Financial literacy is so much more than just knowing how to budget or save. For women, it's about gaining the confidence and the know-how to make smart money decisions that secure your future, on your own terms. It’s the tool that helps you move from feeling stressed about money to feeling empowered by it, allowing you to build wealth, find personal freedom, and protect your family’s future.

This guide is designed to give you practical, jargon-free advice to build that solid financial foundation, one step at a time.

Why Financial Literacy Is Essential for Women

So many women I’ve talked to over the years share a common feeling: that they’re starting from behind with their finances. Let me be clear—this isn't some personal failing. It’s often the result of systemic issues and life circumstances that stack the deck against us. Acknowledging that reality is the very first step toward turning financial knowledge into your superpower.

Try to think of financial literacy not as a chore, but as the key that unlocks genuine freedom and security. It’s the skill that transforms money from a source of stress into a resource you can use to build the life you truly want.

Overcoming the Confidence Gap

Globally, women often start at a structural disadvantage, even when they’re the ones managing the day-to-day household budgets. The numbers are pretty stark: worldwide, only about 30% of women are considered financially literate, compared to 35% of men. That gap means millions of women are making critical financial decisions without the information and confidence they deserve. You can learn more about the global state of women's financial well-being here.

In my 50+ years of experience as a financial advisor, I've seen a powerful shift happen the moment a woman gains even a little bit of financial knowledge. When concepts like interest and inflation suddenly click, the entire family dynamic changes. Money stops sending a message of fear and starts sending one of confidence and shared decision-making.

The Real-World Impact of Financial Knowledge

Getting a handle on your finances has a direct, tangible impact on your life and the lives of those you love. It’s what gives you the ability to confidently support your family, help fund a grandchild's education, or retire comfortably without lying awake at night worrying.

The benefits are undeniable:

- Increased Confidence: Making informed decisions melts away anxiety and builds powerful self-assurance.

- Greater Independence: Financial stability gives you the freedom to leave a bad job, end a relationship, or finally pursue that dream you’ve put on hold.

- Enhanced Security: An emergency fund and a solid plan create a safety net for when life throws you a curveball.

- Stronger Legacy: You can build and pass on wealth, setting up future generations for a better start.

This guide is designed to provide you with the essential financial advice for women you need to build that confidence. Think of it as your personal roadmap to transforming your relationship with money and building the secure future you absolutely deserve.

Building a Strong Financial Foundation

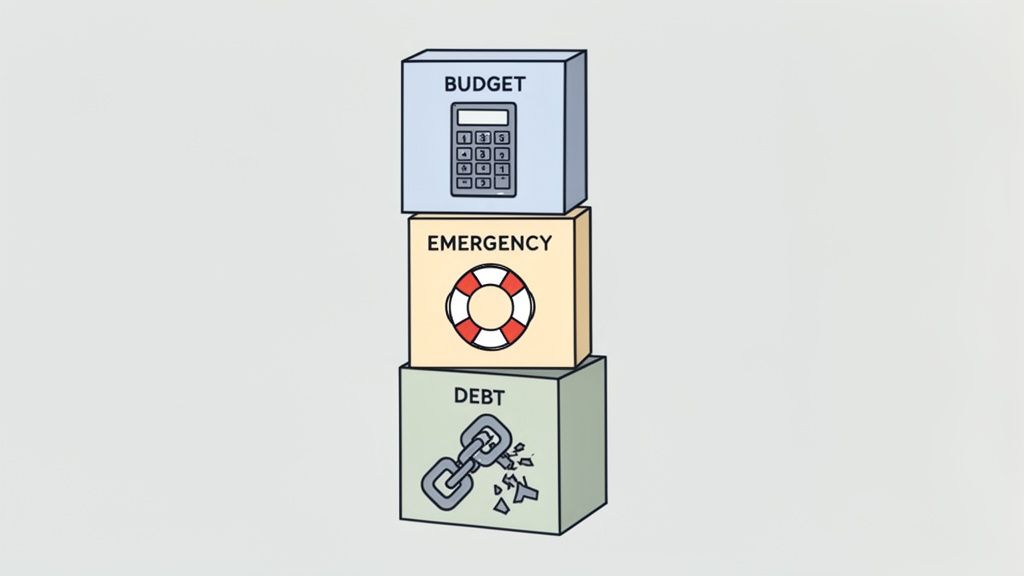

Before you can even think about building wealth, you need a solid base to build upon. I like to think of it like building a house—a strong financial future needs a secure foundation. For women, this foundation really rests on three core pillars: a realistic budget, a reliable emergency fund, and a smart plan to get out of debt. Getting these areas right creates the stability you need for future growth and, just as importantly, for your own peace of mind.

This is all about taking control of your cash flow. You’re not just tracking pennies; you’re telling your money exactly where to go. You're making sure every single dollar is working toward your personal goals. This isn't about restriction. It's about being intentional and feeling empowered.

Creating a Budget That Actually Works

Let’s be real: a budget is just a plan for your money. But so many traditional, rigid budgets just don't work for the realities many women face, like fluctuating income from a side hustle or the unpredictable costs that come with caregiving. A budget that actually works is one that adapts to your life.

To get started, just track your income and expenses for one month. See where your money is really going. Then, you can sort your spending into three simple buckets:

- Fixed Expenses: These are your non-negotiables. Think mortgage or rent, insurance payments, and car loans.

- Variable Expenses: This bucket is for costs that change month to month, like groceries, gas, and utilities.

- Discretionary Spending: This is the fun stuff—your wants, not your needs. Think dining out, hobbies, and entertainment.

Once you have that clear picture, you can build a flexible plan. The goal is simple: make sure your income covers your expenses with enough left over for savings and paying down debt.

Building Your Emergency Fund for True Security

An emergency fund is your financial safety net. It’s there to cover those curveballs life throws at you without forcing you to derail your long-term goals. Life is unpredictable. A sudden job loss, a surprise medical bill, or a leaky roof shouldn't force you into debt. This is such a critical piece of financial literacy for women because it provides a buffer that creates genuine independence.

A well-stocked emergency fund changes your entire mindset. It transforms a potential crisis into a manageable inconvenience, giving you the breathing room to make calm, rational decisions instead of panicked ones.

Most financial experts, including myself, suggest saving three to six months' worth of essential living expenses. I know, that can sound like a huge number, but you can start small. The key is consistency. Set up an automatic transfer of just $25 or $50 from each paycheck into a separate, high-yield savings account. If you want a step-by-step guide, check out our emergency fund checklist with 8 must-have steps for true financial resilience.

A Strategic Plan to Eliminate Debt

High-interest debt, especially from credit cards, can feel like you're running on a treadmill—you're putting in a ton of effort but getting absolutely nowhere. To actually get ahead, you need a clear strategy, not just random extra payments. Two of the most effective methods I’ve seen work for my clients are the debt snowball and the debt avalanche.

- The Debt Snowball: With this method, you focus on paying off your smallest debt first, no matter the interest rate. It's all about quick wins that build powerful motivation to keep you going.

- The Debt Avalanche: Here, you prioritize paying off the debt with the highest interest rate first. This approach will save you the most money on interest over time, though it might take a bit longer to feel that forward momentum.

The best method is the one that fits your personality. Whether you need the psychological boost of the snowball or the mathematical edge of the avalanche, what really matters is creating a plan and sticking with it. Committing to this process is a direct investment in your future financial freedom.

Investing with Confidence for Long-Term Growth

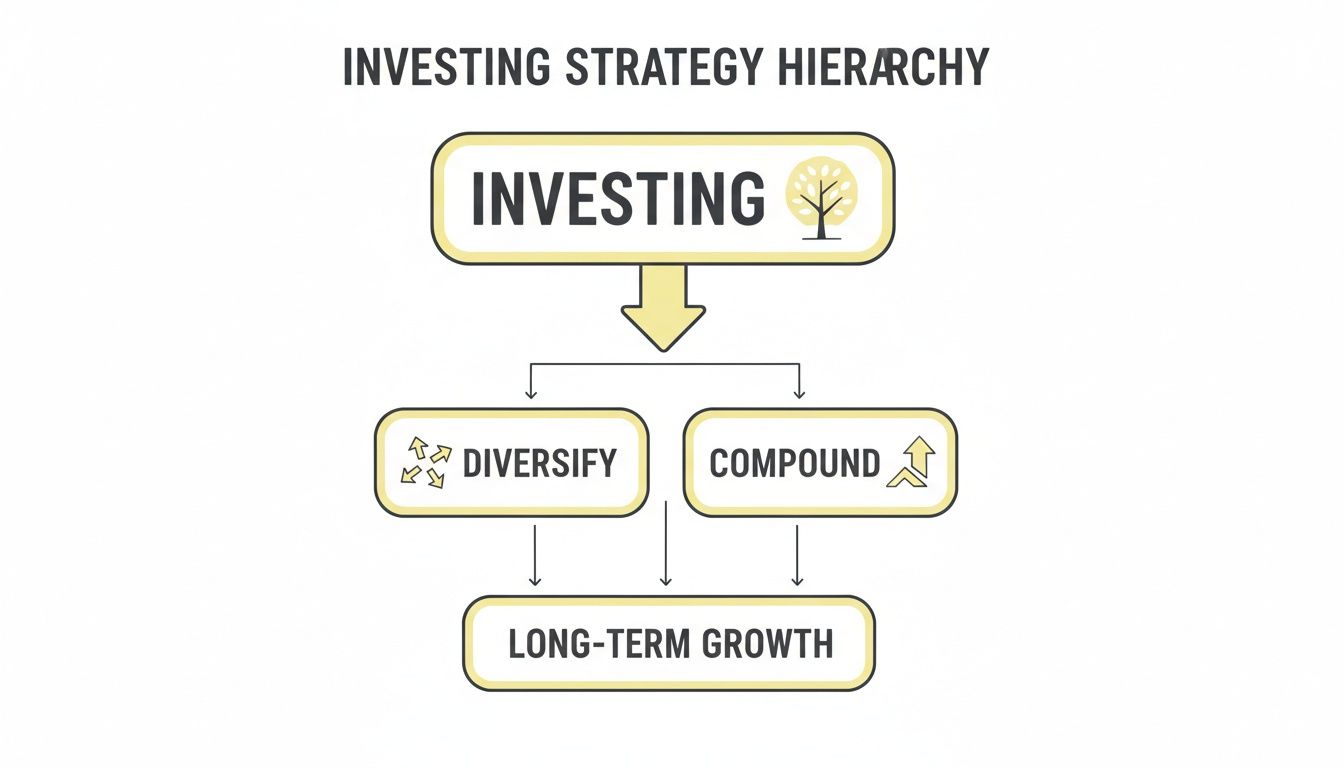

Let's be honest: investing can feel like an exclusive club with its own secret language. But it's one of the most powerful tools you have to build real, lasting wealth. It’s how you put your money to work for you, creating a future with more options, more security, and ultimately, more freedom. This isn't about gambling or taking wild risks; it's about making smart, consistent choices over time.

Think of it like planting a tree. You start with a small seed—your first investment. With a little time, sunlight, and water, it grows into something strong and substantial. Investing works the exact same way, helping your money grow far beyond what it ever could in a simple savings account.

The Power of Compound Interest

The secret ingredient here is something called compound interest. This is the absolute magic that happens when your investments earn returns, and then those returns start earning their own returns. It creates a snowball effect that can turn small, regular contributions into a serious nest egg down the road.

For example, a one-time investment of $5,000 could blossom into over $38,000 in 30 years, assuming an average annual return of 7%. The longer your money has to grow, the more powerful that compounding becomes. This is exactly why starting early, even with tiny amounts, is one of the smartest financial moves you can ever make.

Demystifying Your Investment Options

Getting started is often the hardest part, mainly because the terminology can feel so intimidating. The good news? You don't need to be a Wall Street whiz to begin. For most of us, a couple of simple, effective options are all it takes to build a really strong portfolio.

Here are two of the most common places to start:

- Mutual Funds: Think of these as professionally managed baskets of investments. They pool money from many people to buy a wide range of stocks, bonds, or other assets. The biggest benefit is instant diversification, which helps spread out your risk.

- Exchange-Traded Funds (ETFs): Very similar to mutual funds, ETFs also hold a collection of assets. They usually track a specific market index (like the S&P 500) and are well-known for their low fees and how easy they are to trade.

You don't have to get bogged down in picking individual stocks to be a successful investor. In fact, for most people, funds and ETFs are a much better and far less stressful approach. If you're looking for a clear, step-by-step guide, our article on how to start investing for beginners can walk you through those first essential moves.

Overcoming Common Investing Fears

Over the years, I’ve heard two main reasons why many women hesitate to invest: they’re afraid of the risk, or they feel they don’t have enough money to even begin. Let's tackle these head-on, because they shouldn’t be roadblocks.

1. "I'm afraid of losing money."

This is a completely valid concern. No one likes seeing their account balance go down. The key to managing this risk is diversification—it’s the financial version of "don't put all your eggs in one basket." By spreading your investments across different assets and industries with funds or ETFs, you soften the blow if one particular investment has a bad year. Risk is part of the game, but it can absolutely be managed with a smart, long-term strategy.

2. "I don't have enough money to invest."

This is one of the biggest myths out there. You absolutely do not need a fortune to start. Thanks to modern investment platforms, you can open an account with as little as $50 or $100.

The most important factor isn't how much you start with, but that you simply start. A small, consistent investment made regularly will almost always outperform a large, one-time investment made years down the road.

Your goal here is to build a habit. Set up automatic contributions, even if they're small, and let the power of compounding and time do the heavy lifting for you. This steady, consistent approach is how you methodically build wealth, turning those small seeds into a strong financial tree.

Planning for a Secure and Fulfilling Retirement

For women, retirement planning isn't just a numbers game. It's about designing a future that often looks a lot different from men's. We tend to face a unique set of hurdles, from longer life expectancies to career breaks for caregiving, and both can throw a wrench in our savings plans.

This is exactly why getting a handle on our finances is so critical. The goal isn’t just to clock out for good. It’s to achieve true financial freedom, where you have the resources—and the confidence—to live life completely on your own terms.

Understanding Your Retirement Landscape

Let’s be real: women typically live longer than men. That means our retirement savings need to stretch further to cover more years of living expenses and, often, higher healthcare costs down the road. This biological reality, combined with the stubborn gender pay gap and time taken out of the workforce, can create a perfect storm that leaves many women financially vulnerable later in life.

This is where financial literacy becomes a non-negotiable skill. A study of Americans aged 60–75 found that while 35% of men could pass a basic retirement income literacy quiz, only a startling 18% of women could. This knowledge gap often leads to more anxiety and a real fear of outliving our money. As you can learn from the research on women's retirement readiness, making smart financial decisions isn't just a good idea—it's a survival skill for protecting your future and your family's legacy.

Your Primary Retirement Savings Tools

Jumping into the world of retirement accounts can feel like learning a new language, but you can build a powerful foundation with just a few key options. Think of these accounts as special savings buckets designed to help your money grow more efficiently over the long haul.

Here are the heavy hitters you’ll most likely run into:

- 401(k) or 403(b) Plans: These are the retirement plans you get through your job. Money comes directly out of your paycheck before taxes are taken out, which cleverly lowers your taxable income for the year. The best part? Many employers offer a "match," which is literally free money they kick in on your behalf. Always, always contribute enough to get the full match.

- Traditional IRA (Individual Retirement Arrangement): This is an account you open on your own, separate from an employer. Your contributions might be tax-deductible, and the money grows tax-deferred until you pull it out in retirement. It's a fantastic choice if you don't have a plan at work or if you want to save more than your 401(k) allows.

- Roth IRA: This is another account you open yourself. You contribute with after-tax dollars, so there's no immediate tax break. But here's the magic: all of your qualified withdrawals in retirement are 100% tax-free. This can be a huge advantage, especially if you think you’ll be in a higher tax bracket when you retire.

These accounts are fueled by a few simple, yet powerful, principles.

As this shows, it all starts with the act of investing. From there, you strengthen your position through diversification and let the incredible power of compounding do the heavy lifting over time.

To make things a bit clearer, here’s a quick snapshot of how these accounts stack up.

Retirement Account Snapshot for Women

| Account Type | Who It's For | Key Benefit | Contribution Limit Example |

|---|---|---|---|

| 401(k) / 403(b) | Employees whose company offers a plan | Employer match (free money!) & pre-tax contributions | $23,000 in 2024 |

| Traditional IRA | Anyone with earned income, especially freelancers or those without a workplace plan | Tax-deductible contributions to lower your current tax bill | $7,000 in 2024 |

| Roth IRA | Savers who expect to be in a higher tax bracket in retirement | 100% tax-free qualified withdrawals in retirement | $7,000 in 2024 |

Choosing the right account—or a combination of them—depends entirely on your personal situation, but understanding these core options is the first step toward building a solid retirement plan.

Strategies for Catching Up on Savings

If you’ve taken time away from the workforce to raise kids or care for a parent, you might look at your retirement balance and feel a pang of panic. Don't. It's never too late to get back on track, and there are specific strategies designed to help you close the gap.

One of the best tools at your disposal is the "catch-up contribution." Once you turn 50, the IRS gives you a green light to contribute extra money into your retirement accounts each year, well above the standard limits. It was created for this exact reason—to help people supercharge their savings as they get closer to retirement.

Here are a few other steps you can take right now:

- Automate Everything: Set up automatic transfers to your IRA. Get a raise? Immediately bump up your 401(k) contribution percentage. This "pay yourself first" mindset ensures you're consistently building wealth without a second thought.

- Redirect Your Cash Flow: As life changes, so does your budget. Once the kids are out of the house or you've finally paid off the car, take that newly freed-up money and channel it straight into your retirement accounts.

- Look into a Spousal IRA: If you're married and have little to no income of your own, your working spouse might be able to contribute to an IRA for you. This is an incredibly important tool that allows non-working partners to keep building their own nest egg.

Navigating Major Financial Transitions with Strength

Life comes in chapters, and some of those transitions are more jarring than others. A divorce, the loss of your spouse, or a sudden career change can feel like a financial earthquake, shaking the very foundation you thought was solid. These moments are emotionally draining, and piling money stress on top of it all can feel absolutely impossible.

But here’s something I’ve seen time and again in my 50+ years of experience: these gut-wrenching moments can also be an incredible catalyst. They can become the very reason you grab the reins of your financial life, forging a new path toward security and independence with a strength you didn’t know you had. This is about arming you with the tools to handle these changes with clarity, not fear.

This isn’t about making huge, sweeping decisions overnight. It's about taking small, deliberate steps to bring order back to the chaos and set yourself up for a stable future.

Rebuilding After Divorce

Going through a divorce means untangling a shared financial life to build a new one entirely on your own. It can feel like an overwhelming task, but it’s also your chance to create a financial future that belongs completely to you. The immediate goal is to find your footing and gain clarity.

Your first move should be to get a crystal-clear picture of your new financial reality. This means knowing exactly what you have and what you owe, now as a single individual.

Here’s where to start:

- Create a New Budget: Your income and expenses have almost certainly changed dramatically. Build a fresh budget based on your solo earnings and costs to see exactly where your money is going.

- Separate Your Accounts: Open new checking and savings accounts in your name only. This creates a clean break and gives you sole control over your funds.

- Update Your Beneficiaries: This is one of those steps that’s easy to forget but is critically important. Go through all of your retirement accounts, life insurance policies, and your will, and update the beneficiaries.

Taking these steps is all about regaining a sense of control. You’re building a solid foundation for your new, independent life, one piece at a time.

Financial Steps After Losing a Spouse

Losing a partner is a devastating experience, and the last thing you want to do while grieving is deal with finances. It’s absolutely essential to give yourself grace and take things slowly. The key here is to handle only the most immediate needs first and put off any major, irreversible decisions.

During this incredibly emotional time, your main objective is to avoid making any rash financial moves. Give yourself at least six months to a year before you even think about big changes like selling your home or making significant new investments. This breathing room allows you to make decisions from a place of clarity, not grief.

First, just focus on gathering the essential documents and getting a handle on the immediate financial situation. You’ll need to get multiple copies of the death certificate; you'll be surprised how often you’re asked for it.

Next, work your way through this list, one step at a time:

- Locate Important Documents: Find your spouse's will, Social Security information, life insurance policies, and statements for any accounts they held.

- Notify Key Institutions: You’ll need to contact the Social Security Administration, your spouse's former employer (to ask about pensions or other benefits), and all banks and investment firms.

- Assess Your Cash Flow: Figure out what income sources have stopped and what new ones (like life insurance or survivor benefits) might be starting.

This whole process is a marathon, not a sprint. Be patient with yourself, and please don't hesitate to lean on a trusted financial advisor or a family member for support. The only goal right now is to create stability while you heal.

Managing a Career Change

A career change, whether you chose it or it chose you, can also send major ripples through your finances. A period of lower income, or the shift from a steady paycheck to a more variable one, requires some careful planning. Think of this as an opportunity to re-evaluate your financial goals and make sure your spending aligns with your new professional path.

The most important step is to adjust your budget to reflect your new income, especially if it’s lower or less predictable. Proactively trimming back on discretionary spending can give you a much-needed buffer. If you received a severance package, resist the urge to treat it like a windfall. Instead, think of it as an extended emergency fund to cover your expenses while you get settled.

This proactive approach is what ensures a career pivot doesn't turn into a financial crisis, giving you the freedom to pursue new opportunities with a solid safety net in place.

Putting Your Knowledge Into Action

Knowing this stuff is one thing, but actually doing something with it is where the magic happens. This is where we turn all that information into a simple, real-world plan you can start using today. Getting your financial life in order isn't a one-and-done task; it's a journey, and this little checklist is your roadmap.

Don't think of this as a rigid set of rules you have to follow perfectly. Instead, see it as a series of small, powerful steps. Each one builds momentum and helps you shift from just learning about money to actively managing it. The goal here is progress, not perfection.

Action Steps for Your 20s and 30s

These are your foundation-building years. Seriously, the habits you lock in now will have a massive impact on your future, all thanks to the power of compounding. Your main job is to create good systems and get your investing journey started.

- Schedule a Monthly Money Date: Put 30 minutes on your calendar each month. Use this time to glance at your spending, check in on your goals, and make sure your budget still feels right for your life.

- Automate Your Savings: This is a game-changer. Set up automatic transfers to your emergency fund and your IRA with every single paycheck. Even $50 a month adds up faster than you think.

- Give Your 401(k) a 1% Raise: If you have a 401(k) at work, log into your account right now and bump up your contribution by just one percent. You probably won't even notice it in your paycheck, but your future self will be incredibly grateful.

Priorities for Your 40s and 50s

You're likely in your peak earning years now, so the focus shifts to hitting the gas on your savings and protecting everything you've worked so hard to build. Life is probably more complicated, so making things efficient and planning ahead are your superpowers.

- Review Your Insurance Coverage: Life happens. Kids grow up, mortgages get paid down, and incomes change. Take a hard look at your life and disability insurance policies to make sure they still cover your family's actual needs.

- Maximize Catch-Up Contributions: Once you're over 50, the government lets you put extra money into your 401(k) and IRA. These "catch-up" contributions are a powerful way to supercharge your savings as you head toward retirement.

- Meet with a Financial Professional: It’s a great time to get a second opinion. Schedule a meeting to go over your retirement plan and investment portfolio. An expert eye can spot opportunities or risks you might have missed and confirm you’re on the right track.

Every smart financial decision, no matter how small it feels, sends a powerful message. It tells your money—and yourself—that you are in control, building a future defined by security and choice.

This action plan is just a starting point. Your mission, should you choose to accept it, is to pick just one item from your life stage and get it done this week. That single step is the beginning of a whole new chapter in your financial story—one where you are the confident, capable author. You have the knowledge; now go build the future you deserve.

Your Questions, Answered

Starting your financial journey is going to bring up questions. That’s a great sign—it means you're diving in and getting serious. Below, I’ve tackled some of the most common concerns we hear from women, offering straightforward answers to build your confidence.

Think of this as your quick-reference guide. Whenever a question pops up, you can come back here for a clear, direct answer to keep you moving forward.

How Much Money Do I Need to Start Investing?

This is probably the biggest myth that holds too many women back. Let me be clear: you absolutely do not need a pile of cash to start investing. The most important factor isn't how much you start with; it's the simple habit of doing it consistently.

Many of today's brokerage platforms will let you open an account with as little as $50, sometimes even less. The real power comes from setting up small, automatic contributions. Investing just $100 a month is a fantastic start that gets the magic of compound interest working in your corner.

The best time to start investing was yesterday. The second-best time is right now. Don’t let the feeling that you don't have "enough" stop you from starting small and building momentum.

I'm Overwhelmed. What's the Very First Step I Should Take?

When you’re staring at a huge to-do list and don't know where to begin, I want you to focus on just one thing: building your emergency fund. This is the absolute foundation of financial security and, frankly, the ultimate act of self-care. It’s your safety net—the cushion that gives you the freedom to make choices from a place of stability, not panic.

Here’s your first tangible step:

- Open a separate high-yield savings account. Don't mix it with your daily spending money.

- Set up an automatic transfer from your checking account right after every payday.

- Start with whatever you can afford—$25, $50, $100—and let it grow on its own.

Once that system is running on autopilot, you can turn your attention to mapping out a budget and tackling high-interest debt.

How Do I Balance Paying Off Debt with Saving for Retirement?

This is a classic financial puzzle, and the answer isn't about choosing one over the other. It’s about finding a smart balance. Ignoring either can really set you back in the long run. The key is to direct your money where it will have the most impact.

First things first, always contribute enough to your 401(k) to get the full employer match—that’s 100% free money, and you never want to leave that on the table.

After you've secured the match, get aggressive with any high-interest debt, especially credit cards with rates above 7-8%. For lower-interest debt like a mortgage or federal student loans, you can often earn a better return by investing in your retirement accounts than you’d save by paying the debt off early. This strategy ensures you're building for your future while efficiently managing the debts you have today.

At Smart Financial Lifestyle, we believe every woman deserves the confidence that comes from taking control of her financial future. For more practical insights like these, explore our resources at https://smartfinancialifestyle.com.