Retirement isn't an end; it's a fundamental shift in your financial life. The accumulation strategies that successfully built your nest egg are often ill-suited for the distribution phase, where the primary goals become generating reliable income, preserving capital, and ensuring your wealth lasts. This transition requires a new playbook, one focused on stability and longevity rather than aggressive growth. Without a clear plan, retirees risk depleting their assets too quickly or living more frugally than necessary.

This comprehensive guide is designed to provide that clarity. We will move beyond generic advice to detail the best investment strategies for retirees, offering actionable frameworks you can implement immediately. You will discover practical methods for creating predictable income streams, managing market volatility, optimizing for tax efficiency, and aligning your portfolio with your personal legacy goals. Each strategy is broken down into its core mechanics, complete with its pros, cons, and the specific retiree profile it suits best.

From time-tested withdrawal frameworks like the 4% Rule to sophisticated income-layering techniques like the Bucket Strategy, this article serves as a detailed roadmap. We will explore ten distinct approaches, including:

- Income Generation: Strategies centered on dividends, interest, and annuities.

- Withdrawal Frameworks: Systematic plans for drawing down your portfolio.

- Asset Protection: Methods for hedging against inflation and market downturns.

- Tax Optimization: Techniques like Roth conversions to minimize your tax burden.

- Legacy Planning: How to structure your wealth for multi-generational impact.

Whether you are a new retiree seeking security, a grandparent focused on legacy, or someone navigating a major life transition, these proven strategies will equip you to manage your wealth with confidence and purpose. Let's explore the blueprints for a financially secure and fulfilling retirement.

1. The 4% Rule (Safe Withdrawal Rate)

The 4% Rule is a cornerstone of retirement income planning and one of the best investment strategies for retirees seeking a simple yet effective framework. Popularized by financial planner William Bengen in 1994, this guideline suggests withdrawing 4% of your portfolio's value in your first year of retirement and then adjusting that dollar amount for inflation each subsequent year. The goal is to provide a steady, predictable income stream with a high probability of your savings lasting for at least 30 years.

For example, a retiree with a $1 million portfolio would withdraw $40,000 in their first year. If inflation is 3% that year, their next year's withdrawal would be $41,200 ($40,000 x 1.03), regardless of the portfolio's performance. This method's simplicity and historical success have made it a trusted starting point for millions.

How to Implement the 4% Rule

To effectively use this strategy, a balanced portfolio is crucial. Bengen's original research was based on a portfolio of 50-75% stocks and the remainder in intermediate-term bonds. This allocation provides the growth needed to outpace inflation and withdrawals, while bonds offer stability during market downturns.

Actionable Tips:

- Maintain a Cash Buffer: Keep one to two years' worth of living expenses in cash or very safe, short-term bonds. This allows you to avoid selling stocks during a market dip to cover your bills.

- Be Flexible: While the rule is a great guideline, it isn’t rigid. Consider forgoing the inflation adjustment in years following a significant market decline to give your portfolio time to recover.

- Consider a Lower Rate: If you retire early or anticipate a retirement longer than 30 years, starting with a lower rate like 3% or 3.5% can significantly increase your portfolio's longevity.

This rule works best for retirees who value a consistent, inflation-adjusted income and prefer a straightforward, "set-it-and-adjust" approach. To see how different rates might impact your own savings, you can experiment with our Retirement Withdrawal Rate Calculator.

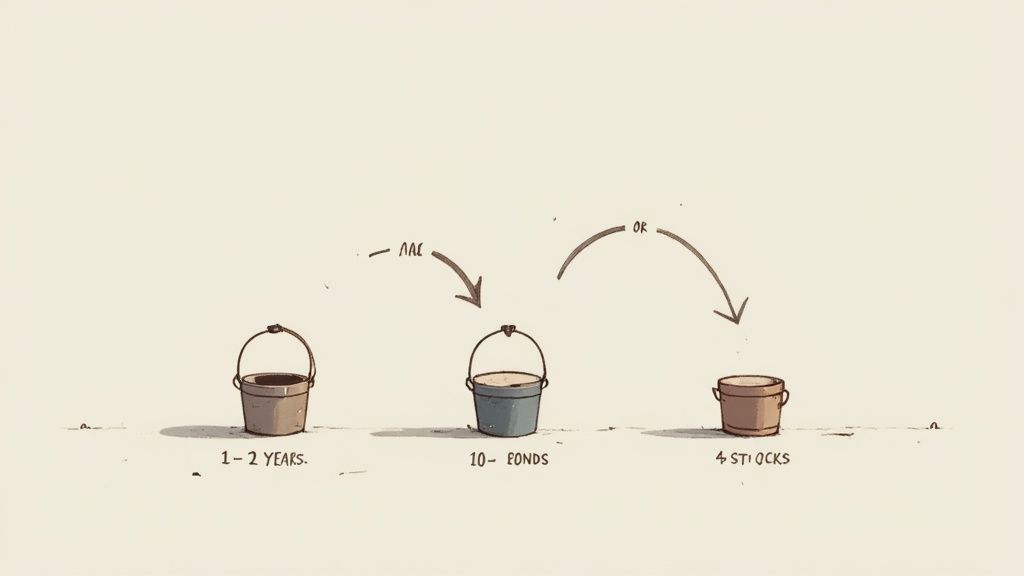

2. Bucket Strategy (Time-Segmented Approach)

The Bucket Strategy is a popular investment strategy for retirees that mentally divides your portfolio into different "buckets" based on time horizons. Developed by financial planner Harold Evensky, this approach helps manage both short-term income needs and long-term growth goals, providing a psychological buffer against market volatility. The core idea is to secure near-term expenses while allowing the rest of your portfolio to grow, reducing the need to sell assets at an inopportune time.

For instance, a retiree with a $600,000 portfolio might allocate it into three buckets: a short-term bucket with $20,000 in cash for one year of expenses, a medium-term bucket with $120,000 in bonds for the next 2-5 years, and a long-term bucket with $460,000 in stocks for growth. This structure provides peace of mind, knowing immediate cash flow is covered.

How to Implement the Bucket Strategy

Implementing this strategy starts with segmenting your funds. The first bucket should hold one to three years of living expenses in highly liquid, safe assets like cash, money market funds, or short-term CDs. The second bucket typically covers the next three to seven years with a balanced mix of bonds and conservative stocks. The third bucket is for long-term growth (eight-plus years) and is heavily weighted toward stocks and other growth assets.

Actionable Tips:

- Establish Buckets Pre-Retirement: Set up your bucket allocations before you stop working. This ensures you have a clear plan and the necessary liquidity from day one of your retirement.

- Refill Your Buckets Systematically: Annually or when markets are performing well, sell appreciated assets from your long-term bucket to refill your short-term and medium-term buckets. This locks in gains and secures future income.

- Use High-Yield Savings: In a rising interest rate environment, holding your Bucket 1 funds in a high-yield savings account can generate a modest, safe return on the cash you need to access soon.

This approach is ideal for retirees who feel anxious about market fluctuations but still need long-term growth. It provides a clear, logical framework that aligns your assets directly with your spending timeline, offering both security and growth potential.

3. Dividend and Interest Income Strategy

The Dividend and Interest Income Strategy is a conservative approach favored by retirees who prioritize capital preservation and a predictable cash flow. Instead of selling off portfolio assets to cover living expenses, this strategy focuses on living off the natural income generated by your investments. This income comes from dividend-paying stocks, bond interest payments, and other interest-bearing accounts, creating a regular "paycheck" from your portfolio.

For example, a retiree with a $1 million portfolio yielding an average of 3.5% would generate $35,000 in annual income without ever needing to sell the underlying stocks or bonds. This method provides a psychological benefit, as retirees can see their principal remain intact while still funding their lifestyle. The core idea is to build a portfolio of high-quality, income-producing assets that can reliably support you through retirement.

How to Implement the Dividend and Interest Income Strategy

Success with this strategy hinges on selecting durable, income-producing assets and diversifying your sources. A common approach involves a mix of "dividend aristocrats" (companies like Johnson & Johnson or Coca-Cola with long histories of increasing dividends), high-quality corporate or municipal bonds, and potentially alternative income sources like REITs. This blend creates a resilient income stream that is less dependent on stock market appreciation.

Actionable Tips:

- Focus on Dividend Quality: Prioritize companies with a long, consistent history of paying and increasing dividends. Look for "dividend aristocrats" or "dividend champions" that have proven their stability across different economic cycles.

- Build a Bond Ladder: Purchase a series of individual bonds with staggered maturity dates. As each bond matures, you can either spend the principal or reinvest it, providing predictable cash flow and helping to manage interest rate risk.

- Reinvest for Compounding: If your income exceeds your immediate needs, especially in early retirement, reinvesting the surplus dividends and interest can significantly compound your portfolio's value and future income potential.

- Diversify Income Sources: Don't rely solely on one type of asset. Broaden your income base with real estate investment trusts (REITs), preferred stocks, and high-yield savings accounts to enhance stability.

This strategy is one of the best investment strategies for retirees who are risk-averse, value a steady and predictable income, and want to preserve their principal for legacy goals or future needs.

4. Total Return/Systematic Withdrawal Strategy

The Total Return Strategy is a modern and flexible approach to retirement income, shifting the focus from generating specific income (like dividends or interest) to the overall growth of your portfolio. This method combines all sources of return - capital gains, dividends, and interest - into a single pool. From this pool, you systematically sell assets to create the income you need, regardless of where the gains came from. This holistic view often leads to superior long-term results compared to income-only strategies.

For example, a retiree with a $1 million portfolio and a 4.5% withdrawal goal would create $45,000 in annual income by selling the most advantageous assets at that time. This might mean selling appreciated stock shares one year and rebalancing bonds another, allowing the portfolio to remain optimized for growth. This is a core reason it's considered one of the best investment strategies for retirees who prefer an adaptable, growth-oriented plan.

How to Implement a Total Return Strategy

Success with this strategy hinges on a well-diversified, growth-oriented portfolio, often with a higher allocation to equities (like 60% stocks, 40% bonds) than traditional income-focused portfolios. The goal is to maximize long-term growth, providing a larger asset base to draw from over decades. You then establish a disciplined, periodic withdrawal plan, often executed quarterly or monthly.

Actionable Tips:

- Automate Withdrawals: Use your brokerage’s systematic withdrawal plan (SWP) to automatically sell a set dollar amount of assets and transfer the cash to your bank account. This enforces discipline.

- Rebalance Strategically: Use your withdrawals as an opportunity to rebalance. Sell assets from an overweight asset class to generate cash, bringing your portfolio back to its target allocation.

- Be Tax-Smart: When selling assets, prioritize those held in tax-advantaged accounts like IRAs. In taxable accounts, consider selling shares with the highest cost basis to minimize capital gains taxes.

- Stay the Course: The key is to trust the long-term growth of the total portfolio and not react emotionally to short-term market fluctuations. Avoid selling more than planned during a downturn.

This strategy is ideal for retirees who are comfortable managing a balanced portfolio and want the flexibility to optimize for long-term growth and tax efficiency, rather than being constrained by an asset's income production.

5. Annuities and Guaranteed Income Strategy

The Annuities and Guaranteed Income strategy is one of the most effective ways for retirees to create a personal pension and secure their financial future. This approach involves converting a portion of your retirement savings into a guaranteed stream of income for life by purchasing an annuity from an insurance company. The primary goal is to cover essential, non-discretionary expenses like housing, food, and healthcare, completely eliminating the risk that market volatility will impact your ability to pay for basic needs.

By creating a reliable income "floor," this strategy allows the remainder of your investment portfolio to be invested for growth with greater confidence. For instance, a 65-year-old retiree might use $300,000 of their savings to buy an immediate annuity that generates $1,750 per month for life. This predictable cash flow acts as a powerful buffer against sequence-of-returns risk, where poor market performance early in retirement can permanently damage a portfolio's longevity.

How to Implement a Guaranteed Income Strategy

Implementing this strategy starts with calculating your essential monthly expenses and subtracting any other guaranteed income sources like Social Security or a pension. The remaining gap is the amount you need to cover with an annuity. You then work with a financial advisor to select the right type of annuity, such as an immediate annuity for income now or a deferred income annuity (DIA) for income that starts later.

Actionable Tips:

- Shop Around: Rates can vary significantly between insurance providers. Get quotes from multiple highly-rated companies (A+ or better) like Fidelity, Vanguard, and Principal to find the best payout.

- Cover Needs, Not Wants: Use annuities to create an income floor for essential expenses only. Keep the rest of your portfolio liquid and invested for growth to cover discretionary spending.

- Consider Inflation Protection: A Cost-of-Living Adjustment (COLA) rider will increase your payments over time to combat inflation. While it reduces your initial income, it preserves your purchasing power for a long retirement.

- Use QLACs for Tax Efficiency: A Qualified Longevity Annuity Contract (QLAC) allows you to use pre-tax retirement funds (from an IRA or 401(k)) to buy an annuity that starts paying out later in life, often reducing your required minimum distributions (RMDs).

This strategy is ideal for retirees who prioritize security and predictability above all else, ensuring their core lifestyle is protected regardless of market conditions. To dive deeper, you can explore our guide on how to get retirement income for life and stop hating annuities.

6. Delay Social Security and Live Off Portfolio Strategy

One of the most powerful and often overlooked investment strategies for retirees involves using your portfolio as a temporary bridge to maximize a guaranteed, inflation-adjusted income stream: your Social Security benefits. This strategy involves deliberately withdrawing from your investment portfolio in early retirement (e.g., from age 62 to 70) while delaying the start of your Social Security payments. By waiting, your monthly benefit grows by approximately 8% for each year you delay past your Full Retirement Age (FRA) up to age 70.

This approach effectively "buys" a larger, government-backed annuity for life. For example, a retiree eligible for a $2,200 monthly benefit at their FRA of 67 could increase that payout to over $2,728 per month by waiting until age 70. This creates a higher, more secure income floor for the rest of their life, reducing the pressure on their investment portfolio in their later years.

How to Implement the Delay Strategy

Implementing this strategy requires careful planning to ensure your portfolio can sustain the withdrawals needed during the "gap years" before Social Security begins. The core idea is to treat your portfolio as the primary income source for a defined period, allowing your guaranteed government benefit to grow to its maximum potential. This is especially valuable for the higher-earning spouse in a couple or for individuals with a family history of longevity.

Actionable Tips:

- Calculate Your Break-Even Point: Use the Social Security Administration's calculators or a financial planner to determine the age at which the total benefits received from delaying surpass what you would have received by claiming early. This is often in the early-to-mid 80s.

- Structure Your "Bridge" Portfolio: The funds you'll use to cover expenses during the delay period should be conservatively invested. Consider a bucket approach with several years of expenses in cash and short-term bonds to avoid selling stocks in a down market.

- Coordinate with Your Spouse: Married couples can be highly strategic. One common approach is for the lower-earning spouse to claim benefits earlier for cash flow, while the higher-earning spouse delays to maximize the largest benefit, which also determines the survivor's benefit.

This strategy is ideal for retirees with sufficient savings to cover their income needs for several years and who have a life expectancy that extends beyond their break-even age. It trades portfolio value now for significantly higher, guaranteed income later.

7. Core and Satellite Strategy

The Core and Satellite approach is one of the most flexible and best investment strategies for retirees, blending stability with controlled opportunities for growth. This strategy involves dedicating the majority of your portfolio (the "core," typically 75-85%) to stable, low-cost investments like broad-market index funds or ETFs. The smaller "satellite" portion (15-25%) is then allocated to more specialized or actively managed investments to potentially enhance returns or provide specific exposures.

For example, a retiree might allocate 80% of their portfolio to a core holding of a Vanguard Total World Stock ETF and a U.S. Aggregate Bond ETF. The remaining 20% satellite could be invested in a handful of high-quality dividend growth stocks, a real estate investment trust (REIT), or a sector-specific fund like healthcare. This structure provides a solid, diversified foundation while allowing for tactical adjustments without disrupting the entire portfolio.

How to Implement the Core and Satellite Strategy

The key to this strategy is defining the purpose of each component. The core is your portfolio's anchor, designed for consistent, market-like returns with minimal management. The satellites are your opportunity to express a specific investment view, target income, or pursue higher growth, but they are limited in size to contain risk.

Actionable Tips:

- Keep the Core Simple: Use ultra-low-cost, broadly diversified index funds or ETFs for your core. This minimizes fees and ensures you capture the market's overall performance.

- Research Satellites Thoroughly: Treat satellite positions with extra diligence. Whether it's individual stocks or specialized funds, understand the specific risks and potential rewards before investing.

- Limit Your Satellites: Avoid "satellite clutter." Restrict this portion to a manageable number of positions, typically no more than three to five, to ensure you can monitor them effectively.

- Rebalance Strategically: Review your satellite holdings quarterly or semi-annually. If a position has performed exceptionally well, trim it back to its original allocation to lock in gains and maintain your target risk level.

This strategy is ideal for retirees who want the reliability of passive investing but also desire the flexibility to actively pursue specific opportunities without jeopardizing their core retirement capital.

8. Required Minimum Distribution (RMD) Optimization Strategy

Once you reach age 73 (as of 2023), the IRS requires you to start taking withdrawals, known as Required Minimum Distributions (RMDs), from most of your tax-deferred retirement accounts. RMD Optimization is less of an investment strategy and more of a critical tax-planning strategy that helps you manage these mandatory withdrawals to minimize your tax burden and maximize your after-tax income, making it one of the best investment strategies for retirees with significant traditional IRA or 401(k) balances.

This approach focuses on how and when you take your RMDs to avoid being pushed into higher tax brackets and to coordinate with other income sources like Social Security or pensions. For example, a retiree might use a Qualified Charitable Distribution (QCD) to send up to $105,000 (for 2024) of their RMD directly to a charity, satisfying the withdrawal requirement without adding to their taxable income. This strategic management is key to preserving wealth.

How to Implement an RMD Optimization Strategy

Effectively managing RMDs requires proactive planning, often beginning years before they are mandatory. The goal is to control your taxable income in retirement by deciding which accounts to draw from and in what order, all while satisfying the IRS rules. Strategic Roth conversions in your 60s, for instance, can lower your traditional IRA balance and thus reduce your future RMD amounts.

Actionable Tips:

- Use Qualified Charitable Distributions (QCDs): If you are age 70½ or older and charitably inclined, a QCD is a powerful tool. It allows you to donate your RMD directly to a charity, bypassing your taxable income entirely.

- Coordinate with Other Income: Time your RMD withdrawals strategically. If you have a large one-time expense, you might take the RMD early in the year, but if you want to defer taxes, you can wait until the December 31 deadline.

- Plan with a Tax Professional: RMD rules can be complex, especially with inherited IRAs or multiple accounts. Work with a CPA to accurately calculate your RMD using IRS life expectancy tables and build a multi-year withdrawal plan.

This strategy is essential for retirees with substantial assets in tax-deferred accounts who want to minimize their lifetime tax liability and enhance the longevity of their portfolio. To learn more about calculating your specific RMD, you can consult the official IRS RMD Worksheets.

9. Roth Conversion Ladder Strategy

The Roth Conversion Ladder is a powerful tax-planning tool that ranks among the best investment strategies for retirees aiming to create tax-free income later in life. It involves systematically converting funds from a Traditional IRA or 401(k) to a Roth IRA over several years. By paying income taxes on the converted amount during lower-income years, you build a "ladder" of Roth assets that can be withdrawn completely tax-free after a five-year waiting period for each conversion.

This strategy is particularly effective in the gap years between retiring and starting Social Security or Required Minimum Distributions (RMDs), when your taxable income is often at its lowest. For instance, a retiree could convert $50,000 annually for five years. After the first conversion's five-year holding period is met, that $50,000 (plus its earnings) becomes available as a source of tax-free income, with a new "rung" of converted funds becoming available each subsequent year.

How to Implement a Roth Conversion Ladder

Executing this strategy requires careful planning to manage your tax liability. The goal is to "fill up" lower tax brackets with converted income without pushing yourself into a higher bracket. You must also have a separate source of funds to pay the income taxes on the conversion, as using the retirement funds themselves can trigger penalties.

Actionable Tips:

- Time It Strategically: The ideal time for conversions is during low-income years, such as after you stop working but before you claim Social Security or start RMDs.

- Have Tax Money Ready: Set aside non-retirement funds to pay the taxes due on the converted amount. This preserves the full value of your retirement savings for tax-free growth.

- Monitor the Pro-Rata Rule: If you have both pre-tax and after-tax (non-deductible) funds in Traditional IRAs, the IRS pro-rata rule requires any conversion to be a mix of both, which can complicate taxes.

- Consult a Professional: Work with a tax advisor to project the long-term impact on your tax situation, including potential effects on Medicare premiums and the taxation of your Social Security benefits.

This forward-thinking strategy is best for retirees who anticipate being in a higher tax bracket in the future and want to minimize their tax burden while reducing future RMDs. To dive deeper, you can explore our detailed guide on how to maximize your Roth conversion strategy.

10. Home Equity and Reverse Mortgage Strategy

For many retirees, their home is their largest asset, yet it remains illiquid. The Home Equity and Reverse Mortgage Strategy transforms this asset into a functional part of your retirement plan, providing cash flow or a safety net without forcing you to sell your home. This approach is one of the best investment strategies for retirees who are “house-rich” but may need additional cash for living expenses, healthcare costs, or market downturns. It unlocks the value tied up in your home to support your financial security.

For example, a retiree could downsize from an $800,000 family home to a $500,000 condo, investing the $300,000 difference to generate income. Alternatively, a 70-year-old with significant home equity might use a Home Equity Conversion Mortgage (HECM), or reverse mortgage, to create a tax-free monthly income stream or a line of credit they can tap as needed, all while continuing to live in their home.

How to Implement a Home Equity Strategy

Successfully leveraging home equity requires careful planning and understanding the different tools available. A Home Equity Line of Credit (HELOC) can act as a low-cost emergency fund, while a reverse mortgage is better suited for generating long-term income or as a buffer against portfolio losses. Downsizing is a more permanent move that can instantly boost your investment portfolio and lower your living expenses.

Actionable Tips:

- Establish a "Standby" HELOC: Open a HELOC before you retire and need it. This can serve as a powerful emergency fund, allowing you to borrow against your home to cover unexpected costs without selling investments at an inopportune time.

- Use a HECM as an Insurance Policy: Consider setting up a reverse mortgage line of credit early in retirement but not drawing from it. This line of credit can grow over time and acts as a safety net if your investment portfolio underperforms or you face a major expense later.

- Work with a HUD-Approved Counselor: Before committing to a reverse mortgage, the law requires you to meet with a U.S. Department of Housing and Urban Development (HUD) approved counselor. They provide impartial advice on the costs, benefits, and obligations.

This strategy is ideal for retirees who intend to age in place and need to supplement their income or create a robust financial buffer. It provides liquidity and flexibility, but it's crucial to understand the costs and long-term implications, especially if leaving the home to heirs is a primary goal.

Top 10 Retirement Investment Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐ | Ideal Use Cases 📊 | Key Advantages / Tips 💡 |

|---|---|---|---|---|---|

| The 4% Rule (Safe Withdrawal Rate) | 🔄 Low — simple rule and annual inflation adjustment | ⚡ Moderate — requires diversified portfolio (60/40–80/20) + 2–3 years cash | ⭐⭐⭐ — historically reliable for ~30-year retirements | Retirees seeking a simple, rules-based withdrawal plan | Simple to implement; review annually, keep cash buffer |

| Bucket Strategy (Time-Segmented) | 🔄 Moderate–High — multiple accounts and rebalancing | ⚡ Moderate — needs segregation of assets and monitoring | ⭐⭐⭐⭐ — reduces sequence‑of‑returns risk for near term | Those anxious about volatility or with staged cash needs | Protects short‑term needs; set buckets before retirement and rebalance |

| Dividend & Interest Income Strategy | 🔄 Moderate — security selection and income monitoring | ⚡ High — larger portfolio needed in low‑rate environments | ⭐⭐⭐ — predictable income but limited growth potential | Conservative income-focused retirees prioritizing capital preservation | Build dividend aristocrats, use bond ladders, monitor sustainability |

| Total Return / Systematic Withdrawal | 🔄 Moderate — disciplined selling and tax planning required | ⚡ Moderate — flexible allocation; needs trading/tax resources | ⭐⭐⭐⭐ — typically superior long‑term outcomes with flexibility | Investors seeking growth + disciplined withdrawals and tax efficiency | Use systematic plans, harvest losses, rebalance regularly |

| Annuities & Guaranteed Income | 🔄 Moderate — contract selection and rider choices | ⚡ Low liquidity/high cost — premiums, fees, insurer credit risk | ⭐⭐⭐⭐ — strong longevity protection; predictable income | Risk‑averse retirees needing an essential‑expense income floor | Shop multiple providers, use for essentials only, consider COLA and insurer ratings |

| Delay Social Security & Live off Portfolio | 🔄 Low — decision timing + coordination | ⚡ High — requires portfolio to fund gap years | ⭐⭐⭐⭐ — significantly larger lifetime Social Security if delayed | Those with long life expectancy and sufficient early retirement assets | Calculate break‑even age, coordinate spousal claiming, use buckets for gap |

| Core & Satellite Strategy | 🔄 Moderate — passive core + active satellites management | ⚡ Efficient — core is low‑cost; satellites require research | ⭐⭐⭐ — balance of stability and upside with tax benefits | Investors wanting broad diversification with selective active bets | Keep core low‑cost, limit satellites (3–5), rebalance periodically |

| RMD Optimization Strategy | 🔄 High — complex rules, calculations and coordination | ⚡ Resource‑intensive — CPA/advisor often required, detailed records | ⭐⭐⭐⭐ — high tax savings potential; avoids IRMAA spikes | Individuals with large tax‑deferred balances approaching RMD age | Use QCDs, Roth conversions, coordinate timing with other income; work with a tax pro |

| Roth Conversion Ladder Strategy | 🔄 High — multi‑year tax planning and pro‑rata complexity | ⚡ High — requires cash to pay taxes and long timeline (5+ years) | ⭐⭐⭐⭐ — creates tax‑free income and reduces future RMDs | Early retirees in low‑income years or those wanting tax diversification | Convert in low‑income years, track 5‑year rules, consult tax advisor |

| Home Equity & Reverse Mortgage Strategy | 🔄 Moderate–High — loan terms, counseling, and exit planning | ⚡ Variable — unlocks liquidity but involves fees and possible rate risk | ⭐⭐–⭐⭐⭐ — provides cash relief but can be costly and reduce inheritance | Asset‑rich, cash‑poor homeowners or those aging in place | Use HELOC as emergency backup, get HUD‑approved counseling, consider downsizing first |

Crafting Your Personal Retirement Blueprint

Navigating the transition from asset accumulation to wealth distribution is one of the most significant financial shifts you will ever make. Throughout this guide, we have explored a diverse landscape of the best investment strategies for retirees, each offering a unique set of tools to build a secure and fulfilling future. From the structured simplicity of the 4% Rule and the intuitive logic of the Bucket Strategy to the income-focused precision of Dividend Ladders and the tax-savvy foresight of Roth Conversions, the path to a sustainable retirement is not a single, predetermined road but a custom-built highway.

The key takeaway is that there is no single "best" strategy; there is only the best strategy for you. Your retirement blueprint will be as unique as your life story, reflecting your specific income needs, risk tolerance, health considerations, and legacy aspirations. Think of the strategies we've discussed not as competing options but as complementary components in a sophisticated financial toolkit.

Synthesizing Your Strategy: From Theory to Action

The true power lies in the thoughtful combination of these approaches. You might anchor your plan with a guaranteed income stream from an annuity or delayed Social Security, while employing a Bucket Strategy to manage your remaining portfolio. This allows you to segment your assets, matching short-term spending needs with stable investments and long-term growth goals with equities, thereby mitigating sequence-of-return risk.

Similarly, a Total Return approach can be paired with RMD optimization to ensure you are withdrawing funds in the most tax-efficient manner possible. The goal is to create a layered, resilient plan that can adapt to changing market conditions and personal circumstances.

Your next steps are to move from learning to doing. This involves a clear-eyed assessment of your financial reality and a commitment to creating a tangible plan.

- Quantify Your Needs: Start by calculating your essential and discretionary annual expenses. This number is the foundation of your entire withdrawal strategy.

- Assess Your Risk Tolerance: Honestly evaluate how you would react to a significant market downturn. Your answer will guide how much you allocate to growth assets versus stable, income-generating ones.

- Model Different Scenarios: Use retirement planning software or work with a financial advisor to stress-test your plan. How does it hold up if you live to 100? What if inflation remains high? What if a major healthcare expense arises?

- Create a Written Policy: Document your chosen strategy. An Investment Policy Statement (IPS) for your retirement can outline your withdrawal rules, asset allocation targets, and rebalancing schedule. This document acts as your financial North Star, keeping you on course during periods of market volatility or emotional stress.

The Ultimate Goal: A Retirement of Confidence and Purpose

Mastering these retirement investment strategies is about more than just numbers on a spreadsheet; it is about securing your independence, empowering your choices, and funding a life rich with purpose. It’s about having the confidence to travel, pursue new hobbies, support your family, and leave a meaningful legacy without the constant worry of outliving your money.

By thoughtfully designing a personalized withdrawal and investment plan, you are not just managing assets; you are architecting your freedom. You are ensuring that the wealth you worked a lifetime to build can now work for you, providing security, opportunity, and peace of mind for all the years to come. This deliberate approach is the cornerstone of a successful retirement, transforming your financial resources into the fuel for your dreams.

Ready to build a comprehensive plan that integrates these strategies into a cohesive financial life? At Smart Financial Lifestyle, we provide the tools and guidance to help you craft a retirement blueprint with confidence. Explore our resources at Smart Financial Lifestyle to start your journey today.