At first glance, a Traditional IRA and a Rollover IRA sound like two completely different things. It's a common point of confusion, but the reality is much simpler. A Rollover IRA isn't a separate type of account; it's just a special name for a Traditional IRA that holds money from a specific source.

The real difference boils down to one question: Where did the money come from?

Untangling Your Retirement Options

Think of it this way. You open a regular Traditional IRA and fund it with your own money, making annual contributions from your savings up to the IRS limit. Its purpose is to build your nest egg year by year with new money.

A Rollover IRA, on the other hand, is opened for one specific reason: to be a new home for funds you’ve moved out of an old workplace retirement plan, like a 401(k) or 403(b). It's a holding pen for money you've already saved.

The key takeaway is this: A Rollover IRA is just a Traditional IRA that only contains funds "rolled over" from an employer's plan. This separation is a strategic choice, not a legal one, and it keeps your options open down the road.

While both accounts grow tax-deferred and are taxed when you take withdrawals in retirement, keeping these funds separate is a smart move. When you mix your annual contributions with money rolled over from a 401(k)—a practice called commingling—it can create headaches.

Why? Some employer 401(k) plans will only let you roll in money that came from another employer plan. By keeping your old 401(k) funds pure in a dedicated Rollover IRA, you preserve the option to move that money into a new employer's 401(k) later on.

To make this crystal clear, let's break down the core differences in a simple table.

Traditional IRA vs Rollover IRA At a Glance

This table cuts through the noise and shows you exactly what sets these two labels apart. It's all about how you use them.

| Feature | Traditional IRA | Rollover IRA |

|---|---|---|

| Primary Funding Source | Direct annual contributions from personal savings | Transfers (rollovers) from an employer plan like a 401(k) |

| Commingling Rules | Can contain both annual contributions and rollover funds (but it can get messy) | Intentionally kept separate, holding only rollover assets to preserve flexibility |

| Main Use Case | Building retirement savings year by year with new money | Consolidating and preserving retirement funds after leaving a job |

As you can see, the distinction isn't about complex tax rules or investment options. It’s a simple organizational strategy to give you more control over your retirement savings as you move through your career.

How Each IRA Is Funded and Why It Matters

The biggest difference between a Traditional IRA and a Rollover IRA really boils down to one thing: where the money comes from. It sounds like a small detail, but understanding how each account gets funded is critical because it shapes how you can use your money down the road.

A Traditional IRA is your personal, ongoing savings account. You fund it yourself, making direct contributions from your bank account each year, up to the annual IRS limits. Think of it as the account you build from scratch with new money, year after year.

A Rollover IRA, on the other hand, is built for one specific purpose: to receive money from an old employer-sponsored plan. When you leave a job, you can move the funds from your 401(k) or 403(b) into this account. It's essentially a holding tank that keeps the tax-deferred status of your hard-earned retirement savings intact.

The Power of Keeping Funds Separate

So, why does this distinction matter so much? The main reason to use a dedicated Rollover IRA is to keep those work-related retirement funds "clean." By making sure the account only holds money from a former employer’s plan, you avoid a messy situation called commingling.

This separation becomes incredibly important if you ever want to move that money into a new employer’s 401(k). Many company plans simply won't accept funds from an IRA that has a mix of your personal contributions and old 401(k) money.

Keeping rollover assets separate is a simple organizational trick that preserves your ability to consolidate them into a future 401(k). This move provides maximum flexibility as your career evolves—a crucial insight for anyone navigating job changes.

Understanding the Flow of Retirement Money

The way these accounts are funded tells a bigger story about how people are actually using them. While you can technically roll 401(k) funds into any Traditional IRA, the data shows that rollovers are overwhelmingly the main source of money going into them.

In 2020, a staggering $594.8 billion (96.4%) of the money flowing into Traditional IRAs came from rollovers. Only a tiny slice came from direct annual contributions. You can explore more data on retirement fund movements to see this trend for yourself.

This highlights the primary role Traditional IRAs now play—they've become the go-to spot for consolidating assets from old workplace plans. A dedicated Rollover IRA just formalizes this process, making sure your money stays portable and easy to manage for whatever comes next. It’s a smart move that keeps all your options on the table.

How the IRS Sees Your Contributions and Withdrawals

When it comes to taxes on Traditional and Rollover IRAs, things are surprisingly simple. Here's the key: if the money in both accounts is pre-tax—which is almost always the case for 401(k) rollovers and deductible Traditional IRA contributions—the IRS treats them exactly the same. That’s a huge relief when you’re trying to manage your retirement savings.

Think of it this way. Your contributions to a Traditional IRA can often be tax-deductible, which lowers your taxable income for the year. In the same vein, when you move pre-tax money from an old 401(k) into a Rollover IRA, that move is not a taxable event. From that point on, investments in both accounts get to grow tax-deferred, meaning you don't owe any taxes on the gains year after year.

The Rules for Taking Money Out

The tax consistency doesn't stop there; it carries right into your retirement years. Any withdrawals you take from a Traditional IRA or a Rollover IRA (funded with pre-tax dollars, of course) are taxed as regular income. The IRS doesn't distinguish between the two accounts when you start taking distributions. It just sees pre-tax retirement money coming out, ready to be taxed.

This uniform approach applies to the big rules you’ll need to follow as you get older, too. The regulations for early withdrawals, for instance, are identical for both.

- Early Withdrawal Penalty: If you take money out before you turn 59½, you're looking at a 10% penalty on top of the usual income taxes, unless you happen to qualify for a specific exception.

- Required Minimum Distributions (RMDs): Once you hit the magic age (currently 73 for most people), you have to start taking annual RMDs from both types of accounts. If you don't, the penalty is pretty stiff.

Getting a handle on these withdrawal rules is non-negotiable for smart, long-term planning. To really dive in, it’s worth learning more about effective retirement withdrawal strategies and how to make sure your savings go the distance.

Here’s the most important tax takeaway you need to remember: A rollover does not count toward your annual IRA contribution limit. You could roll over hundreds of thousands of dollars from a 401(k) and still contribute the maximum amount to your Traditional IRA that same year.

When all is said and done, the difference between a Traditional and Rollover IRA pretty much vanishes from a tax perspective once your money is in the account. The real distinction is all about where the funds came from and the strategic reasons you might want to keep them separate—not how they’re taxed as they grow or when you take them out.

Investment Flexibility and Strategic Account Management

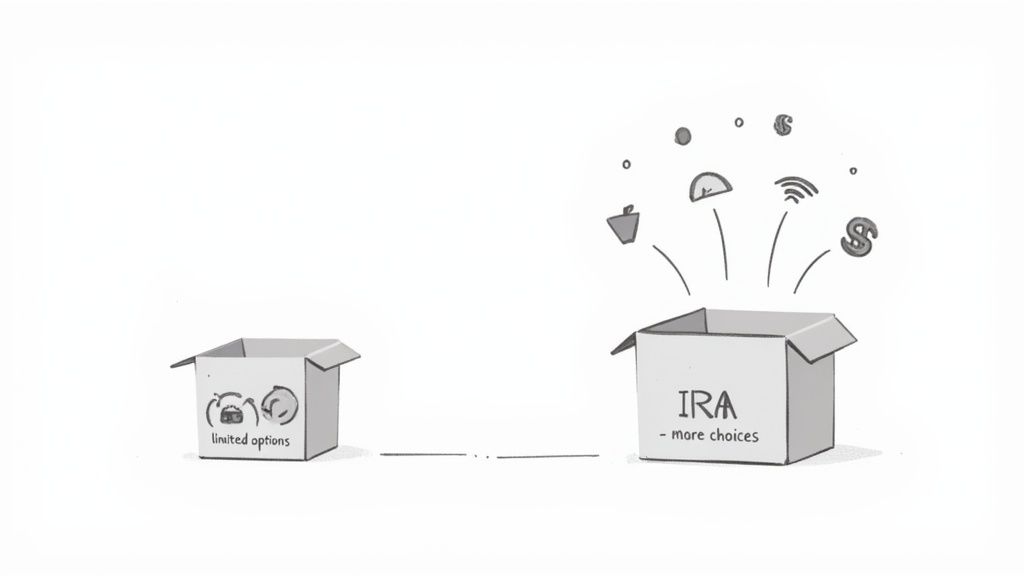

Let's be honest, one of the biggest reasons people move money out of an old employer plan is to get a massive upgrade in investment choices. Both Traditional and Rollover IRAs throw open the doors to a much wider universe of options, letting you build a portfolio that actually lines up with your family's goals and comfort level with risk.

Think about it: a typical 401(k) might corner you with just a handful of pre-selected mutual funds. An IRA, on the other hand, puts you in the driver's seat. You can invest directly in individual stocks, bonds, a huge variety of exchange-traded funds (ETFs), and other securities that were completely off-limits before. This control is a game-changer for so many people.

The Strategic Value of a Dedicated Rollover IRA

This is where the practical difference between a Traditional and Rollover IRA really starts to matter. While both give you the same investment freedom, keeping a dedicated Rollover IRA offers a huge administrative advantage, especially if you think you might change jobs again down the road.

The core benefit is keeping your old 401(k) money "pure." By holding these funds in a separate Rollover IRA—and not mixing in your annual contributions—you make your financial life so much simpler. It makes tracking performance a breeze and, more importantly, keeps all your options on the table.

Some company 401(k) plans won't let you roll money in from an IRA that has commingled funds (a mix of rollover assets and your own direct contributions). A dedicated Rollover IRA preserves your ability to move those assets into a new employer’s plan later, giving you maximum portability for your career.

This distinction is all about playing the long game. The choice you make today isn't just about now; it’s about setting yourself up for easier financial moves five or ten years from now. Keeping these accounts separate can prevent some major administrative headaches later on—a small step that pays off big in simplicity.

Expanding Your Investment Horizons

The flexibility you gain by moving to an IRA really can't be overstated. Rolling over those old 401(k) funds gives you access to a full menu of stocks, bonds, mutual funds, and ETFs, empowering you to fine-tune your portfolio with much more precision. This is a huge win for anyone looking to consolidate accounts, slash fees, or simply chase better-performing investments. You can explore more insights about this expanded investment control at SmartAsset.com.

This kind of strategic management becomes even more critical as your financial life grows. Many families start to wonder if they should keep different accounts for different goals. For more on that, check out our guide on whether you should have multiple retirement accounts. Ultimately, using a Rollover IRA is a strategic move to manage your retirement assets with foresight and control.

Real-World Scenarios for Choosing Your IRA

Knowing the rules is one thing, but seeing how a Traditional vs. Rollover IRA plays out in real family situations makes the choice much clearer. Let's walk through a few common scenarios to see which strategy makes the most sense for different goals.

These stories show how a simple decision today can shape your financial freedom for years to come.

The Career Changer Seeking Maximum Flexibility

Meet Sarah, a 45-year-old marketing director who just landed a great new role at a tech company. She has a sizable 401(k) from her previous job and is eager for more investment choices than her old plan offered.

At the same time, she knows she might want to consolidate her funds into her new employer's 401(k) down the line, since it has some unique investment funds and loan provisions she likes.

Recommendation: Sarah should open a dedicated Rollover IRA.

By moving her old 401(k) into a Rollover IRA and keeping it separate from any new contributions, she keeps those funds "pure." This move gives her immediate access to a wider world of investments—stocks, ETFs, you name it—while keeping the door open to easily roll those same funds into her new company’s 401(k) later. If she started mixing her annual IRA contributions into this account, she’d likely lose that portability.

The Retiree Simplifying Their Financial Life

Now, let's look at David, a 68-year-old who is finally retiring after a long career with three different companies. He’s juggling a 401(k) from his last job, a 403(b) from an earlier one, and a smaller pension he’s taking as a lump sum.

His main goal? Simplify everything. He wants less paperwork and a single account to manage for his required minimum distributions (RMDs).

Recommendation: A Rollover IRA is the perfect tool for consolidation.

David can move all three of his old workplace accounts into one new Rollover IRA, which streamlines his financial life in a huge way. Instead of tracking three separate accounts and calculating three different RMDs, he now has one central hub for his retirement savings. The process of moving pension funds can be tricky, so it’s important to understand what happens to your pension if you change jobs before making any moves.

For retirees like David, the biggest win is administrative simplicity. Consolidating into a single Rollover IRA makes it far easier to manage withdrawals, oversee investments, and coordinate with estate planning, delivering some much-needed peace of mind.

The Self-Employed Professional Juggling Old and New Savings

Finally, there’s Maria, a 50-year-old graphic designer who recently launched her own freelance business. She has a 401(k) from her last corporate job, but now that she’s self-employed, she needs a new place to make tax-deductible contributions for her future.

Recommendation: Maria should use both a Rollover IRA and a separate Traditional IRA.

This two-account strategy is perfect for her situation. Here’s how it works:

- Rollover IRA: She should move her old 401(k) into a dedicated Rollover IRA. This keeps those funds cleanly managed and separate.

- Traditional IRA: She should then open a completely separate Traditional IRA for all her new annual contributions.

This approach gives Maria the best of both worlds. She gets the investment freedom she wants for her old 401(k) money while creating a clear, simple path for her ongoing savings—all without commingling the two.

Making Your Decision and Taking the Next Steps

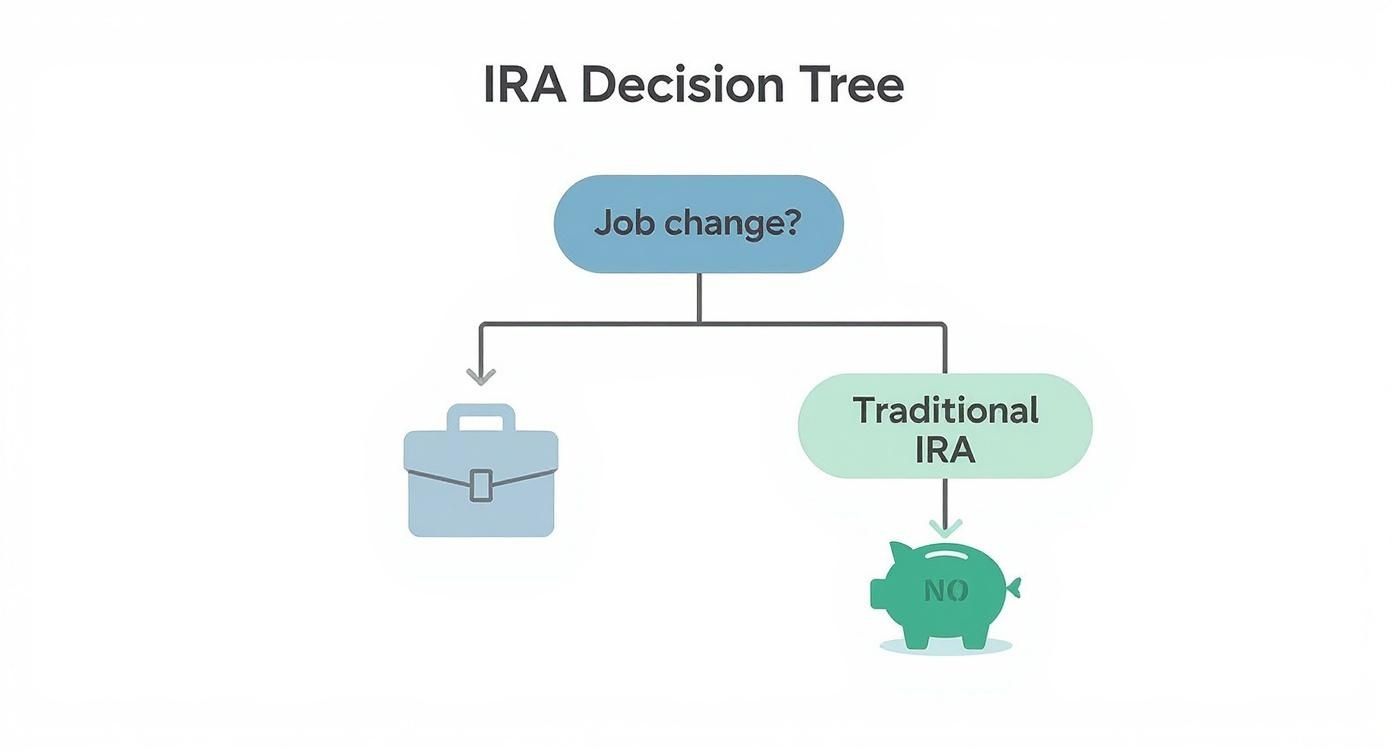

So, how do you actually choose between a Traditional and a Rollover IRA? It really boils down to your personal situation and what you're trying to accomplish. The decision usually hinges on the answers to a few key questions about the difference between a traditional and rollover ira for you.

Think about it this way: Is your main goal to find a new home for funds from an old 401(k)? Do you also plan on making new, annual contributions to keep saving? And—this is a big one—do you want the flexibility to potentially roll this money into a future employer's 401(k)? Your answers here create a clear path forward.

Sometimes a simple visual helps. The decision tree below shows how a common event, like changing jobs, can point you in the right direction.

As you can see, a job change is the most common reason people look into a Rollover IRA. On the other hand, if you're focused on your ongoing savings goals, a Traditional IRA is typically the go-to choice.

Your Action Plan for Moving Forward

Once you've made up your mind, it's time to take action. Kicking off a rollover is a pretty straightforward process, but you need to follow a few specific steps to make sure your retirement funds move over smoothly and without any tax surprises.

- Open Your New IRA: The first step is to pick a financial institution (like a brokerage firm or bank) and open the IRA you plan to use. Be very clear about whether you're opening a dedicated Rollover IRA or a Traditional IRA that you might also contribute to later.

- Contact Your Former Plan Administrator: Get in touch with the HR department or the financial company managing your old 401(k). Let them know you want to start a direct rollover into your new IRA.

- Complete the Necessary Paperwork: You'll likely have some forms to fill out for both your old 401(k) provider and your new IRA custodian. Insisting on a direct rollover is critical here—it means the check will be made out to your new IRA custodian, not directly to you.

- Confirm the Transfer: After a week or two, check your new account to verify that the funds have landed correctly. From there, you can start investing that money according to your personal financial plan.

Your most important task is to request a direct rollover. This ensures the money moves from one institution to another without ever touching your hands, avoiding mandatory tax withholding and the risky 60-day rule associated with indirect rollovers.

Have More Questions? Let's Dig In.

It's completely normal for questions to pop up when you're sorting through the details of retirement accounts. Here are a few common ones I hear all the time when people are comparing Traditional and Rollover IRAs.

Can I Have Both a Traditional and a Rollover IRA?

Yes, you absolutely can, and for many people, it’s the cleanest and smartest way to organize your retirement savings. Think of it as giving your money different jobs.

You can use a dedicated Rollover IRA as the landing spot for funds from an old 401(k). At the same time, you can open and contribute to a separate Traditional IRA for your new, annual savings. Keeping them separate just makes everything crystal clear and preserves the unique advantages of each account.

What Happens If I Mix My Own Contributions with Rollover Money?

When you put your personal contributions into the same Traditional IRA that holds your rollover funds, it’s called commingling. While it's perfectly legal, it can throw a serious wrench in your plans later on if you ever want to move that money into a new employer’s 401(k).

Why? Many company retirement plans will refuse to accept funds from a commingled IRA. By mixing the money, you might accidentally close the door on consolidating your assets into a future 401(k), which limits your financial flexibility. The simple solution is to keep rollover funds in their own separate account from the start.

The biggest reason to avoid commingling is to keep your retirement assets portable. A "clean" Rollover IRA ensures you can move the funds into a new 401(k) if a great opportunity comes up—that's a strategic advantage you don't want to give up.

Is There a Deadline for Rolling Over My 401(k)?

Yes, and this one is critical. If you opt for an indirect rollover—where your old employer cuts you a check—the clock starts ticking. You have just 60 days from the day you receive the funds to get them deposited into your new IRA. Miss that window, and the whole amount could be treated as a taxable distribution, which could mean a hefty tax bill and a 10% early withdrawal penalty.

Honestly, the safest and most recommended route is a direct, trustee-to-trustee rollover. With this method, the money moves straight from your old 401(k) provider to your new IRA custodian. It never even touches your personal bank account, which completely sidesteps the 60-day deadline and any potential tax withholding headaches.

At Smart Financial Lifestyle, we believe in making smart financial decisions that serve your family for generations. To continue building your knowledge and securing your future, explore more resources at https://smartfinancialifestyle.com.