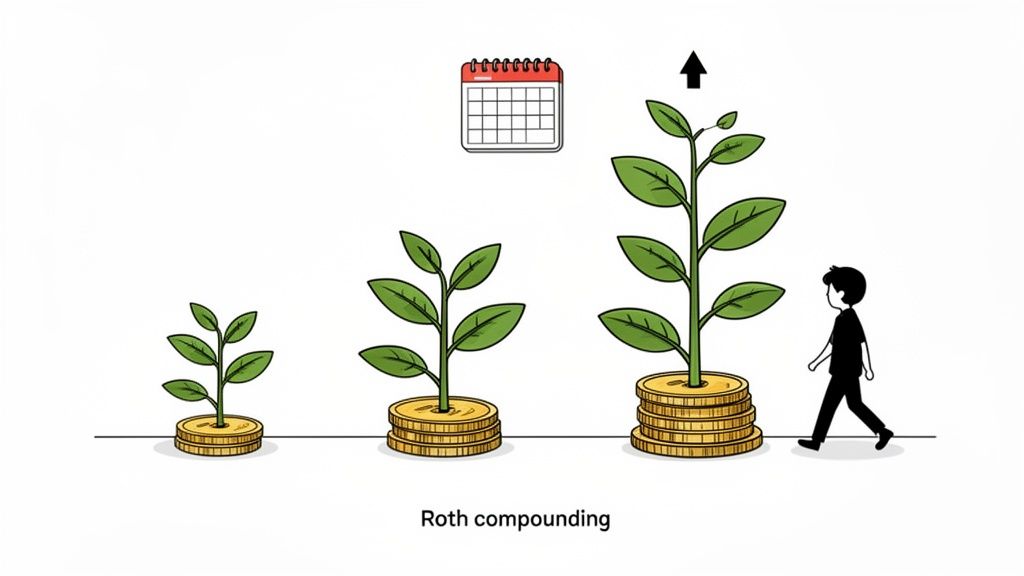

The Power Of Tax-Free Compounding

The concept of tax-free growth is where the Roth really pulls away from the pack. In a pre-tax account, your money grows tax-deferred, which is good, but all that growth will eventually get taxed when you pull it out. With a Roth, the growth is completely and forever tax-free.

This means that decades of compounding interest and investment gains are all yours. You don't have to slice off a piece for the government. That distinction becomes more and more important over time, as the earnings portion of your account balance starts to dwarf what you originally put in. It transforms your account from a tax-deferred piggy bank into a true tax-free wealth-building engine.

Unmatched Flexibility and Control in Retirement

Beyond just the numbers, Roth accounts deliver some crucial non-financial benefits that give you more control over your own money. The biggest one? No Required Minimum Distributions (RMDs) for the original owner of a Roth IRA.

Unlike pre-tax accounts that force you to start taking taxable withdrawals in your 70s whether you need the money or not, a Roth IRA lets your money keep growing tax-free for your entire lifetime. This opens up some incredible planning flexibility:

- You control the timing: You only take money out when you actually need it, not when the IRS says you have to.

- You manage your taxable income: In years where you need a little extra cash, you can pull from your Roth without pushing yourself into a higher tax bracket.

- You simplify legacy planning: Passing a Roth IRA to your kids or grandkids provides them with a tax-free inheritance. It's one of the cleanest and most powerful ways to transfer wealth.

For anyone focused on being a good steward of their family's finances and building a lasting legacy, this level of control makes the Roth a cornerstone of smart, multigenerational planning.

While the idea of a tax-free future with a Roth account is incredibly appealing, it's a huge mistake to ignore the immediate, strategic power of pre-tax contributions. For a lot of people, especially those at the peak of their careers, the traditional approach has a clear and compelling edge. This isn't just about kicking the tax can down the road; it's about optimizing your financial picture today and setting yourself up for smarter tax planning tomorrow.

The biggest reason to go pre-tax is the instant reduction in your current taxable income. This is a game-changer for high-income earners who find themselves in the upper tax brackets.

Every single dollar you contribute pre-tax directly lowers your Adjusted Gross Income (AGI), which can lead to massive tax savings for the year. We're not talking about a minor adjustment here—it can mean thousands of dollars back on your annual tax return.

Maximizing Your Investable Capital Today

When you make a pre-tax contribution, you’re essentially investing money that you would have otherwise handed over to the government. This lets you put a larger gross amount to work in the market from day one, giving you more capital to grow and compound over the years.

Think about a professional in their 50s earning a high salary. By maxing out their pre-tax 401(k) contributions, they might save $8,000 or more in federal and state income taxes for that year alone. That's $8,000 they can now invest, pay down debt, or put toward other goals instead of just losing it to taxes.

The core principle is simple: contribute pre-tax when your income—and therefore your tax rate—is at its peak. This strategy is built on the reasonable assumption that your income and tax bracket will be lower in retirement, allowing you to withdraw the funds at a more favorable rate.

This whole approach is about making a calculated bet on your future financial situation. For a deeper dive into how these accounts work, you can explore the key differences between a rollover vs traditional IRA in our detailed guide.

The Strategic Path to Future Roth Conversions

Here's a little secret: choosing pre-tax contributions today doesn't lock you out of the Roth world forever. In fact, it can be the first move in a powerful two-step strategy that involves Roth conversions down the line. It's a more sophisticated planning technique that gives you incredible flexibility.

The idea is to build up a big pre-tax nest egg during your high-income years. Then, during years when your income is temporarily lower—maybe in early retirement, between jobs, or before Social Security and RMDs start—you can strategically convert chunks of that pre-tax money into a Roth account.

This move lets you "fill up" the lower tax brackets, paying taxes on the converted amount at a much friendlier rate than you would have during your peak earning years.

Here’s what this looks like in the real world:

- Case Study: A 55-year-old executive is in the 35% federal tax bracket and maximizes her pre-tax 401(k).

- The Plan: She plans to retire at 62. From age 62 to 70, before her RMDs kick in, her taxable income will drop significantly, putting her in the 12% or 22% bracket.

- The Action: During those low-income years, she converts $50,000 annually from her Traditional IRA to a Roth IRA, paying taxes at that much lower rate.

This method lets her have the best of both worlds: a hefty tax deduction when she needed it most and a growing bucket of tax-free Roth money for later in retirement. It's a perfect example of how pre-tax contributions can be a foundational tool for advanced tax planning.

Advanced Retirement Tax Planning Strategies

Once you get past the basic pre-tax versus Roth decision, a whole new world of smart, intentional tax planning opens up. For those serious about building wealth, these advanced techniques aren't loopholes. They're powerful financial moves that give you far more control over your tax bill down the road.

Two of the most effective strategies out there are the Roth conversion and the Backdoor Roth IRA. Learning how to use these tools can fundamentally change your retirement outcome, turning a standard nest egg into a flexible, tax-free resource for you and your family.

Mastering The Roth Conversion

A Roth conversion is simply the process of moving money from a traditional, pre-tax retirement account—like a Traditional IRA or 401(k)—into a Roth account. When you do this, you have to pay ordinary income tax on the amount you convert in the year you make the move.

So, why on earth would anyone volunteer to pay taxes sooner than they have to? It all comes down to strategic timing. A Roth conversion makes a ton of sense in a few key situations.

- During a Low-Income Year: Are you between jobs, launching a new business, or in that sweet spot of early retirement before Social Security kicks in? Your income—and your tax bracket—might be temporarily low. This creates a golden opportunity to convert pre-tax funds to a Roth at a much lower tax rate than you’d face in your peak earning years or later in retirement.

- To Manage Future RMDs: Those pre-tax accounts come with a catch: Required Minimum Distributions. These forced withdrawals can easily bump you into a higher tax bracket and even make your Medicare premiums more expensive. Converting funds to a Roth IRA completely eliminates future RMDs on that money, putting you back in the driver's seat.

By thoughtfully executing conversions, you're essentially pre-paying your tax bill at a discount. This secures a larger pot of tax-free money for whatever the future holds. For more ideas on managing your tax burden, you can find valuable insights in our guide on how to reduce taxes in retirement.

The Backdoor Roth IRA: A Path For High Earners

What if your income is too high to contribute directly to a Roth IRA? This is where the Backdoor Roth IRA comes into play. It’s a perfectly legal, two-step process that lets high-income earners fund a Roth IRA when the front door is closed.

Here’s the simple breakdown of how it works:

- Contribute to a Traditional IRA: First, you make a non-deductible contribution to a Traditional IRA. Since you're a high earner, you probably can't deduct this contribution anyway.

- Convert to a Roth IRA: Shortly after, you convert those funds from the Traditional IRA into a Roth IRA. Because your initial contribution was made with after-tax money, you typically only owe tax on any small amount of earnings the money made while it was briefly in the traditional account.

This strategy effectively bypasses the income limits on direct Roth contributions, providing a crucial path for high earners to build tax-free retirement savings. It's a prime example of using the rules of the financial system to your advantage to build lasting wealth.

The growing popularity of Roth accounts shows a major shift in how Americans think about retirement. When Roth IRAs first appeared in 1998, they were a niche product. Yet by 2020, they pulled in about $85 billion in total inflows in a single year, with a huge chunk coming from rollovers and conversions. This trend highlights a collective decision to pay taxes now for tax-free income later—a move that buys predictability and flexibility. For more details, you can explore the data from the Congressional Research Service report on Roth IRAs.

Making Your Choice: A Practical Decision Framework

Figuring out whether to go with pre-tax or Roth contributions can feel overwhelming, but it gets a lot simpler when you connect it to your own life. Forget about finding one "best" answer. The real goal is to find the right fit for your financial situation today—and where you see yourself down the road.

This framework isn't about getting lost in the weeds; it's about moving from thinking to doing. By asking yourself a few pointed questions, you can zero in on which strategy, or mix of strategies, truly lines up with your vision for building wealth.

Key Questions To Guide Your Decision

Your honest answers here will light the path toward the most logical choice. Give each one some thought, because they’re the foundation of a smart financial move.

- Where is your tax bracket today versus tomorrow? This is the heart of the matter. If you’re a young professional in the 12% or 22% bracket, your income is likely to climb, pushing you into higher brackets later. In that case, paying taxes now with a Roth contribution is a smart bet. On the flip side, if you're a peak earner in the 32% or 37% bracket, you can reasonably expect a lower tax rate in retirement, making a pre-tax contribution the more attractive option.

- Do you value tax certainty and flexibility above all else? A Roth account gives you a known quantity: tax-free withdrawals. That predictability is gold when you’re trying to budget in retirement and acts as a shield against the government deciding to raise taxes in the future. If you want maximum control and peace of mind, a Roth delivers.

- Is lowering your taxable income today a top priority? A pre-tax contribution gives you an immediate tax break by reducing your Adjusted Gross Income (AGI). This can be a powerful tool if you're trying to qualify for other tax deductions or credits, or if you simply need the biggest tax break you can get this year. For that, pre-tax is the clear winner.

The right choice isn't permanent. You can—and should—re-evaluate your strategy as your income, family, and goals change. A Roth-heavy approach in your 20s can easily shift to a pre-tax focus in your 40s.

Situational Strategies: Finding the Best Fit

Based on those questions, let's look at some common scenarios and the strategies that usually work best.

For the Young Professional or Career Starter:

- Likely Best Fit: A Roth-heavy strategy. Your income and tax bracket are probably the lowest they will ever be. Paying taxes now at a favorable rate to lock in decades of tax-free growth is an incredibly powerful wealth-building move.

For the Peak-Earning Family Steward:

- Likely Best Fit: A pre-tax focus. When you're in a high tax bracket, the immediate deduction from pre-tax contributions provides significant savings. This also positions you perfectly for strategic Roth conversions during lower-income years in the future.

For Those Seeking Maximum Flexibility:

- Likely Best Fit: A hybrid approach. Contribute enough to your pre-tax 401(k) to get the full employer match—that’s free money. Then, direct your remaining savings to a Roth IRA. This creates tax diversification, giving you options in retirement. If you've already filled those buckets, our guide explains how to save for retirement after maxing out your 401k.

This decision tree shows how more advanced strategies like Roth conversions can fit into your long-term plan.

As the flowchart illustrates, your initial choices open up future opportunities to optimize your tax situation, which just reinforces the idea that your strategy should evolve with you.

Ultimately, the choice between pre-tax or Roth is about intentionally designing your financial future. By understanding the trade-offs and mapping them to your own life, you can confidently pick the path that best supports your American Dream.

Pre-Tax vs. Roth: Your Questions Answered

Even when you've got a solid plan, specific questions always pop up when choosing between pre-tax and Roth contributions. Let's tackle some of the most common ones.

Can I Contribute To Both A Pre-Tax 401(k) And A Roth IRA?

Absolutely, and for a lot of people, this is a seriously smart move. While income limits might cap your ability to contribute to a Roth IRA directly, using both accounts is the key to building real tax diversification.

Think of it this way: this hybrid approach gives you incredible flexibility down the road. You'll have one bucket of money that's taxable (your pre-tax funds) and another that’s completely tax-free (your Roth money). This lets you play offense in retirement, strategically pulling from either account to manage your income and stay in a lower tax bracket each year.

What Happens If I Choose Pre-Tax And My Retirement Income Is Higher Than Expected?

This is a classic concern, but don't worry—your initial choice isn't permanent. If you find yourself with a larger pre-tax nest egg than you planned for, you can use strategic Roth conversions to get ahead of that future tax bill.

During years when your taxable income is naturally lower—maybe in that sweet spot after you retire but before Social Security or RMDs kick in—you can convert chunks of your pre-tax balance over to a Roth account. You'll pay taxes on the conversion, but you get to do it at a more favorable rate, essentially shifting money into that tax-free bucket on your own terms.

How Can I Possibly Estimate My Future Tax Rate?

It’s true, no one has a crystal ball for future tax laws. But you can make a surprisingly educated guess by looking at the whole picture of your financial life.

Start piecing the puzzle together. Consider all your potential income streams in retirement:

- Will you have a pension or other fixed income?

- What are your expected Social Security benefits?

- Will you be taking RMDs from inherited IRAs or your own pre-tax accounts?

- Do you plan on having income from rental properties or a side business?

By adding all these up, you can get a rough idea of which tax bracket you'll land in. It’s not about getting it perfect; it’s about making a more informed choice today based on where you’re likely headed.

At Smart Financial Lifestyle, we believe in making smart financial decisions that build lasting wealth. To create a personalized plan that aligns with your family's goals, explore our resources at https://smartfinancialifestyle.com.